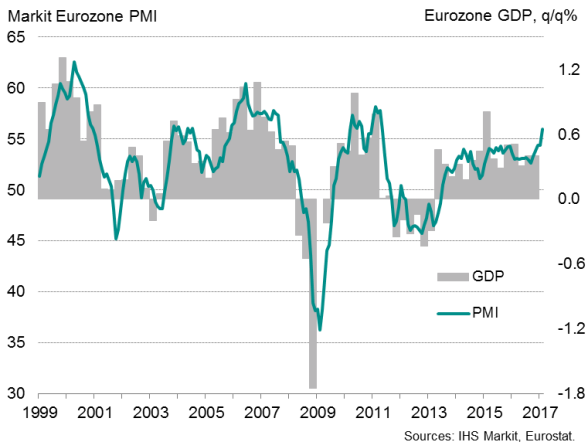

Eurozone PMI signals 0.6% eurozone growth in first quarter

The pace of eurozone economic growth improved markedly to hit a near six-year high in February, according to PMI" survey data. Job creation was the best seen for nine and a half years, order book growth picked up and business optimism moved higher, all boding well for the recovery to maintain strong momentum in coming months.

Inflationary pressures meanwhile continued to intensify, all of which adds to scope for the ECB to start talking about tapering its stimulus later in the year if such solid growth is sustained.

Increased rate of expansion

The Markit Eurozone PMI registered 56.0 in February according to the preliminary 'flash' estimate. Up from 54.4 in January, the latest reading was the highest since April 2011.

The rise in the flash PMI means that GDP growth of 0.6% could be seen in the first quarter if this pace of expansion is sustained into March.

Economic growth

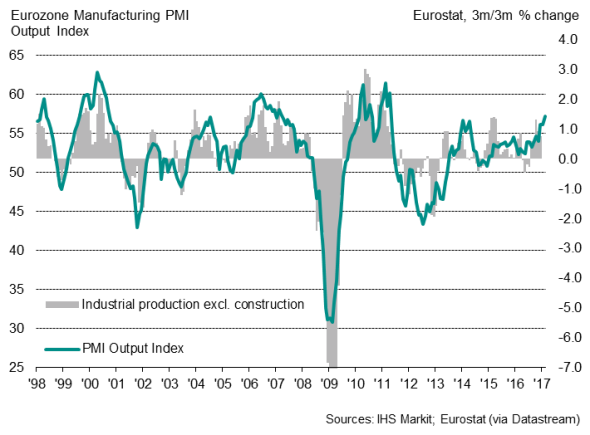

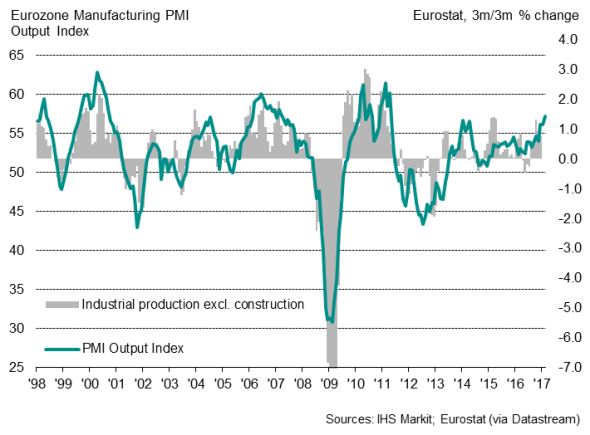

Growth accelerated in both manufacturing and services to rates not seen since early-2011, with the goods-producing sector again enjoying the faster rate of expansion, aided by exports being boosted by the weaker euro.

Manufacturing output

February saw the largest monthly rise in employment since August 2007 as rising sales encouraged hiring. Service sector jobs were created at a rate not seen for nine years and factory headcounts showed the second-largest rise in almost six years.

Employment

Firms' appetite to hire was also buoyed by improved confidence about the outlook. Business expectations about activity levels in a year's time rose to the highest since comparable data were first available in July 2012.

The survey therefore indicates that companies are currently firmly-focused on expanding in the face of rising sales and fuller order books.

The big surprise was France, where the PMI inched above that of Germany for the first time since August 2012. Both countries look to be growing at rates equivalent to 0.6-0.7% in the first quarter.

France's revival represents a much-needed broadening out of the region's recovery and bodes well for the eurozone's upturn to become more self-sustaining.

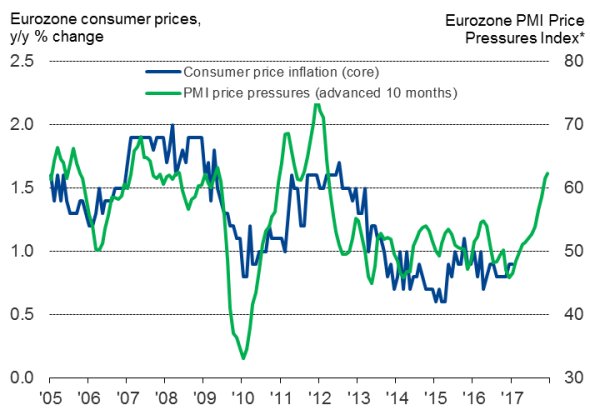

Rising inflationary pressures

Inflationary pressures meanwhile continued to intensify. Firms' average input costs rose in February at the steepest rate since May 2011, with rates accelerating in both services and manufacturing. The latter once again recorded the steeper rise, linked to higher global commodity prices, the weak euro and suppliers regaining some pricing power amid stronger demand.

Inflation

Suppliers' delivery times, a key indicator of supply chain capacity constraints and pricing power, signalled that delivery delays were the most widespread since June 2011.

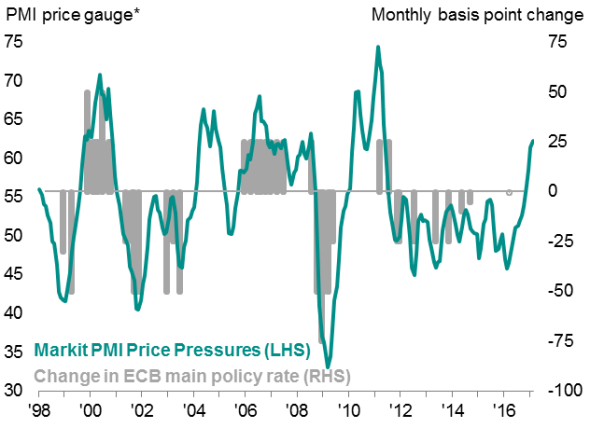

An index based on the combination of input costs and suppliers' delivery times provides a useful gauge of price pressures, and tends to move ahead of core inflation. This gauge is now at its highest since May 2011.

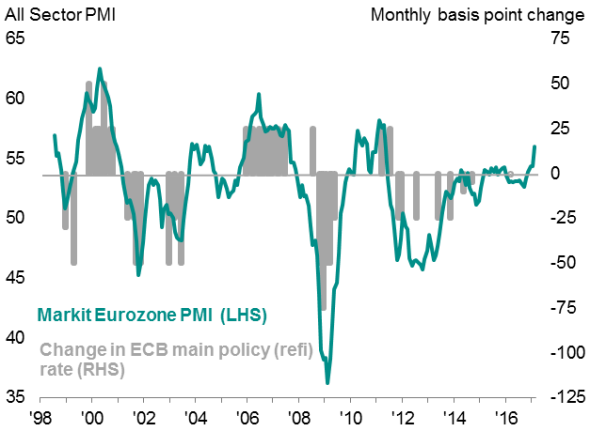

The ECB will be cheered by the signs of stronger growth and further upturn in price pressures. Only in 2004 and 2010 have we seen the combination of such robust growth and rising price pressures without the ECB tightening policy (see charts). However, policymakers will no doubt remain concerned that elections and Brexit could disrupt the business environment this year. No change in policy therefore looks likely until at least after the German elections in September.

ECB policy and PMI business activity

ECB policy and PMI price pressures

* Based on input prices and supplier delivery times indices

Sources for charts: IHS Markit, Eurostat.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com