Daily Global Market Summary - 18 November 2021

All major European and most APAC equity indices closed lower, while the US was mixed. US government and benchmark European bonds closed higher. CDX-NA and European iTraxx closed almost flat on the day across IG and high yield. Oil, natural gas, and copper closed higher, while the US dollar, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Nasdaq +0.5%, S&P 500 +0.3%, DJIA -0.2%, and Russell 2000 -0.6%.

- 10yr US govt bonds closed -1bp/1.58% yield and 30yr bonds -1bp/1.97% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY flat/296bps.

- DXY US dollar index closed -0.3%/95.54.

- Gold closed -0.5%/$1,861 per troy oz, silver -1.1%/$24.90 per troy oz, and copper +0.9%/$4.31 per pound.

- Crude oil closed +1.1%/$78.41 per barrel and natural gas closed +1.6%/$5.00 per mmbtu.

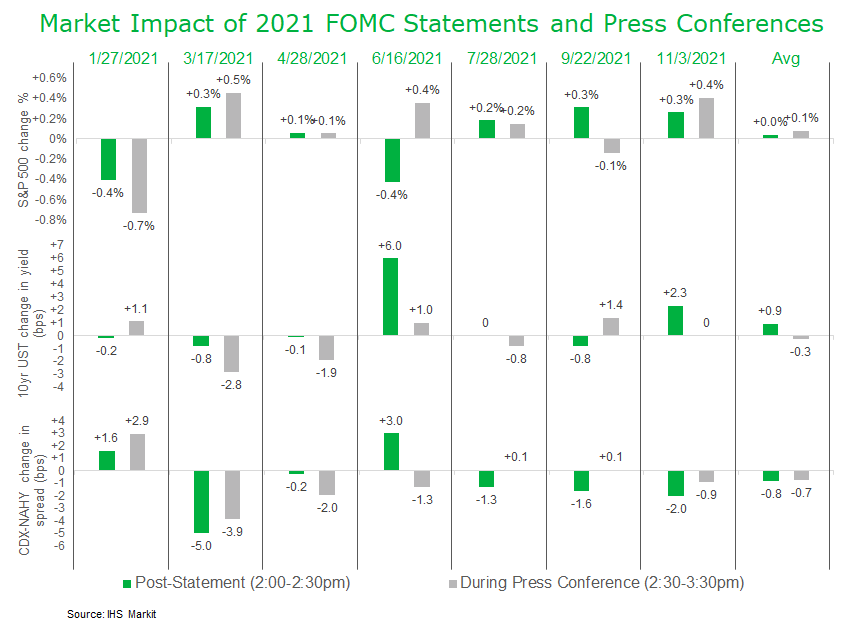

- The conclusion of FOMC meetings often drives substantial

repositioning and the below chart separates the market reaction to

the FOMC statement vs the press conference across the S&P 500,

10yr UST, and IHS Markit's CDX-NAHY. The data indicates that the

market direction post-statement reversed from positive to negative

only once this year across all three markets (during the Sept 22

meeting).

- The US EIA's November "Drilling Productivity Report" indicates

that new wells will, on average, produce 6,273 Mcf/d in December

2021, down from a forecast 6,465 for November. The big dropoff is

in the Anadarko, where average production will fall by 10% to 4,086

Mcf/d from an estimated 4,450 Mcf/d this month. (IHS Markit

PointLogic's Kevin Adler)

- Compared to a year ago, new well productivity is down sharply. December 2020 was 7,258 Mcf/d, so the December 2021 figure is down nearly 14%.

- Looking regionally year over year, Anadarko and Niobrara are causing the reductions, while other basins are up from December 2020. In particular, Appalachia's producers are showing a strong performance, with December 2021 projected at 30,284 Mcf/d per new well, compared to 26,727 Mcf/d a year ago.

- As for total production, EIA forecasts that November will average 89.1 Bcf/d and December will be at nearly 89.4 Bcf/d. Appalachia will lead the way with 36.8 Bcf/d in both months, followed by the Permian at 19.3 Bcf/d.

- The number of drilled but uncompleted (DUCs) wells continues to slip, as EIA found that they were 5,326 DUCs at the end of September and 5,104 at the end of October. At end-October 2020, EIA estimated the US had 7,592 DUCs, thus the current figure represents a decline of about 33%.

- The IHS Markit Maritime & Trade division provides a

real-time source for ship movements data and documents combined

with trade data and commodity movements. Research Signals has

tapped specifically into the Bill of Lading data, a source of

detailed import and export data that can provide timely information

on company economic activity measured by shipping trends. In total,

we introduce 48 factors derived from four underlying import and

export data items including shipping volume, shipping weight,

shipping value and total shipments, along with measures of

sector/industry relative shipping activities and the relationship

of shipping levels to sales. (IHS Markit Research Signals)

- Sector Relative Monthly Import Shipping Volume was a top performing factor in the US, with an average monthly spread of 0.26% between top and bottom ranked names, while Standardized Unexpected Quarterly Export Shipping Volume was a key contributor in Developed Europe (0.13%) and Developed Pacific (0.51%)

- Rank correlations between three representative Shipping factors and key style measures from the Research Signals factor library indicate very low commonality, demonstrating the uniqueness of this alternative data source and its added value to quantitative strategies

- In a portfolio application using two newly introduced factors, we screen for stocks with a strong link between imports and sales and demonstrate 1.9% annual outperformance since 2010 for those stocks with increasing imports relative to those with a decline.

- Seasonally adjusted US initial claims for unemployment

insurance decreased by 1,000 to 268,000 in the week ended 13

November, hitting its lowest level since 14 March 2020. With job

openings at a still historically elevated 10.4 million in September

and wages growing at a robust pace, hiring should continue to

improve and the level of claims should continue trending toward its

pre-pandemic steady state. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 129,000 to 2,080,000 in the week ended 6 November, hitting its lowest since 14 March 2020. The insured unemployment rate edged down 0.1 percentage point to 1.5%.

- In the week ended 30 October, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 16,478 to 272,974.

- California reported an increase of 568,007 in continuing claims for the Pandemic Unemployment Assistance (PUA), more than accounting for the entire increase in the total level of PUA claims in the week ended 30 October.

- In the week ended 30 October, the unadjusted total of continuing claims for benefits in all programs rose by 618,804 to 3,184,657. Despite the latest upturn, claims under all programs have declined sharply since the expiration of pandemic-related benefits—there were 11,250,306 claimants in the week ended 4 September.

- Seasonally adjusted US e-commerce retail sales registered

$214.6 billion in the third quarter of 2021, a decrease of 3.3%

from the second quarter. (IHS Markit Economist James

Bohnaker)

- Growth was 6.6% year on year (y/y), up from already high levels last year. Growth over the last eight quarters was 45.0%.

- The e-commerce share of total retail trade edged down from 13.3% to 13.0%. Prior to the pandemic, the share was 11.0% in the fourth quarter of 2019 and then peaked at 15.7% in the second quarter of 2020 amid business closures.

- Among retail categories for which detailed e-commerce data are available, year-on-year growth of e-commerce sales at furnishing and home furnishing stores (4.8%) led the pack, followed by sporting goods, hobby, music, and book stores (3.1%). E-commerce sales in all other categories were lower than in the third quarter of 2020.

- Rio Grande LNG has submitted an application to FERC in which it

explains how operation of a proposed carbon capture and storage

(CCS) system will enable it to capture and sequester at least 90%

of the CO2 emitted from its operations. (FERC Docket CP22-17) (IHS

Markit PointLogic's Kevin Adler)

- Rio Grande's application with FERC for the LNG project was approved in 2020. It is planned as five liquefaction trains with a total capacity of 27 million metric tons/annum, and four LNG storage tanks with a total of 720,000 cubic meters of capacity. The facility, located in the Brownsville Ship Channel in Cameron County, Texas, will have two LNG carrier loading berths. (FERC Docket CP16-454)

- In the new notice, Rio Grande says that construction of the LNG terminal might begin in Q1 2022, and that the first of the CCS installations would begin about nine months later, with each one being matched to construction of one of the LNG trains.

- "The carbon capture process, as detailed in the exhibits submitted herewith, removes CO2 from both the feed gas to be liquefied at the RGLNG Terminal and the exhaust flue gas from the main refrigerant compressor gas turbines central to the liquefaction process," Rio Grande LNG explained in its 17 November filing.

- "To provide context for this 90% reduction, according to the national net carbon dioxide equivalent (CO2e) emissions estimate in the Environmental Protection Agency's Inventory of U.S. Greenhouse Gas Emissions and Sinks, 5.769 billion metric tons of CO2e were emitted at the national level in 2019.

- As contemplated in the Authorization Order, the operational emissions of the RGLNG Terminal were assessed to potentially increase the annual CO2e emissions based on the 2017 levels by approximately 0.17 percent at the national level. Deploying CCS systems at the RGLNG Terminal that capture 90% or more of the CO2 means the RGLNG Terminal would potentially increase the annual CO2e emissions based on the 2019 national levels by approximately 0.0001 percent," it said.

- Waymo has expanded its autonomous freight truck partnership with delivery and logistics company UPS, according to a company statement. Under this partnership, Waymo Via, the company's trucking and cargo transportation service, will deploy its Class 8 trucks equipped with the fifth-generation Waymo Driver. These trucks will make deliveries for UPS's North American Air Freight unit by hauling goods between facilities in Dallas-Fort Worth and Houston, Texas (United States). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Canadian province of Ontario aims for its auto sector to produce at least 400,000 battery electric vehicles (BEVs) by 2030. According to the website for the Ontario government, Driving Prosperity Phase 2 has four overall goals. The province is working to reposition parts and vehicle production from the car to more electrified solutions, including mandates for vehicle production, a new battery plant, and an increase in the exports of Ontario-produced cars and innovations. The government intends to establish and support a battery supply chain ecosystem connection Northern Ontario's access to mineral wealth. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed lower; Germany/France -0.2%, UK -0.5%, Italy -0.6%, and Spain -1.0%.

- 10yr European govt bonds closed higher; France/Italy -5bps, Spain/UK -4bps, and Germany -3bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -1bp/249bps.

- Brent crude closed +1.2%/$81.24 per barrel.

- Weather-related demand remains the fundamental driver for gas

price volatility this winter, with extreme cold weather risk

potentially adding up to 30-50 Bcm of gas in total concentrated

between November and March. (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst)

- Attention is focused on Russia as a traditional swing supplier in tight conditions, with European storage at roughly 72% of capacity, or 14% lower than the five-year average for this time of year. Yet given current storage levels, the supply levers from Russia or from more LNG imports would still be unlikely to completely counter the demand shocks of extremely cold weather.

- Cold weather in Asia would divert more LNG imports away from Europe, potentially up to 1.3 Bcm per month over the winter season, but also offset to a varying degree by gas-to-oil switching. US LNG exports are maxed out, and the US natural gas price is delinked from Europe and Asia.

- High coal prices through 2022 will likely help improve relative gas-fired generation economics in Europe, and act as a backstop on lower prices after winter. Gas demand in the power generation sector would rise until the power sector is balanced or when all potential coal plants have been displaced.

- Startup commercial vehicle (CV) brand Tevva has announced that it has raised another USD57 million to support investment in its manufacturing footprint. According to a statement, the cash was raised via an oversubscribed private placement from new and existing investors. The company said that it will be used "to fit out its brand-new London [UK] based production facility and rapidly scale up manufacturing." It has also said that first deliveries of its battery electric vehicle (BEV) are scheduled to begin from the third quarter of 2022. The fundraising follows Tevva revealing its first vehicle in September. Instead of developing a ground-up design like some of its rivals, it is instead largely underpinned by the Iveco Eurocargo, which offers a broad range of gross vehicle weight (GVW) options. Iveco also already offers a glider chassis for such applications. Although it plans to offer a vehicle with a GVW of 7.5 tons initially, it intends to expand this to 19.5 tons eventually. The latest funding comes on top of around USD13 million that has been raised during the past 12 months, and will lead to it being able to build a brand-new facility at London Thames Freeport, which will have an area of 11,000 square meters and is expected to create around 1,000 new "skilled mechanical, software, engineering, and manufacturing jobs in the next 24 months". Production is expected to commence in July 2022. It has confirmed that vehicles will be manufactured at a rate of 3,000 units per annum (upa) during 2023, at which point a hydrogen range-extender variant will be launched. (IHS Markit AutoIntelligence's Ian Fletcher)

- German utility and trader RWE plans to spend about $7 billion

(€5 billion) a year to install wind, solar, batteries, flexible

generation, and hydrogen globally ahead of closures for its

profitable German nuclear and coal plants. (IHS Markit Net-Zero

Business Daily's Cristina Brooks)

- The company released its "growing green" investment strategy on 15 November, revealing how it will add up to 50 GW, or about 2.5 GW annually, of renewables and green solutions through 2030 in Europe, North America, and Asia, which it called "attractive markets."

- Almost all of the investment (90%) is going to renewable energy sources and batteries, currently operating only in Germany, the utility's CFO Michael Müller said. Its offshore wind capacity will triple from 2.4 to 8 GW, while growing its combined onshore wind and solar capacity from 7 to 20 GW.

- What remains of the investment will be used to grow RWE's flexible power supply in its traditional markets in Germany, Benelux, and Great Britain, where it operates many gas-fired power plants.

- RWE doesn't have much renewable capacity outside the West and Australia, but it was looking into offshore wind prospects in Japan, South Korea, and Taiwan alongside plans to grow its trading activities.

- Despite the renewable pledge, most of RWE's generation capacity in Europe and Turkey came from gas-fired and lignite coal power plants over the first three quarters of the year.

- Nuclear and coal-fired power plants boosted the company's third-quarter profits, thanks to high wholesale energy prices and less maintenance on its nuclear power plants. Its lignite coal-fired power plants in Germany recorded the biggest gain of all in meeting higher post-pandemic electricity demand.

- But RWE is being forced out of its most profitable segments in Germany as the country plans to phase out nuclear by 2022, following on from the 2011 Fukushima Daiichi disaster in Japan. Germany has pledged to phase out coal by 2038 at the latest.

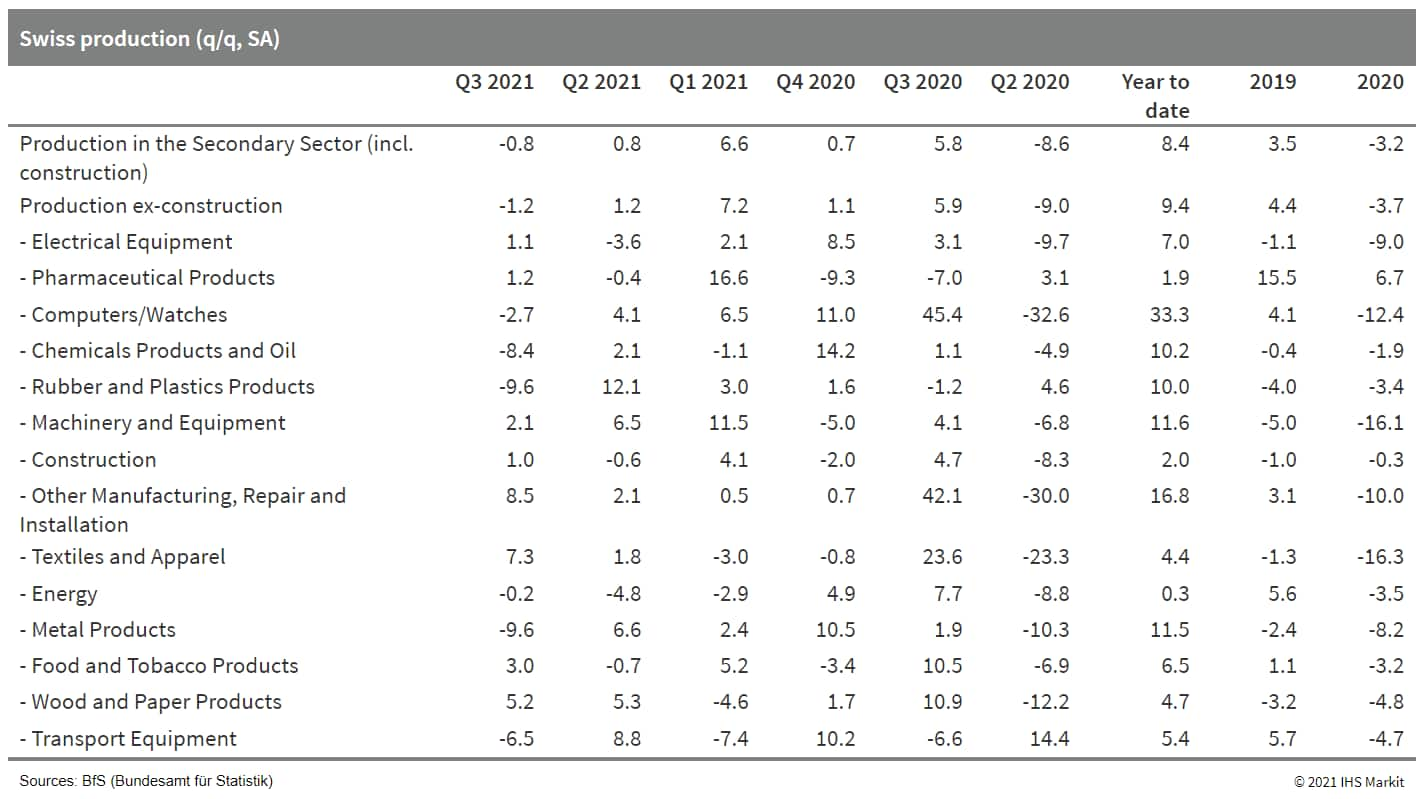

- Based on indices according to the NOGA 2008 classification, the

Swiss Federal Statistics Office (BFS) reports a seasonally adjusted

third-quarter decline of industrial production ex-construction by

1.2% quarter on quarter (q/q). Additionally considering

construction (up 1.0% q/q), secondary-sector output slipped by 0.8%

q/q. The secondary sector encompasses industry (broken down into

manufacturing, mining/quarrying, energy supply, and water supply)

and construction. (IHS Markit Economist Timo

Klein)

- Notwithstanding slippage at the data edge, the year-on-year (y/y) comparison still shows a sizeable increase of 7.3% for the secondary sector as a whole and even 8.3% for industry. Furthermore, a comparison with pre-pandemic levels of the third quarter of 2019 reveals increases of 3.5% and 3.4%, respectively. This underlines that Swiss industry has coped better than most of its European peers with the ramifications of the pandemic.

- The separate monthly series (seasonally adjusted) reveals that

production ex-construction actually posted a small net increase

during the July-September period. July's 0.6% m/m was followed by

-0.4% in August but a renewed increase of 1.0% in September. The

decline in q/q terms thus owes to overhang effects from corrective

declines in the April-June period. This demonstrates additionally

that production was not hurt unduly by supply chain issues in the

most recent past.

- Toyota has partnered with app-based mobility service provider Drivr to introduce hydrogen taxis on the streets of Copenhagen (Denmark). Toyota will supply 100 units of its Mirai fuel-cell vehicle to Drivr. Alar Metsson, CEO of Toyota Denmark, said, "We are pleased to have delivered the first 100 hydrogen taxis to Drivr and are ready to deliver even more going forward. In this way, we support their mission to be the greenest taxi company in Denmark." This move has been announced as part of the European 'hydrogen for transport' projects, Hydrogen Mobility Europe 2 (H2ME2) and Zero Emission Fleet vehicles For European Rollout (ZEFER). It is also in line with the Danish government's aim that no new taxis should emit carbon dioxide or air pollution from 2025, and by 2030 it wants all moving taxis to be zero-emission cars. In addition, the move is expected to create opportunities for Toyota by increasing access to its fuel-cell vehicles and expanding their exposure to riders as well as drivers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Africa's real GDP is expected to contract by an estimated

2.0% q/q during the third quarter, from a 1.2% q/q expansion during

the second quarter, according to IHS Markit's estimates. The risk

to the outlook is tilted towards the downside as preliminary

figures for the manufacturing, retail, and mining sectors show.

(IHS Markit Economist Thea

Fourie)

- Real seasonally adjusted retail trade sales fell by 5.4% q/q and 0.04% year on year (y/y) during the third quarter. The categories that were main negative contributors to the annual slowdown in retail trade sales were general dealers (contracting 1.9% y/y and contributing minus 0.8 percentage point), followed by hardware, paint, and glass (down by 5.0% y/y and contributing minus 0.5 percentage point), reports statistical agency Statistics South Africa (StatsSA). A 7.0% y/y rise in textile, clothing and footwear sales made a 1-percentage-point contribution to the overall annual growth in retail trade sales during the third quarter.

- Real seasonally adjusted manufacturing production fell by 3.9% q/q and 0.5% y/y during the third quarter. Sub-sectors showing the largest contributions to the quarterly slowdown included motor vehicles, parts and accessories and other transport equipment (down 18.1% q/q and contributing minus 1.9 percentage point); food and beverages (down 4.4% q/q and contributing minus 1.1 percentage point); and basic iron and steel, non-ferrous metal products, metal products and machinery (down 2,2% q/q and contributing minus 0.5 percentage point).

- Real seasonally adjusted mining production fell by 0.7% q/q but increased by 2.4% y/y during the third quarter. Reduced output of platinum group metals (PGMs), other metallic minerals, and coal contributed to the quarterly slowdown.

Asia-Pacific

- Most major APAC equity indices closed lower except for Australia +0.1%; Japan -0.3%, Mainland China -0.5%, South Korea -0.5%, India -0.6%, and Hong Kong -1.3%.

- A Mainland China State Council executive meeting on 17 November

decided to introduce a targeted re-lending program with a quota of

CNY200 billion to support the clean and efficient use of coal. (IHS

Markit Economist Yating

Xu)

- According to the meeting, the re-lending program involves coal mining, coal processing, thermal power generation and coalbed methane development and utilization.

- Besides re-lending quota, policy support such as tax incentives, special government bonds, lowering the requirement of capital portion for green projects, accelerating the fixed-asset depreciation and trade-in policies will also be rolled out in the near future to promote the de-carbonization process.

- The planned CNY200 billion of re-lending quota is an increase of green loans on top of the structural decarbonization tools published by the central bank on 8 November.

- China's green loans are expected to increase faster in the fourth quarter and support related infrastructure investment. As of the end of third quarter 2021, total green loans rose by 16.3% year on year (y/y) with green infrastructure loans increasing by 17.1%, compared with 11.9% y/y growth of total credit.

- Chinese autonomous truck startup Trunk.Tech has announced that it has raised hundreds of millions of yuan in its latest round of financing. The funding round was led jointly by Yuexiu Industrial Fund, ZWC Partners, and BHCP, reports Gasgoo. The company plans to put the infused capital towards research and development (R&D) and mass production of its new-generation autonomous trucks. Trunk.Tech also aims to expand its autonomous logistics operations and increase its intelligent port market share. Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. These trucks enable autonomous loading and unloading of containers in yards, thereby improving efficiency. Trunk.Tech focuses on developing next-generation autonomous solutions that can enhance movement of goods and materials in logistics networks. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baidu has announced that its Level 4 autonomous test vehicles have completed over 10 million miles, reports TechCrunch. The company also mentioned that its robotaxi service, Apollo Go, offered 115,000 rides in the third quarter of this year. Robin Li, co-founder and CEO of Baidu, estimated the company is "probably the largest robotaxi service provider in the world by number of rides". Li also said the Apollo Go service will be available in 65 cities by 2025 and 100 cities by 2030. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hong Kong SAR placed a three-tranche Green Bond package in

dollars and euros worth USD3 billion: the USD1.75-billion 10-year

portion was priced at 1.855%, a 23-basis-point margin over US

Treasuries, versus initial price talk of a 50-basis-point spread,

with USD2.9 billion in demand.(IHS Markit Economist Brian

Lawson)

- Asian buyers took 72%, led by banks with 63% of allocations and 21% was sold to official purchasers.

- It also sold five- and 20-year euro-denominated debt at 0.019% and 1.059%, 10 and 65 basis points over mid-swaps and 10 and 20 basis points tighter than initial guidance.

- The euro tranche gained EUR2.2 billion, with 67% and 89% respectively placed in Europe. EUR500 million was sold for the longer duration, and EUR1.25 billion for five years.

- Paul Chan Mo-Po, Financial Secretary, previously stated on 20 October tht Hong Kong plans to sell HKD175.5 billion (USD22.5 billion) of Green debt in the next five years using various currencies and maturities in efforts for it to become "a leading green and sustainable financing hub in the region".

- In early 2021, it already sold USD2.5 billion of 5-, 10-, and 30-year bonds at 0.635%, 1.414% and 2.431%, which were sold primarily (65%) to Asian buyers.

- Teras Offshore's (TOPL) wind turbine transport and installation

(T&I) contract for Taiwan Power Company's (Taipower) 300 MW

Changhua Phase 2 offshore wind farm has been unilaterally

terminated by Foxwell Energy. (IHS Markit Upstream Costs and

Technology's Genevieve Wheeler Melvin)

- TOPL, a wholly-owned subsidiary of Ezion Holdings, is currently reviewing its options and may seek legal action, where appropriate, in relation to the terminations.

- TOPL signed the turbine T&I contract with Foxwell Energy, a subsidiary of Shinfox Energy, in December 2020. Foxwell has claimed TOPL failed to meet one of the conditions of the contract, alleging that TOPL did not provide an externally audited financial statement by a mutually agreed cutoff date. The financial statement was required in order to show TOPL was in a positive net asset position, with net assets exceeding total liabilities.

- Ezion claims the group was in discussions with TRS on the scope of work, fee structure and payment terms in light of the effects of the COVID-19 pandemic on Taiwan and Singapore when it was served the termination notice.

- TOPL's T&I contract included the installation of 31 wind turbines, which was due to commence in September 2024. In addition, TOPL's appointment as the installation contractor for the project's foundations scope has been consequently affected. Changhua Phase 2 is planned with 31 units of 9.5 MW wind turbines and an offshore substation, and is expected to be grid-connected by the end of September 2025.

- Tata Motors is planning to establish vehicle scrappage centers

under a franchise model in India and intends to make them

operational by the first quarter of 2022, reports the Press Trust

of India. According to the source, Tata has collaborated with the

Gujarat government to support the establishment of a vehicle

scrappage facility in the city of Ahmedabad in the state of

Gujarat. The facility is due to have the capacity to recycle up to

36,000 vehicles (including both passenger and commercial vehicles)

in a year. Tata Motors executive director and president (commercial

vehicles) Girish Wagh said, "Today, it appears that about 25,000

trucks are dismantled every year in the country and we do not have

proper systematic scrappage facilities. Now, we have tied up with a

European expert and with his help, we have made a model scrapping

center. So, we have created this model, and this model we are going

to deploy through franchise arrangement." He added, "The company

has already started sending out a letter of intent to the franchise

partners to set up the scrappage facilities. We should see the

first one coming in the beginning of the next financial year."

Significance: The Indian government views scrappage centers as

employment generation opportunities. In September, the Ministry of

Road Transport & Highways (MORTH) announced rules to set up

registered vehicle scrapping facilities (RVSFs) as well as

automated testing stations (ATSs) across India. (IHS Markit

AutoIntelligence's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.