Daily Global Market Summary - 20 April 2021

APAC equity markets closed mixed, while all major US and European indices closed lower. US and benchmark European government bonds closed higher on the day. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar and gold closed higher, silver was flat, and oil, copper, and natural gas closed lower.

Americas

- US equity indices closed lower for the second consecutive day; S&P 500 -0.7%, DJIA -0.8%, Nasdaq -0.9%, and Russell 2000 -2.0%.

- 10yr US govt bonds closed -4bps/1.56% yield and 30yr bonds -4bps/2.26% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +6bps/297bps.

- DXY US dollar index closed +0.2%/91.24.

- Gold closed +0.4%/$1,778 per troy oz, silver flat/$25.84 per troy oz, and copper -0.6%/$4.21 per pound.

- Crude oil closed -1.2%/$62.67 per barrel and natural gas closed -0.8%/$2.73 per mmbtu.

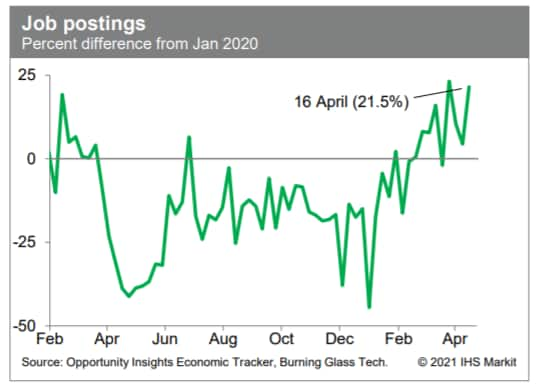

- Job postings last week were 21.5% above the January 2020 level,

according to the Opportunity Insights Economic Tracker. These data

are volatile, but recent averages are well above averages from last

summer and fall, suggesting an improving trend in labor demand.

(IHS Markit Economists Ben Herzon and Joel Prakken)

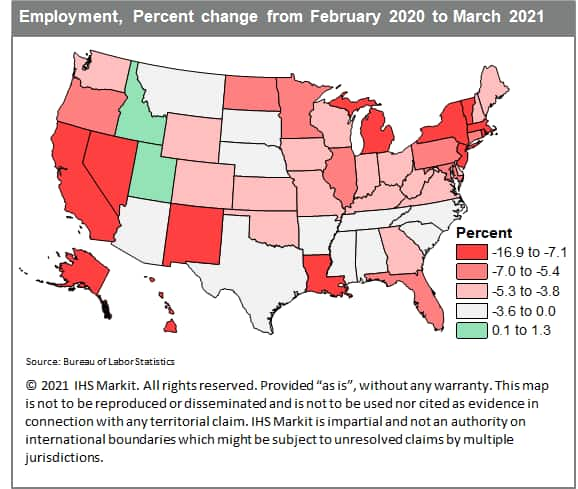

- The percentage change in payrolls from February 2020 to March

2021 shows which state economies have fared the best or worst since

the beginning of the pandemic. States in the Northeast,

specifically New York, Massachusetts, New Jersey, Vermont, and

Rhode Island, suffered the biggest early employment impacts from

the coronavirus outbreak and efforts to contain it. Tourism and

travel-reliant states such as Hawaii and Nevada, and heavily

goods-producing midwestern states such as Michigan, also sustained

heavy blows. A good portion of manufacturing jobs have now

returned, but businesses dependent upon travel and tourism face a

much longer road to recovery. In all these states, including the

Northeast, Hawaii, Nevada, and Michigan, March 2021 payrolls were

still at least 7.2% below last year's level. (IHS Markit Economist

Steven Frable)

- The non-dairy ice cream market is growing at a compound annual growth rate of 13.7%, according to a study conducted by Allied Market Research reported by the Food Institute. With about 39% of the market, North America dominated non-dairy ice cream sales with Unilever, Tofutti Brands, General Mills, Van Leeuwen, and Trader Joe's listed among the largest players. The increasing popularity of vegan ice cream is part of the growing demand for all vegan and plant-based food products of all kinds. The plant-based industry was worth USD5.6 billion in 2020 in the US alone and is projected to reach USD10.7 billion by 2027. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- President of General Motors (GM) North America Steve Carlisle has said that the company's 100% zero-emission vehicle (ZEV) sales target for 2035 remains its goal, but added that GM will not give up on gasoline (petrol)-powered cars if consumers still want them, reports Automotive News. The executive's remarks come as there has been a strong focus on GM's EV target, and the reveal of the GMC Hummer sport utility vehicle (SUV) and an upcoming reveal of the Cadillac Lyriq EV. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Innospec says it has withdrawn its interest in a possible all-share offer for Elementis after a conditional approach on 31 March to the board of Elementis was rejected on 9 April. The conditional offer was at a price of £1.60 ($2.23) per Elementis share, with a maximum 50% cash alternative with mix and match facility, it says. Innospec says it "is no longer currently considering this acquisition" after ceasing active consideration on 15 April following the rejection by the Elementis board. In a response issued later today, the board of Elementis confirms it "unanimously rejected" the conditional proposal on 9 April after assessing it with its management and advisors against a "rigorous valuation framework comparing it against an assessment of the fundamental value of Elementis as well as the likely value to be created by the continued delivery of its strategy and its medium-term performance objectives." (IHS Markit Chemical Advisory)

Europe/Middle East/Africa

- Major European equity indices closed lower; Germany -1.6%, UK -2.0%, France -2.1%, Italy -2.4%, and Spain -2.9%.

- 10yr European govt bonds closed higher; Germany/UK -3bps, France -2bps, and Italy/Spain -1bp.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +7bps/254bps.

- Brent crude closed -0.7%/$66.57 per barrel.

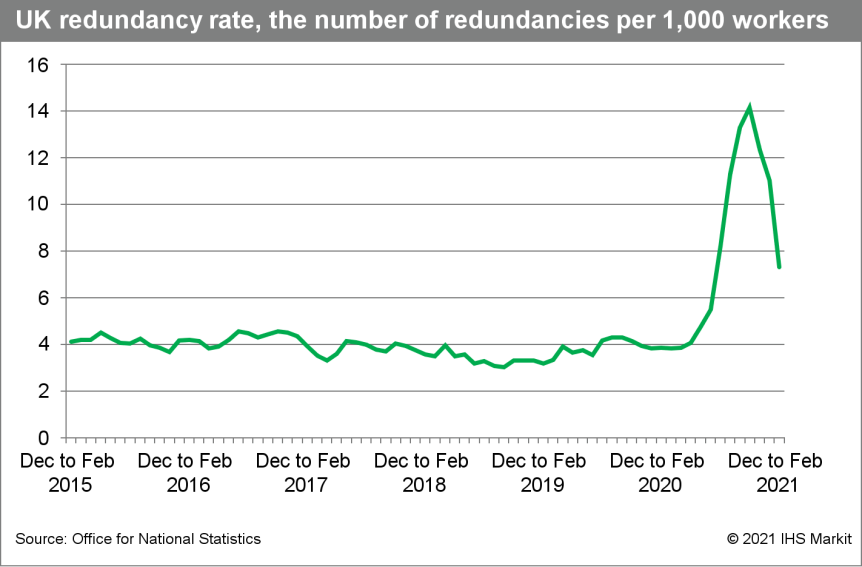

- The UK government's decision to extend the furlough scheme

until September 2021 is helping protect the labor market from the

tighter COVID-19 restrictions introduced in early 2021. However,

with 5 million currently on furlough, the end of the scheme could

trigger a step-up in the unemployment rate in late 2021 or early

2022. (IHS Markit Economist Raj Badiani)

- According to the UK Office for National Statistics (ONS), the early estimate for March 2021 suggests that the number of workers on payroll has shrunk by 2.8%, or 813,000, since March 2020.

- The highest incidence of job losses during the pandemic related to employees working in the accommodation and food service activities and the wholesale and retail trade sector, shedding 355,000 and 273,000 jobs, respectively. In addition, workers under 25 have suffered the highest number of job losses since March 2020, estimated at 436,000.

- The number of payrolls fell in March, decreasing by 0.1% month on month (m/m) or 68,000 m/m to 28,200.

- The pace of job losses slowed in early 2021 despite the fresh

national lockdown. The number of redundancies decreased by 191,000

to 204,000 in December 2020-February 2021, compared with the three

months to November 2020. This represents a redundancy rate of 7.3

per 1,000, down from 14.3 in September-November 2020.

- The ECB's quarterly bank lending survey (BLS) for the first

quarter was compiled between 11 and 26 March, based on the

responses of 143 banks across the eurozone's member states. The key

findings include the following (IHS Markit Economist Ken Wattret):

- There was a net tightening of credit standards for loans to enterprises in the first quarter for the third straight quarter, although the net percentage of banks reporting a tightening fell back markedly (from +25 to +7).

- Regarding loans to households, credit standards for loans for house purchase eased in the first quarter for the first time in six quarters, with the net percentage dropping from +7 to -2. For consumer credit, credit standards tightened but to a limited extent, with the net percentage edging up from +3 to +5, well below the recent peak of +26 in the second quarter of 2020.

- Switching to the demand side of the survey, loan demand from enterprises continued to weaken in the first quarter, with the net percentage falling sharply again, from -12 to -20, its weakest level since the second quarter of 2013 amid the eurozone crisis.

- The EU Council of Ministers has agreed that the European Commission should formally submit a proposal for a global ban on the insecticide, chlorpyrifos, to the secretariat of the Stockholm Convention on Persistent Organic Pollutants (POPs). The Commission requested clearance from Ministers in February. It wants chlorpyrifos to be listed in Annex A, for "elimination", in the Convention. This would require countries to take measures to stop production and use of the active ingredient (ai). Chlorpyrifos has been phased out in the EU, following the decision not to renew its approval. The Commission argues that international action is needed because the ai is persistent, bio-accumulative and subject to long-range environmental transport. (IHS Markit Food and Agricultural Policy's Jackie Bird)

- Mercedes-Benz's new flagship battery electric vehicle (BEV), the EQS, offers hands-off automated technology. The Mercedes EQS Drive Pilot system allows the car to drive in conditionally automated mode under certain conditions, but the driver needs to be ready to retake the wheel when needed. The Drive Pilot system employs Veoneer's 4th-generation stereovision camera system, which has fully integrated hardware and perception software to support highly automated vehicle operation. The system also contains Veoneer's advanced 77-GHz radars, which uses super-pulse modulation techniques for enhanced perception. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Board of the National Bank of Belarus (NBB) at its monetary

policy meeting on 14 April decided to increase its refinancing

interest rate to 8.50% from 7.75%, the 75-basis-point rise taking

effect on 21 April. At the same time, the overnight credit rate

will increase to 9.5% from 9.0%, and the overnight deposit rate to

7.5% from 7.0%. Before this, the latest policy rate revision had

been a 25-basis-point cut in June. (IHS Markit Economist Venla

Sipilä)

- The NBB noted that inflation in Belarus accelerated in late 2020 due to pass-through of depreciation of the Belarusian ruble, as well as in response to supply shocks in some food markets. Imported inflation has continued to push up prices of non-food goods, while global food price growth and supply constraints due to the pandemic have also persisted in early 2021.

- The latest data from the State Statistics Agency show that consumer prices in March increased by 8.5% year on year (y/y), inflation thus just slightly decelerating from the February rate of 8.7% y/y. Non-food good prices continued to increase the fastest, followed by prices of paid services.

- AutoX has selected Arbe's 4D imaging radar platform for its Level 4 autonomous vehicle (AV) fleet, according to a company statement. Radars support AVs for object detection and navigation in severe climatic conditions, such as fog, rain, and snow. AutoX will integrate 400,000 Arbe-based ultra-high resolution radar systems into its AV fleet. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ghana's communications minister, Ursula Owusu-Ekuful, announced on 16 April that local mobile operator AirtelTigo has agreed to transfer its operations to the Ghanaian government. Under the proposed deal, the Ghanaian government will acquire 100% of AirtelTigo's shares, as well as its customers, assets, and liabilities, and operate the company as a state entity. This follows an announcement by AirtelTigo in October 2020 of its departure from the Ghanaian market, as part of a more-comprehensive corporate portfolio restructuring exercise. The government will likely demand more local content and local participation as one of the preconditions for any sale and to list part of the shares on the local stock exchange. (IHS Markit Country Risk's Theo Acheampong)

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.7%, Hong Kong +0.1%, Mainland China -0.1%, India -0.5%, Australia -0.7%, and Japan -2.0%.

- Renesas Electronics, a major supplier of automotive semiconductors, expects to restore lost production capacity at its fire-damaged plant by the end of May, after restarting production on 17 April, according to a company press release. "As of April 17, 2021, our production capacity is just under 10% in comparison to the production capacity before the occurrence of the fire. We aim to recover the capacity to 30% by the end of this week, 50% by the end of April and return to 100% by the end of May," said the company. Renesas also highlighted that its shipments will return to normal levels about 100 days after the fire, although this schedule could be delayed by a week or 10 days. (IHS Markit AutoIntelligence's Jamal Amir)

- India has reported more than 200,000 COVID-19 cases daily since

14 April, with each day since then representing a new record.

National media reports indicate widespread and large-scale

shortages of hospital beds, oxygen, ventilators, and medicines in

nearly every Indian state, with almost 30% of new daily cases being

recorded in Maharashtra. (IHS Markit Country Risk's Deepa Kumar,

Angus Lam, and Hanna Luchnikava-Schorsch)

- Restrictions on non-essential activity are highly likely by early May given the acute pressure on the health system. Maharashtra and Delhi have already imposed near-lockdowns, with a halt on all non-essential activity until 30 April. These are highly likely to be extended, and to be replicated by other states including Karnataka, West Bengal, Odisha, Chhattisgarh, and Jharkhand.

- The prolonged COVID-19 surge has negatively affected India's economic outlook. Following the national lockdown in the second quarter of 2020, India's real GDP contracted sharply by 24.4% year on year (y/y) and by a further 7.3% y/y in the third quarter.

- The COVID-19 resurgence increases the likelihood of renewed loan moratoriums and capital injections into state-owned banks. India's loan moratorium program officially ended in August 2020.

- Indian finance minister, Nirmala Sitharaman, yesterday (19 April) approved an advance payment totaling INR45.67 billion (USD609.64 million) to domestic COVID-19 vaccine manufacturers Serum Institute of India (SII) and Bharat Biotech. According to various news sources, including India's Business Standard, SII will receive INR30 billion as suppliers' credit for more doses of Covishield, the licensed version of the Vaxzevria (AZD1222) COVID-19 vaccine from AstraZeneca (UK) and the University of Oxford, and Bharat Biotech will receive INR15.675 billion for its Covaxin (BBV152B) doses. The credit will be provided as upfront payment for a total of around 300 million vaccine doses from the two companies at a price of around INR150 per dose, excluding taxes. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.