UK retail sales show first annual fall for 4½ years as real pay squeeze bites

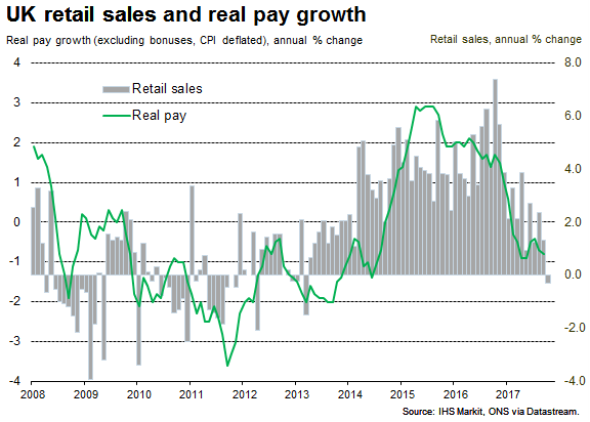

UK retail sales showed the first annual decline since March 2013 at the start of the fourth quarter. Sales were up 0.3% compared to September - beating analysts' expectations of a mere 0.1% rise - but down 0.3% on the same period last year, according to the Office for National Statistics.

The annual comparison suffered due to an especially strong October last year, when growth peaked at 7.4%. However, the extent to which annual sales growth has slipped from boom to decline over the course of a year underscores the plight faced by retailers and the degree to which households are being squeezed.

As to the cause of the deteriorating trend in the retail sector, fingers generally point to the ongoing double-whammy of rising prices and weak pay growth. Real pay has been in continual decline since February, with the latest numbers showing inflation rising at 3.0% but regular pay growth at just 2.2%. Food prices are rising at their fastest rate for four years.

Mixed outlook

With inflation looking likely to have peaked either in October or November, the squeeze on household finances may start to ease in coming months, providing pay growth does not falter. Survey evidence from recruiters in fact suggests that a lack of candidates to fill vacant jobs is helping drive up starting salaries, which should help boost wider pay growth in coming months.

The latest Household Finance Index survey in fact recorded an uptick in financial confidence in October that contributed to a slight recovery in households' appetite for spending on big ticket items such as cars, holidays and large household appliances. The worry is that the rise in spending signalled by the survey was being fuelled at least in part by rising demand for unsecured credit.

Furthermore, the latest labour market data brought news of the employment trend deteriorating in recent months, which may lead to increased job insecurity and cause some pull-back in consumer spending, especially if Brexit uncertainty intensifies.

On balance, therefore, the outlook for the retail sector remains highly uncertain, and risks to the downside suggest that sales may come under further pressure in the near-term.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com