Daily Global Market Summary - 18 October 2021

Most US equity indices closed higher, APAC was mixed, and all major European markets were lower. US government bonds closed mixed with the curve was flatter on the day, while benchmark European government bonds closed lower. European iTraxx closed slightly wider on the day across IG and high yield, while CDX-NA was unchanged. WTI and the US dollar closed flat, while natural gas, Brent, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher, except for DJIA -0.1%; Nasdaq +0.8%, S&P 500 +0.3%, and Russell 2000 +0.1%.

- 10yr US govt bonds closed +1bp/1.59% yield and 30yr bonds -2bps/2.02% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY flat/300bps.

- DXY US dollar index closed flat/93.95.

- Gold closed -0.1%/$1,766 per troy oz, silver -0.4%/$23.26 per troy oz, and copper -0.1%/$4.73 per pound.

- Crude oil closed flat/$81.69 per barrel and natural gas closed -7.8%/$4.99 per mmbtu.

- GE Renewable Energy has received a firm order from Vineyard Wind to supply Haliade-X wind turbines for 800MW Vineyard Wind 1. GE was announced as the preferred turbine supplier in December 2020 and received firm order after the financial close of Vineyard Wind 1. The contract includes 62 units of 13MW Haliade-X offshore wind turbines. Offshore work is expected to be completed by 2022 followed by completion of the entire project by 2023. Vineyard Wind is a joint venture between Avangrid Renewables and Copenhagen Infrastructure Partners. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

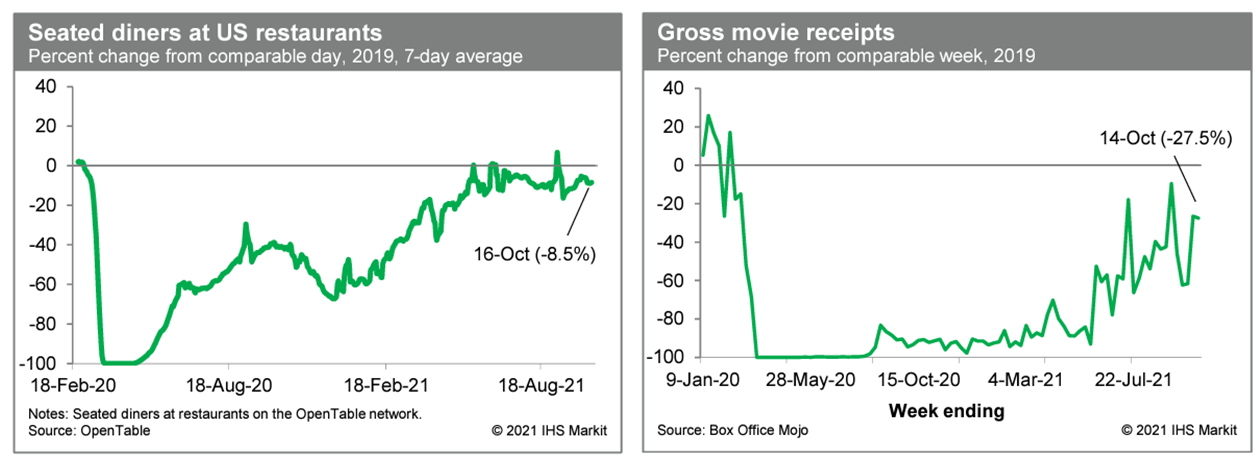

- Averaged over the seven days ending Saturday, the count of US

seated diners on the OpenTable platform was 8.5% below the

comparable period in 2019. Restaurant activity has yet to make a

full and sustained recovery. Meanwhile, box-office revenues last

week were 27.5% below the comparable week in 2019, according to Box

Office Mojo. This was close to the prior week's reading and

consistent with gradual, yet broadly ongoing recovery in the

movie-theater industry. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- Total US industrial production (IP) fell 1.3% in September,

reflecting decreases in manufacturing (down 0.7%), utilities IP

(down 3.6%), and mining (down 2.3%). The change in IP for August

was revised down from a gain of 0.4% to a decline of 0.1%.

Lingering effects of Hurricane Ida and supply constraints in the

automotive industry held back IP in September. (IHS Markit

Economists Ben

Herzon and Akshat Goel)

- Vehicle assemblies were revised lower for August and were below the assumption for September, implying less third-quarter motor vehicle output and inventory investment. In response, IHS Markit analysts lowered the estimate of third-quarter GDP growth 0.2 percentage point to 1.4%.

- Manufacturing IP fell 0.7% in September as the production of both durable and nondurable goods recorded losses. Hurricane Ida forced plant closures for petrochemicals, plastic resins, and petroleum refining in late August and production was not restored to normal as of September. As a result, large decreases were reported in chemicals (down 2.1%), and petroleum and coal products (down 2.4%). The hurricane shaved 0.3 percentage point from growth of manufacturing output in September.

- Output of motor vehicles and parts (down 7.2%) was the main drag on factory output in September as it continues to be restrained by a shortage of semiconductor chips used in vehicle components. Manufacturing output excluding motor vehicles and parts was down 0.3% in September. Vehicle assemblies fell 1.0 million units to 7.8 million in September, their lowest level since May 2020.

- The output of utilities fell 3.6% in September as demand for air conditioning moderated after an unseasonably warm August.

- Mining activity decreased 2.3% in September as lingering effects of Hurricane Ida continued to stymie oil and gas production in the Gulf of Mexico.

- According to the National Association of Home Builders (NAHB),

strong consumer demand helped push the US housing market index

higher, despite affordability challenges stemming from rising

material prices and shortages. The NAHB expects upward pressure on

home prices to ease when supply-chain difficulties are addressed.

(IHS Markit Economist Patrick

Newport)

- The headline housing market index increased 4 points to 80 in October. A reading above 50 indicates that more builders view conditions as good rather than poor. A 4-point gain should be interpreted as a modest boost in confidence.

- The current sales conditions index rose 5 points to 82; the index measuring sales prospects over the next six months picked up 3 points, to 84; the traffic of prospective buyers' index rose 4 points to 65.

- By region, the Northeast increased 6 points to 76 and the West rose 5 points to 85; the South picked up 4 points to mark 84 and the Midwest also increased 4 points to 73.

- The Biden administration on Monday (October 18) unveiled a new

strategy for tackling pollution from per- and polyfluoroalkyl

substances (PFAS), pledging a suite of EPA actions to address the

"forever chemicals" and touting efforts by USDA and FDA to improve

research and testing of PFAS contamination in the food supply. (IHS

Markit Food and Agricultural Policy's JR Pegg)

- EPA's new "strategic roadmap" includes a promise to set drinking water standards for PFOA and PFAS─two of the most widely used PFAS─as well as efforts to expedite cleanup of contaminated sites.

- The plan comes amid growing pressure on the White House and Congress to address the public health concerns from PFAS, a class of more than 5,000 chemicals used in a dizzying array of industrial applications and products, including food packaging, cleaning supplies, machinery and clothing.

- Studies have found PFAS are linked to an array of health problems such as weakened immunity, thyroid disease, reproductive harm and cancer, and the chemicals are virtually indestructible. Researchers have found widespread contamination of groundwater supplies, largely from manufacturing and use in firefighting foams on military bases across the country.

- Tests by EPA and state agencies have found the chemicals in drinking water supplies for 16 million Americans in 33 states and the extent of the pollution is likely far greater. The chemicals have also been found in bottled water and food and the issue is also a worry for US ag interests as dairies in Maine and New Mexico have been effectively ruined by PFAS-contaminated water supplies and fertilizer.

- Stellantis and LG Energy Solution have signed a memorandum of understanding (MoU) to form a joint venture (JV) to produce battery cells and modules for North American market, according to a statement by Stellantis. Under the partnership, the two companies will establish a new battery manufacturing plant in North America that aims to have an annual production capacity of 40 gigawatt hours (GWh). The location of the new facility is currently under review and further details will be shared at a later date. The groundbreaking for the facility is expected to take place in the second quarter of 2022, and it is targeted to start production by the first quarter of 2024. The battery cells and modules to be produced at the plant will be supplied to Stellantis assembly plants in the US, Canada, and Mexico for installation in its electrified vehicles, including plug-in hybrids (PHEVs) and battery electric vehicles (BEVs) that will be sold under the Stellantis family of brands. (IHS Markit AutoIntelligence's Jamal Amir)

- Swiss firm Roche has released a statement announcing a new agreement with US tech firm PathAI, a leader in artificial intelligence (AI)-powered technology for applications in pathology analyses. Under the new development and distribution agreement, both companies plan to jointly develop an embedded image analysis workflow for use by pathologists. PathAI image analysis algorithms will be adjusted to enable access within the cloud version of Roche's uPath enterprise software, NAVIFY Digital Pathology. The collaboration will be facilitated via Roche's Digital Pathology Open Environment, enabling secure access for pathologists to third-party AI-powered technologies in conjunction with Roche's AI-based image analysis tools. Roche plans initial distribution of PathAI-developed research-use-only (RUO) algorithms via NAVIFY Digital Pathology across multiple cancer types to enhance diagnostic procedures and improved personalized treatment plans, and the AI collaboration should also help to support Roche's own companion diagnostic and drug development programs. The new PathAI collaboration is one of the first to be secured for expansion of digital tool applications via Roche's open environment, and is also one of the first of PathAI's solutions to be distributed via a third-party platform. It is the latest in a series of AI-based collaborations from Roche, which are intended to enhance the company's prominent standing on the digital healthcare front and for use in optimization of personalized patient care and/or enhanced drug discovery program support. (IHS Markit Life Sciences' Janet Beal)

- The Public Service Commission of Wisconsin said in an October

18 notice that it has given a preliminary environmental review of

an application from Koshkonong Solar Energy Center LLC (KSEC) for a

hybrid solar/battery energy storage system (BESS). The proposed

project is to be located in the towns of Christiana and Deerfield

in Dane County, Wisconsin. The Commission is sending this October

18 letter to property owners near the proposed solar facilities,

including the new substation, as well as individuals who have asked

to be placed on its mailing list. It is also being sent to public

officials who may wish to place this notification in a location

where it can be viewed by the public. (IHS Markit PointLogic's

Barry Cassell)

- Commission staff completed an environmental review of the proposed project and prepared an environmental assessment (EA) to determine if a more detailed environmental impact statement (EIS) was necessary. "The preliminary determination indicates that no significant impacts on the human or natural environment are likely to occur as a result of the construction and operation of this project," said the October 18 notice. "Therefore, preparation of an EIS is not required." It will take comment on that decision until November 3.

- KSEC is proposing a 300-MW photovoltaic solar facility and 165-MW BESS. Invenergy developed the project on behalf of Koshkonong Solar. The project would be located directly west of the Village of Cambridge, approximately six miles northeast of the City of Stoughton, two miles south of the Village of Deerfield, seven miles north of the City of Edgerton, and 10 miles west of the Cities of Jefferson and Fort Atkinson.

- Movement in Canada's housing starts varied across segments and

provinces in the month. Notable changes include the big drop in

British Columbia's starts thanks to the outsized decline in

Vancouver's multiples. Yet, urban single starts in British Columbia

rebounded 9.6% m/m after declining in the previous five months. The

8.5% m/m decline in Ontario's housing starts were due to losses

outside of Toronto. Saskatchewan's housing starts hit a 14-month

high with a rebounding surge in multiples. (IHS Markit Economist Chul-Woo

Hong)

- Housing starts declined 4.4% month over month (m/m) to 251,151 units (annualized).

- All housing starts segments fell as urban single and multiple starts decreased 5.9% m/m and 4.0% m/m, respectively. Rural starts decreased 4.0% m/m.

- Starts dropped in half of the provinces, led by British Columbia, Ontario, and Alberta.

- While the declining trend was in line with our expectation, third-quarter housing starts average was less than the IHS Markit October forecast. Starts are expected to remain at a firm level in the fourth quarter.

- The Alberta Utilities Commission said in an October 18 notice that it will take comment until November 8 on an application from TransCanada Energy Ltd. for approval to construct and operate the Saddlebrook Solar and Storage Project. This project would consist of a solar photovoltaic plant with an installed capacity of 102.5 MW that would operate in conjunction with a battery storage facility with a capacity of 6.5 MW. The project would also include a collector system, access roads and the Saddlebrook 303S Substation. The project would be sited within the existing Saddlebrook Industrial Park, southeast of the intersection at Highway 2A and Township Road 200. (IHS Markit PointLogic's Barry Cassell)

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.4%, Spain/Germany -0.7%, and France/Italy -0.8%.

- 10yr European govt bonds closed lower; France/Italy/Spain/UK +3bps and Germany +2bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +3bps/259bps.

- Brent crude closed -0.6%/$84.33 per barrel.

- The LPG industry's road to a carbon-neutral bioLPG (also known

as bio-propane) future is strewn with feedstock quantity, quality,

and cost challenges that do not favor a discounted byproduct in the

shade of higher-value cuts of the crude barrel. (IHS Markit

Net-Zero Business Daily's Kevin Adler and OPIS' Inge Erhard)

- But industry participants in Europe believe some hurdles could be overcome with the use of eco-friendly substitutes and state support, according to executives participating in the recent European LPG e-Congress.

- LPG is used in Europe as a transportation fuel in the farming sector and, increasingly, for road transportation as well, according to the industry trade group Liquid Gas Europe. In its 2020 annual report, the association said LPG also covers the heating needs of more than 20 million EU citizens and 700,000 businesses.

- In the transport sector, LPG fuels more than 15 million vehicles at 47,000 stations. Demand increased 3% year over year in 2019 to 10.9 million metric tons.

- New energy taxation rules have been proposed in Europe as part of the EU's "Fit for 55" program aimed at achieving a 55% reduction in GHG emissions by 2030 from a 2005 baseline. The new rules would treat LPG as transition fuel, with preferential rates for a decade.

- MAN Truck & Bus, a subsidiary of Volkswagen (VW) Truck & Bus, in partnership with German logistics company Hamburger Hafen und Logistik AG (HHLA) has completed a three-year pilot project, according to a company statement. The project involved testing of automated trucks at the HHLA Container Terminal Altenwerder (CTA) as a part of mobility partnership between the City of Hamburg and VW Group. Logistics partner Spedition Weets carried 40-foot containers from Weets Logistic Center in Soltau to Hamburg on behalf of VW Group Logistics. To make way for a trained MAN safety driver, the Weets driver shifted to the passenger seat at the check gate of the terminal's entrance. The truck accelerated autonomously to reach block storage and maneuvered backwards into the correct parking position. After handling the container, the return trip to the check gate was also autonomous. The companies collaborated in 2018 as part of Hamburg TruckPilot, a project focusing on testing and development of autonomous trucks, to help truck drivers automate most of their tasks and rest while the truck is in motion, or while it is loading or unloading automatically. This project is a part of the strategic alliance between VW Group and the City of Hamburg, which is aimed at making the city a "futuristic, sustainable and integrated transport city model." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A second estimate shows French EU harmonized prices rising by

2.7% year on year (y/y) in September. This matches a provisional

estimate released in late September and follows readings of 2.4% in

August and 1.5% in July. (IHS Markit Economist Diego

Iscaro)

- September's inflation rate was the highest since late 2011.

- Energy prices continued to be the main contributor to headline inflation in September, increasing by 14.9% y/y (up from 12.7% y/y in August). Gas prices rose by 38.8% y/y (+31.2% y/y in August), while petroleum products and electricity prices rose by 19.6% y/y and 2.2% y/y, respectively.

- Food prices rose by 1.0% y/y, down from 1.3% in August. The prices of fresh food products continued to rise strongly, but their increase moderated from 6.8% y/y in August to 4.9% y/y.

- Core inflation, which is not released with the provisional estimate, eased from 1.5% (which had been the highest reading since July 2012) to 1.3% in August. Changes in the timing of the summer sales, when compared with 2020, have injected volatility to core inflation in recent months.

- Renault Group has revealed that its Hyvia joint venture (JV) with Plug Power has unveiled its first prototype vehicles based on the Master light commercial vehicle (LCV). The Master H2-TECH van, which will be displayed at the HyVolution trade show in Paris (France) later in October, features a 30-kW fuel cell, four 1.5-kg hydrogen tanks, and a 33-kWh battery that are said to offer a range of up to 500 km. However, it is also reported to offer 12 cubic meters of cargo volume. The van is expected to be available to customers from 2022. The JV has also revealed its hydrogen-refuelling station prototype. This can either provide hydrogen that is generated on site using water electrolysis or supplied ready converted in tanks. The system then compresses the hydrogen into storage before dispensing when required. It is reported to be able to refuel a vehicle in around five minutes and can be purchased, leased or rented from Hyvia. (IHS Markit AutoIntelligence's Ian Fletcher)

- Vestas has launched a new circularity roadmap which shows

details of a set of commitments to be implemented across the

company's value chain to accelerate the journey to reach zero-waste

turbines by 2040. Through the roadmap, the company aims to set a

new benchmark as the first wind industry leader to implement a

broad circularity approach for the wind industry within circularity

and waste reduction. The company also aims to develop the first

fully circular wind turbine, capable of keeping turbine materials

in circulation across the value chain for longer than ever before.

(IHS Markit Upstream Costs and Technology's Monish Thakkar)

- This step is the result of the evolution of the company's previously announced ambition to produce zero-waste turbines by 2040, which was launched as part of global sustainability strategy entitled 'Sustainability in everything we do'. The roadmap also outlines circularity pathways for Vestas' entire value chain by setting new targets across three key areas: design, operations, and material recovery.

- In design, the roadmap adds commitments to increase material efficiency by 90 per cent, achieve 100 per cent rotor recyclability and reduce in supply chain waste by 50 per cent, all by 2030. Across operations, commitments to expand efforts to refurbish and reuse turbine components, whilst regionalizing its repair and refurbishment infrastructure where possible are added. And for material recovery, commitments to achieve a 55 per cent total refurbished component utilization by 2030 and 75 per cent by 2040, in large part by creating new repair loops for minor components are added.

- Vestas has decided to install the V236-15.0 MW prototype

offshore wind turbine at the Østerild National test center for

large wind turbines. The development of the prototype has already

started across Vestas' R&D and production sites in Denmark. The

installation of the turbine prototype will take place in the second

half of 2022 and its first kWh is expected in the fourth quarter of

that year. (IHS Markit Upstream Costs and Technology's Monish

Thakkar)

- The blade molds will be developed at Vestas' blade factory in Lem and the 115.5-meter-long prototype will begin manufacturing later this year at Vestas' offshore blade factory in Nakshov. The nacelle will be developed and assembled at the offshore nacelle factory in Lindø port of Odense. All the large components will be preassembled and transported to Østerild, where the installation will take place.

- Initially the prototype will be installed onshore to facilitate easy access for testing prior to installation, and the main prototype components will already have undergone testing and verification. Also, during the initial period of operations, Vestas will collect data needed to obtain a Type Certificate, which will help company reach serial production of the turbine in 2024.

- Russian car-sharing company Delimobil has filed for an initial public offering (IPO) to list its shares on the New York Stock Exchange, reports Reuters. BofA Securities, Citigroup Global Markets, and VTB Capital will act as joint lead book-running managers and Renaissance Securities, Sberbank CIB, and Banco Santander will serve as joint book runners. Delimobil was established in 2015 and currently has a fleet of more than 16,000 vehicles, with more than 1 million members. The company announced its IPO plans in 2019, saying that it would float a 40% stake. In 2020, it announced plans to sell up to a 10% stake to investors in a pre-placement ahead of its IPO on the New York Stock Exchange. Recently, Delimobil received a USD75-million investment from Russia's second largest lender, VTB Bank. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Federal Government of Nigeria (FGN)'s official budget

deficit, released on 7 October, is expected to end fiscal year (FY)

2022 at 3.4% of GDP, based on the FGN's retained earnings

projections. The country's retained revenue and spending

projections diverted from the original 2022-24 Medium Term Fiscal

Framework (MTFF) to incorporate the terms in the Petroleum Industry

Act (PIA) 2021, as well as to allow for critical additional

expenditures, particularly defense spending. (IHS Markit Economist

Thea

Fourie)

- The FGN's retained revenue (including government-owned enterprises [GOEs]) is expected to end 2022 24.8% above the original MTFF estimates, at NGN10.13 trillion (USD24.6 billion). The revenue windfall will stem from stronger earnings assumed from GOEs, the introduction of an education tax and dividend from the Bank of Industry, and the FGN's oil royalty windfall based on transfers to the Nigerian Sovereign Investment Authority under the provisions of the new PIA. Overall oil revenue will make up 34.9% of total FGN revenue.

- FGN spending commitments are expected to exceed the original MTFF by 12.5% to end 2022 at a projected NGN16.39 trillion. Recurrent expenditure will make up 41.7% of the FNG's total spending commitment during 2022, followed by capital expenditure at 32.7% and debt-servicing costs at 22%. The Nigerian government's projections show that debt-servicing costs will take up 35.6% of total retained income of the FGN. The 13% possible deviation in government revenue is, however, not taken into consideration in the calculation.

- Financing of the 2022 budget deficit will depend mostly on external borrowing, with foreign lending financing NGN2.51 trillion of the budget deficit and multilateral/bi-lateral loans NGN1.16 trillion. Domestic financing is expected to end 2022 at NGN2.51 trillion, while privatization proceeds is penciled in at NGN90.7 billion.

- The 2022 FGN budget assumes GDP growth of 2.6% in 2022 while oil production is expected to reach 1.88 MMb/d in 2022, 2.23 MMb/d in 2023, and 2.22 MMb/d in 2024. A Brent oil price of USD57 per barrel is assumed over the MTFF period, while the official exchange-rate projection remains unchanged at NGN410.15 per US dollar over the 2022-24 period. The Nigerian government expects headline inflation to end 2021 close to 15%, slowing to 10% by the end of 2024.

Asia-Pacific

- Major APAC equity indices closed mixed; India +0.8%, Hong Kong +0.3%, Australia +0.3%, Mainland China -0.1%, Japan -0.2%, and South Korea -0.3%.

- Top Asian economies may need to spend the most decarbonizing

shipping, but industry experts say they are well positioned to

create business opportunities from these climate efforts. Taking a

look at China, Japan, and South Korea, which together account for

roughly a third of the world's CO2 emissions, ING analysts

concluded the countries' mid-century net-zero pledges will cost

them at least $12.4 trillion in the transportation sectors alone.

(IHS Markit Net-Zero Business Daily's Max Lin)

- Of the massive bill, $4.38 trillion is estimated to be devoted to shipping, $3.08 trillion to rail systems, $2.73 trillion to road transportation, and $2.22 trillion to aviation.

- The three countries are among the world's top 10 maritime trade nations by volume, and ING analysts assumed their seaborne cargo would be all carried by vessels running on ammonia generated from renewable energy.

- The scope of ING's study is limited to the capital costs in building sufficient electricity generation capacity that can power the three countries' transportation sectors. To simplify the calculations, spending on other parts of the supply chain is not taken into account.

- For now, green ammonia is produced from hydrogen generated from an electrolyzer powered by solar or wind power, and nitrogen separated from the air.

- Citing an unidentified source, Bloomberg reported on 15 October

that the China Banking and Insurance Regulatory Commission (CBIRC)

and the People's Bank of China (PBoC) have "told some major banks

to accelerate approval of mortgages" in the fourth quarter of 2021.

At the same time, to further increase the quota, banks are allowed

to sell mortgage-backed securities (MBS) to the market. Reuters

reported that the CBIRC and the PBoC did not comment. (IHS Markit

Banking Risk's Angus

Lam)

- In recent months, to ensure house-price stability, the banking regulators have limited the amount of loans that banks are allowed to disburse to real estate and mortgage sectors. On the other hand, local authorities are setting the maximum discount that real estate companies are allowed give at 30%.

- By allowing only major banks to relax their lending quota, it is unlikely to affect credit risk significantly because of the banks' better credit standards and liquidity position. However, IHS Markit is uncertain whether this is a permanent relaxation on the maximum mortgage proportion limit. For the largest banks, this is set at 32.5%, already much higher than the rate set for small and medium-sized banks, which have limits between 12.5% and 20%, and two large banks had already surpassed the limit set in mid-2021.

- National Electric Vehicle Sweden (NEVS), Evergrande's Swedish electric vehicle (EV) unit, which also owns assets in Saab, is in discussions with US and European venture capital firms and industrial partners to find buyers, according to Reuters. The company has declined to comment on its valuation but, according to an unnamed source, the unit is worth around USD1 billion. NEVS CEO Stefan Tilk said, "If Evergrande can continue its operations, which they hope to do, they will be interested in having a footprint in Europe, with infrastructure like a plant, tests, lab. And we have that." Evergrande Group has been in the headlines after it reported losses during the first half of the year. According to some reports, the real-estate group faces USD300 billion in debt and liabilities, and is seeking support from the Chinese authorities and investors to raise funds. However, last week Tianjin's local government gave assurances of support for the company. Evergrande Group acquired a 51% stake in NEVS in January 2019 as part of the group's plan to make inroads into the automotive industry. The group later increased its stake in NEVS to 82.4%. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korea's wine imports nearly doubled to $370.4 million in

the first eight months of 2021, up from $188.5 million between

January and August 2020, as more people enjoyed drinking at home

and alone amid the coronavirus pandemic. (IHS Markit Food and

Agricultural Commodities' Vladimir Pekic)

- The country's wine imports in the first eight months are already 12% larger than the total value of South Korea's wine imports in 2020 that amounted to $330.0 million.

- Trade data shows that Asia's fourth-largest economy imported 96.5% y/y more wine in the January-August period. This year's partial wine import value is a record figure for the first eight months of any previous year. Furthermore, demand for foreign wine also overshadowed beer imports, which amounted to $147.8 million in the eight-month period.

- South Korea's industry sources said wine imports soared in the first eight months as people preferred drinking by themselves at home instead of going to bars amid the coronavirus pandemic, reported the country's Yonhap news agency.

- France was the largest exporter of wine to South Korea at $116.6 million (+121.8% y/y), followed by the US at $61.0 million (+85.6% y/y), Italy at $60.0 million and Chile at $50.8 million (+48.1% y/y) in the first eight months of 2021.

- Other countries that reported large increases in exports to South Korea include Spain at $28.5 million (+83.7% y/y), Australia at $21.7 million (+95.8% y/y) and New Zealand at $10.1 million (+174.7% y/y).

- In contrast, beer imports dipped in 2021 as imports of Japanese brands tumbled on a boycott of goods from the neighboring country due to Tokyo's curbs on exports of key materials to Seoul. Also responsible was the growing popularity of homegrown craft beer among local drinkers, according to Yonhap sources.

- The average price of imported wine amounted to $7,085 per ton in 2021, up almost 20% y/y from $5,923 per ton in the period between January and August 2020.

- Ola Electric, the electric vehicle (EV) arm of ride-hailing startup Ola, has reportedly raised more than USD200 million in funding. Following this funding round, Ola Electric's valuation has reached more than USD5 billion, reports The Economic Times. The latest round saw participation from existing investors and some US-based bluechip tech funds. Ola Electric, which has launched its first electric scooter, plans to use the infused capital to accelerate the development of other vehicle platforms, including electric motorcycles, mass-market scooters, and an electric car. This comes days after Ola Electric raised more than USD200 million in funding from Falcon Edge, SoftBank Group, and others. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Indonesian government plans to produce 600,000 units of

battery electric vehicle (BEV) and 2.45 million units of electric

motorcycles by 2030, reports Antaranews. The government has

provided fiscal and non-fiscal incentives, including a zero-percent

sales tax on luxury goods (PPnBM) and a zero-percent vehicle

ownership transfer fee (BBNKB) for electric vehicle (EV) consumers

in Jakarta, as part of its efforts to boost BEV production,

according to Indonesian Industry Minister Agus Gumiwang

Kartasasmita. Meanwhile, in West Java, the BBNKB for EVs is set at

10% and that for electric motorcycles is set at 2.5%, with no down

payment on sales orders. Furthermore, to promote the use of EVs,

the government will issue a roadmap for EV use in state

institutions. Under the roadmap, the government targeted the

purchase of EVs to reach around 531,500 units by 2030. This is

split between 132,983 units of cars and 398,530 units of

motorcycles. The Indonesian government aims to make the country an

electrified vehicle hub for Asia and beyond, with the target of

starting production of such vehicles in 2022. The government also

aims for electrified vehicles to account for 20% of total car

production by 2025. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.