A Bond Evaluation of the Anadarko Petroleum Acquisition

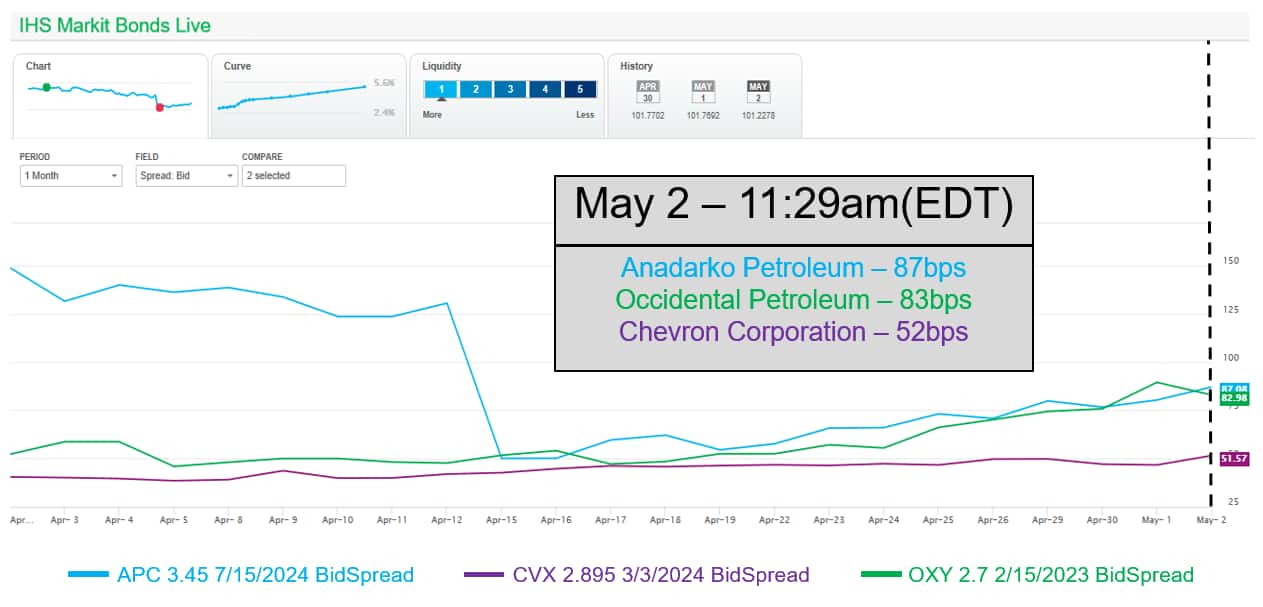

Leveraging Bond Pricing data through our Price Viewer portal, IHS Markit's John Cowan reviews the fluctuation of spreads for Occidental Petroleum (OXY), Chevron Corporation (CVX) and Anadarko Petroleum (APC) - as OXY and CVX make competing offers to acquire APC.

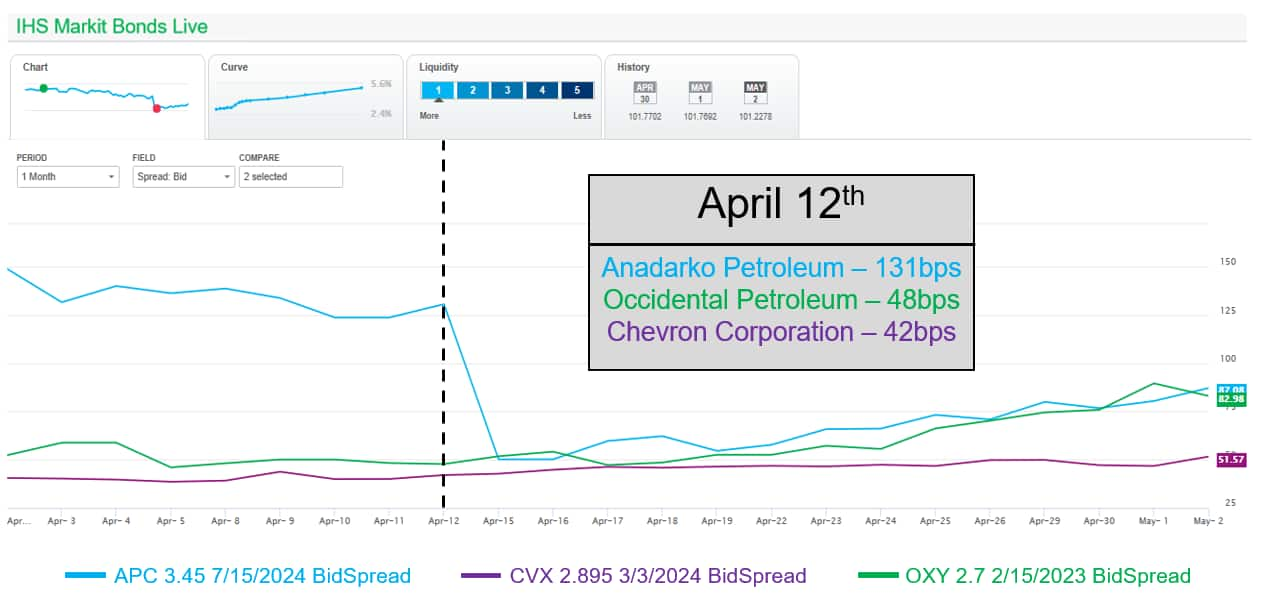

April 12

- Chevron Corporation announced that it had entered into an agreement to purchase Anadarko Petroleum Corporation - cash and stock totaling $33 billion

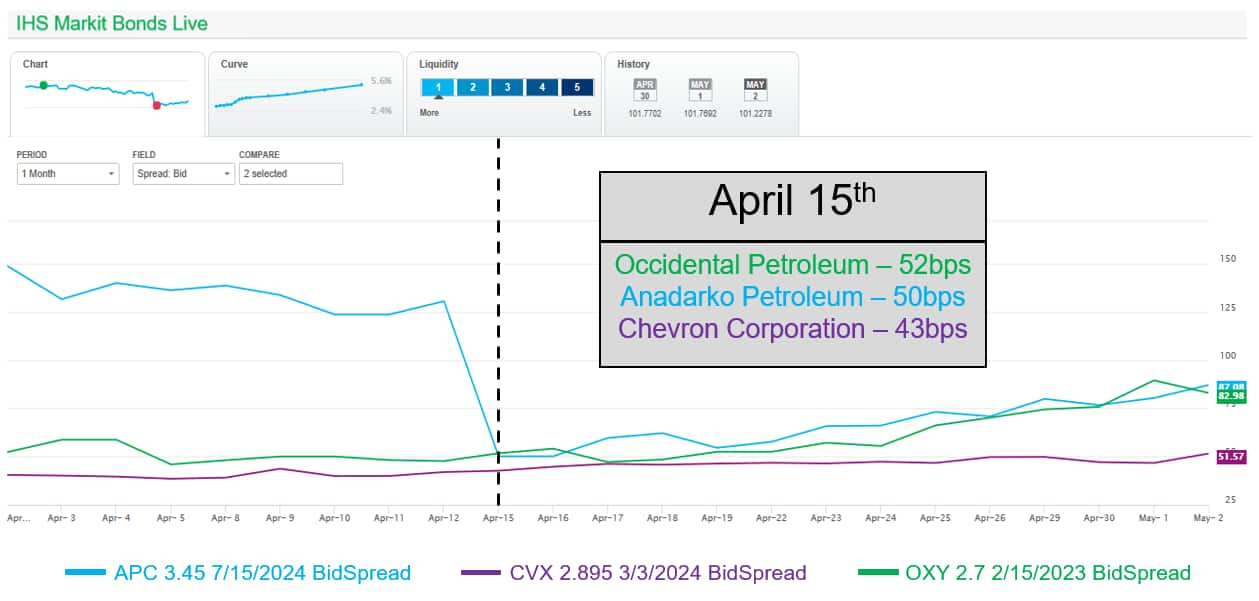

- With the Chevron announcement on April 12, through April 15:

- Anadarko bond spreads tighten approximately 81bps to treasuries

- Chevron bond spreads widened approximately 4bps to treasuries

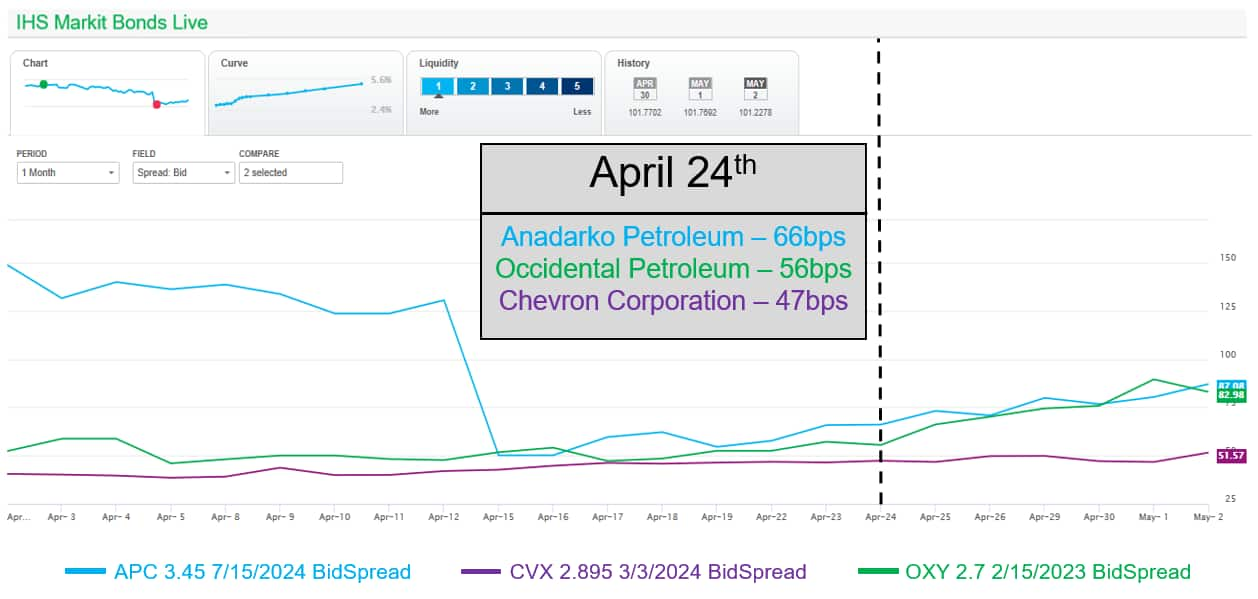

April 24

- Occidental Petroleum Corporation announces that it made a 3rd and public proposal to acquire Anadarko Petroleum Corp - $38 billion counteroffer

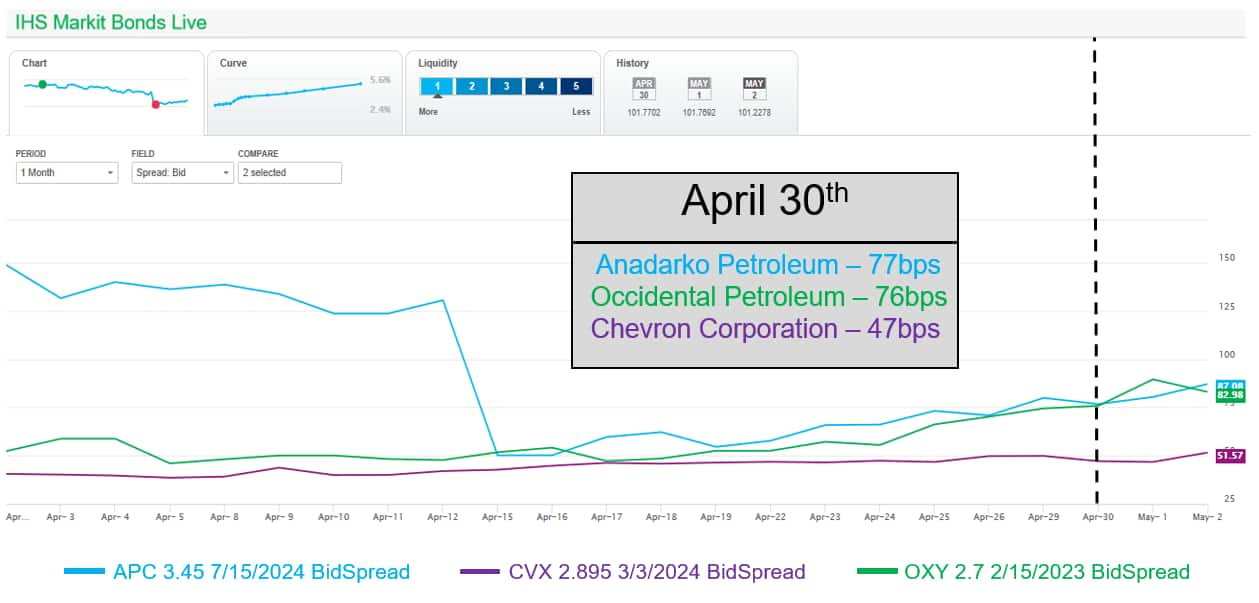

- After the April 24th Occidental announcement, both Anadarko and Occidental spreads continued to widen through month's end, reaching the widest spreads since the April Chevron announcement

Above: Might be an indicator that investor sentiment for the $10 billion preferred stock commitment to Occidental from Berkshire Hathaway on April 30

Spreads as of May 2, 11:29 AM EDT

IHS Markit Pricing Data - Bonds

IHS Markit provides independent pricing, transparency and liquidity data on corporate, government, sovereign, agency and municipal bonds, as well as securitized products. Given the vast number of bond issues in the market, sourcing pricing information can prove difficult. IHS Markit uses price inputs from a variety of sources that are either aggregated to calculate composite levels or fed into a dynamic model to produce a price validated against a number of parameters.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.