Daily Global Market Summary - 11 February 2021

Most major US equity indices closed higher, and APAC and European markets closed mixed. US government bonds closed sharply lower, while all benchmark European bonds closed higher. European iTraxx and CDX-NA credit indices were close to unchanged across IG and high yield. Oil reported its first down day this month, with gold/silver also lower and copper flat on the day.

Americas

- Most US equity indices closed modestly higher except for DJIA which was unchanged on the day; Nasdaq +0.4%, S&P 500 +0.2%, and Russell 2000 +0.1%.

- 10yt US govt bonds closed +4bps/1.17% yield and 30yr bonds +5bps/1.96% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +1bp/286bps.

- DXY US dollar index closed +0.1%/90.42.

- Gold closed -0.9%/$1,827 per ounce, silver -0.1%/$27.05 per ounce, and copper flat/$3.77 per pound.

- Crude oil closed -0.7%/$58.24 per barrel.

- The custody bank Bank of New York Mellon Corp said Thursday it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients. In time, BNY Mellon will allow those digital assets to pass through the same plumbing used by managers' other, more traditional holdings—from Treasuries to technology stocks—using a platform that is now in prototype. The bank is already discussing plans with clients to bring their digital currencies into the fold. (WSJ)

- Mastercard said on Wednesday that later this year it would begin moving cryptocurrencies directly across its card payments network. Previously, the company had only worked with crypto wallets and exchanges to move funds after they had been converted from digital coins into fiat currency. (FT)

- US gas demand showed relative resiliency in 2020, with low prices providing strong support for gas for power generation (+0.6 Bcf/d year-on-year), and expanded LNG export capacity driving a 1.6 Bcf/d year-on-year increase in LNG export feedgas demand. As we look to 2021, however, lower-48 gas-fired power generation is expected to retreat in 2021 and LNG exports will show only a slight increase in spite of continued capacity expansion. Higher natural gas prices and renewables growth are expected to suppress 2021 gas demand for power generation our experts identify three key disrupters to gas for power demand in 2021 (IHS Markit Energy Advisory's Breanne Dougherty and Yulia Ivanovskaya): a. Economic-driven gas-to-coal switching within the electric generation stack tied to the $0.74/MMBtu annual increase in Henry Hub spot market prices b. Retirement of three nuclear plants, resulting in the record removal of 5.1 GW of nuclear capacity in a single year—or 5% of the current operating nuclear fleet. The loss of this carbon-zero generation will make it more difficult for affected states and regions to meet their targeted emissions goals. c. The US Lower 48 will retire 9.3 GW of generation capacity in 2021, including nuclear, and add 43.2 GW, mostly from solar and wind. The net capacity addition of 33.9 GW will be the largest annual increase on record. The impact of continued renewables penetration and its displacement of gas-fired power plants are prevalent throughout our gas demand and power generation forecasts.

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 19,000 to 793,000 in the week ended 6 February.

The not seasonally adjusted (NSA) tally of initial claims fell by

36,534 to 813,145. Even as initial claims trend down, they remain

at historically high levels—the high during the Great Recession

was 665,000. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 145,000 to 4,545,000 in the week ended 30 January. The insured unemployment rate edged down 0.1 percentage point to 3.2%.

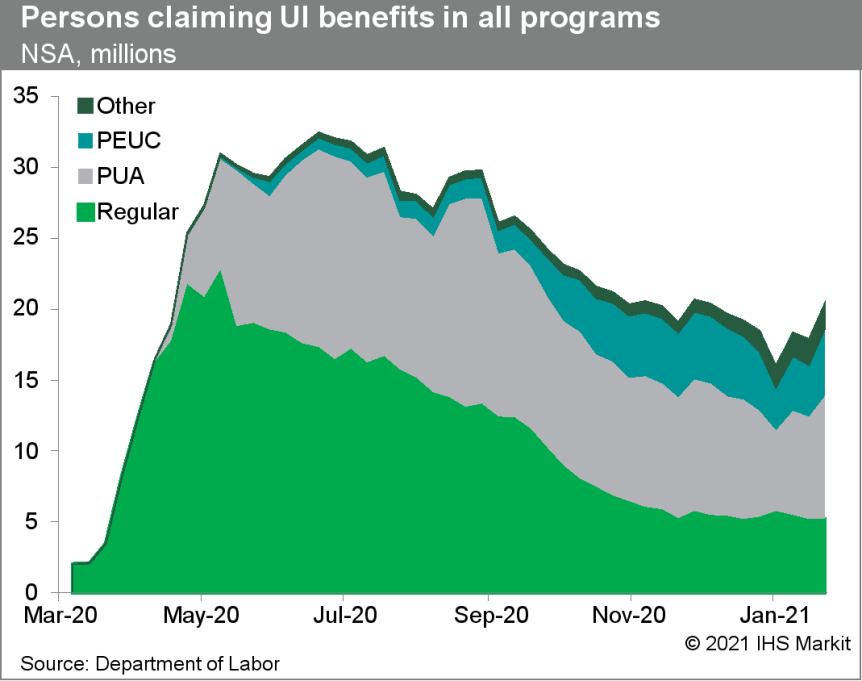

- There were 334,524 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 6 February. In the week ended 23 January, continuing claims for PUA rose by 1,496,505 to 8,715,306.

- In the week ended 23 January, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 1,172,948 to 4,777,842. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 23 January, the unadjusted total rose by 2,596,539 to 20,435,018, breaching the 20-million mark for the first time in seven weeks.

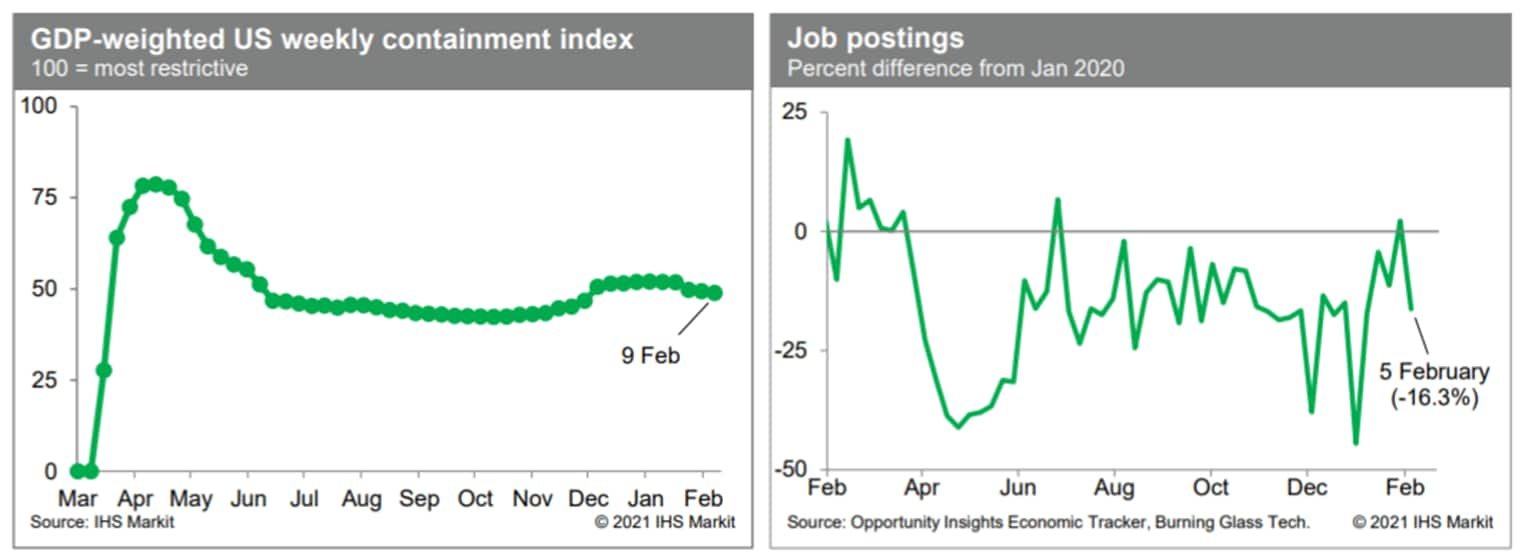

- Passenger throughput at US airports has remained depressed in recent days near levels prior to a temporary lift around the holidays. Recovery in the travel sector remains slow. Meanwhile, consumption of gasoline inched up last week but remains below a normal range, an indication of continued depressed internal mobility. (IHS Markit Economists Ben Herzon and Joel Prakken)

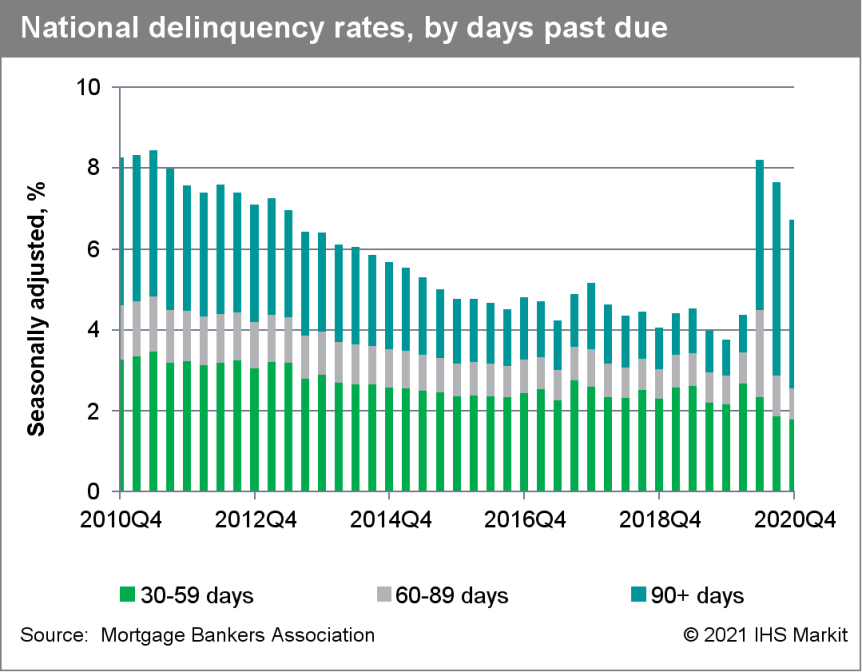

- The seasonally adjusted US mortgage delinquency rate fell 92bps from the end of the third quarter to 6.73% at the end of the fourth quarter; it was up 296 basis points from a year earlier. (IHS Markit Economist Patrick Newport)

- The serious delinquency rate—loans more than 90 days delinquent or in foreclosure—was 5.03%, 327 basis points higher than a year earlier.

- The five states with the sharpest increase in delinquency rates from a year earlier—New York, New Jersey, Nevada, Florida, and Hawaii—were all initially hit hard by the pandemic.

- On 27 December (about the end of the fourth quarter), 2.7 million homeowners were in forbearance plans. That number has dropped slightly, but, after rounding, is still 2.7 million. The Coronavirus Aid, Relief, and Economic Security (CARES) Act allows homeowners to delay mortgage payments for 90 days and apply for a one-year extension; currently, just over 80% of loans in forbearance are in an extension. The Mortgage Bankers Association (MBA) expects "a sharp increase in exits" from forbearance in March and April as borrowers reach the 12-month expiration date.

- This report was not all grim: the percentage of loans in the foreclosure process was 0.56%, down 22 basis points from a year earlier and the lowest reading since the second quarter of 1982; the 30-day delinquency sank to a record low; and the seasonally adjusted rate on new foreclosures remained at a survey low 0.03%—almost zero.

- US fruit, vegetable and sunflower growers are pressing EPA to reregister chlorpyrifos, arguing the organophosphate insecticide is a critical crop protection tool and that alternatives are costly and less effective. Comments sent to EPA by the Pacific Northwest Vegetable Association, Florida Fruit and Vegetable Association and the National Sunflower Association lay out support for continued use of chlorpyrifos, with the groups telling the agency the insecticide can be used safely. The backing of the industry groups comes as the Biden administration is reviewing EPA's work on chlorpyrifos, notably the decision by Trump administration officials to abandon an agency plan to revoke food tolerances and effectively ban agricultural use of the insecticide. In 2015 EPA found cumulative exposures to the known neurotoxin exceeded the safety standard set by federal food safety law and proposed granting a petition that called for revocation of food tolerances. Pressure from ag groups and the pesticide industry helped convince the Trump administration to change course and deny the petition. EPA subsequently issued new risk assessments in September 2020 to support a reregistration decision and proposed an interim registration decision last December. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Toyota has announced plans to debut three new electrified vehicles for the US market in 2021; these will include two battery electric vehicles and one plug-in hybrid electric vehicle (PHEV). Furthermore, Toyota has confirmed that it expects 40% of its US sales to be electrified models - including traditional hybrid vehicles, battery electric vehicles (BEVs), and PHEVs - by 2025. By 2030, Toyota aims to increase that to 70%. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Stellantis group has announced that the Jeep automotive hub, located in Goiana (in the state of Pernambuco), is the first carbon-neutral industrial complex in Latin America, reports Automotive Business. The plant had already achieved the Gold Seal of the Greenhouse Gas Protocol (GHG) Protocol Brazil Program, which was launched in 2008 to promote voluntary GHG management and reporting. Sixteen plants (including factories as well as suppliers) joined the emissions compensation programs, making the entire automotive hub carbon neutral. (IHS Markit AutoIntelligence's Tarun Thakur)

- Automated truck startup Plus has raised USD200 million in a Series B funding round led by new investors Guotai Junan International, CPE, and Wanxiang International Investment, reports VentureBeat. Existing investors including Sequoia, Lightspeed, GSR Ventures, CGC, Mayfield, SAIC, and Full Truck Alliance also participated in the round. The company will use the infused capital to accelerate the commercialization and deployment of its automated trucking system. In addition, Plus will develop a sales and support network to support fleets in integrating its automated trucking system and will scale up deployments in the United States and China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Velodyne Lidar and ThorDrive have entered into a five-year LiDAR sensor supply agreement. ThorDrive will integrate Velodyne's Ultra Puck LiDAR sensors, which allow 360-degree surround view, into its cargo and baggage ground support tractors. These tractors will be deployed for an autonomous vehicle (AV) program at the Cincinnati/Northern Kentucky International Airport (CVG) in the United States. This will enable airlines to autonomously transport baggage and cargo to and from planes and throughout facilities, thereby improving airport safety and cargo efficiencies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.8%, Italy +0.2%, UK +0.1%, France flat, and Spain -0.3%.

- 10yr European govt bonds closed higher across the region, with Italian bonds closing -5bps and at a new record low yield of 0.46%; France, Germany, Spain, and UK all closed -2bps on the day.

- Italy's 5-Star Movement, the party with the largest number of lawmakers, will hold an online vote on Thursday on whether to support a government led by Draghi, a former European Central Bank chief. It urged its members to vote yes. (Reuters)

- iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -3bps/241bps.

- Brent crude closed -0.5%/$61.14 per barrel.

- Fuel-cell vehicle conversion company ULEMCo has announced that it is set to supply ambulances powered by hydrogen fuel cells to the London Ambulance Service NHS Trust (LAS) later in 2021 for testing purposes. The ambulances are being developed under the Zero Emission Rapid Response Operations (ZERRO) project banner, and ULEMCo is leading a range of other businesses in shaping the vehicle, which is being funded by the UK government's Office for Zero Emission Vehicles (OZEV). These other businesses include Lyra Electronics, which is providing its specialist DC-DC electronics capability; Promech Technologies, which is providing battery technology solutions and expertise; and Woodall Nicholson Group's Mellor and VCS Limited, which has designed and manufactured the body. (IHS Markit AutoIntelligence's Ian Fletcher)

- Aker Solutions, in a consortium with Siemens Energy, has been selected by Vattenfall as preferred bidder for the Norfolk offshore wind project located in the UK North Sea off the coast of Norfolk. If Vattenfall proceeds with the development, the intention is to conclude an EPCI contract where the consortium will deliver HVDC converter platforms for the grid connection infrastructure. The Norfolk wind zone consists of the Norfolk Vanguard and Norfolk Boreas offshore wind farms. The planned 3.6 GW total installed capacity will make this one of the largest offshore zones in the world. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- The rapid adoption of technology will allow supermarkets to reduce food waste and drive ever greater customer loyalty, according to Mel Smith CBE, chief executive of Ocado, the UK online supermarket operation. On 10 February, speaking at the City Food Lecture to an international online audience of over 1,400 food and drink industry leaders, the largest to ever attend the event, she said that technology has been the driving force behind Ocado's success, has enabled the company to service the rapid rise in online shopping in the last 12 months, and that the rapid expansion of online grocery shopping is set to continue post pandemic. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- "The growth in online sales has wildly accelerated over the past year. Before the pandemic online grocery sales accounted for 7% of the total market. In 2020, the channel almost doubled to 13%," she said. "The UK has one of the highest online penetrations globally, and we expect that the online channel will double in size again over the next few years.

- She added that Ocado produces hardly any food waste, partly because it has a really short supply chain but also because it has a perfect view of what its customers have in their baskets, up to 28 days in advance.

- "5G and the growing number of smart appliances also open up huge new possibilities. Smart appliances are filled with sensors and connect to the internet to upload and analyse collected data."

- The Volkswagen (VW) Group has agreed an alliance for its Car.Software organization to work together with Microsoft on building a new automated driving technology platform, according to a company statement. The platform will be cloud-based and collaborative, and will be aimed at sharing technology and data which will help VW accelerate its research and development (R&D) times in the area. The Car.Software organization will look to simplify its autonomous vehicle (AV) technology developing processes to bring technology to production with shorter lead times. This enhanced collaboration with Microsoft on a development platform to speed the introduction of new AV technologies, will help the VW Group in its goal of developing core proprietary technologies. This will, in turn, ensure it retains technological relevance and autonomy as the industry moves ever closer to the production of full AVs. (IHS Markit AutoIntelligence's Tim Urquhart)

- The European Commission has announced that it has approved a new fuel cell joint venture (JV) between Daimler and Volvo Group. According to a statement, the JV, known as Daimler Truck Fuel Cell and based in Germany, has been approved under the 'EU Merger Regulation'. The announcement is an important step towards finalizing the JV which will development, produce, sell and provide aftersales support for hydrogen fuel cell systems (FCS) primarily for heavy-duty trucks but also, to a smaller extent, for stationary applications. The companies signed a binding agreement in November 2020 under which Volvo would acquire a 50% stake in the organization for around EUR600 million on a cash and debt free basis. (IHS Markit AutoIntelligence's Ian Fletcher)

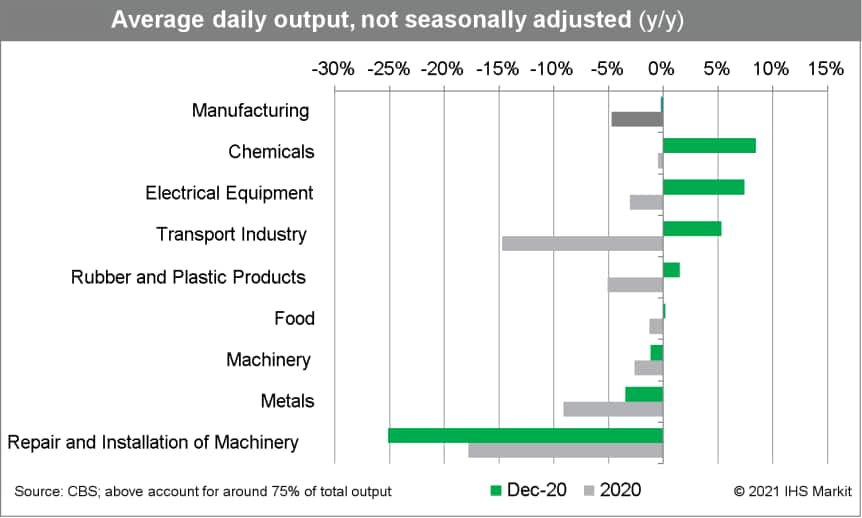

- In December 2020, on a seasonally and working-day adjusted basis, Dutch manufacturing output was up by 0.5% month on month (m/m), while the data for November were revised up from a contraction of 0.2% to growth of 0.1%. Output was down by just 0.7% year on year (y/y) and by 1.9% compared with February 2020, prior to the impact of the COVID-19 virus pandemic. (IHS Markit Economist Daniel Kral)

- On a seasonally unadjusted basis, average daily output of the Dutch manufacturing sector was down by 0.2% y/y in December, compared to -2.7% y/y in November. On a three-month moving average basis, output was down by 2.4% y/y and by 1.8% since February 2020.

- In December, around half of the sub-components were a drag. The biggest drops were recorded for the repair and installation of machinery, which was down 25.1% y/y; metals, down 3.5% y/y; and machinery, down 1.2% y/y. Chemicals, electronics, and transport equipment recorded strong annual growth (see Chart 3).

- For the full year, manufacturing output was down by 4.6% on a seasonally adjusted and 4.7% on a seasonally unadjusted basis. After large contractions in February-May 2020, Dutch manufacturing output has been on an uninterrupted recovery path, apart from a small contraction in September.

- The Dutch manufacturing purchasing managers' index (PMI) continued to indicate strong growth in January. The output sub-index rebounded to 58.4, the highest level since September 2018.

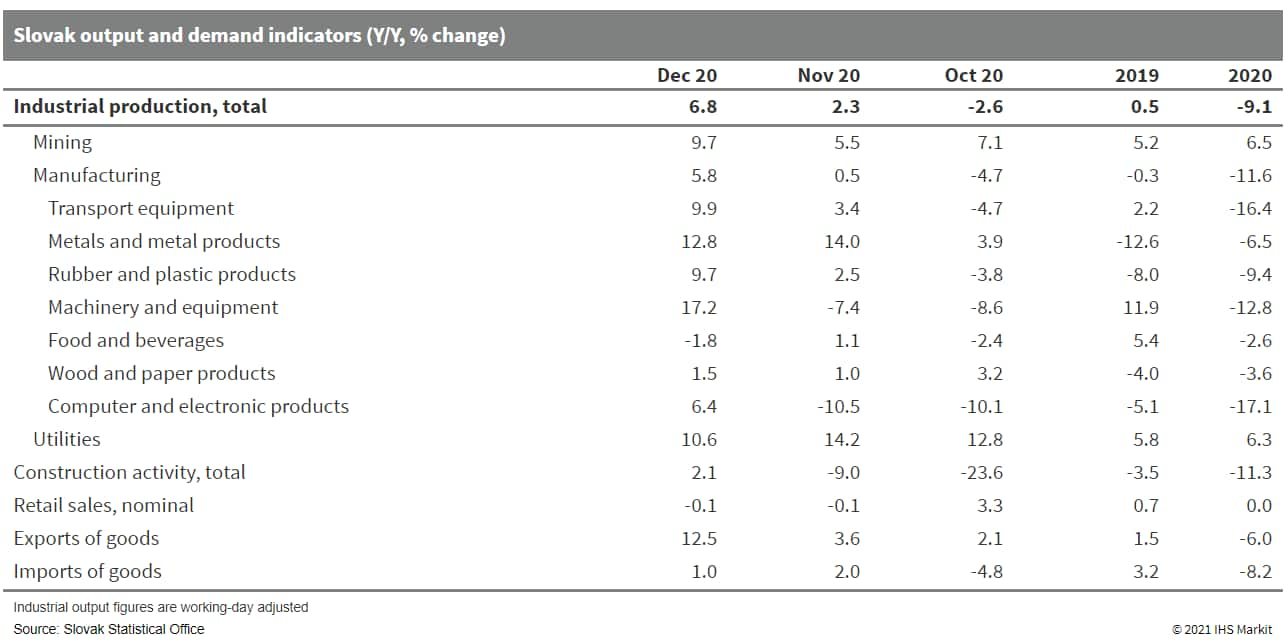

- Slovakia's December 2020 output and trade data were broadly positive despite coronavirus COVID-19 virus restriction, signaling that fourth-quarter-2020 GDP results may be stronger than previously expected. (IHS Markit Economist Sharon Fisher)

- Although seasonally adjusted industrial production edged downwards by 0.3% month on month (m/m) in December 2020, working-day-adjusted output jumped by 6.8% year on year (y/y). December output growth benefitted from strong results across all three sectors: mining, manufacturing, and utilities.

- Within manufacturing, the key machinery and equipment, metals, transport equipment, and rubber and plastics categories reported especially robust growth. In contrast, food and beverages production declined.

- By industrial groupings, production of intermediate goods jumped by 11.0% y/y in December 2020, while capital goods output increased by 8.0%, the fastest rate since May 2019. The only category to record a decline was non-durable consumer goods (-6.0% y/y).

- In 2020 as a whole, industrial output fell by 9.1%, a better result than we had expected around mid-2020. Mining and utilities production increased in 2020, but manufacturing output plummeted by 11.6%, partly because of a steep drop in the transport equipment category.

- As per the Russian Ministry of Energy, coal exports (seaborne and overland) during January 2021 stood at 16.3mt (up 30% y/y). As per IHS Markit's Commodities at Sea, Russian seaborne coal export shipments during January 2021 stood at 12.1mt (down 4% y/y). Thus, indicating around 4mt Russian coal was exported via overland to Europe and China (Mainland). One of the reasons for the increase in overland transportation was lower railcar lease rates which were reduced early this year. In terms of import regions, during January 2021, Russian shipments increased to JKT (3.7mt, up 19% y/y), Mediterranean (1.7mt, up 47%), and Mainland China (1.9mt, up 17%). Shipments declined to NW Europe (1.6mt, down 48% y/y) and the Indian Subcontinent (0.4mt, down 71%). As the year had ended, there was a severe cold blast that hit North Asian countries which significantly increased electricity demand and hence the demand for fuels ranging from coal to LNG across the region. (IHS Markit Maritime and Trade's Pranay Shukla)

Asia-Pacific

- Several major APAC equity markets were closed for the Lunar New Year holiday; Hong Kong +0.5%, India +0.4%, and Australia -0.1%.

- Resurgence of COVID-19 cases in some regions of China present some short-term uncertainty, but domestic milk price averages and production continue to rise at the beginning of 2021. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- The China-wide milk price average continued to rise in the first three weeks of 2021, according to Rabobank's latest China report. Milk currently averages CNY4.26 per kilo (USD0.66/kg) which is just below the historical high of February 2014 and 12% above the 2020 price average.

- The rising milk price trend is mirroring the prices of feed, in particular corn and soymeal, which have also reached multi-year highs.

- With recent global price increases for WMP, the discount of the Oceania-origin WMP to the domestic average milk price has narrowed from 25% to 18% at the end of the third quarter of 2020 (based on import parity).

- Full-year 2020 milk production grew 7.5% y/y, implying a slowdown to 5-6% in the fourth quarter of 2020 versus 8.2% rise during the first three quarters, according to the National Statistics Bureau.

- Autonomous vehicle (AV) startup WeRide has received a permit for ride-hailing operation by the Guangzhou Municipal Transportation Bureau, according to a blog posted on the Medium website. The company claims to becoming China's first AV company with this kind of qualification. Tony Han, founder and CEO of WeRide, said, "Today I am very delighted to see that we have taken another solid step towards the commercialization of autonomous driving. WeRide becomes the first AD company in China to have obtained the permit for ride-hailing operation, adding another important advantage to those we have already had in the industry. We have been prepared for the application of this license with significant investment of energy and time throughout the process". (IHS Markit Automotive Mobility's Surabhi Rajpal)

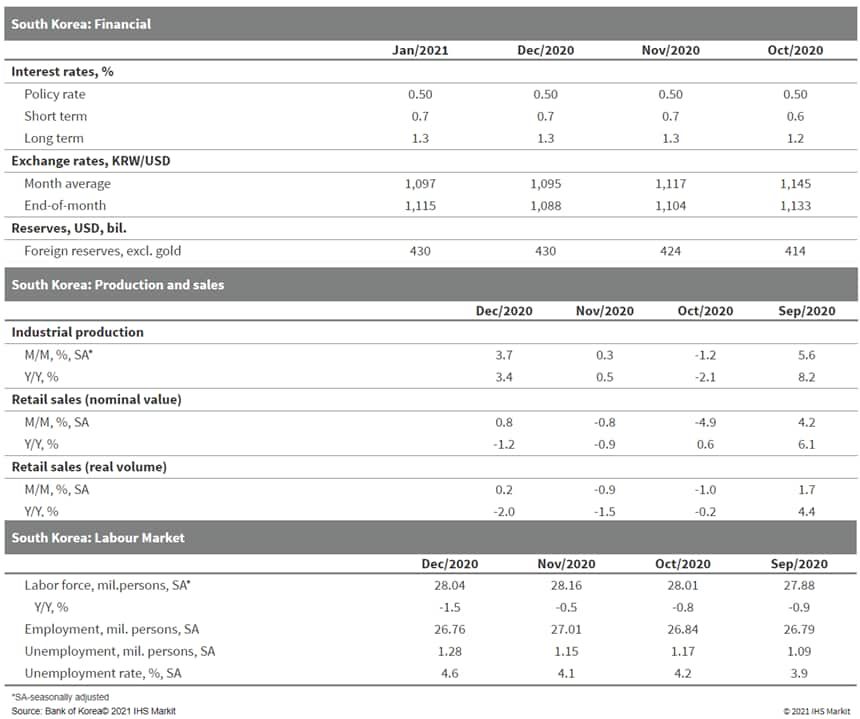

- Monthly-frequency data for South Korea show a deceleration at end-2020, not surprising due to the increase in COVID-19 cases. (IHS Markit Economist Dan Ryan)

- Exports now appear to be moderating, after their post-pandemic rebound. In fact, exports in the past two months nearly returned to the highs of 2018, before the 2019 global slowdown and the 2020 pandemic.

- Imports have also been rising, although not to the extent of exports, due to the lack of domestic demand. In the short term, imports could decline as a response to the resurgence of COVID-19, although this should quickly reverse in mid-year as vaccinations become widespread.

- Prices have recently been rising at a slow pace, but much of this is a return to normal valuation as the economy approaches pre-pandemic levels. However, it is surprising that consumer prices have been rising faster than producer prices, since consumer spending remains sluggish.

- The Bank of Korea is keeping interest rates low during the domestic and global recovery phase. We do not expect the policy rate to increase until the second half of next year.

- Industrial production has performed well, thanks to the strong export recovery of exports in recent months. But the industrial index is now looking very high, at the upper end of the growth envelope of recent years, suggesting that a negative correction is likely.

- The resurgence of COVID-19, and the resulting lockdowns, had a negative effect on jobs. The unemployment rate jumped a half-percentage point to 4.6%, only slightly lower than the 4.7 seen during the recession over a decade ago.

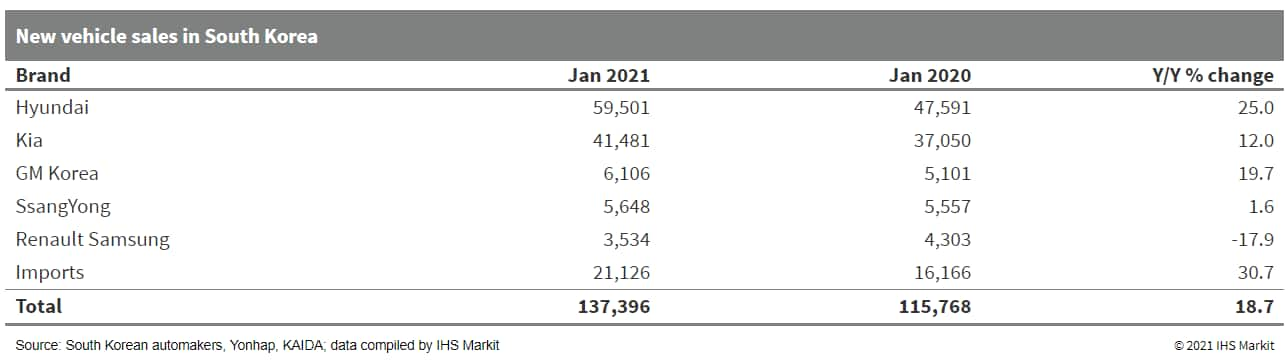

- The growth in the South Korean new vehicle market during January can be attributed to rising demand for newly launched models, attractive sales promotions by automakers, growth in imported passenger vehicle sales, and a higher number of working days compared with January 2020. IHS Markit expects light-vehicle sales in South Korea to decline by 4.0% year on year (y/y) to around 1.79 million units in 2021, mainly owing to a high base of comparison as consumption tax relief on passenger vehicles pulled forward new vehicle demand to 2020. (IHS Markit AutoIntelligence's Jamal Amir)

- The Korea Fair Trade Commission (KFTC) has approved a proposal by T Map Mobility to form a taxi-hailing joint venture (JV) with Uber, reports Yonhap News Agency. Last year, T Map Mobility, SK Telecom's mobility spin-off, announced its intention to form a JV with Uber, which will invest USD100 million for a 51% stake. South Korea's anti-trust watchdog has given the green light to the JV as it will not hurt market competition. This gives Uber an opportunity to expand in South Korea's ride-hailing market, which is dominated by local player Kakao's mobility unit, which has a market share of nearly 80%. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.