A rough first quarter for bullish sentiment

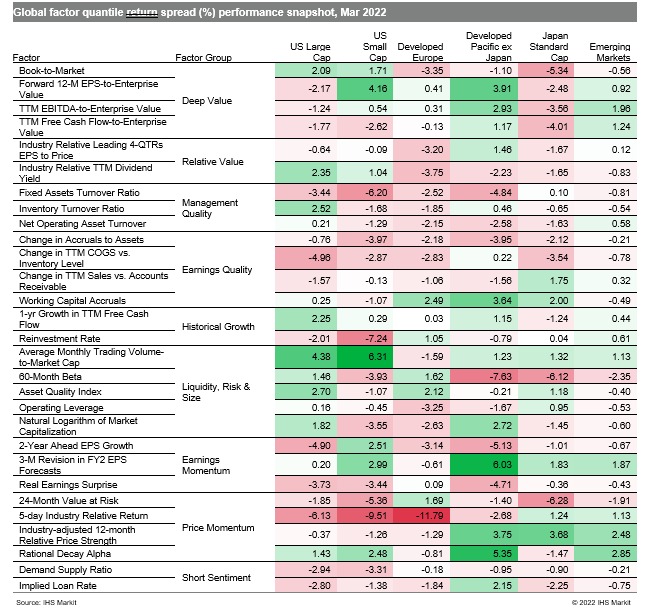

While news from the Russia-Ukraine conflict occupied headlines throughout the month, varying degrees of investor sentiment and factor performance were seen across regional equity markets (Table 1). Economic data was also mixed, as the J.P.Morgan Global Manufacturing PMI slipped to an 18-month low with positive notes from Europe and North America offset by subdued growth in Asia. Alongside the elevated geopolitical tensions, concerns over higher inflation, central bank interest rate hikes and monetary tightening, stretched global supply chains and renewed COVID-19 outbreaks ultimately contributed to the worst quarter for stocks since the start of the pandemic.

- US: 3-M Revision in FY2 EPS Forecasts was a positive indicator in March, particularly among small caps

- Developed Europe: Investors favored growth and quality signals such as Reinvestment Rate and Working Capital Accruals, respectively

- Developed Pacific: An escalation in risk-on sentiment across the region was captured by 60-Month Beta

- Emerging markets: Earnings and Price Momentum, gauged respectively by 3-M Revision in FY2 EPS Forecasts and Rational Decay Alpha, were successful strategies last month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.