Daily Global Market Summary - 11 May 2021

All major equity indices closed lower across the US, Europe, and APAC except for Mainland China's markets closing modestly higher. US and European government bonds closed lower, with 10yr European bonds lower by more than 4bps on the day. European iTraxx closed wider across IG and high yield, while CDX-NA indices were almost flat on the day. The US dollar and gold closed lower, while oil, natural gas, copper and silver were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower for a second consecutive day; Nasdaq -0.1%, Russell 2000 -0.3%, S&P 500 -0.9%, and DJIA -1.4%.

- 10yr US govt bonds closed +2bp/1.62% yield and 30yr bonds +3bps/2.35% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY +2bps/293bps.

- DXY US dollar index closed -0.1%/90.14.

- Gold closed -0.1%/$1,836 per troy oz, silver +0.6%/$27.67 per troy oz, and copper +1.0%/$4.76 per pound.

- Crude oil closed +0.6%/$65.28 per barrel and natural gas closed +0.8%/$2.96 per mmbtu.

- The latest US JOLTS report points to a strong March for the

labor market. With a third of the total population fully vaccinated

and a falling tally of new daily infections, states are

accelerating their reopening plans, giving a boost to the labor

market, which is evident in this release. (IHS Markit Economist

Akshat Goel)

- Job openings rose to a series high of 8.1 million in March, with industries worst hit by the pandemic recording large increases in job openings: accommodation and food services saw an increase of 185,000 and arts, entertainment, and recreation saw an increase of 81,000. The number of hires rose to 6.0 million.

- Job separations fell to 5.3 million in March as layoffs and discharges fell to a series low of 1.5 million.

- The quits rate, a valuable indicator of the general health of the labor market, was unchanged at 2.4%, 0.1 percentage point above its pre-pandemic average.

- Over the 12 months ending in March, there was a net employment loss of 3.3 million.

- There were 1.2 workers competing for every job opening in March. In the two years prior to the pandemic, the number of job openings exceeded the number of unemployed in every report.

- The US Department of the Interior has given Vineyard Wind the go ahead to start building what would be the nation's largest commercial offshore wind facility to date by issuing a record of decision, which spells out where and how many turbines can be installed. With this decision in hand, Vineyard Wind now has the approval to build and install 84 or fewer wind turbines for a total of 800-MW of capacity at a distance of about 12 nautical miles each from the Massachusetts shorelines of Nantucket and Martha's Vineyard. Slated for completion in the second quarter of 2024, the facility will meet 10% of Massachusetts' power needs, while giving a huge boost to the Biden-Harris administration's goal of reaching 30 GW of offshore wind by the end of the decade. President Joe Biden has made offshore wind generation a key part of plans to halve the nation's GHGs and to decarbonize the power sector entirely by 2035. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- The United States of Massachusetts's utility companies have launched a request for proposals (RFP) for 200 to 1,600 MW of offshore wind energy. The distribution companies are seeking to procure at least 400 MW, up to 1,600 MW. The ceiling on the nominal levelized price has been set at USD77.76 per MWh, and is to include costs for all development, network upgrades, and energy storage systems. For the procurement process, the first stage will be a bidder qualification round, followed by the second stage, which is a qualitative and quantitative evaluation. The third, and final, round will be a further evaluation considering further risk assessments, and additional factors not covered in the second stage. Deadline for submissions is 23 September 2021, with successful bidders announced in December. This is the third such solicitation by the state. The first two were won by Vineyard Wind (800 MW), and Mayflower Wind (804 MW) respectively. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- US retail sales of orange juice have dropped by 22%, according

to the seventh monthly report conducted by A C Nielsen for the

Florida Department of Citrus (FDOC). This follows a decline of 18%

in the previous four-week period, with steep declines recorded in

every single category. Total sales were 31.85 million gallons

(40.98 million gallons last year). (IHS Markit Food and

Agricultural Commodities' Neil Murray)

- The only category to report an increase this month was the small shelf-stable US category, which recorded sales of 1.10 million gallons compared with 1.06 million gallons last year. Value sales were down over 20% to USD236.29 million (USD297.74 million last year).

- NFC juice sales were down by nearly 20% to 19.56 million gallons (24.35 million gallons), worth USD173.15 million (USD213.21 million). NFC orange juice prices rose by 1% to an average of USD8.85 per gallon (USD8.75/gallon).

- Frozen orange juice prices fell by over 40% to 1.1 million gallons and sales value dropped by over 41% to USD5.67 million (USD9.73 million).

- For the season to date, retail sales are down 0.6% to just under 250 million gallons (251.45 million gallons) and revenues are up by 2.3% to USD1.81 billion from USD1.78 billion.

- This is news the US industry did not want to hear. It means that the COVID-induced boom in retail orange juice sales is probably over. If there is any comfort to be gleaned from these figures, it is that this month's sales are at least slightly above the pre-COVID figures for the 2018/19 season.

- Prince International, a maker of specialty chemicals, minerals, and industrial additives, has agreed to acquire Ferro for $2.1 billion, or $22/share plus assumed debt and other liabilities. Prince is owned by private equity firm American Securities (New York, New York), which acquired it in 2018. The deal represents a multiple of 12.4 times (x) Ferro's adjusted EBITDA for the year ended 31 March 2020. It has been unanimously approved by Ferro's board of directors. (IHS Markit Chemical Advisory)

- Autonomous vehicle (AV) startup Pony.ai in collaboration with Luminar Technologies has introduced its newly designed sensing platform. Pony.ai's next-generation autonomous fleet will be integrated with Luminar's LiDAR sensor Iris, which is about 10 cm high, and four of them will be mounted on top of the car for 360-degree views, reports Reuters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Plus will go public through a merger agreement with Hennessy Capital Investment Corp. V (HCIC V), a special-purpose acquisition company (SPAC). This will bring market value of the combined entity to USD3.3 billion. The combined company will get proceeds of USD500 million from the deal, which includes USD345 million of cash from HCIC V and USD150 million of financing through PIPE. AV companies are looking to public markets for financial support as they plan to launch their technology at a commercial scale. Plus, which was founded in 2016, focuses on developing Level 4 autonomous technology to make commercial freight transport safer, more efficient, and less expensive for its customers. The company plans to begin mass production of its autonomous solution, PlusDrive, starting in 2021 with Chinese commercial vehicle maker FAW. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Bosch plans to invest USD100 million in new manufacturing lines and digitization projects at several Mexican facilities, according to media reports. Reuters reports that the supplier's plans include investments in digitization projects at the Toluca plant and new manufacturing lines at the Mexicali and Hermosillo plants. The company also plans to implement a three-axis network motion-control system for auto-parts through cold pressing at Rexroth. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity indices closed lower; Italy -1.6%, Spain -1.7%, Germany -1.8%, France -1.9%, and UK -2.5%.

- 10yr European govt bonds closed sharply lower; Italy/France +6bps and Germany/Spain/UK +5bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +5bps/256bps.

- Brent crude closed +0.3%/$68.55 per barrel.

- Gordon Murray Group has announced that it will invest GBP300 million over the next five years as part of the expansion of its business. The automaker said in a statement that the investment will include a new technology campus; heritage and customer center; and bespoke design and engineering facility that will start construction during July. This first facilities will be ready in 2022 and the project will be completed in 2024. As part of its wider strategy, the company is "directing substantial investment" towards a 'superlight' research and development (R&D) facility, that will help weight reduction and reduce complexity. The company is also investing in additional facilities at its existing Dunsfold (UK) site that will manufacture "superlight" frames for Gordon Murray Design and Gordon Murray Automotive vehicle programs. It has also established a new division, Gordon Murray Electronics, which will focus on designing and engineering advanced, lightweight electric vehicles (EVs). (IHS Markit AutoIntelligence's Ian Fletcher)

- Italy's industrial output was flat in February and March, which

was in line with adverse GDP developments in the first quarter of

2021, with tight regional lockdowns targeting yet again the

hospitality, leisure, transport, and non-essential retail sectors.

(IHS Markit Economist Raj

Badiani)

- Despite not being affected directly by the tighter COVID-19 virus-related restrictions during the first quarter, industrial activity appeared to endure some residual damage.

- According to the national statistical office (ISTAT), industrial production grew 0.1% month on month (m/m) in March after a 0.1% m/m drop in February. In addition, industrial output in March remained 1.2% below its February 2020 level, the last pre-pandemic month.

- Average output rose by 0.9% quarter on quarter (q/q) in the first quarter.

- Rising output in March took place in investment (+0.2% m/m), intermediate (+0.5%) and energy goods (+1.8% m/m). However, restrictions on non-essential retailing both in Italy and key export markets triggered a 1.5% m/n fall in the output of durable consumer goods.

- On a working-day-adjusted basis, the picture was distorted, with industrial output rising by 37.7% year on year (y/y) in March after a 29.6% y/y drop in the same month a year earlier.

- Production contracted by 11.4% y/y in the full year 2020, compared with a 1.0% drop in 2019.

- BMW has given an update on its collaboration with world-renowned film soundtrack composer Hans Zimmer to create bespoke sounds for its battery electric vehicles (BEVs), according to a company statement. The collaboration between composer and curator Zimmer and the BMW Group's Creative Director for Sound Renzo Vitale has produced a distinctive driving sound, which customers will soon be able to experience in a version developed specially for electric BMW M cars. (IHS Markit AutoIntelligence's Tim Urquhart)

- DAF Trucks has announced new charging infrastructure to go with its range of LF and CF electric trucks, according to a company statement . DAF will now offer a full range of fixed charging stations with power levels through its parent company PACCAR from 20 kW up to 350 kW. In addition, to provide maximum flexibility, mobile chargers with power levels from 24 kW up to 40 kW are also now available. The most popular charger types initially are expected to be the 120 kW and 180 kW PACCAR chargers, which are perfectly suited for fleets operating electric vehicles (EVs) on multiple routes or in multiple shifts. The 180 kW unit can charge most truck types in less than three hours. (IHS Markit AutoIntelligence's Ian Fletcher)

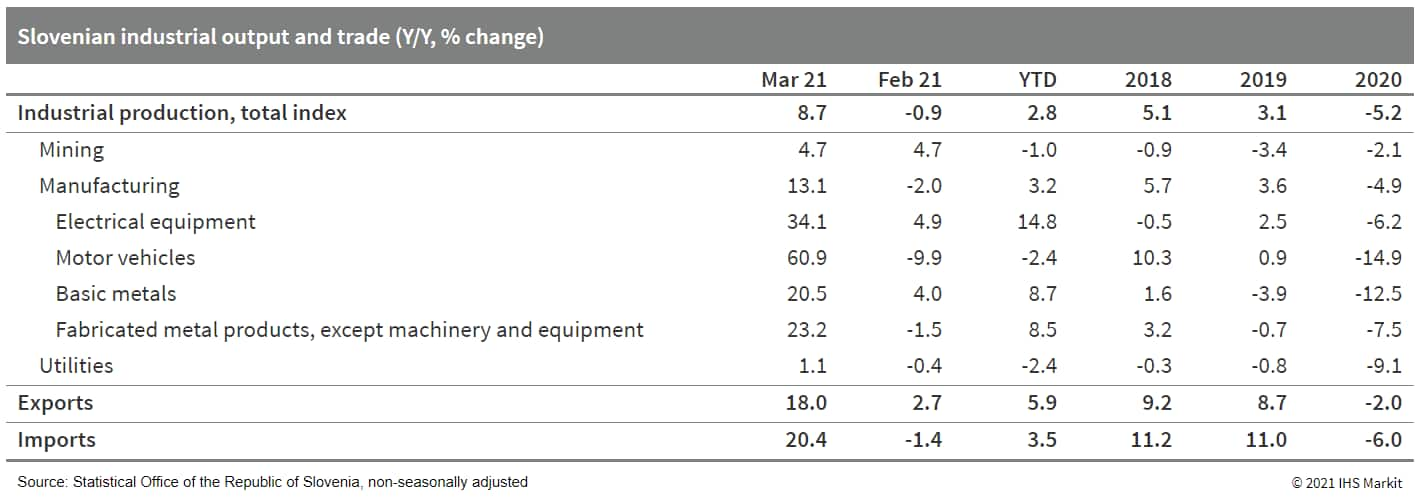

- Base effects sent Slovenian industrial production and

merchandise-trade volume growth soaring in March 2021 on a y/y

basis. The dramatic, sudden shutdown across Europe in March 2020 in

reaction to the spread of COVID-19 collapsed economic activity last

year. (IHS Markit Economist Andrew

Birch)

- On a m/m basis, there was a faltering of industrial production in March, however. After rising by 1.5% m/m and 1.1% m/m in the first two months of 2021, industrial output slipped by 0.9% m/m in March.

- The production of capital goods dropped off particularly

sharply in March. The manufacture of intermediate goods continued

to grow relatively robustly, reflecting the ongoing rally in the

European production cycle.

- Sustainable protein company Unibio has strengthened ties with Russia's Protelux with a new partnership agreement on using natural gas to produce animal feed. Unibio said the two partners would work to develop industrial-scale production of Uniprotein, which offers a sustainable alternative to traditional proteins, such as fishmeal and soy. Relative to soy production, Uniprotein claims to use 1/300th of the water and 1/25,000th of the land. Located in Ivangorod, close to Russia's border with Estonia, Protelux is the first industrial plant that has brought Unibio's patented U-Loop continuous-flow fermentation process into industrial-scale production. This location has access to cost-effective natural gas, as well proximity to the EU and the Baltic Sea for shipping. Protelux currently has an installed capacity of 6,000 tons of Uniprotein per year, which can be scaled up to 20,000 tons. (IHS Markit Food and Agricultural Commodities' Max Green)

Asia-Pacific

- Most APAC equity markets closed lower except for Mainland China +0.4%; India -0.7%, Australia -1.1%, South Korea -1.2%, Hong Kong -2.0%, and Japan -3.1%.

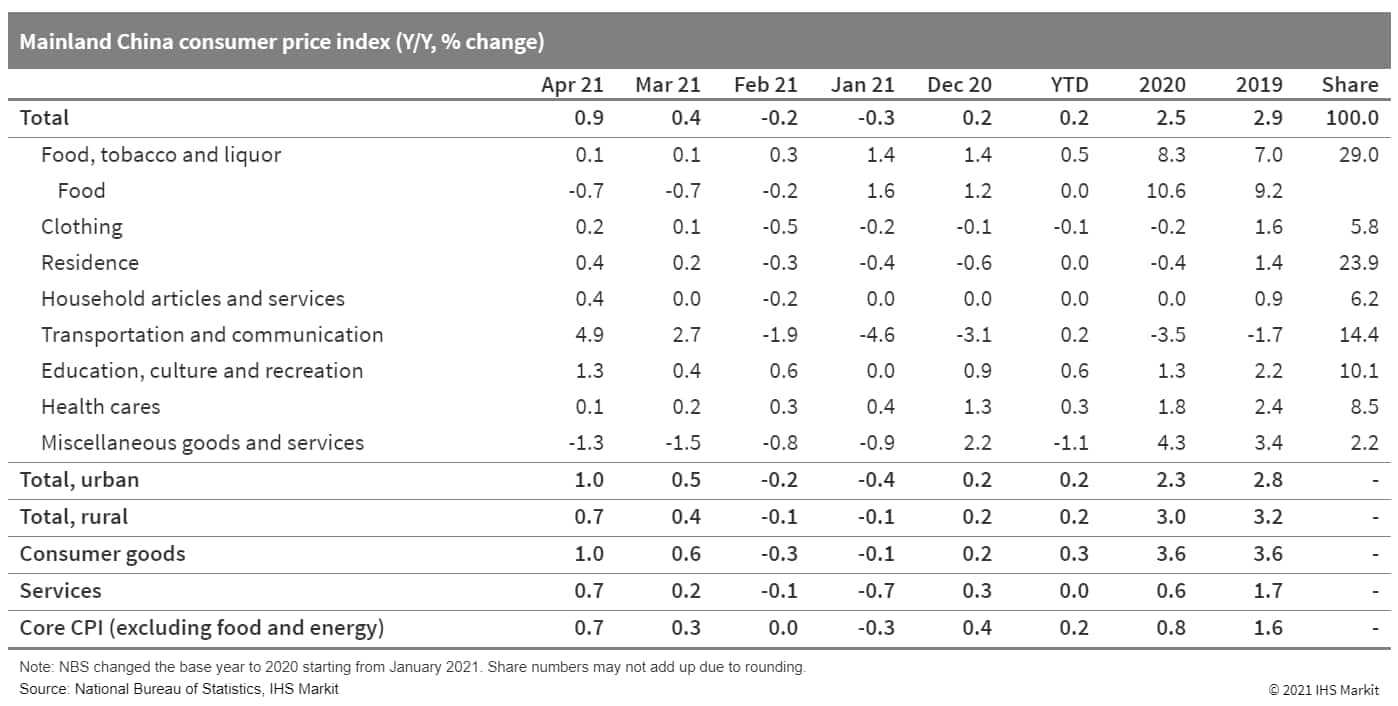

- Mainland China's Consumer Price Index (CPI) increased by 0.9%

year on year (y/y) in April, up by 0.5 percentage point from March,

according to data released by the National Bureau of Statistics

(NBS). Month-on-month (m/m) CPI deflation narrowed to 0.3%,

compared with 0.5% m/m deflation a month ago. (IHS Markit Economist

Lei Yi)

- Sustained recovery in consumer demand drives the uptick in April headline CPI inflation. While food prices further declined as pork prices fell by 21.4% y/y, non-food prices rose by 1.3% y/y in April, up by 0.6 percentage point from the previous month.

- Producer Price index (PPI) surged by 6.8% y/y in April, the

highest since October 2017 and up by 2.4 percentage points from

March. On a month-on-month basis, PPI inflation fell to 0.9% m/m

from 1.6% m/m in the prior month, which should partially attribute

to the slightly weakened crude oil prices in April.

- The Shanghai city government is to stop issuing free license plates to electric vehicle (EV) buyers, reports the South China Morning Post. The report cites statements from three managers with local car dealerships, who claim that the municipal government has suspended granting free license plates for electric cars priced at less than CNY100,000 (USD15,560). The move is expected to significantly increase the price and reduce the demand for smaller EVs such as the Hongguang Mini and Ora-branded EVs, which are quite popular due to their size and price. (IHS Markit AutoIntelligence's Nitin Budhiraja)

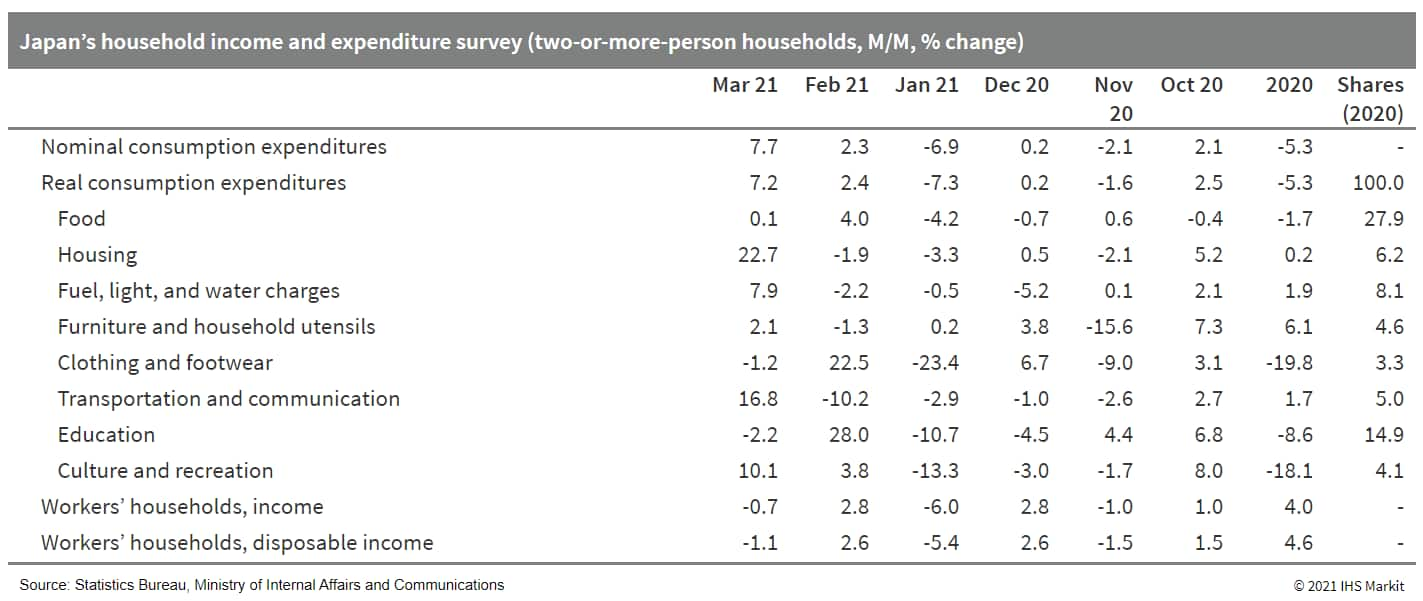

- Japan's real household expenditures rose by 7.2% month on month

(m/m) in March following a 2.4% m/m rise in February. The solid m/m

increase also led to the first year-on-year (y/y) growth in five

months, moving up to a 6.2% rise from a 6.1% drop in February,

thanks largely to the lifting of the state of emergency and low

base effects. (IHS Markit Economist Harumi

Taguchi)

- The m/m improvement largely reflected solid rebounds in spending for housing, transportation, and miscellaneous items, as well as continued increases in spending for culture and recreation. The rises were partially offset by a decline in spending for clothing and footwear.

- The March results were stronger than IHS Markit expected.

However, a 3.9% quarter-on-quarter (q/q) decline in the first

quarter suggests that sluggish private consumption because of the

negative effect of the state of emergency in many prefectures is

likely to shrink real GDP for the first quarter (which will be

released on 18 May).

- Showa Denko (Tokyo, Japan) has raised its earnings and sales

guidance for the first half and full year 2021 due to increasing

sales of semiconductor-related products and graphite electrodes,

and higher petrochemical prices, with the improvement in all

segments driven by stronger demand, it says. The company is now

forecasting net income of ¥9.0 billion ($83 million) for the six

months ending 30 June, compared with a projected net loss of ¥16.0

billion in its previously issued forecast on 17 February. Net sales

are forecast to rise to ¥695.0 billion for the half year, 10%

higher than in its prior guidance. Full-year 2021 net income is now

projected at ¥11.0 billion, switching from guidance issued on 17

February for a forecast annual loss of ¥14.0 billion, while sales

are now estimated at ¥1.3 trillion for the full year, up 5% from

its previous guidance. (IHS Markit Chemical Advisory)

- In the materials segment, sales of semiconductor-related products "have been exceeding [the] previous forecast due to [a] tighter supply-demand situation," it says.

- In the inorganics segment, sales volumes of graphite electrodes have also been surpassing the previous forecast due to an improved supply and demand situation, it says.

- For its petrochemicals business, product prices have been higher than previously forecast "due to a rise in raw naphtha prices and strong demand in Asia," it adds.

- Showa Denko has also confirmed it will record an extraordinary loss of about ¥9.0 billion in the first quarter of 2021 to cover the cost of construction work required at its aluminum specialty components manufacturing plant at Kitakata, Japan. The company says groundwater contamination by fluorine and other chemicals has exceeded environmental standards, "caused by a business operated in the past."

- Alternative-powertrain vehicles, including electric vehicles (EVs), fuel-cell electric vehicles (FCEVs), and hybrid vehicles, accounted for 71% of the total vehicles purchased by the South Korean public organizations in 2020, reports the Yonhap News Agency. The country's 609 public organizations purchased 7,736 automobiles in 2020, of which 5,494 were eco-friendly models, according to the government data. The survey was based on public organizations that own six or more vehicles and that made new purchases in 2020. In a separate survey on a total of 1,538 public organizations, alternative-powertrain vehicles accounted for 16% of their fleet of 120,000 vehicles in 2020, highlights the report. (IHS Markit AutoIntelligence's Jamal Amir)

- The Australian investment bank Macquarie will exit the coal sector within the next three years. Macquarie on 7 May released its quarterly and fiscal-year earnings results, with a twist: equity and lending exposure to coal projects will "run off" by 2024, it said. The bank emphasized a strategic shift to lower carbon energy forms-and the finance needed to bring them to life-in a separate statement, called "Supporting the transition to a net-zero economy," released in parallel with the earnings. In a sign of a measured approach to fossil fuel investing, the bank said it would not exit all types of carbon-intensive industries. The firm intends to keep funding oil and natural gas projects in what it termed a "managed transition to net zero." (IHS Markit Climate and Sustainability News' William Fleeson)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.