Daily Global Market Summary - 2 September 2021

All major US and most European equity indices closed higher, while APAC was mixed. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. Oil, natural gas, and copper closed higher, while the US dollar, gold, and silver were lower on the day. Volatility has been relatively constrained this week as the markets patiently await tomorrow's 8:30am ET US non-farm payroll report for any indication that the delta variant is materially impacting the recovery in employment.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +0.7%, DJIA +0.4%, S&P 500 +0.3%, and Nasdaq +0.1%.

- 10yr US govt bonds closed -1bp/1.29% yield and 30yr bonds -2bps/1.90% yield.

- CDX-NAIG closed flat/46bps and CDX-NAHY flat/274bps.

- DXY US dollar index closed -0.2%/92.23.

- Gold closed -0.2%/$1,812 per troy oz, silver -1.3%/$23.92 per troy oz, and copper +0.6%/$4.30 per pound.

- Crude oil closed +2.0%/$69.99 per barrel and natural gas closed +0.6%/$4.64 per mmbtu.

- US seasonally adjusted (SA) initial claims for unemployment

insurance decreased by 14,000 to 340,000 in the week ended 28

August, its lowest level since the week ended 14 March 2020. Claims

continue to move lower and show no signs of a new round of layoffs

in response to the fourth wave of COVID-19. While the level of

initial claims is trending down and is far below the pandemic-era

high, initial claims closer to 200,000 would suggest a normal level

of "churn" for an economy in its prime. (IHS Markit Economist

Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 160,000 to 2,748,000 in the week ended 21 August, hitting its lowest since 14 March 2020. The insured unemployment rate edged down by 0.1 percentage point to 2.0%.

- In the week ended 14 August, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 6,044 to 3,800,000.

- In the week ended 14 August, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 408,485 to a seven-week high of 5,413,238.

- In the week ended 14 August, the unadjusted total of continuing claims for benefits in all programs rose by 178,526 to 12,186,158.

- US employers announced 15,723 planned layoffs in August,

according to Challenger, Gray & Christmas—down 17% from

July's 18,942. The total for August is the lowest monthly reading

since June 1997 and is 86% lower than the August 2020 reading. (IHS

Markit Economist Juan

Turcios)

- For the year to date (YTD), 247,326 job cuts have been announced, down 87% from the 1,963,458 job cuts announced over the same period in 2020 and the lowest January-August total on record. (Challenger began tracking job-cut announcements in January 1993.)

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "Companies are much more concerned about their talent getting poached than with finding ways to cut staff. They are in full retention mode."

- So far this year employers have cited COVID-19 as a reason for 7,950 planned job cuts. No employer cited COVID-19 as a reason for planned job cuts in August despite the surge in cases due to the rapidly spreading Delta variant. Employers have cited other reasons, including market conditions (48,103), closing (47,142), demand downturn (45,146), restructuring (43,407), and acquisition/merger (11,981) more frequently than COVID-19 as causes of job-cut announcements this year.

- Last year, 2,304,755 job cuts were announced, the highest yearly total on record. COVID-19 was the leading reason cited for job-cut announcements last year but was cited less frequently toward the end of the year. As of August, COVID-19 is the eighth-leading reason for job-cut announcements in 2021 and has been trending downward.

- Job hiring plans picked up in August as Walmart, Michaels Stores, and USPS announced upcoming seasonal holiday hiring plans. In August, employers announced plans to hire 94,004 workers with 80,000 of those announced hires being seasonal workers. So far in 2021 employers have announced plans to add 664,074 jobs, down 61.9% from the 1,743,033 announced through the same time last year. The robust hiring announcements last year reflected a surge in hiring in grocers, delivery apps, food chains, and warehouses as employers dealt with a pandemic-driven increase in demand for online shopping.

- Aerospace/defense has announced 33,303 job cuts so far this year, the highest number of any industry. Rounding out the five sectors that have announced the most job cuts this year are telecommunications (25,085), services (20,826), energy (18,458), and healthcare/products (16,263).

- US productivity (output per hour) rose at a 2.1% annual rate in

the second quarter, revised down 0.2 percentage point from the

previously reported figure, following an increase of 4.3% in the

first quarter. (IHS Markit Economists Ken

Matheny and Lawrence Nelson)

- Compensation per hour rose at a 3.4% annual rate in the second quarter and at a 1.4% rate in the first quarter. The second-quarter increase was revised up 0.1 percentage point. Compensation per hour has risen at a 6.4% annual rate from the fourth quarter of 2019, far higher than the 2.7% annualized increase in productivity over that span. The marked increase in compensation per hour reflects pandemic-induced effects on employment: employment in lower-wage sectors has declined relative to employment in higher-wage sectors.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. However, the rise in unit labor costs has slowed on average in more recent quarters. During the first quarter, unit labor costs rose at a 1.3% rate, revised up 0.3 percentage point from the previously reported figure, but this followed a decline of 2.8% in the first quarter. Even with the upward revision to the second quarter, unit labor costs declined at 0.7% rate over the first half of 2021, down from a 1.1% increase over the second half of 2020 and from a 10.1% increase over the first half of 2020.

- Hours rose at a 6.0% rate in the second quarter, continuing a strong recovery that began in the third quarter of 2020. Over the last four quarters, hours have risen 13.7%, reversing more than three-fourths of the 14.5% decline over the first two quarters of 2020.

- As pandemic-induced distortions on labor markets unwind, we expect growth in compensation per hour and productivity to continue to moderate, resulting in moderate growth of unit labor costs.

- US manufacturers' orders rose 0.4% in July, while shipments

rose 1.6% and inventories rose 0.5%. The increase in orders matched

the consensus expectation; inventories fell short of our

assumption. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- Orders and shipments of core capital goods (nondefense capital goods excluding aircraft) remained elevated and were little revised from the advance estimates.

- Both orders and shipments have surpassed their pre-pandemic levels, but recent gains have been boosted by surging prices in the manufacturing sector.

- Year to date, manufacturers' orders are up 8.5% and manufacturers' shipments are up 7.0%. Over the same period, the producer price index (PPI) for manufacturing is up 11.4%, making clear that the recent strength in orders and shipments is purely nominal; in inflation-adjusted terms, after mounting a full recovery last year, orders and shipments are down so far this year.

- In light of current supply-chain issues, we took the soft tone for inventories in July as an indication that inventory-building may be more challenging in coming months than we had assumed. So, we marked down our forecast of inventory investment for August and September as well.

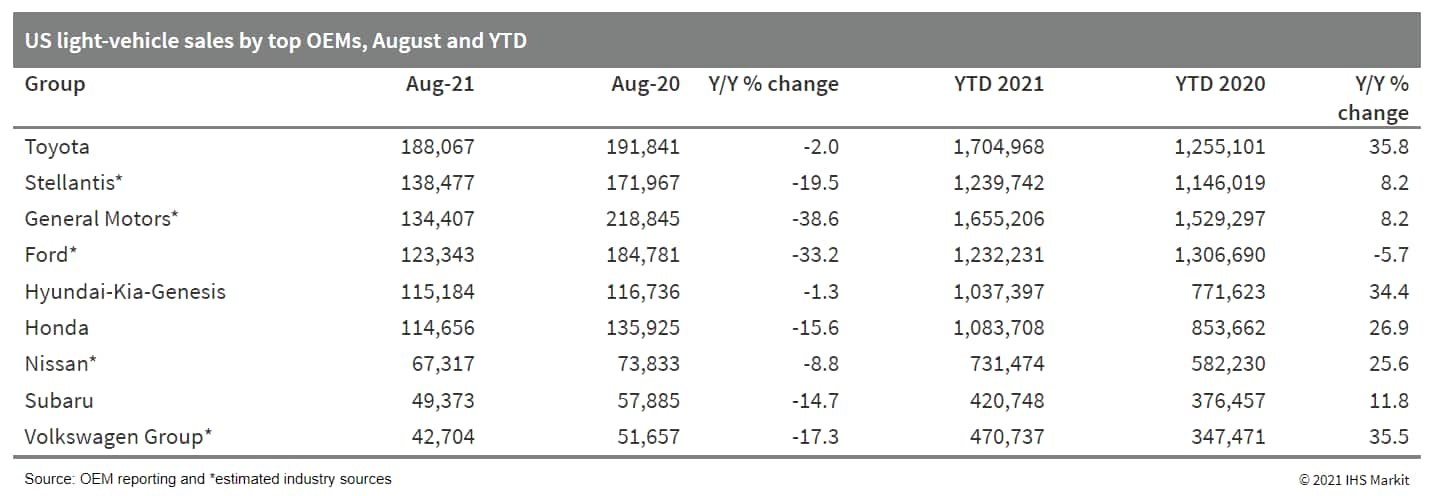

- Supply issues impacted on US light-vehicle sales severely in

August, with sales dropping 17.2% compared with August 2020. The

seasonally adjusted annual rate (SAAR) is estimated to have fallen

to between 12.9 million and 13.3 million units. Light-vehicle sales

in August were at the lowest monthly level since June 2020, which

was just two months after the depths of the COVID-19 lockdown

period last year. Although consumer interest and buying conditions

remain favorable, auto demand levels have been affected by low

inventory levels and are expected to continue to be so over the

next several months. Automakers are using available microchip

supplies to prioritize production of high-margin utility vehicles

and trucks; however, the semiconductor supply issue is not

affecting all automakers to the same degree. (IHS Markit

AutoIntelligence's Stephanie

Brinley)

- Caterpillar will begin offering Cat generator sets capable of operating on 100% hydrogen, including fully renewable green hydrogen, on a designed-to-order basis in late 2021. More immediately, the company will launch commercially available power generation solutions that can be configured to operate on natural gas blended with up to 25% hydrogen. The new solutions build upon Caterpillar's hydrogen solutions portfolio, including Solar Turbines' gas turbine generator sets, which have run on high hydrogen blends for decades and are capable of operating on 100% hydrogen today. The ability to work with hydrogen fuel helps address customers' carbon-reduction goals. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

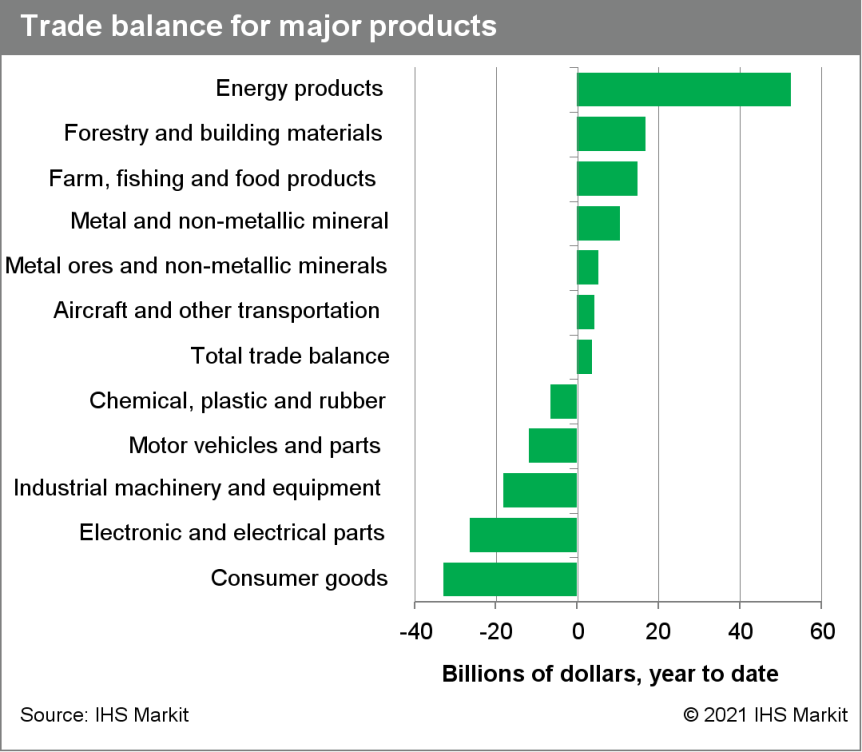

- Canada's July merchandise trade surplus narrowed from a month

prior to $778 million. Additionally, June's trade surplus was

heavily revised from $3.2 billion to $2.6 billion. (IHS Markit

Economist Evan Andrade)

- Exports advanced marginally at 0.6% month on month (m/m) to $53.7 billion, while imports jumped 4.2% m/m to a record level of $53.0 billion.

- Growth in real terms was slower, as export volumes remained at $42.7 billion and import volumes rose 1.2% m/m to $45.3 billion.

- The deficit in international trade of services widened to $301

million, with exports rising 1.2% m/m to $9.7 billion and imports

rising 3.7% m/m to $10.0 billion.

- According to the Brazilian Institute of Geography and

Statistics (IBGE), the country's real GDP declined by 0.1% quarter

on quarter (q/q) during the second quarter. This was after the

economy expanded by 1.2% q/q during the first quarter. (IHS Markit

Economist Rafael

Amiel)

- Growth in volume exported was offset by the decline in fixed investment, while private consumption (almost two-thirds of GDP) was flat. The acceleration in growth in the world economy coupled with higher commodity prices prompted an increase in exports. The sharp decline in fixed investment obeys a correction after spectacular growth in the previous three quarters: as of the second quarter, fixed investment was 14.2% higher than pre-pandemic levels, while the whole economy was just at the level recorded at the end of 2019.

- Imports of goods and services were down by 0.6% q/q, while exports jumped by 9.4%, thus the contribution of net trade to growth was significant, although this was offset, as mentioned above, by lower investment.

- From a supply perspective, agriculture and manufacturing were the major drag to growth: adverse weather conditions (first a drought, and then a frost) have significantly hurt the fields and the harvest of produce, coffee plantations in particular; the drought has also negatively affected production of electricity. The Brazilian industry is suffering from the worldwide shortage of semiconductors, and the all-important automotive industry has experienced production declines.

- On a positive note, construction continued its recovery and posted its fourth consecutive quarterly increase; the services sector expanded by 0.7% q/q.

- The Brazilian Ministry of Agriculture's crop protection department has submitted a proposal to supervise and accredit agrochemical trials bodies to public consultation. The department has issued a normative instruction establishing criteria for the accreditation and supervision of public and private pesticide research entities, as well as the minimum requirements for conducting studies and reports on the agronomic efficacy and practicability produced for registration processes. The Department's general co-ordinator of pesticides, Bruno Breitenbach, explains the objectives. "One of the points to ensure the quality of products is that studies and tests be performed with the same criteria and parameter," he says. "In addition, we are improving and modernizing the control and audit mechanisms of the companies that carry out this type of research." The text of the proposed regulation is available at the Ministry's website. The regulation would revoke Ministry Normative Instructions Nos 36/2009, 42/2011 and 15/2016 as well as Ordinance No 85/2017. Comments are to be submitted through regulations monitoring system, Sisman. Ordinance No 380 has set a 60-day comment period running until October 15th. (IHS Markit Crop Science's Robert Birkett)

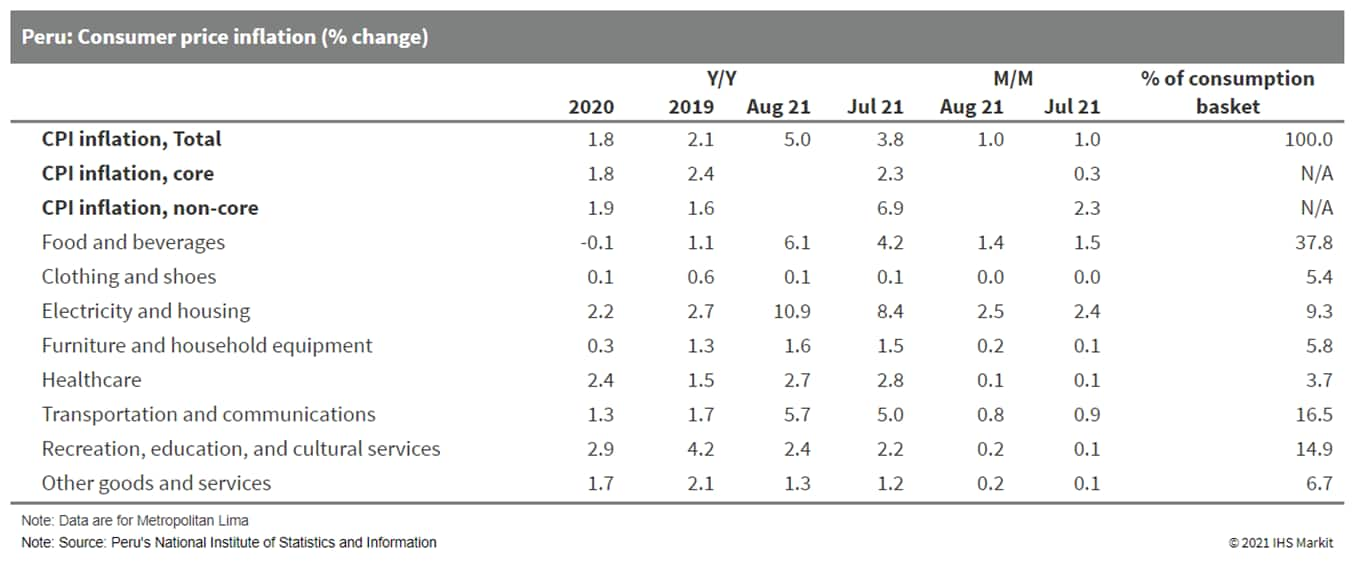

- Consumer prices in Peru rose by 5.0% year on year (y/y) in

August, the fastest pace since February 2009. (IHS Markit Economist

Jeremy Smith)

- August was the second consecutive month in which the consumer price index (CPI) increased at the rapid pace of 1.0% month on month (m/m).

- Similar to recent months, nearly all price increases occurred within just three consumption categories: electricity and housing, food and beverages, and transportation and communications. These groups accounted for 94% of the variation compared with July.

- Recent increases in international commodity prices continue to filter into Peruvian consumer goods, especially staple grains, vegetable oils, and crude oil prices.

- The depreciation of the Peruvian sol, now at 13.0% year to date, only further increases the price of imports and, indirectly, of goods with imported intermediate components.

- Excluding the volatile food and energy categories, inflation

stood at 2.4% y/y in August, up from 1.7% at the start of the year

but comfortably within the 1-3% range targeted by the Central

Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP).

Europe/Middle East/Africa

- Most major European equity indices closed slightly higher except for Spain -0.1%; UK/Italy +0.2% and Germany/France +0.1%.

- 10yr European govt bonds closed higher; Italy/Spain -3bps, France -2bps, and Germany/UK -1bp.

- iTraxx-Europe closed +1bp/45bps and iTraxx-Xover +1bp/227bps.

- Brent crude closed +2.0%/$73.03 per barrel.

- Navya has deployed its autonomous shuttle on public roads in the United Kingdom at the Harwell Science and Innovation Campus, according to a company statement. The shuttle, which is to be operated by Darwin, will pick passengers up, transport them around the campus, and drop them off at their destination. Insurance company Aviva plc is also a partner and is to build its first comprehensive insurance model for the autonomous shuttle based on the result of the trials. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The year-on-year (y/y) rate of increase in the eurozone PPI

rose by almost two percentage points to 12.1% in July, a record

high for the series and well above the market consensus expectation

(of 11.0%, according to Reuters' survey). (IHS Markit Economist Ken

Wattret)

- While base effects have played a key part in boosting y/y inflation rates during 2021, the month-on-month (m/m) increases in the eurozone PPI have also been exceptionally robust. July saw a 2.3% m/m rise in the PPI, well above the already robust 1%-plus average m/m increase over the first half of the year.

- Energy prices have been pivotal to the acceleration in PPI rates, with the y/y inflation rate surging by more than three percentage points to almost 30% in July, also a record high for the series.

- PPI inflation rates for other goods have also been picking up, led by intermediate goods, which rose by more than 12% y/y in July.

- Producer price inflation rates for capital and consumer goods have accelerated much less sharply to date, although upward pressure is also becoming evident there too. July's 2.6% y/y increase in consumer goods inflation, although relatively low, was the highest since 2012.

- The eurozone PPI inflation rate excluding energy prices also hit a new record high in July accordingly, rising from 5.6% to 6.7%.

- German battery electric vehicle (BEV) start-up Sono has claimed that it has 14,000 reservations for its low-cost EV, according to an RWE report. The company has received an average down payment of USD3,300 from each reservation, according to the report. With a unit price for the vehicle starting at USD25,670, this means that the company has an advanced order value of more than USD350 million. The majority of these pre-orders are from German customers, according to the report. CEO Laurin Hahn said, "14,000 reservations, with an average down payment of $3,300, is unequivocal proof that the Sion both is wanted and needed. Virtually every car we will produce in the first year of production is already reserved by customers. We want to bring the Sion to the streets as soon as possible to meet the people's desire for a resource-friendly and affordable mobility solution." (IHS Markit AutoIntelligence's Tim Urquhart)

- Swiss biopharmaceutical firm VectivBio has announced that it has entered into a definitive agreement to buy Comet Therapeutics (US), a privately held company that specializes in the development of therapies for previously untreated inherited metabolic diseases (IMDs). The acquisition will enable VectivBio to access Comet's proprietary small molecule platform dedicated to studying potential new treatments for IMDs that share a common metabolic pathway, irrespective of the specific underlying mutation. The technology developed by Comet is based on a stabilized coenzyme A (CoA) precursor backbone and, according to VectivBio, has demonstrated the ability to supply functional CoA and carry tailored intermediary metabolite cargos in preclinical studies. (IHS Markit Life Sciences' Ewa Oliveira da Silva)

- Energy company Shell has announced that it is planning to install around 50,000 electric vehicle (EV) charging posts in the UK by the end of 2025. According to a statement, Shells Ubitricity arm would install them. The company added that in order to drive the expansion, Shell will support local authorities with a financing offer to install more Ubitricity on-street chargers "at potentially zero cost". David Bunch, Shell's UK Country Chair, said, "It's vital to speed up the pace of EV charger installation across the UK and this aim and financing offer is designed to help achieve that…Whether at home, at work or on-the-go, we want to give drivers across the UK accessible EV charging options, so that more drivers can switch to electric." (IHS Markit AutoIntelligence's Ian Fletcher)

- Turkish economic growth remained relatively robust in the

second quarter. GDP grew by 0.9% quarter on quarter (q/q) in

seasonally adjusted data in April-June 2021. (IHS Markit Economist

Andrew

Birch)

- Although growth slowed from the newly revised 2.2% q/q reported gain in the first quarter, it nonetheless remained relatively vigorous against the backdrop of ongoing high COVID-19 infection rates in the country. Turkish officials pushed through some of the most severe lockdown measures across Europe throughout April, with restrictions relaxed but remaining relatively severe in May as well.

- Sustained q/q expansion since mid-2020 pushed total GDP as of the second quarter of 2021 to 21.7% higher than it had been a year earlier; the fastest annual expansion ever recorded in the country. Overall, the economy grew by more than 14% year on year (y/y) in the first half.

- After faltering in the first quarter and declining by 2.8% q/q, exports of goods and services grew by 2.2% q/q in the second quarter. A revival of tourism service exports - though still well down from pre-pandemic levels - provided a boost in q/q growth in the second quarter. Rising demand from Europe meanwhile drove forward merchandise export expansion.

- Imports of goods and services, on the other hand, contracted throughout the first half of 2021; down 9.7% q/q and 3.3% q/q in the first and second quarters, respectively.

- For the second time since the mid-2020 downturn, domestic demand contributed more than double-digits to overall GDP annual growth; by 14.5 percentage points in the second quarter.

- Testing platform developer for automated vehicles Foretellix has raised USD32 million in a Series B funding round, according to a company statement. This will bring the company's total raised capital to over USD50 million. The round was led by MoreTech Ventures in participation with Volvo Group Venture Capital, Nationwide, NI (National Instruments) and Japan-Israel High Tech Ventures. All Series A investors, including 83North Ventures, Jump Capital, OurCrowd and NextGear also participated in this round. Foretellix, which was founded in 2018, is a developer of safety verification software for automated vehicles. It recently released its advanced driver-assistance systems and highway solution, a verification package for Level 2 to Level 4 autonomy, which now includes implementation of the new regulation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In a press release, Eni announced a new oil and gas discovery at the Baleine-1x exploration well in block CI-101 offshore Ivory Coast. The discovery is estimated to hold an in-place volume of 1.5 to 2 billion barrels of oil and 1.8 to 2.4 Tcf of associated gas. The Baleine-1x well, located approximately 60 kilometers off the coast, encountered light oil in two different intervals with 40° API and was drilled to a total depth of 3,445 meters (11,302 feet) in 1,200 meters (3,937 feet) of water, the company said. This is the first exploration well in the block (and country) by Eni, which was awarded in March 2017. Eni is the operator of the block with a 90% interest. State-owned company Petroci is holding the remaining stake. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Mozambique's real GDP bounced back with growth of 3.7% quarter

on quarter (q/q) and 1.9% year on year (y/y) during the second

quarter of 2021, from 6.5% q/q and 0.1% y/y in the first quarter.

This leaves headline GDP up by 1.0% y/y in the first half of 2021.

(IHS Markit Economist Thea

Fourie)

- Latest statistics released by the Mozambique Statistical Service (INE) show that sectors recording the strongest annual growth during the second quarter include hotels and restaurants - a proxy for tourism - (up 4.0% y/y), services (including government services) (up 3.2% y/y), and transport and communication (up 2.9% y/y). Output in the trade sector - a barometer for household spending - rose by 2.2% y/y in the second quarter, from a 0.9% y/y decline in the previous quarter.

- The agriculture and fishing sector, the biggest contributor to Mozambique's overall GDP, grew by 1.7% y/y in the second quarter, from 4.7% y/y in the first quarter. Non-agriculture GDP expanded by 2.1% y/y in the second quarter, from a 1.3% y/y contraction in the previous quarter.

- The electricity and water sector was the only sector recording a contraction during the second quarter, shrinking 9.8% y/y.

Asia-Pacific

- Major APAC equity markets closed mixed; India +0.9%, Mainland China +0.8%, Japan +0.3%, Hong Kong +0.2%, Australia -0.6%, and South Korea -1.0%.

- Mainland China policy is moving toward a more expansionary

position amid the slowdown in economic recovery since the third

quarter. Targeted support for small businesses and sectors related

to people's livelihoods is also expected as part of efforts to

foster "common prosperity". (IHS Markit Economist Yating

Xu)

- The Chinese central bank will increase relending quotas by CNY300 billion to help local banks offer loans to small and medium-sized firms and self-employed individuals, according to the cabinet at the State Council meeting on 1 September.

- The State Council also pledged to promote effective investment growth by using local government special-purpose bonds. Meanwhile, the annual loan aid for undergraduate students will be increased by 50% from CNY8,000 to CNY12,000, with the interest on the loans to be subsidized by the government.

- Chinese regulators have summoned 11 ride-hailing firms to a meeting to discuss points of concern in the sector. At the meeting, regulators urged companies including Didi Global Inc. (DiDi), Meituan's ride-hailing unit, Geely's Caocao, and Alibaba's ride-sharing and navigation unit Amap, among others, to comply with relevant rules and protect data security. Authorities also mentioned that hiring of unqualified drivers and use of promotions have disrupted fair market order, reports Reuters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese ride-hailing giant Didi Global Inc. has established a union for its workers. DiDi's union, announced on an internal forum last month, will be initially managed by employees at the company's Beijing headquarters and will be guided by the government-backed All-China Federation of Trade Unions (ACFTU). This development stems from Chinese President Xi Jinping's "common prosperity" campaign that aims to ease inequality. DiDi has faced media criticism for not paying its drivers fairly and thus it plans to set up a drivers' committee to improve income stability and transparency over wages. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korean battery-maker SK Innovation has announced plans to invest USD1.06 billion in its local subsidiary in Yancheng through 2024 to set up a new battery plant in China, reports the Maeil Business Newspaper. The new plant, which is expected to be operational by 2023, is to be the company's fourth in China, after one in Changzhou with a 7 gigawatt-hour (GWh) capacity, Yancheng with a 10-GWh capacity, and Huizhou with a 10-GWh capacity. Construction of the new facility is expected to begin next month, according to the news source. SK Innovation is one of the leading global suppliers of batteries for electrified vehicles. Sales of the company's battery business more than doubled to KRW1.61 trillion (USD1.39 billion) during the full year 2020, compared with KRW690.3 billion in 2019. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- India has urged domestic automakers to reduce reliance on electric vehicle (EV) component imports and other automotive parts from China, reports Bloomberg News. Amitabh Kant, Niti Aayog CEO said, "It is important that certain automotive components, which are being imported from China purely on the back of cost competitiveness and development capabilities, be manufactured here." He added, "We should not become a major importing nation in electric-vehicle components like we've done in solar. You've got to de-risk the supply chain by boosting localization, reducing dependency on imports and I would like to say imports from China. Indian manufacturers must clearly read the writing on the wall and aim to secure a strategic position in the global value chain." (IHS Markit AutoIntelligence's Tarun Thakur)

- AC Energy, the energy subsidiary of the Philippines's Ayala Group, sold USD400 million of perpetual non-call 3.5-year debt, priced on 1 September at 4% versus 4.45% guidance after attracting USD1.88 billion of demand. The issue was in Green Bond format, to finance eligible projects. Non-domestic Asian buyers subscribed 70% of the deal with 25% taken domestically, with asset managers purchasing 59% of the deal. (IHS Markit Economist Brian Lawson)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.