Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Walgreens-Rite Aid saga continues to drive short sellers

- Carillion still heavily shorted despite the recent implosion of its share price

- Asian short sellers circle round apparel retailer Right On as its results slip

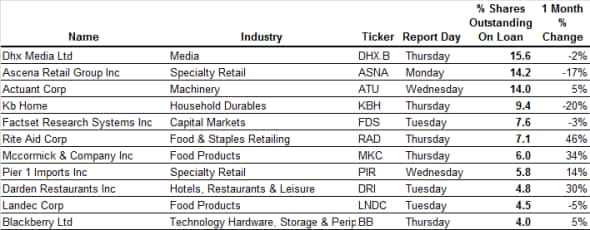

North America

The most shorted company announcing next week is Canadian film and TV production firm DHX Media, which has more than 15% of its shares out on loan. Short sellers have steadily built their positions in the company over the last year and a half to the current all-time high.

This increase in bearish sentiment looks to be spurred on by the company's inability to live up to analyst expectations. Its profit margins failed to match the consensus forecast for the last five quarters. Although DHX shares rallied over the last few weeks, the high short interest indicates not every investor is buying into this rally.

Short sellers continue to pick over the carcass of the Walgreens -Rite Aid tie-up which came to light in October of 2015. The initial deal would have enabled Walgreens to acquire Rite Aid for $9.4bn, but it came undone after the firms failed to jump over regulatory hurdles.

Both Walgreens and Rite Aid have since settled on a much less aggressive compromise deal that will see Walgreens pay $4.4bn for roughly 1,900 Rite Aid locations. Short sellers have little faith in Rite Aid as a standalone company - the demand to borrow shares of the company has jumped by more than 40% in the last month.

Blackberry narrowly makes this week's list of top short targets with more than 4% of its shares out on loan. While relatively high, the current demand to borrow marks a steep improvement in investor sentiment over the last 12 months.

Most of this covering occurred in the days following Blackberry's second quarter earnings update. The market views this as a major step forward in its efforts to pivot to the software space.

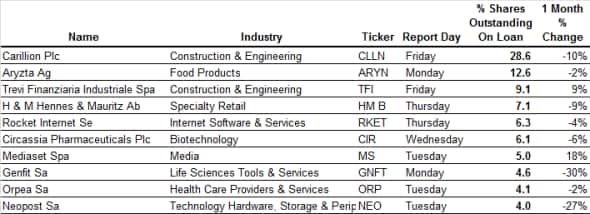

Europe

The top short play among European companies announcing earnings this week is UK construction firm Carillion. It has 28% of shares out on loan on the eve of its interim results announcement.

Carillion has already been a cash cow for bears since the shock profits warnings led to its CEO's ouster. Short sellers think this slump may have more room to run. The demand to borrow shares is roughly the same as it was just back in July, just before the latest implosion.

The only other firm to have more than 10% of its shares shorted prior to earnings is Swiss-listed Irish baker Aryzta, which has 12.6% of its shares on loan. Aryzta's heavy short interest comes after a string of disappointing trading updates - most notably its latest in the second quarter of 2017 that sank its shares by a third.

Aryzta shares have rallied somewhat from the depths set in February, but the company is still under intense scrutiny. Short sellers are driving the demand to borrow shares to a level that is more than two thirds higher than it was at the start of the year.

Retail remains a popular play among European investors - clothing giant H&M has more than 7% of its shares out on loan. Short sellers have circled the firm over the last couple of years, as the hypercompetitive retail environment took its toll on the company's growth credentials. H&M shares lost a third of their value from the highs set back in early 2015.

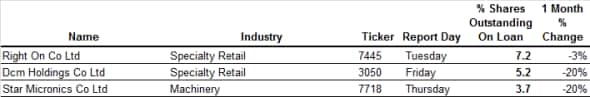

Asia

The high conviction short play among Asian companies is Jeans retailer Right On, which has 7% of its shares on loan. Demand to borrow Right On steadily ticked up over the last 18 months. The firm slipped into a loss, and this earnings setback has been profitable for short sellers. Right On shares have more than halved from their recent high back in March of last year.

The other two Japanese firms who round out this week's list of heavily shorted Asian firms is DCM Holdings and Star Micronics. Both have seen short sellers trim a fifth of their positions over the last month.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.