A focused study on SPACs

Research Signals - June 2022

The interval following the pandemic market bottom through the end of 2021 marked a heightened period of speculative investing, as investors and corporations were flush with cash due to monetary and fiscal stimulus. The proliferation of retail investors and sharp increase in SPAC issuance were indicative of this risk-on environment. However, since the start of 2022, froth has been removed from the equity market, mirrored in the SPAC market by an elevated level of scrapped deals and going-concern warnings. We perform an in-depth examination of this asset class given the heightened importance of identifying signals that have distinguished the more successful SPAC listings.

- While SPAC media attention outstripped that of non-SPAC IPOs in late 2020 and early 2021, conventional IPOs outperformed SPACs by a large spread, though this lead was relinquished during the 2022 market downturn

- SPACs have tended to be celebrated on merger announcement days with average returns of 5.29%; however, the enthusiasm tailed off on redemption days (0.18%) and merger completion days (0.84%)

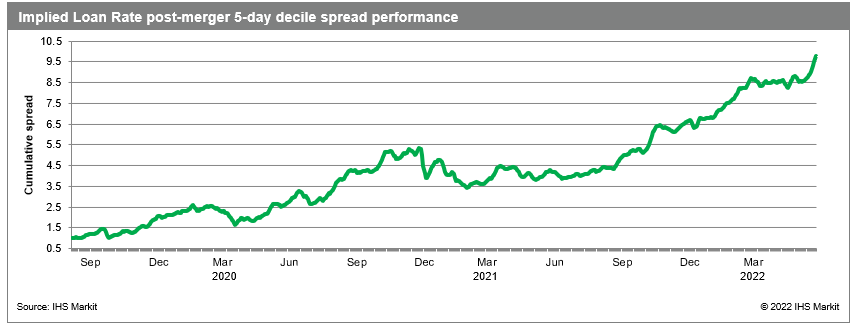

- From an alpha perspective, smaller SPACs outperformed their larger cap counterparts on a daily basis over our analysis period, while Implied Loan Rate, a securities lending indicator, was a strong signal over one- and five-day holding periods

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.