Daily Global Market Summary - 14 January 2021

Most major European and APAC equity markets closed higher, while most US indices were lower. US government bonds closed sharply lower and benchmark European bonds were mixed. European iTraxx and CDX-NA closed almost flat on the day across IG and high yield. The US dollar and gold closed lower, while oil, silver, and copper were higher on the day. Major news today was that US initial claims for unemployment insurance increased by a disappointing 231K (NSA) and the late-day announcement of President-elect Joe Biden's proposal for a new $1.9 trillion COVID-19 relief bill.

Americas

- Most US equity markets closed lower except for Russell 2000 +2.1%; S&P 500 -0.4%, DJIA -0.2%, and Nasdaq -0.1%.

- 10yr US govt bonds closed +4bps/1.13% yield and 30yr bonds +5bps/1.87% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY flat/296bps.

- DXY US dollar index closed -0.1%/90.24.

- Gold closed -0.2%/$1,851 per ounce, silver +0.9%/$25.80 per ounce, and copper +1.1%/$3.66 per pound.

- Crude oil closed +1.2%/$53.57 per barrel, which is the highest close since 20 February.

- President-elect Joe Biden will ask Congress for $1.9 trillion to fund immediate relief for the pandemic-wracked U.S. economy, a package that risks swift Republican opposition over big-ticket spending on Democratic priorities including aid to state and local governments. The proposal unveiled Thursday will be followed in coming weeks by a second, broader jobs and economic recovery plan that will include money for longer-term development goals such as infrastructure and climate change, a senior incoming Biden administration officials told reporters. (Bloomberg)

- US seasonally adjusted (SA) <span/>initial claims for unemployment insurance

rose by 181,000 to 965,000 in the week ended 9 January, its highest

level since mid-August 2020. The not seasonally adjusted (NSA)

tally of initial claims rose by 231,335 to 1,151,015. This sharp

increase in claims suggests that the recovery in labor markets is

flagging as the pandemic rages on across the country. The

resurgence of the virus has led many states to tighten business

restrictions. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, rose by 199,000 to 5,271,000 in the week ended 2 January. Prior to seasonal adjustment, continuing claims rose by 474,180 to 5,856,230. The insured unemployment rate rose 0.2 percentage point to 3.7%.

- There were 284,470 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 9 January. In the week ended 26 December, continuing claims for PUA fell by 940,499 to 7,442,888.

- In the week ended 26 December, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 325,152 to 4,166,261. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 26 December, the unadjusted total fell by 744,511 to 18,406,940.

- The index of US import prices increased 0.9% month on month

(m/m) in December following a 0.2% advance in November. The index's

12-month growth rate increased to -0.3%. (IHS Markit Economist

Gordon Greer)

- The index of import prices increased 0.9% m/m in December. Among imported fuel price categories, natural gas prices receded 7.5% m/m after surging 44.2% m/m in November, while imported petroleum prices jumped 9.1% m/m. Excluding petroleum, monthly import price growth was 0.4% m/m in December.

- Fuel import prices jumped 7.8% in December after an upwardly revised 4.8% increase in November. The cost of imported fuel was down 19.5% versus December in the prior year.

- The index of exported goods prices rose in December, with the index's m/m change registering at 1.1%. The increase in this index was driven by growth in both agricultural and nonagricultural commodities prices.

- Agricultural prices growth came in at 0.6% m/m and marked a 5.1% 12-month increase, while nonagricultural commodities growth came in at 1.3% month on month and was down 0.2% versus December in the prior year. Industrial supplies and materials export prices surged 3.3% m/m. Capital goods prices inched up 0.1% m/m, consumer goods prices rose 0.4% m/m, and automotive goods prices ticked up 0.1% m/m.

- The US National Transportation Safety Board (NTSB) has issued a report requesting that automakers improve guidelines on handling emergencies involving electric vehicle (EV) battery fires. The NTSB report is called 'Safety Risks to Emergency Responders from Lithium-Ion Battery Fires in Electric Vehicles'. The agency studied three accidents in particular in which vehicle crashes resulted in battery fires, comprising two in California and one in Florida, as well as one EV battery fire not resulting from a crash, also in California. The NTSB report states that, in the accidents, extensive damage extended into the protected area of the high-voltage battery cases, rupturing the cases and damaging the battery modules and individual cells. The NTSB states that each situation created risks to first responders from batteries related to electric shock, thermal runaway, battery ignition and reignition, and stranded energy (electrical energy remaining without an effective way of removal, typically after battery damage). In addition, the study reviewed response guidance from OEMs to such situations. According to the NTSB, from this review, two main issues emerged. First, vehicle manufacturers' emergency response guidelines for first and second responders are inadequate for minimizing risks posed by high-voltage lithium-ion batteries involved in high-speed, high-severity crashes, says the agency. In addition, the agency found gaps in safety standards and research related to the issue. Consequently, the NTSB has issued recommendations to the US National Highway Traffic Safety Administration (NHTSA), automakers, and professional organizations that operate training programs for first and second responders. In the NTSB's findings, it recognizes that existing standards address damage to batteries in survivable crashes, but it states that they do not address high-speed, high-severity crashes. Overall, the NTSB report issues a set of 10 findings, from thorough reviews of the crashes studied. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) startup Lordstown Motors Corporation says that it is in advanced discussions with the US Department of Energy on a government loan, reports Reuters. According to the report, the loan would be used to help pay for the costs of retooling a factory in Lordstown, Ohio, United States, to build its electric truck and other EVs in future. Reuters reports Lordstown Motors CEO Steve Burns as saying that the loan would help "us make more [vehicles] once we start" and "pull future vehicles forward a little bit". According to the report, Burns said that Lordstown Motors does not need the loan to take its plans forward, but that it could "put things on steroids". The report states that Burns did not disclose the specific amount sought, but the CEO suggested that it would be similar in size to the loan that Tesla received in 2010. Tesla's loan, which the company has since repaid, was for USD465 million. Lordstown Motors was first reported to have applied for a US federal loan in January 2020. The latest report indicates that a decision on the loan is due soon, although one is not likely before the 20 January inauguration of Joe Biden as US president. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Boehringer Ingelheim Animal Health is set to benefit from a new collaborative agreement with Google Quantum AI. The wider Boehringer group has entered a partnership with Google focused on exploring and implementing "cutting-edge use cases" for quantum computing in pharmaceutical R&D, including molecular dynamics simulations. Boehringer said the collaboration combines its own expertise regarding computer-aided drug design and in silico modeling with Google's leading resources in quantum computers and algorithms. Boehringer is the first pharmaceutical and animal health company to partner with Google in quantum computing. The three-year partnership will be co-led by Boehringer's Quantum Lab - a newly established outlet that is part of the firm's plan to "invest significantly in the coming years to realize the full potential of quantum computing". Like numerous leading animal health companies, Boehringer is subject to a digital transformation strategy. The wider Boehringer organization said it is significantly increasing investment "in a broad range of digital technologies, encompassing key areas such as artificial intelligence (AI), machine learning and data science to better understand diseases, their drivers and biomarkers, and digital therapeutics". Michael Schmelmer, member of Boehringer's board of managing directors, said: "Quantum computing has the potential to significantly accelerate and enhance R&D processes in our industry. Quantum computing is still very much an emerging technology. However, we are convinced this technology could help us to provide even more humans and animals with innovative and ground-breaking medicines in the future." Ryan Babbush, head of quantum algorithms at Google, commented: "Extremely accurate modelling of molecular systems is widely anticipated as among the most natural and potentially transformative applications of quantum computing. Therefore, Google is excited to partner with Boehringer to explore use cases and methods for quantum simulations of chemistry. Boehringer brings both an impressive quantum computing team and deep expertise in real world applications of these capabilities in the pharmaceuticals space." (IHS Markit Animal Health's Sian Lazell)

- Colombia's index of consumer confidence (ICC) increased by 3.2

percentage points in December from November 2020, registering its

highest level since the start of the COVID-19-virus pandemic in the

first quarter of 2020. It is, however, 0.9 percentage points below

its December 2019 level. (IHS Markit Economist Lindsay Jagla)

- Consumer confidence increased on a monthly basis among all socioeconomic levels as well as in four of the five cities included in the survey, showing widespread recovery across the country.

- In monthly terms, consumer's willingness to buy housing increased, while willingness to buy durable goods (such as furniture and household appliances) and vehicles decreased.

- Colombia had already begun its reactivation process prior to December 2020, with the majority of lockdown measures lifted. However, some areas with high numbers of COVID-19 cases increased social-distancing measures during the Christmas season, such as reimplementing curfews, to prevent a spike in cases.

- As such, the continued recovery in Colombia's consumer confidence stems largely from the more optimistic global outlook as vaccines were approved in record time and vaccination programs have begun to be rolled out globally.

- Up to this point, Colombia has acquired enough vaccines to vaccinate 29 million people (slightly under the government's goal to vaccinate 35 million people: 70% of the population). However, the vaccine will not be available until February.

- According to a report by CNN Brazil, four Chinese manufacturers - Changan, GAC, Geely, and Great Wall Motors - have announced their interests in buying Ford's Camaçari (Brazil) plant. The report states that the brands are negotiating with Ford with the help of local intermediary CAOA Chery. Ford is also reportedly looking for a buyer for its plant in Horizonte, which manufactures the Troller sport utility vehicle (SUV). Brazilian President Jair Bolsonaro has criticized Ford, which has received BRL20 billion (USD3.7 billion) in assistance in recent years, alleging that the company was seeking tax breaks and subsidies to compete with other automakers. He added, "People complained about the Ford factories. I'm sorry, but I will no longer keep spending your money to support their factories." Recently, Ford announced that it would end production in Brazil in 2021. Its shutdown will result in 5,000 employees being laid off. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- Most European equity markets closed higher except for Italy -0.5%; UK +0.8%, Germany +0.4%, France +0.3%, and Spain +0.1%.

- The leaders of the two largest parties in Italy's government have thrown their support behind prime minister Giuseppe Conte after the resignation of three ministers yesterday left him scrambling to keep his coalition together. Mr Conte's government was plunged into crisis on Wednesday after Matteo Renzi, the former Italian prime minister, announced three ministers from his small Italia Viva party were leaving the coalition, blaming dissatisfaction with its response to the COVID-19 pandemic. (FT)

- 10yr Italian govt bonds closed +5bps/0.64% yield, further adding to this week's volatility.

- 10yr European govt bonds closed mixed; Italy +5bps, Spain +1bp, France/UK -2bps, and Germany -3bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Europe -2bps/250bps.

- Brent crude closed +0.6%/$56.42 per barrel.

- The ECB's December policy meeting concluded with a

recalibration of its policy stance focused on a third increase in

the envelope of the pandemic emergency purchase programme (PEPP)

and more generous terms for long-term loans to commercial banks.

The key takeaways from the ECB's views expressed in the published

account of that meeting are below. (IHS Markit Economist Ken

Wattret)

- The rebound in eurozone GDP in the third quarter of 2020 had surprised on the upside. Given the more positive starting point, it was possible that the second wave of the pandemic would not make output losses deeper overall, but could make them more drawn out. This might inflict more lasting damage on a number of sectors, due to heightened risks of rising insolvencies and unemployment.

- Private consumption rebounded strongly in the third quarter of 2020 but remained well below its pre-pandemic level. The extent to which lockdown-induced pent-up demand had been satisfied was unclear. Business investment also rebounded but the outlook remained subdued in light of reduced revenues, low rates of capacity utilization and fragile corporate balance sheets. Trade had rebounded strongly but renewed lockdown restrictions were likely to interrupt the recovery.

- Measures of underlying inflation had generally stabilized after the downward trend seen previously, but they continued to point to broad-based weakness in price pressures and wage dynamics. The euro's appreciation also constituted a headwind to inflation. Market-based measures of longer-term inflation expectations remained at very subdued levels, after a slight improvement in response to the positive vaccine news.

- December 2020's economic projections pointed to a more protracted weakness in inflation than previously envisaged. They implied that by the end of the projection horizon in 2023, eurozone inflation would have remained below the ECB's inflation aim for around a decade (with the exception of 2018).

- Close attention is being paid to the role of the exchange rate in the inflation outlook. The nominal effective exchange rate had reached an all-time high, although the impact of currency strength on inflation depended on the nature and persistence of the shock driving its movements.

- The next ECB meeting will take place on 21 January, with zero chance of another change in policy so soon after December's package of measures. The focus for now will remain on the implementation of the announced asset purchases and long-term loans to banks which will continue to drive a huge expansion of the balance sheet of the Eurosystem.

- Still, the ECB has signaled that growth risks are still to the downside and uncertainty remains high which, in line with its forward guidance, implies that an easing bias for policy is explicitly retained, including for policy rates.

- With this in mind, a key issue for upcoming ECB policy

communications is whether there will be any more hints about the

possibility of a further cut in the Deposit Facility Rate (DFR)

from the current -0.5%. The rate was last reduced back in September

2019, just prior to former president Mario Draghi's departure.

- Germany's "Flash" GDP data for 2020 are modestly more positive

than expected, suggesting broadly flat activity in the fourth

quarter despite the hard lockdown implemented in mid-December. As

the latter will last at least until the end of January and possibly

during part of February, 2021 will start with another GDP

contraction ahead of a strong rebound in the second and third

quarters as vaccination progress enables a successive loosening of

COVID-19 virus-related restrictions. (IHS Markit Economist Timo

Klein)

- The initial GDP release for 2020 from the German Federal Statistical Office (FSO) shows a slightly smaller-than-expected decline of 5.0% (consensus: -5.1%). Once the additional working days in 2020 are accounted for (impact of almost 0.4 percentage point), the calendar-adjusted figure is -5.3% (rounding has helped). This compares with growth of 0.6% in 2019 and an average growth rate of 1.9% during 2009-19. The FSO speaks of a massive impact from the COVID-19 virus pandemic but also points out that the GDP contraction in 2009 in the wake of the global financial market crisis was even larger (-5.7% unadjusted).

- As usual, implications for data-edge developments are somewhat difficult to determine given the still high degree of estimation for the fourth quarter and the implicit (but unpublished) revisions to data for previous quarters. Ahead of the release of the fourth-quarter 2020 data on 29 January that will reveal those revisions, the annual data released today and a hypothetical assumption of there being no revisions argue for GDP growth in the final quarter of 2020 having been near zero.

- Administrative restrictions (i.e. lockdowns) imposed during 2020 in order to maintain control over COVID-19 virus infections and thus prevent the healthcare system from being overwhelmed were the key influence on GDP growth in 2020. In the first wave of infections in March-April, German industry was hurt to a similar degree as services because of supply-chain interruptions (notably linked to China), whereas (export-led) industrial growth was affected much less during the second wave that emerged during the fourth quarter of 2020 because economic activity in most Asian countries was no longer severely restrained by the pandemic. Output in the automotive industry had plunged by 85% in April but was within 5% of February's pre-pandemic level by November.

- The component breakdown shows that negative net exports contributed 1.1 percentage point and domestic demand 3.9 percentage points to the GDP decline in 2020. As net destocking of inventories is said to have been responsible for 0.7 percentage point of the latter, this implies that domestic demand without inventory changes dampened the GDP level by 3.2 percentage points.

- German service-sector activity will be hurt markedly anew in early 2021 by the strict lockdown in place since mid-December 2020 and which will be maintained at least until the end of January, and quite possibly for several more weeks in February. Notwithstanding the resilient construction and manufacturing sectors, GDP will thus contract in the first quarter of 2021 by around 2%. It should rebound in the second quarter, however, as progress on vaccination numbers (especially among the most vulnerable elderly population, which is highly significant for hospitalisation rates) and warmer weather will allow the government to loosen restrictions substantially in that period.

- Leading indicators (Ifo, PMI, ZEW) are likely to suffer a setback around the turn of the year due to the need to impose another strict lockdown of uncertain duration, but this will be limited in magnitude as knowledge of available vaccines provides reassurance about a foreseeable end to restrictions in the course of 2021. We do not expect the now-concluded Brexit to be a major drag on Germany's economy, notwithstanding the difficulties that lie ahead for the UK economy in this respect.

- IHS Markit currently predicts calendar-adjusted GDP growth of 2.8% in 2020 as the renewed dip in the first quarter markedly restrains average growth this year.

- The Volkswagen (VW) Group has posted a 15.2% year-on-year (y/y) decline in global sales during 2020 as a result of the impact of the COVID-19 virus pandemic to 9,305,400 units. The company noted a concerted recovery in its sales trend towards the end of the year, with the decline in the fourth quarter limited to 5.7% y/y, while there was a 3.2% y/y fall December. On an overall basis the VW Group said as a result of its 2020 sales performance it had actually expanded its global market share in 2020, as its sales had fallen at a lower rate than those of its rivals. "The Covid-19 pandemic made 2020 an extremely challenging year," said Dr. Christian Dahlheim, Head of VW Group Sales. "The Volkswagen Group performed well in this environment and strengthened its market position. We are particularly pleased that we hit the ground running in our e-offensive in spite of the pandemic and thus took a big step forward in the implementation of our Together 2025+ strategy. We will keep up the momentum this year, adding many more attractive electric models." The VW Group did not post individual brand performance figures as part of its 2020 Group sales data, although the VW passenger car brand reported its own headline data yesterday, with an overall global decline in line with the wider group performance. As in the VW passenger car sales data release, the wider Group was keen to promote the strong sales development of its plug-in vehicles, combining battery electric vehicle (BEVs) and its plug-in hybrids (PHEVs). Group BEV sales were up by 214% y/y to 231,600 units, while PHEV deliveries were up by 175% y/y to 190,500 units. (IHS Markit AutoIntelligence's Tim Urquhart)

- Fiat Chrysler Automobiles (FCA) has announced that its shareholders will receive a payout from a special cash dividend on 29 January. According to a statement, the distribution - amounting to around EUR2.9 billion or EUR1.84 per share - will be paid to those who hold common stock on 15 January having now become unconditional. Shareholders holding common shares traded on the New York Stock Exchange (NYSE) will receive the dividend in US dollars at the official USD/EUR exchange rate reported on 13 January by the European Central Bank. The dividend is being paid out by FCA as part of its merger with Groupe PSA to create Stellantis. It related to the fact that FCA is a larger business than PSA and is designed to equalize the transaction, which completes on 16 January. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ziton jackup Wind Enterprise is undergoing its 10-year class approval at Fayard shipyard in Denmark, before commencing a long-term turbine maintenance charter with Siemens Gamesa Renewable Energy (SGRE) on 1 March. Ziton is to acquire the vessel after signing the three-year and eight month-long charter agreement with SGRE in December 2020. During final contract negotiations, SGRE and Ziton agreed to further future-proof the vessel to perform major component exchanges on larger turbines. Ziton has therefore committed to extend the crane boom on the Wind Enterprise within the first nine months of 2021. SGRE will pay the required CAPEX, estimated at approximately USD1.8 million (EUR1.5 million), and pay the charter hire during an expected boom extension period of three weeks. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Siemens Gamesa and Siemens Energy have joined forces combining

their ongoing wind to hydrogen developments. The projects target a

total investment of approximately EUR120 million (USD146 million)

over five years in developments leading to a fully integrated

offshore wind-to-hydrogen solution. (IHS Markit Upstream Costs and

Technology's Kamila Langklep)

- The companies are developing an innovative solution that fully integrates an electrolyzer into an offshore wind turbine as a single synchronized system to directly produce green hydrogen. The companies intend to provide a full-scale offshore demonstration of the solution by 2025-26. Through these developments, the companies aim to contribute towards a decarbonization of the economy and a solving of the climate crisis.

- Over a timeframe of five years Siemens Gamesa plans to invest EUR80 million (USD97 million) and Siemens Energy is targeting an investment of EUR40 million (USD49 million) in the developments. Siemens Gamesa will adapt its development of the SG14-222 DD offshore wind turbine to integrate an electrolysis system seamlessly into the turbine's operations. Siemens Energy will develop a new electrolysis product to meet the needs of the harsh maritime offshore environment in sync with the wind turbine. The ultimate fully integrated offshore wind-to-hydrogen solution will produce green hydrogen using an electrolyzer array located at the base of the offshore wind turbine tower. The solution will lower the cost of hydrogen by being able to run off grid.

- The developments are part of the H2Mare initiative which is a lighthouse project likely to be supported by the German Federal Ministry of Education and Research ideas competition "Hydrogen Republic of Germany". The H2Mare initiative under the consortium lead of Siemens Energy is a modular project consisting of multiple sub-projects to which more than 30 partners from industry, institutes and academia are contributing. Siemens Energy and Siemens Gamesa will contribute to the H2Mare initiative with their own developments in separate modular building blocks.

- Siemens Energy owns 67% of Siemens Gamesa.

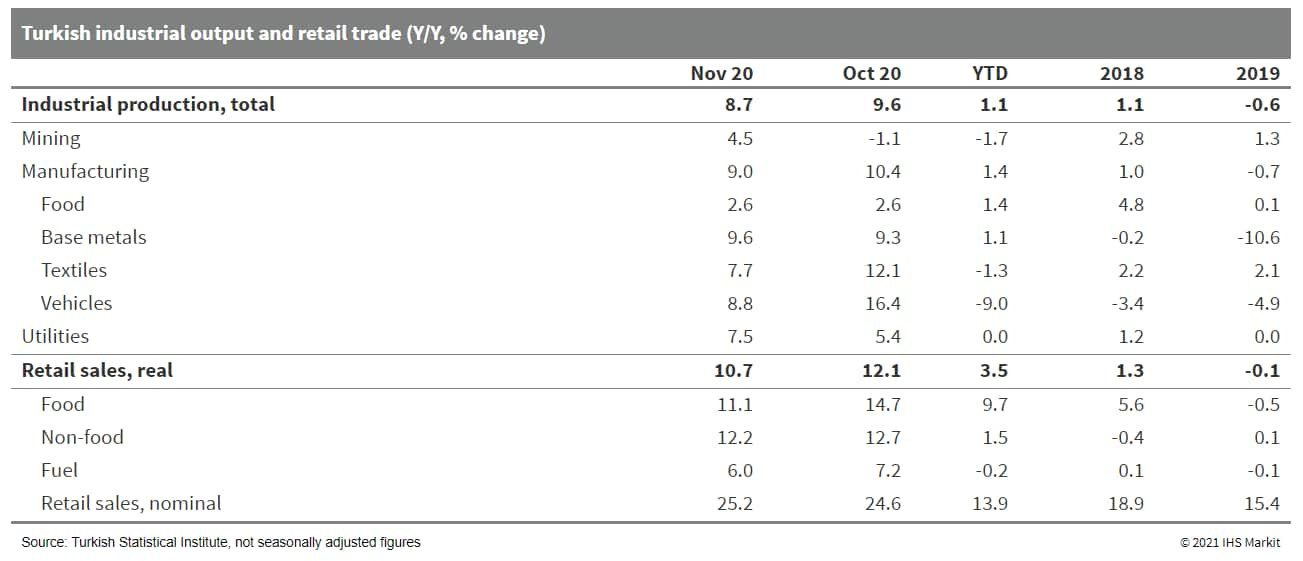

- The Turkish economic recovery continued in November 2020, even

as the central bank moved to a more defensive monetary policy.

However, the tightening of economic policies might have had more

impact in December according to leading indicators. In early 2021,

tighter economic policies are likely to affect retail trade more

notably, though industrial production gains may continue. (IHS

Markit Economist Andrew Birch)

- In November, Turkish industrial production continued to grow, by 1.3% month on month (m/m) in seasonally adjusted data, the seventh consecutive month of expansion after output plunged in March and April with the implementation of the first wave of anti-pandemic lockdowns. Sustained growth since that drop pushed total production up by 11.0% year on year (y/y) in calendar-adjusted data, the strongest such gain since the beginning of 2018.

- Retail trade also continued to expand in November. The volume of retail sales increased by 2.2% m/m in seasonally adjusted terms, also the seventh consecutive month of expansion. The total volume of retail sales was up by 11.9% y/y in calendar adjusted data.

- Over the course of November, the central bank governor and the treasury and finance minister were replaced, with the incoming officials promising tighter economic policies. By the end of the year, the central bank had raised interest rates and credit growth had begun to subside.

- Leading indicators suggest that this economic policy tightening will negatively impact both industrial production and retail sales in December. The IHS Markit Purchasing Managers Index slipped for the second consecutive month, to 50.8 - still positive but the weakest it had been since May 2020. Meanwhile, labor data through October show that the rise of employment that had underpinned the retail sales recovery faltered, likely further contracting in November and December.

- Based on the resilient economy in November, we have tempered

the expected m/m fourth-quarter retreat in GDP after its

third-quarter recovery. Nonetheless, the full-year 2020 GDP

forecast will fall to 0.2% based on further adjustments to the

third-quarter data.

- The International Monetary Fund (IMF) has made a disbursement

of USD34.4 million to the Central African Republic (CAR) following

a favorable program performance under the country's Extended Credit

Facility (ECF) agreement. (IHS Markit Economist Thea Fourie)

- The IMF disbursed USD34.4 million to the CAR government following the completion of the first and second reviews under the country's Extended Credit Facility (ECF) agreement. The IMF approved the CAR's ECF, which amounts to USD115.1 million, in late 2019. To date, the disbursements under the ECF total USD51.6 million.

- The IMF warns that the negative impact of the coronavirus disease 2019 (COVID-19) pandemic on CAR's early policy and reform efforts under the program was significant, particularly through external channels. However, the IMF says the country's program performance improved in recent months as the authorities stepped up efforts to enhance the use and transparency of donor financing to fight the pandemic while focusing on key structural reforms.

- The IMF report states, "Looking ahead, the authorities will pursue their efforts to support the economic recovery and make progress toward poverty reduction. They aim to prioritize social spending, improve domestic revenue mobilization, consolidate the single treasury account, and enhance public sector supervision. They will also implement reforms to strengthen governance and the business climate, including through the submission to parliament of new anti-corruption law and the publication of public procurement contracts."

- CAR qualified for the deferral of external debt payments under the G-20 Debt Service Suspension Initiative (DSSI) during April 2020. The potential DSSI debt savings amount to USD7.4 million (or 0.3% of GDP), IMF numbers show. The G-20 is due to re-evaluate the continuation of the DSSI initiative in mid-2021.

- The IMF approved USD38 million of emergency assistance to CAR under the Rapid Credit Facility (RCF) and debt service relief under the Catastrophe Containment and Relief Trust in April 2020.

- CAR remains one of the poorest countries in the sub-Saharan African region and has limited economic diversification. CAR's economic activity is made up primarily of subsistence farming and forestry. The country remains highly dependent on donor aid flows, while exports consist of coffee, cotton, diamonds, and forestry products. This leaves CAR's external liquidity highly susceptible to domestic and external shocks. CAR is a member of the regional bloc the Central African Economic and Monetary Community (CEMAC), which minimizes risk factors weighing on monetary and financial stability and external liquidity availability.

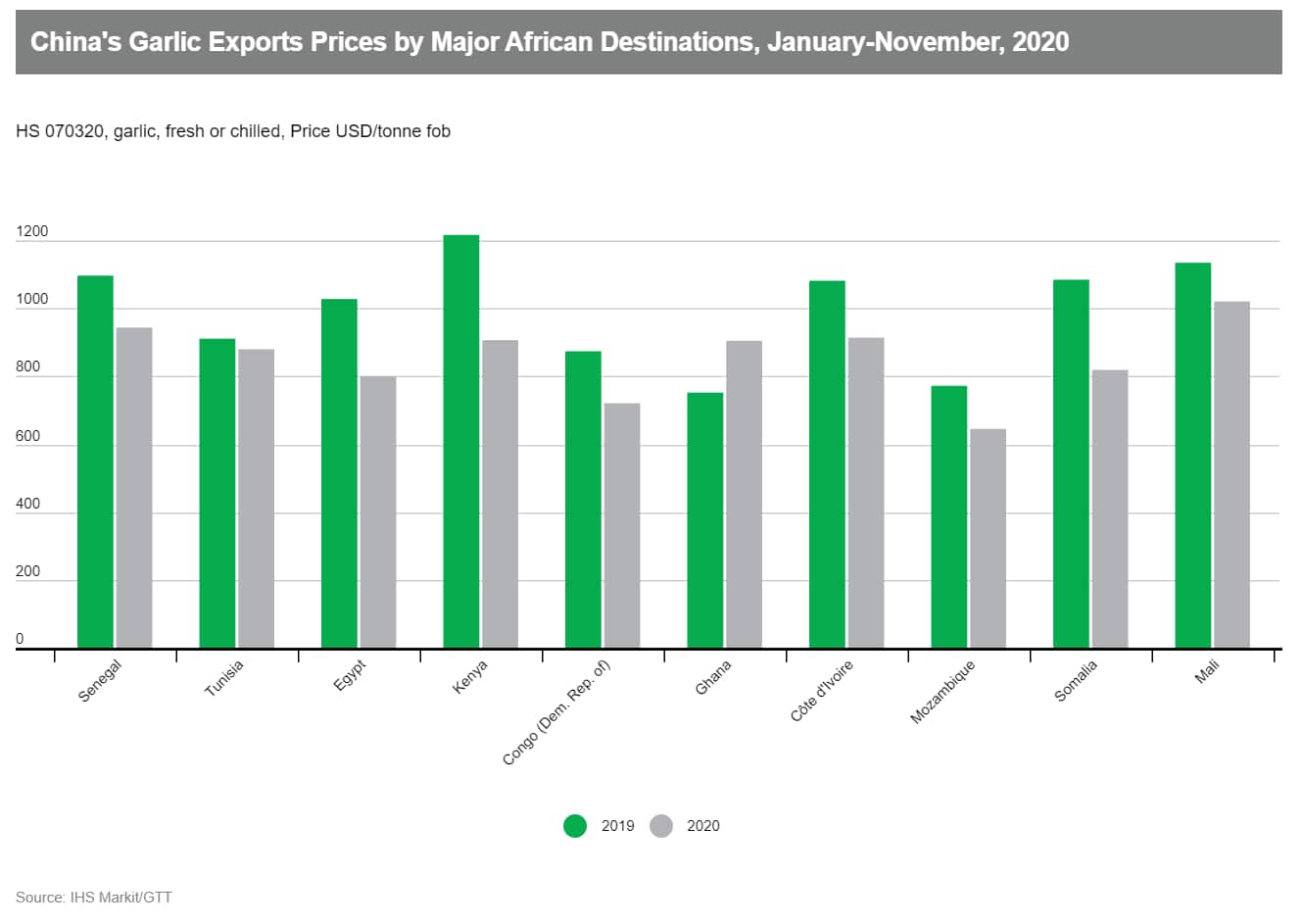

- In January-November 2020, China's garlic exports to the US fell

19% year-on-year to 45,000 tons, at a price of USD1,700 per ton

fob, down 8% y-o-y. US tariffs on Chinese garlic have increased

from 10% to 25% since May 2020, which has encouraged sourcing from

local US produce. China has in turn expanded its exports to Africa,

up 43% to 102,000 tons in the same period, at a price of USD880 per

ton fob. Trade data shows that Chinese garlic are sold in about 44

African countries, with Senegal, Tunisia and Egypt jointly

accounting for 43% of the total volume. In 2020, most export

destinations enjoyed a huge price cut from 2019. (IHS Markit Food

and Agricultural Commodities' Hope Lee)

- China tripled its deliveries to Tunisia to 14,000 tons while sales to Egypt doubled to 11,000 tons compared with the same period in 2019.

- In the first week of January 2021, the wholesale price for coldstore mixed grade garlic was CNY4.52-4.68 per kilo (USD0.66-0.69/kg).

- Meanwhile, India is also interested in the African market. However, its price seems a bit high compared with Chinese offerings. In January-November 2020, India sent 54 tons to Mauritius at USD1,800/ton fob compared with China's shipments of 1,500 tons for a price of USD890/ton fob.

- Zambian farmers are reportedly calling on Chinese garlic growers to help them gain more knowledge about garlic cultivation. Norman Kalenga, chairman for Kasumbalesa Farmers Association, said Zambian garlic growers are intent on growing the cash crop on a commercial basis. A local trader said that the Chinese should consider investing in farming in Zambia to get closer to the African markets.

- Zambia has expanded planted areas for high value fruits and

tree nuts. Its blueberries have been exported to China, according

to a Chinese press outlet.

Asia-Pacific

- Most APAC equity markets closed higher except for Mainland China -0.9%; Japan +0.9%, Hong Kong +0.9%, Australia +0.4%, India +0.2%, and South Korea +0.1%.

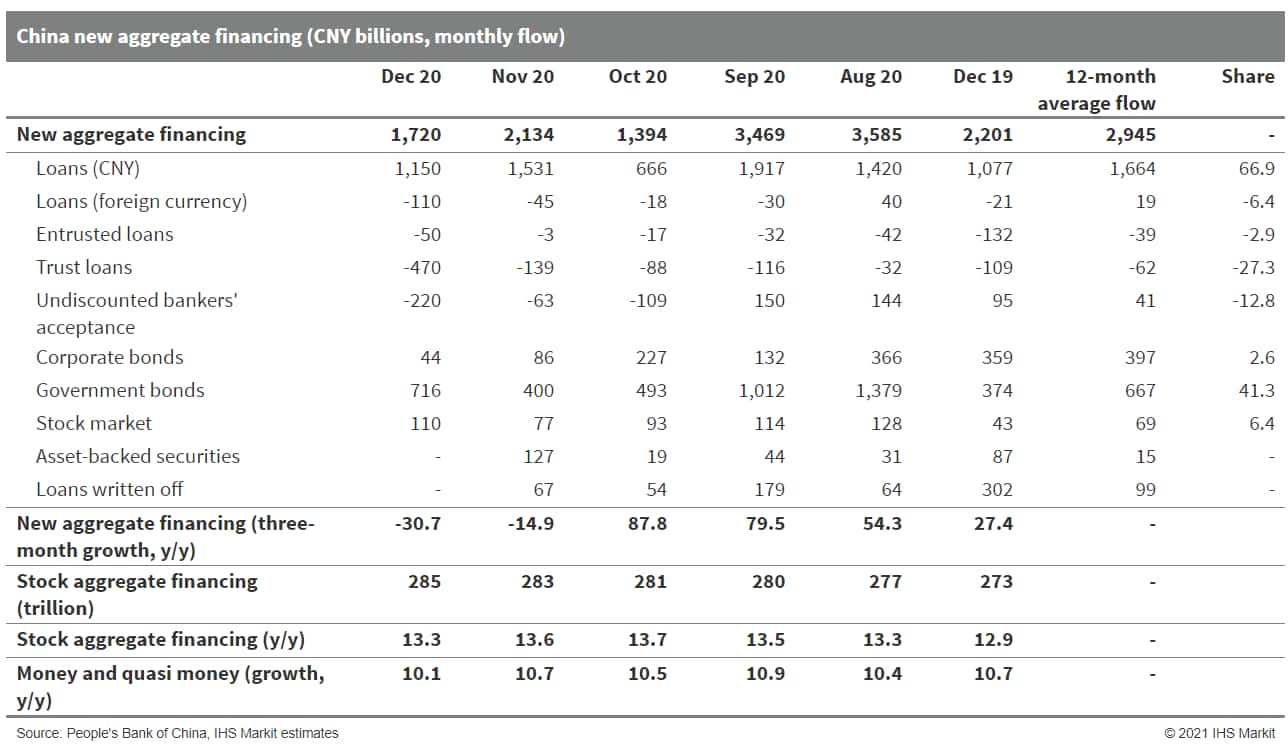

- Total social financing (TSF) is likely to continue to moderate

into 2021 as monetary policy returns to normalcy; structural credit

support for high-tech manufacturing, environmental protection, and

small firms is still expected. (IHS Markit Economist Yating Xu)

- China's TSF, the broadest measure of net new financing in the real economy, amounted to CNY1.7 trillion (USD262.79 billion) in December 2020, down CNY383 billion year on year (y/y) and CNY500 billion month on month, according to a release from the People's Bank of China (PBOC). Stock TSF rose 13.3% y/y in December, declining by 0.3 percentage point from November, marking the second consecutive month of deceleration.

- The contraction in TSF largely came from declines in off-balance sheet financing and short-term corporate loans. Combined, financing through entrusted loans, trust loans, and undiscounted bankers' acceptance decreased by CNY738 billion, CNY592 billion more than the reduction a year ago. The month-on-month decline in trust loans was a historical high. Corporate bond financing further declined to CNY44 billion, down CNY218 billion y/y. Moreover, corporate short-term borrowing declined to a 10-year low and household borrowing fell owing to the recent resurgence in COVID-19 cases and tightening property market controls.

- Government bond issuance and credit expansion remained the main drivers of new financing. The net increase in government bonds was CNY716 billion in December, up CNY342 billion y/y, and new credit for the real economy increased by CNY68 billion.

- Broad money supply (M2) growth dropped by 0.6 percentage point to 10.1% y/y owing to weakening fiscal spending and reduction in structural deposits. M1 growth fell by 1.4 percentage points to 8.6%, partially as a result of tightening real estate controls and the moderation of the property market in lower-tier cities.

- TSF increased by CNY34.9 trillion in 2020, up CNY9.2 trillion y/y. Bank loans increased by CNY19.6 trillion, just below the annual target of CNY20 trillion.

- With milder credit expansion moderation and government bond

issuance expected, TSF growth is likely to decline further in the

first quarter of 2021 from 13.3% y/y in 2020. To date, the State

Council has not issued the early quota of local government bond for

2021, while the 2020 quota was released in early January that

year.

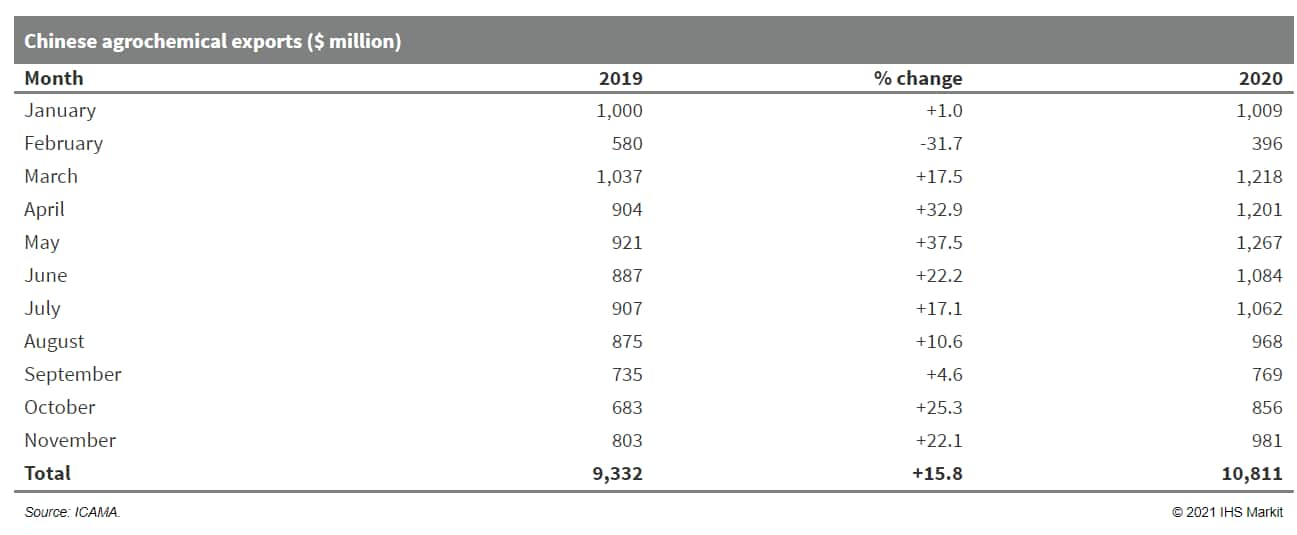

- Chinese agrochemical exports grew strongly during the first 11

months of 2020, according to figures published by the country's

Institute for the Control of Agrochemicals, Ministry of Agriculture

(ICAMA). Exports during the period January-November crossed $10.8

billion, overtaking the total exports of $10.2 billion during 2019.

Growth in value terms was witnessed in all months except February.

The year began slowly with exports inching up 1% in January, before

diving by almost a third (-31.7%) in February. There was a quick

turnaround in March, with growth being maintained throughout the

following months. It was a similar picture in volume terms. Exports

of 2.2 million tons during the first 11 months overtook the total

of 1.9 million tons during all of 2019. The monthly trend was

similar as well, with growth in all months except February. (IHS

Markit Crop Science's Sanjiv Rana)

- Telecoms equipment company Huawei Technologies has developed smart roads in Chinese city Wuxi, Jiangsu province, that can communicate with driverless vehicles. The site is part of China's first national project for intelligent and connected vehicles. The road is embedded with traffic lights, street signs, cameras, and radars that enable the vehicle to receive information from its surroundings. This helps the vehicle undertake actions such as making stops, swerving past obstacles, accelerating, and decelerating. Jiang Wangcheng, president of Huawei's information and communications technology business, said, "Autonomous driving is an irresistible trend, but any isolated vehicle alone can't nail it. The only solution is to get more information from the roads." Huawei's 5G technology offers advantages such as high transmission speed, reliability, and latency that meet the technical connectivity requirements for autonomous vehicles (AVs). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker SAIC Motor Group (SAIC) has unveiled two new models from its new electric vehicle (EV) brand IM, and debuted the logo for the new brand. The mid-size electric sedan and mid-to full-size electric sport utility vehicle (SUV) will be the first two production models from the premium brand jointly introduced by SAIC and Alibaba. The two new vehicles are expected to feature a 93-kWh battery pack with the option to upgrade to a 115-kWh battery pack with higher energy density. The 115-kWh version of the new electric sedan can deliver a maximum range of 1,000 km, according to SAIC. The new IM vehicles will feature a wireless charging module that promise a maximum charging capacity of 11kW. SAIC said reservations for its new electric sedan will begin in April, while the launch date for the new electric SUV will be announced at a later date. SAIC claimed the two new models it showcased are near production-ready, but details regarding their specifications and technologies have not been confirmed at this stage. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Autonomous vehicle (AV) startup WeRide has completed a Series-B funding round of USD310 million, reports VentureBeat. WeRide said that USD110 million is an extension of the USD200-million funding round announced in December 2020 (see China: 23 December 2020: Chinese autonomous vehicle startup WeRide raises USD200 mil. in funding). The funding round was led by Yutong Group and attracted investors including CMC Capital Partners, CDB Equipment Manufacturing Fund, Hengjian Emerging Industries Fund, Zhuhai Huajin Capital and Tryin Capital. Previous investors including Sinovation Ventures, Qiming Venture Partners and Kinzon Capital also participated in this round. Tony Han, CEO and founder of WeRide, said, "In the year 2021, more leading investors and partners are joining us, bringing in their strategic resources to fulfill the goal of commercializing self-driving technology. WeRide is capturing the upward trend in the development of AI- empowered mobility industry, and further accelerates R&D and the commercialization of our technologies". WeRide and Yutong had already developed an autonomous minibus for mass production. It has no steering wheel, accelerator or brakes, and is designed for urban open road operations. WeRide focuses on deploying Level 4 AVs on public roads and recently announced that it has started testing fully driverless vehicles in China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's private machinery orders continued to rise in November,

suggesting a rebound in fixed investment and larger demand

associated with digitalization. However, uncertainties induced by

the COVID-19 pandemic remain downside risks. (IHS Markit Economist

Harumi Taguchi)

- Japan's private machinery orders (excluding volatiles), a leading indicator for capital expenditure (capex), rose by 1.5% month on month (m/m) in November following a 17.1% increase in October. The value of private machinery orders (excluding volatiles) reached JPY854.0 billion (USD8.2 billion), the highest level since February, reflecting continued growth in orders from non-manufacturing (excluding volatiles; up 5.6% m/m), which offset a 2.4% m/m drop in orders from manufacturing.

- The decline in orders from manufacturing was due largely to drops in orders from non-ferrous metals, automobiles, iron and steel, and other transport equipment following rises. However, continued increases in orders from general-purpose and production machinery and some other industry groupings suggest improved demand for machinery in line with a recovery in production. The improvement in orders from non-manufacturing was largely thanks to orders from telecommunication and construction.

- The November results were stronger than expected, and signal that private capex has started to pick up. The resumption of economic activity and steadier uptrends of overseas demand are likely to underpin a recovery in production and then machinery orders from manufacturing. Another factor that could support a recovery in machinery orders is stronger demand associated with digitalization.

- A wider decline in domestic orders for metal-cutting machine tools in December suggests that recovery in machinery orders remains patchy by industry. The surge in the new confirmed cases of COVID-19 and the state of emergency for Tokyo and several prefectures could make companies cautious about starting investment in capex, although containment measures are limited relative to those implemented in April and May.

- US-based Plug Power is set to raise USD1.5 billion investment from South Korea's SK Group, according to a company press release. Under the terms of the investment, a US subsidiary of SK Group will make the investment in Plug Power by acquiring approximately 51.4 million shares of common stock. Plug Power and SK Group have decided to form a partnership to accelerate the use of hydrogen as an alternative energy source in Asian markets. The two companies have also announced that they will form a joint venture company in South Korea pertaining to the effort. "SK Group has an established strategy for building out the hydrogen economy in South Korea and beyond. The current relationship with SK Group offers immediate strategic benefits to Plug Power to accelerate its expansion into Asian markets - and is intended to result in a formal joint venture by 2022. Due to the complementary strengths in this partnership, we expect rapid growth and significant revenue generation from the joint venture that are incremental to our 2024 plan," said Plug Power CEO Andy Marsh. Plug Power is building the hydrogen economy as the leading provider of comprehensive hydrogen fuel cell turnkey solutions. Through this partnership, the two companies intend to provide hydrogen fuel cell systems, hydrogen fueling stations, and electrolyzers to the South Korean and broader Asian markets. The US company has deployed over 40,000 fuel cell systems for e-mobility and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.