Daily Global Market Summary - 13 September 2021

All major European and most US equity indices closed higher, while APAC was mixed. US government bonds closed higher, while benchmark European bonds were mixed. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. The US dollar, natural gas, oil, and gold closed higher, while silver and copper were lower on the day. All eyes will be on tomorrow morning's 8:30am ET US CPI report to determine how much the uptick in demand combined with supply chain disruptions continues to weigh on inflation.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for Nasdaq -0.1%; DJIA +0.8%, Russell 2000 +0.6%, and S&P 500 +0.2%.

- 10yr US govt bonds closed -1bp/1.33% yield and 30yr bonds -3bps/1.91% yield.

- CDX-NAIG closed flat/47bps and CDX-NAHY -2bps/275bps.

- DXY US dollar index closed +0.1%/92.68.

- Gold closed +0.1%/$1,794 per troy oz, silver -0.4%/$23.80 per troy oz, and copper -1.9%/$4.37 per pound.

- Crude oil closed +1.0%/$70.45 per barrel and natural gas closed +5.9%/$5.23 per mmbtu.

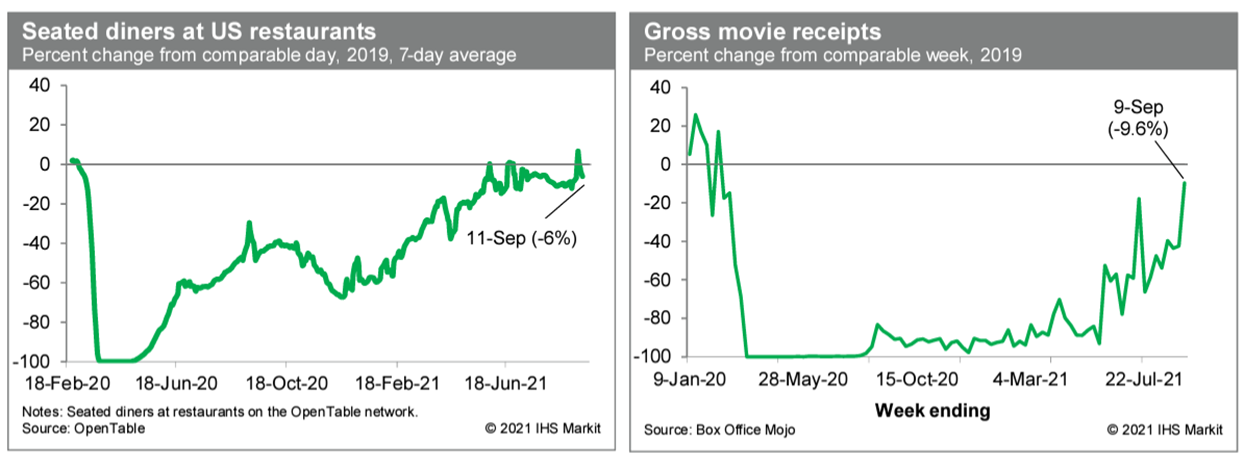

- Averaged over the last seven days, the count of seated diners

on the OpenTable platform was 6% below the comparable period in

2019. This was down from the prior week and likely more indicative

of the underlying trend in dining activity, as the timing of the

Labor Day holiday probably created some volatility in this

comparison. Meanwhile, box-office revenues last week were only 9.6%

below the comparable week in 2019, the best pandemic-era reading to

date. The favorable comparison reflects the timing of the Labor Day

weekend and the release of a popular Marvel film (Shang-Chi and the

Legend of the Ten Rings). As was the case with the release of Black

Widow, this week's reading suggests that people are willing to get

back to movie theaters when sufficiently motivated. (IHS Markit

Economists Ben

Herzon and Joel

Prakken)

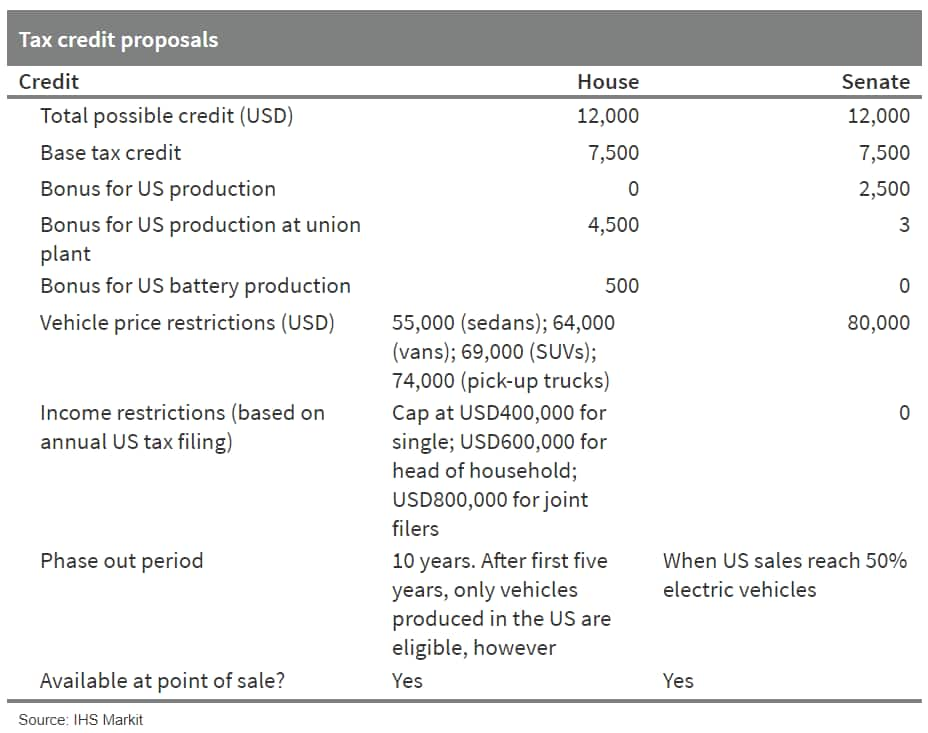

- On 10 September, the US House of Representatives Ways and Means

Committee submitted a proposal for USD3.5 trillion in tax credits

to encourage consumer adoption of electric vehicles (EVs). The

House proposal has the agenda of supporting affordable EVs,

domestic battery production and union jobs. The maximum credit

would be USD12,500, transferrable at the point of sale, and phase

out over a 10-year period (see chart below for detailed breakout

and comparison to Senate proposal from May 2021). Today's credits

for a purchase are applied to a customer's yearly income tax

statement, and there are thresholds which can reduce the full

USD7,500 credit. Automotive News quotes the proposing

representative, Democrat Dan Kildee from Michigan, as saying,

"[A]nyone making less than $400,000 would still qualify for the tax

advantages of purchasing an electric vehicle. However, it is our

intent that this tax credit not be used by high-wealth individuals

to purchase luxury vehicles… We think it aligns very much with the

president's goal of getting us to the point where we have half of

the new vehicles sold in the United States being electric vehicles

within a decade. Once we're at that point, we don't think credits

are going to be required anymore. We think the scale and the

pricing will be such that the market will be fully able to

integrate electric vehicles without any additional consumer credit

support." (IHS Markit AutoIntelligence's Stephanie

Brinley)

- New Jersey has broken ground on its first dedicated wind port facility. Earthworks will begin shortly and major construction is slated for December 2021, with target opening set for the winter of 2023/2024. The facility will be purpose-built to serve projects on the East Coast of the United States, and will be used for staging, assembly, and manufacturing activities. The port, to be sited on an artificial island on the Delaware River, southwest of the City of Salem, was selected in June 2020, after a selection process spanning close to two years. Costing around USD257 million, the port will be funded largely by the state of New Jersey (USD200 million), with contributions by the NJ Board of Public Utilities (NJBPU) (USD13 million), and the NJ Department of Transportation (USD44 million). AECOM-Tishman has been appointed the Construction Manager. Extensive engagement with industry, government, and environmental stakeholders was carried out and a project labor agreement (PLA) was signed with the United Building Trades Council of Southern New Jersey AFL-CIO was signed for the construction works. (IHS Markit Upstream Costs and Technology's Melvin Leong)

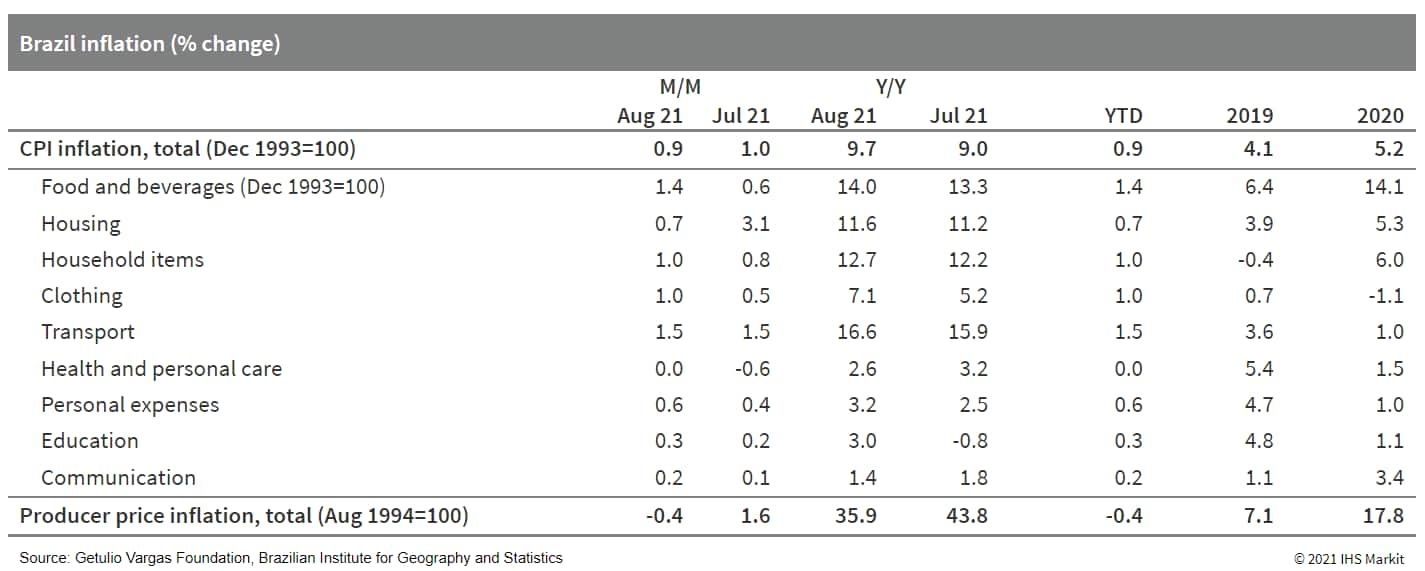

- According to the Brazilian Institute of Geography and

Statistics (IBGE), the extended consumer price index increased by

0.9%. Although this is down from 1.0% in July, it is significantly

high and represents the highest value in 21 years for the month of

August. Annual inflation amounted to 9.7% at the end of August,

which was up from 8.9% in July and is far above Brazil's central

bank target (3.75 +/- 1.5 percentage points). (IHS Markit Economist

Rafael

Amiel)

- As in previous months, high inflation was driven by sizeable increases in food and energy prices. Domestically, drought and frost are damaging crops, which leads to reduced supply. Brazil is a food commodity exporter, and increased demand from China - as well as reduced harvest expectations in several major exporting countries - are pushing up world food prices. The United Nations Food and Agriculture Organization (FAO) reports that world food price inflation grew by 3.9% in August, and increased by 32.0% compared with one year earlier.

- The hike in electricity tariffs is a major factor driving inflation. Brazil is experiencing a severe drought, and hydroelectric power reservoirs are reaching very low water levels. This has prompted the authorities to increase electricity tariffs as the plants require a greater use of thermoelectric plants, making electricity more expensive. Higher global oil prices are also contributing to domestic inflation.

- Petrol prices have increased by 32% so far this year, while international crude oil prices have risen by 44%. In August alone, petrol prices in Brazil went up by 2.8% and IBGE reports that this accounted for 0.2 percentage point (out of the 0.9) of the monthly inflation. In the very near term, there may be further increases in petrol prices as crude oil prices remain high, with additional pass-through onto fuel prices.

- Annual core inflation amounted to 6.3%. This excludes items

with volatile prices such as food and energy related: that is,

higher food and energy prices have had a knock-on effect on other

goods and services in the economy.

- The size of Brazil's 2021-22 orange crop has been downgraded to

267.87 million boxes (40.8 kilos), a reduction of 9% or more than

26 million boxes from the first forecast published by Fundecitrus

in May 2021. (IHS Markit Food and Agricultural Commodities'

Vladimir Pekic)

- The new crop has small fruits and a high drop rate, according to the Fundecitrus forecast for the São Paulo and West-Southwest Minas Gerais citrus belt that was prepared jointly with Markestrat, FEA-RP/USP and FCAV/Unesp.

- This means the 2021-22 crop will be slightly lower even than the previous season's final figure of 269 million boxes. However, the 2020-21 season was an off year and so this figure is still below the average of 329 million boxes for the last 10 seasons.

- The main reason for this crop loss is a poorer rainfall regime caused by "the most severe water crisis ever to hit Brazil for the last 91 years". The combination of this never-before-seen drought by the citriculture sector and successive frosts in July culminated in a gradual crop decline.

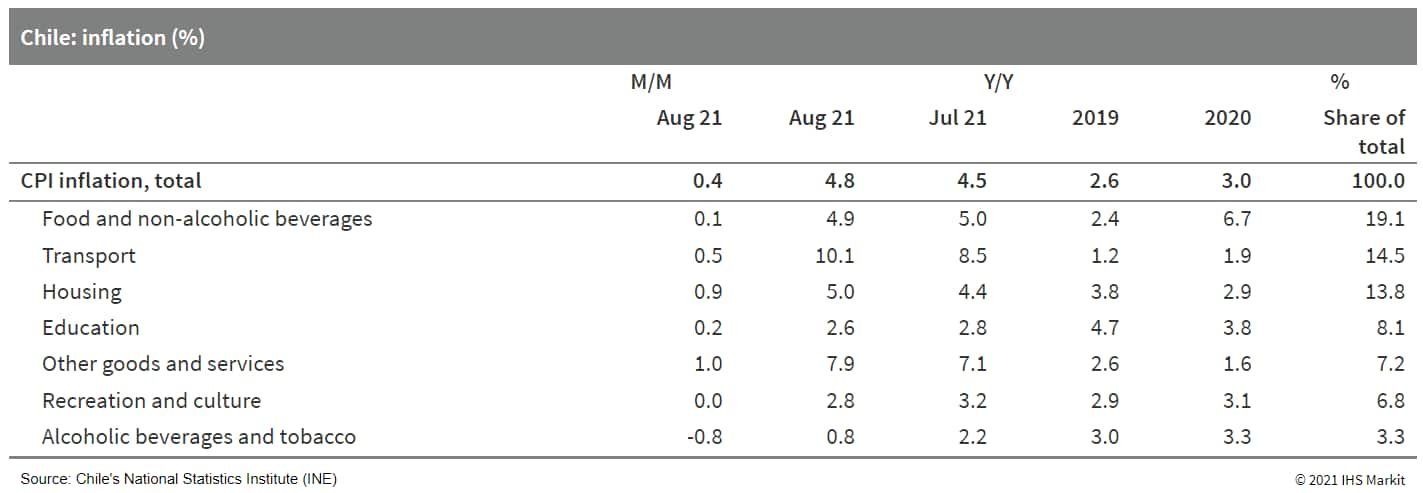

- After recording the highest reading since January, Chile's

consumer price inflation slowed in August. The annual reading

remains well above the 4% upper bound of the inflation target

range. (IHS Markit Economist Claudia

Wehbe)

- After advancing by 0.81% month on month (m/m) in July, consumer prices rose 0.36% in August. The result was mainly driven by rising prices in the housing and basic services categories, mainly driven by increases in liquefied gas and water.

- In contrast, a 0.81% m/m drop in prices in the alcoholic beverages and tobacco category reverted the July increase and had a modest negative effect on overall inflation.

- The month-on-month increase pushed year-on-year (y/y) inflation

to 4.8%, up from the 4.5% recorded in July. On an annual basis, all

consumption basket components have shown rising prices, except for

communications.

- At its September meeting, the Central Reserve Bank of Peru

(Banco Central de Reserva del Perú: BCRP) increased its policy

interest rate from 0.5% to a still accommodative 1.0%. The BCRP

directorate did not commit to subsequent moves but will respond to

rising inflation expectations and strengthening economic

indicators. (IHS Markit Economist Jeremy Smith)

- Following last month's 25-basis-point rate increase, the consumer price index again jumped 1.0% month on month (m/m) in August, prompting more a more aggressive monetary policy response in September.

- Headline inflation now stands at 5.0% year on year (y/y), well exceeding the 1-3% target range, and 12-month inflation expectations again increased to 3.1% in August.

- The BCRP reiterated its assessment that high inflation is a transitory phenomenon and that inflation will return to the target range within 12 months as the three dominant factors - food, energy, and exchange-rate depreciation - reverse.

- Colombia's banking regulator, the Financial Superintendence of

Colombia (Superientendencia Financiera de Colombia: SFC), on 9

September released a presentation revealing the current state of

the banking sector, following the measures devised to contain the

effects of the COVID-19 pandemic. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- The document highlights several factors dealing with the current state of loans, particularly the performance of loans that are under forbearance. The evolution of these will detail the trend of the non-performing loan (NPL) ratio over the following years.

- Colombia instituted two waves of forbearance: the first one delayed and refinanced all loans judged to be at risk, with banks making assessments themselves; and the second one involved the issuance of more specific guidelines. As of end of August 2021, 6.8% of credit outstanding was under this second program, with an average deferral of 7 months and an average extension of the maturity of the credit by an additional 29 months from the original agreement.

- According to the presentation, a significant proportion of these forbearance loans has started to become past-due, with 11.6% of these loans having 30 days or more of delays in payments. Most of these are of microfinance and consumption credit, up from less than 2% in August 2020, when the program was launched. This indicates that a significant part of loans under this program will inevitably fall into the past-due category, increasing the NPL ratio in future.

- Colombia has one of the highest NPL ratios in Latin America at 4.6% as of June 2021, mostly contributed by the non-mortgage household segment. Moreover, the portfolio at risk has been growing steadily since the second quarter of 2020.

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain +1.4%, Italy +0.9%, Germany/UK +0.6%, and France +0.2%.

- 10yr European govt bonds closed mixed; Italy -2bps, UK -1bp, and France/Germany/Spain flat.

- iTraxx-Europe closed flat/45bps and iTraxx-Xover +1bp/228bps.

- Brent crude closed +0.8%/$73.51 per barrel.

- The UK government is planning to mandate the pausing of electric vehicle (EV) charging at peak times to protect the country's power grid. According to a report in the Sunday Times, under new regulations which come into force from 30 May 2022, all new chargers installed in domestic and office settings will be the smart type which are automatically set not to function between 08:00 and 11:00 and between 16:00 and 22:00. However, public chargers and rapid chargers on key arterial routes will be exempt from the new rules. The newspaper also reports that the government will also take on powers to impose a "randomized delay" of up to 30 minutes at other times to avoid pressure on the grid if too many vehicles are being charged at any one time. The report adds that a draft statutory instrument setting out the plans has been lodged with the World Trade Organization (WTO) by the UK's Department for Transport (DfT). (IHS Markit AutoIntelligence's Ian Fletcher)

- Italvolt, an Italian battery manufacturing startup, has announced that it has signed an agreement to purchase 1 million square meters of land in Italy to build a new production site. According to a statement, the land is in Scarmagno, in the Piedmont region. The company added that the location will eventually have a planned capacity of 45 GWh of lithium-ion batteries per annum, and will represent an investment of around EUR3.4 billion. This is the second large scale battery-manufacturing site to be announced for Italy in recent times, with Stellantis having previously confirmed that its ACC joint venture (JV) will also manufacture batteries at Termoli. (IHS Markit AutoIntelligence's Ian Fletcher)

- Siberian Coal Energy Co (SUEK) placed a USD500-million

five-year debut dollar bond on 8 September that gained USD1.8

billion of demand, pricing at 3.375% versus guidance of

3.75-3.875%, according to IFR website. (IHS Markit Economist Brian

Lawson)

- Reportedly, 170 accounts placed orders for the deal; a lead manager reported "huge demand", with a skew towards Russian and Cyprus-based (offshore Russian) demand, but with other European and US involvement as well.

- Another source reported that international demand had been reduced by pricing factors, with non-Russian investors seeking returns based on the initial guidance, while the Russian bid had been far more aggressive.

- Olga Ilina, SUEK Head of Investor Relations, noted that the deal reflected "the favourable window in the public debt market to further diversify our debt portfolio" with the firm retaining access to domestic debt and bank lending among other funding sources.

- Chinese ride-hailing app DiDi Global Inc. (DiDi) will launch its services in Egyptian city Alexandria on 13 September, reports Daily News Egypt. The company will provide a welcome package worth EGP150 (USD9.5), which includes discount vouchers for new users, as well as free journeys for EGP25 every Thursday for four weeks. The application also has a referral scheme that awards an EGP25 discount coupon for each successful invitation. DiDi said that it will not charge drivers any fees during the first four weeks of operation, with drivers being given a financial reward after completing 10 trips during the first week of registration. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Africa's real seasonally adjusted manufacturing

production fell by 8.0% m/m and 3.1% year on year (y/y) during

July. This represents the fourth consecutive monthly contraction in

manufacturing output, of which the fall during July has been the

most severe. Business disruptions escalated during July, reflecting

the impact of the social unrest during the month. (IHS Markit

Economist Thea

Fourie)

- The biggest real seasonally adjusted monthly contraction was recorded in the motor vehicles, parts and accessories and other transport equipment sub-sector (down by 26.8% m/m), followed by the radio, television and communication apparatus and professional equipment sub-sector (down by 12.3% m/m) and food and beverages (down by 6.9% m/m). No manufacturing sector recorded m/m growth during the month.

- Seasonally adjusted manufacturing sales also fell by 13.1% m/m during July, but increased by 3.2% y/y. The biggest annual decline in manufacturing sales were recorded in the motor vehicles, parts and accessories and other transport equipment (down by 22.9% y/y), followed by radio, television and communication apparatus and professional equipment (down by 6.9% y/y). Sales held up in most of the remaining manufacturing sub-sectors with the biggest gains in the basic iron and steel, non-ferrous metal products, metal products and machinery (up 16.2% y/y) and the food and beverages sector (up 8.2% y/y).

- The IMF has approved the Tanzanian government's request for

USD567.25 million in emergency financial assistance to meet urgent

balance-of-payment needs stemming from the outbreak of the COVID-19

virus pandemic in the country. The Tanzanian government will

receive USD189.08 million from the Rapid Credit Facility (RCF) and

USD378.17 million from the Rapid Financing Instrument (RFI). (IHS

Markit Economist Thea

Fourie)

- IMF projections show that Tanzania's real GDP growth decelerated to 4.8% in 2020, and is expected to remain subdued during 2021. The economy has been adversely affected by the fallout from global travel restrictions and the impact this has had on the country's tourism industry and external liquidity availability.

- Employment conditions remain unfavorable, while poverty will continue to rise, the IMF warns. The USD567.25-million facility "will help finance the interventions needed to mitigate the severe socio-economic impacts of the pandemic and help catalyze support from development partners," the IMF states.

- The Tanzanian government has adopted a comprehensive pandemic response plan - Tanzania COVID-19 Socioeconomic Response Plan (TCRP) - to mitigate the impact of the COVID-19 shock on the overall economy. Support under the RCF and RFI will substantially contribute to the immediate external financing needs of the program, but will have the aim of securing other donor support.

Asia-Pacific

- Major APAC equity markets closed mixed; Mainland China/Australia +0.3%, Japan +0.2%, South Korea +0.1%, India -0.2%, and Hong Kong -1.5%.

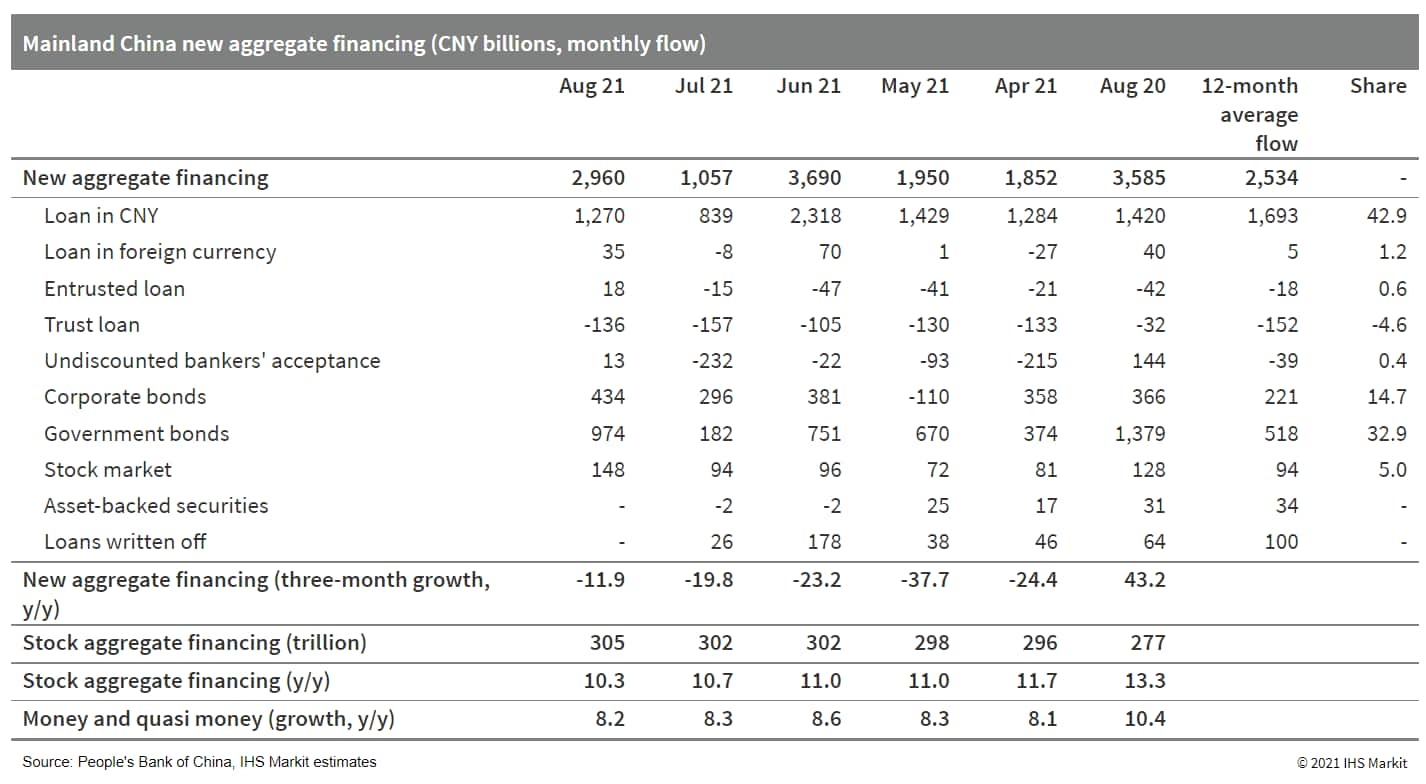

- Mainland China's new stock total social financing (TSF), the

broadest measure of net new financing to the real economy, amounted

to CNY2.96 trillion (USD 457.06 billion) in August, down by

CNY629.5 billion year on year (y/y) according to the People's Bank

of China (PBOC). Stock TSF increased by 10.3% y/y to reach

CNY305.28 trillion by the end of August, marking the sixth

consecutive month of decline or no change in year-on-year growth.

(IHS Markit Economist Lei Yi)

- The year-on-year moderation in August new TSF was again largely driven by the weakness in government bond issuance, which registered a year-on-year decline of CNY405 billion. That said, signs of acceleration in fiscal spending have emerged as government bond issuance increased by CNY791.8 billion month on month (m/m), and the August reading of CNY974 billion was the highest level so far this year. Similarly, fiscal deposits only rose by CNY172.4 billion y/y in August, compared with CNY600.8 billion y/y in the prior month.

- On the bank lending front, the clouded growth outlook and

pandemic-related disruptions continue to weigh on financing demand

of the real economy. Medium-to-long-term borrowing of corporates

recorded the second month of year-on-year decline in August, and

paper financing remained the only component registering

year-on-year gains. With tight mortgage rules remaining in place,

medium-to-long-term household borrowing contracted year on year for

the fourth consecutive month.

- Authorities of Guangdong, Hong Kong SAR and Macao SAR jointly

released the final version of detailed regulations for the

cross-border WMC in the Greater Bay Area on 10 September. (IHS

Markit Economist Yating

Xu)

- The WMC allows mainland residents of the nine Guangdong cities in the Greater Bay Area to invest in certain products sold by banks in Hong Kong SAR and Macao SAR via the so-called "southbound link". Residents of the two special administrative regions will be able to invest in eligible products sold by mainland China's in the area via the "northbound link".

- According to the regulation, an initial quota of CNY150 billion has been set for the northbound and southbound links, while the cap on an individual's investment will be set at CNY1 million. Also, qualified mainland investors need to have at least two years of investing experience and have either outstanding household net financial assets worth at least CNY1 million or total asset worth at least CNY2 million. Additionally, the eligible products should be investments with low-to-medium risks.

- The regulations will be trialed on 10 October by the branches of the People's Bank of China in Guangzhou and Shenzhen, while the Hong Kong Monetary Authority and Macao Monetary Authority will commence the business after relevant preparation work.

- China's State Administration for Market Regulation (SAMR) has fined three auto chip sales companies - Shanghai Chengsheng Industrial, Shanghai Cheter, and Shenzhen Yuchang Technologies - for driving up the prices of chips, reports Reuters. The authority has levied CNY2.5 million (USD387,326) on the three companies and would continue to monitor the market for any such illegal behavior, as per the report. The move is in line with the recent announcement that the SAMR is investigating auto chip dealers that are suspected of illegal practices like hoarding and price gouging and collusion, which resulted in the increase of semiconductor chip prices during the global shortage. Chinese authorities have vowed to establish semiconductor supply chains that rely less on imports and have said that they are engaging with auto manufacturers and chip makers to match supply and demand. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan's current Business Survey Index (BSI) for large

enterprises rose by 8.0 points to 3.3 in the Business Outlook

Survey for the third quarter of 2021. The first positive figure in

three quarters reflected the improvement of both manufacturing (up

8.4 points to 7.0) and non-manufacturing (up 7.7 points to 1.5).

While persistent containment measures to curb Delta variant

COVID-19 infections and semiconductor shortages continued to erode

domestic business conditions for all sized enterprises, external

demand drove the improvement for the BSI overall. However, the

contractions of BSIs for small enterprises narrowed, but remained

slack for both manufacturing and non-manufacturing groupings. (IHS

Markit Economist Harumi

Taguchi)

- Projected sales and ordinary profits for all industries in fiscal year (FY) 2021/22 (ended in March 2022) were revised up to a 3.5% year-on-year (y/y) rise from a 2.8% y/y rise and to a 11.2% y/y rise from an 6.8% y/y rise, respectively, largely thanks to upward revisions to figures for manufacturing.

- Fixed investment plans in FY 2021/22 for all industries were revised down to 6.6% y/y from 7.4% y/y, due largely to lower outlooks for non-manufacturing, which moved down to 4.7% y/y from 5.8% y/y. Demand for digitization is the major driver for fixed investment, as businesses are focused on software and information and communication machinery. The weakness in fixed investment plans for non-manufacturing largely reflected more downbeat plans in retail sales and services (such as amusement and life-related services).

- Boston Dynamics will expand its partnership with Hyundai Motor Group to integrate its robotics technologies in future mobility solutions and expand their applications in other industrial sectors, reports the Yonhap News Agency. The US-based robotics startup's humanoid bipedal robots called Atlas smoothly run, jump, leap, vault, and perform back flips, which are modelled and designed on computers. The company's four-legged robotic dog, called Spot, equipped with cameras and other sensors, is designed to work in a range of environments, covering utilities, manufacturing, construction, and offshore oil rigs. Its huge robotic arm, called Stretch, capable of moving boxes and building pallets, is currently in an early pilot stage and is expected to be commercialized in late 2022, highlights the report. (IHS Markit AutoIntelligence's Jamal Amir)

- Merger and acquisition (M&A) deals in India's healthcare sector grew to reach a value of nearly USD1.9 billion in the first half of 2021, compared with USD772 million in the same period of 2020. According to data from India's Venture Intelligence, the first six months of 2021 saw 18 M&A deals worth a total of USD1.89 billion, representing a 59% year-on-year increase in the value of transactions. Deals included the e-pharmacy network PharmEasy's acquisition of Thyrocare Technologies for USD612 million in June 2021 and Advent International (US)'s USD275-million investment in the active pharmaceutical ingredients business of ZCL Chemicals (India). The surge in M&A deals reflects a slump in transactions due to pandemic-related disruptions in the previous year. Despite ongoing coronavirus disease 2019 (COVID-19)-related challenges, a number of segments in the healthcare sector, primarily those focused on digital solutions, have been bolstered by the dynamic market environment. Positive driving factors include digitization, a focus on supply chain optimization, new business models and incubation, demand for domestic production of raw pharmaceutical ingredients, and positive regulatory developments aimed at encouraging investment in the sector. (IHS Markit Life Sciences' Sacha Baggili)

- All-electric ride-hailing platform BluSmart has partnered with Jio-bp, the fuels and mobility joint venture (JV) between Reliance Industries Limited and bp, to install a network of commercial large scale electric vehicle (EV) charging stations in India, reports Livemint. The companies will work towards planning, development, and operation of EV charging infrastructure, at suitable locations across Indian cities where BluSmart operates. In the initial phase of rollout in the National Capital Region, these EV charging stations will be concentrated in urban areas and each station will be capable of handling a minimum of 30 vehicles. Blu Smart offers a 100% electric mobility platform, which has covered more than 350,000 trips. The service is currently available in Delhi-NCR with a fleet of more than 400 EVs, which includes the Tata Tigor EV, Mahindra e Verito, and Hyundai Kona EV. Last year, BluSmart raised INR510 million (USD7 million) in a pre-series A funding round from multiple investors. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ford India Private Limited has announced that it is to hold talks with representatives of the Chennai Ford Employees' Union to discuss the settlement process when the automaker closes its plant in Chennai, reports the Deccan Herald. Ford reportedly says that it aims to devise a fair and balanced plan to safeguard the welfare of the affected employees. Senthilkumar, general secretary of Chennai Ford Employees' Union, said, "This is the initial meeting that we will have with Ford India management. We will discuss the broad contours of the settlement that the management has announced. It will take at least a few months for us to reach an agreement." He added, "We have asked the state government to intervene and ensure that jobs are not lost if Ford India sells the plant to another car manufacturer. The government should step in and help us." Meanwhile, the government of Tamil Nadu state has intervened by offering the same financial benefits to a buyer of the Ford plant in Chennai as it would give to a manufacturing entity setting up a plant on a greenfield site in the Indian state. The Tamil Nadu state government is also offering a hassle-free documentation approval process to resolve the issue quickly. According to an Economic Times report, the buyer of the Ford factory will be offered a people-plant package. The Chennai plant is on a 350-acre site, employs around 2,000 people, and has a production capacity of 200,000 vehicles and 340,000 engines per annum. (IHS Markit AutoIntelligence's Tarun Thakur)

- Orsted and Vietnam's T&T Group have signed a memorandum of

understanding to develop a pipeline of greenfield offshore wind

projects off the coasts of Bin Thuan and Ninh Thuan provinces,

Vietnam. T&T will contribute local expertise in developing

large energy projects, having previously completed several large

solar PV projects, and being on track to complete five onshore wind

projects by the end of 2021. (IHS Markit Upstream Costs and

Technology's Melvin Leong)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.