Are you ready for MiFID II transaction reporting?

Despite the deadline for MiFID II being less than a year away, over 40% of firms have not yet begun to tackle the challenges presented by transaction reporting. This was one of the key findings from our recent webinar, held with WatersTechnology, with over 100 buy-side and sell-side firms from across the globe. A quarter highlighted the January 2018 deadline as the greatest challenge when it comes to meeting the transaction reporting requirements.

These findings show that there is still plenty of work to be done in a very short space of time if firms are to become compliant within the timeframe set out by ESMA. Importantly, firms must prepare to manage significant increases in data volumes under MiFID II, as reporting will be expanded to cover all asset classes, and transaction reports will be extended to include many new fields – 65 in total. In addition, firms must also consider how they will combine and maintain diverse data sets, including transaction, legal entity, personnel and reference data, throughout the transaction lifecycle. It’s perhaps this complexity that led to 21% of our webinar attendees admitting that they do not yet have a full understanding of the work to be done in this area.

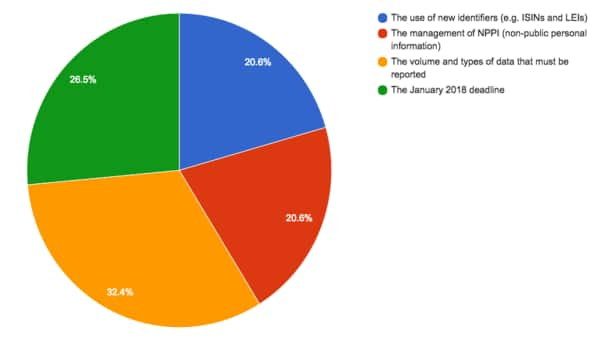

Managing data sets that are growing in size, diversity and complexity is not a straight-forward task. As a result, firms give similar weighting to a number of challenges associated with transaction reporting. The volume and types of data that must be reported was identified by 32% of attendees as the biggest challenge. However, the use of new identifiers, such as ISINs and LEIs, and the management of NPPI (non-public personal information) followed closely – see pie chart below. The requirement around NPPI in particular is unlike any other regulatory regimes, as it requires the collection of personal data on the trader.

Q: Which aspect of the transaction reporting requirements poses the greatest challenge?

Given the challenges, it’s unsurprising that firms are expecting to make sizeable investments in compliance. research (BCG/ IHS Markit MiFID II peer intelligence study) shows that of the overall $2.1 billion spend on MiFID II predicted for 2017, approximately $700 million will be spent on transaction and trade reporting by the asset management and investment banking community. For buy-side firms, transaction reporting will become the most expensive component of their MiFID II technology investment.

To make the most of this investment, firms – across the buy-side and sell-side – should be looking to implement a comprehensive data management solution that can meet all MiFID II requirements. As previously mentioned, there are 65 data fields needed to comply with the transaction reporting elements of MiFID II, compared to just 25 under MiFID I. However, once all of this data is in place, a small number of additional fields can help meet other MiFID II requirements. For example, venue analysis demands only one extra data field, while best execution requires just a further ten and TCA another 20.

An overall enterprise data management solution that can handle all of MiFID II’s requirements using a single, combined data set will be a solid, future-proof investment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.