US manufacturing production trend close to stalling

Official data showed a poor start to the third quarter for US manufacturers, corroborating earlier survey data from IHS Markit. Output fell 0.1% in July, according to the Federal Reserve, marking the third monthly fall in the past five months.

The volatility of the monthly data make it unwise to read too much into any single data point, and looking at the change in production in the latest three months compared to the prior three months provides a smoother series. Here the picture was similarly disappointing, with the data showing the weakest rise in output since last October. Production was up just 0.1% in the latest three months.

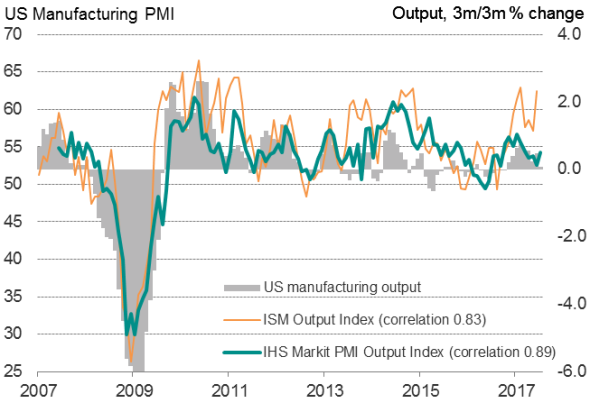

Surveys v manufacturing output

This near-stalling of the manufacturing sector had been signalled in advance by the IHS Markit PMI, which in June had fallen to 52.6 - its lowest since last September. The good news is that the survey's Output Index has since risen to 54.1. This latest index reading was a four-month high and suggests that the official data will perk up again in August, albeit only tentatively (see chart).

The similarly weak production trends recorded by the recent official and IHS Markit PMI data contrast with strong expansion registered by ISM survey. The ISM Output Index rose to 62.4 in June, indicating one of the largest monthly expansions seen over the past seven years, and fell back only slightly to remain at an elevated 60.6 in July.

The more-accurate signal from the IHS Markit data is no fluke: the series exhibits an 89% correlation with the three-month change in the official manufacturing output data, with the PMI acting with a one-month lead. The equivalent index from the ISM exhibits a lower 83% correlation over the same period.

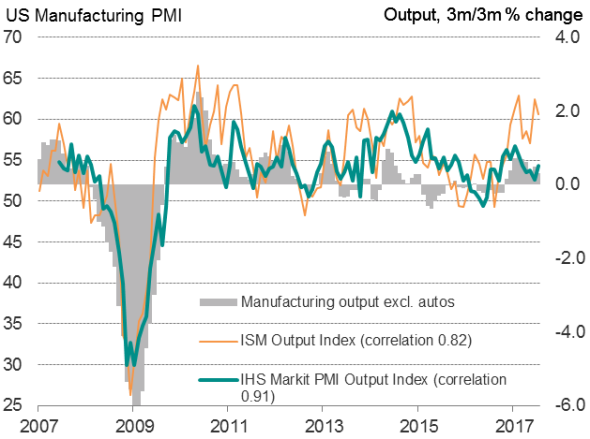

If the volatile auto sector is excluded (in which post-financial crisis incentives distorted the underlying manufacturing trend compared to the surveys), the correlation with the IHS Markit PMI data rises to 91% (but drops to 82% for the ISM).

Flash PMI data will be updated by IHS Markit on 23rd August, providing a more comprehensive view of economic trends in the third quarter.

Surveys v manufacturing output excluding autos

Sources: IHS Markit, Federal Reserve.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com