Daily Global Market Summary - 13 July 2020

APAC and European equity markets closed higher across those regions today, while US markets were higher for most of the day before sharply reversing course in the afternoon on California's announcement that it will be rolling back its reopening plans and instituting targeted business closures to slow the spread of COVID-19. The news triggered an immediate sell-off in risk assets, with CDX IG/HY, equities, and oil ending the day lower. The market is expecting the current Q2 earnings season to be particularly weak, with most investors generally more focused on companies' outlooks for the remaining quarters of 2020 and the rapid growth of new COVID-19 cases in the US is could shift that outlook during the course of this earnings season.

Americas

- Monday afternoon, California Gov. Gavin Newsom rolled back the state's reopening and ordered an immediate halt to indoor activities in restaurants, bars, museums, zoos and movie theaters, sending businesses hurrying to close up after they had just begun reopening in recent weeks. The Los Angeles Unified School District, the nation's second largest after New York City, and the San Diego Unified School District said they would start the school year online for about 800,000 students combined on Aug. 18 for Los Angeles and Aug. 31 for San Diego. (WSJ)

- US equity markets were higher for most of the day, before shifting course at 1:40pm EST after California's announcement; Nasdaq -2.1%, Russell 2000 -1.3%, S&P 500 -0.9%, and DJIA flat.

- S&P 500 companies are expected to unveil an overall 45% plunge in quarterly profits, according to data provider FactSet — the biggest drop since the 69% fall of the fourth quarter of 2008. All 11 of the US benchmark's sectors are forecast to post declines. (FT)

- 10yr US govt bonds closed -3bps/0.62% yield.

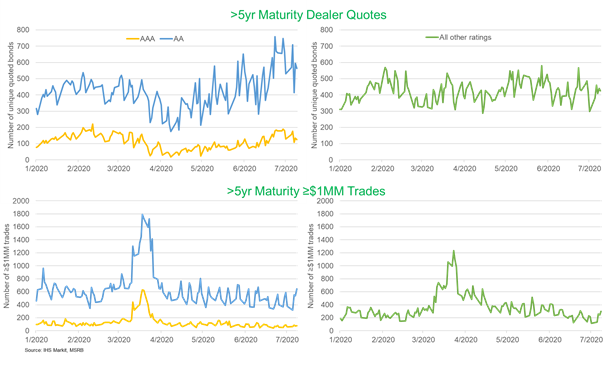

- The charts below indicate that number of daily unique quotes

from the 10 largest municipal bond dealers have been increasing for

>5yr maturity AAA and AA rated municipal bonds since

early-April, while activity for all other rating categories for the

same maturities has been relatively flat (top charts). However, the

number of $1MM+ sized trades has been flat to slightly lower since

volumes peaked in late-March (bottom charts).

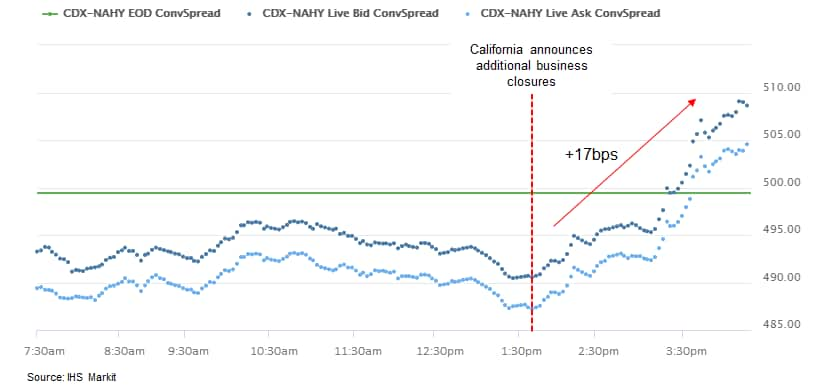

- Like US equities, CDX was higher most of the day before

widening on California's announcement and closing lower on the day

across IG/high yield; CDX-NAIG closed +1bp/75bps and CDX-NAHY

+7bps/507bps.

- Crude oil closed -1.1%/$40.10 per barrel.

- Electric vehicle (EV) startup Rivian has raised USD2.5 billion

in a fresh investment round led by T. Rowe Price Associates,

according to a company press release. (IHS Markit

AutoIntelligence's Jamal Amir)

- Rivian's latest fundraising was joined by Soros Fund Management LLC, Coatue, Fidelity Management and Research Company, and Baron Capital Group. Existing shareholders Amazon and funds managed by BlackRock also joined the round.

- No new board seats have been added and additional details about this investment are not being disclosed at this time.

- The latest funding round follows an active 2019 for the company, which brought in USD2.85 billion in funds through four rounds of investments.

- Rivian in February 2019 announced a USD700-million funding round led by Amazon, followed by a USD500-million investment from Ford in April 2019 and the two companies will collaborate on a new EV program.

- In September 2019, Rivian announced a USD350-million investment by Cox Automotive.

- Rivian closed the year with an investment round of USD1.3 billion led by T. Rowe Price Associates with additional participation from Amazon, Ford, and funds managed by BlackRock.

- Rivian is in the later stages of preparing for production. The company introduced its R1T electric truck and R1S electric sport utility vehicle (SUV) in November 2018 and plans to begin production at its plant in Normal, Illinois, in 2021, delayed by a few months because of the COVID-19 pandemic

- Karma Automotive has partnered with China-based intelligent vehicle company PATEO to improve its vehicle's connectivity. Under this partnership, Karma will integrate the PATEO Qing Mobile solution to its Revero GT vehicles. In addition, the companies are looking for opportunities to jointly develop digital cockpit solutions. Dr Lance Zhou, CEO of Karma Automotive, said, "PATEO has been an innovative leader in connected vehicle, intelligent navigation and comprehensive telematics services for over two decades. We have been investing in product innovation and working to leverage new technology applications for Karma vehicles that improves connectivity. PATEO Qing Mobile is our new solution and we are excited to be working with the PATEO team to bring this new advanced technology to market". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Air Liquide says it plans to invest over $100 million in a new air separation unit (ASU) on its Gulf Coast pipeline network at Ingleside, Texas. The move follows the signing of a long-term agreement with Steel Dynamics (SDI), one of the largest steel producers and metals recyclers in the US, to supply gaseous oxygen, nitrogen, and argon to SDI's steel mill at Sinton, Texas. The ASU will have the capacity to produce over 770 metric tons/day of oxygen, as well as nitrogen and argon to supply SDI's planned 3-million metric tons/year steel mill starting up in 2021. Air Liquide will also add 45 kilometers of pipeline connecting SDI to its Gulf Coast pipeline system, strengthening the company's position in the US Gulf Coast region and in the growing industrial basin of Corpus Christi where it has been present since the mid-1930s. Air Liquide's ability to provide large volumes of oxygen and nitrogen from Corpus Christi, Texas, to New Orleans, Louisiana, via its integrated production and supply pipeline network provides its customers with an enhanced competitiveness over the long term, the company says. The project will strengthen the US steel industry through the establishment of the largest steel mill in Texas, says Michael Graff, executive vice president and executive committee member at Air Liquide.

- Brazil's consumer price index (CPI) increased 0.26% in June

following two months of declines. In the first half of the year

inflation amounted to 0.1%. Economic activity is still depressed

and, thus, inflationary pressures are limited. (IHS Markit

Economist Rafael Amiel)

- Inflation in June was driven by higher gasoline prices (up 3.2%) which accounted for more than half of the monthly inflation. It contributed 14 basis points out of the total 26 (i.e. the 0.26% inflation reported). In the previous four months, gasoline prices had declined, driven by low international oil prices.

- In addition to transport, two sectors in which inflation was relatively high were Food and Beverages and Household Items: the first one strictly related to excess demand pushed by COVID-19 virus-induced behavior and the second one by the depreciation of the exchange rate, which make imported goods more expensive. Food inflation in the first half of the year amounted to 4.1%

- In the 12-month period ended June 2020, core inflation - which excludes items with volatile prices mainly related to energy and food - amounted to 1.4%, and in June the core price index actually declined.

- Annual inflation at 2.13%, at the end of June, and deflation in the core price index show that the recession still prevails and keeps inflationary pressures at bay. We expect a significant but still partial rebound in economic activity and demand during the third quarter; this will not be enough push up inflation.

- An upsurge in Panama's COVID-19 cases will continue to delay

reopening of the economy through July and August. The government

has recently halted reopening plans based on a 145% increase in the

number of COVID-19 cases in the last month, with the country's

intensive care unit (ICU) bed utilization rate almost at capacity,

a critical indicator for the reopening the economy, according to

Minister of Industry and Commerce Ramón Martínez. (IHS Markit

Economists Paula Diosquez-Rice and Veronica Burford)

- A slow execution of COVID-19-related funding for businesses and delays in reopening will increase job losses. Some of the government measures to help businesses include a moratorium on taxes and the establishment of a fund for small and medium-sized enterprises (SMEs) and agro-producers financed through a USD300-million loan from Inter-American Development Bank (IDB). Business associations have warned about the need for funds obtained through the IDB to reach companies quickly. The national union of SMEs (Unpyme) has anticipated that up to 40,000 SMEs would go bankrupt due to the COVID-19 virus. In July, the government announced further support for SMEs via USD20 million in soft loans, which are expected to start in August 2020.

- Protests and strikes are likely by year-end as welfare support programs are unlikely to be maintained indefinitely. There is a high likelihood that labor strikes will increase across sectors in the 12-month outlook, particularly in the public and construction sectors, because of high job insecurity and likely salary caps, with previous strikes by powerful construction sector union SUNTRACS in May 2019 and April 2018 causing significant disruptions lasting for weeks at a time.

- Peru's central bank maintained its expansionary policy stance

during its 9 July monthly meeting. Lima's annual inflation rate

stands below the 2% target rate. (IHS Markit Economist Claudia

Wehbe)

- The Central Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP) decided to maintain its policy rate unchanged at 0.25% for the third consecutive month, following a rate cut by 100 basis points earlier in April during its monthly meeting.

- To further support liquidity injection operations, annual interest rates on the BCRP's window facility operations in domestic currency with financial entities were left unchanged at 0.15% for overnight deposits and at 0.50% for direct security/currency repo and rediscount operations.

- Consumer price inflation decelerated to 1.6% in June, down from 1.8% in May, while GDP fell by 40.49% year on year in April, deepening economic activity loss - April was the first full month under mandatory quarantine and multiple non-essential business closures set by Peru's government.

Europe/Middle East/ Africa

- European equity markets closed higher across the region; France +1.7%, Spain +1.5%, Germany/UK +1.3%, and Italy +1.2%.

- European govt bonds closed lower across the region; France/Germany +5bps, Spain +4bps, UK +3bps, and Italy +2bps.

- iTraxx-Europe closed -2bps/61bps and iTraxx-Xover -8bps/369bps.

- Brent crude closed -1.2%/$42.72 per barrel.

- After extending record supply cuts into July, the OPEC+ group

appears set to formally signal it will start easing production

restraints in August at the virtual JMMC meeting on 15 July. (IHS

Markit Energy Advisory's Roger Diwan, Karim Fawaz, Justin Jacobs,

Edward Moe, and Sean Karst)

- Assuming the group sticks to their pre-agreed schedule, this next phase will entail an easing of aggregate cuts from 9.6 MMb/d to 7.7 MMb/d for a duration of six months, a 1.9 MMb/d month-on-month increase in supply beginning in August.

- Commitments by countries that under-complied in past months to compensate with larger cuts through September will likely be used to allay market fears of a sharp surge, but the reality remains that the sequential increase will be sizeable and marks the first real test of the resilience of the demand recovery.

- Brent opened the pivotal week flat at around $43/bbl, where it has been rangebound for several weeks.

- The market will now have to gauge the ongoing balance between recovering global oil demand, amid a slowdown in Chinese crude buying, and the combination of returning OPEC+ volumes and easing US and Canada shut-ins, all of which are swinging on an unprecedented scale.

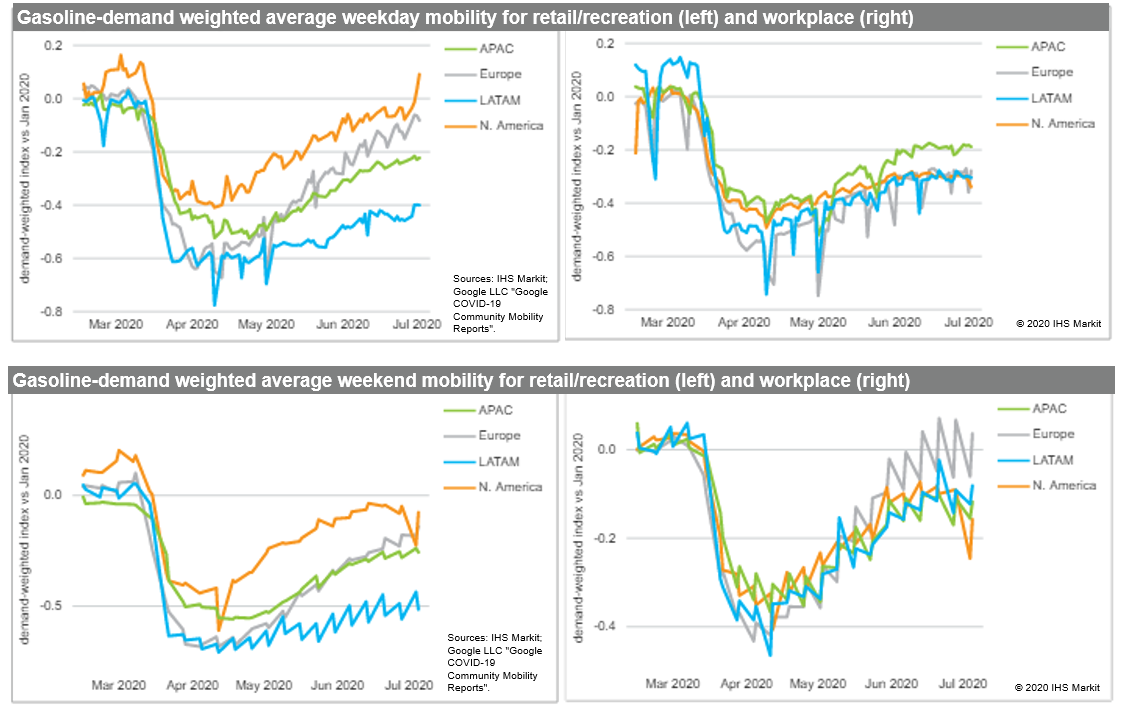

- Demand is still facing a formidable foe, and mobility indicators have started to point to a deceleration in the activity recovery rate worldwide, partly from renewed outbreaks and partly from sectoral trends.

- Worsening outbreaks throughout the Southern US, Latin America

and localized shutdowns in India go to show that the road back will

be far from smooth. OPEC+ may have its hands on the steering wheel,

but the road ahead could well entail some swerving.

- The Financial Stability Board (FSB) and the Basel Committee on

Banking Supervision (BCBS) on 9 July jointly published a report

titled 'Supervisory issues associated with benchmark transition'.

Three main policy priorities were suggested. (IHS Markit Economist

Brian Lawson)

- National bodies are requested to promote awareness of the transition and undertake regular surveys and inquiries to monitor progress.

- Authorities are urged to establish formal strategies for the transition and increase the "intensity of supervisory actions" where bank preparations appear inadequate.

- Authorities should promote a co-ordinated approach, both across the banking sector and between different regulatory bodies on best practices and challenges.

- The FSB will seek a global perspective to monitor the progress of the transition and report to the G20, for which LIBOR transition is a priority.

- Data from Statistics Denmark show that in June 2020, consumer

price inflation increased by 0.3% year on year (y/y) or 0.1% month

on month (m/m). This comes after two months of annual inflation at

0%. (IHS Markit Economist Daniel Kral)

- Overall in June, prices of goods decreased by 0.6% y/y, while services were up by 0.9% y/y. Core inflation, which excludes food and energy, came in at 0.9% y/y, slightly above the 0.7% average in the preceding 12 months (Chart 1).

- On an annual basis, the largest drag on headline inflation was in transport, which subtracted 0.2 percentage points (pp), down from 0.5pp in May. Restaurants and hotels subtracted 0.13pp in June, likely reflecting discounting to stimulate activity.

- On a monthly basis, the largest increases were in food and non-alcoholic beverages, up 0.4% m/m, and alcoholic beverages and tobacco, up 0.3% m/m. Transport rebounded by 1.6% m/m, reflecting a partial recovery in global oil prices, although the subcomponent still remains the largest drag in annual terms.

- Although the Danish government has eased many COVID-19 virus-related restrictions, sufficient activity to pose overall upward price pressures will take some time. We expect headline and core inflation to remain subdued.

- The Bank of Italy estimates that the impact of the COVID-19

virus pandemic on the economy during the second quarter of 2020 was

severe. (IHS Markit Economist Raj Badiani)

- The containment measures implemented from 22 March shut non-essential activities for the whole of April, which account for about one-third of total value added. The central bank observed the steady reopening of suspended activities from May to being complete during June.

- The central bank believes the Italian economy shrunk by 'around 10% quarter on quarter (q/q)' in the second quarter, according to its July economic bulletin, after a 5.3% q/q drop in the first. This implies Italy remains in a technical recession (defined as two successive quarters of q/q decline) after contracting by 0.3%q/q in the fourth quarter of 2019.

- According to IHS Markit's June forecast, we estimate that real GDP shrunk by 13.7% q/q in the second quarter.

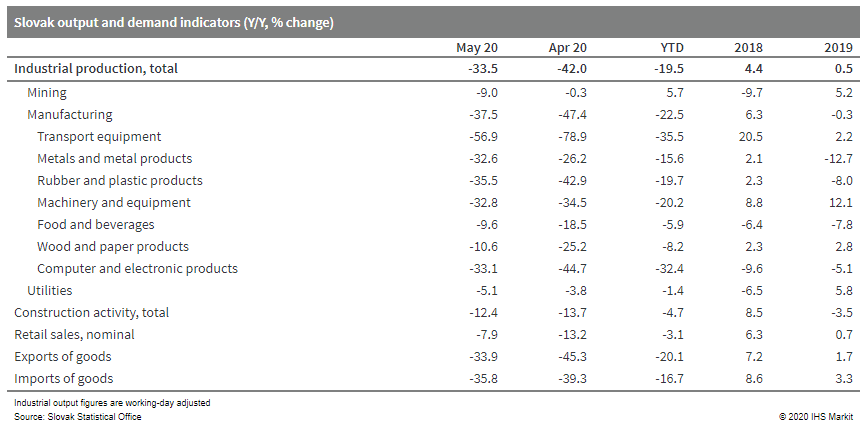

- Slovakia's seasonally adjusted industrial output surged by

19.7% m/m in May, but this figure is far from sufficient to make up

for the steep March-April declines. Working-day-adjusted industrial

production plunged by 33.5% y/y. (IHS Markit Economist Sharon

Fisher)

- While the y/y declines in the mining and utilities sectors remained in single digits, manufacturing was the driving force behind the poor May results. Slovakia's automotive plants have gradually restarted production, but transport equipment manufacturing continued to fall sharply (down by 56.9% y/y; worse than the 45.2% drop reported in neighboring Czechia).

- The poor May manufacturing results translated into a continued weak export performance, falling by 33.9% y/y in euro terms. Imports fell even faster (down by 35.8% y/y), contributing to an improvement in the monthly trade balance.

- Other recent releases have been more favorable. Although construction activity fell by 12.4% y/y in May, seasonally adjusted construction activity rose by 2.0% m/m, signaling that a recovery is under way.

- Real, seasonally adjusted domestic trade data for May showed

mixed results, with a m/m improvement in restaurant services (up by

26.1%), motor vehicles (up by 16.7%), and retail sales (up by 2.8%)

matched by an 8.5% drop in accommodation services. In real,

unadjusted terms, retail sales fell by 8.9% y/y, while automotive,

restaurant, and hotel sales dropped considerably faster.

Asia-Pacific

- APAC equity markets closed higher across the region; Nikkei +2.2%, China +1.8%, South Korea +1.7%, Australia +1.0%, and Hong Kong +0.2%.

- China's new aggregate financing, the widest measure of net new

financing to the real economy, increased by CNY3.43 trillion in

June 2020, up by CNY240 billion from the previous month, according

to a release by the People's Bank of China. Stock total social

financing (TSF) increased by 12.8% year on year (y/y), 0.3

percentage point up from May. (IHS Markit Economist Yating Xu)

- Bank loans increased by CNY1.81 trillion in June and loans injected to the real economy increased by CNY1.9 trillion. Household loans registered the largest monthly increase since the beginning of this year as new short-term loans rose, with recovery in private consumption and a booming real-estate market continuing to boost medium- and long-term term loans.

- Acceleration in infrastructure investment led new corporate medium- and long-term loans to rise by 95.8% y/y, following 96.5% y/y and a 110.2% y/y expansion in April and May, respectively, while receipt financing declined further.

- Off-balance-sheet financing, including entrusted loans, trust loans, and undiscounted bankers' acceptance, increased by CNY85.3 billion in June, compared with a CNY212.3-billion decline a year ago. Government bond financing rose as CNY210 billion worth of special national bonds were issued in June.

- Broad money supply (M2) growth remained at 11.1% y/y for a third consecutive month with the expansion in credit and financing, while M1 growth fell due to a high-base effect. Fiscal deposit declined by more than CNY110 billion compared with the same period last year, reflecting the acceleration of fiscal stimulus. Meanwhile, household deposits continued to rise.

- TSF increased by CNY20.8 trillion in the first half of the year, with new bank loans reaching a historic record of CNY12.1 trillion.

- CNY780 billion worth of special national bonds will be issued in July and are expected to support government bond financing accordingly.

- China's Dalian Commodity Exchange (DCE) on July 6 officially launched polypropylene (PP), PVC and linear-low density polyethylene (LLDPE) options, marking the first time that three options in the same industry are simultaneously launched, the exchange said in a statement. There are 10 options series (July 2020-May 2021) launched for each of the three chemicals, with a total of 1,174 contracts. September series is the benchmark, with trading volume for PP, PVC and PE accounting for 77%, 85% and 79% of total lots traded respectively. Fang Xinghai, vice-chairman of the China Securities Regulatory Commission (CSRC), said in his speech that to accelerate the listing of options products was a concrete measure taken by the CSRC to follow through the instructions of the CPC Central Committee and the State Council on accelerating the development of the capital market. This is to ensure stability on six fronts -- employment, the financial sector, foreign trade, foreign investment, domestic investment, and expectations -- and security in six areas -- job security, basic living needs, operations of market entities, food and energy security, stable industrial and supply chains, and the normal functioning of primary-level governments.

- The Chinese vehicle market experienced a strong month in June.

New vehicle sales on a wholesale basis increased by 11.6% year on

year (y/y) to 2.3 million units during the month, while production

rose by 6.3% y/y to 2.325 million units, according to preliminary

data from the China Association of Automobile Manufacturers (CAAM).

(IHS Markit AutoIntelligence's Nitin Budhiraja)

- In the YTD for June, China's new vehicle sales are down 16.9% y/y at 10.257 million units, while production volumes have fallen by 16.8% y/y to 10.112 million units.

- The passenger vehicle (PV) market posted an increase of 1.8% y/y to 1.764 million units last month, while PV production increased by 12.5% y/y to 1.798 million units.

- The CAAM definition of passenger vehicles includes sedans, sport utility vehicles (SUVs), multi-purpose vehicles (MPVs), and minivans. In the YTD, sales of PVs are down 22.4% y/y at 7.873 million units, while production of PVs has fallen 22.5% y/y to 7.754 million units.

- Sedan sales in the YTD declined by 26% y/y, SUV sales fell by 14.9% y/y, MPV sales dropped by 45.7% y/y, and microvan sales fell by 19.8% y/y.

- Commercial vehicle sales surged 63.1% y/y to 536,000 units during June, contributing to the strong rebound in new vehicle sales. Commercial vehicle production increased 77.9% y/y to 527,000 units.

- In the YTD, sales of commercial vehicles are up by 8.6% y/y at 2.384 million units, while production of commercial vehicles has increased by 9.5% y/y to 2.359 million units.

- Broken down by vehicle type, heavy-truck sales increased 63.3% y/y to 169,000 units in June, while sales of light trucks grew by 81.5% y/y to 237,000 units.

- Sales of new energy vehicles (NEVs), which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), declined 33.1% y/y to 104,000 units in June, while NEV production fell by 25.0% y/y to 102,000 units.

- Sales of BEVs fell by 37.6% y/y to 82,000 units in June, while production of BEVs dropped 31.9% y/y to 79,000 units.

- Sales of PHEVs totaled 21,000 units, down 6.0% y/y, in June, while production of PHEVs increased 17.0% y/y to 23,000 units.

- In the YTD, sales of NEVs are reported at 393,000 units, down 37.4% y/y, while NEV production volumes are down 36.5% y/y to 397,000 units.

- NIO has secured CNY10.4 billion (USD1.4 billion) in credit limit from six Chinese banks including Bank of China and China Construction Bank, according to China Daily. According to a statement by the automaker, "Nio China will work with the banks extensively in corporate account system building, supply chain financing and auto financing to other business". The deal, which is expected to improve NIO's financial strength, came around two months after NIO entered into definitive agreements for investments with a group of investors led by Hefei City Construction and Investment Holding (Group), CMG-SDIC Capital, and Anhui Provincial Emerging Industry Investment. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese city of Shanghai has opened a 30.6-kilometre downtown road for autonomous vehicle (AV) testing, reports Xinhua News Agency. This is the first open road for AV testing in the downtown area located in the city's Pudong New Area. Shanghai previously opened test roads in the Fengxian, Jiading, and Lingang areas in the city's suburbs. Shanghai opened its first road section for testing of intelligent connected vehicles (ICVs) in March 2018. By 2019, the city had allocated 53.6 km of road for AV testing, covering 1,580 different scenarios. In 2019, a total of 11 companies received permits for AV testing from the Shanghai authorities. In August 2019, the port town of Lingang in Shanghai's free trade zone opened a testing zone for ICVs, called Future LAIV. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Honda Motor will buy a 1% stake in Chinese battery maker Contemporary Amperex Technology Company Limited (CATL) to jointly develop batteries for electric vehicles (EVs), according to Reuters. The companies will also research a battery recycling business. The Japanese automaker further plans to launch its first EV with CATL's battery in China in 2022. CATL is a leading battery supplier in China, supplying batteries to global automakers including BMW, Honda, Nissan, Volkswagen, and many others. CATL will help Honda to integrate resource advantages in the EV industry and accelerate electrification. (IHS Markit AutoIntelligence's Nitin Budhiraja)

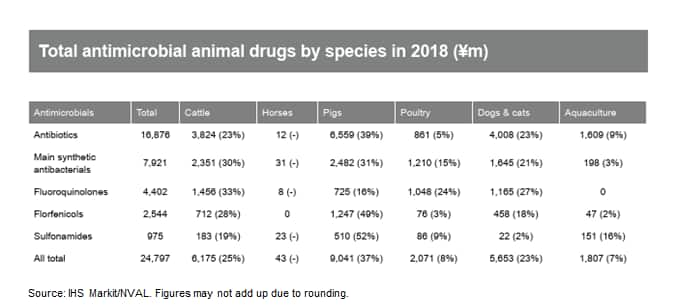

- Japan's National Veterinary Assay Laboratory (NVAL) has

revealed the latest sales figures of antibiotic and synthetic

antibacterials by species. In 2018, the most recent year for this

information, ¥16,876 million ($157 million) of antibiotics were

sold. Of this total, ¥6,568m was for pigs (39%) and ¥4,008m was for

dogs and cats (24%). ¥3,824m was used for cattle (23%), ¥1,609m for

aquaculture (9%), ¥861m for poultry (5%) and ¥12m used for horses.

The main synthetic antibacterials were fluoroquinolones (¥4,402m or

56%), florfenicols (¥2,544m or 32%) and sulfonamides (¥975m or

12%). Of the ¥7,921m in total synthetic antibacterials, ¥2,482m was

used for pigs (31%), ¥2,351m for cattle (30%), ¥1,645m for dogs and

cats (21%), ¥1,210m for poultry (15%), ¥198m for aquaculture (3%)

and ¥31m for horses. According to the NVAL and the Japanese

Ministry of Agriculture, Forestry and Fisheries, sales of

antibiotics and anthelmintics have been slowly increasing in recent

years. (IHS Markit Animal Health's Dr Atsuo Hata)

- As lockdown restrictions on India industrial production were

eased on 22 April and again in early May, the pace of contraction

in industrial production moderated to 34.7% year on year (y/y) in

May compared with a 57.6% y/y decline in April. Manufacturing

output, which accounts for 77.6% of the total industrial production

index, declined by 39.3% y/y in May, compared with a contraction of

67.1% in April. (IHS Markit Economist Rajiv Biswas)

- Despite the improvement in May, many manufacturing sectors of continued to record severe declines in output on a y/y basis. Among the worst-affected sectors in which production was still at very low levels were the motor vehicles and other transport equipment, electrical equipment, computers, electronic and optical products, fabricated metal products, leather products, textiles, and tobacco sectors.

- Sectors that continued to produce a significant proportion of their normal production capacity included food products, refined petroleum products, and chemicals.

- The pharmaceuticals sector was the only manufacturing industry to record growth in May, growing by 2.5% y/y owing to the COVID-19 pandemic-related rise in demand for pharmaceutical products from the domestic market as well as for export abroad. Many countries had requested for Indian exports of pharmaceutical products required for treating COVID-19 patients, thus boosting export orders.

- Among the major industry sector groups, production of consumer non-durables, such as essential food products, was the most resilient, contracting by 11.7% y/y, much improved compared with the 48.7% y/y decline in April. Production of consumer durable goods such as automobiles contracted by 68.5% y/y in May, much improved on April, when output came to almost a complete halt, resulting in output falling by 96.0% y/y.

- Production of capital goods fell by 64.3% y/y in May, which - although still a severe decline - is an improvement from the 92.6% y/y contraction in April.

- Production of infrastructure/construction goods declined by 42% y/y in May, also improving on the 84.7% y/y drop in April.

- Tata Motors, including Jaguar Land Rover (JLR), recorded a 64%

year-on-year (y/y) decline in global wholesale deliveries to 91,594

units during April-June, according to a filing with the Bombay

Stock Exchange (BSE). (IHS Markit AutoIntelligence's Isha Sharma)

- Global wholesale deliveries of its commercial vehicles (CVs) and Tata Daewoo range declined 89% y/y to 11,598 units during the second quarter, while its passenger vehicle sales fell 49% y/y to 79,996 units.

- Global vehicle shipments by the JLR division accounted for 65,425 units, including volumes from CJLR, a joint venture (JV) between JLR and China's Chery.

- Sales of Jaguar-brand vehicles stood at 17,971 units during the second quarter, while Land Rover brand's sales totaled 47,454 units.

- Indian company Sharda Cropchem (Mumbai) recorded a 19.3% rise in agrochemical revenues to Rs 8,223 million ($110.2 million at the current rate) in its fourth quarter ended March 31st, 2020. Agrochemicals made up an increased share of total sales at 93.9% against 90.3% the previous year. Total sales were up 14.7% at Rs 8,756 million ($117.3 million). Agrochemical business was up in all regions. It grew by 23.1% in Europe, 13.8% in the NAFTA region, 10% in Latin America excluding Mexico, and by 25.4% in the rest of the world. There was a strong switch to sales of formulations from active ingredients. The former grew from 85.9% of agrochemical business to 95.8%. Profit before tax on all business increased by 10.4% to Rs 1,381.3 million. Earnings before interest, tax, depreciation and amortization jumped by 48.2% to Rs 2,336 million. The EBITDA margin rose by six percentage points to 26.7%. (IHS Markit Crop Science's Robert Birkett)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.