Daily Global Market Summary - 2 June 2021

All major US and most European equity indices closed higher, while APAC markets were mixed. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed flat on the day across IG and high yield. The US dollar, oil, silver, and gold closed higher, while natural gas and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed slightly higher; S&P 500, Nasdaq, Russell 2000, and DJIA all closed +0.1%.

- 10yr US govt bonds closed -3bps/1.59% yield and 30yr bonds -1bps/2.28% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY flat/285bps.

- The Federal Reserve will soon begin selling off the corporate bonds and exchange-traded funds it amassed last year through an emergency-lending vehicle set up to contain the COVID-19 pandemic's economic fallout. The vehicle, known as the Secondary Market Corporate Credit Facility, or SMCCF, held $5.21 billion of bonds. In addition, it held $8.56 billion of exchange-traded funds that hold corporate debt. A Fed official said the sales should be completed by the end of this year. (WSJ)

- DXY US dollar index closed +0.1%/89.91.

- Gold closed +0.3%/$1,910 per troy oz, silver +0.4%/$28.20 per troy oz, and copper -1.3%/$4.59 per pound.

- Crude oil closed +1.6%/$68.83 per barrel and natural gas closed -0.9%/$3.08 per mmbtu.

- Organic investments by the world's global integrated oil

companies (GIOCs) on low-carbon projects held stable in 2020 at $6

billion, despite a 30% year-on-year downturn in total capital

spending due to COVID-19 cost-cutting. Low-carbon spending from

this peer group is expected to accelerate to $15 billion/year by

2025, according to IHS Markit. (IHS Markit Climate and

Sustainability News' Kevin Adler)

- "Organic spending" is expenditure on existing operations and company-developed new projects, in contrast to merger-and-acquisition (M&A) activity. IHS Markit noted that some of the GIOCs, particularly TotalEnergies, have been aggressive in low-carbon M&A as well. "Furthermore, given rapidly changing developments within this area, the balance of risks is skewed toward higher organic spending," said Chris DeLucia, director; Franca Davila, associate director; and senior analysts Claudia Belahmidi and Alyssa Coelho in a presentation on 19 May.

- Identifying BP, Chevron, Eni, Equinor, ExxonMobil, Shell, and TotalEnergies as GIOCs, IHS Markit said these companies continued to maintain their low-carbon investments last year despite sharp overall capex reductions. These decisions mark "an inflection point" that shows "the rising prominence of low-carbon portfolios" in their strategies, IHS Markit added.

- However, the companies in the peer group are taking different

spending approaches in their low-carbon investments:

- BP and Eni have been reallocating capital most heavily to the low-carbon space, with IHS Markit forecasting it will represent 20-30% of their total organic spending by 2025.

- Equinor, Shell, and TotalEnergies are expected to direct 10-20% of their annual capital to this segment by 2025.

- Chevron and ExxonMobil will spend about 3% of capex on low-carbon activity through the medium term, and IHS Markit said those investments will "align with or are complementary to the core oil and gas business."

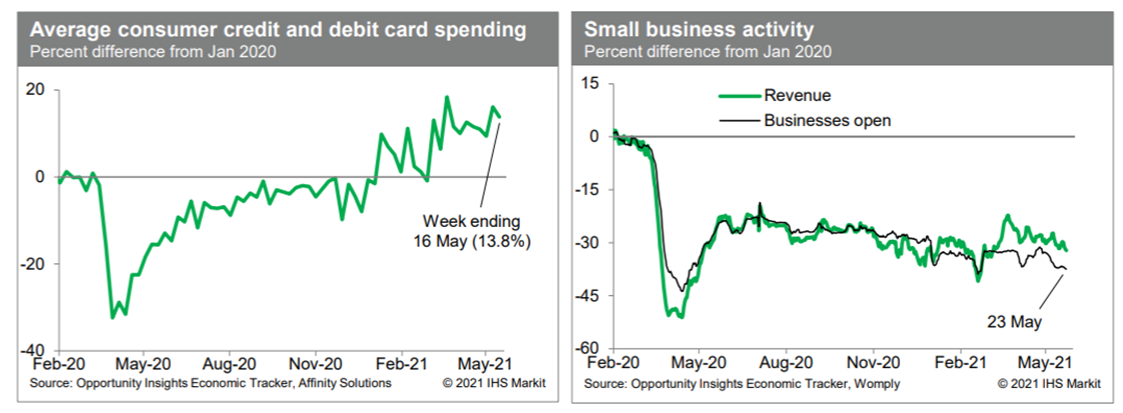

- Average consumer credit- and debit-card spending remained

strong during the week ending 16 May at 13.8% above the January

2020 level, according to the Opportunity Insights Economic Tracker.

This was down slightly from 16.1% above the January 2020 level as

of the prior week but nevertheless suggests robust retail and food

services sales through May. Meanwhile, small-business activity

(revenues and the number open) remained depressed through 23 May,

according to the Opportunity Insights Economic Tracker. These data

suggest that the small-business sector has yet to participate in

the broad recovery. Separately, the IHS Markit GDP-weighted US

weekly containment index declined (eased) 6.1 index points this

week to 14.8, continuing a string of easings that began in late

January and accelerated in March. This week's decline reflects

easing conditions in 33 states, with the largest contributions

originating in Texas, Massachusetts, New York, and Pennsylvania.

(IHS Markit Economists Ben

Herzon and Joel

Prakken)

- JBS says 'vast majority' of its facilities will reopen today.

JBS USA and Pilgrim's said that after making "significant progress"

in the wake of the cyberattack and that its systems are "coming

back online." Given the progress made in the past 24 hours, JBS

said Tuesday evening that "the vast majority of our beef, pork,

poultry and prepared foods plants will be operational tomorrow."

(IHS Markit Food and Agricultural Policy's Richard Morrison)

- The firm said that on Tuesday, JBS USA and Pilgrim's were able to ship product from "nearly all its facilities to supply customers." JBS said it continues to make progress to resume plant operations in the US and Australia and its Canada beef facility resumed production.

- The firm reiterated its prior assertion that they are unaware of any customer, supplier or employee data was compromised in the attack. Meanwhile, USDA released a statement that they have been reaching out to other meat packers and to food, agriculture and retail organizations on the matter. "USDA continues to work closely with the White House, Department of Homeland Security, JBS USA and others to monitor this situation closely and offer help and assistance to mitigate any potential supply or price issues," the agency said.

- "As part of that effort, USDA has reached out to several major meat processors in the United States to ensure they are aware of the situation, encouraging them to accommodate additional capacity where possible, and to stress the importance of keeping supply moving." As for the retail side, USDA said it has emphasized "maintaining close communication and working together to ensure a stable, plentiful food supply."

- Ørsted and Eversource have signed a charter agreement with Dominion Energy for its Jones Act compliant Wind Turbine Installation Vessel (WTIV), Charybdis. The vessel will carry out turbine installation activities in support of Ørsted and Eversource's offshore wind developments: Revolution Wind and Sunrise Wind. Dominion says the charter terms also allow the vessel to support construction activities at the developer's Coastal Virginia Offshore Wind project, which is expected to be operational by the end of 2026. Charybdis is under construction at Keppel AmFELS in Brownsville, Texas, and is expected to be delivered in late 2023. During construction of Revolution and Sunrise Wind, the WTIV will work out of State Pier in New London, Connecticut. Revolution Wind is a proposed 704 MW windfarm that will sit off the coast of Rhode Island, while the 924 MW Sunrise Wind project will be located 30 mi (48 km) east of Montauk Point, New York. The USD500 million vessel will operate as part of Dominion Energy's Contracted Assets segment, and will be homeported in Hampton Roads, Virginia. According to Dominion Energy, the vessel is designed to handle next-generation turbine sizes of 12 MW or larger, as well as foundations. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Tesla CEO Elon Musk has posted on Twitter that the first Model S Plaid deliveries are to be on 10 June, and that recent Model 3 and Model Y price increases have been made on materials costs and supply-chain issues, report several media outlets. On the price rises, Musk tweeted, "Pricing increasing due to major supply chain price pressure industry-wide. Raw materials especially." Musk's tweet was in response to a post on Twitter from someone complaining about the pricing changing, as well as vehicle content. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) company Cruise LLC, which is backed by General Motors and Honda Motor, has urged President Joe Biden to support efforts to accelerate AV deployment in the United States, reports Reuters. Cruise has requested that Biden support legislation raising the cap on the number of AVs that a company can seek to be exempted from existing federal safety rules. Cruise CEO Dan Ammann, in a letter to Biden, wrote that the cap, "acts as a U.S.-only impediment to building these vehicles at scale in the United States. China's top down, centrally directed approach imposes no similar restraints on their home grown AV industry. We do not seek, require or desire government funding; we seek your help in leveling the playing field." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Central Bank of Colombia (Banco de la República de Colombia: Banrep) on 31 May published its Financial Stability report covering March 2021 data. The key points of the report are a sharp increase in the loans-at-risk (LAR) ratio, rising from 9.2% of total loans at the end of 2019 to 12.4% in January 2021. All segments of the credit portfolio rose, although corporate and microfinance were the most affected, reaching their highest levels since Banrep started to measure them in 2007. Moreover, debt service ratios are at their highest levels since 2003, with household debt instalments representing 28.4% of their total income, well above the historical average at 22.4%. Additionally, corporations at a "fragile" state (a measure that compounds their solvency, impairment, and debt service ratios) increased over the same period, driven by an increase in interest coverage. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

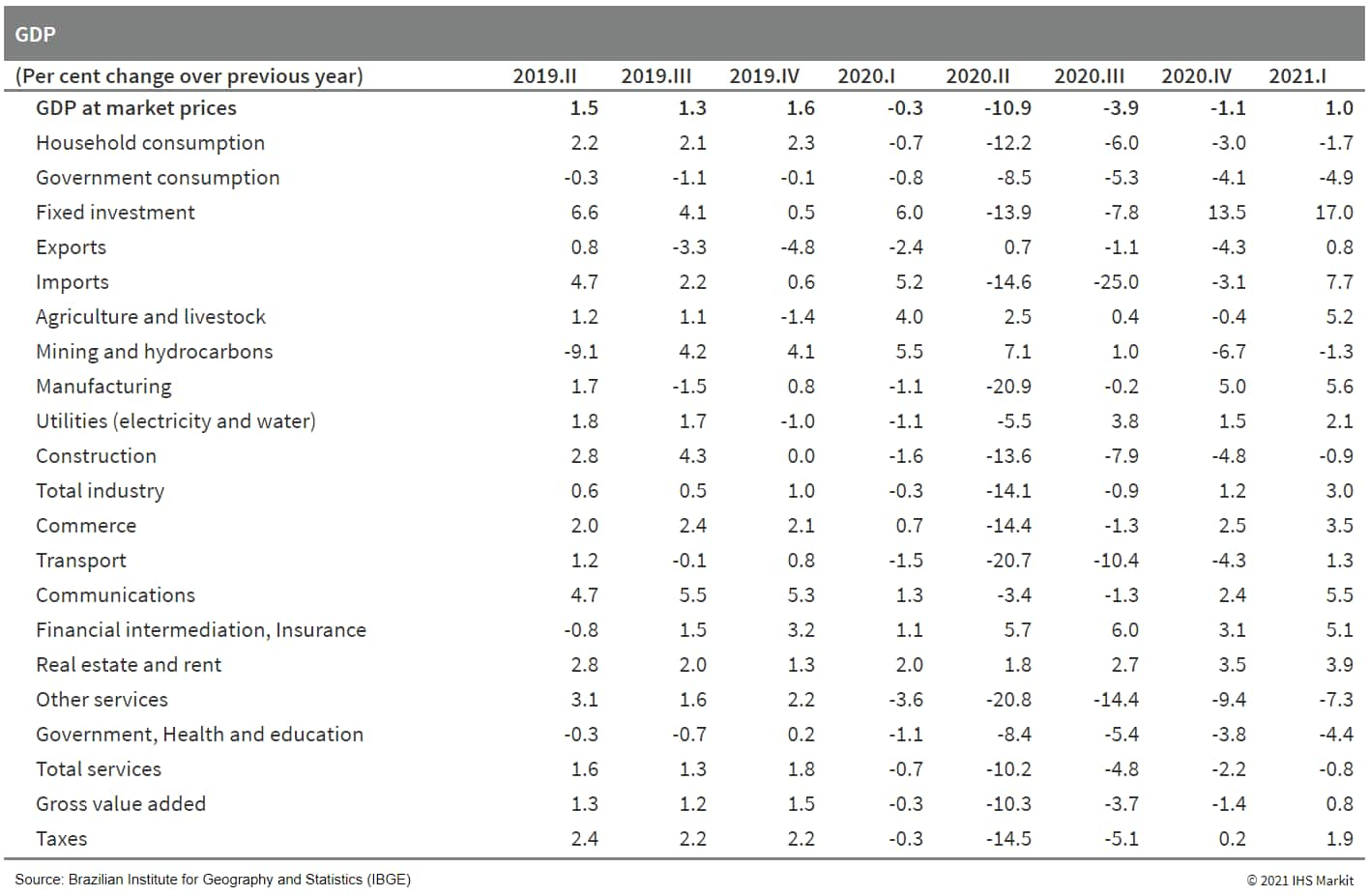

- The Brazilian Institute of Geography and Statistics (Instituto

Brasileiro de Geografia e Estatísticas: IBGE) has reported that GDP

grew by 1.2% in the first quarter of 2021 compared with the

previous quarter, based on seasonally adjusted data. (IHS Markit

Economist Rafael

Amiel)

- GDP has returned to its fourth-quarter 2019 level; stronger-than-anticipated growth in January to March points to an upwards revision for the full-year 2021.

- Quarter on quarter (q/q), consumption (both government and private) was down; the interruption of government cash transfers to households during the first quarter had a negative impact on their ability to spend. Unemployment also remains relatively high and, according to the IBGE, wages also did not increase.

- Growth in the first quarter was driven by the strong rebound in fixed investment, coupled with a favorable global scenario that not only helped volume exported but also revenues as skyrocketing commodity prices favored exports and tax collection. Exports of iron ore and soya beans are climbing sharply. Inventory replenishment also explains growth in January to March.

- Credit continued to grow in the first quarter and supported

investment and consumption.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Spain -0.1%; France +0.5%, UK +0.4%, Germany +0.2%, and Italy +0.2%.

- 10yr European govt bonds closed higher; UK -3bps, Germany/France/Italy -2bps, and Spain -1bp.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -1bp/243bps.

- The y/y rate of increase in the eurozone producer price index

(PPI) jumped again in April, from an already elevated 4.3% to 7.6%,

the highest rate since September 2008. (IHS Markit Economist Ken

Wattret)

- This was above the market consensus expectation (of 7.3%, according to Reuters' survey) and not far below the record high for the series (of 8.9% in July 2008).

- Energy has been pivotal to the recent surge, with the y/y rate of change in the energy sub-index soaring to over 20% in April, again close to its record high.

- Eurozone PPI inflation excluding energy prices has also picked up markedly over recent months, with the average month-on-month (m/m) increase over the three months to April (of 0.8%) not far short of the equivalent rise in the overall index (of 0.9%).

- On a y/y basis, the ex-energy PPI inflation rate rose from 2.3% to 3.5% in April, the highest rate since September 2011, with the upward pressure set to continue

- The EU has authorized the first insect as a novel food under the 2015 regulation (2283/2015) clearing French producer SAS EAP Group Agronutris to sell dried yellow mealworm for use as whole insects or as a powder ingredient in other foods. A 1 June Commission implementing regulation authorizes Agronutris to sell dried Tenebrio molitor larva (yellow mealworm), whole or in powder, from 22 June. The regulation sets a 10 gram per 100g limit on the powdered mealworm content, which it specifies can be used in protein products, biscuits, legumes-based dishes or pasta-based products. Either snacks containing the whole dried insects or foods containing the powdered form must be labelled as "Dried Tenebrio molitor larva (yellow mealworm)". Allergen labelling is also required. More precisely a statement, which has to appear in close proximity to the list of ingredients, that the dried yellow mealworm may cause allergic reactions to consumers with known allergies to crustaceans and dust mites. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Porsche is looking at building a rival to the new BMW i4 battery electric vehicle (BEV), which would probably slot into the brand's range below the Taycan model, reports Autocar. According to the report, the model would be closest to the forthcoming Audi A4 e-tron model and would use the new Premium Performance Electric (PPE) architecture being developed jointly by Porsche and Audi. Autocar reports a source in Porsche's engineering department as saying, "The modular nature of the PPE platform will allow us to extend our electric car line-up with a range of different models. It is engineered for standard and high ground clearance. A second sedan [saloon] model is one possibility." (IHS Markit AutoIntelligence's Tim Urquhart)

- Total employment in Italy rose for a third straight month when

rising by 0.1% month on month (m/m), or 19,000 to 22.344 million in

April. Nevertheless, cumulative job losses during March 2020-April

2021 stood at 814,000, or 3.5% lower when compared with February

2020, the pre-pandemic level. (IHS Markit Economist Raj

Badiani)

- The unemployment rate rose from 10.4% in March to a 30-month high of 10.7% in April. The number of unemployed people increased by 88,000 m/m to 2.67 million in April.

- The rise in the unemployment rate in April was primarily due to the inactivity rate falling for a second straight month. Despite continued COVID-19 containment measures targeting the hospitality, transport, and retail sectors, the number of people neither working nor looking for work fell in April.

- Furthermore, the labor force participation rate rose to 63.8% in April, but still remains below its pre-COVID-19 level of 65.2% in February 2020.

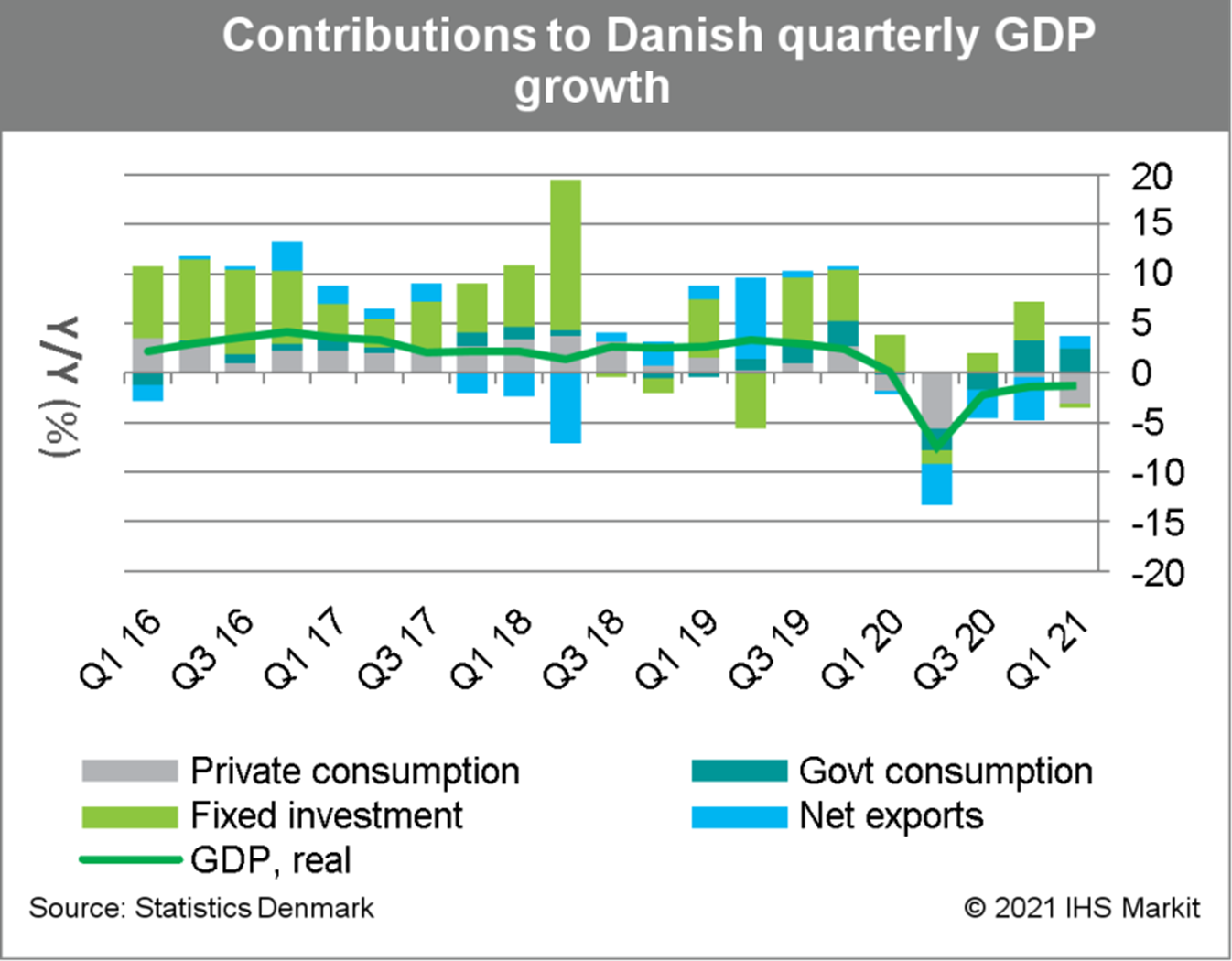

- According to a detailed release of Statistics Denmark, Danish

real GDP growth amounted to -1.3% quarter on quarter (q/q) in the

first quarter of the year, which means the economy fell back into

contraction, after rebounding by 0.8% q/q in the final quarter of

2020. As of the first quarter, the total size of the Danish economy

amounted to DKK 526.7 billion, which is still 2.7% below its

pre-pandemic level of DKK 541.4 billion, as of the fourth quarter

of 2019. (IHS Markit Economist Michal Plochec)

- The detailed expenditure breakdown reveals that compared to the last quarter of 2020, the main drag on growth in the first quarter of 2021 was private consumption, which contracted by 4.9% q/q. Also, government consumption as well as fixed investment declined by 2.2% and 0.5% q/q respectively. On a positive note, exports in the first quarter grew by an impressive 6.1% q/q, while imports increased by 1.6% q/q.

- In annual terms, the economy shrunk for the fourth consecutive

quarter: by 1.3% year on year (y/y) in the first quarter of 2021,

after shrinking by 1.4%, 2.2% and 7.5% y/y in the fourth, third and

second quarters of 2020 respectively. Also, when comparing to the

corresponding quarter of 2020, the main drag on growth in the first

quarter was private consumption, which contracted by 3%, while the

major category which contributed positively to the headline growth

was government consumption, which increased by 2.5% y/y

- Fred. Olsen Windcarrier has signed three new wind turbine transport and installation (T&I) contracts totaling USD151 million (EUR124 million) over the past two months. The awarded contracts are for work in Europe and Asia Pacific from 2022 to 2024. An upgraded vessel will execute two contracts and the projects will cover up to 630 vessel days in total. Fred. Olsen Windcarrier's wind turbine installation vessel (WTIV) Bold Tern is expected to depart Europe in the summer of 2021 to undergo a planned crane upgrade and will remain in Asia Pacific to fulfill commitments during 2022. Bold Tern will replace WTIV Brave Tern to undertake the T&I of 62 MHI Vestas Offshore V174-9.5MW wind turbines at Copenhagen Infrastructure Partners' 589 MW Changfang and Xidao offshore wind farms in Taiwan. The swap will allow Brave Tern to complete wind turbine installation for Siemens Gamesa Renewable Energy at developer wpd's 640 MW Yunlin wind farm offshore Taiwan in a continuous campaign. Meanwhile, Fred. Olsen has sent WTIV Blue Tern to Moray Offshore's 950 MW Moray East in the UK North Sea to continue the turbine installation which had originally commenced with Bold Tern. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- EasyPark Group has announced the completion of its acquisition of digital parking services provider Park Now after receiving approval by the relevant anti-trust authorities, according to a company statement. Park Now is a part of EasyPark Group effective from 1 June. The deal enables EasyPark Group to expand in the digital parking, electric vehicle (EV) charging and mobility services. Johan Birgersson, CEO of EasyPark Group, said, "This is a historic milestone in the industry, and we are very excited to embark on this journey. Most of all, I am proud to be leading such a strong organization with talented employees. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Central Bank of Kenya's (CBK) 2020 Bank Supervision Annual

Report contains the biannual FinAccess Business Supply-Side Survey

conducted in February 2021. This survey highlighted that, as

expected, micro, small, and medium-sized enterprises (MSMEs)

struggled to service their loans in 2020, leading to a significant

rise in defaults when compared with 2017 (the last time the survey

was conducted). (IHS Markit Banking Risk's Ronel Oberholzer)

- The survey shows that 15.5% of the total value of MSME loans was classified as non-performing as of December 2020, compared with 13.6% in 2017. The survey attributes this rise to the COVID-19-virus pandemic affecting borrowers' debt service capacity.

- It shows that MSME loans constitute around one-fifth of the overall banking sector's loans. The value of the MSME portfolio was KES638 billion (USD5.84 billion), 21% of the total banking sector loan portfolio in 2020, up from KES414 billion or 19.2% of the entire loan book in 2017.

- MSME loans grew at an annual average rate of 15% between 2017 and 2020, higher than the 11% average yearly growth for the overall banking sector's loan portfolio.

- South Africa's unemployment remained broadly unchanged at 32.6%

during the first quarter of 2021, from 32.5% in the previous

quarter, latest figures from South African statistical agency

Statistics South Africa (StatsSA) show. An additional 8,000 people

were added to the unemployed pool, the majority from the private

households, informal, and agricultural sectors of the economy. The

number of people added to the formal-sector job market during the

first quarter amounted to 79,000. Overall, "compared to a year ago,

total employment decreased by 1,4 million", StatsSA reported. (IHS

Markit Economist Thea

Fourie)

- The biggest gains in quarterly formal-sector employment were in the finance sector (215,000), followed by utilities (16,000), community and social services (16,000), and mining (12,000). Sectors in which job losses continued were construction (87,000), trade (84,000), and transport (40,000).

- Compared to a year ago, sectors of the economy in which job cuts were the largest were trade (341,000), construction (265,000), manufacturing (208,000), community and social services (192,000), and private households (189,000).

Asia-Pacific

- APAC equity markets closed mixed; Australia +1.1%, Japan +0.5%, South Korea +0.1%, India -0.2%, Hong Kong -0.6%, and Mainland China -0.8%.

- Chery Automobile has deepened its co-operation with iFlytek to use each other's resources to develop a series of intelligent products. This includes the development of smart cockpit, Internet of Vehicles solutions, and intelligent vehicle audio systems. The partnership also aims at jointly trying in building an autonomous vehicle that can reach Level 4 under specific scenarios. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup NIO said that its vehicle deliveries in May increased by 95.3% year on year (y/y) to 6,711 vehicles. The deliveries consisted of 1,412 units of the ES8 sport utility vehicle (SUV), 3,017 units of the ES6 SUV, and 2,282 units of the EC6, a couple-style variant of the ES6. In the first five months of 2021, cumulative deliveries of the ES8, ES6 and EC6 stood at 109,514 units. The automaker has maintained delivery guidance of 21,000-22,000 vehicles in the second quarter of 2021. In a separate statement, EV startup Xpeng said that it delivered 5,686 vehicles in May, consisting of 3,797 units of the P7 sedan and 1,889 units of the G3 SUV. In the year to date (YTD), deliveries stood at 24,173 units, up 427% y/y. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Mitsui Chemicals and BASF's Japanese subsidiary have started a collaborative study to promote chemical recycling in Japan, Mitsui says. By cooperating across the value chain, BASF and Mitsui will evaluate collaborative business models and various options to commercialize chemical recycling in Japan to address the local challenge of plastic waste recycling, it says. Mitsui notes that BASF, through its ChemCycling™ project, is working with technology partners that use novel technologies to convert post-consumer plastic waste into pyrolysis oil that can serve as a feedstock to produce chemicals. These chemicals are used to produce new materials such as plastics without compromising on quality in even the most sensitive applications, Mitsui says. The share of recycled material is allocated to these products according to a third-party audited mass-balance approach. From 2025, BASF aims to process 250,000 metric tons/year of recycled feedstock, according to Mitsui. (IHS Markit Chemical Advisory)

- Mitsui Chemicals says its affiliate Prime Polymer will construct a polypropylene (PP) manufacturing facility at Chiba, Japan. The PP plant will have a production capacity of 200,000 metric tons/year. Construction work will commence in August 2021 and operations will start in November 2024. The project forms part of plans for a scrap-and-build-style restructuring of Prime Polymer's production system, Mitsui adds. Prime Polymer, meanwhile, plans to close an existing PP facility to align its capacity to the current supply/demand balance. Through the restructuring, Prime Polymer anticipates an approximately 70,000 metric tons/year reduction in greenhouse gas emissions compared with 2013 figures. Mitsui Chemicals says that the new PP plant will meet the need for lightweight and thin automotive materials. "Through its offering of recycling-conducive materials here, Prime Polymer will help drive material recycling," it adds. (IHS Markit Chemical Advisory)

- Nissan and Mitsubishi's 50/50 joint venture (JV), NMKV Company Ltd, plans to add production of new electric minivehicle models (known as Kei cars in Japan) at Mitsubishi's Mizushima plant. An investment of nearly JPY8 billion (USD73 million) has been set aside for the plant to add production of the new models. NMKV president Junichi Endo said, "NMKV is combining the best of Nissan and Mitsubishi Motors to create appealing vehicles for Japan's national car, the minivehicle. Going forward, the three companies will continue to strengthen the source of their strength, Japanese manufacturing capabilities, and cross-company and cross-functional collaboration to promote even better vehicle manufacturing through the teamwork of the alliance." As of May this year, combined sales of vehicles produced under the JV had reached a cumulative total of 1.52 million units. (IHS Markit AutoIntelligence's Isha Sharma)

- PepsiCo has announced an exclusive beverage partnership with an Australian fast food chain. FAT (Fresh. Authentic. Tasty.) Brands is the parent company of nine restaurant concepts. Under the new agreement, FAT Brands restaurants such as Fatburger, Johnny Rockets and Elevation Burger will sell up to a dozen popular PepsiCo beverages, including Pepsi, Diet Pepsi, Mountain Dew, Brisk Iced Tea, Tropicana Fruit Punch and Dr Pepper. The companies will also debut new, brand-specific offerings at the restaurant level, as well as a variety of items from the PepsiCo food and snacks line-up. Additionally, many franchisees will expand their bottle and can offerings of soft drinks and Aquafina and leverage PepsiCo's digital expertise to further build on their takeout and delivery business, as consumer demand has increased. (IHS Markit Food and Agricultural Commodities' Neil Murray)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.