Cash no longer king to borrow US equities

Dramatic shifts in the demand to borrow US equities - the most traded asset in the global lending market - have caused an increasingly large portion of lendable inventory to remain unused

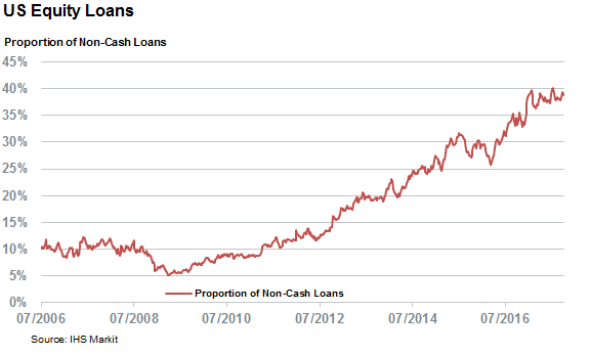

- The share of non-cash loans in US Equities has quadrupled in five years

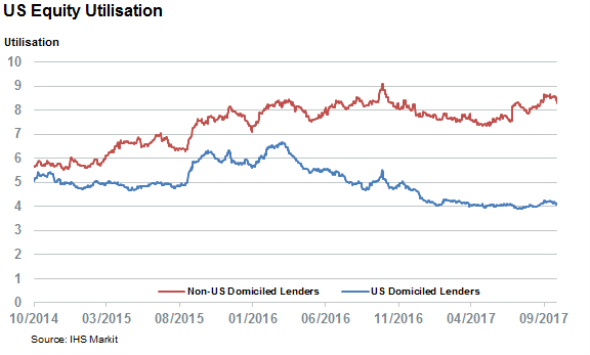

- Cash-only lenders utilization rates less than a fifth of their non-cash peers

- Overseas-domiciled lenders step in to meet demand from non-cash borrowers

This article was featured in the 3rd edition of the IHS Markit Securities Finance Quarterly Review. Click here if you want to access the full 24 page report.

In the past, beneficial owners typically lent out US equities against cash collateral, but this trend started to lose favor to non-cash collateralized trades in recent years. Non-cash collateralized trades accounted for less than 10% of the volume of US equities transactions back in 2012, but their market share has now surged to 40% of the aggregate volume. This shift in collateral preferences is even starker in absolute dollar terms: non-cash balances have jumped more than sevenfold to $140bn since 2012, and cash collateralized trades have stagnated at the $200bn mark.

Much of the shift towards non-cash collateral can be directly linked to the implementation of post-crisis regulations that aimed to reduce bank/broker-dealer funding and liquidity risks; in reality, the new rules forced them to drastically adjust operating practices. Chief among those regulations is the Net Stable Funding Ratio (NSFR), which gauges the health of a bank's assets against the liabilities used to fund its activities. Although NSFR - which is slated to go live in January 2018 - doesn't implicitly dictate bank collateral practices, it creates a regulatory mismatch between the treatment of cash and non-cash collateral in securities lending transactions, making non-cash borrowing far more attractive for banks.

If lenders were free to accept non-cash collateral on equal terms, NSFR wouldn't lead to a dramatic shift in the US securities lending industry; however, the regulatory burdens placed on many US-domiciled lenders will cause a large portion of the US equity inventory to be less appealing to potential borrowers. This lack of appeal will be exemplified by diverging utilization paths between funds which can accept non-cash collateral and those that can't. According to the IHS Markit benchmarking analysis, in the last three years, the utilization rate of $3.5 trillion in US equities held by funds that can only accept cash collateral has shrunk by a quarter to a very meager 1.5%. Funds that can lend either all or part of their US equities against non-cash collateral have proven much more popular with borrowers - these funds now see utilization rates of 7.7%, or five times that of their cash-only peers.

Although regulation has made cash-only lenders much less attractive to borrowers, borrowers still turn to them for high value intrinsic lending. This has enabled cash-only lenders to charge fees nearly three times higher than their less constrained peers. Intrinsic lending isn't enough to overcome their regulatory handicap, however, and the average return for cash-only US domiciled lenders has been less than half of those accepting non-cash collateral.

To rub salt on the wound for cash-only lenders, the returns made from reinvesting cash balances have remained anemic - despite the Fed's recent interest rate hikes. In fact, the average reinvestment returns on cash balances over the first three quarters of the year (26bps) have been more than a tenth lower than the 29.4bps achieved over the same period last year. Astonishingly, these returns are even less than the 27.7bps of cash average cash reinvestment return earned in the opening three quarters of 2015, which predated the Fed's interest rate hike.

Beneficial owners domiciled outside the US are far more likely to accept non-cash collateral, and have been large beneficiaries of the shift towards non-cash. These lenders have seen their US equity book of business grow from $60bn to $102bn over the last three years. This has enabled them to eclipse US domiciled lenders in utilization terms, and these funds now see twice the proportion of their assets out on loan versus their US peers. That is a staggering reversal of fortunes considering both sets of lenders used to achieve roughly similar utilization levels for US equities three years ago.

Although the sands of securities lending are always shifting, the pace and severity at which US cash trading fell out of favor speaks volumes about the lengths to which borrower behavior has changed over the last few years. And it also demonstrates how not catching the right regulatory trend can nearly wipe out the returns derived from securities lending.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.