FRTB accentuates the need for good, clean data

The introduction of FRTB will put considerable pressure on banks' resources to gather, cleanse and analyse a large volume of transaction and pricing data. The challenges were clearly illustrated last year when the Basel Committee for Banking Supervision published its October 2015 Quantitative Impact Study (QIS) and it could only be completed in a usable form by 31 out of 78 banks.

This inability to aggregate good, clean data to meet the new standards will directly lead to higher capital requirements in banks. According to the most recent QIS results published by ISDA, the add-on capital for non-modellable risk factors (NMRFs) accounted for 30% of market risk capital under the new rules. The study saw a minimum increase in capital of 1.5 times the current levels but only under a full IMA model approval assumption that ISDA believes is unattainable. There is clearly potential to impact these punitive capital add-ons with better data and better management of that data in the context of risk factors.

When the final FRTB guidelines were published in January this year, we were curious to see how much impact data would have under NMRF. Prior capital impact studies conducted by many banks have been based on their existing Risks Not In VaR (RNIV) frameworks. Using sets of historical pricing and transaction data, we conducted an initial study. The results made the impact of transaction data availability very clear.

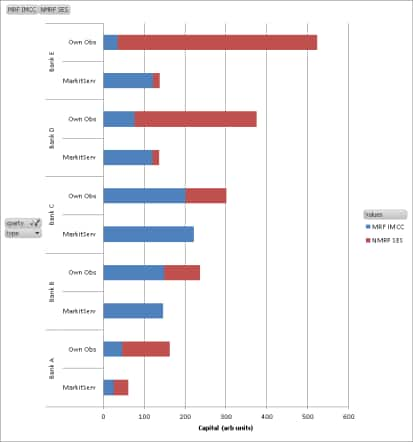

The chart that follows shows the results for the swaps desk of five of the 20 banks examined in the study. Although the findings vary from bank to bank, the addition of an external data set presents the opportunity to significantly reduce the capital held in each instance - and by a significant margin in most cases. No matter how adept at data management, these results illustrate the difficulties banks are likely to face when trying to use only their own observations for proving modellability under FRTB.

We believe the impact of data availability cannot be overstated. Although this example uses a fairly liquid asset class, it does show that a typical bank using only their own transaction data will have meaningful gaps that lead to higher capital requirements. We found that the average saving from using our data is 40% of the swap desk capital compared to banks using only their own data.

There is of course room to add to this analysis using more complex desk strategies. However, it is already evident from this simple example that the potential impact of FRTB as a result of NMRF alone is big enough to require careful evaluation of data and external data sources.

Yaacov Mutnikas, Executive Vice President-Financial Market Technologies, IHS Markit

Tel: +442033670656

Yaacov.mutnikas@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.