Roll on spring

Its mid-March, spring is upon on us and the credit markets are rallying. A rate hike by the US Federal Reserve was greeted positively by the market thanks to a dovish tone struck by Janet Yellen and her colleagues.

Technical factors also played their part. Option expiry occurs on the third Wednesday of the month, and position covering no doubt contributed to the tightening in the indices.

But mid-March also means that another regular event in the CDS market is impending. The semi-annual roll is on March 20, resulting in a longer contract and new constituents for the on-the-run indices. This iTraxx Europe roll hasn't resulted in a huge amount of changes, but some of them are noteworthy nonetheless.

Two names have been removed from the iTraxx Europe on ratings grounds. Specialty chemicals firm Lanxess agreed to acquire Chemtura a few days after the last roll, which prompted S&P to place its BBB- rating on negative outlook. Ericsson's BBB- rating is also on negative outlook from Moody's amid poor financial performance. Four other names, including Astrazeneca, Linde, SABMiller and Bayerische Landesbank were removed as they failed to meet the liquidity criteria.

Ericsson is the only one of the six to merit inclusion in the Markit iTraxx Crossover index, Lanxess's spreads being too tight. Three names in the Crossover series 26 are removed on this criterion: NXP, ConvaTec and STMicroelectronics. HeidelbergCement is now investment grade and thus funds itself in the Markit iTraxx Europe, while Unilabs completes the list of excluded names, as it has less than "100m in outstanding bonds.

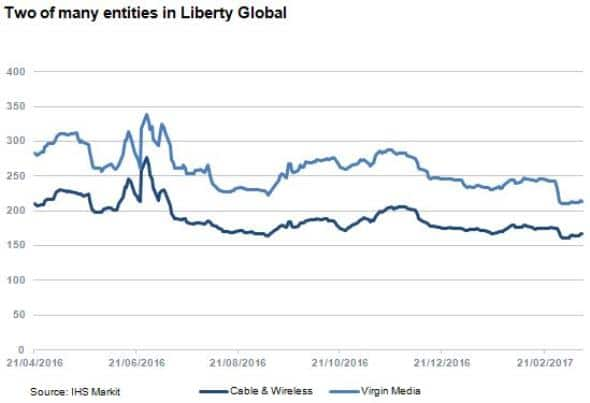

Perhaps the most striking aspect of the Crossover constituents, though, isn't a new one. No fewer than seven of the names making up the index are part of the Liberty Global group. The US telecoms firm is highly acquisitive, most recently taking control of Cable & Wireless - one of the Liberty names in the index - in 2015. Liberty's M&A spree has left it with a complex capital structure and considerable leverage. Despite this debt burden, however, the parent entity Liberty Global doesn't trade in the CDS market as it depends on distributions from its subsidiaries, where the debt resides. Companies such as Liberty Global are a reminder that CDS market participants often get their edge through accurate reference data and high quality corporate structure research, as well the more obvious fundamental and technical factors.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.