Referendum sees bears circle UK hospitality firms

Short sellers have targeted UK hospitality operators as the impending referendum and newly enacted national living wage cloud the sector.

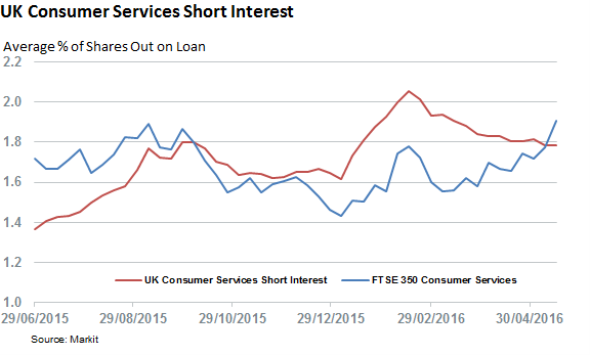

- Consumer services FTSE 350 constituents have seen a 30% increase in short interest ytd

- Whitbread and Restaurant Group have seen the largest jump in short interest across the sector

- The Markit/CIPS UK Services PMI indicated that the living wage coincided with a sharp rise in costs

UK hospitality firms, which depend on cheap and plentiful labour, have become target of short sellers in recent weeks as the rise in the UK's minimum wage and the risks around the UK's upcoming EU referendum threaten to throw the sector into turmoil.

Consumer services, the sector which encompasses the hospitality sector, constituents of the FTSE 350 index have seen their short interest jump by 30% year to date on average, which is over three times the level seen across the index's average. The sector used to see less demand to borrow on average than the overall index but the recent surge in shorting activity, which has taken short interest to an 11 month high across the sector, means that the sector now sees 7% more shorting activity than the index as a whole.

Most of the surge in shorting activity has occurred in the weeks since the referendum was announced in February and short sellers show no signs of slowing down in the lead-up to next month's election despite the news that the "remain" camp was ahead by 15% in a recent poll.

Whitbread-Restaurant Group targeted

The two firms which underpin the recent spike in short interest are Whitbread, the UK's largest hospitality, and Restaurant Group which operates casual dining chains across the country.

Whitbread, which is by far the biggest of the two, has underperformed the FTSE 100 by over 7% ytd has been one of the most vocal corporate proponents of the "remain" campaign. Its short interest has climbed by over 500% ytd to 3.1% of shares outstanding. The most recent spike in short interest marks the first time short sellers have borrowed more than 3% of the company's shares since 2009.

The latter firm has seen its shares fall by more than 50% ytd in the wake of three profits warnings. This dire share price performance has seen short sellers double their positions to 4.5% of the company's outstanding shares.

Pub firms Marston's and JD Weatherspoon and bookmakers Ladbrokes, all of which have underperformed the FTSE 100, round out the top 5 most shorted FTSE 350 index constituents.

PMI data indicates headwinds

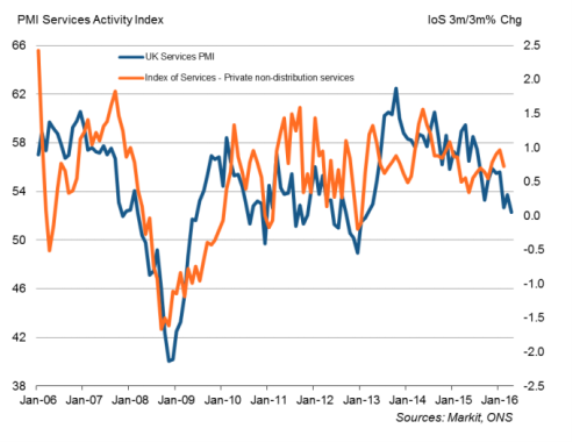

The uncertainty spurring on the recent bearish investors sentiment also reflected in the operating environment according to the latest publication of the Markit/CIPS UK Services PMI indicated that growth among UK services firms, which includes the hospitality sector, slowed down to the weakest pace in over three years.

The rate of inflation reported by survey respondents jumped to a 27 month high which showed the immediate impact of the national living wage on the industry's bottom line.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.