Pizza on the menu for short sellers

Papa John's management team was quick to pin their company's recent setbacks to the ongoing NFL anthem controversy, but shorting activity across globally listed pizza firms shows that the industry's woes may be much more deep-rooted

- More than 8% of Papa John's shares have been shorted since May

- US, UK and Australian listed Domino's firms see elevated shorting activity

- Food delivery apps targeted as Uber Eats and Deliveroo gain momentum

In what was arguably the most controversial earnings call of the Q3 earnings season, Papa John's CEO John Schnatter and COO Steve Ritchie attributed their company's weak forward guidance to the ongoing standoff between the minority of NFL players that are kneeling during the US national anthem and those - including US president Donald Trump - that wish to see the league force them to stand.

Although Messrs Schnatter and Richie may have some legitimate reasons for blaming the NFL for the company's recent headwinds, investor skepticism towards Papa John's had been building up long before the recent controversy. In fact, sort sellers have been targeting Papa John's since May of this year - a full three months prior to the NFL's latest season.

Granted, short sellers did redouble their attention since the controversy boiled over in October, but the existing high levels of short interest indicates that Papa John's headwinds may be more deep rooted than its leadership is willing to admit. Furthermore, short sellers think that more bad news may surface in the near future, as demand to borrow Papa John's shares has increased significantly since last week's earnings announcement.

Short sellers aren't limiting their pizza binge to Papa John's - rival Domino's shares have also experienced above average shorting activity. The company now has over six percent of its shares out on loan to short sellers - twice the level seen across the S&P 500 index. Just like its rival, skepticism around Domino's shares predated the NFL season a further indication that the pizza short is driven by something other than the immediate impact of the NFL season.

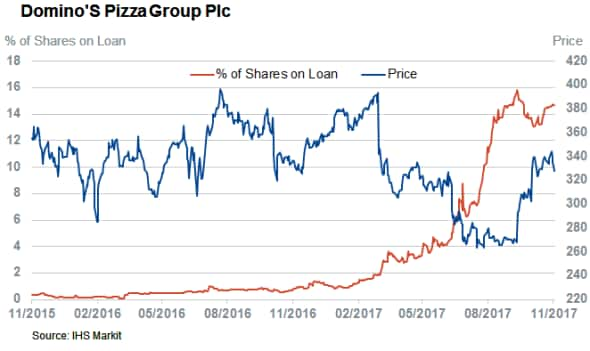

In a further indication that there may be more for pizza executives to worry about, internationally listed Domino's operations have also been targeted. In fact, both Australian listed Domino's Pizza Enterprises Ltd and UK listed Domino's Pizza Group Plc now have 15% of their shares out on loan - nearly three times the levels of their US listed parent.

Short sellers had profited handsomely from both firms in recent months, however, Domino's Pizza Enterprises Ltd has started to backfire after its shares rebounded sharply after it announced some better than expected results. Short sellers have brushed aside this recent setback, and the demand to borrow shares in the UK firm is as buoyant as ever.

Delivery apps causing waves

One reason behind these elevated levels of shorting activity could be the proliferation of the new wave of food delivery apps such as Deliveroo and Uber Eats. According to a recent research report by consulting firm Mc Kinsey, they have the potential to upend the established delivery ecosystem by offering customers a seamless food delivery experience - regardless of the restaurant chosen - while also lowering the operational burdens faced by restaurants looking enter the takeaway game. These apps initially focused on higher end restaurants, however, they have since moved into the more mass market side of the market served by the likes of Domino's and Papa John's. While it's unlikely that delivery apps will deal established pizza chains the type of disruptive blows that Amazon dealt its retail competitors, there is no denying that they has made the battle for late night takeaway much more competitive.

Short sellers are also busy taking bets that these up and coming competitors will offer ever fiercer competition the first generation of the food delivery apps dubbed "aggregators" by Mc Kinsey. Grub Hub - the first such firm to list back in 2014 - has been the focal point of these bearish bets; short sellers have borrowed more than 15% of its shares outstanding. Grubhub's recent bumper results haven't given short sellers reasons to celebrate as of late. The ongoing strong demand to borrow the company's shares indicates that bears are still willing to play the long game with this firm.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.