Daily Global Market Summary - 17 July 2020

Most equity markets closed modestly higher and benchmark government bonds were lower on the day. iTraxx and CDX indices closed a bit tighter across IG and high yield, while Brent/WTI closed lower. The preliminary reading of the University of Michigan Consumer Sentiment Index for July revisited levels near April's low, likely reflecting consumer's growing concerns over both the increases in COVID-19 cases across the US and the financial implications of the reinstatement of restrictive measures to stop the spread.

Americas

- Most US equity indices closed higher except for DJIA -0.2%; Russell 2000 +0.4% and Nasdaq/S&P 500 +0.3%.

- 10yr US govt bonds closed +1bp/0.63% yield.

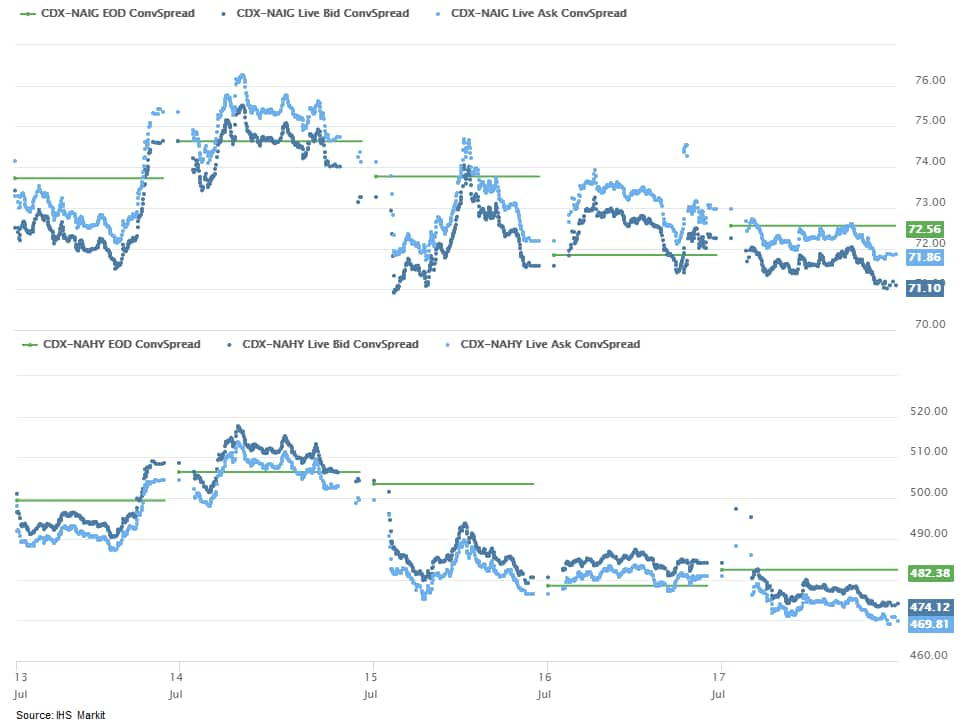

- CDX-NAIG closed -1bp/71bps and CDX-NAHY -10bps/472bps, which is

-2bps and -27bps, respectively, on the week.

- Crude oil closed -0.4%/$40.59 per barrel.

- The University of Michigan US Consumer Sentiment Index fell 4.9

points (6.3%) to 73.2 in the preliminary July reading, returning

nearly to its April low of 71.8. Consumers' attitudes shifted

quickly in response to the rapid surge in new COVID-19 cases that

began in the latter half of June. Survey collection ended on 15

July. (IHS Markit Economists David Deull and James Bohnaker)

- The reading suggests that caution on the part of consumers will combine with renewed shutdown orders to slow and perhaps even reverse recent recoveries in consumer spending. It is consistent with our view that the risk of a second downturn has increased.

- The current conditions index fell 2.9 points in July, to 84.2, while the expectations index fell 6.1 points to 66.2 amid dwindling hopes for a speedy end to the pandemic.

- Regional changes in consumer sentiment were at odds with their moves in June. Sentiment in the Northeast region unexpectedly dropped 14.8 points despite a relatively low and stable rate of recorded new COVID-19 infections. In the West, sentiment fell 10.6 points. In contrast, sentiment in the South increased 2.1 points, putting the region at the head of the pack.

- Consumer sentiment fell 3.9 points to 77.7 among households earning more than $75,000 a year and fell 5.6 points to 67.8 among lower-earners.

- Buying conditions mostly fell in July. The index of buying conditions for large household durable goods retreated 12 points to 103, while that for vehicles dove 17 points to 123. Both were the lowest since April. The index of buying conditions for homes, in contrast, rose 2 points to 132 and was just shy of its 2019 average. In mid-July, the 30-year conventional mortgage rate as reported by Freddie Mac fell to the lowest on record.

- Inflation expectations ticked up in July; the expected 1-year inflation rate rose 0.1 percentage point to 3.1%, while the expected 5-year rate rose 0.2 point to 2.7%. Both were at or near the top of their recent range.

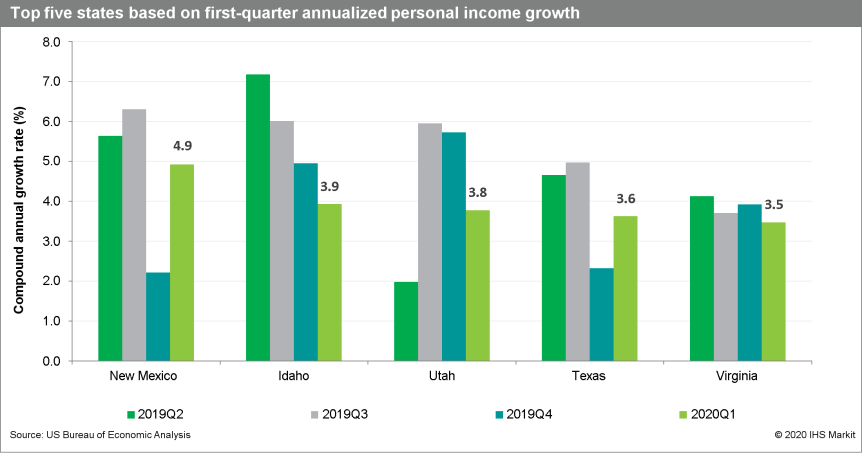

- Nominal, US state personal income increased at an annualized

rate of 2.3% quarter on quarter (q/q) in the first quarter of 2020,

according to the most recent data release by the Bureau of Economic

Analysis (BEA). (IHS Markit Economist Eric Po)

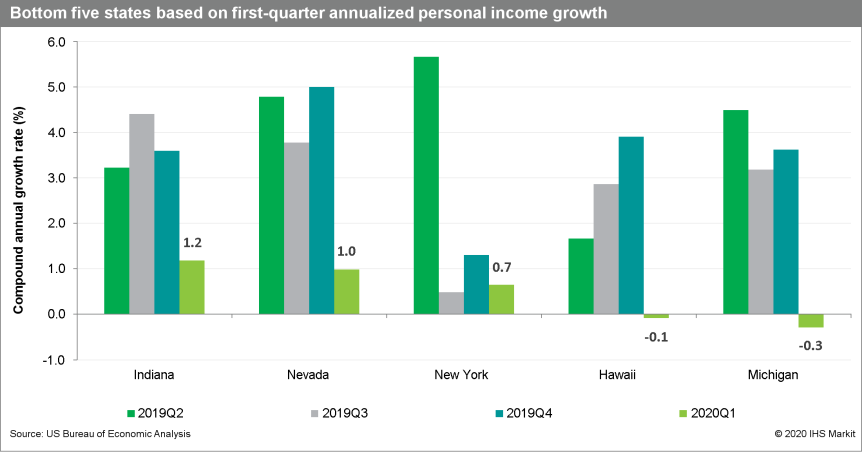

- Personal income rose in all but two states on a quarter-on-quarter basis, led by New Mexico, Idaho, and Utah.

- Michigan and Hawaii, the exceptions, had contractions of 0.3% q/q and 0.1% q/q (annualized), respectively.

- The BEA typically estimates wages and salaries based on monthly state employment data, which use a reference pay period that includes the 12th day of the month. However, to more accurately reflect business closures and job losses related to the COVID-19 outbreak that occurred after the reference pay period, weekly Unemployment Insurance claims and both March and April state employment data were used.

- Wages and salaries in leisure and hospitality plunged in every state as many restaurants and bars closed or severely reduced their services, contributing to a significant deceleration in overall wage and salary growth.

- Furthermore, the closure of many healthcare facilities such as dentist offices and child daycare centers resulted in a decline in healthcare wages and salaries in many states.

- The quarter-on-quarter contraction in Hawaii's personal income came in large part from the sharp decline in leisure/hospitality wages and salaries, a product of outbreak-related restrictions.

- Michigan experienced a similar decrease for leisure/hospitality, although manufacturing drove the overall drop in total wages and salaries as the states' top auto manufacturers temporarily shut down production.

- States hit particularly hard by the COVID-19 outbreak, including New York and New Jersey, appeared to register relatively low personal income gains.

- States reopening earlier will likely post strong growth in the second quarter. However, the rebound may be short-lived as Southern and Western states experience a rise in the number of new COVID-19 cases, raising the possibility of another set of business restrictions.

- Nominal personal income is forecast to be lower on a

year-over-year basis by the end of 2020. The federal stimulus

package will keep transfer receipts elevated in the second quarter,

partially offsetting losses in other income components incurred

during April and May. The rise in transfer receipts is expected to

be most prominent in the South, where household incomes are

relatively lower.

- US housing starts jumped 17.3% (+/- 11.0%, statistically

significant) in June to a 1,186,000-unit seasonally adjusted annual

rate (SAAR). Single-family starts expanded 17.2% (+/- 10.0%,

statistically significant); multifamily starts increased 17.6%. All

four regions posted double-digit gains. In the Northeast, starts

more than doubled. (IHS Markit Economist Patrick Newport)

- Housing permits grew 2.1% (+/- 1.2%, statistically significant) to a 1.241-million rate in June. Housing permits are more informative than starts because they are better measured, less affected by weather, and forward looking.

- Housing permits were 2.5% (+/- 1.7%, statistically significant) below last June's level but 13.7% below February's pre-pandemic level. Housing starts were 4.0% (+/- 9.1%, not statistically significant) below the year-earlier level and 24.3% below February's. Housing starts and permits were elevated early in the year because of mild weather and were poised to drop by about 200,000 units—so the year-earlier level is a better reference point for comparisons.

- Housing starts dropped from a 1.48-million rate in the first quarter to a 1.04-million rate in the second. The 441,000 quarterly drop was a record (data start in 1947).

- According to the Census Bureau, "data quality and determined estimates in this release meet publication standards."

- Social distancing is more easily practiced in building new homes than most other lines of work. This matters because the resurgence of the pandemic in many states, particularly those in the South, may spare the building industry.

- Housing starts will not return to the first quarter's weather-elevated 1.48-million rate any time soon. Instead, we expect starts to quickly bounce back from a second-quarter trough to a near normal 1.28-million rate by the end of this year.

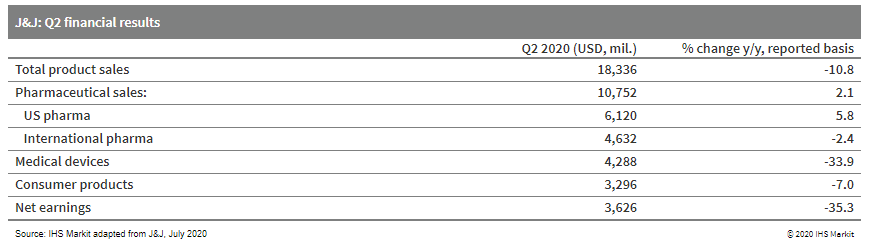

- Johnson & Johnson has released its financial results for

the second quarter of 2020, highlighting the significant impact of

the COVID-19 virus pandemic on sales of its products in the United

States and internationally. Total revenues were down 10.8% year on

year (y/y) in the quarter to USD18.33 billion, mainly driven by

double-digit declines (-33.9% y/y) within the medical device

segment due to deferral of procedures that utilize the company's

surgical, orthopedics, vision, and interventional solutions

products. The consumer health business was also affected by the

pandemic and declined by 7.0% y/y, partially due to reduced sales

of skin health and beauty care products, followed by women's

healthcare products and international baby care products.

Meanwhile, the firm's pharmaceutical business was largely spared

from the impact of COVID-19, as it achieved 2.1% y/y growth in the

second quarter to USD10.75 billion. This represents about 59% of

J&J's total revenues. (IHS Markit Life Science's Margaret

Labban)

- J&J's pharmaceutical sales were driven by growth in key products, including anti-inflammatory biologic drug Stelara (ustekinumab), multiple myeloma drug Darzalex (daratumumab), oral oncology drug Imbruvica (ibrutinib), prostate cancer drug Erleada (apalutamide), and plaque psoriasis biologic Tremfya (guselkumab), among others. However, this growth was nonetheless partially offset by the negative impact of COVID-19, as well as biosimilar and generic competition.

- J&J has also provided an update on its COVID-19 vaccine

development timeline. Chief scientific officer Paul Stoffels

announced during a conference call that a Phase I/IIa clinical

trial with more than 1,000 adults aged 18-55 is to be launched in

Belgium next week, as well as in the United States the following

week, followed by the Netherlands, Spain, Germany, and Japan. The

study will also include an arm to test the vaccine in individuals

aged 65 and older. The company anticipates that results might be

available in September, which could support the launch of a Phase

III trial that month.

- Uber acquires US-based public transportation software company Routematch for an undisclosed amount. Uber will integrate its expertise in on-demand technologies with Routematch's capabilities across paratransit, payments, fixed-route tools, and trip planning services to expand its transit agency customer base. Routematch that has developed software for about 550 transit agencies in North America and Australia has a team of 175 employees which are expected to join Uber. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The governor of the US state of New York has announced a USD750-million investment program aimed at improving the state's electric vehicle (EV) infrastructure. Under the plan, more than 50,000 charging stations will be created, largely funded by the state's investor-owned utility companies, reports Reuters. According to the report, the total budget is capped at USD701 million through 2025, with an additional USD48.8 million allocated from the New York settlement with Volkswagen over the diesel scandal in 2017. Reuters reports that the US state of Florida has also announced an investment program of USD7.8 million for a similar purpose. The availability of EVs will continue to increase in coming years, but insufficient charging infrastructure is still a reason for slow adoption of the solution by consumers. In New York, registrations of EVs reached 8,098 units in 2019, up from 6,971 units in 2018. (IHS Markit AutoIntelligence's Stephanie Brinley)

- A first-of-its-kind study has found one in five dogs visiting dog parks in major US cities tested positive for intestinal parasites. Elanco, IDEXX Laboratories and Oklahoma State University collaborated on the Detection of Gastrointestinal Parasitism at Recreational Canine Sites in the United States (DoGPaRCS) study - the first to sample such a large number of owned pets from different locations across the country. In addition to assessing the overall prevalence of intestinal parasites, the study also supported the value of high-quality fecal diagnostic procedures for detecting worms and not just the presence of eggs. Over 3,000 samples were examined in the study - results showed at least one in five dogs had parasites. Additionally, 85% of parks sampled in 30 major areas had at least one dog test positive for intestinal parasites such as roundworm, whipworm, hookworm and Giardia. While intestinal parasites were present nationwide, findings indicated there were regional variances. In the south, 90% of dog parks had at least one dog identified positive at the time of sample collection. Of the estimated 76 million pet dogs currently living in the US, the study identified more than 15 million may be involuntarily spreading parasites into the environment on any given dayday. Researchers also explained dogs may not be fully protected even if they visit the veterinarian annually - an estimated 40% to 52% of dogs remain completely unprotected from internal parasites and only a minority receive the recommended full 12 months of protection every year. The experts suggested consistent use of preventive medications coupled with antigen fecal testing for detection of worm eggs and worm presence - even if eggs are not being shed - can greatly reduce the spread of intestinal parasites. (IHS Markit Animal Health's Daniel Willis)

- Brazil's monthly index of economic activity (MIEA) grew by 1.3%

in May compared with April. This is based on seasonally adjusted

data and comes after sizeable declines in March, down by 6.1% month

on month (m/m), and April, down by 9.4% m/m. (IHS Markit Economist

Rafael Amiel)

- In a yearly comparison and using unadjusted data, the MIEA plunged by 14.2% with respect to May 2019, demonstrating the deep recession in which the Brazilian economy is immersed as a result of lockdown measures, reduced trade, and disruption in supply chains as a consequence of the COVID-19-virus outbreak.

- The Brazilian Institute of Geography and Statistics(Instituto Brasileiro de Geografia e Estatistica: IBGE) had already reported encouraging data for May: retail sales jumped by 13.9% m/m, while industrial production posted sizeable growth, up by 7.0% m/m; however, the index for service sales was down by 0.9% m/m.

- The IHS Markit Brazil Manufacturing PMI rebounded by 13.3 points to 51.6 in June, returning to expansion for the first time since February. Gains in production, new domestic orders, and output expectations were partially offset by declines in export orders and employment. Input prices increased at the fastest pace in 21 months because of the earlier depreciation of the Brazilian real against the US dollar.

- Peru's economic activity fell by 8.51% month on month in a

seasonally adjusted comparison in May, having declined by 17.29%

during January-May. (IHS Markit Economist Claudia Wehbe)

- On the demand side, the unfavorable May performance was driven by strong contractions in retail sales (-49.87% year on year [y/y]), and in investment in construction (-66.43% y/y), as well as in external demand (-49.38% y/y).

- Negative contributions were driven by 7 economic sectors, which account for 82% of the overall -32.75% y/y result: mining and hydrocarbons, commerce, manufacturing, construction, transportation, lodging and restaurants, and business services. On the upside, financial services and insurance, agricultural, and public administration and defense had positive outcomes.

- The decrease in employment during the April-June moving quarter worsened to 55.1% in comparison with the same moving quarter in 2019, the equivalent to 2.7 million persons, in all activities: construction, manufacturing, services, and commerce. The unemployment rate reached 16.3%, compared with 6.3% during the respective 2019 quarter.

Europe/Middle East/ Africa

- European equity markets closed mixed; UK +0.6%, Germany +0.4%, Italy +0.3%, France -0.3%, and Spain -0.5%.

- Most 10yr European govt bonds closed lower; UK +3bps, Germany +2bps, France +1bp, and Italy flat.

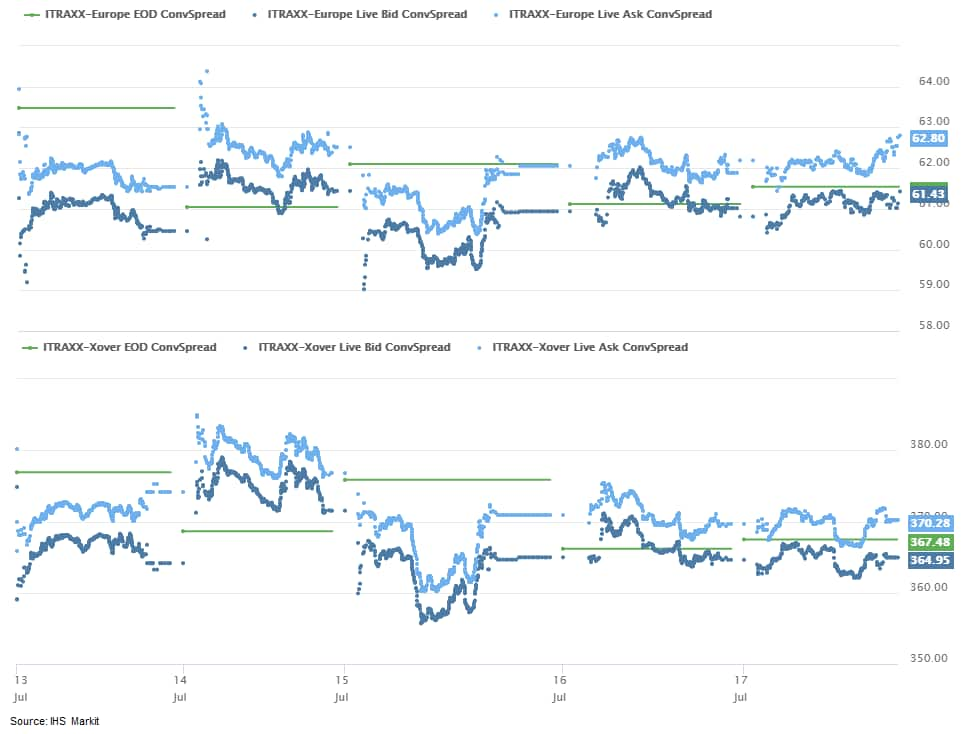

- iTraxx-Europe closed +1bp/62bps and iTraxx-Xover flat/368bps,

which is -1bp and -9bp, respectively, on the week.

- Brent crude closed -0.5%/$43.14 per barrel.

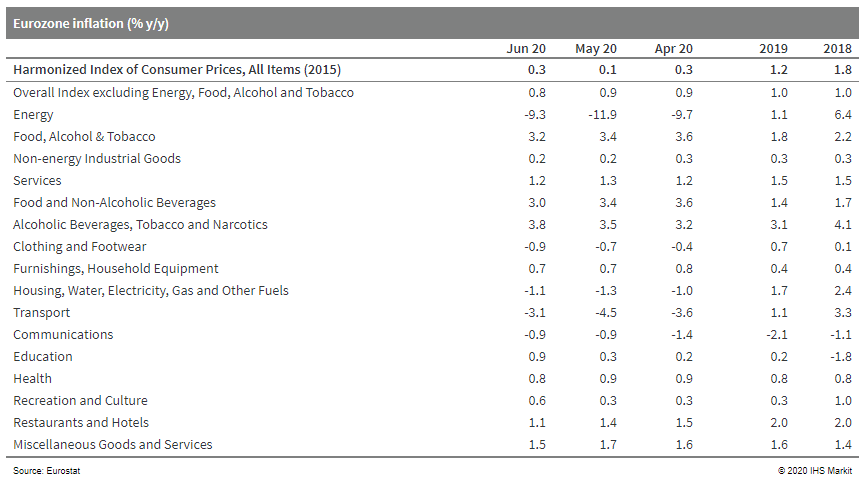

- Final HICP data for June Eurozone inflation confirms very low

underlying inflation rates, although energy effects marginally

lifted the headline measure. (IHS Markit Economist Ken Wattret)

- June's "flash" eurozone Harmonized Index of Consumer Prices (HICP) inflation rate of just 0.3% was confirmed in the final release, up from 0.1% in May, the first acceleration in five months. A lesser contraction in energy inflation was the main reason for the pick-up (see table below), reflecting higher oil prices.

- Energy inflation remained deeply negative nonetheless (-9.3%), keeping the overall inflation rate well below the European Central Bank's (ECB) aim of "below but close to 2%".

- The final HICP also confirmed the marginal deceleration in the inflation rate excluding food, energy, alcohol, and tobacco prices, which slipped from 0.9% to 0.8%, its lowest level since May 2019 and not far above its record low of 0.6% in early 2015.

- Services inflation decelerated again, to 1.2%, well down on the recent peak of 1.9% in November 2019, while non-energy goods inflation was flat at just 0.2%.

- IHS Markit's "super core" measure of inflation in the eurozone dropped for the fourth successive month, to 1.19%, its lowest level since March 2017. This too is not far above the record low of just under 1% in late 2016.

- The "super core" measure of inflation includes only the HICP

items that are sensitive to changes in the eurozone output gap. Its

movements are therefore more sensitive to domestic economic

developments, with services prices accounting for around

three-quarters of the "super core" index.

- Daimler has announced preliminary second-quarter financial data of an EBIT loss for the period of EUR1.682 billion, according to a company statement. Although this was a substantial loss, the figure at least was significantly better than the expectations of analysts, who had forecast a combined average loss of EUR2.069 billion. The adjusted EBIT figure was EUR708 million, against a consensus figure of EUR1.709 billion. The Mercedes Car and Van unit reported an EBIT loss of EUR1.125 billion while the Truck and Bus unit's loss was EUR756 million. Speaking about the company's second quarter CEO Ola Källenius said, "This has been a complex quarter. We took proactive decisions on costs and spending and focused intensely on working capital management. We were then able to seize opportunities allowed by the market recovery, thanks to our compelling product line-up. We also announced key strategic partnerships in electrification and vehicle software during the quarter that position us well for the future. But, there is still much to do. Our systematic efforts to lower the breakeven of the company by reducing costs and adjusting capacity will need to continue." (IHS Markit AutoIntelligence's Tim Urquhart)

- The Volkswagen (VW) passenger car brand has said that it will not recruit any new staff in 2020 as part of the company's cost-cutting measures in response to the COVID-19 virus outbreak. According to a Reuters report, the brand's CEO Ralf Brandstätter outlined the company's recruitment freeze in an internal newsletter. He said, "We remain under substantial cost pressure. Deliveries and therefore revenue have dropped sharply. At the same time a large amount of costs remain. This is why we have decided not to add new people." The Group's works council leader Bernd Osterloh recently stated that he saw no reason for more job cuts other than those that were agreed as part of 2016's Future Pact program, despite the global market facing the new reality of the post-COVID-19 economy. (IHS Markit AutoIntelligence's Tim Urquhart)

- BMW Group has signed an electric vehicle (EV) battery supply contract for EUR2 billion (USD2.28 billion) with Swedish company Northvolt, according to a company statement. The cells will be made at Northvolt's new factory, currently under construction, in Skellefteå from 2024. The cells will be manufactured using renewable sources, including wind power, which, according to BMW CEO Oliver Zipse, was a key component in the two companies signing the contract. He said, "To make an effective contribution to climate protection, we aim to improve our products' overall environmental balance - from resources to recycling. This applies in particular to energy-intensive production of high-voltage batteries for electric vehicles. That is why we now have a contractual agreement with our cell manufacturers that they will only use green power to produce our fifth-generation battery cells." Northvolt is the third battery-cell manufacturer with which BMW has signed a supply contract, alongside CATL and Samsung SDI. By 2023, BMW will have 25 electrified models on the road, with more than half of this number being fully electric. (IHS Markit AutoIntelligence's Tim Urquhart)

- Mobileye has received a permit from German certification body TÜV SÜD to test autonomous vehicles (AVs) on public roads in Germany, reports VentureBeat. The permit will allow Mobileye to conduct testing anywhere in the country at a regular driving speed of up to 130 km/h. The company announced that it will begin testing in Munich before expanding elsewhere. Johann Jungwirth, vice-president of Mobility-as-a-Service (MaaS) at Mobileye, said, "The new AV Permit provides us an opportunity to instill even more confidence in autonomous driving with future riders, global automakers and international transportation agencies. We thank TÜV SÜD for their trusted collaboration as we expand our AV testing to public roads in Germany." Mobileye, an Israeli-based company acquired by US chipmaker Intel, claims to be the first non-OEM to receive a permit from the German regulator to test AVs. Mobileye offers vision-based systems to support advanced driver assistance systems (ADAS) and automated vehicle solutions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

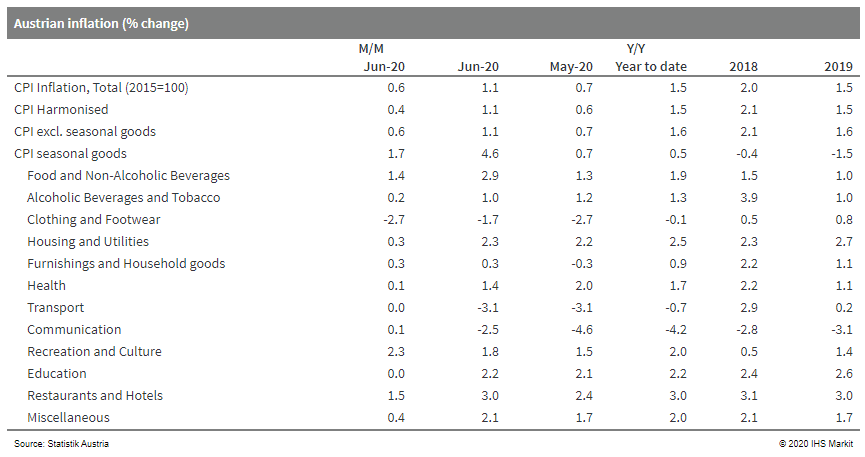

- Half of Austria's May's major inflation dip was recouped in

June, driven by a large majority of categories rather than just

energy. Austrian inflation last exceeded that of the eurozone

average by 0.8 percentage points. (IHS Markit Timo Klein)

- Statistik Austria data reveal that consumer prices rebounded sharply by 0.6% month on month (m/m) in June, which is roughly 0.5 percentage points higher than the long-term average for this month. Headline inflation thus rebounded from a four-year low of 0.7% to 1.1% year on year (y/y).

- The European Union-harmonized measure, which displays a different seasonal pattern (relatively higher weights for fuel and restaurants and hotels, and lower weights for insurance services and housing maintenance), increased by 0.4% m/m.

- This led to an identical increase of its annual rate from 0.7% to 1.1% y/y that also lifted its spread with that of the eurozone average (0.3%) from 0.5 to 0.8 percentage points.

- This latest gap broadly represents a return to the 0.7-point average observed during 2011-17, having narrowed temporarily (between mid-2018 and end-2019) to 0.3 points.

- Only some services related to recreation, entertainment, and travel have not returned to normal yet and therefore still required price estimations. This lowered the affected share of the basket of goods and services, which had peaked at 26% in April before falling to 17.5% in May, to 4.2% in June.

- Surprisingly, energy prices rebounded by a mere 0.3% m/m, driven by mineral-oil products (0.8%) while the aggregate of non-oil energy components (electricity, natural gas, coal, district heating) even slipped marginally once more (-0.1% m/m).

- The annual decline of energy prices was curtailed only modestly from -9.5% to -8.2%. This was more than made up for by the fact that nine of the 12 main Classification of Individual Consumption According to Purpose (COICOP) groups of goods and services posted a rising annual rate, with transport holding steady and only two categories (alcohol/tobacco, health) showing another deceleration.

- Food/beverages, hotels/restaurants, clothing/footwear, furnishings and household goods, and recreation and culture were the most important inflation drivers in June.

- Prices of seasonal goods increased by an above-average 1.7% m/m, boosting their y/y rate from 0.7% to 4.6%. Their weight is not large enough to make a difference, however, so that the index excluding seasonal goods posted results identical to the headline measure (0.6% m/m, 1.7% y/y).

- Half of May's unexpectedly large dip has been corrected in

June, restoring Austria's traditionally large positive gap with

average eurozone inflation. This confirms that Austrian core

inflation remains clearly higher than in the eurozone at large,

which can also be seen from the fact that service-sector price

inflation rebounded from 2.1% to 2.2% y/y.

- Groupe PSA's consolidated global sales slumped during the first

half of 2020 as a result of the COVID-19 virus pandemic. According

to the latest data published by the automaker, demand during the

first six months of the year dropped by 45.7% year on year (y/y) to

1,033,253 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- At a brand level, the retreat was broadly similar across all its marques. Leading the way in terms of volumes was Peugeot which sold 445,221 units, although this was a decline of 42% y/y.

- Behind it was Citroën; demand contracted by 43.5% y/y to 303,101 units, as combined sales of its Opel and Vauxhall brand fell by 53.1% y/y to 266,118 units. In addition, the DS Automobiles brand slipped by 41.6% y/y to 18,813 units.

- On a regional basis, the biggest influence on PSA's performance was Europe. Taking in the European Union, the European Free Trade Association (EFTA), Albania, Bosnia, Croatia, Kosovo, Montenegro, North Macedonia, and Serbia under PSA's definition, European sales dropped 47.3% y/y to 884,524 units.

- Although Opel Vauxhall was the biggest drag on sales with a percentage decline of 55.4% y/y to 246,851 units, its other brands fell on a broadly similar scale including its biggest volume brand, Peugeot, which dropped by 42.5% y/y to 367,593 units.

- The devastation to Croatian merchandise-trade volumes continued

throughout April and May 2020. Preliminary data show that in May,

the contraction of merchandise exports intensified as compared to

April, surging to 23.9% year on year (y/y). After shrinking by 2.1%

y/y in January-April 2020, exports dropped by 17.8% y/y in May.

(IHS Markit Economist Andrew Birch)

- Meanwhile, the contraction of imports was even more severe in April and May. Although the y/y losses ebbed somewhat from April to May, import contraction remained severe, at 29.4% y/y in May according to preliminary data. Low global energy prices contributed to the sharp drop of overall imports, with energy imports down by 20% y/y in the first four months of the year.

- With imports continuing to contract more sharply than exports, Croatia's merchandise trade deficit is rapidly dwindling, though remains large overall. In January-May 2020, preliminary data show that the trade deficit was down by over HRK7.3 billion, to HRK26.492 billion. Although the gap remains large as a share of the economy (still around 17-18% of GDP), it is nonetheless well down from year-earlier levels.

- S&P Global Ratings has reaffirmed Kenya's long-term

sovereign credit risk rating at B+ but has changed the rating

outlook to negative. S&P Global Ratings' change of the outlook

on Kenya's long-term sovereign credit risk rating to Negative

reflects the risk of the external liquidity gap breaching current

expectations, particularly if funding from official lenders is not

forthcoming. Furthermore, the economic fallout from the COVID-19

pandemic and/or slowing policy momentum could widen the country's

twin deficits and leave external debt higher. (IHS Markit Economist

Thea Fourie)

- For the fiscal year 2019/20 (ended June 2020), S&P expects the fiscal deficit to widen to 8.7% of GDP, compared with the target of 6.3% of GDP before the COVID-19 pandemic, and trail down to 7.9% in FY 2020/21.

- A reduction in tax rates (personal, corporate, and value-added tax) and higher spending commitments on health, social, and employment schemes to mitigate the impact of the COVID-19 virus outbreak contributed to the weaker fiscal backdrop in FY 2019/20.

- The wider budget deficit in FY 2019/20 is to be financed partly by an International Monetary Fund Rapid Credit Facility of USD739 million and a USD1-billion loan from the World Bank. The FY 2020/21 budget is to be financed through domestic sources (4.4% of GDP) and non-yet-fully-defined external sources (3.1% of GDP).

- The financing of these deficits will increase the general government's debt levels. S&P estimates show that the Kenyan government's stock of general government debt will amount to an average of 61.2% of GDP in 2020-23, from 52.6% of GDP in 2019.

- S&P expects the current-account deficit to average 5.2% of GDP, financing of which will rely heavily on concessional multilateral and bilateral financing. Overall, this will push Kenya's external debt (net of liquid public and financial sector assets) up to 193% of current-account proceeds during 2020 and average 188% in 2020-23.

Asia-Pacific

- Most APAC equity closed higher except for Japan -0.3%; India +1.5%, South Korea +0.8%, Hong Kong +0.5%, Australia +0.4%, and Shanghai Composite +0.1%.

- The Economic Times reported on 15 July that according to a government source, the Indian government has identified "strategic and non-strategic sectors" to be privatized. The newspaper reported that Punjab & Sind Bank and Indian Overseas Bank have been identified as candidates, together with the National Insurance Company, United India Insurance, and Oriental Insurance Company. There has not been any news with regards to state-capital injection; however, the Economic Times reported on 16 July that the Reserve Bank of India will join the growing list of Indian banks to raise INR50 billion (USD666 million) of capital either via a follow-on public offer or rights issue or a combination of both. Major mergers between state-owned banks had taken place in April, despite the impact from the coronavirus disease 2019 (COVID-19) virus outbreak. IHS Markit assesses this as a pre-requisite for eventual privatization. The reported privatization of Punjab & Sind Bank and Indian Overseas Bank comes as a surprise as banks are currently inundated with operation and asset quality pressure because of the COVID-19-virus outbreak. However, the fact that these two banks were not included in any merger suggests that they are good candidates for privatization, especially to test the demand from markets. (IHS Markit Country Risk's Angus Lam)

- China has renewed its efforts to promote new energy vehicles (NEVs) in rural areas, according to a statement released by the Ministry of Industry and Information Technology (MIIT). The latest program is aimed at speeding up the adoption of NEVs in rural areas, where low-priced, subcompact electric vehicles (EVs) have a good chance to replace two-wheelers, such as e-scooters, as a practical and affordable upgrade. Five promotional events will be held in a selection of cities, including Qingdao, Haikou, Kunming, Chengdu, and Taiyun, by the China Association of Automobile Manufacturers (CAAM) to showcase automakers' NEV models, and, more importantly, attract new buyers. The CAAM released the list of automakers participating in the events and key models on 14 July, including BAIC's EC3, Great Wall Motor's Ora R1 and IQ, and SAIC-General Motors-Wuling's Hongguang mini-EV and E-series. The program will not involve central government subsidies, but qualifying models will receive local government subsidies. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese company Hunan Haili Chemical's agrochemical sales rose by 32.9% to Yuan 1,701 million ($240.7 million at the current rate) in 2019. Agrochemical sales made up 79.2% of total sales, which increased by 32% to Yuan 2,148.7 million ($304 million). Net profit on total sales rose by 74.9% to Yuan 113.9 million ($16.1 million). Exports accounted for 38.6% of the company's agrochemical sales. (IHS Markit Crop Science's Shuyou Han)

- Taiwan's Food and Drug Administration (TFDA) has permanently revoked marketing authorization for Eisai (Japan)'s weight loss drug Belviq (lorcaserin HCl 10 mg), citing cancer risks, according to a statement from the TFDA. The decision follows a drug safety assessment by the TFDA, which concluded that the risks of taking Belviq outweighed the benefits. The TFDA had requested the temporary suspension of sales of Belviq in Taiwan in February 2020, and a re-evaluation of the drug's safety and a recall from the Taiwan market, after the US FDA analyzed new data from the long-term CAMELLIA-TIMI 61 trial and noted a small increase in malignancies in patients taking the treatment (462; 7.7% of patients) compared with the placebo group (423; 7.1%) (IHS Markit Life Science's Sophie Cairns)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.