Daily Global Market Summary - 19 January 2022

All major US and most APAC equity indices closed lower, while European markets closed mixed. US government bonds closed slightly higher, while benchmark European bonds were lower on the day. CDX-NA closed wider across IG and high yield, iTraxx-Europe was flat, and iTraxx-Xover was slightly tighter on the day. Silver, copper, gold, and oil closed higher, while the US dollar and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -1.5%, S&P 500 -1.8%, Nasdaq -2.6%, and Russell 2000 -3.1%.

- 10yr US govt bond closed -1bp/1.87% yield and 30yr bonds -1bp/2.18% yield.

- CDX-NAIG closed +1bp/56bps and CDX-NAHY +3bps/317bps.

- DXY US dollar index closed -0.2%/95.51.

- Gold closed +1.7%/$1,843 per troy oz, silver +3.1%/$24.23 per troy oz, and copper +2.0%/$4.47 per pound.

- Crude oil closed +1.1%/$85.80 per barrel and natural gas closed -5.0%/$3.85 per mmbtu.

- US builders started 1.595 million houses in 2021, the highest

since 2006 and 15.6% more than in 2020; 1.123 million units

(highest since 2006) were single-family and 472,000 were

multifamily (highest since 1987). (IHS Markit Economist Patrick

Newport)

- Housing starts fell in the second and third quarters but bounced back to a 1.644-million-unit rate in the fourth, their highest level since the third quarter of 2006. It is too early to tell how much of this was weather-related and how much was underlying demand. December 2021 was the warmest December on record, going back to 1895; October and November also ranked in the top 10 warmest for their respective months. Housing starts in December increased 1.4% but that increase was not statistically significant.

- Builders took out an annualized 745,000 multifamily housing permits in December, a 30-year high. According to the press release, "Philadelphia enacted several real estate tax changes for residential projects permitted after December 31, 2021." These changes led builders to take out permits early. Single-family permits ended the year on a solid note, increasing 2.0% in December and 5.4% in the fourth quarter. Builders took out 1.725 million permits in 2021, 17.2% more than in 2020 and a 15-year high.

- The number of homes under construction in December increased to a seasonally adjusted 1.519 million, the highest total since November 1973. Authorized but not started homes are at a series high of 270,000 (data start in 2000).

- Builders are facing stiff pandemic-fueled headwinds—rising material costs, labor shortages, and issues with the supply chain for building materials. Another headwind has also emerged: higher mortgage rates, which have moved up 40 basis points in the past three weeks. All this adds up to declining housing starts this year.

- Ford has announced an agreement with security provider ADT to

create camera-based vehicle surveillance systems for retail and

fleet customers, as well as an agreement with payment service

provider Stripe to facilitate e-commerce and payments in North

America and Europe. With Stripe, Ford has signed a five-year

agreement to "transform the automotive e-commerce and payments

experience". (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Stripe is to enable FordPro FinSimple solutions for commercial customers. Ford says the Stripe Connect product will help it scale up new services that require a robust e-commerce system, facilitating payments and purchases between third-party buyers and sellers, including facilitating a customer's payments to the correct local Ford dealer, in the case of reservations for a new product.

- The agreement between Ford and ADT is a joint venture to bring to the market a new business called Canopy, which will provide artificial-intelligence (AI)-powered connected security cameras and a mobile app for monitoring security of a variety of vehicle makes and models. Ford also intends to integrate the service into future products. ADT is a home and property security company and, under the agreement with Ford, it will integrate its Safe ADT platform to provide professional monitoring of vehicles.

- Canopy is to build and sell the subscription product, and it was incubated in Ford's New Business Platform over the past two years. Canopy aims to arrive on the market early in 2023, with its first product designed to protect cargo areas of high-volume commercial trucks and vans in the United States and the United Kingdom, regardless of make. The first Canopy system will have an external camera the user can mount in a van's cargo area or a pick-up bed. The system will have acoustic sensors for vans, onboard cameras, radar, LTE and GPS. AI technology will identify and report credible threats, while reducing false alarm signals. Customers connect to the Canopy system via a smartphone app for a livestream video of the vehicle, receive notifications of suspicious activity, and are able to review past events. Canopy says the system can distinguish between benign acts and security threats, and it will alert ADT monitoring professionals if a person breaches the vehicle protection or is loitering near the vehicle.

- Both agreements are part of Ford's efforts to create a relationship with vehicle owners that it calls "always on" and which it outlined as part of its Ford+ plan. Both plans leverage technology that works with Ford vehicles but also draws on expertise the company does not have in-house. These new partnerships are not due for launch immediately. The rollout of the Stripe technology is expected to start in North America in the second half of 2022.

- Stellantis's aftermarket components arm Mopar has announced a new at-home plug-in wall charger designed for Jeep Wrangler 4xe and Chrysler Pacifica, while charging equipment supplier Blink Charge announced it is a supplier to General Motors (GM) dealers as that company prepares to roll out Utium electric vehicles (EVs) across brands. Mopar announced the new equipment in a press statement, the company says the new wall chargers are priced at USD599 and are "factory-backed, Wi-Fi capable" Level 2 (240-volt) units. Mopar notes that these can charge the Wrangler 4xe, Grand Cherokee 4xe and Pacifica in just over two hours, which it says is six times faster than a standard Level 1 (120-volt) charger. Mopar says its units are available in plug-in or hardwired units that can supply 32 amps/7.7kW maximum power. They are portable, lightweight and lockable for indoor or outdoor charging. Mopar is working with Qmerit to connect customers with installation, an installation company that several other automakers are also working with. Separately, Blink Charging announced that it is part of the GM rollout of EV charging stations at its dealerships in the US and Canada. Blink Charging is working with facilities solutions provider ABM to install its chargers at selected GM dealerships across the US and Canada. Although the number of chargers was not specified, Blink says it has shipped chargers and has orders on hand to install more chargers in the coming months. Blink says its IQ 200 chargers are the fastest Level 2 AC charging stations available; they deliver 80 amps of output to deliver 19.2 kW to EVs. The chargers can be wall-mounted, pole-mounted, or pedestal-mounted. According to IHS Markit light-vehicle registration data, through 30 November 2021, registrations of plug-in hybrid vehicles (PHEVs) jumped to 1.15% of the market, from 0.49% in 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

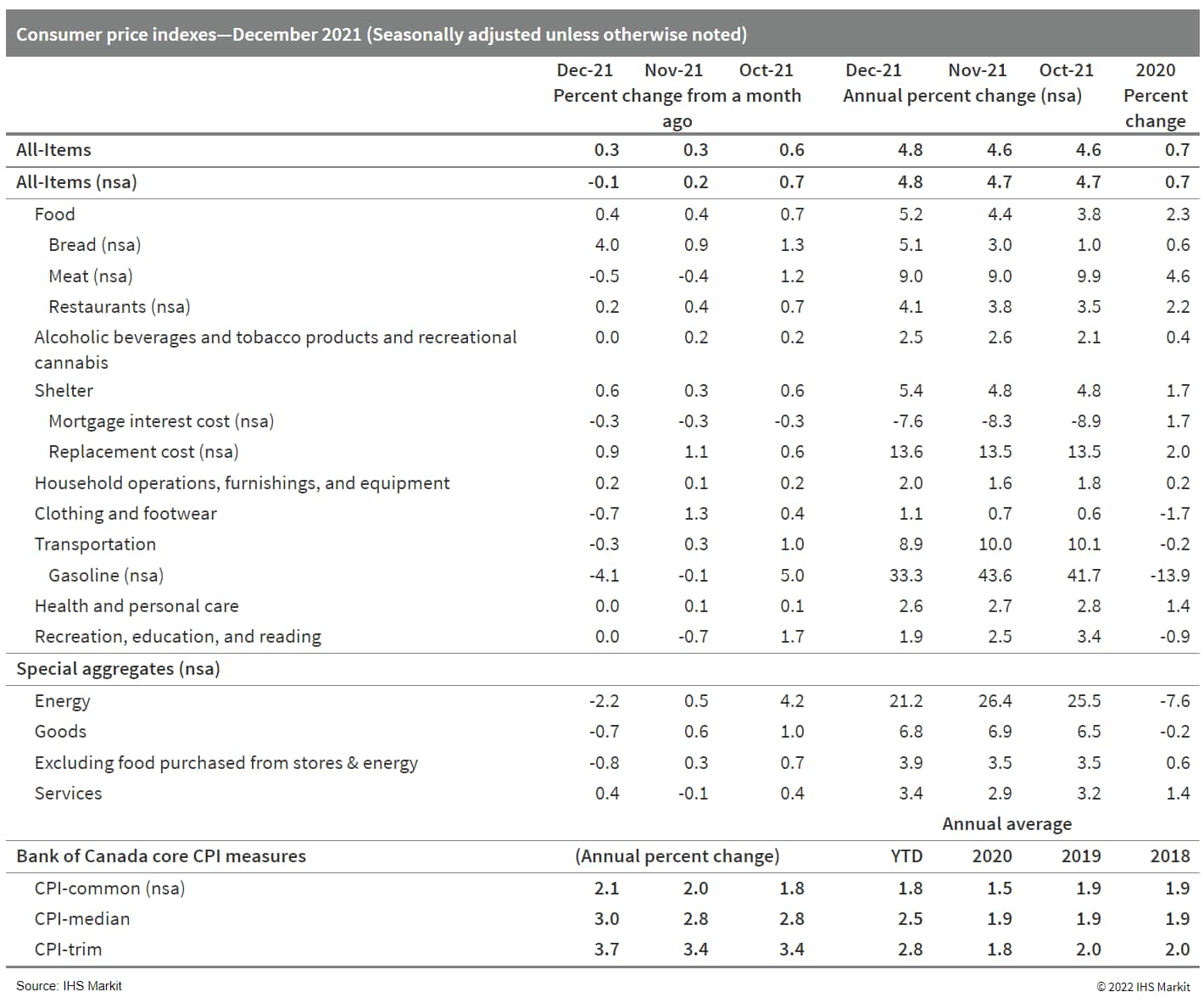

- Canada's consumer prices peaked once again in December,

matching rates not seen since the early 1990s. Annual price

inflation rose faster for food, shelter, household operations,

furnishings, and equipment, as well as clothing and footwear. The

monthly decline in gasoline prices contributed the most to the

slower annual increase in the transportation price index. Gasoline

price inflation moderated to 33.3% y/y in December after rising

43.6% y/y in November. Other top contributors to annual inflation

include homeowners' replacement costs at 13.6% y/y, purchase of

passenger vehicles at 7.2% y/y, other owned accommodation expenses

at 13.4% y/y, and meat at 9.0% y/y. As restrictions were few in the

month Canadians resumed usual December travel patterns as demand

lifted air transportation prices 24.7% m/m, which was similar to

the increase two years earlier. (IHS Markit Economist Arlene

Kish)

- There was a notable difference in the monthly change in consumer prices as there was a gain of 0.3% month on month (m/m) on a seasonally adjusted basis (SA) but a decline of 0.1% m/m on a non-seasonally adjusted basis (NSA).

- Annual inflation quickened to 4.8% year on year (y/y) NSA and SA.

- All three Bank of Canada preferred core inflation rates were higher in the month, averaging 2.9%, 0.2 percentage point higher than November's average.

- High inflation, pandemic restrictions, and consequential job

cuts are making a rough road for many Canadians in the third year

with COVID-19.

Europe/Middle East/Africa

- Major European equity markets closed mixed; France +0.6%, UK +0.4%, Germany +0.2%, Spain -0.1%, and Italy -0.4%.

- 10yr European govt bonds closed lower; Germany/France +1bp, Italy/Spain +2bps, and UK +4bps.

- 10yr German Bunds briefly traded at an intraday high yield of 0.02%, which was the first time it traded at a positive yield since 2019 before closing at a -0.01% yield.

- iTraxx-Europe closed flat/54bps and iTraxx-Xover -2bps/264bps.

- Brent crude closed +1.1%/$88.44 per barrel.

- The Office for National Statistics (ONS) has reported that the

UK's 12-month rate of consumer price index (CPI) inflation

increased from 5.1% in November to 5.4% in December 2021, the

highest rate since the series began in January 1997, and since

March 1992 (7.1%) when using the historical modelled data. (IHS

Markit Economist Raj

Badiani)

- During 2020 and 2021, CPI inflation averaged 0.9% and 2.6%, respectively.

- The CPI including owner-occupiers' housing costs (the CPIH) rose by 4.8% in the 12 months to December, up from an increase of 4.6% in November. In addition, the 12-month rate of the retail prices index increased to a 30-year high of 7.5% during the same month.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 26.8% year on year (y/y), the ninth successive double-digit increase. This was in line with global crude oil prices rising by 48.4% y/y to average USD74.4 per barrel (pb) in December, the 12th successive y/y gain.

- The ONS also reported an even sharper rise in household energy bills during December after the increased regulatory price cap on domestic natural gas and electricity from 1 October. Natural gas and electricity prices increased by 28.1% y/y and 18.8% y/y in December, respectively.

- Meanwhile, restaurant and café prices increased by 6.0% y/y in December, compared with a gain of 5.2% y/y in November.

- Food prices rose at a brisker rate, increasing by a nine-year high of 4.2% y/y in December from 2.4% y/y in November. This is a worrying development, adding to the cost-of-living crisis facing many UK households.

- The ONS also reported that steeper increases in prices of furniture and clothing contributed to the higher inflation rate during December.

- All-services price inflation was 3.4% in December, up from 3.2% in November; for goods, it stood at 6.9%, up from 6.5% in the previous month.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, moved up to 4.0% in November from 3.4% in October.

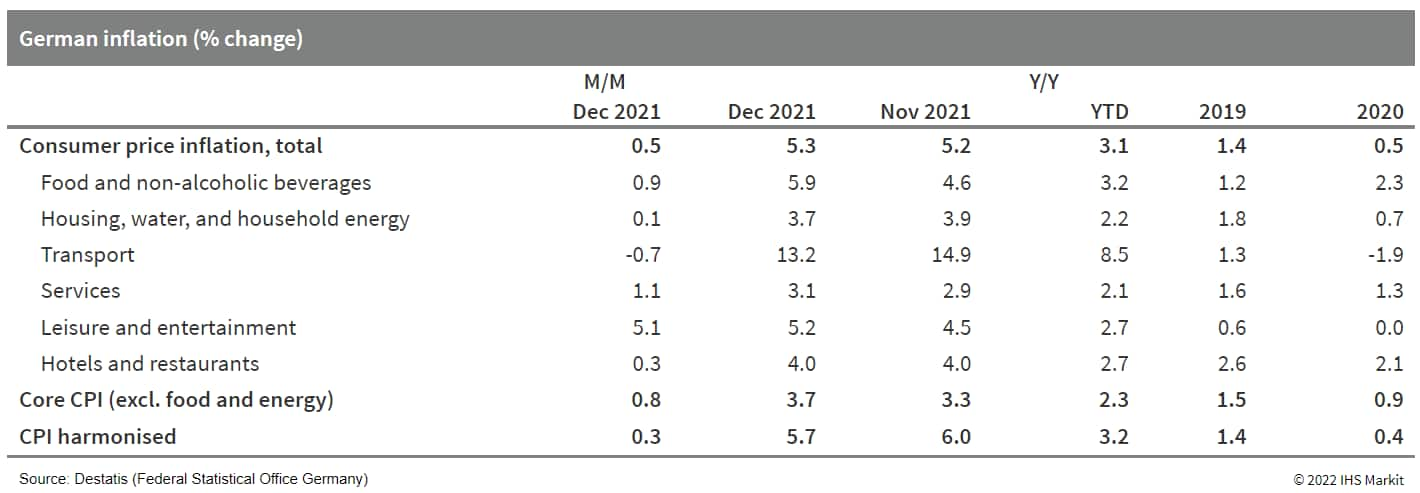

- Germany's final December inflation data based on national

methodology from the Federal Statistical Office (FSO) confirm the

'flash' release of 6 January, posting inflation rates of 0.5% month

on month (m/m) and 5.3% y/y. The latter is up slightly from

November's 5.2% and at its highest level since mid-1992, then

related to reunification. The 2021 average of 3.1% contrasts

starkly with average levels of just 1.5% in 2019 and even 0.5% in

2020. (IHS Markit Economist Timo

Klein)

- The EU harmonized consumer price index (CPI) measure only increased by 0.3% m/m in December, thus correcting from November's peak of 6.0% y/y to 5.7% y/y. This exceeded the eurozone average of 5.0%, but the gap narrowed compared with November (4.9%). The divergence between Germany's harmonized and national measures of inflation mainly owes to different weights for package tours and this component's extreme seasonality.

- The national core CPI (excluding food and energy) rate increased from November's 3.3% to 3.7% y/y in December, which compares with only 0.4% y/y in December 2020. Roughly one percentage point of this annual rate owed to the temporarily lower VAT rate during July-December 2020, an effect that will unwind now in January 2022.

- Underlying inflation is close to the 3% level at present, which

is attributable to rising prices for services and for various

commodities and intermediate goods, the latter owing to global

supply chain bottlenecks that have persisted for more than a year

now. In December, for instance, the annual inflation rate jumped

from 1.9% to 5.5% for clothing and shoes and increased from 4.5% to

5.2% in the category of recreation and entertainment (driven by the

increase in package tour prices reaching 11.8% y/y). Consumers have

both the means - via accumulated savings - and the urge to satisfy

pent-up demand from previous lockdown periods. This gives companies

the leeway to pass on their higher costs.

- Volkswagen (VW) and Bosch have signed a memorandum of understanding (MoU) to work towards exploring 'the establishment of a European battery equipment solution provider', according to a joint company statement. The two companies will work together to design a production platform to supply 'integrated battery production systems as well as on-site ramp-up and maintenance support for battery cell and system manufacturers.' The aim of the MoU is to eventually establish a joint venture (JV) business that will provide a cost and technology leadership 'turnkey' production solution for existing battery manufacturers. As part of the MoU's work, VW and Bosch aim to develop a production system that will employ a 'local for local' production approach, as much as possible, in order to maximize supply security, create simpler logistics networks and lower the environmental impact of the plants as much as possible. The rationale behind the partnership is the two companies' complementary areas of expertise, with VW - Europe's biggest carmaker - also moving towards becoming a large-scale battery manufacturer, Bosch brings significant knowledge in factory automation and systems integration. This is a smart move by VW as it can partner with Bosch to supply a turnkey battery cell production solution for its own plants, while also selling the production technology solution to other battery cell companies that want an easy and cost-effective way of establishing a presence in Europe, or indeed, elsewhere. The MoU also gives Bosch a route to become involved in the European battery manufacturing industry, which will undergo immense growth over the next decade. (IHS Markit AutoIntelligence's Tim Urquhart)

- Per capita consumption of potato in Germany was 59.4 kilograms

in the 2020/21 marketing year (July 2020-June 2021), about 2.0 kg

more than in the previous year, according to data from the Federal

Agricultural Information Center (BZL). (IHS Markit Food and

Agricultural Commodities' Cristina

Nanni)

- Demand for fresh potatoes rose against a downward trend for processed products. Fresh table potato per capita consumption is estimated at 24.2 kg, about 3.0 kg more y/y, while French fries, potato salad or potato chips, fell by 400 grams. The main reasons are the Corona-related restrictions on out-of-home consumption and increased meal preparation in private households.

- Due to a sharp decline in sales of processed potatoes, in particular French fries, part of the crop was earmarked to starch factories or became livestock feed. In the 2020/21 marketing year about 68% of potatoes used domestically were for food consumption (against 70% in 2019/20), 14% for starch (13% in 2019/20), 8% as seed potatoes (9% in 2019/20), and 4% as feed (3% in 2019/20). Losses were about 6% (5% in 2019/20).

- Cultivation area smaller again for the first time in 2021. The potato cultivation area in 2021 was 258,300 hectares - around 6% less y/y. This was the first time since 2016 that the cultivation area did not expand continuously. The preliminary harvest volume fell by a good 9% and amounts to 10.6 million tons.

- Navya will showcase fleet of autonomous shuttles running without an operator on board at the Autonomy Paris exhibition, according to a company statement. Navya said NavyaDrive and NavyaOperate are the two solutions that make up the software foundation of their autonomous vehicle (AV) system. At the exhibition, Navya will demonstrate its shuttles monitoring the environment autonomously and self-diagnosing their operations. Sophie Desormière, CEO of Navya, said, "These new developments provide transport operators with the critical functionalities to remotely control a fleet of autonomous vehicles. They improve service availability and ensure the safety of all shuttles and their passengers. This is a key achievement for Navya to launch the commercialization of its Level 4 solutions". Navya focuses on deploying Level 4 autonomous systems on a wide range of vehicle platforms. The company launched its Autonom Shuttle more than five years ago and claims to have sold more than 191 units across 23 countries as of June 2021. In 2017, Navya introduced Autonom Cab, which can carry six passengers at speeds of up to 55 mph. The company has also launched Autonom Tract for autonomous transport of goods. Recently, Navya launched the 6.X version of its AV system Navya Drive. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Following two public consultations, most recently between mid-June and end-August 2021, Spain's Official State Gazette published a new regulation on 17 January regarding advertising of crypto-assets for investment purposes, which will become effective one month later. The stock market regulator, the National Stock Market Commission (Comisión Nacional del Mercado de Valores: CNMV), drafted and will supervise the new requirements. For mass advertising, involving materials targeting 100,000 people or more, a "prior communication regime" will apply. Details of planned campaigns must be communicated to the CNMV at least 10 days in advance, with the CNMV entitled to block them, delay their commencement, or demand changes. All materials must be "clear, balanced, fair and non-misleading", and must warn investors that crypto-investments are unregulated and "may not be appropriate" since "the full amount invested may be lost". Additionally, vendors should attach links that explain risk factors in greater detail. The new rules apply both to crypto-asset service providers and the advertising sector, but continue not to regulate the assets themselves. The CNMV already intervened in November 2021 when footballer Andrés Iniesta recommended the Binance crypto-currency trading portal on social media; the CNMW responded by flagging "relevant risks" to investors from unregulated products. The CNMV measures align with wider concerns expressed by representatives of the European Central Bank (ECB), EU financial regulators, and national authorities over the risks of misleading private investors and inappropriate marketing. (IHS Markit Country Risk's Brian Lawson)

- Uber has partnered with energy supplier Repsol to accelerate electric vehicle (EV) adoption for its drivers in Spain, according to a company statement. Uber drivers using EVs or plug-in hybrid vehicles (PHEVs) will be able to use Repsol's electric charging points in Spain. Through this agreement, Uber drivers will also have access to a comprehensive home charging solution at a competitive price that includes advice, installation, maintenance, and operation of the charging point at home. In addition, Uber divers will have access to two free charges per month at public charging points as well as 50% off the charge price in Waylet, Repsol's payment app, for those who sign up for Repsol's home electricity tariff. The partnership will begin in Madrid and will then be extended to other cities in the country. Juan Galiardo, managing director of Uber in Spain, said, "As the largest mobility platform in Spain, we have a key role to play in the fight against climate change and the promotion of a more sustainable economic recovery. Today we are taking a big step in our commitment to become a zero-emissions platform by launching the first 100% electric product in Spain. In addition, we are partnering with an energy company such as Repsol to support drivers who work with our platform and facilitate their transition to electric vehicles." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to S&P Global's news outlet, foreign-owned bank

UniCredit SpA, Russia's 12th largest bank by assets, is aiming to

acquire PJSC Bank Otkritie Financial Corporation, the country's

sixth-largest bank. The merger, if it takes place, would create the

fourth-largest entity in the Russian banking sector by assets.

Otkritie has been owned by the Central Bank of the Russian

Federation (CBR) since it took it over after severe liquidity

strains in 2017. Prior to that, it was the largest privately owned

bank in Russia. The CBR in August 2021 released its intention to

offload shares in Otkritie, in the hopes of completely removing its

stake in the bank. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- While Unicredit appears not to be the only bank interested in acquiring Otkritie, its recent attempts to expand its operations (such as through Banca Monte dei Paschi di Siena SpA in Italy, which was unsuccessful because of valuation discrepancies between the relevant parties) suggest that it has the funds and strategic aims to concretize a merger.

- The latest developments in Otkritie suggest that its sale would not impose a burden on the sector as it has improved its balance sheet and has progressively become more efficient. Additionally, given its extensive network of operations across most of Russia, it could expand UniCredit's coverage domestically.

- Otkritie was one of the affected entities of the Moscow Garden Ring crisis in 2017, becoming the first bank to experience liquidity problems. In the years prior to that crisis, Otkritie had experienced very high levels of credit growth, prompted by related-party lending. The rapid levels of growth eventually eroded the trust of its depositors, leading to liquidity strains.

- Since its takeover by the CBR, Otkritie has refocused its efforts towards embracing digital technologies across its businesses. This acquired efficiency has translated into increased net interest margins, standing at 4.8% in September 2021, when last reported. Consequently, it has grown at a fast rate, particularly through 2021, where the total group assets grew by 9%, reaching RUB3,780 billion (USD49.3 billion), largely because of credit growth in the retail and small and medium-sized enterprise (SME) segments.

- The gross loan portfolio has also shown signs of improvement, with the non-performing loan (NPL) ratio falling to 6.1%, from 7.7% at the end of 2020, and the NPL coverage ratio increasing to 95.0%, from 86.0% as of end-2020, in the third quarter of 2021.

Asia-Pacific

- Most major APAC equity indices closed lower except for Hong Kong +0.1%; Mainland China -0.3%, South Korea -0.8%, Australia -1.0%, India -1.1%, and Japan -2.8%.

- The People's Bank of China (PBOC) announced a cut to the

medium-term lending facility (MLF) rate on 17 January. The PBOC

injected CNY700 billion worth of one-year MLF loans to replace the

CNY500 billion worth of matured loans, with the rate lowered to

2.85% from 2.95% in previous operations. This marks the first cut

since April 2020. (IHS Markit Economist Yating

Xu)

- The PBOC also announced seven-day reverse purchase rate cuts worth CNY100 billion, with the interest rate lowered by 10 basis points to 2.1%.

- The central bank's decision to cut policy rate in January 2022 - following the reserve requirement ratio cut, introduction of structural tools, and loan prime rate (LPR) cut in December 2021 - is in line with the authorities' pledge early this month to roll out monetary policies that support economic stabilization. It points to the increasing downward pressure on the economy, with the continuous real estate market weakness and spread of the Omicron variant of COVID-19. Expectations of a US rate hike also accelerated mainland China's monetary easing. We expect a corresponding cut to mainland China's LPR on 20 January 2022.

- BYD has entered into a joint venture (JV) with FAW Group (FAW) in China for electric vehicle (EV) battery development, manufacturing and sale, reports Yicai. BYD holds 51% of the JV through a wholly owned subsidiary while FAW holds the rest 49% through a wholly owned investment company. The two are said to be planning to build a production facility for EV batteries with an annual capacity of 45 GWh in northeastern China. The factory is to be built in three phases and will supply blade batteries for FAW's electric vehicles. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese battery manufacturer CATL has launched its battery-swapping service brand, EVOGO, in China. Through its wholly owned subsidiary, Contemporary Amperex Energy Service Technology (CAES), CATL says that it will soon begin to provide battery-swapping services in 10 cities in China under this new brand. The battery manufacturer demonstrated its battery-swapping solution at an online launch event and provided technical details regarding the design of its battery blocks, battery-swapping station, and service app. According to electrive, the battery block, which CATL is calling 'Choco-SEB', has adopted the company's cell-to-pack technology, in which the cells are integrated directly into the battery pack. "SEB stands for Swapping Electric Block and 'Choco' is meant to refer to the SEB's appearance, which is meant to resemble a bar of chocolate," said electrive. Thanks to the cell-to-pack technology, each of the Choco-SEB blocks can provide high energy density in a compact size. The battery block's energy density is said to be 160 Wh/kg and each of the battery blocks can provide a range of 200 kilometers. According to CnEVPost, CATL says that its battery-swapping service can be adapted to 80% of the world's vehicles already on the market and those due to be launched in the next three years on pure electric platforms. The battery manufacturer also showcased its battery-swapping station at the EVOGO brand launch. The battery-swapping station occupies only three parking spaces and takes approximately one minute to change a single battery block. CATL has also announced that the Bestune NAT, a model from the FAW Group, will be the first model to feature its battery-swapping system. However, the battery manufacturer has not provided any details about the Bestune NAT at this stage. CATL is the latest of an array of companies to announce plans to support the roll-out of EV battery-swapping stations in China. The field of battery swapping has attracted growing interest from both Chinese and foreign players in the past two years. In November 2021, British oil giant BP signed a deal with China's Aulton New Energy Automotive Technology (Aulton) to provide battery-swapping services in Guangzhou, Guangdong province, while Geely has also said that it will introduce a battery-swapping service brand this year. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) startup AIWAYS is said mulling over plans to produce vehicles in Europe, reports elective citing Alexander Klose, head of AIWAYS's overseas operations. Klose told German publication WirtschaftsWoche in an interview that a location has yet to be determined but the company would prefer to use an existing plant. He also stressed that these considerations are "still at the very beginning". AIWAYS's production plant in Shangrao (China) has capacity for 150,000 units and can be expanded to produce up to 300,000 vehicles per annum. The startup currently ships its vehicles from China to Europe. Although Klose did not rule out the possibility of launching production in Europe, it still seems too early for the startup to consider making substantial investment in production capacities in Europe. In Europe, AIWAYS has already started sales in Germany and plans to enter 10 countries this year, leveraging its two battery electric models, the U5 and U6. Last year, AIWAYS started co-operation with Italian auto distributor, Koelliker Group, to launch the AIWAYS U5 in Italy. The U5 is also available in Sweden under partnership with Andersen Motors. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Honda has announced that it signed an agreement with Boston-based SES Holdings in December 2021 for joint development of lithium-metal secondary batteries, reports JCN Newswire. The Japanese automaker plans to acquire approximately 2% of the shares of SES when it lists on the New York Stock Exchange (NYSE). The two companies will pursue joint research for the realisation of safe, high-durability, and high-capacity next-generation electric vehicle (EV) batteries. Honda's managing executive officer in charge of electrification, Shinji Aoyama, said, "The battery is an essential component of EVs, and Honda has been concurrently looking into several options toward the realization of high-capacity, safe and low-cost next-generation batteries. Recognizing the advanced technologies of SES, Honda signed a joint development agreement with SES with the aim to establish a good relationship with SES and expeditiously generate substantial achievements through our joint research activities. Honda will continue to establish collaborative relationships with companies which have advanced technologies, as needed, to offer highly-competitive and attractive EVs to our customers." (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korean President Moon Jae-in held talks with Saudi

Arabia's Crown Prince Mohammed bin Salman to co-operate on fields

including hydrogen. During the talks, the two leaders have agreed

to build a hydrogen ecosystem where Saudi Arabia will supply

carbon-neutral hydrogen and ammonia while South Korea will support

the Arab nation in operating hydrogen-powered cars and hydrogen

facilities such as fueling stations. Moon also confirmed that the

two nations have expanded co-operation beyond construction,

infrastructure and energy by signing 14 preliminary agreements on

areas of manufacturing, energy and public health as well as

hydrogen, reports The Korea Herald. The latest development is in

line with the South Korean government's aim to improve air quality

in the country by bringing down particulate levels, increasing the

adoption of alternative-powertrain vehicles, fostering

hydrogen-related businesses as future growth drivers, and reducing

the country's heavy reliance on imported oil. South Korea is one of

Saudi Arabia's key strategic partners for its Vision 2030 policy,

under which the country aims to reduce its reliance on oil and

develop its public service sector. Saudi Arabia plans to increase

hydrogen production to 400 tons per year by 2030, to achieve carbon

neutrality by 2060. (IHS Markit AutoIntelligence's Surabhi

Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.