BLOG

Oct 20, 2020

A better Q3 and clear optimism in most markets with growing concerns and uncertainty over the second wave of COVID-19

Key findings

- Without any doubt, Q2 of 2020 was the worst quarter on record for global trade and this is very likely to apply to 2020 as a whole; nonetheless, the situation in most markets has improved consistently since May

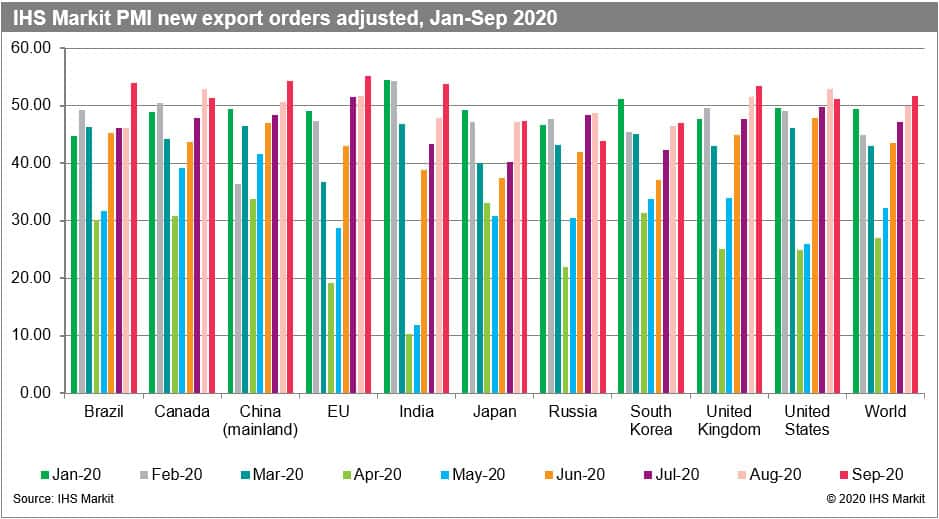

- PMI new export orders' readouts for all the main economies of the world apart from Japan, South Korea, and Russia in September 2020 were above 50.0 points indicative of rising market optimism

- The COVID-19 pandemic is the worst global health crisis in a century particularly challenging to the global economy as it represents a simultaneous supply and demand shock that struck the key economies of the global trading system, and thus main global value chains, with the economic effects driven by the pattern of the pandemic itself and reactions of individual states

- The pandemic starts to resemble the Spanish flu pandemic of 1918-19 which raises the probability of second/third waves thus increases the likelihood of the double/triple-hit scenario; the incoming information can dampen the growing optimism in the markets; the IHS Markit PMI readouts for October 2020 will be a key guide for the forthcoming developments

- China (mainland) is the only top economy showing clear and consistent signs of recovery in Q2 and Q3; the results for September point to a recovery in South Korea as well

Changes in exports and imports of the top ten economies

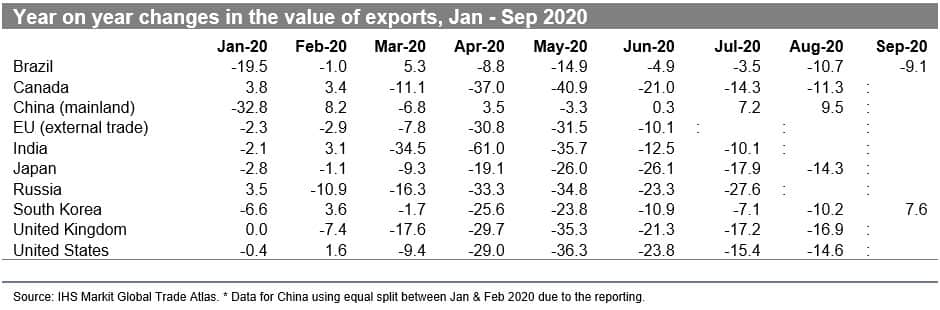

- Year-on-year (yoy) changes in exports in May 2020 were negative for all reporting states ranging from -3.3% for China up to -40.9% for Canada; June 2020 brought about an improvement on May 2020 for all reporting states apart from Japan; July brought a further improvement on June with exception of Russia

- Yoy changes in July 2020 varied from +7.2% for China and lower decreases in the value of exports for Brazil (-3.5%), South Korea (-7.1%), India (-10.1%), Canada (-14.3%), the US (-15.4%), the UK (-17.2%), Japan (-17.9%); Russian exports in turn were lower by -27.6%

- In August we saw a further increase in Chinese exports to +9.5% yoy and an improvement in all other states such as Canada (-11.3%), Japan (-14.3%), the US (-14.6%) and the UK (-16.9%), the situation in comparison to a prior month worsened only in the case of South Korea (-10.2%) and Brazil (-10.2%)

- The available data for September 2020 is optimistic - Brazilian exports are lower by less than 10% (-9.1%) and South Korean exports are larger by 7.6% yoy

- China is the only top economy showing clear and consistent signs of recovery in Q2 and Q3 2020 - Chinese exports were higher by 0.3% in June, 7.2% higher in July, and 9.5% higher in August

- Taking all eight months of 2020 (Jan-Aug) to the corresponding period of the last year Chinese exports are lower by 2.3% in total with some prominent markets already growing - Turkey (+15%), Saudi Arabia (+13,4%), Thailand (+11.9%), Israel (+10.5%), Poland (+9.2%), Vietnam (+8.8%) or Singapore (+8.5%)

- The South Asian revival by now is not only restricted to Mainland China (actually it includes Hong Kong SAR, Macao SAR as well as Vietnam - not shown in the report) but includes another Southeast Asian top economy - South Korea

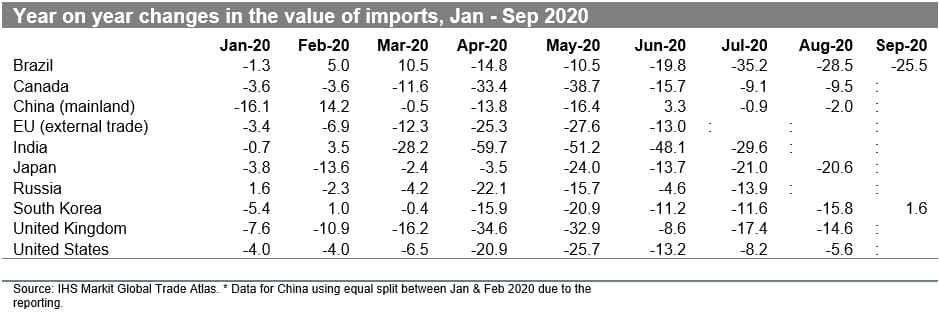

- Changes in imports in June 2020 were negative for all reporting states apart from China (an increase of 3.3% yoy) and ranged from -4.6% for Russia to a massive fall of -48.1% for India

- In July and August all countries that have already reported data for the months in question recorded falls in the level of imports that ranged from -0.9% for China to -35.2% for Brazil in July and from -2.0% for China to -28.5% for Brazil in August 2020

- The situation in Brazil continued into September 2020 with a fall of 25.5% but imports have grown in South Korea yoy by 1.6% (the first time it happened since February)

- In recent months the situation observed in imports is much worse than the situation in exports in all the top ten Asian economies and Brazil this could be indicative of weaker import demand, postponement of purchasing decisions, and substitution of foreign goods with domestic alternatives

Prospects for the forthcoming months

- The reaction in trade so-far is consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigatingit; COVID-19 is a global health crisis with asymmetric impact and represents a simultaneous supply and demand shock with a high degree of unpredictability thus increasing over levels of uncertainty difficult for making sound business decisions

- By 16 October 2020 WHO reported a cumulative number of 39,023,292 confirmed cases globally and 1,099,586 confirmed COVID19-related deaths so far; the number of new cases reported daily is rising and reached 414,000 cases - the highest figure since the beginning of the pandemic. The cumulative number of cases is the highest in the US (8.4 million), India (7.6 million), Brazil (5.2 million), and Russia (1.4 million). It's above 500,000 cases as well in Argentina, Spain, Colombia (close to 1.0 million cases), and in France, Peru, Mexico, UK, South Africa, and Iran. The worst affected regions in total are the Americas, Europe, and South-East Asia

- As has already been stressed several times the impact of COVID-19 on global trade and global economy will depend on the duration, severity, and spatial distribution of the pandemic, with several scenarios possible, and critically depends on the development and implementation of a successful vaccine. The pandemic increasingly resembles the Spanish flu pandemic of 1918-19 which lasted two years and had three distinctive waves;

- The threat of the second wave of the COVID-19 pandemic seems to be materializing with the number of reported cases increasing in recent weeks in many regions of the world and in particular in Europe. An increasing number of states are re-imposing strict overall or partial (regional) lockdowns or declaring states of emergency

- The second wave in autumn 2020 might have drastic consequences for the global economy postponing the expected recovery to the end of Q2 or even Q3 of 2021; the threat of the so-called double-hit or even triple-hit scenario is here potentially changing the shape of the crisis from V to W

- The adjusted manufacturing PMI new exports orders readouts for September 2020 were above of 50.0 points for Brazil, Canada, China, EU, India, UK, and the US, and for the first time in 2020 in the world as a whole; the values were below of 50.0 in the remaining top ten economies: Japan, South Korea, and Russia (where the readouts significantly deteriorated from August); these point to optimism among managers in the prospects for global exports in the forthcoming months and at the same time financial indices for top stock markets are also closer to the values preceding the pandemic which could be indicative of overall higher optimism or higher immunity of financial markets to incoming information on the spread of the pandemic

- Similarly, to the August report, we confirm that the trend in the PMI is clear and consistent within Q2 and Q3 2020 showing a gradual improvement in market confidence from May onwards

- It is however important to note that the September readouts did not have a chance to account for the rise in numbers of new cases reported in recent weeks (potential second wave) thus the October PMI readouts could bring a change in market sentiment

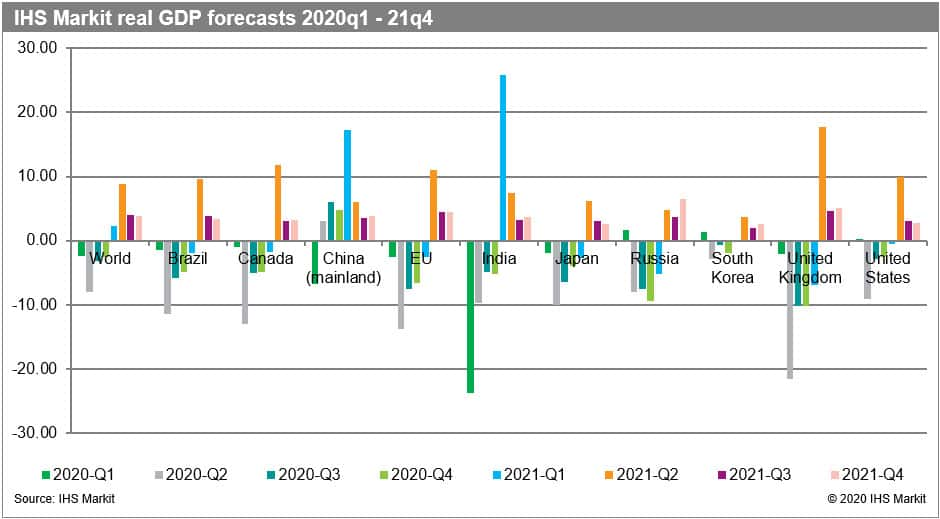

- The most recent real GDP growth forecasts from IHS Markit Comparative World Overview (published on 15 October 2020) point once again to a recession in most of the top economies throughout 2020 and Q1 of 2021, apart from China (recovery already in Q2 2020) and India (recovery in Q1 2021).The readouts for the world indicate positive growth rates already in the Q1 of 2021

- The worst affected countries (regions) in Q3 2020 are the UK (-10.2% yoy), EU (-7.5%), Russia (-7.5%), Japan (-6.5%), Brazil (-5.8%), Canada, and India (-5.0%); China at the same time has been forecasted to grow yoy by 6.0%; the results in comparison to the prior forecast from August have improved

- The forecasts for Q4 2020 vary from -10.2% for the UK to -1.9% for South Korea and +4.8% for China with a deteriorating situation in Russia and South Korea; global real GDP is now forecasted to decline by 2.6% yoy

- Stronger recovery in global real GDP is still expected for Q2 2021; the forecast, unfortunately, depends critically on the ability to deal with the potential waves of the pandemic and thus uncertainty levels are still high; the forecast is not accommodating the effects of the second-wave

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-better-q3-and-clear-optimism-in-most-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-better-q3-and-clear-optimism-in-most-markets.html&text=A+better+Q3+and+clear+optimism+in+most+markets+with+growing+concerns+and+uncertainty+over+the+second+wave+of+COVID-19+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-better-q3-and-clear-optimism-in-most-markets.html","enabled":true},{"name":"email","url":"?subject=A better Q3 and clear optimism in most markets with growing concerns and uncertainty over the second wave of COVID-19 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-better-q3-and-clear-optimism-in-most-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+better+Q3+and+clear+optimism+in+most+markets+with+growing+concerns+and+uncertainty+over+the+second+wave+of+COVID-19+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-better-q3-and-clear-optimism-in-most-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}