Daily Global Market Summary - 30 June 2021

Most major US equity indices closed higher, APAC was mixed, and all major European markets were lower. US government bonds closed flat and benchmark European bonds closed sharply higher. CDX-NA closed flat across IG and high yield, and European iTraxx closed slightly wider. The US dollar, silver, oil, natural gas, copper, and gold all closed higher.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Most major US equity indices closed higher except for Nasdaq

-0.2%, with the S&P 500 +0.1% closing at yet another all-time

high; DJIA +0.6% and Russell 2000 +0.1%.

2. 10yr US govt bonds closed flat/1.47% yield and 30yr bonds

flat/2.09% yield.

3. CDX-NAIG closed flat/48bps and CDX-NAHY flat/274bps.

4. DXY US dollar index closed +0.4%/92.44.

5. Gold closed +0.5%/$1,772 per troy oz, silver +1.1%/$26.19 per

troy oz, and copper +0.6%/$4.29 per pound.

6. Crude oil closed +0.7%/$73.47 per barrel and natural gas closed

+0.6%/$3.65 per mmbtu.

7. The US Pending Home Sales Index (PHSI) jumped 8.0% in May from

April and 13.1% from a year earlier. The Index had dropped four

straight months. Lawrence Yun, the National Association of

Realtors' chief economist, called the latest readings "a surprise."

(IHS Markit Economist Patrick

Newport)

a. All four regional indexes posted solid gains, led by the New

England states (up 15.5%), followed by the West (up 10.9%), the

Midwest (up 6.7%), and the South (up 4.9%).

b. A second forward-looking housing indicator suggests that sales

are still sliding. The Mortgage Bankers Association (MBA)'s

Purchase Index (four-week moving average), down 18% from the start

of the year, is back to its pre-pandemic levels and edging

down.

c. Princeton economist Alan Blinder recently penned an opinion

commentary in the Wall Street Journal, writing that "the pandemic

wreaked havoc on the normal seasonal pattern last winter,

distorting our short-run view of the economy."

d. With one leading indicator pointing up, another down, and

seasonal adjustment procedures muddying the data, it is prudent not

to put too much weight on the latest monthly readings.

e. Pivotal for sales in the upcoming months are inventories. In

recent months, super-strong demand for houses has mostly led to

higher home prices because listings have not picked up.

8. Fugro has finished with the first phase of a two-year contract

with Atlantic Shores Offshore Wind, off the coast of New Jersey in

the US, to build and manage the geo-data repository for the

development of the company's lease. The web-based engagement

platform uses Fugro's Gaia technology to provide enhanced

information access. Fugro will uphold the Gaia solution till 2022

to support Atlantic shores. For the development of geo-data

repository, Fugro is combining public datasets, real-time field

data, information from Fugro's metocean, geophysical, geotechnical

and environmental data. (IHS Markit Upstream Costs and Technology's

Lopamudra De)

9. Celanese (Dallas, Texas) has agreed to buy ExxonMobil's

Santoprene thermoplastic vulcanizate (TPV) elastomers business for

$1.15 billion. Celanese expects the acquisition, which will be

financed with cash and available liquidity, to close in the fourth

quarter and to be earnings accretive in 2022. Celanese says the

business has generated approximately $100 million in average

adjusted EBITDA over the past five years. Celanese will acquire the

Santoprene, Dytron, and Geolast trademarks and product portfolios;

all customer and supplier contracts and agreements; two world-scale

production facilities in Pensacola, Florida, and Newport, UK,

including over 190,000 metric tons/year of production capacity;

intellectual property and associated technical and R&D assets;

and about 350 employees. (IHS Markit Chemical Advisory)

10. Commercial electric vehicle (EV) company Electric Last Mile

Solutions (ELMS) has begun trading on the NASDAQ exchange, on track

for first deliveries by end of 2021. The company went public

through a reverse merger with Forum III (see United States: 14

December 2020: EV companies Lightning eMotors and Electric Last

Mile plan to go public through reverse mergers). In a statement,

CEO and co-founder Jim Taylor said, "Today is an important

achievement for ELMS and a significant milestone in our mission to

transform last mile productivity for our customers with efficient,

sustainable and connected e-mobility workstations intended to

improve their bottom line. We are focused on execution to launch

the Urban Delivery, which we anticipate will be a first-mover in

the Class 1 commercial electric vehicle segment. As a public

company, we believe we now have all the pieces in place to launch

the Urban Delivery later this year and are excited to help position

America as the leader in EV manufacturing." (IHS Markit

AutoIntelligence's Stephanie

Brinley)

11. Cummins has announced that it plans to acquire a 50% equity

stake in Momentum Fuel Technologies from Rush Enterprises. From the

investment, a joint venture (JV) will be created to produce

Cummins-branded natural gas fuel delivery systems for the

commercial vehicle (CV) market in North America, according to a

company statement. The JV will leverage the strengths of Momentum

Fuel Technologies's compressed natural gas (CNG) fuel delivery

systems, Cummins's powertrain expertise, and the engineering and

support infrastructure of both. Momentum Fuel Technologies offers a

CNG fuel system solution for Class 6 to 8 vehicles, while Rush

Enterprises operates a Rush Truck Centers network of CV

dealerships, representing a number of truck and bus manufacturers.

The JV will be able to provide aftermarket support through Rush

Truck Centers dealerships and Cummins distributors, which will be

able to service both the engine and the fuel delivery system.

Customers will have access to a CNG vehicle parts and service

network in more than 250 locations in the United States and Canada,

with both Cummins's and Rush Enterprise's networks combined. (IHS

Markit AutoIntelligence's Stephanie

Brinley)

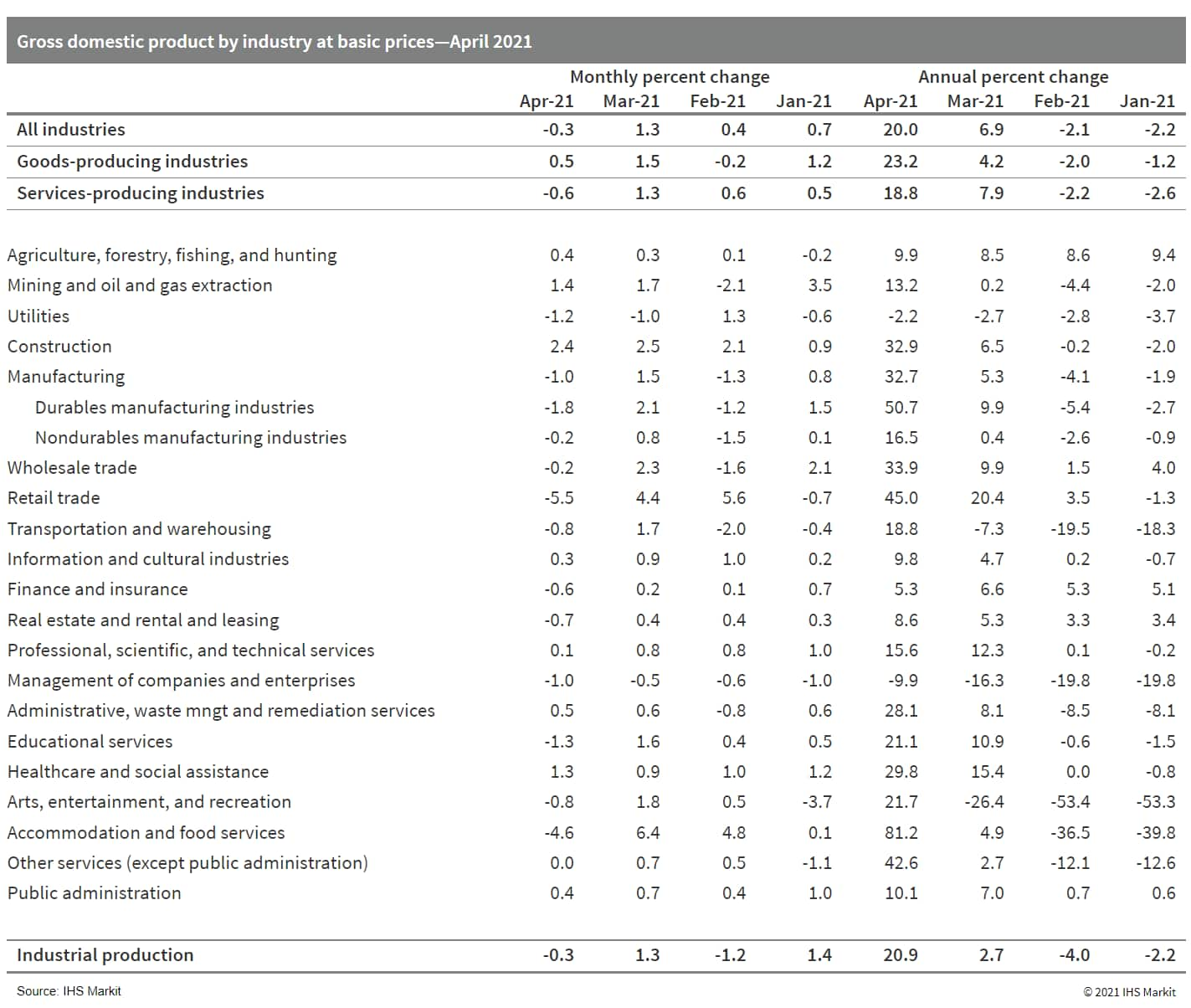

12. Canadian real GDP by industry output declined only 0.3% month

on month (m/m) in April, a performance that exceeded Statistics

Canada's initial estimate as well as both consensus and IHS Markit

expectations. This was the first monthly real GDP decline in a

year. (IHS Markit Economist Arlene

Kish)

a. Output in the goods-producing industries jumped 0.5% m/m as

advances in construction and natural resources led for a second

consecutive month. A drop in manufacturing and utilities

contributed to the 0.3% m/m decline in industrial production.

b. Services industries output was 0.6% m/m lower with widespread

losses (9 of 13 industries), led by the dramatic downturns in

retail trade and accommodation and food services.

c. Statistics Canada estimates May's real GDP by industry output

will lose another 0.3% m/m.

d. Canada's economic slowdown in the second quarter is likely not

as pronounced as previously estimated. With goods industry output

recovered as of April, services' slow slog should pick up based on

progressing regional reopening plans, setting the stage of robust

gains in the second half of the year.

13. The Central Bank of Mexico (Banco de México: Banxico) and the National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores: CNBV) issued a joint statement on 29 June warning about the risks of virtual assets and explaining that banks are unauthorized to operate using these instruments. The statement flags that banks that "issue or offer such instruments" will be fined and sanctioned under relevant existing regulations. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

a. The statement is primarily a reaction against a proposal by

Ricardo Salinas Pliego, the main shareholder of Banco Azteca,

Mexico's 10th largest bank by assets, which had suggested that the

bank would consider accepting Bitcoin as a means of payment.

Banxico's statement is likely to also be a reaction to the recent

approval of Bitcoin as legal tender currency in El Salvador, which

also served as an encouragement for Salinas's comments (see El

Salvador: 11 June 2021: El Salvador approves cryptocurrency Bitcoin

as legal tender, potentially jeopardizing IMF deal and increasing

AML, corruption risks).

b. The announcement reaffirms the stance of Mexican regulators

towards Bitcoin and similar cryptocurrencies: they will not permit

a link between unregulated digital assets and the traditional

financial sector. In our view, keeping a sharp delimitation between

highly volatile virtual assets and the conventional banking sector

will avoid the risk of new direct and indirect currency risks

within Mexico's financial system and therefore will help preserve

the low-risk category in which we are currently positioning the

banking sector.

Europe/Middle East/Africa

1. All major European equity indices closed lower; UK -0.7%, France

-0.9%, Italy/Germany -1.0%, and Spain -1.1%.

2. 10yr European govt bonds closed sharply higher; Italy -5bps,

Germany/France/Spain -4bps, and UK -2bps.

3. iTraxx-Europe closed +1bp/47bps and iTraxx-Xover

+3bps/232bps.

4. Brent crude closed +0.5%/$74.62 per barrel.

5. Wejo, a UK-based connected vehicle data startup, has said that

Microsoft Corporation and insurer Sompo Holdings Inc. will invest

USD25 million in the company, reports Reuters. The investment comes

as part of Wejo's private investment in public equity (PIPE)

financing, which now stands at USD125 million. Wejo has prepared to

go public through a reverse merger deal with Virtuoso Acquisition

Corporation, a special-purpose acquisition company. Microsoft and

Sompo will join General Motors (GM) and data analytics firm

Palantir Technologies Inc. as participants of PIPE. Wejo, which was

founded in 2014, has organized data from almost 11 million vehicles

connected to the internet through embedded modems for clients such

as GM, Hyundai Motor, and Daimler. (IHS Markit Automotive

Mobility's Surabhi Rajpal)

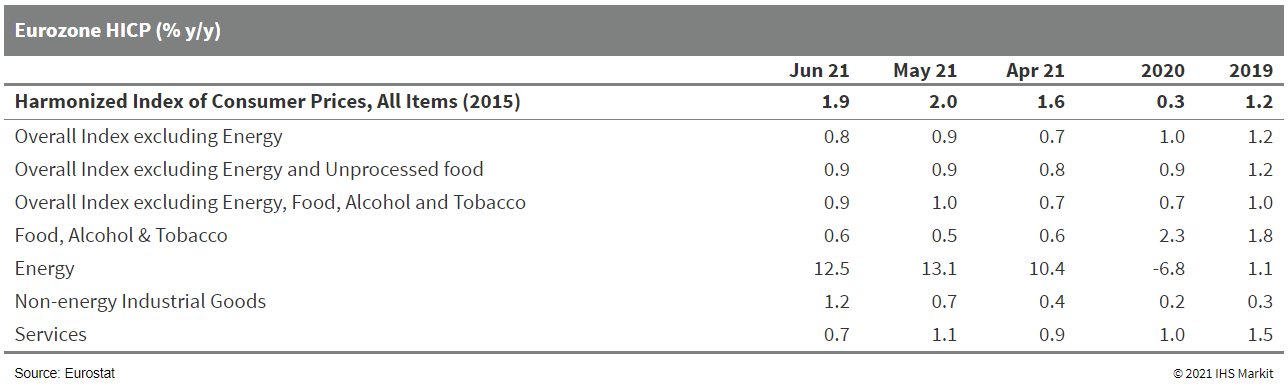

6. Eurozone Harmonized Index of Consumer Prices (HICP) inflation

has slipped from 2.0% in May to 1.9% in June, according to

Eurostat's "flash" estimate, the first deceleration since September

2020 and in line with the market consensus expectation. (IHS Markit

Economist Ken

Wattret)

a. After six straight months of strong accelerations, energy

inflation has slipped back a little in June, although this is

primarily due to a favorable base effect. In month-on-month (m/m)

terms, energy prices have risen by 1.2%.

b. Food inflation has edged up to 0.6%, although this masks a

contrast between weakness in unprocessed food prices (-0.3% year on

year; y/y) and a pick-up in processed food, alcohol, and tobacco

prices (0.9% y/y).

c. The core HICP inflation rate excluding food, energy, alcohol,

and tobacco prices has ticked down from 1.0% to 0.9% in June, again

matching the market consensus expectation, although there is a

marked divergence between its two sub-components.

d. Non-energy industrial goods inflation, which accounts for around

40% of the core index, has jumped from 0.7% to 1.2%. This rate has

now risen by 1.7 percentage points since the end of 2020.

e. Inflation for services, accounting for the remaining 60% of the

core index, has dropped from 1.1% to 0.7% in June.

7. The German Labor Agency report for June reveals that the

tendency towards improvement in the labor market has accelerated in

the course of the second quarter. This reflects the distinct

loosening of pandemic-related restrictions from May onwards,

helping the service and retail sectors in particular. (IHS Markit

Economist Timo

Klein)

a. Seasonally adjusted German unemployment has declined by 38,000

month on month (m/m) in June, signaling an accelerating downward

trend most recently. As a result, 37% of the initial,

pandemic-related surge recorded in the second quarter of 2020 has

now been unwound, as the end-June unemployment level of 2.691

million compares with the March 2020 cyclical low of 2.266 million

and an interim high of 2.937 million in June 2020.

b. The Labor Agency calculates a cumulative COVID-19 effect on

unemployment of 399,000 in June 2021, down from 453,000 in May and

an interim peak of 638,000 in June 2020. This represents a

comparison with a hypothetical continuation of the pre-pandemic

trend if the pandemic had never occurred.

c. Germany's (national) unemployment rate remains at 5.9% in June,

having slipped from the 6.0% level seen during January-April in

May. The rate had reached a pre-pandemic 40-year low of 5.0% in

March 2020 and an interim high of 6.4% in June and July 2020.

8. Porsche, mapping company HERE Technologies, and telecoms company

Vodafone have collaborated to develop a real-time warning system

for vehicles as part of a feasibility study to improve road safety.

The focus is on researching how 5G technology can enhance road

safety when used in conjunction with real-time detection and

localization of hazardous traffic situations. The companies are

testing the real-time warning system under everyday situations at

the Vodafone 5G Mobility Lab in Aldenhoven (Germany). The system's

core goal is to offer warnings that are beyond the driver's

immediate vision, such as when traffic is obstructing the view

ahead. HERE's Live Sense SDK is deployed with HD maps and

positioning technology to detect potentially hazardous

circumstances ahead. (IHS Markit Automotive Mobility's Surabhi

Rajpal)

9. Germany's biggest supermarkets have pledged to stop selling meat

labelled as produced using the lowest welfare standards - level 1 -

by 2025. Hard discounter, ALDI, started the ball rolling on 25 June

when its Northern and Southern affiliates ALDI Nord (North) and

ALDI Süd (South) issued a joint statement, explaining that they

were moving away from level 1 meat in the four-level "Haltungsform"

(farming type) voluntary labelling system that Germany introduced

in November 2019. ALDI pledged to stop selling level 1 meat by 2025

and level 2 meat by 2030 as part of a conversion to the higher

welfare level 3 and 4 (IHS Markit Food and Agricultural Policy's

Sara Lewis):

a. Level 1 labels show that production has been certified in a

quality assurance scheme as complying with the legal minimum animal

welfare standards and involves fully intensive husbandry, dubbed

'factory farming';

b. Level 2 "Stallhaltung plus" labels show that the animals are

still raised conventionally, mainly inside, but comply with the

"Tierwohl" animal welfare initiative, known by the acronym ITW in

Germany;

c. Level 3 "Außenklima" (outdoor climate) requires, more space and

access to outdoors; and,

d. Level 4 "Premium" corresponds to a significantly higher level of

animal welfare, with free range husbandry. Meat from organic

livestock is generally labelled level 4.

10. Both French consumer confidence and consumption in goods have

improved sharply, suggesting that private consumption is likely to

rebound strongly. (IHS Markit Economist Diego

Iscaro)

a. Consumption of goods, which account for around one-third of

total consumption, rose by 10.4% month on month (m/m) in May. This

followed declines of 8.7% m/m in April and 0.7% m/m in March.

b. May's strong rebound was driven by a 26.0% m/m increase in

spending on manufactured goods. The reopening of shops on 19 May

resulted in sales of clothing/footwear almost tripling, while

consumption of durables rose by 11.3% m/m.

c. Consumption of foods stagnated in May, while energy consumption,

which had been stable in April, rose by 2.6% m/m.

d. Data released by the National Institute of Statistics and

Economic Studies (Institut national de la statistique et des études

économiques: INSEE) show the consumer confidence headline index

standing at 102 this month, up from 98 in May. Consumer confidence

has thus improved for the second successive month and it now stands

above its long-term average (100) for the first time since March

2020.

11. Renault Group is said to be one of several organizations that

is interested in taking a stake in the Ionity fast charging network

business, reports Reuters. Sources have linked the automaker and

energy company Royal Dutch Shell to the sale of a 20-25% stake in

Ionity. Final bids for this part of the business, valued at between

EUR400 million and EUR500 million, are due to be delivered in July.

(IHS Markit AutoIntelligence's Ian Fletcher)

12. Abu Dhabi National Oil Co. (Adnoc) says that Reliance

Industries has signed an agreement to join a new world-scale

chlor-alkali, ethylene dichloride (EDC), and polyvinyl chloride

(PVC) project at Ruwais, Abu Dhabi. The complex will be constructed

in the Ta'ziz industrial chemicals zone, which is a joint venture

(JV) between Adnoc and Abu Dhabi National Energy Co. (ADQ). The

cost of the project has not been disclosed. (IHS Markit Chemical

Advisory)

a. Under the terms of the agreement, Ta'ziz and Reliance will

construct an integrated complex with capacity to produce

940,000-metric tons/year of chlor-alkali products, 1.1-million

metric tons/year of EDC, and 360,000 metric tons/year of PVC.

b. The market for chlorine, caustic soda, EDC, and PVC is expected

to see steady growth supported by increasing demand, particularly

in Asia and Africa. Adnoc says the manufacture of these products

will create opportunities for local industry to source critical raw

materials in the UAE for the first time, such as caustic soda for

local aluminum production, creating additional opportunities for

"in-country value."

c. According to IHS Markit, stronger PVC consumption is usually

more concentrated in the developing economies in Asia, such as

mainland China, India, Pakistan, Vietnam, and Indonesia. "The

common drivers of PVC consumption for high-demand locations include

a large population base," it says. India requires significant

systems to irrigate its farmlands, and has a large, sustainable

demand for PVC pipes and fittings, adds IHS Markit.

13. The total numbers of liquidations in South Africa increased by

37.5% year on year (y/y) during the first four months of 2021,

according to latest data from the country's statistical service,

Statistics South Africa (StatsSA). (IHS Markit Economist Thea

Fourie)

a. The uptick meant liquidity numbers were well above the

historical average since 2014. More than 50% of new liquidity cases

were in the trade, catering and accommodation sector (21.6% of the

total) and the finance, insurance, real estate, and business

services sector (32.1% of the total) during January-April 2021. The

unclassified sector contributed 26.8% of the total number of

liquidity cases.

b. The liquidations were spread evenly between companies and closed

corporations, whereas closed corporations make up a large share of

small and medium-sized businesses in South Africa.

c. At the same time, the number of insolvencies continued its

downward path, witnessed since 2010. StatsSA reports a 71.4% y/y

fall in the numbers of insolvencies over January-April 2021.

14. Toyota has launched a vehicle assembly unit in Ghana with an

investment of USD7 million, reports Reuters. The unit will have an

annual production capacity of 1,330 vehicles. Ghanaian President

Nana Akufo-Addo said, "Ghana aims to boost its auto sector and

attract automakers with generous fiscal incentives to assemble and

produce cars in the country." He added, "The use of foreign

exchange to import cars in Ghana will be reduced, at the same time,

the export of made in Ghana cars to other African markets will earn

our nation much needed foreign exchange." According to the source,

Ghana passed a law in order to ban the import of second-hand cars

more than 10 years old from October 2020 to boost vehicle sales in

the country. This order was later suspended indefinitely following

pressure from vehicle importers. (IHS Markit AutoIntelligence's

Tarun Thakur)

15. Zimbabwe's annual headline inflation rate dropped for the 12th

consecutive month in June, decreasing by 41 percentage points and

reaching 106.6% year on year (y/y), down from 161.9% y/y in May.

(IHS Markit Economist Alisa Strobel)

a. The highest price pressures were witnessed in Mashonaland East

region as well as Matabeleland North region in June. Matabeleland

South and Midlands recorded the lowest inflation rates and the

biggest drops in prices in June. Non-food prices pressures remained

a key driver of the headline figure.

b. On a monthly basis, Zimbabwe's headline inflation witnessed a

moderate increase in June, growing at 3.9%, up from 2.5% in May.

This was the third consecutive monthly increase since April, but

the figure remained below the level of 5.4% in January. Notably,

prices of housing, electricity, water, and other fuels were

significantly higher than other items in the consumer price index

basket, while the communications and restaurants and hotels sectors

recorded the softest price pressures.

Asia-Pacific

1. APAC equity markets closed mixed; Mainland China +0.5%, South

Korea +0.3%, Australia +0.2%, Japan/India -0.1%, and Hong Kong

-0.6%.

2. Chinese ride-hailing giant Didi Chuxing (DiDi) has reportedly

raised USD4.4 billion in its initial public offering (IPO) in the

United States. DiDi sold 317 million American Depository Shares

(ADS), as against 288 million planned earlier, at USD14 apiece. The

company set the pricing of the shares at the top of its indicated

range, which was between USD13 and USD14 apiece, and increased the

number of shares sold. On a fully diluted basis, this would value

DiDi at about USD73 billion. It will be worth USD67.5 billion on a

non-diluted basis, reports Reuters. (IHS Markit Automotive

Mobility's Surabhi Rajpal)

3. DeepRoute.ai's Level 4 autonomous shuttles are transporting

coronavirus disease 2019 (COVID-19) virus test samples to local

hospitals in the Chinese city of Shenzhen, Guangdong. The vehicles

are currently transporting about 14,000 COVID-19 test samples per

day in the city where sporadic cases are surfacing. (IHS Markit

Automotive Mobility's Surabhi Rajpal)

4. Electric vehicle (EV) startup Evergrande has launched its

automated valet parking system capable of several Level 4

autonomous functions in specific scenarios, such as cruising on

narrow roads, pedestrian and obstacle avoidance, automatic

car-following, and automatic recognition of car parks, reports

Gasgoo. The system will be available in Hengchi-branded vehicles

equipped with ultrasonic radars, millimeter-wave radars,

high-definition cameras with panoramic view, as well as

high-precision map. The Hengchi models will be trialed in the

fourth quarter of this year. (IHS Markit AutoIntelligence's Nitin

Budhiraja)

5. The Seoul Bankruptcy Court has accepted SsangYong's request to

extend the deadline for its rehabilitation plan by two months until

1 September amid its ongoing sale process, reports the Yonhap News

Agency. The bankruptcy court put the debt-laden automaker under

court receivership in April and ordered it to submit its

rehabilitation plan by 1 July. A majority stake in SsangYong was

put up for auction on 28 June after its Indian parent company

Mahindra & Mahindra (M&M) failed to attract an investor. In

a public notice of sale, EY Han Young, the accounting firm in

charge of the sale process, said it would accept letters of intent

from potential buyers until the end of July and conduct preliminary

reviews of them in August. Court-appointed administrator Chung

Yong-won said last month that the company aimed to select a

preferred bidder in late September and enter price negotiations in

October, but it remains unclear whether the automaker will be able

to find a new investor within this timeframe, given its heavy debt

load and weak sales. (IHS Markit AutoIntelligence's Jamal Amir)

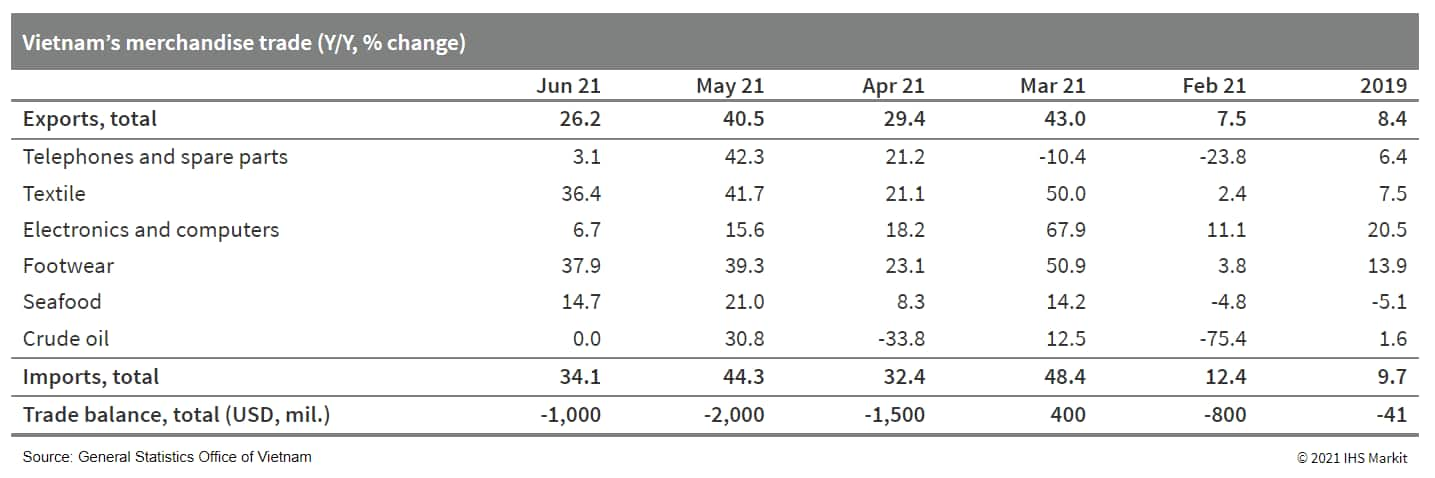

6. Preliminary data from the General Statistics Office of Vietnam

suggest that Vietnam's economic recovery picked up the pace in the

second quarter to 6.61% year on year (y/y), up from 4.48% y/y in

the previous quarter. (IHS Markit Economist Jola Pasku)

a. The biggest support to growth during the second quarter came

from industry and manufacturing (up 11.4% y/y).

b. On the external front, exports of goods increased by 32% y/y to

USD154.3 billion in the January-June period. Despite successive

COVID-19 outbreaks, trade has remained robust in the first half of

2021, supported by the strong economic recoveries in mainland China

and the US, Vietnam's two major trading partners.

c. Despite Vietnam's remarkable resilience in 2020 and the first

half of 2021, there is a growing concern over the effect of the

recent COVID-19 outbreak on overall growth in 2021. Vietnam is

facing the sharpest jump in new infections since the beginning of

the pandemic, triggering the authorities to ramp up social

distancing measures to contain the spread of the virus. Since the

COVID-19 Delta variant began to spread in late April, Vietnam has

recorded more than 10,000 cases, marking a significant jump from

the 1,000 caseload that was kept largely unchanged in the first

quarter of the year.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.