Daily Global Market Summary - 09 February 2021

Major equity indices closed mixed across the US, APAC, and Europe. US government bonds closed slightly higher and most benchmark European bonds closed unchanged on the day. European iTraxx and CDX-NA credit indices closed modestly wider across IG and high yield. The US dollar and silver closed lower, while oil, gold, and copper were all higher.

Americas

- US equity indices closed mixed; Russell 2000 +0.4%, Nasdaq +0.1%, DJIA flat, and S&P 500 -0.1%.

- 10yr US govt bonds closed -1bp/1.16% yield and 30yr bonds -1bp/1.95% yield.

- CDX-NAIG closed +1bp/51bps and CDX-NAHY +4bps/287bps.

- DXY US dollar index closed -0.5%/90.44.

- Gold closed +0.2%/$1,838 per ounce, silver -0.7%/$27.40 per ounce, and copper +1.4%/$3.72 per pound. Today was copper's highest closing price since February 2013 and was trading even higher at $3.76 per pound as of 9:38pm EST.

- Crude oil closed +0.7%/$58.36 per barrel.

- The administrators of the COVAX Facility for equitable access to COVID-19 vaccines have issued a statement stressing the importance of further studies to determine the Oxford/AstraZeneca vaccine's effectiveness in preventing more severe illness caused by the B.1.351 South African variant. The "COVAX Statement on New Variants of SARS-CoV-2" was released by the WHO and Gavi, the Vaccine Alliance on 8 February after the Witwatersrand (Wits) Vaccines and Infectious Diseases Analytics (VIDA) research unit in South Africa - which is currently leading the local clinical trials for the AstraZeneca (UK)/Oxford University COVID-19 vaccine - reported that a two-dose regimen of the vaccine provided "minimal protection" against mild-to-moderate COVID-19 infections from the B.1.351 variant. The statement also emphasized that manufacturers must be prepared to adapt vaccines to the SARS-CoV-2 viral evolution. (IHS Markit Life Sciences' Janet Beal and Eóin Ryan)

- The US December JOLTS report suggests that the labor market remained resilient even as businesses were hit by tighter COVID-19 restrictions in December. (IHS Markit Economist Akshat Goel)

- The number of hires fell to 5.5 million, the lowest since last April. There were 6.6 million job openings in December, unchanged, after rounding, for the third straight month.

- Job separations were flat at 5.5 million in December as layoffs and discharges fell to 1.8 million.

- The quits rate, a valuable indicator of the general health of the labor market, edged up to 2.3%, its highest level since the start of the pandemic.

- Over the 12 months ending in December, there was a net employment loss of 5.5 million.

- There were 1.6 workers competing for every job opening in December. In the two years prior to the pandemic, the number of job openings exceeded the number of unemployed in every report.

- British oil major BP has taken a 50% non-operating stake from Equinor in the recently awarded Empire Wind and Beacon Wind projects for a total cash consideration of USD1.1 billion. The projects are off the east coast of the United States, and administered by the New York State Energy Research and Development Authority (NYSERDA). The first announcement of the intended sale was in September 2020. BP has stated that the formation of a strategic partnership with Equinor was an important part of delivering its strategy and plans to become an integrated energy company. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Citing a congressional report found popular baby food brands contain potentially unsafe levels of heavy metals, plaintiffs from a dozen states have filed class action lawsuits against Gerber, Campbell's Plum Organics and Beech-Nut alleging the companies are misleading consumers by portraying their products as safe and free of contaminants. (IHS Markit Food and Agricultural Policy's JR Pegg)

- The class actions were filed Friday (February 5) in three different federal courts one day after a report from the House Subcommittee on Economic and Consumer Policy found baby foods made by Gerber, Beech-Nut, Plum and four other major manufacturers contain "dangerously high levels" of arsenic, lead, cadmium and mercury.

- The report said the findings underscore the perils of allowing the baby food industry to essentially "self-regulate" and showcase the need for FDA to intervene.

- FDA has found that exposure to heavy metals - which are absorbed from soil and water by grains, vegetables and other crops - can cause brain damage in children, but has not crafted specific limits for baby food other than a standard to restrict the amount of arsenic in rice cereal. . This has left baby food manufacturers free to set their own internal standards for heavy metals in their products, limits that critics contend may be far too high given the public health threats.

- The report contends that manufacturers "routinely ignore" their own internal standards and only test their ingredients, thereby concealing higher levels of toxic metals in finished baby foods.

- The US state of California has released is ZEV (zero-emission vehicles) Market Development Strategy (ZEV Strategy), the path forward for meeting its objective of ending non-zero-emission light-vehicle sales in the state in 2035. Along with the aim to eliminate internal combustion engines (ICE) and vehicles powered by fossil fuels, the ZEV Strategy also notes that California aims to reduce vehicle miles travelled, locating more homes, jobs, services and education in close proximity to each other "so that people can rely less on personal cars and trucks and rely more on transit, biking, walking and micro-mobility options." The ZEV Strategy answers some of the questions about setting regulation and government support for the transition, although at this early stage it does not detail specific actions. Setting the priorities, however, does provide a basis for the agencies to make detailed decisions, and can help automakers and others better understand the priorities of the state and make better-informed decisions on how to get there. (IHS Markit AutoIntelligence's Stephanie Brinley)

- DuPont reported fourth-quarter net income of $230 million, up 22% year-on-year (YOY) on gains in electronics and a tax benefit. Net sales of $5.3 billion were up 1% YOY. Volumes were also up 1% YOY for the quarter. Growth in electronics & imaging, led by strength in both semiconductors and smartphone technologies, coupled with further recovery in automotive markets, more than offset continued weakness in oil & gas, aerospace and select industrial markets which led to declines in the safety & construction segment. (IHS Markit Chemical Advisory)

- The electronics & imaging segment reported net sales of $1.0 billion, up 9% YOY. Operating EBITDA for the segment was $323 million, an increase of 10% YOY.

- Nutrition & biosciences reported net sales of $1.5 billion, up 3%. Operating EBITDA for the segment was $341 million, an increase of 8% YOY.

- Transportation & industrial segment sales were $1.2 billion, up 1% YOY. Operating EBITDA for the segment was $317 million, an increase of 14% YOY as higher volumes and savings from productivity actions more than offset price declines.

- Safety & construction reported net sales of $1.2 billion, down 2% YOY. Operating EBITDA for the segment totaled $310 million, flat with operating EBITDA of $311 million in the year-ago period. Continued gains in protective garments partially offset soft aerospace, oil & gas and some industrial markets. Segment volumes were down 7% YOY.

Europe/Middle East/Africa

- European equity markets closed mixed; Spain -1.4%, Italy -0.5%, Germany -0.3%, and France/UK +0.1%.

- Most 10yr European govt bonds closed unchanged, except for UK -2bps and Germany/France/Italy/Spain flat.

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +3bps/247bps.

- Brent crude closed +0.9%/$61.09 per barrel.

- An autonomous vehicle (AV) developed by Oxbotica has completed trials at BP oil refinery in Germany. During these trials, the vehicle travelled over 180 km fully autonomously, safely navigating the complex environment of the refinery. The companies claim this trial to be the first for the energy sector. BP also plans to deploy AVs to monitor operations at the refinery by the end of the year as it believes these vehicles can improve safety, increase efficiency, and decrease carbon emissions at its sites. Erin Hallock, managing partner at BP Ventures, said, "Oxbotica's technology makes autonomous vehicles safer due to improved vision, more efficient due to reduced downtime and less carbon intensive through forensic control of acceleration, braking and driving patterns. We are delighted to partner with a business at the forefront of the future of mobility that can modernize BP through autonomy and look forward to scaling the software across bp's ecosystem." Global energy players are looking to diversify their businesses to lower reliance on fossil fuels. BP claims that the use of AVs at its sites can decrease carbon emissions in support of its net-zero goals. This development follows the company's recent USD13-million investment in Oxbotica. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The European Commission is updating guidance on applying for EU agrochemical approvals of "basic substances" to take account of new rules allowing greater public access to registration data. (IHS Markit Crop Science's Jackie Bird)

- The working document covers substances that are not normally used as agrochemicals but have a value for plant protection purposes. They are eligible for unlimited approval periods but must meet strict safety criteria such as those applying to foodstuffs. The update will apply to all applications submitted after March 27th.

- One of the requirements of the new transparency rules is that applicants must provide details of all the studies that they have commissioned to support their applications. Experience to date has shown that applications for basic substances are mainly based on information that is already publicly available, the Commission says. Nevertheless, applicants that commission or carry out one or several scientific studies after March 27th will have to comply with the transparency rules and notify the European Food Safety Authority.

- Similarly, the requirement to make scientific and study information publicly available, together with the ability to request confidentiality, will apply to applications for basic substances. Companies have to justify that disclosure would potentially harm their interests, but the Commission advises that only "very limited" information would meet the criteria.

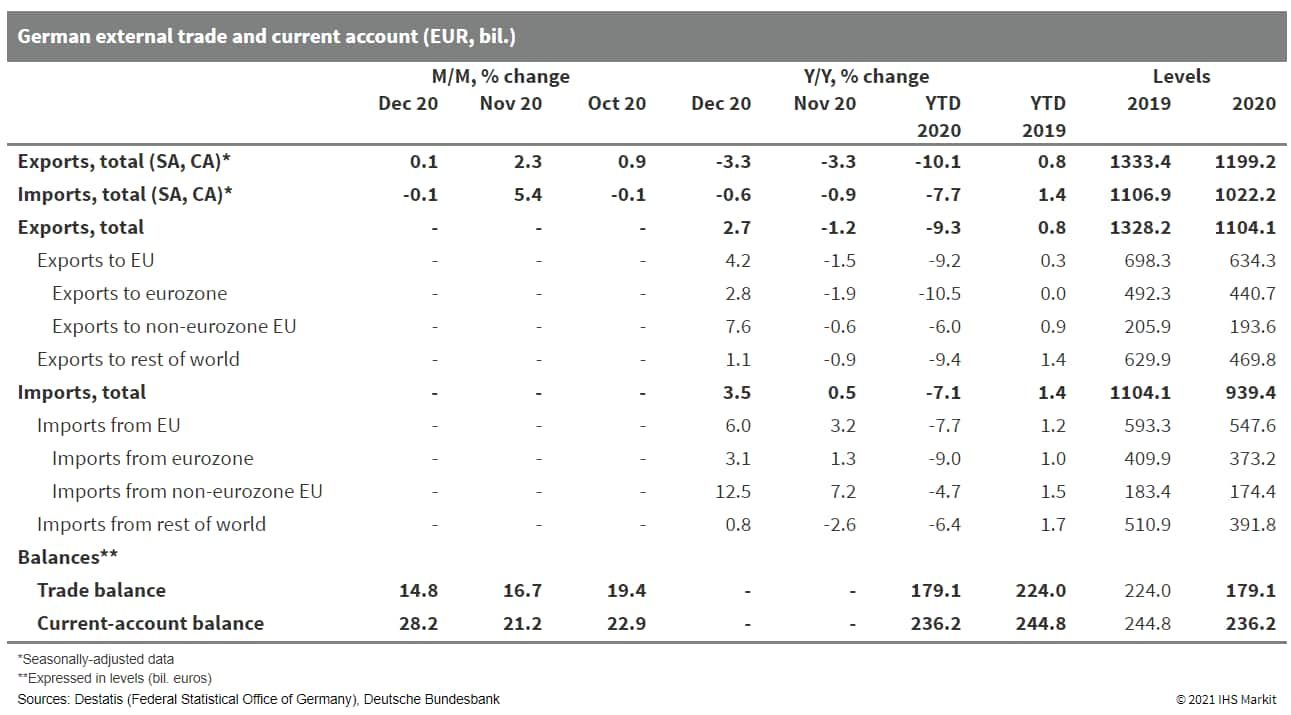

- Germany's Federal Statistical Office (FSO) external trade data for December 2020 (customs methodology, seasonally adjusted, nominal) reveal virtually steady exports and imports in month-on-month (m/m) terms. Seasonally and calendar-adjusted imports were almost back at year-ago levels, while exports were still about 3% lower than in December 2019. Nevertheless, in 2020 as a whole, exports fell by 10% and imports by 8% year on year (y/y). (IHS Markit Economist Timo Klein)

- The seasonally adjusted trade surplus, which was around EUR18 billion during September-October 2020 before dipping to EUR15.9 billion in November, stabilized at EUR16.1 billion in December 2020. Notwithstanding the interim near-20-year low of EUR3.4 billion in April 2020, the monthly average in 2020 was EUR14.7 billion, down only moderately from EUR18.9 billion in 2019.

- The ongoing lockdown - likely to last more or less until at least the end of February - will have a dampening effect on German trade during the first quarter of 2021, but its magnitude must not be overstated because the measures imposed mostly affect the services sector rather than manufacturing, the latter being much more interlinked with international trade.

- The latter point is underscored by the fresh rebound of the IHS Markit PMI export orders sub-index from the December 2020 interim low of 57.3 to 58.8 in January.

- Mercedes-Benz will offer a full range of high-performance AMG variants of its EQ battery electric vehicle (BEV) sub-brands, according to an Autocar report. The report was confirmed by Markus Schäfer, Daimler AG's board member for research and Mercedes-Benz's chief operating officer (COO). Speaking at the launch of Mercedes-Benz's new entry-level EQA BEV, Schäfer said, "An electrical platform in the direction of AMG is coming," adding, "There will be performance variants of the EQA, B, S, E." No further details were provided of Mercedes-Benz's plans for its AMG EQ range, but it is highly likely that the AMG EQA will be the first variant to be launched, as it is the first model of the car mentioned to go into series production. (IHS Markit AutoIntelligence's Tim Urquhart)

- Lonza says it has reached an agreement with a consortium of private equity firms Bain Capital and Cinven for the previously announced sale of the Lonza Specialty Ingredients (LSI) business and operations, for an enterprise value of 4.2 billion Swiss francs ($4.7 billion). The transaction is expected to close in the second half of 2021, subject to customary closing conditions, Lonza says. LSI is one of two segments within Lonza, with the other being pharma, biotech, and nutrition. The LSI business is a provider of microbial control solutions for professional hygiene and personal care products that operates across 17 manufacturing sites worldwide and has approximately 2,800 permanent employees. LSI was reported as discontinued operations in Lonza's 2020 results. The segment's sales declined 2.1% to SFr1.68 billion in 2020. (IHS Markit Chemical Advisory)

- GE Renewable Energy is expanding its facility at Montoir-de-Bretagne, France, to accommodate the assembly of the Haliade-X offshore wind turbine nacelles. The company has awarded a contract to a consortium of subsidiary companies under VINCI Construction for the design and construction of the extension. Activities began in December 2020. The current Montoir-de-Bretagne factory produces Haliade 150-6 MW nacelles and delivered its first of 80 units for the 480 MW Saint-Nazaire offshore wind farm in September 2020. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to the national statistical office (ISTAT), Italy's industrial production declined 0.2% month on month (m/m) in December after a 1.4% m/m drop in November. (IHS Markit Economist Raj Badiani)

- Falling output in December was across several categories. The main falls on a m/m basis arose from consumer non-durables (0.8%) and investment goods (0.8%).

- Therefore, the average output contracted by 0.8% quarter on quarter (q/q) in the fourth quarter.

- In addition, industrial output in December remained 3.7% below its February 2020 level, the last pre-pandemic month.

- Meanwhile, on a working-day-adjusted basis, the picture was bleak, with industrial output falling by 2.0% year on year (y/y) in December. This implies that production contracted by 11.4% y/y in the full year 2020, compared with a 1.0% drop in 2019.

- Some of the largest y/y falls in December occurred in manufacture of textiles, wearing apparel, leather and accessories (28.5%), coke and refined petroleum products (16.5%) and machinery and equipment (4.6%).

- The IHS Markit Italy Manufacturing Purchasing Managers' output index improved from 52.0 in December to a three-month high of 54.4 in January, which is above 50.0 to signify expansion for the eighth straight month. This was due to a further improvement in order books, showing greater resilience to continued COVID-19 restrictions.

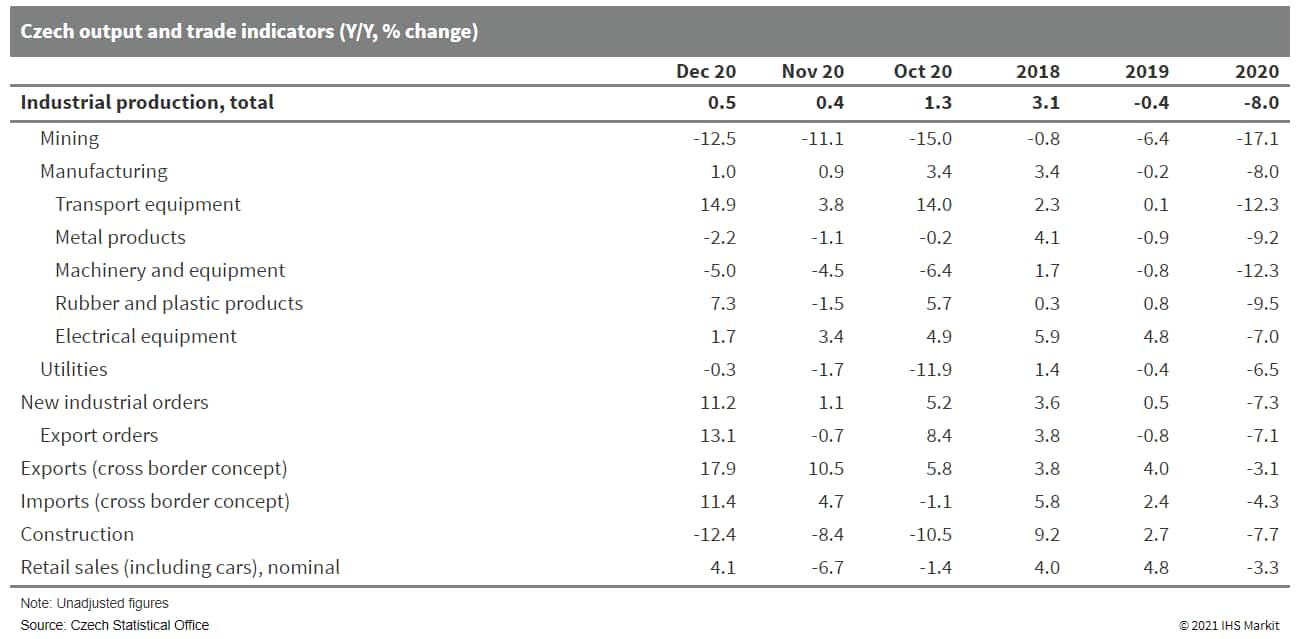

- Czechia's working-day-adjusted industrial output rose by 0.5% year on year (y/y) in December 2020, thanks to modest growth in manufacturing production. In seasonally adjusted terms, industrial output edged up by 0.2% month on month (m/m). (IHS Markit Economist Sharon Fisher)

- Within manufacturing, December 2020 output benefitted from a surge in the transport branch (up by 14.9% y/y, partly owing to low base effects), as well as gains in rubber and plastic products, chemicals, and electrical equipment. Production of computers and electronics, machinery and equipment, and metal products declined.

- Owing to a steep drop in all leading manufacturing branches, Czech industrial output fell by 8.0% in 2020 as a whole, slightly worse than the 7.8% drop that we had expected in our January forecast but better than the consensus estimate of -8.3%. Fourth-quarter-2020 output increased by 0.8% y/y while rising by 3.8% quarter on quarter (q/q) in seasonally adjusted terms.

- On the labor front, industrial employment fell by 3.4% in 2020, while the average industrial wage rose by 1.9%. In the fourth quarter of 2020 alone, employment was down by 3.8% y/y while wages increased by 4.0% y/y.

- Although industrial output growth was modest in December 2020, goods exports soared by 17.9% y/y. Imports have started to recover, but growth (at 11.4% y/y) was still considerably slower than exports, contributing to a rising trade surplus.

- December 2020 results for the construction sector were considerably less favorable, with calendar-adjusted output plunging by 12.4% y/y and seasonally adjusted production down by 2.0% m/m. In 2020 as a whole, construction activity fell by 7.7%, despite a modest drop in the civil engineering sector (down by 1.0%).

- Retail trade bounced back in December, with nominal sales (including the automotive sector) rising by 4.1% y/y, as COVID-19 virus restrictions were loosened prior to the Christmas holiday. In real terms, strong growth in the non-food goods category pushed sales (excluding cars) up by 3.7% y/y and 8.3% m/m.

- In 2020 as a whole, automotive and fuel sales had a negative impact on retail trade. However, excluding cars, real sales were down by just 0.6%, partly thanks to a surge in internet sales.

- Zimbabwe's Chamber of Mines stated on 5 February that the government was reverting to the indigenization program, seeking to limit the shareholding of private and foreign companies in the mining sector to 49%. At the end of 2020, the Zimbabwean government proposed amendments to the Indigenization and Economic Empowerment Act which would give the right to ministers to prescribe minerals to be owned by 'appropriate designated entities'. The proposed amendments are currently going through parliament for approval. Mining is Zimbabwe's largest earner of foreign currency, generating about USD2 billion annually and contributing more than 60% of the country's export revenues. In 2018, the government legislated to allow 100% foreign ownership of mining companies, with the exception of platinum and diamonds. However, the opening up of the sector has had a negligible impact on investment flows and was insufficient to persuade the International Monetary Fund (IMF) and other multilateral financial institutions to disburse loans to the country, the two primary objectives of the legislation. The proposed amendments are highly likely to be approved as a result of the government's comfortable majority support in parliament. (IHS Markit Country Risk's Langelihle Malimela)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +2.0%, Hong Kong +0.5%, Japan +0.4%, India flat, South Korea -0.2%, and Australia -0.9%.

- Officials in China have held a meeting with Tesla on customers' complaints, according to a Reuters report. Reuters reports that Chinese government officials indicated that they met with Tesla over consumer complaints ranging from battery fires and unexpected accelerations to over-the-air update failures. According to the report, China's State Administration for Market Regulation said in a social media post that its officials recently met with Tesla, along with officials from the Ministry of Industry and Information Technology, the Ministry of Emergency Management, the Cyberspace Administration, and the Ministry of Transportation. The report says that the agencies "urged" Tesla to operate according to Chinese law and to protect consumer rights. The Reuters report quotes a Tesla representative as saying that the company will thoroughly investigate problems reported by customers and step up inspections. The company representative added, "We will strictly abide by Chinese laws and regulations and always respect consumer rights." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Baidu has partnered with the Guangzhou Huangpu District government to roll out multi-modal autonomous MaaS (mobility as a service) platform. The platform is powered by artificial intelligence (AI) technology to provide diverse transportation services in Guangzhou (China) by deploying over 40 autonomous vehicles (AVs). This autonomous fleet comprises five different model types - Robotaxi, Robobus, Apolong, Apollocop, and New Species Vehicle, and will begin serving the city starting this Chinese New Year holiday period. To facilitate the service, Baidu has established over 50 Robotaxi pick-up stations in the district and has plans to increase it to 1,000. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) startup Byton is in talks to go public through a merger with a special-purpose acquisition company (SPAC), according to Reuters. The report indicates that Byton is in talks with potential SPACs and investors about its listing plan and aims to go public as early as this year. Byton did not comment on the report at the time of writing. However, the startup has made a few announcements in the past three months to accelerate the market launch of its first model, the M-Byte. In January, the company signed a deal with Foxconn Technology Group. Under the partnership, Foxconn will help Byton begin production of the M-Byte in the first quarter of 2022. According to a Bloomberg report, Foxconn also plans to invest around USD200 million in the startup. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's current-account surplus fell by 2.6% in December 2020 from the previous month to JPY2.3 trillion (USD21.6 billion) on a seasonally adjusted basis but rose by 113.9% year on year (y/y) to JPY1.2 trillion on a non-seasonally adjusted basis. (IHS Markit Economist Harumi Taguchi)

- The non-seasonally adjusted surplus fell by 13.8% y/y to JPY17.7 trillion in 2020, the lowest level since 2015. The continued y/y rise for December 2020 was thanks to increases in the trade surplus (up JPY895 billion to JPY965 billion) and the primary balance (up 47.0% y/y to JPY64.9 billion), offsetting a deficit for the service balance.

- The increase in the trade surplus reflected a 0.3% y/y rise in exports, while imports remained sluggish (down 13.5% y/y). The first increase in exports in 10 months was thanks largely to rises in exports of plastics, non-ferrous metals, and semiconductor machinery, driven by a robust demand in Asia.

- The continued weakness for imports was due largely to lower prices, particularly for resources and mineral fuels. The rise in the primary balance largely reflected increased revenue from direct and portfolio investment.

- Mitsubishi Heavy Industries and Vestas have launched a joint-venture (JV), MHI Vestas Japan, to target the onshore and offshore wind turbine markets in Japan. MHI will hold the majority take of 70%, with Vestas holding the rest. The JV will be headquartered in Chiyoda-ku, in Tokyo, and will be helmed by CEO Masato Yamada, the former Asia Pacific Manager of MHI Vestas Offshore Wind. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Nissan plans to build a sustainable future community in Japan. To achieve this, the automaker has partnered with three local governments and eight companies to develop new modes of transportation using renewable energy. It has begun a field test of new mobility services in the Hamadori area of Fukushima Prefecture to assess receptiveness among residents. The tests include deployment of an electric shuttle service that runs in a loop around the central district of Namie town. The service uses roadside stations as mobility hubs to connect with other vehicles to support travel to nearby areas. The tests also operate an autonomous vehicle (AV) that will run on a route around central Namie. In addition, this initiative aims at building an energy management system that uses electric vehicles (EVs) and stationary rechargeable batteries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

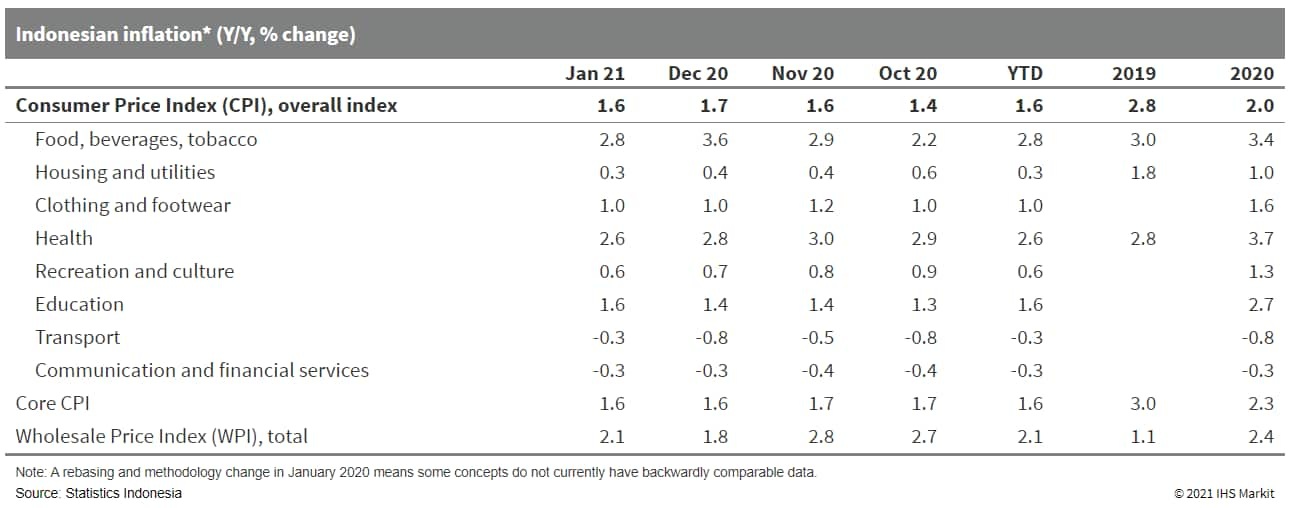

- Indonesia's economic activity picked up slightly in the fourth quarter of 2020, supported by mild improvements in domestic demand, but the economy still contracted by 2.19% year on year (y/y). High frequency data such as consumer price inflation continue to point to a subdued domestic demand outlook, which could remain a drag on growth throughout 2021 unless containment of COVID-19 through social distancing measures or vaccinations beats expectations. (IHS Markit Economist Bree Neff)

- Government consumption spending expanded in real (inflation-adjusted) terms during the fourth quarter of 2020, but at a much slower pace after the significant ramping-up of spending recorded during the third quarter. Government spending for individual consumption rose only 3.2% y/y in real terms during the fourth quarter, down from a 16.2% y/y rise during the third quarter, as the pace of payouts to households slowed. Government spending on collective consumption slowed to 0.9% y/y in the fourth quarter from 5.6% y/y in the third quarter.

- Private consumption spending improved thanks to easing contractions for transport and communication and restaurant and hotel services, although both still contracted by -9.5% and -7.3% y/y, respectively. Households pulled back spending on non-restaurant food and beverages during the quarter, with that category contracting -1.4% y/y in the fourth quarter vs -0.7% y/y in the third quarter, hinting at households potentially reining in their spending because of tighter budgets.

- Fixed investment spending improved very marginally as continued weakness in building investment (- 6.6% y/y) was mitigated by improvements in spending on machinery and equipment (-7.6% y/y in the fourth quarter versus -21.0% y/y in the third quarter). The contraction for transportation investment also eased to -6.5% y/y from -14.6% y/y, possibly led by government projects.

- Core inflation, which excludes volatile food prices and administered prices, held at 1.6% y/y or a survey low, and was flagged by Statistics Indonesia and Bank Indonesia as a sign of weakness in domestic demand.

- The fourth quarter 2020 result was stronger than IHS Markit had expected; as such, it appears that our 2021 GDP forecast will need to be upgraded from 2.9% possibly to the mid-3% range because of better momentum. Our view is that risks to the outlook remain skewed towards the downside; as such, our forecasts will remain close to the bottom of market forecasts.

- As per IHS Markit's Commodities at Sea, Indonesian coal shipments during January 2021 stood at 36.7mt, up 1% y/y. Out of total Indonesian coal shipments, around 50% were destined to China (Mainland). On average Indonesia, shipments to China (Mainland) during 2020 were 30% of their total loadings. However, Indonesian coal shipments to India slowed down for the 3rd consecutive month to 7mt (down 31% y/y). Shipments also slowed down to South Korea (1.3mt, up 41%), Japan (2.3mt, down 20%), Malaysia (1.9mt, down 9%), Taiwan (0.7mt, down 57% y/y), and Philippines (1.3mt, down 29%). Indonesian shipments to China (Mainland) were quite strong to North China ports (4.5mt in November 2020 versus 0.5mt during November 2019). The shipments were high cv coal cargoes for steel mills which were running on tighter inventory ever since there has been an unofficial ban on discharge of Australian coal cargoes. (IHS Markit Maritime and Trade's Pranay Shukla)

- In an article for the Australian Institute of Company Directors, the commissioner of the Australian Securities & Investment Commission (ASIC), Cathie Armour, reiterated that disclosure and management of climate risk is a key responsibility for company directors. Armour warned that although voluntary implementation has progressed, remaining gaps risk formal intervention if consultation-based recommendations prove inadequate. Armour noted that ASIC began climate-related surveillance in 2019-20, regarding it as a systemic risk and seeking "appropriate governance structures" and disclosures "providing the market with reliable and useful information". Armour reported that ASIC subsequently has reviewed larger firms in several sectors, generally noting "materially improved standards" with improved board supervision and disclosure since 2017-18. However, she assessed that "some companies are much further along than others", with diverging standards in terms of the scenarios applied and the treatment of particular risks by directly comparable firms, while scientific assessment of physical risks from climate change remains an "underdeveloped area", lacking "common language and taxonomies". Climate risk disclosure is a sensitive issue in Australia, evidenced by past challenges of sovereign-level disclosure - and particularly ahead of federal elections that are likely to be held from as early as October 2021. ASIC reiterated that "the law requires … a discussion of climate risk" when this is material to a firm's financial performance. To achieve this, it will seek improved governance and disclosure, planning "targeted guidance" for the companies previously studied to incorporate in their next reports, while reminding "potential laggards" of their obligations. For the financial sector, the Australian Prudential Regulation Authority's assessment of climate change vulnerability for banks should indicate focus areas for adjustment. (IHS Markit Country Risk's Brian Lawson)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.