Stocks to watch out for this week

We reveal 40 stocks that are heavily targeted by short sellers ahead of earnings announcements

- Mattel short sellers multiply since the Toys R Us bankruptcy

- Norwegian Air targeted by short sellers after war of words with Ryanair

- BYD short sellers willing to double down in the face of its recent rally

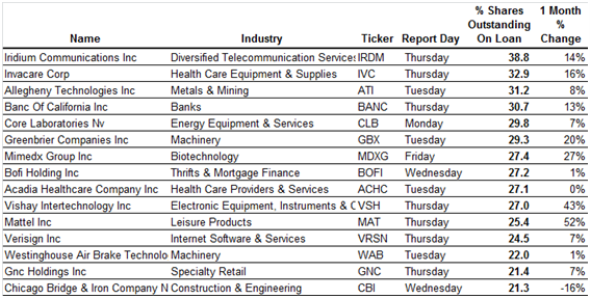

North America

The company seeing the largest portion of its shares out on loan this week, satellite phone operator Iridium, is literally out of this world.

Although the company’s current short interest is stratospheric, a large part is likely due to reasons other than directional shorting: Iridium has relied heavily on convertible bonds and preference shares to fund its new satellite constellation. The few iridium directional short sellers are also likely to be ruing their decision – Iridium’s shares surged to new multi-year highs after the company’s last earnings update delivered better than expected numbers.

Invacare – the second most shorted company announcing earnings this week – has also relied heavily on convertible bonds to fund itself. However, a large part of its short interest is most likely directionally-driven. Short sellers are also increasing their positions in Invacare since the company’s last set of earnings missed expectations. While Invacare shares have traded largely flat since these disappointing earnings, short sellers think that the lull won’t last forever, and they have more than doubled their positions.

The last month has also seen short sellers circle round toymaker Mattel, which has seen the demand to borrow its shares jump by over 50%. Mattel has the shock Toys R Us bankruptcy to thank for this deterioration in investor sentiment (since the firm was its largest distribution partner).

Mattel shares have lost more than a quarter of their value since Toys R Us announced its bankruptcy filing, but bears aren’t going anywhere. The demand to borrow the company’s shares has continued to climb with every new low registered.

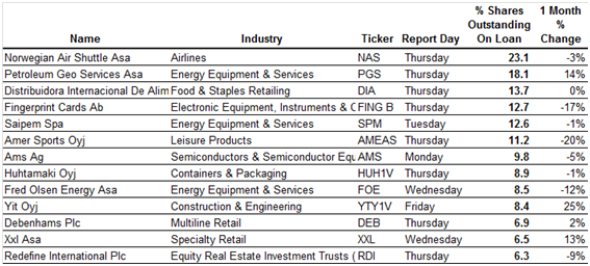

Europe

Europe’s top short this week is perennial short Norwegian Air Shuttle. Nearly a quarter of its shares are out on loan ahead of Thursday’s earnings announcement. Norwegian has been tied up in a war of words with fellow budget airline Ryanair over the last few weeks; its arch rival flung accusations of pilot poaching that forced Ryanair to cancel thousands of flights.

Ryanair shares lost more than 10% of their value since the news broke, but short sellers think that Norwegian will offer the most downside going forward. Nearly a quarter of Norwegian’s shares are being shorted, while less than 1% of Ryanair shares are now out on loan.

The largest European short play outside of Scandinavia this week is Spanish grocer Distribuidora Internacional De Alimentacion (DIA). The recent troubles in Catalonia have dragged down the value of the company’s shares, however, short sellers haven’t taken the opportunity to add to their positions. The demand to borrow DIA shares has remained flat over the last month.

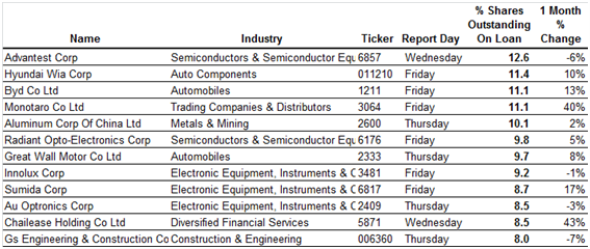

Asia

Semiconductor test equipment firm Advantest is the most shorted Asian firm announcing earnings this week; nearly 13% of its shares are now out on loan. Short sellers have more than doubled their positions in Advantest following its last earnings announcement. Revenue and profit results failed to live up to expectations, analysts think Advantest’s recent setback is only a passing trend. They are forecasting the firm to post a healthy 15% increase in revenue – yet the company’s surging short interest proves this rosy forecast also has plenty of thorns.

Hong Kong traded BYD takes the last step on this week’s most shorted Asian companies announcing earnings. Short sellers have remained relatively steadfast in BYD over the last few months – despite a rally which has seen the company’s shares surge by more than 70%. Shorts will find it increasingly hard to double down in BYD since its current short interest represents more than 80% of lendable shares.

Simon Colvin, Research Analyst at IHS Markit

Posted 23 October 2017

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.