A deeper dive into the value-momentum high sigma event

Research Signals - September 2019

While trading anomalies are rare events, they are of much interest to the investment community given their potentially large impact from both a monetary and risk perspective. For example, in August 2012, we reviewed abnormal market events including the August 2007 quant crisis along with the May 2010 flash crash. In this report, we take a closer look at the more recent high sigma event that occurred between 5 September and 10 September with respect to the performance of value strategies relative to growth and momentum strategies. This rotation is of further interest in light of our recent publication investigating value and growth cycles.

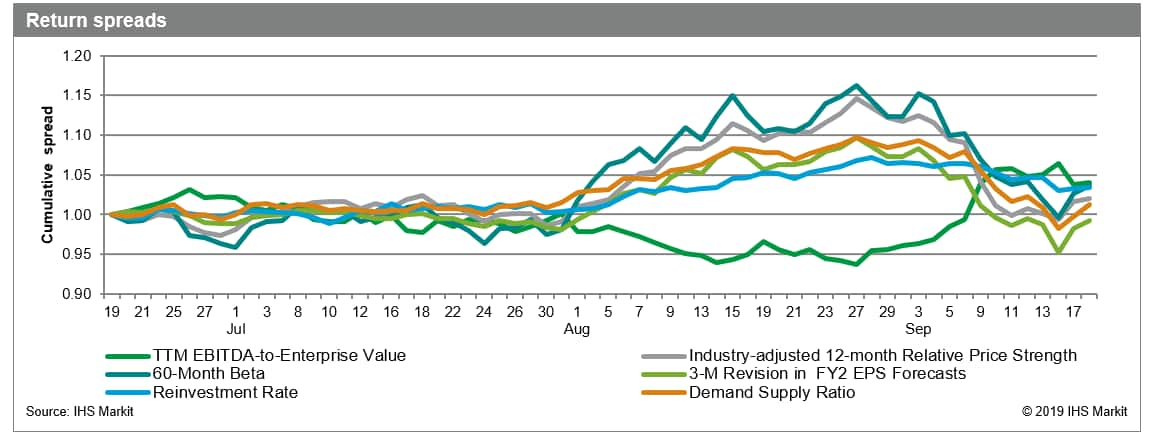

- The iShares S&P 500 Value ETF experienced a dramatic spike in performance relative to its growth and momentum counterparts in the week ending 9 September, reaching the distinction of 3- and 4-sigma events, respectively, followed by quick snapbacks the following week

- Extreme factor reversals relative to value were also evident within our factor library, including that of Industry-adjusted 12-month Relative Price Strength (5.7-sigma), 60-Month Beta (4.6-sigma) and the Historical Growth Model (6.1-sigma)

- While some movement in retail and institutional sentiment preceded the 9 September factor reversal, the increased relationship between low beta and high momentum stocks may have been of greater importance given the unexpected increase in interest rates around that same time

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.