Daily Global Market Summary - 20 December 2021

All major APAC, European, and US equity indices closed lower. US and benchmark European government bonds closed lower on the day. European iTraxx closed wider across IG and high yield, CDX-NAHY was also wider, and CDX-NAIG was flat on the day. Natural gas closed higher, the US dollar and copper were flat, and oil, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; S&P 500 -1.1%, DJIA/Nasdaq -1.2%, and Russell 2000 -1.6%.

- 10yr US govt bonds closed +2bps/1.43% yield and 30yr bonds +4bps/1.86% yield.

- CDX-NAIG closed flat/53bps and CDX-NAHY +3bps/311bps.

- DXY US dollar index closed flat/96.55.

- Gold closed -0.6%/$1,795 per troy oz, silver -1.1%/$22.29 per troy oz, and copper flat/$4.29 per pound.

- Crude oil closed -3.0%/$68.61 per barrel and natural gas closed +3.9%/$3.83 per mmbtu.

- Two doses of the Pfizer and BioNTech vaccine Comirnaty were found not to generate sufficient levels of immunity in children aged two to under five years, the company said in an update on 17 December. The conclusion is based on a pre-specified immunogenicity analysis conducted on a subset of the study population one month after the application of second dose. The study, which is ongoing and remains blinded, also includes children aged 6 to 24 months, in whom immunogenicity was found to be non-inferior to that observed in people aged 16 to 25 years. The study did not identify any safety concerns associated with the administration of two 3 µg doses in young children. The amount of the vaccine being tested in this age group is much smaller than the doses approved for adults (30 µg) and older children (10 µg). Following the review, the company has decided to test a third 3 µg dose across the entire study population from six months of age. Contingent on positive results of the three-dose regimen, regulatory filings are currently planned in the first half of 2022. Pfizer and BioNTech are also planning to evaluate a third 10 µg dose in the older pediatric group of children aged 5 to 12 years. (Life Sciences by GlobalData's Ewa Oliveira da Silva)

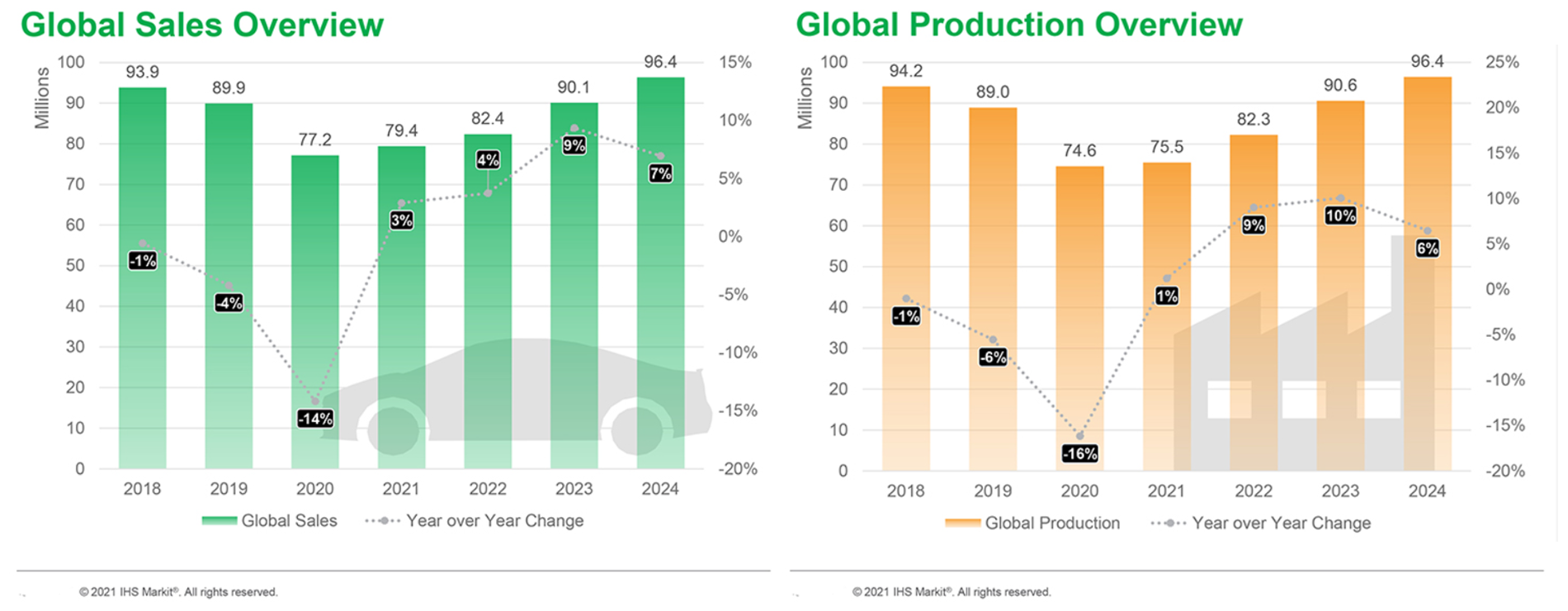

- IHS Markit forecasts global light-vehicle sales to increase

3.7% and production to increase 9.0% in 2022. Next year, global

light-vehicle sales and production volumes are forecast to still be

below the levels of 2019, as the recovery cycle from the COVID-19

pandemic has been held back by supply constraints and new virus

variants. Auto demand levels are expected to remain depressed on

the microchip shortage, as well as the race between vaccination

programs and new COVID-19 variants. Although the supply situation

is expected to improve through 2022, the ability to replenish

inventories may not come before 2024. IHS Markit expects the

semiconductor shortages and wider supply chain disruptions to

continue until 2023. IHS Markit projects light-vehicle sales

globally of nearly 79.4 million units in 2021. We forecast new

light-vehicle sales of nearly 82.4 million units globally in 2022

and auto industry demand to continue to be constrained next year as

the challenges in the semiconductor supply chain remain. Global

light-vehicle production is expected to be 75.5 million units in

2021, a paltry 1.2% improvement over levels in 2020. However, in

2022, IHS Markit forecasts a rebound in global light-vehicle

production of 9.0% to 82.3 million units. (IHS Markit

AutoIntelligence's Stephanie

Brinley)

- US corn growers, furious about skyrocketing costs for phosphate

fertilizers, have accused leading domestic producer Mosaic with a

plot to derail foreign competitors with punishing trade

tariffs—a move they say handed the world's second largest

phosphate fertilizer producer undue influence over US fertilizer

supply and thus pricing. (IHS Markit Food and Agricultural Policy's

William Schulz)

- In a December 17 open letter to Mosaic executives, leaders of the National Corn Growers Association (NCGA) say Mosaic's petition to the US International Trade Commission (ITC) for countervailing duties (CVD) against fertilizer producers in Russia and Morocco was nothing more than a feigned act of corporate social responsibility.

- "Mosaic has almost single-handedly erected an insurmountable tariff barrier to keep its top competitors in Morocco and Russia out of the US phosphate market," reads the NCGA letter. "Thanks to Mosaic's petition, only 15 percent of phosphorous imports now come into the US without tariffs. And experts say that using [the Department of Commerce] and ITC to manipulate the supply curve does indeed dictate price to farmers."

- The NCGA is not alone in its price-gouging accusations. "The economic conditions of the fertilizer sector suggest market abuses are likely, and farmers are experiencing a price squeeze that is highly suspicious in its timing," the Family Farm Action Alliance said in a December 8 letter to the Department of Justice's Antitrust Division.

- But ITC investigated Mosaic's charge that foreign producers were competing unfairly by dumping low-cost phosphate fertilizer product on the US market and artificially lowering prices. In June, the agency issued a CVD on Moroccan and Russian phosphate fertilizer imports due to unfair foreign subsidies.

- "Based on the available pricing data obtained by the Commission … cumulated subject imports undersold the domestic like product in 16 of 52 quarterly comparisons with margins of underselling ranging from 0.1 percent to 13.0 percent and an average underselling margin of 2.8 percent," an ITC's report says. "Subject imports oversold the domestic like product in the remaining 36 instances with margins of overselling ranging from 0.1 and 11.2 percent and an average overselling margin of 4.0 percent."

- GM announced two milestones for its Ultium electric vehicle (EV) platform programmes on 17 December, making the first deliveries of BrightDrop vans to transport and delivery services company Federal Express and producing the first saleable GMC Hummer EV pick-up truck. The first BrightDrop vans delivered were the EV600, comprising five units of a 500-unit. GM's BrightDrop commercial delivery vehicle business was formed less than a year ago, and GM says the EV600s were the fastest-built vehicles from concept to market in the company's history. In addition, GM reconfirmed that the Cadillac Lyriq is the company's next EV due for production, during the first half of 2022 at the Spring Hill assembly plant in Tennessee (United States). The speed with which GM was able to develop the BrightDrop vans and the GMC Hummer EV suggests that the Ultium platform and architecture can support the faster overall product development times planned by GM. With shorter times to bring products to the market, GM may be in a position to more quickly expand its EV product portfolio. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) manufacturer Nikola delivered its first battery electric trucks on 17 December, supplying the Tre trucks to Total Transport Services Inc for a pilot programme in the US state of California, according to a company statement. Total Transport Services is a port trucking company, specifically serving the ports of Los Angeles and Long Beach. The announcement follows Total Transport Services Inc signing a letter of intent for the purchase of 100 zero-emission trucks from Nikola, with the agreement beginning with the delivery of four trucks for a pilot scheme, comprising two battery electric trucks and two fuel-cell EVs. Under the agreement, depending on the performance of the "pilot trucks", delivery of 30 EVs is due in 2022 and delivery of 70 fuel-cell EVs (FCEVs) is to start in 2023. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Peru's monthly GDP declined by 1.2% month on month (m/m),

according to the National Institute of Statistics and Information

(Instituto Nacional de Estadistica e Informatica: INEI). This

result may differ from the forthcoming figure from the Central

Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP),

whose monthly output indices IHS Markit uses to conduct forecasts.

(IHS Markit Economist Jeremy Smith)

- Monthly output increased by 4.6% year on year (y/y), explained by the weak comparison base in 2020.

- Construction, which plunged by 4.7% m/m, drove the October result. Construction activity had been as much as 22% above the pre-COVID-19 pandemic mark in March but has since moderated significantly. The sector confronts multiple headwinds, including the withdrawal of fiscal stimulus, rising input costs, and weak overall business sentiment.

- Apart from the mining sector, all major economic sectors are at or above their pre-pandemic peak. Services continue to recover as COVID-19 vaccination progresses and daily infections remain at low levels.

- During the third quarter of 2021, Argentina's seasonally

adjusted GDP increased by 4.1% q/q after decreasing by 0.9% q/q in

the previous quarter, according to the revised figures. On an

annual basis, GDP grew by 11.9% year on year in July-September on

the back of a low comparison base in the third quarter of 2020 when

GDP shrunk by 10.2% y/y because of COVID-19-related response

measures and extreme lockdown. (IHS Markit Economist Claudia

Wehbe)

- The estimate for the GDP deflator shows a rise of 54.1% y/y, while the private-sector consumption deflator increased at a slower rate of 50.1% y/y during the same period.

- By sector, the primary sector showed the only annual decline in the third quarter. All other sectors posted annual growth in the double digits, except for utilities, whose cost increases are controlled by the government, education, financial intermediation, and real estate and business services.

- Sectors with a severely depressed comparison base posted an annual growth rate over 25% y/y, such as construction, hospitality and restaurants, and non-profit and social services. Activity in the hospitality and restaurant sector was nearly half the size compared with the first half of 2018. Meanwhile, manufacturing gained 12.7% y/y.

- IHS Markit's forecast for 2021 has been adjusted upwards to 7.5%, expecting the sudden increase in public-sector spending to gain the population's trust before the November 2021 mid-term election to have a marginal bump in GDP in the last quarter of the year, paired with strong external demand for manufactured goods of agriculture origin. The economy is not projected to return to pre-pandemic levels until the second half of 2023.

Europe/Middle East/Africa

- All major European equity indices closed lower; France/Spain -0.8%, UK -1.0%, Italy -1.6%, and Germany -1.9%.

- 10yr European govt bonds closed lower; Germany/Spain +1bp, France/UK +2bps, and Italy +3bps.

- iTraxx-Europe closed +1bp/52bps and iTraxx-Xover +7bps/260bps.

- Brent crude closed -2.7%/$71.52 per barrel.

- Supermarkets across Europe have pledged to remove beef products

that are linked to deforestation in Brazil from their stores. On 15

December, US activist group Mighty Earth announced that six

European supermarket chains will stop selling Brazilian beef

products after an investigation found that these products

contribute to the destruction of the Amazon rainforest. The most

far-going pledge came from Lidl Netherlands, which said it would

stop sales of all beef originating from South America in January

2022. Albert Heijn, the largest supermarket chain in the

Netherlands, said it will stop sourcing beef from Brazil entirely.

(IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Other supermarket chains made less dramatic moves and decided to focus on specific beef products. Sainsbury's UK said will stop sourcing its store brand corned beef from Brazil and highlighted that 90% of its beef is already sourced from the UK and Ireland. Auchan France will remove beef jerky products linked to Brazilian meat processor JBS from its shelves, while Carrefour Belgium and Delhaize will stop selling Jack Link's brand beef jerky.

- The withdrawals came after an investigation by Mighty Earth and Reporter Brasil, a Brazilian NGO, found that JBS indirectly sourced cows from illegally deforested areas, in a scheme known as "cattle laundering". In such schemes, cows are raised on illegally deforested land and then sold on to a legitimate farm before being sent to the slaughterhouse, to obscure the true origin of the cattle.

- In reaction, JBS said it has zero tolerance for illegal deforestation and has blocked more than 14,000 suppliers for failing to comply with its policies. The company said monitoring indirect suppliers - the ones before the final seller to the slaughterhouse - is a challenge for the entire sector, but it promised to set up a system capable of doing so by 2025.

- Mercedes-Benz has reached agreement with its European dealers to transition to an agency model, reports Automotive News Europe (ANE) citing information from Mercedes-Benz. With the agency model, customers buy directly from the automaker rather than the dealer. Dealers would receive a fee per vehicle sold, and as well as revenue from after-sales services. The agreement with the European Association of Mercedes-Benz Dealers, or FEAC, creates a framework to introduce the change, which would affect passenger cars and vans. The agency model is expected to be rolled out in Germany and the UK by 2023, according to the report. Britta Seeger, Daimler management board member responsible for sales, was quoted as saying that by the end of 2023, more than half of new Mercedes-Benz vehicles available in Europe "should be sold under the agency model." Daimler CEO Ola Källenius said to ANE in an interview in June that the agency model would be put in place in a number of European countries, as part of a wider digital transformation of the selling process. Pilot projects have been conducted in Austria, Sweden, and South Africa, according to the automaker. The agreement with FEAC will speed up Mercedes-Benz's plan to transform its distributional network in the UK and Germany to place the carmaker itself at the center of the car-selling process. The agency model will not only reduce costs for consumers, it will also enable the automaker to establish direct contact with customers and streamline the selling process by the introduction of the latest online shopping tools. With more electric vehicles (EVs) joining automakers' product lines, the agency model will also facilitate automakers' efforts to roll out software and digital services to customers to tap new revenue opportunities. The Volkswagen (VW) Group, for instance, has already adopted an agency model for the VW ID series EVs. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Swedish battery developer Northvolt is racing to meet the 2021 timeline for its new battery plant, according to Reuters. Northvolt's chief executive officer (CEO) Peter Carlsson, said, "We are working extremely intensely right now to keep that schedule, and even if it means the first battery is made on New Year's Eve, it's going out this year". The Li-ion battery is the first to be built in the European Union (EU) by a European company. The company plans to produce enough batteries to power 1 million electric vehicles (EVs) annually. Northvolt also aims to open at least two more factories in the next 10 years. As well as launching this battery plant, Northvolt has recently signed a binding joint venture (JV) agreement with Volvo Cars to develop and manufacture batteries together for the automaker's next-generation vehicles. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- MAN Energy Solutions will supply compressor system for the

carbon capture and storage (CCS) plant at the HeidelbergCement

Norcem cement factory in Norway. The project will utilize Aker

Carbon Capture's proprietary carbon-capture technology. From

mid-2024, 400,000 tons of CO2 will be captured annually from the

cement factory in Brevik, corresponding to 50% of the factory's

overall emissions. The CO2 will be compressed and liquefied with

technologies from cooperation partners, Aker Carbon Capture and MAN

Energy Solutions, and then transported by ship to an underground

storage location. (IHS Markit Upstream Costs and Technology's Kamila

Langklep)

- MAN Energy Solutions and Aker Carbon Capture signed a technology-cooperation agreement in December 2020 to develop energy-efficient compression solutions for CCS applications with heat recovery. The cement factory in Brevik will be the first to use the Carbon Capture Heat Recovery technology (CCWHR®) developed through this partnership. The new process allows the heat emerging from the compressor system to be recovered and used as steam to meet approximately one third of the total heat demand from the Aker Carbon Capture plant. Consequently, the system solution demands significantly less energy compared with conventional carbon-capture technologies.

- The scope of work by MAN Energy Solutions includes the supply of an electrically-powered compressor train—type RG 63-7 with integrated CCWHR® technology—which allows the compression heat of the recovery compressor to be exploited. The steam generators cool the CO2 mixture between the compressor stages and generate steam that is in turn used for capture.

- Using digital tools, the compression system for the CCS application has been significantly simplified. The digital-twin-based engineering approach of MAN Energy Solutions has resulted in system optimizations. The dynamic process simulation showed that originally planned system components, including heating, valves, and additional pipes for safe plant operation, were not required. The time taken for a cold start of the plant can thus be reduced from around 12 hours to 20 minutes.

- During its monetary policy session on 14 December, the Monetary

Policy Council of the National Bank of Hungary (MNB) raised the

main policy rate by 30 basis points to 2.40%, the highest level

since May 2014. The MNB has been tightening policy since June for a

low of 0.60% in a bid to rein in spiking inflation amid a fast

economic recovery. The MNB also raised the rate on its overnight

deposit facility by 80 basis points to 2.4%. In addition, the bank

ended its quantitative easing program. (IHS Markit Economist Dragana

Ignjatovic)

- On 16 December, the MNB raised its one-week deposit rate by 30 basis points to 3.6% at a weekly tender - the sixth increase in a month. Since 16 November, the central bank has raised the rate by a cumulative 180 basis points.

- Following the meeting, the MNB Deputy Governor Barnabas Virag pledged more rate rises for next year to anchor rising inflation expectations. He declared that the bank was prepared to front-load the tightening in what he described would be a long campaign against inflation.

- Despite the hawkishness displayed by the MNB in the second half of the year, Hungary's consumer price inflation has continued to soar beyond the 2-4% target set by the central bank. In November, consumer price inflation reached a 14-year high of 7.4% y/y, driven by soaring energy and food costs. In the first 11 months of 2021, consumer prices averaged 4.9% compared with the same period of 2020.

- UAE-based car-sharing platform Ekar has expanded its operations to Thailand, reports The National News. The company will offer its car subscription service, which provides cars from one to nine months for a single monthly subscription cost with no down payments via the app, in Bangkok starting in January 2022. The company will also launch its peer-to-peer car sharing services, which allow people to rent their own cars to the general public, later in 2022. Ekar is a startup company founded in 2016 in the United Arab Emirates, which operates a pay-as-you-drive hourly and daily car rental service. The company has booked over 1.33 million trips with over 250,000 customers in seven cities across the Gulf Cooperation Council (GCC) region. The company operates in the UAE and Saudi Arabia and will introduce the service in Malaysia soon, with the latter scheduled to be launched in Egypt and Turkey in 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- All major APAC equity indices closed lower; Australia -0.2%, Mainland China -1.1%, South Korea -1.8%, Hong Kong -1.9%, India -2.1%, and Japan -2.1%.

- An independent Chinese-Russian financial system may benefit

China's energy trade with Iran, said three petrochemical traders in

Asia, responding to news that China and Russia are working on this

project. Such a system will facilitate the settlement of trade,

which has been an issue in the past, said a trader based in

Singapore. (IHS Markit Chemical Market Advisory Service's Chuan

Ong)

- "It has been tricky for Chinese importers bringing petrochemicals, such as methanol, from Iran. First tier banks in China are jittery about financing these, leaving no choice but third or fourth tier banks," said the trader.

- China has been a key outlet for Iranian energy exports but it has not been an easy road, the trader said.

- A Zhejiang Province-based trader said Russia can help settle trades between Chinese and Iranian parties in this trading system down the road.

- "I don't dare to import Iranian cargoes now. One's source of funding will be hurt by sanctions. And then one will lose one's cargo as well. It's a double whammy," said a trader based in Shandong Province.

- The Kremlin announced last Wednesday that Russia and China will develop a shared financial structure to deepen economic ties, Russia's state-controlled media outlet RT reported.

- This move followed warnings to Russia that it could be severed from the Brussels-based SWIFT financial system as a form of sanction. The SWIFT payment platform supports the majority of international transactions.

- The U.S. can seek to block any objectionable transactions using the U.S. dollar on the SWIFT network, such as those involving sanctioned countries like Iran.

- Russian President Vladimir Putin and Chinese President Xi Jinping spoke last Wednesday highlighting the need for an independent financial infrastructure to service trade between Russia and China, which cannot be influenced by third countries," RT reported Putin's foreign policy advisor as saying.

- China has reportedly proposed to amend legislation to allow ride-hailing drivers and food delivery workers to form unions. Beginning in December, China will evaluate an update to its trade union legislation with plans to add rules to broaden the types of organizations and jobs for which unions may be formed, reports Reuters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Indian union cabinet has approved a production-linked incentive scheme (PLI) worth over INR760 billion (USD9.9 billion) for production of semiconductors over the next six years, reports The Economic Times. Under the new scheme, called Programme for Development of Semiconductors and Display Manufacturing Ecosystem, over 20 semiconductor design, components manufacturing, and display fabrication units will be set up including one to two fabrication units for displays and 10 units each for designing and manufacturing components. The government will offer incentives to companies involved in the manufacturing of silicon semiconductor fabs, display fabs, compound semiconductors, silicon photonics, sensors fabs, semiconductor packaging, and semiconductor design. Additionally, the cabinet also approved a plan for the modernization and commercialization of the Semi-conductor Laboratory (SCL). The launch of the scheme comes at a time when automakers are struggling with the semiconductor shortage globally and have been forced to adjust production levels since several months ago. By localizing development and production, the Indian government aims to reduce dependence for such chips on other countries. (IHS Markit AutoIntelligence's Isha Sharma)

- Indonesia's tech firm GoTo Group has reportedly appointed underwriters to manage its initial public offering (IPO). According to the report by Reuters, GoTo Group is expected to launch its USD1-billion IPO as early as the first quarter of next year. The company has initially planned to launch a local IPO, with a US listing expected to follow. Indonesia is keen for its tech startups to sell shares on the local exchange and has established guidelines allowing multiple voting shares to pave the way for IPOs. GoTo Group is an internet firm created through a merger deal between ride-hailing company Gojek and e-commerce provider PT Tokopedia. The merger was aimed at supporting Gojek and Tokopedia in efforts to take on larger, regional rivals such as Grab and internet company Sea, which operates e-commerce platform Shopee. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baker Hughes has been awarded a contract by Santos to supply

turbomachinery equipment for the Moomba carbon capture and storage

(CCS) project (Moomba CCS), including gas turbine, compressors, and

heat recovery steam generator (HRSG). The project will serve a gas

processing plant and permanently store 1.7 million tons of carbon

dioxide (CO2) annually in depleted natural gas reservoirs in the

onshore Cooper Basin in South Australia. (IHS Markit Upstream Costs

and Technology's Kamila Langklep)

- Specifically, Baker Hughes will provide PGT25+G4 aeroderivative gas turbine (nameplate power capacity of 34 MW), MCL compressor and BCL compressor, which will enable Santos to compress CO2 captured at Moomba CCS for transportation and subsequent injection for storage.

- Baker Hughes' broader carbon capture, utilization, and storage (CCUS) portfolio features advanced turbomachinery, solvent-based capture processes, well construction and management for CO2 storage, and advanced digital monitoring and industrial asset management solutions.

- The contract for Baker Hughes' technology lays a foundation for

Santos' future objectives of decarbonizing natural gas, lowering

emissions and ultimately producing hydrogen fuel using stored CO2.

A final investment decision on the Moomba CCS project was reached

in November 2021.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.