Factor interactions with credit markets

Research Signals – December 2017

IHS Markit provides financial information across numerous markets, including bond, equity, options, securities lending and credit default swap (CDS), allowing for evaluation of firm pricing across its various underlying securities. The Research Signals factor library taps upon several of these markets to construct equity and CDS indicators that include cross-asset measures. In this report we investigate the impact on equity momentum and short sentiment factor performance when outlook is more closely aligned in particular with credit markets. Some of the findings include:

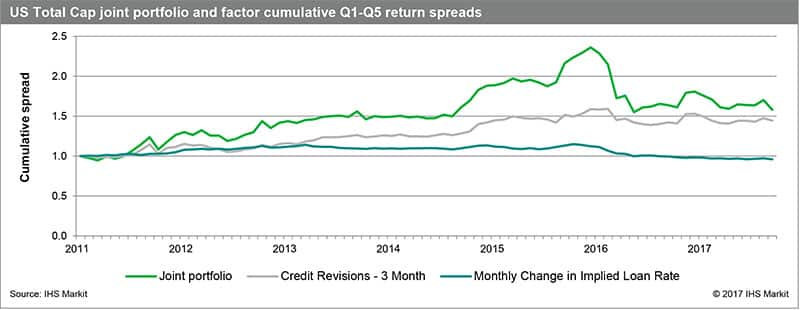

- In US markets, combining momentum signals from both credit and equity markets on average enhances individual factor performance

- In European markets, a joint portfolio of credit risk and price momentum outperforms single factor portfolios, particularly by isolating low momentum stocks with high credit risk

- Stocks with outlier credit risk and costs to borrow shares demonstrate outperformance (or underperformance) on average when compared with the respective groups based solely on the individual characteristics

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.