Daily Global Market Summary - 15 November 2021

All major European and most APAC equity indices closed higher, while most US indices were flat on the day. US government bonds closed sharply lower, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed flat on the day across IG and high yield. The US dollar, natural gas, and WTI closed higher, while Brent, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed flat on the day except for Russell 2000 -0.5%; DJIA/S&P 500/Nasdaq 0%.

- 10yr US govt bonds closed +6bps/1.62% yield and 30yr bonds +7bps/2.01% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY flat/295bps.

- DXY US dollar index closed +0.3%/95.41.

- Gold closed -0.1%/$1,867 per troy oz, silver -1.0%/$25.11 per troy oz, and copper -1.1%/$4.40 per pound.

- Crude oil closed +0.1%/$80.88 per barrel and natural gas closed +4.6%/$5.10 per mmbtu.

- After threatening a response to OPEC+'s schedule to stick to a

slower production increase, the US administration has suggested

several strategies to try to mitigate high oil prices but has

committed to none so far. There are no unilateral silver bullets,

or even clear good options, to the predicament that the Biden

Administration is attempting to target - high gasoline prices - but

the vocal rhetoric and recent spread of the oil intervention

conversation to the mainstream political discussion and Congress

mean that reversing course will be difficult. The options currently

being discussed or rumored to be under discussion include the

following (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst):

- Crude SPR release - most likely and least disruptive. A release would ease crude prices modestly and poses the least amount of political resistance. It would be even more impactful if paired with Jones Act waivers to move gasoline into PADD 1 from PADD 3.

- Gasoline export ban - highly disruptive and unpredictable fallout. Such a move could help ease pressure in the US and de-link US gasoline prices from the world. To work, it would need to be coupled with Jones Act waivers. It risks upending global and domestic gasoline markets in unpredictable ways.

- Crude export ban - highly disruptive and ultimately counter-productive. A crude export ban remains the worst possible option, as it would upend global oil supply chains, discourage domestic production, and ultimately add upward pressure on gasoline prices by squeezing global markets and Brent higher.

- Sanction waivers on Iran - less disruptive but highly unlikely. Allowing Iranian oil to flow would be the most impactful lever on global oil price formation, but such a measure remains unlikely at the current juncture, with negotiations set to restart on 29 November and the state of play yet to be determined.

- The US University of Michigan Consumer Sentiment Index sank 4.9

points from its October level to 66.8 in the preliminary November

reading—its lowest level since 2011. The decline was driven by

worsening views on both the present situation and the future. The

present situation index fell 4.5 points to 73.2, and the

expectations index declined 5.1 points to 62.8. (IHS Markit

Economists James

Bohnaker and William Magee)

- Elevated inflation remains the foremost drag on sentiment. According to the report, half of all families expected lower real incomes over the next year. The 12-month change in the consumer price index (CPI) in October was the fastest since 1990 at 6.2%, with highly visible consumer prices such as those for gasoline and food rising at even sharper rates. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.1 point to 4.9% to reach its highest level since 2008.

- Households in the bottom half of the income distribution were most affected by higher consumer prices. The index of sentiment for households earning below $100,000 per year declined 7.0 points, while that for households earning over $100,000 per year was unchanged.

- The indexes of buying conditions for large household durable goods, automobiles, and homes retreated as rising prices for those items were cited by respondents more frequently than any other time in more than 50 years.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the expectation for strong job and wage growth in the coming months, and the fact that healthy consumer balance sheets and excess savings will continue to support solid growth of consumer spending. Recent data on credit- and debit-card spending suggest that consumers are spending confidently in the early stages of the holiday shopping season. IHS Markit analysts expect that sentiment will track spending more closely as inflation subsides, although these may not align until next year.

- US job openings fell by 191,000 to 10.4 million between the

last business days of August and September. Job openings increased

in healthcare and social assistance (up 141,000) and state and

local government excluding education (up 114,000); openings shrank

in state and local government education (down 114,000) and "other"

services (down 104,000.) The job openings rate edged down from 6.7%

to 6.6%. (IHS Markit Economist Patrick

Newport)

- The number and rate of hires during September were unchanged at 6.3 million and 4.4%, respectively. Hires increased in healthcare and social assistance (up 109,000) and finance and insurance (up 60,000); hires fell the most in state and local government education (down 92,000) and educational services (down 89,000.) (Note: Hires include all new hires during the month; this differs from the payroll concept, which measures employment during the payroll period that includes the 12th day of the month.)

- Job separations and the separations rate edged up to series highs of 6.2 million and 4.2%. Separations consist of quits, layoffs and discharges, and other separations. (Note: December 2000 is the initial data point for most of the data in this report.)

- A record 4.4 million workers quit their jobs in September, as the quits rate moved up to a series-high 3.0%. Typically, a high quits rate is a good thing—it indicates that workers can improve their lot by pursuing opportunities elsewhere. In the age of COVID-19, though, quits could rise because workers are leaving unsafe working conditions or eschewing vaccine mandates. Quits increased the most in arts, entertainment, and recreation (up 56,000) and "other" services (up 47,000)—but the increase was broad-based across industries; wholesale reported the largest decline (down 30,000.) (Note: quits excludes retirements.)

- GM Defense is reportedly working on a prototype of a Hummer electric vehicle (EV) for the US military, in a project called "electric Light Reconnaissance Vehicle" (eLRV), according to a CNBC report. The report cites GM Defense president Steve duMont as saying about the potential project, "The Army's very excited about the fact that we're investing in this. The eLRV, that's the first purpose built from the ground up, you saw it today, it's our Hummer EV. Our Hummer EV is what we're going to base that vehicle on." CNBC reports that US Deputy Secretary of Defense Kathleen Hicks visited GM to learn about GM Defense's research and GM's EV plans. It reports that the eLRV will be based on the GMC Hummer EV, modified for military use, but keeping the frame and Ultium batteries. It is not expected to look very much like the consumer vehicle, either. CNBC cites GM Defense's vice-president of product development and advanced engineering as saying that the company plans to begin assembling eLRV prototypes for testing and evaluation in 2022. The report also notes that the project is in its early phases. The US Department of Defense has reportedly asked 10 companies for information about a potential EV, including an event in May 2021 where the Army evaluated off-road capability, defined some of its goals, and gathered information about possible solutions. Once the Army has gathered information, the next phase will be for detailed specifications for potential prototypes and then selection of two companies to produce them. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup Plus and perception systems provider Aeva have entered into a multi-year supply agreement, according to a company statement. Aeva will provide its 4D LiDAR sensors to Plus's commercially available driver-in product, which will be launched in late 2022. The 4D LiDAR sensors will enable Plus's autonomous trucks to augment their long-range perception, shorten response time in safety-critical situations, and address edge cases. Shawn Kerrigan, COO and co-founder of Plus, said, "Our global deployment of automated trucks to fleets commercially at scale requires leading technology that is automotive grade, high performance, and practical. We selected Aeva as our production partner because its 4D LiDAR complements Plus's state-of-the-art long-range perception by adding important instant velocity detection for the safe operation of autonomous trucks, and Aeva shares our commitment to bring autonomous trucks to market." Plus focuses on developing Level 4 autonomous technology to make commercial freight transport safer, more efficient, and less expensive for its customers. Plus recently delivered the initial production units of its PlusDrive autonomous solution to Chinese truck-maker FAW. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In a press release, Global Infrastructure Partners announced the signing of an agreement to sell its 25.7% interest in Freeport LNG Development, L.P. to JERA Americas Inc. for a total consideration of $2.5 billion. Freeport LNG project is an export facility located on Quintana Island, near Freeport, Texas. In May 2020, Freeport completed construction on the third of its three liquefaction trains, which together produce 15+ Mtpa and are underpinned by long-term contracts with top-tier off-takers. In May 2019, Freeport LNG received FERC and DOE approvals to add a fourth liquefaction train (Train 4). The Train 4 expansion will allow for the export of an additional 5 million tons of LNG per year, increasing the total export capability of the facility to over 20 Mtpa of LNG. Train 4 is expected to begin commercial operations in early 2025. JERA Americas is the subsidiary of JERA Co., Inc. JERA owns 25% of Freeport LNG Train 1 and purchases and transports 2.32 Mtpa of LNG for use in Japan and other LNG importing countries. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- The Central Bank of Chile (Banco Central de Chile: BCC)

published on 3 November its Financial Stability Report covering the

second half of 2021, detailing its outlook for banks and other

financial institutions in the country. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- The report highlights that Chile's current financial perspective has been stable because of stimulus measures in advanced economies, which have kept the price of raw materials at high levels, benefiting the Chilean economy and keeping impairment very low over 2021. However, the BCC warns that tapering in these countries will increase the probability of a change in investors' appetite for emerging economies, likely leading to a liquidity dry-up in some sectors.

- In IHS Markit's view, it will be a key risk to watch given the banking sector's reliance on both a resilient economy focused on the production of raw materials and a tight liquidity position in the financial sector. The two factors have been mainly supported by a very developed financial sector. However, the structure of the financial sector has already deteriorated and is likely to deteriorate further over our three-year outlook.

- The reports indicates that the depth of the Chilean financial market has worsened because of the three consecutive forced withdrawals from the pension funds, which has led to rising long-term interest rates and local currency depreciation. More importantly, it has changed the structure of the financial system, leading to a reduction in the maturity of all loans, and has significantly reduced access to derivatives, exposing the sector to currency and financial volatility.

- Meanwhile, non-performing loans (NPLs) have remained very contained through 2021, although the BCC warns that the current monetary environment gives little scope to the sector to replicate measures similar to the ones implemented and winded down as a response to the coronavirus disease 2019 (COVID-19) pandemic. The central bank warns that the liquidity measures have led to increased risk taking and a large leverage in some actors, posing risks in terms of barrowers' capacity to roll over debts, increasing the potential of NPLs rising.

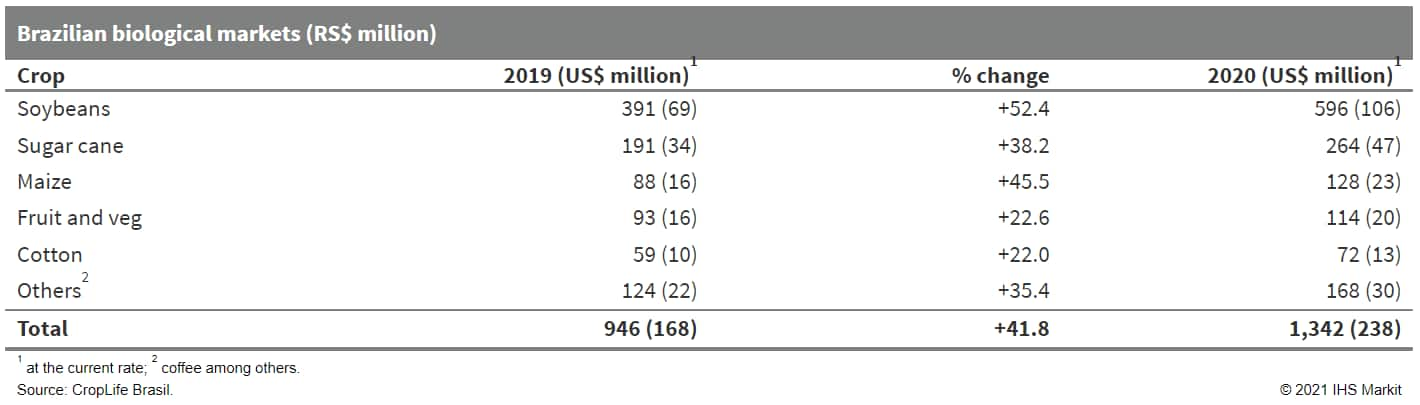

- The biological control market in Brazil is booming with

registration at record levels and the market growing at well into

double digits, Professor Dr Italo Delalibera Júnior, of University

of São Paulo (Esalq) Brazil told delegates at the Annual Biocontrol

Industry Meeting - ABIM 2021 last month. The professor cited

studies showing that Latin America was projected to have "by far"

the highest compound annual growth rate for the 2020-25 period.

"This is mainly to the expected entrance of biocontrol into row

crops and cereals in Brazil." Soybeans, sugar cane, fruit and

vegetables, coffee, and cotton hold some 86% of the current

biological market in Brazil, he added. (IHS Markit Crop Science's

Robert Birkett)

- The Brazilian biologicals market is expected to be worth some R$1,789 million (US$317 million) in 2021, according to industry association, CropLife Brasil. That would be a 33% rise on last year and an almost doubling in the two years since the R$946 million (US$168 million) market of 2019. Soybeans would account for 46% of this year's market.

- Biological products were to be applied to about 23 million ha in 2021, according to the Ministry of Agriculture. That is compared with a total planted area in the country of 77.4 million ha.

- Among fruit growers, adoption rates have been climbing strongly. In the two years to 2021, orange growers' adoption of biologicals has risen from 16% to 35%, while for banana growers, it has gone from 31% to 50%, for apples from 23% to 32%, for grapes from 21% to 29%, and papayas from 50% to 57%.

- The professor cited IHS Markit data that on farm produced

products for own use accounted for 22% of the 2019/20 market at 3.1

million ha. Such production has been greatly encouraged by

companies that offer kits with biological assets and substrates for

fermentation, in addition to equipment for installing

"biofactories" on properties. There is strong pressure for

regulation of on farm production, which should only serve those

growers with the capacity to establish well equipped biofactories,

with infrastructure and qualified personnel to meet control and

quality standards, the professor suggests.

Europe/Middle East/Africa

- All major European equity indices closed higher; France +0.5%, Italy +0.5%, Germany +0.3%, Spain +0.2%, and UK +0.1%.

- Most 10yr European govt bonds closed lower except for Spain -2bps; France +1bp, Germany/Italy +3bps, and UK +5bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover flat/249bps.

- Brent crude closed -0.1%/$82.05 per barrel.

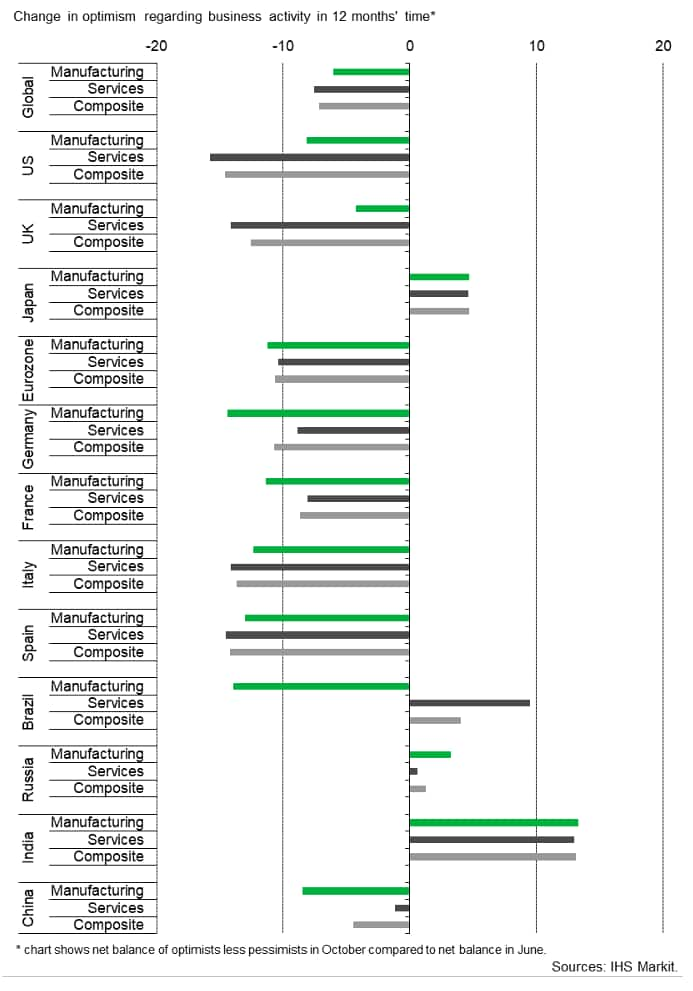

- October data from the Accenture/IHS Markit UK Business Outlook

survey - a tri-annual survey based on a panel of around 1,300

companies in the manufacturing and services sectors - indicated

that UK businesses remained confident of a recovery in activity

over the coming 12 months, but there was a steep loss of momentum

from earlier in the year. More than half of UK private sector firms

(56%) expect an increase in business activity during the year

ahead, compared to 11% that project a decline. Whilst falling

sharply from the level seen in the summer to a 12-month low, the

resulting net balance of +45% was higher than seen throughout much

of the last six years. (IHS Markit Economist David Owen)

- A new battery electric double-decker bus is to begin trials in the UK during the first quarter of 2022. According to a statement released by electric drivetrain solutions company Equipmake, trials of the Jewel E bus developed in conjunction with Spanish bus body maker Beulas will take place in London with operator Go-Ahead. The vehicle will feature Equipmake's Zero Emission Drivetrain (ZED) which features its HTM 3500 electric motor that develops maximum power of 400kW and 3,500Nm of torque. Customers will be able to specify three battery options: 325kWh, 434kWh and 543kWh. This is said to deliver a range of over 300 miles. (IHS Markit AutoIntelligence's Ian Fletcher)

- Johnson Matthey has announced that it is planning to exit its Battery Materials business. In a statement, the company said, "Following a detailed review and ahead of reaching a number of critical investment milestones, we have concluded that the potential returns from our Battery Materials business will not be adequate to justify further investment". It said, "Whilst demand for battery materials is accelerating, so is competition from alternative technologies and other manufacturers. Consequently, this is rapidly turning into a high volume, commoditized market". Furthermore, after exploring strategic partnerships in recent months, "it has also become clear that our capital intensity is too high compared with other more established large scale, low-cost producers". The board has now chosen to "pursue the sale of all or parts of this business with the ultimate intention of exiting" and plans to "move swiftly to determine the best outcome for all of our stakeholders and intend to make a further announcement as soon as possible". (IHS Markit AutoIntelligence's Ian Fletcher)

- Ride-hailing firm Bolt will be testing new features that allows drivers to set their own prices and passengers to choose their driver in select UK cities, reports Reuters. The company will initially test these features across three cities in the Midlands region this week, ahead of a planned UK-wide rollout before Christmas. Bolt said these changes will give drivers greater control over their business and will address national concerns about driver shortages, which have resulted in increased waiting times, cancellations, and surge pricing. Sam Raciti, Bolt's regional manager for Western Europe, said, "We hope to reduce waiting times on the Bolt app and have fewer driver cancellations so customers can get to their destination quickly and safely following increased demand in recent weeks". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The UK will this week announce the launch of a private storage

aid (PSA) scheme designed to support market prices in England by

taking up to 14,000 tons of surplus pigmeat off the market. This

follows a move by junior agriculture minister Victoria Prentis last

week to announce 'exceptional market conditions' for pigmeat in

England - a necessary prerequisite for opening market support

measures under the terms of the UK's new post-Brexit Agriculture

Act. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- The PSA scheme is part of a package of measures, announced in outline last month, which are aimed are at alleviating a serious logjam in the UK pig supply chain.

- The main cause of the difficulties is a weak global market, but this has been exacerbated by a serious shortage within the UK of lorry drivers, vets and pork butchers. The latter factor has been responsible for a build-up of unprocessed pig carcasses in UK facilities.

- However, a spokesperson for the Department for the Environment, Food and Rural Affairs (Defra) also identified other causes for the current problems.

- "We've been working closely with the pig industry in order to understand how best to support them in response to the challenges caused by the pandemic, access to CO2 supplies and the reduction in exports to the Chinese market, all of which have contributed to a backlog of pigs," the spokesperson told IHS Markit.

- The UK pigmeat processing crisis has arisen at a time when EU pig prices have been sinking rapidly due in large part to the collapse of EU pigmeat exports to China.

- As much as 2.5 TW of long duration energy storage may need to

be deployed by 2040 if the world is to meet its Paris Agreement

commitments, a group of companies predicted as diplomats met in

Glasgow to codify mechanisms for achieving the landmark climate

pact's goals. Long term energy storage, typically described as

lasting eight to 10 hours or more, is expected to support the

growing shift towards electrification—offering a smoothing out

of the ebbs and flows of intermittent generation, resources when

demand spikes, and a conduit for the myriad of hydrogen plans

unveiled in recent months. (IHS Markit Net-Zero Business Daily's

Keiron Greenhalgh)

- Such a buildout won't come cheap, said the companies, who are all members of the Long Duration Energy Storage (LDES) Council. Some 2.5 TW of capacity would cost as much as $3 trillion in capital expenditure, they said.

- Launched in Glasgow 4 November, the LDES Council is on "a mission to replace the use of fossil fuels in meeting energy imbalances with zero-carbon alternatives." The trade group is set to lobby governments and grid operators on the requirements for accelerating the LDES sector. It will unveil more details on 23 November with the launch of a study, it said.

- Building 2.5 TW of LDES capacity would see dispatchable renewable energy help eliminate the 1.5-2.3 gigatons of CO2 produced annually from fossil fuels to meet grid energy imbalances, equivalent to 10-15% of the global power sector's emissions, the LDES Council said.

- The LDES Council has 24 founder members, including Alfa Laval, BP, Form Energy, Highview Power, and Siemens Energy.

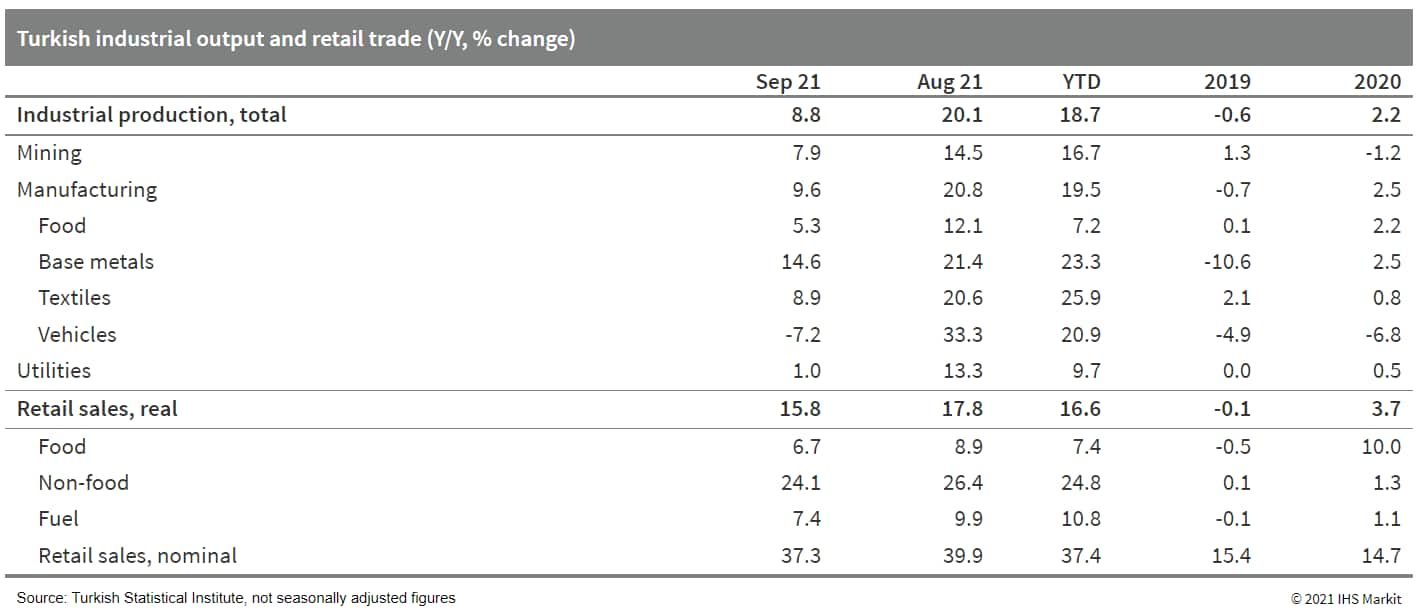

- In line with faltering business sentiment, Turkish industrial

production slipped in September compared to August, down by 1.5% in

seasonally and calendar-adjusted terms. Overall industrial output

remained well ahead of year-earlier levels because of base effects

- the onset of the COVID-19 virus pandemic in 2020 decimated total

output. (IHS Markit Andrew

Birch)

- Previously, leading sentiment had suggested a waning of manufacturers' confidence closing the third quarter, primarily deriving from a drop of export orders. The IHS Markit Purchasing Managers' Index (PMI) as of September was down to 52.55 from 54.07 in August.

- The slowdown of the European production cycle - tied to the global supply-chain and transport problems - undermined Turkish industrial production. A rise of domestic demand and greater export competitiveness deriving from the lira's losses did not fully offset lost demand from its European markets.

- Meanwhile, retail trade activity continued to expand in

September. That month, the total volume of retail trade grew by

1.2% m/m in seasonally and calendar adjusted data, continuing three

months of relatively modest expansion as compared to the strong

gains noted in late 2020. Through September, credit growth had been

decelerating and the central bank only began reducing interest

rates late in September.

- South Africa's newly appointed Finance Minister Enoch

Godongwana presented his maiden Medium Term Budget Policy Statement

(MTBPS) to Parliament on 11 November. Godongwana stuck to the

fiscal consolidation path that his predecessor Tito Mboweni had

adopted, amid weak medium-term growth prospects. Public-sector debt

is expected to stabilize at 78.1% of GDP by fiscal year (FY)

2025/26 and to decline thereafter. To achieve this objective, the

government will have to ensure that public-sector wage adjustments

toe the line and that financial demands from financially stretched

state-owned entities (SOEs) are contained while keeping the tax

buoyancy resilient, a situation where government revenues increase

at least in line with or more than the anticipated proportionate

response to a rise in national income or output. (IHS Markit

Economist Thea

Fourie)

- The MTBPS allows for a fall in government spending to 28.6% of GDP in FY 2024/25 from 30.7% of GDP in FY 2021/22, amounting to an average compound annual growth rate of 2.5% over the period. The biggest spending austerity will happen in FY 2022/23, with main budget expenditure expected to remain broadly unchanged from FY 2021/22 levels. A 1.5% change in wage costs is assumed for both FY 2021/22 and FY 2022/23.

- The FY 2021/22 budget did however allow for the unplanned ZAR1,000 once-off cash payment to public-sector workers, to the amount of ZAR20.5 billion, with a preliminary carry-through of ZAR20.5 billion in FY 2022/23. However, the National Treasury has warned that if the final leg of the 2018 wage agreement (CPI plus 1% at approximately 5.5%) - which was not implemented during FY 2021/22 - becomes legally binding, the budget wage objectives will not be met during the MTBPS period. The MTBPS allows for no additional financial support to SOEs.

- A corporate and personal tax windfall has left government income ZAR120 billion (USD7.8 billion) above previous estimates for FY 2021/22. Part of the tax windfall was used to offset rising spending commitments during FY 2021/22, which included the re-introduction of the basic income grant (BIG), recapitalization of South African Special Risks Insurance Association (SASRIA) following social unrest in July 2021, and additional wage costs. Overall, the tax windfall trimmed ZAR60 billion from the budget deficit, which is now expected to end FY 2021/22 at 6.6% of GDP from 7.5% of GDP previously.

Asia-Pacific

- Most major APAC equity indices closed higher except Mainland China -0.2%; South Korea +1.0%, Japan +0.6%, Australia +0.4%, Hong Kong +0.3%, and India +0.1%.

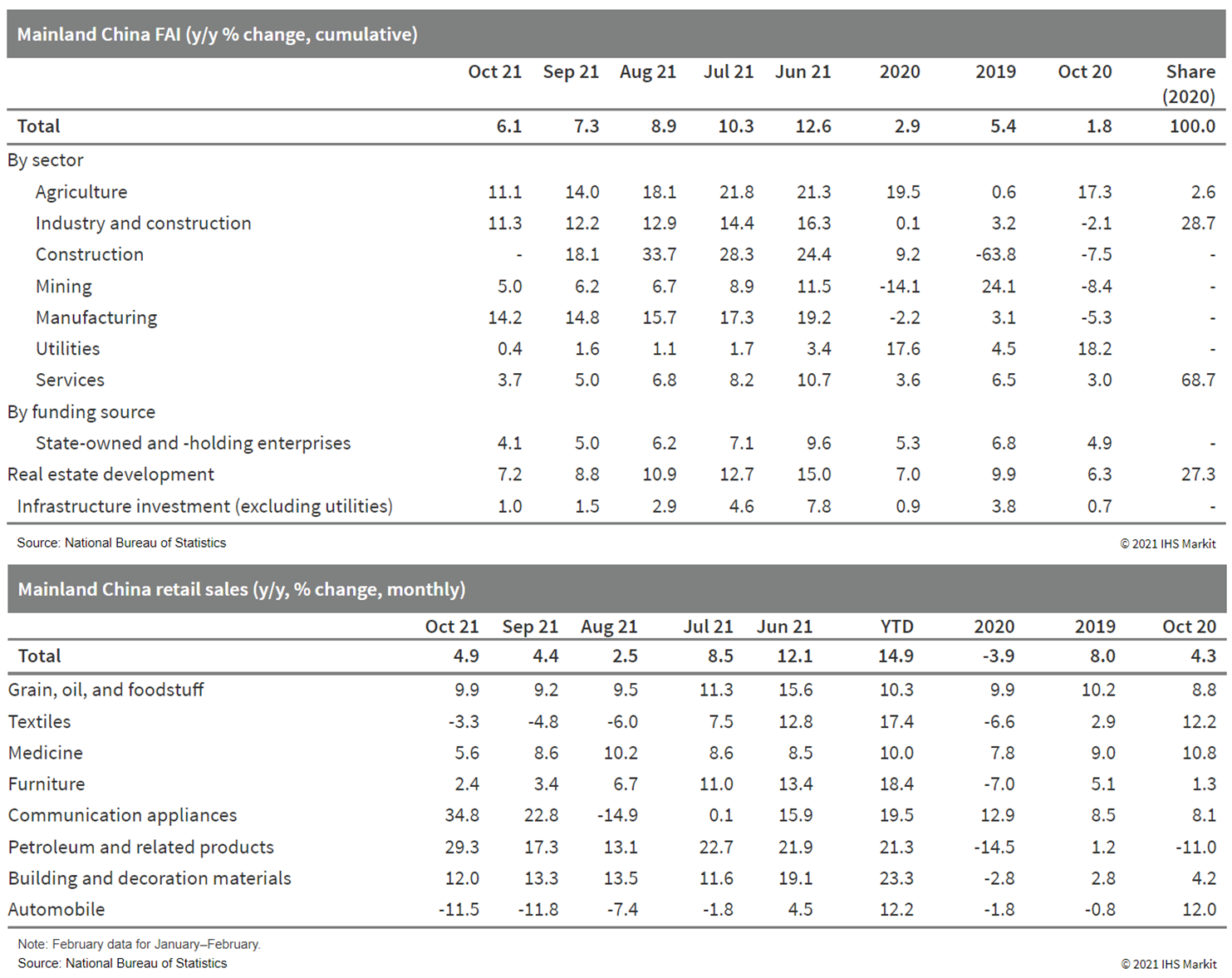

- Mainland China's industrial value-added growth accelerated to

3.5% y/y in October, the first increase since the beginning of the

year, although it remains the second-lowest reading in 10 months.

Meanwhile, the two-year (2020-21) average growth and month-on-month

(m/m) growth improved from the previous month. (IHS Markit

Economist Yating

Xu)

- By sector, the headline improvement was largely driven by the mining and utilities sectors. As the government has relaxed restrictions on coal production in response to the coal and power shortage, mining production growth in October rebounded to its fastest in years despite a rising baseline, and the utilities sector accelerated accordingly. However, manufacturing remained in one of the weakest rates over the past two years. High-tech manufacturing growth accelerated in year-on-year (y/y) terms, while in two-year (2020-21) average growth terms it has been moderating for two consecutive years.

- Fixed-asset investment (FAI) growth declined from 7.3% y/y through September to 6.1% y/y in the first 10 months of 2021, and in month-on-month terms the growth rate further slowed to 0.15%. On a 2020-21 average basis, the growth rate stayed at 3.8%, unchanged from the figure in the first three quarters. According to IHS Markit estimates, FAI in October declined by around 2.3% y/y, accelerating from a 1.8% y/y contraction in September.

- Sales of commercial housing floor space increased 7.3% y/y through October, dropping from 11.3% y/y in the previous month. The estimated de-cumulative figure showed a 21.5% y/y contraction, widening from the 13.0% contraction in September.

- Weakening housing sales further tightened liquidity conditions for developers, which have been relying on housing sales for financing since the second half of the year. Sources of funds for developers further declined to 8.8% y/y, as a result of faster contraction in domestic loans and slower increase in mortgages and pre-sales funds. Given this, floor space of new starts, completions, and land purchases all registered deeper contractions compared with a month ago.

- Nominal retail sales growth rebounded to 4.9% y/y in October

from 4.4% y/y in September. The 2020-21 average growth rate rose to

4.6% y/y from 3.8% in September. However, real retail sales

excluding price inflation actually declined from 2.5% y/y in

September to 1.9% y/y in October as the Retail Price Index rose

from 1.8% to 2.9%.

- Mainland China's average new home price deflation came in at

0.25% month on month (m/m) in October, widening by 0.17 percentage

point from the prior month, according to the survey conducted by

the National Bureau of Statistics covering 70 major cities. (IHS

Markit Economist Lei Yi)

- The larger month-on-month decline in new home prices in October was driven by tier-2 cities, in which average new home prices fell into deflation territory, registering a month-on-month decline of 0.21% in October compared with an increase of 0.02% m/m in September. In the meantime, weakness in new home price inflation in tier-1 cities persisted, with the cities of Guangzhou and Shenzhen reporting new home price deflation of 0.3% m/m and 0.2% m/m, respectively. For tier-3 cities, the drop in average new home prices deepened by 0.13 percentage point to 0.33% m/m.

- Up to 52 out of the 70 surveyed cities reported month-on-month new home price declines in October, up by 16 cities from the month before, marking the highest count since early 2015. A total of 13 cities registered month-on-month new home price gains, 14 cities less than in September.

- Japan's real GDP fell by 0.8% quarter on quarter (q/q, or 3.0%

q/q annualized) in the third quarter after a 0.4% q/q (or 1.5% q/q

annualized) increase in the second quarter. The decline was mainly

driven by sluggish private consumption and private capital

expenditure (capex), which offset increases in government

consumption and changes in private inventories. (IHS Markit

Economist Harumi

Taguchi)

- Exports of goods and services declined by 2.1% q/q in the third quarter of 2021, the first decrease since the second quarter of 2020, largely because of a fall in exports of autos, reflecting shortages of semiconductors and parts. Foreign spectators were banned for the 2020 Tokyo Olympic and Paralympic games, and sluggish figures for transport and other services prompted export services to decrease. Nevertheless, net exports rose thanks to a faster decline in imports of goods and services and marginally contributed to mitigate the q/q drop in real GDP.

- Private consumption fell by 1.1% q/q in the third quarter of 2021 following a 0.9% q/q rise in the second quarter. The weakness was largely driven by a 13.1% q/q decline in spending on durable goods. Decreases in auto production because of shortages of chips and other parts led to a 34.3% year-on-year (y/y) drop (or 27.6% month on month [m/m] fall, seasonally adjusted by IHS Markit) for new passenger car sales in September. Declines in sales of large specialty retailers for home electric appliances also suggested waning demand for home electronics and information appliances.

- Spending on semi-durable goods, such as clothes, fell by 5.0% q/q in the third quarter. Spending on services weakened to 0.1% q/q in the third quarter from 1.3% q/q in the second quarter, largely because of the state of emergency-induced measures to contain a surge in Delta-variant infections in a majority of the prefectures.

- The weaker-than-expected third-quarter results stem from a 3.8% q/q drop in capex and a 2.6% q/q fall in private dwellings' investment. Although details of the private capex will not be released until revisions for the third quarter (set for 8 December), the sluggish capex figures probably reflected declines in investment for transport equipment in response to low supplies of vehicles and weaker machinery orders from the manufacturing sector. Private dwellings' investment dropped despite increases in housing construction starts during the quarter.

- Toyota has announced plans to team up with Mazda, Subaru, Yamaha and Kawasaki Heavy Industries to explore the feasibility of alternative green fuels such as hydrogen and synthetic fuels derived from biomass for internal combustion engine (ICE) cars, reports ET. Although shifting from ICE to green fuels is technically difficult, doing so would allow companies to support employment to hundreds of thousands of workers who may otherwise have to be dropped as they switch to electric vehicles (EVs). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The New Energy and Industrial Technology Development

Organization has commissioned IHI Corporation (IHI) to undertake a

research and development (R&D) project to develop catalysts and

reactors to synthesize lower olefins, and to test exhaust gases at

existing crackers and explore integration with existing facilities.

The project will complete in February 2026. (IHS Markit Upstream

Costs and Technology's Kamila

Langklep)

- Conventional lower olefin production entails cracking naphtha derived from crude oil. IHI aims to create a technology using a reactor and catalyst to synthesize CO₂ and hydrogen recovered from exhaust gases or the atmosphere. This carbon-recycling approach would tap existing CO₂ emissions and help lower CO₂ from manufacturing plastics. IHI developed the catalyst through joint research with the Institute of Chemical Engineering and Sciences of Singapore's Agency for Science, Technology and Research. Laboratory tests confirmed that the catalyst can produce olefins efficiently.

- For the research project, IHI will develop more advanced catalysts based on those developed to date. It will also use petrochemical reactor design technology to develop reactors that can produce olefins efficiently and stably by controlling heat from reactions. The company will also install a CO₂ recovery system and lower olefin production system at a petrochemicals plant. From fiscal 2024, IHI will conduct production tests with CO₂ recovered from exhaust gases and by-product hydrogen at the plant. IHI will undertake comparisons and compatibility evaluations between lower olefins from testing and from existing facilities and assess conditions for integration with existing plants.

- The Korea Automotive Technology Institute (Katech) has partnered with the UK-based automotive consultancy firm Horiba Mira on the early commercialization of autonomous vehicles (AVs), The Korea Herald reports. The entities have agreed to jointly pursue research and development (R&D) on future vehicle technologies and establish new evaluation tests and standards for AVs. Katech's director Heo Nam-yong said, "From our active partnership with Horiba Mira, we seek to contribute to the local automotive industry's technological competitiveness. We will also support the efforts of the local auto parts industry to adapt to new mobility technologies, and the government's policy goals related to autonomous driving technologies." South Korea has been launching numerous initiatives to become a leader in autonomous technology. Katech has recently joined the Korea Autonomous Industry Association, which was launched to strengthen the competitiveness of the AV ecosystem in South Korea. It has also partnered with telecoms company KT to develop technologies for future cars. Horiba Mira is an automotive engineering and development consultancy company with about 600 engineers. It has 39 driving and crash-test facilities, as well as the world's largest proving ground, covering 3.33 million square meters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) sales in South Korea jumped by around 96% year on year (y/y) during January-September to 71,006 units, reports the Yonhap News Agency, citing data released by the Korea Automotive Technology Institute. South Korea is seventh-largest country in the world in terms of EV sales during the period. China sold the largest number of EVs with 1.76 million units in the nine-month period, followed by the US with 272,554 units, Germany with 243,892 units, Britain with 131,832 units, France with 114,836 units, and Norway with 84,428 units. South Korea's total also represented 5.5% of all new vehicles sold in the country during the time, which was lower than China's 9.4% but greater than 2.3% in the US. In the first nine months of 2021, global EV sales reached 3.01 million units, surpassing the 3 million mark for the first time, highlights the report. Hyundai Motor Group sold 159,558 EVs during the period, a 67% y/y increase and the world's fifth-highest total. Tesla was the best EV seller during the period with 625,624 units sold worldwide, followed by SAIC Motor with 413,037 units, Volkswagen (VW) with 287,852 units, and BYD with 189,751 units. (IHS Markit AutoIntelligence's Jamal Amir)

- The State Bank of Pakistan (SBP) announced on 13 November that

it has increased the reserve requirement ratio (RRR). The two-week

average RRR has been raised from 5% to 6%, while the intra-day RRR

has been increased from 3% to 4%. This will apply to demand and

time liabilities of less than one year. The SBP noted that the move

is to "normalize policy settings" and "achieve the government's

medium-term inflation target". (IHS Markit Banking Risk's Angus

Lam)

- Using the SBP's quarterly compendium, IHS Markit calculated that commercial banks' short-term liabilities (typically classified as liabilities of less than one year) were around PKR14.0 trillion (USD79.6 billion) in mid-2021, while the ratio of loan to short-term liabilities was calculated to be 62.4%.

- By increasing the RRR by 1 percentage point and making banks keep the amount with the SBP, it will result in a 1.6% withdrawal in total loans; however, we assess that this will not be the case.

- Since mid-2020, commercial banks have had a looser loan-to-deposit ratio, falling from 45.9% to 42.7%. At the same time, while annual loan-disbursement growth reached 9.4% between mid-2020 and mid-2021, majority of the liquidity did not go to lending.

- Banks' investment rose by 28.8% over the same period, suggesting that the increased liquidity has gone towards this destination instead. Lending to other financial institutions has also risen substantially, as indicated by the increase in banks' borrowings by 42.9% year on year. This suggest that banks will potentially reduce the amount of investments instead.

- The Philippine's real GDP climbed 7.1% year on year (y/y) in

the third quarter of 2021, slowing from a revised 12.0% y/y jump in

the second quarter, which marked the fastest gain since the fourth

quarter of 1988. It also represented the second expansion after the

economic plunge, which was also the country's longest and steepest

recession since 1984-85. (IHS Markit Economist Ling-Wei

Chung)

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy increased by 3.8% from the previous quarter, reversing a 1.4% fall. It also marked the strongest expansion in three quarters.

- Domestic demand remained at the driver's seat and continued to jump at a double-digit pace. Domestic demand contributed 11.2 percentage points to third-quarter 2021 growth, household consumption contributed 5.2 percentage points, and gross investment (including fixed investment and inventory) added 4.0 percentage points. Government spending contributed 2.0 percentage points, after subtracting 0.9 percentage point in the second quarter.

- The contribution from net exports remained negative for the second consecutive quarter. Supported by robust domestic demand, imports continued to expand at the double-digit pace and outpace export growth amid slower overseas demand. Net exports subtracted 2.2 percentage points from the third-quarter expansion, following the contribution of 5.3 percentage points in the second quarter.

- Gross investment spending surged 22% y/y in the third quarter,

after soaring 80.3% y/y in the second quarter, which marked the

strongest expansion in history. Fixed investment jumped 16.0% y/y

in the third quarter, but slowed substantially from a 39.8% y/y

surge in the second quarter.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.