Daily Global Market Summary - 17 December 2021

Most major European and US equity indices closed lower, while APAC was mixed. US and most benchmark European government bonds closed higher. CDX-NA and European iTraxx closed slightly wider on the day across IG and high yield. The US dollar, gold, and silver closed higher, while copper, oil, and natural gas closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Russell 2000 +1.0%; Nasdaq -0.1%, S&P 500 -1.0%, and DJIA -1.5%.

- 10yr US govt bonds closed -1bp/1.41% yield and 30yr bonds -5bps/1.81% yield.

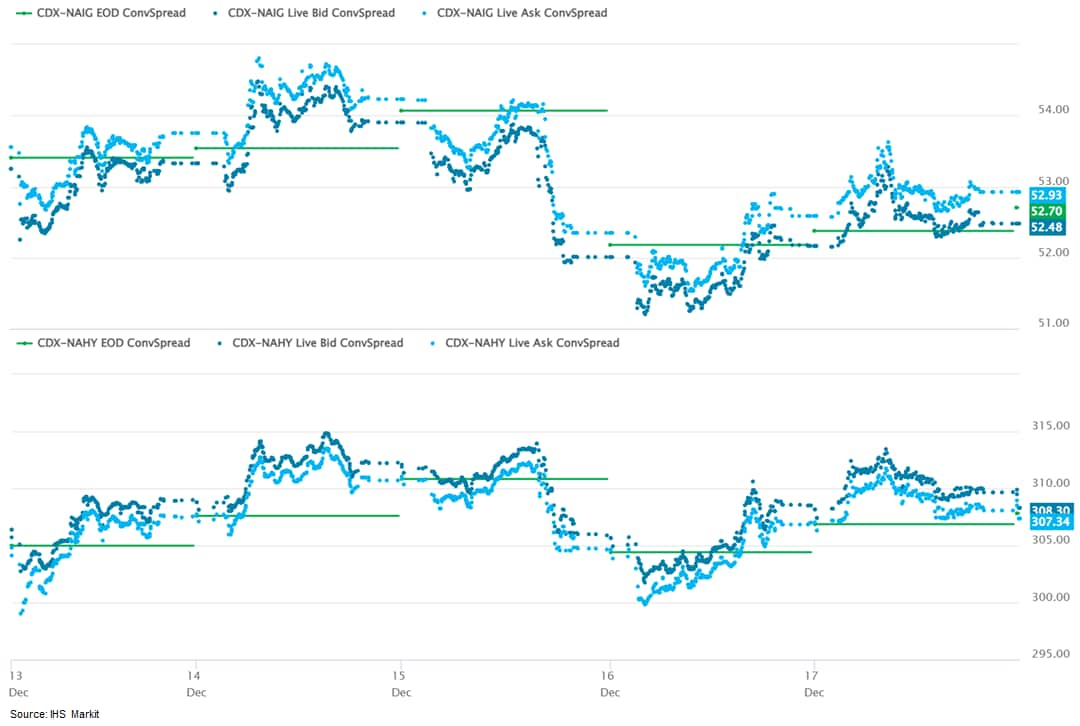

- CDX-NAIG closed +1bp/53bps and CDX-NAHY+1bp/308bps, which is

flat and +3bps week-over-week, respectively.

- DXY US dollar index closed +0.5%/96.57.

- Gold closed +0.4%/$1,805 per troy oz, silver +0.2%/$22.53 per troy oz, and copper -0.2%/$4.30 per pound.

- Crude oil closed -2.0%/$70.72 per barrel and natural gas closed -2.0%/$3.69 per mmbtu.

- Global coal demand is on track to exceed pre-pandemic levels

this year and could reach an all-time high in 2022, putting global

efforts to counter climate change in jeopardy, the International

Energy Agency (IEA) said in its annual report for the most

carbon-intensive fossil fuel. (IHS Markit Net-Zero Business Daily's

Max Lin)

- This year has seen a strong rebound in coal consumption driven by record electricity generation using the fuel, even as many governments are promising to phase out coal from their power mix.

- "Coal is the single largest source of global carbon emissions, and this year's historically high level of coal power generation is a worrying sign of how far off track the world is in its efforts to put emissions into decline towards net zero," IEA Executive Director Fatih Birol said 17 December.

- Birol added that "30% of the entire global CO2 emissions come from coal electricity generation."

- For the world to reach net-zero emissions by 2050 and avoid climate disasters, the IEA estimates that coal usage needs to fall by 24% in 2020-2030 before a further decrease of 73.7% in the following 20 years.

- The world's coal consumption will instead grow by 6% to reach nearly 7.91 billion metric tons (mt) this year, before increasing to 8.03 billion mt in 2022, according to the IEA's Coal 2021 report. This compares with the previous record of 8 billion mt in 2013.

- China's coal consumption, which accounts for more than half the global total, is expected to increase by 4% to 4.13 billion mt in 2021. India, the world's second largest consumer, is forecast to register a 13.4% increase to 1.06 billion mt.

- The IEA also expects coal usage to rise by 74 million mt in the US and 45 million mt in the EU.

- On December 17, New York Gov. Kathy Hochul announced a

framework for the state to achieve at least 10 GW of distributed

solar by 2030, enough to annually power nearly 700,000 homes. The

roadmap, submitted by the New York State Energy Research and

Development Authority (NYSERDA) and the New York State Department

of Public Service (DPS) to the state Public Service Commission for

public comment and approval, proposes a comprehensive strategy to

expand the state's NY-Sun initiative The plant will spur

approximately $4.4 billion in private investment and create 6,000

additional solar jobs across the state - including with the state's

first application of prevailing wage for solar projects between one

and five MW in size. This announcement supports the state's Climate

Leadership and Community Protection Act (Climate Act) mandate to

generate 70% of the state's electricity from renewables by 2030 as

part of a resilient and equitable transition to a clean energy

economy. The Roadmap proposes (IHS Markit PointLogic's Barry

Cassell):

- At least 1,600 MW of new solar capacity to benefit disadvantaged communities and low-to-moderate income New Yorkers, with an estimated $600 million in investments serving these communities;

- At least 450 MW to be built in the Consolidated Edison electric service area (covering New York City and parts of Westchester), increasing the installed solar capacity in this area to over 1 GW by the end of decade; and

- At least 560 MW to be advanced through the Long Island Power Authority.

- Adjusted for seasonal factors, the IHS Markit Flash US

Composite PMI Output Index posted 56.9 in December, down slightly

from 57.2 in November, but still signaling a strong rise in private

sector business activity. Although slower than rates seen earlier

in the year, the pace of output growth was faster than the historic

trend. (IHS Markit Economist Chris

Williamson)

- Supporting the upturn in activity was a quicker increase in new orders during December. The pace of expansion was the sharpest for five months, and largely driven by a faster rise in service sector new business. New order inflows to the manufacturing sector eased to the slowest since October 2020, however. Meanwhile, new export orders increased at the strongest pace since September.

- The seasonally adjusted IHS Markit Flash US Services PMI™ Business Activity Index fell to 57.5 in December, down slightly from 58.0 in November. The upturn in business activity remained sharp despite slowing to a three-month low as demand conditions strengthened at the end of the year. The pace of new business growth accelerated to the fastest for five months. Foreign client demand also rose.

- Operating conditions improved in December, as highlighted by the IHS Markit Flash US Manufacturing Purchasing Managers' Index™ (PMI™)1 posting at 57.8 in December, down from 58.3 in November. That said, the health of the sector improved at the slowest pace for a year as output growth remained subdued. The headline index is also continuing to reflect a severe deterioration in input delivery times, with longer supplier lead times ordinarily signaling a stronger sector performance.

- US electric vehicle (EV) maker Rivian Automotive has announced its financial results for the third quarter, reporting a loss as production of the R1T electric truck started during the quarter. In addition, Rivian provided a fairly detailed overview of its vehicle production and development to date, and confirmed that the location of the company's planned second manufacturing plant is to be the US state of Georgia. Construction of the plant in Georgia is due to begin in 2022 and vehicle production at the facility is scheduled to start in 2024. In terms of financial results, the company's expenses increased with model launches and the launch of manufacturing of the electric delivery van (EDV) and the R1-based products, the R1T truck and the R1S sport utility vehicle (SUV). Rivian's financial results in the third quarter seem to be in line with the company's manufacturing and launch activities during the quarter. The EV manufacturer is positioned with a notable amount of available funding to continue ramping up production. Rivian did not provide any specific guidance on its 2022 financial performance, focusing on providing an update on its efforts to ramp up production of its consumer truck and SUV, as well as confirming the second EDV product. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Logistics company DHL Supply Chain has ordered 100 trucks equipped with TuSimple's self-driving technology. The trucks are to be built by Navistar and delivered between 2024 and 2025. According to an Automotive News report, citing company executives, these trucks are to be installed with TuSimple's self-driving equipment during production by Navistar, and DHL is to obtain the self-driving technology on a subscription basis as part of TuSimple's long-term business plan. TuSimple CEO Cheng Lu reportedly said, "Retrofitting a truck is simply not scalable." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Motional has partnered with Uber Technologies to deliver food orders using autonomous vehicles (AVs) in California (US). According to a company statement, Motional will begin delivering meals from select restaurants on Uber's food delivery app Eats in Santa Monica in early 2022. Motional will deploy its next-generation electric Hyundai IONIQ 5-based robotaxi, which is capable of Level 4 autonomous functions, for the delivery service. Karl Iagnemma, president and CEO of Motional, said, "We're proud that our first delivery partner is Uber and are eager to begin using our trusted driverless technology to offer efficient and convenient deliveries to customers in California. We're confident this will be a successful collaboration with Uber and see many long-term opportunities for further deploying Motional's technology across the Uber platform." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Bank of Mexico (Banco de México: Banxico) on 16 September

increased the policy rate by 50 basis points to 5.50%. At its

previous four meetings, it had increased the rate by 25 basis

points. By accelerating the pace of the increases, Banxico is

signaling its heightened concern about high inflation and a firm

stance against it. (IHS Markit Economist Rafael

Amiel)

- Inflation in Mexico amounted to 7.4% at the end of November, very high by most standards and well above the central bank's target of 3% +/- 1 percentage point. As in most countries in the world, the drivers of inflation are high energy prices, high food prices, supply-chain disruptions, and shortages. The most concerning part of the inflationary picture is that inflation in services is also increasing, which implies that there have been second-round effects or contagion from the price escalation that started in the energy and food sectors.

- The bank points out that inflationary expectations for 2022 have increased and that markets are reacting to this inflationary environment: long-term interest rates are increasing, and the exchange rate is depreciating.

- In terms of risks, the bank highlights several upside risks: external inflationary pressures, a further depreciation of the exchange rate, increases in costs, persistently high core inflation, and higher energy and food prices.

- It also highlights downside risks to inflation: the widening of the slack in the economy, the appreciation of the Mexican peso, and possible social distancing measures that may reduce further demand for services.

Europe/Middle East/Africa

- Most major European equity indices closed lower except for UK +0.1%; Italy -0.6%, Germany -0.7%, Spain -0.8%, and France -1.1%.

- Most 10yr European govt bonds closed higher except for UK flat; Italy -6bps, Spain -4bps, and France/Germany -3bps.

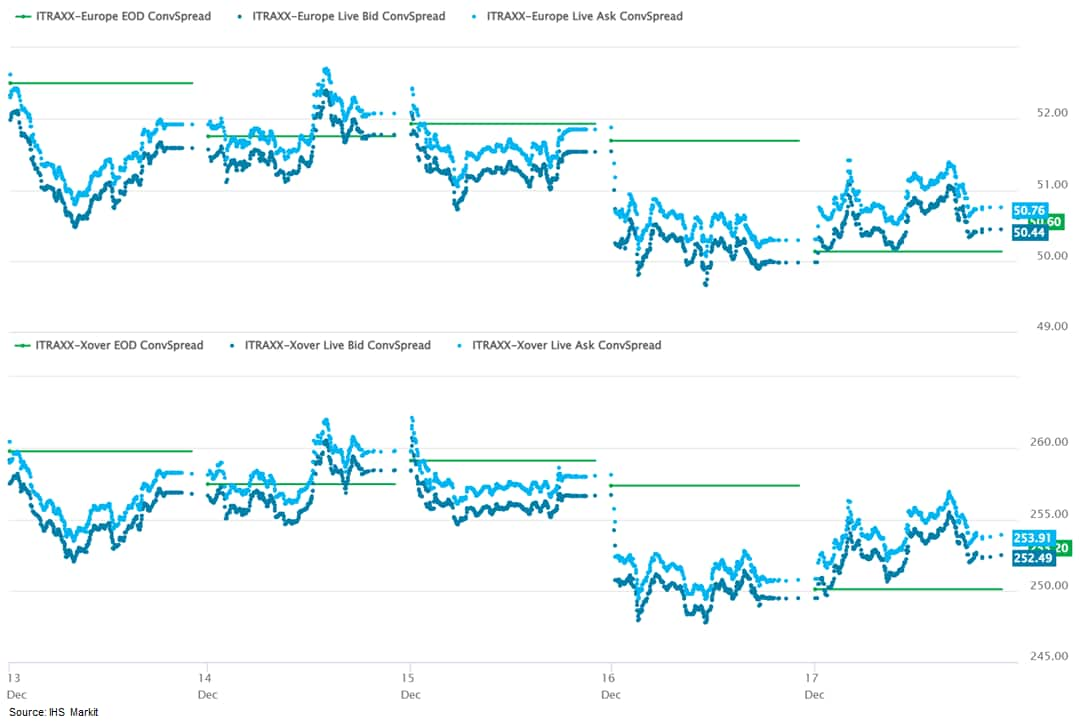

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +3bps/253bps,

which is -1bp and -7bps week-over-week, respectively.

- Brent crude closed -2.0%/$73.52 per barrel.

- Despite the sooner-than-expected interest rate rise and

although inflation is likely to climb even further above target in

early 2022, the Bank of England (BoE) is unlikely to resort to a

flurry of rate increases. The Monetary Policy Committee (MPC)

believes that the appropriate policy stance "will as always focus

on the medium-term prospects for inflation, including medium-term

inflation expectations, rather than factors that are likely to be

transient". (IHS Markit Economist Raj

Badiani)

- The MPC voted 8-1 to increase the Bank Rate by 15 basis points to 0.25% at its meeting that ended on 15 December. The dissenting voice was Silvana Tenreyro who voted against this proposition, preferring to maintain the Bank Rate at 0.1%.

- The BoE last raised its policy rate in August 2018, by 25 basis points to 0.75%.

- However, the MPC voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases at GBP20 billion (USD28 billion), financed by the issuance of central bank reserves.

- Meanwhile, the MPC voted 9-0 in favor of the BoE maintaining the stock of UK government bond purchases, financed by the issuance of central bank reserves, at GBP875 billion, and thus the total target stock of asset purchases at GBP895 billion.

- As of 15 December, the total stock of assets held in the Asset Purchase Facility had reached GBP893 billion, including GBP149 billion of the GBP150-billion program of UK government bond purchases announced on 5 November 2020. The BoE announced that its final gilt purchase auction took place on 15 December, ensuring that the program was complete by the time of the MPC's December policy rate decision.

- The MPC sanctioned an immediate rise in the Bank Rate in the face of stronger-than-expected inflation developments since its November meeting. The 12-month rate of increase in the consumer price index (CPI) climbed to 5.1% in November, and it is now likely to peak at an even higher 6.0% by around April 2022, the highest rate for 30 years.

- Furthermore, the MPC stated that policy inaction "when CPI inflation was materially above the 2% target and the output gap appeared to be closed might cause medium-term inflation expectations to drift up further".

- Another trigger for the policy rate rise was the MPC receiving further evidence that the end of the Coronavirus Job Retention Scheme (CJRS) on 30 September and the subsequent release of 1.1 million furloughed workers had a limited impact on the labor market. Specifically, the Labour Force Survey (LFS) unemployment rate fell to 4.2% in the three months to October, while the number of payrolled employees continued to rise briskly in November.

- Switch Mobility has announced that is establishing a battery electric bus manufacturing facility in Spain. According to a statement, the company will invest EUR100 million into a site in Valladolid over a 10-year period. The plan is to install two production lines, and the first vehicles are set to be built during the fourth quarter of 2022. Initially vehicles built at this factory will be for the European market, but that it will also have the capacity to serve other regions, including South America. The site is also planned to undertake research and development (R&D) of the company's next-generation buses and light commercial vehicles (LCVs). It is anticipated that the investment will eventually create 2,000 direct jobs and another 5,000 indirect roles. Ashok Leyland renamed its UK-based bus business Optare Group to Switch Mobility during November 2020. Reflecting a shift in trends and the expected growth in the electric bus and LCV globally during the coming decade, the move represented a pivot towards "Electric and Green Mobility". Following the implementation of this new name, it also set up a new subsidiary in India, Switch Mobility Automotive Limited, that will support its battery electric vehicle (BEV) strategy in the country and is already moving forward with plans to begin production of such vehicles in India. The company has also outlined a strategy to invest around USD200 million in Switch Mobility during the next few years. Although USD130 million is said to have already been spent, the beginning of production at this site in Valladolid is also likely to form part of this expenditure as it scales up this business. (IHS Markit AutoIntelligence's Ian Fletcher)

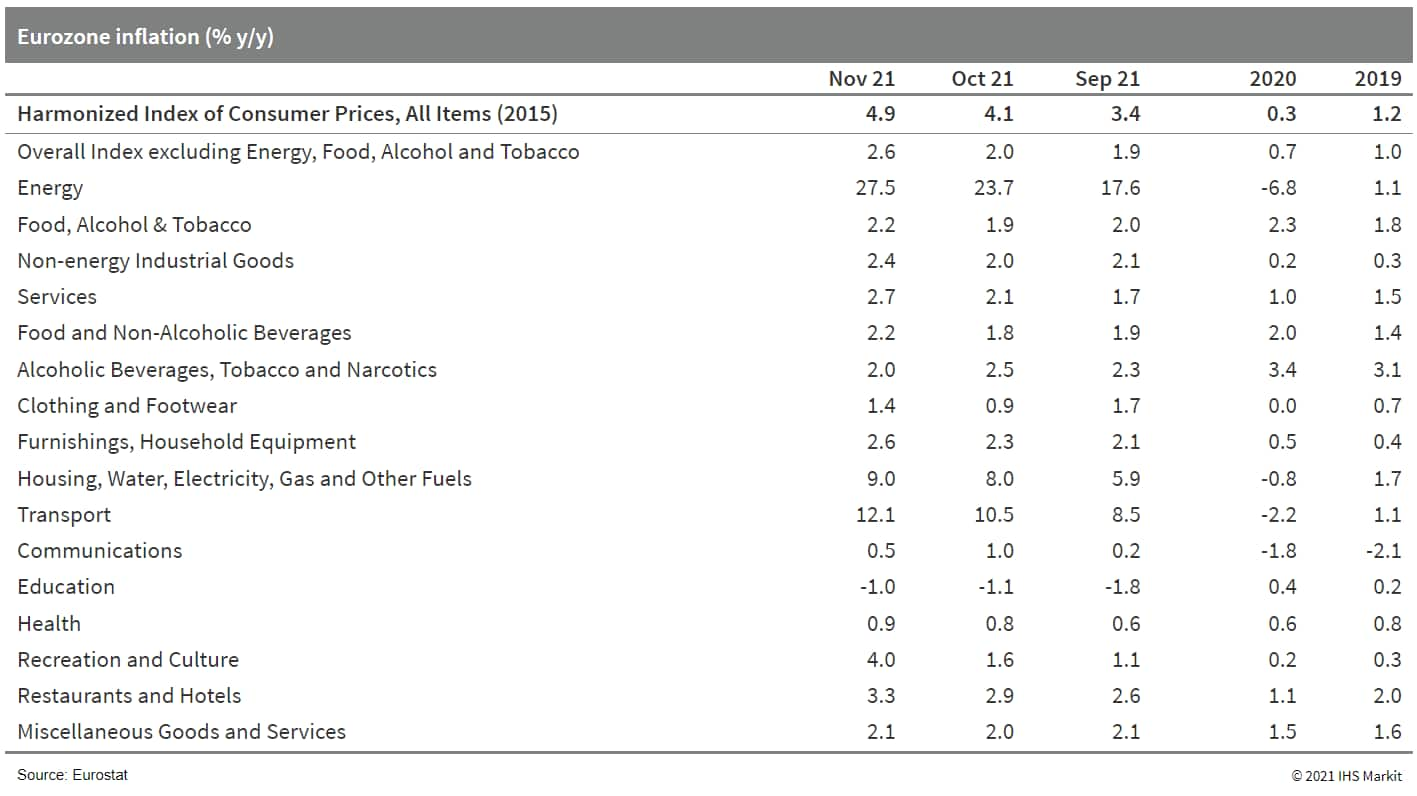

- November's jump in eurozone Harmonised Index of Consumer Prices

(HICP) inflation from 4.1% to 4.9% has been confirmed in Eurostat's

final release. As a reminder, this surpasses both the historical

high (of 4.1% in 2008) and the initial market consensus expectation

(of 4.4%) by some distance. (IHS Markit Economist Ken

Wattret)

- Energy inflation was again pivotal to the increase in November, rising to yet another new (and slightly upwardly revised) record high of 27.5% (see table below). Remarkably, the recent surge in energy inflation has surpassed the previous high from 2008 by more than 10 percentage points. Despite having a weight of just over 9% in the HICP, energy inflation contributed more than half of November's inflation rate (2.6 percentage points.

- The eurozone HICP inflation rate excluding food, energy,

alcohol, and tobacco prices has been confirmed at 2.6% in November,

up from 2.0% and also a record high. Inflation rates for services

(2.7%) and non-energy industrial goods (NEIG, 2.4%), accounting for

around 60% and 40% of the core index, respectively, increased

sharply in November.

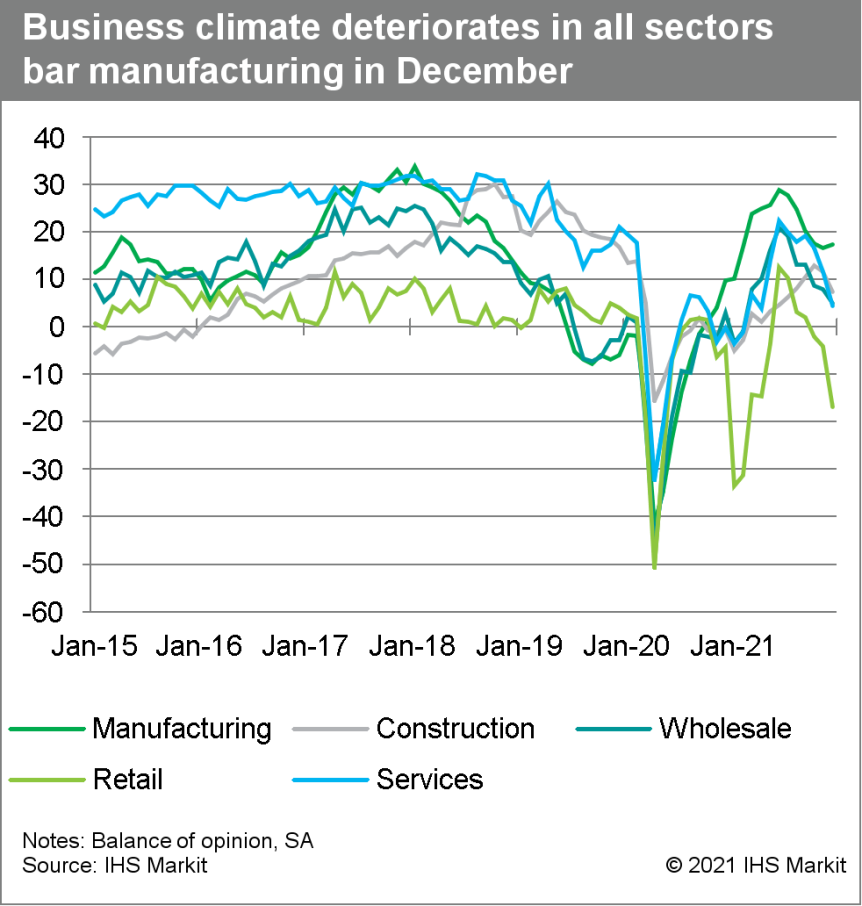

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has declined at a somewhat accelerated pace in December, from 96.6

in November to 94.7. This is the lowest level since February and

equally undershoots both the pre-pandemic level of February 2020

(96.4) and the long-term average of 97.1. The Ifo institute wryly

commented that "the German economy isn't getting any presents this

year". (IHS Markit Economist Timo

Klein)

- Business expectations have worsened only slightly less than the headline measure in December, slipping from 94.2 to an 11-month low of 92.6. This is nearly five points below the long-term average (97.5), although still well above the all-time low of 71.7 in April 2020. The retail and service sectors are the driving elements to the downside in December, although construction firms have also turned a lot more pessimistic about the next six months. Only the manufacturing sector has gone against the trend, for the second consecutive month, confirming that concerns about the persistence of supply chain issues seem to be easing somewhat. This makes itself felt in the automotive industry in particular.

- Meanwhile, the assessment of current conditions has worsened at its fastest pace since the initial pandemic shock in March-April 2020. It has fallen from 99.0 last month to a seven-month low of 96.9, which is almost even with its long-term average of 96.7 and now clearly below its pre-pandemic level of 99.1 in February 2020. Unlike expectations, the current situation index has declined across all sectors - only modestly so in manufacturing and construction, but quite sharply in the service sector and especially among retailers. This pattern is closely linked to the renewed tightening of administrative restrictions in an attempt to regain control over the pandemic. This has greatly reduced the access of unvaccinated people to most shops (except those for essential day-to-day needs) and services.

- Pulling current conditions and expectations together,

December's sectoral breakdown96 confirms that the retail sector has

experienced the sharpest drop in confidence towards the end of

2021. This is followed by services, which had already declined

quite strongly in November. The deterioration is more limited in

construction and the wholesale sector, while the overall

manufacturing climate has edged up for the first time since June as

companies have built up a considerable stock of orders and as they

appear to be seeing light at the end of the tunnel with respect to

supply chain bottlenecks.

- Daimler has said that one of the biggest challenges the company currently faces for its move to electrification is the ethical sourcing of battery materials, according to a Bloomberg report. Commenting in the report Daimler's head of integrity and legal affairs Renata Jungo Brüngger said that cobalt and lithium are the most difficult to source ethically as a result of the well-documented issue of them coming from countries with poor human rights records or a history of child labor. The obvious example of this is the world's biggest supplier of Cobalt, the Democratic Republic of Congo (DRC). Daimler is planning to become an all-electric brand by 2030, where market conditions allow, and battery material sourcing is therefore a primary concern for Daimler and other OEMs. Jungo Brüngger said, "Cobalt, lithium, nickel, rare earths, those will remain the problematic cases. You have got long supply lines in parts and countries with significant challenges." Brüngger also said that the company is coming under increasing investor scrutiny in terms of how it sources battery materials, with investors increasingly aware of the huge reputational harm a misstep in this area could lead to. She said that investors are now grilling the company in-depth, bringing along specialists to discuss supply chains and human rights to investor meetings and calls to ask detailed questions about materials sourcing. The ethical sourcing of battery materials is one of the biggest issues that the automotive industry faces in its shift to electrification. The issue of cobalt procurement is well-known and one of the steps carmakers are looking at is eliminating the use of the material in future battery technologies. While cobalt is prevalent as a cathode material in current battery technology, it is not required for EV batteries. There are already battery chemistries that do not require cobalt, such as those that use nickel-ion-aluminum cathodes, or lithium-ion phosphate. Tesla's current batteries contain less than 5% cobalt and the company announced in September 2020 that it was developing its own batteries that would be cobalt-free, with other OEMs following suit. (IHS Markit AutoIntelligence's Tim Urquhart)

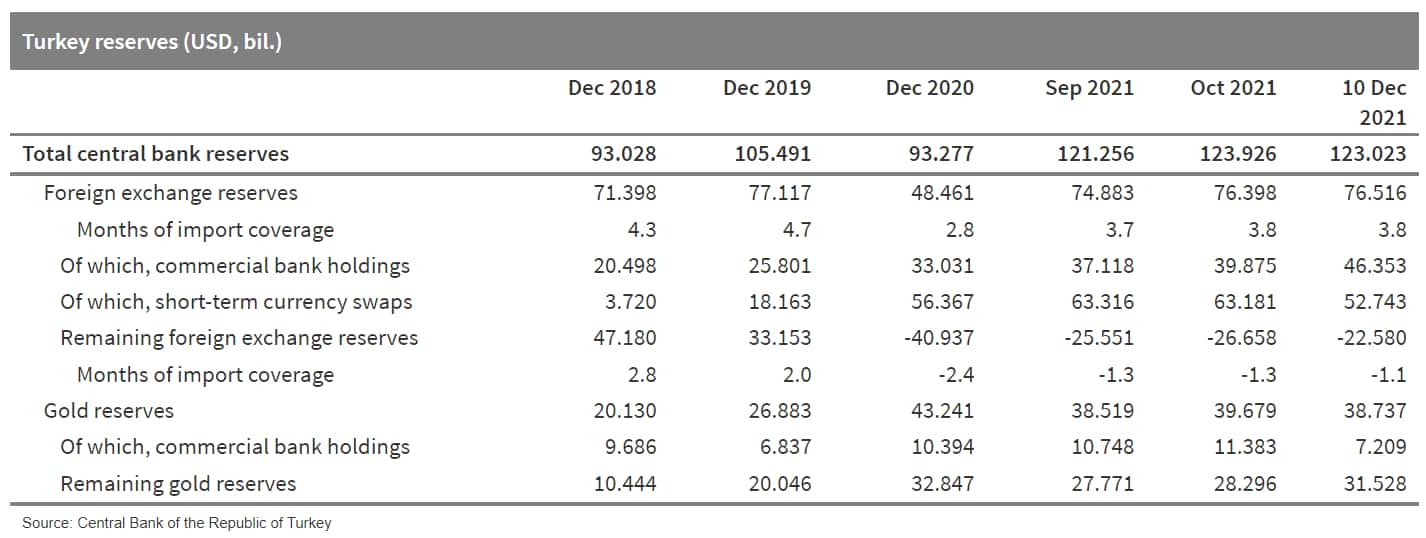

- As anticipated, the Turkish central bank cut its main policy

rates by 100 basis points on 16 December despite rising inflation

that is well above the current one-week repo rate. Predictably, the

lira's depreciation intensified immediately after the cut. Although

the central bank has indicated that this should be the last cut for

now, risks are high that President Recep Tayyip Erdoğan will force

more cuts. Already in crisis, lira losses would further intensify

should rate cuts continue, jeopardizing 2022 external obligations.

- As widely anticipated, the Central Bank of the Republic of Turkey (TCMB) cut its main policy rate, the one-week repo rate, by 100 basis points at its regularly scheduled, 16 December Monetary Policy Committee meeting. The rate now stands at 14.0%, down by 500 basis points since this current rate-cutting cycle began at the September meeting.

- Previously, TCMB Governor Şahap Kavcıoğlu had suggested that the room for further rate cutting was narrowing, leading IHS Markit to consider that this cut might have been smaller than the previous ones in the current cycle. However, since those comments, continuous rhetoric from President Recept Tayyip Erdoğan made clear that no such moderation in TCMB actions would occur in December.

- The TCMB continues to cut interest rates even as the prevailing rate of inflation remains far above the policy rate. In November, the headline consumer price inflation rate was 21.3%, now 730 basis points above the main policy rate. The core inflation rate - which, previously, Kavcıoğlu had suggested was the more important figure to consider in setting the rates - is now 360 basis points above the main policy rate, at 17.6% as of November.

- In its press release alongside the move, the Monetary Policy Committee of the TCMB stated that despite elevated inflation globally, in general, advanced economies were maintaining supportive monetary policy. The Committee ignores, however that across the emerging market economies, monetary policy has indeed begun to tighten across the board, leaving Turkey alone in moving the opposite direction.

- Once again, the Bank suggested that current inflationary pressures within Turkey were from "transitory effects of supply-side factors and factors beyond monetary policy' control". As such, the TCMB decided to make use of what it called the remaining room to make the rate cut. A narrowing current-account deficit, according to the Bank, would contribute to the slowdown of inflation in the first quarter 2022.

- The impact on the lira of the rate cuts in the face of rising

inflation and tightening monetary policy across the rest of the

emerging market world has been severe. Despite the clearly

telegraphed rate cut, the lira dropped by 3.9% against the US

dollar by the close of trading after the announcement, falling to

TRY15.23/USD1.00.

- Intel's Mobileye is expanding its autonomous vehicle (AV) testing program to Paris (France), according to a company statement. Mobileye, in partnership with public transport operator RATP Group, will launch an autonomous on-demand service in the city. Employees of Galeries Lafayette Paris Haussmann will be able to hail an AV to transport them to work using the Moovit app four days a week. The vehicles will have a safety driver behind the wheel to monitor operations. Côme Berbain, director of Innovation for RATP Group, said, "As a leading operator of autonomous mobility, we are very happy to offer to our client Galeries Lafayette a new mobility service by associating our know-how with Mobileye. This is an opportunity for the RATP Group to test a new use case, an autonomous car service for companies, but also to test the vehicle's autonomous technology for possible integration on other transport modes such as a bus or minibus." (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Major APAC equity indices closed mixed; South Korea +0.4%, Australia +0.1%, Mainland China -1.2%, Hong Kong -1.2%, India -1.5%, and Japan -1.8%.

- China's fledgling national emissions market enjoyed a trading

boom in recent weeks, but industry experts say Beijing needs to

push ahead with further regulatory reforms to achieve

decarbonization targets. (IHS Markit Net-Zero Business Daily's Max

Lin)

- Trading volume in China Emissions Allowances (CEA) is up to nearly 87.4 million metric tons (mt) of CO2e in December, according to the Shanghai Environment and Energy Exchange, which manages the national market.

- Daily volume hit 20.5 million mt of CO2e 16 December, the current record high.

- Since trading started 16 July, cumulative volume has totaled 131 million mt of CO2e. Those CEAs changed hands for CNY 5.36 billion ($840 million).

- Observers said the recent buoyancy comes as electricity firms rush to acquire carbon credits to meet their year-end emissions targets.

- The national emissions trading scheme (ETS) covers 2,162 Chinese utilities that reported at least 26,000 mt/year of CO2 for any calendar year from 2013 through 2019. Each company has an emissions quota calculated every year based on carbon intensity rules in China.

- According to the government's regulatory design, Refinitiv estimates that 95% of the power companies had to hold sufficient allowances to stay compliant in their yearly cycle by 15 December, while the rest need to do so by 31 December.

- Yuan Lin, lead carbon research analyst at Refinitiv, said the Chinese carbon market is off to a strong start despite utilities only being allowed to carry out spot trades in the current iteration.

- But the increase in demand failed to provide much of a boost to carbon pricing. CEA closed at CNY 44.20/mt ($6.93/mt) 16 December, compared with an opening price of CNY 48/mt on the first day of trading.

- The US Senate passed legislation to ban imports from China's

Xinjiang region over concerns about forced labor, part of

Washington's continued pushback against Beijing's treatment of its

Uyghur Muslim minority. The measure approved by the Senate had been

cleared earlier in the week by the US House of Representatives

after lawmakers agreed on a compromise that eliminated differences

between bills introduced in the two chambers. The compromise keeps

a provision creating a "rebuttable presumption" that all goods from

Xinjiang, where the Chinese government has set up a network of

detention camps for Uyghurs and other Muslim groups, were made with

forced labor, in order to bar such imports, Reuters states. The

measure now heads to President Joe Biden for his signature. (IHS

Markit Food and Agricultural Commodities' Hope Lee)

- Xinjiang, ranked fourth by per capita of arable land, is China's largest landed province/autonomous region, accounting for one-sixth of the country's land area, IHS Markit previously reported.

- Following over 50 years of cultivation, the state-owned Xinjiang Production and Construction Corps (the Corps) now owns large amount of arable land, with major crops including tomato, corn, cotton, wheat, walnuts, grapes, melons, chili, pears, apples, dates/jujube and goji. In 2020, the Corps had 1.4 million hectares of cultivated area, 2.2% up y/y; fruit 190,920 ha, 3.1% down y/y.

- The Corps' total fruit production was 4.65 million tons in 2020, 9.3% up y/y, according to the Corps' 2020 annual report.

- Grain sat top of the agricultural and food commodities at 2.41 million tons in 2020, 4.8% up y/y.

- Industrial tomatoes reached over two million tons while pears amounted to 520,000 tons, 34% up y/y, the fastest growth among main products.

- Cotton generated the second largest production at 2.13 million tons, 5.2% up y/y. The Corps contributed about 36.1% of national cotton production in 2020.

- It is noted that other privately owned entities or farmers also actively operate in the agriculture sector. However, it is known that the Corps contributes a big chunk of the agricultural activities.

- The sector also hires seasonal farm labor from other provinces (i.e Sichuan and Henan) which have limited arable land and large rural population.

- In line with the "earlier supportive policy" vowed by President

Xi Jinping during the 2021 Central Economic Working Conference

(CEWC), mainland China's top legislature recently approved the 2022

quota for local government borrowing, ahead of the timetable set in

March next year. (IHS Markit Economist Yating

Xu)

- As reported by the 21st Century Business Herald, provincial-level governments have received their allocation for local government bond issuance in 2022, a quarter earlier than the allocation for this year. Quotas of both special-purpose bond (SPB) and general-purpose bond (GPB) have been allocated.

- According to the authorization by the Standing Committee of the National People's Congress (NPC), the amount of early allocation of local government bond could reach CNY2.19 trillion for 2022. The quota of this batch of early allocation has not been released yet.

- Niutron, an electric vehicle (EV) startup launched its auto brand, Niutron, on 15 December. The company, founded by Li Yinan, also the founder of electric scooter company, Niu Technology, plans to reveal its first model, the Niutron NV, in the first half of 2022. Deliveries for the new model are slated to begin in September. Local media reports indicate that Niutron has been engaged in research and development (R&D) activities on vehicle development in 2018. Its manufacturing plant located in Changzhou, Jiangsu province, is said to have a capacity of 180,000 units per year. The company already has a team of 1,000 people, of which mostly focus on R&D-related activities. It also shared some information on its platform to give a glimpse of what to expect from its first model. The Niutron NV, a larger sport utility vehicle (SUV), will be based on the company's Gemini platform, which can accommodate production of both battery electric vehicles (BEVs) and extended-range electric vehicles (EREVs). The model is likely to be positioned in the premium EV segment, although its pricing strategy has yet to be confirmed by the company. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The BoJ left its monetary policy unchanged during the 16 and 17

December monetary policy meeting (MPM). The bank will continue

quantitative and qualitative monetary easing (QQE) with yield curve

control (YCC). The BoJ also maintained its commitment to increase

the monetary base until the year-on-year (y/y) rate of rise in the

observed Consumer Price Index (CPI) exceeds 2% and stays above this

target in a stable manner. (IHS Markit Economist Harumi

Taguchi)

- Regarding the special program to support financing in response to COVID-19, the BoJ decided to end its additional purchases of commercial paper (CP) and corporate bonds at the end of March 2022 as scheduled. The bank will gradually decrease the amounts outstanding of these assets to the pre-pandemic levels. The decision reflected improved financial conditions and favorable issuance conditions for CP and corporate bonds.

- The BoJ also decided to end fund-provisioning against eligible loans to support large firms, as well as fund-provisioning against private debt pledged as collateral, which was mainly to large firms and housing loans, at the end of March as scheduled. While financial conditions in Japan have picked up, improved business conditions since the easing of COVID-19 containment measures and progress in vaccinations were also a reason behind the decision.

- However, the BoJ decided to extend its special fund-supplying operation, which facilitates financing mainly to SMEs, until the end of September 2022. The extension reflected persistent severe business conditions for SMEs, particularly for those in face-to-face-services and as the December Tankan survey indicated.

- The BoJ's assessment remained largely unchanged in that Japan's economy has picked up as a trend with gradual improvement in private consumption. Its economic and inflation outlooks also remained unchanged.

- Samsung Electronics has unveiled a line-up of automotive memory chips designed for next-generation autonomous electric vehicles (EVs), according to a company statement. This includes a 256-gigabyte (GB) PCIe Gen3 NVMe ball grid array (BGA) SSD, a 2GB GDDR6 DRAM, and a 2GB DDR4 DRAM for high-performance infotainment systems. The company has also launched a 2GB GDDR6 DRAM and a 128GB Universal Flash Storage (UFS) to support autonomous vehicle (AV) systems. These new automotive memory products are currently in mass production and meet the AEC-Q100 qualification - the global automotive reliability standard. Jinman Han, executive vice-president and head of memory global sales and marketing at Samsung Electronics, said, "With the recent proliferation of electric vehicles and the rapid advancement of infotainment and autonomous driving systems, the semiconductor automotive platform is facing a paradigm shift. What used to be a seven to eight-year replacement cycle is now being compressed into a three to four-year cycle, and at the same time, performance and capacity requirements are advancing to levels commonly found in servers. Samsung's reinforced lineup of memory solutions will act as a major catalyst in further accelerating the shift toward the 'Server on Wheels' era". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Delhi state government will deregister all diesel vehicles that are 10 years old on 1 January 2022 in compliance with a previous directive by the National Green Tribunal (NGT), reports the Times of India. A no objection certificate (NOC) will be issued for vehicles outside Delhi-National Capital Region (NCR), but this excludes diesel vehicles 15 years old or more on the date of application. The report cites an official from the Delhi government as saying, "We have been taking action against old diesel vehicles, and till date, around 100,000 such vehicles have been deregistered. Now all such vehicles will be stringently de-registered from 01 January 2022. Around 200,000 diesel vehicles that are at least 10 years old will be deregistered from 01 January." (IHS Markit AutoIntelligence's Isha Sharma)

- Indian ride-hailing company Ola has raised USD500 million through a term loan from international institutional investors, reports the Economic Times. Ola says that the loan issuance received a "staggering response" from investors, with commitments and interest of approximately USD1.5 billion. Bhavish Aggarwal, founder and chief executive of Ola, said, "The overwhelming response to our Term Loan B is a reflection of the strength of our business and our continued focus on improving unit economics alongside rapid growth." This comes as Ola prepares to go public in the first half of 2022 and is expected to raise up to USD1 billion through an IPO. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.