Daily Global Market Summary - 21 May 2021

Most major European equity indices closed higher, while US and APAC markets were mixed. US government bonds closed mixed and the curve was flatter on the day, while all benchmark European government bonds were higher. CDX-NA closed almost flat across IG and high yield, and European iTraxx was modestly wider on the day. The US dollar and oil closed higher, while natural gas, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; DJIA +0.4%, Russell 2000 +0.3%, S&P 500 -0.1%, and Nasdaq -0.5%.

- 10yr US govt bonds closed flat/1.62% yield and 30yr bonds -1bp/2.32% yield.

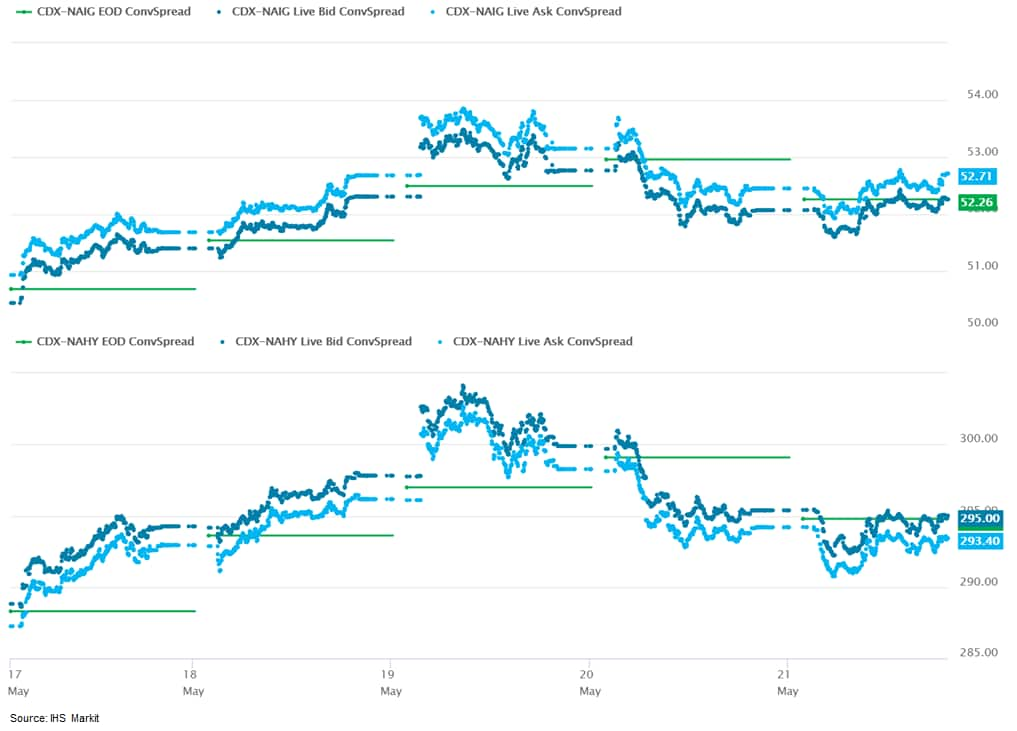

- CDX-NAIG closed flat/52bps and CDX-NAHY -1bp/294bps, which is

+2bps and +6bps week-over-week, respectively.

- DXY US dollar index closed +0.2%/90.02.

- Gold closed -0.3%/$1,877 per troy oz, silver -2.1%/$27.49 per troy oz, and copper -1.9%/$4.48 per pound.

- Crude oil closed +2.6%/$63.58 per barrel and natural gas closed -0.6%/$2.91 per mmbtu.

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 68.1 in May, up from 63.5 in

April. The rate of expansion was unprecedented after surpassing

April's previous series record. (IHS Markit Economist Chris

Williamson)

- The steep rise in costs fed through to the sharpest increase in output charges since data collection began in October 2009, with record rates of inflation registered for both goods and services as soaring demand boosted firms' pricing power.

- While job creation was again seen in the goods-producing sector, the rise was the slowest for five months, linked in part to difficulties filling vacancies.

- The seasonally adjusted IHS Markit Flash U.S. Services PMI™ Business Activity Index registered 70.1 in May, up from 64.7 in April. The rate of expansion was the sharpest since data collection for the series began in October 2009.

- Goods producers registered a record rate of improvement in operating conditions during May, as highlighted by the IHS Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™) posting 61.5, surpassing April's previous series high of 60.5.

- Manufacturing input costs rose in May at a pace not seen since July 2008. The uptick in inflation was widely attributed to higher logistics, raw material and fuel costs, with firms commonly reporting soaring vendor prices and difficulties sourcing materials amid a further severe lengthening of supplier delivery times. Companies made efforts to pass higher cost burdens on to clients, causing output charges to rise at the steepest rate on record.

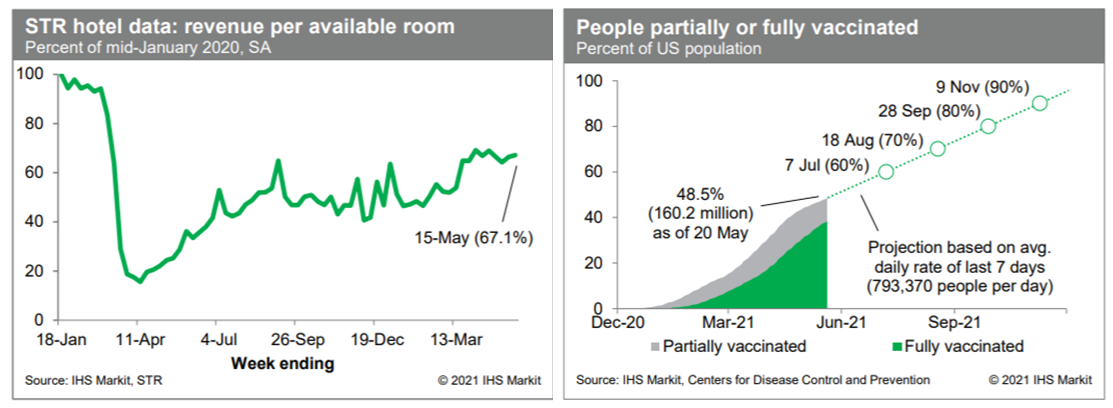

- Revenue per available room at US hotels last week (adjusted for

seasonal variation) was 67.1% of the mid-January 2020 level,

according to our estimate based on data from STR. This is close to

readings over the prior eight weeks. By this measure, the recovery

in travel has stalled. Meanwhile, over the week ending yesterday,

an average of about 793,000 people per day received a first (or

only) dose of a COVID-19 vaccine, up somewhat from about 737,000

per day over the prior week, bringing the total number of US

residents either partially or fully vaccinated to 160.2 million

(about 48.5% of the population). The uptick in the average daily

rate might reflect the recent emergency use authorization of the

Pfizer vaccine for children aged 12-15 years old. At the current

rate, the US would achieve widespread vaccination (70-80% of the

population) by mid- to late summer. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- US existing home sales fell for the third straight month in

April, dropping 2.7% to a 5.85-million-unit annual rate. Sales were

up in the Midwest but down in the other three regions. Year-to-date

sales are 20% and 19% higher than in 2020 and 2019—these are

solid numbers. (IHS Markit Economist Patrick

Newport)

- Total inventory (data go back to April 1999) climbed from 1.05 million units to 1.15 million units; inventory of single-family homes (data go back to June 1982) increased from 890,000 to 990,000 units. These are not seasonal gains: our estimate of single-family home inventory increased from 949,000 to 962,000.

- Lean inventories have led to an unprecedented surge in home prices. Nationally, the median price of a single-family home was up 20.3% from a year earlier in April, while the average price was up 14.3%. All four regions are seeing double-digit increases in both median and average prices.

- Properties took 17 days to sell in April, down from 18 in March and 27 in April 2020. Eighty-eight percent of homes sold in April were on the market less than a month.

- The share of homes bought by individual investors or second-home buyers increased to 17% in April from 15% in March and 10% in April 2020; the share bought all-cash was 25%, up from 23% in March and 15% in April 2020.

- Artificial intelligence (AI)-focused drug discovery company Exscientia (UK) has announced that it has entered into a new collaboration deal with Bristol Myers Squibb (BMS; US). The deal entails the use of AI to accelerate the discovery of small-molecule therapeutic drug candidates in multiple therapeutic areas, including oncology and immunology. Under the terms of the deal, BMS will provide Exscientia with up to USD50 million in upfront funding, and up to USD125 million in near- to mid-term potential milestones, as well as additional clinical, regulatory, and commercial payments that could potentially increase the overall value of the deal to more than USD1.2 billion. Exscientia will also receive tiered royalties on net sales of any marketed drug products resulting from the collaboration. (IHS Markit Life Sciences' Milena Izmirlieva)

- A lawsuit has been filed in the US District Court for the Southern District of Iowa against Syngenta and Chevron, two of the main manufacturers of the herbicide, paraquat. The litigation, filed by farmer Doug Holliday, alleges that the companies had failed to adequately warn farmers that exposure to the active ingredient would enhance their risk of developing Parkinson's disease by more than 300%. The suit alleges that the defendants continue to sell paraquat in the country despite evidence pointing at "heightened risk" of developing Parkinson's disease from exposure to the ai. The defendants, it says, "sold paraquat with complete disregard and reckless indifference to the safety of the plaintiff." (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- California's clean air regulator has approved a standard that would require ride-hailing fleets to shift to zero-emission vehicles (ZEVs). The new rule, known as Clean Miles Standard (CMS), adopted through a unanimous vote by the California Air Resources Board (CARB), is the first such regulation to be approved by a US state. The state is to implement the new rule in phases, mandating electric vehicles (EVs) to account for 2% of ride-hailing vehicle miles travelled in the state by 2023. Then the requirement is to jump to 50% by 2027 and 90% by 2030. This move by the CARB is aligned with state's plan to ban sales of new gasoline (petrol) cars by 2035 and an effort by Californian legislators to reduce greenhouse gas (GHG) emissions of ride-hailing companies. This also supports President Joe Biden's commitment to accelerate production and sales of EVs to combat climate change. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ford took about 20,000 USD100 reservations for the electric variant of the F-150 pick-up, the Lightning, within 12 hours of its reveal, according to CEO Jim Farley. Automotive News reports the CEO as confirming that figure and saying in a CNBC program that the company is "off to the races" after opening the reservation process following the electric truck's reveal on 19 May. In addition, Automotive News reports that Farley indicated at the reveal event that Ford is to limit production of the F-150 Lightning in the first year, as the company also did in its first-year plans for the Mustang Mach-E electric vehicle. Farley declined to provide the planned production figure, however, only saying that the company "made a call on volume". (IHS Markit AutoIntelligence's Stephanie Brinley)

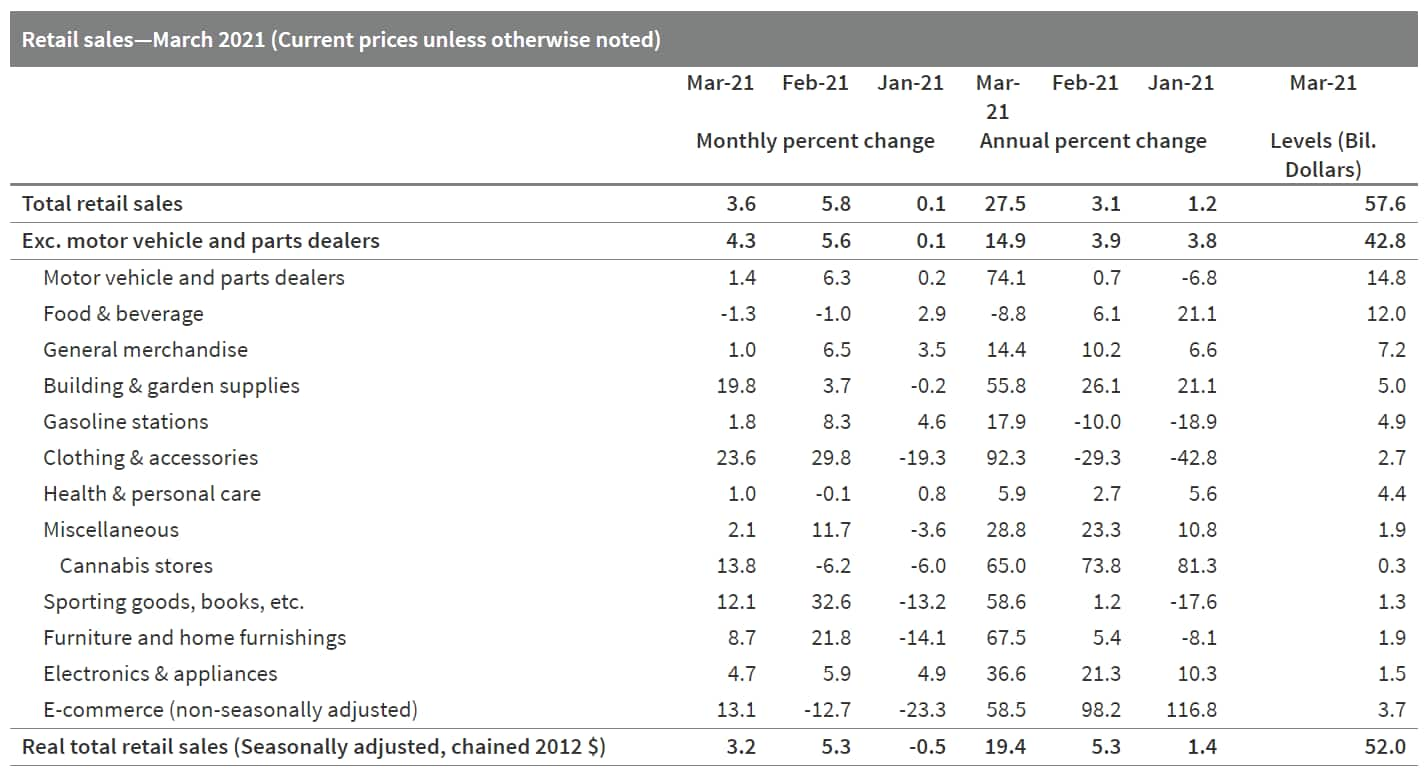

- Canada's nominal retail sales jumped 3.6% month on month (m/m)

to $57.6 billion in March, which is in addition to a hefty

percentage-point upward revision in the 5.8% m/m February increase.

(IHS Markit Economist Evan Andrade)

- Core sales, excluding motor vehicles and parts and gasoline stations, were even stronger, rising 4.7% m/m.

- Retail volumes rose 3.2% m/m, which points to a positive contribution to the 0.9% m/m March GDP estimate.

- The third wave of COVID-19 infections will heavily weigh on

consumer activity, as expected, with the preliminary data collected

by Statistics Canada showing sales sinking 5.1% in April.

- The Central Bank of Brazil (Banco Central do Brasil: BCB) on 19

May announced that it will be implementing and consolidating new

rules regarding the hiring of credit and debit cards. The BCB's

resolution will come into force at the beginning of March 2022,

eliminating the mandate for listing minimum customer registration

information, which is currently required for opening these types of

accounts. It also reduces the requirements for closing accounts and

standardizes the items that must be stated in credit card invoices.

(IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- The aim of this move is to ease regulatory requirements to boost digitalisation in the financial sector. The measure will primarily benefit financial technology companies (Fintech), given that it will reduce regulatory compliance costs. This will enable smaller and/or Fintech banks to compete against larger institutions.

- Digitalization in banks has been one of the central bank's core objectives as a means of reducing concentration in the market and lowering transaction costs. The main product to achieve this is PIX, a digital platform for financial transactions managed by the BCB.

- Brazil is already one of the most financially digitized countries in Latin America and credit cards are largely predominant as Brazilians often opt to pay through long-term instalments.

Europe/Middle East/Africa

- European equity markets closed higher, except for UK flat; Italy +1.1%, Spain +0.9%, France +0.7%, and Germany +0.4%.

- 10yr European govt bonds closed higher; Spain -3bps, Italy/France/Germany -2bps, and UK -1bp.

- iTraxx-Europe closed +1bps/53bps and iTraxx-Xover +3bps/261bps,

which is +2bps and +9bps week-over-week, respectively.

- Brent crude closed +2.0%/$66.44 per barrel.

- The UK flash composite PMI output index, covering both services

and manufacturing, rose from 60.7 in April to 62.0 in May. The

prior peak of 61.7 had been achieved in October 2013. (IHS Markit

Economist Chris

Williamson)

- Factory output is growing at a pace beaten only once in over two decades as global demand for goods continues to revive, and the service sector is reporting near-record growth as the opening up of the economy allows more businesses to trade. The strongest upturns in demand were reported for hotels, restaurants and other consumer—facing services, though improvements were reported across the board in all sectors.

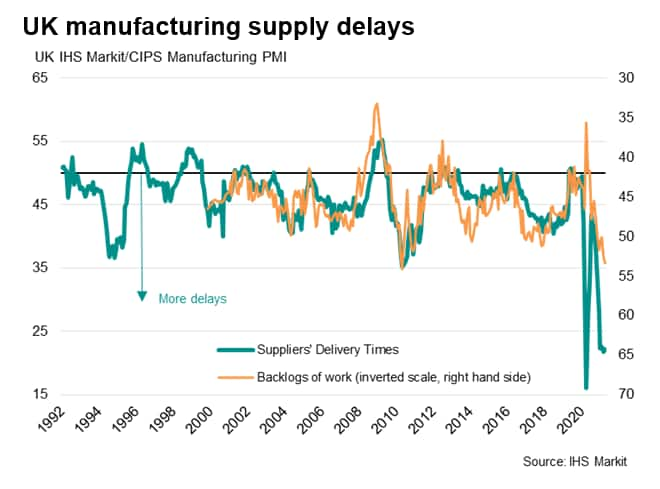

- Even with this burst of hiring, capacity limits are being hit,

leading to the largest ever reported rise in backlogs of

uncompleted work across both manufacturing and services. These

limits have been hit in part due to a further near-record worsening

of supply chain delays in May.

- The UK's Office for National Statistics (ONS) has reported that

retail sales rose for a third straight month in April, by 9.2%

month on month (m/m). This occurred after the reopening of all

non-essential physical shops from 12 April in England and Wales and

from 26 April in Scotland. (IHS Markit Economist Raj

Badiani)

- Retail sales volumes in April stood 10.6% above their pre-COVID-19 virus level in February 2020. Retailers have benefited from households spending less on services and foreign travel during the three national lockdowns in England.

- Clothing stores reported that sales grew by 69.4% m/m in April, with the ONS reporting that many shoppers continued to buy new clothing during the easing of the lockdown restrictions. The easing of measures included the government allowing households in England to meet outside from 29 March, while restaurants and bars could serve groups of up to six people outdoors from 12 April and now indoors since 17 May.

- Food store sales volumes declined by 0.9% m/m in April after rising in the previous three months. Despite the fall in April, food store sales were 8.6% higher than their pre-pandemic level (February 2020).

- Non-store retailing grew modestly in April, by 1.0% m/m. Nevertheless, its share of overall retail spending fell to 30.0% in April, down from 34.7% in March in line with physical shops reopening during the month.

- Fuel sales volumes grew by 10.6% between March and April as the easing of the lockdown measures allowed greater mobility. Nevertheless, sales remained 9.9% lower than in February 2020.

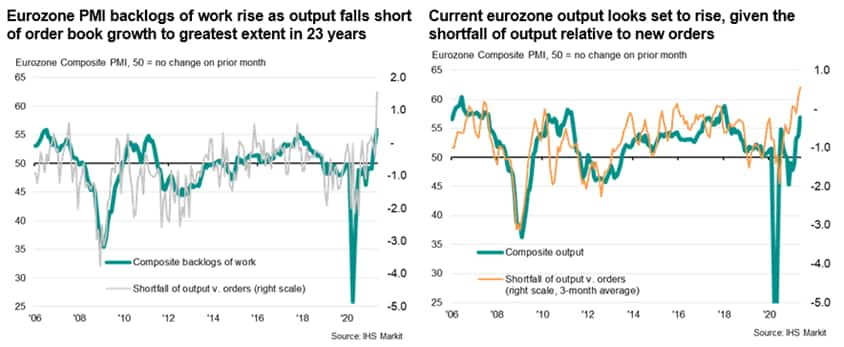

- The headline IHS Markit Eurozone Composite PMI® rose from 53.8

in April to 56.9 in May, according to the preliminary 'flash'

reading, the survey's new orders index rose even more sharply to

58.4. You have to go back to June 2006 until you find faster growth

of new orders. (IHS Markit Economist Chris

Williamson)

- The May survey data indicate that the overall shortfall of business output relative to demand is running at the highest in the survey's 23-year history. Backlogs of uncompleted orders consequently rose to a degree not surpassed since that series began in November 2002.

- Although the rate of job creation remained the second-highest in just under two years, it waned slightly due to instances of difficulties in filling job vacancies.

- Average input prices rose in May at the sharpest rate since

March 2011, led by the largest rise in factory input costs recorded

since survey data were first available 24 years ago. Service sector

costs also grew at an increased rate, registering the sharpest rise

since November 2018.

- Daimler Trucks and Chinese battery supplier Contemporary Amperex Technology Co Limited (CATL) have announced the expansion of their battery supply agreement beyond 2030. According to a CATL company statement, it will supply lithium-ion battery packs for the Mercedes-Benz eActros LongHaul battery-electric truck, which is planned to be ready for series production in 2024. The supply will go beyond 2030. The two companies have also plan to jointly design and develop next-generation battery cells and packs for truck specific applications, with a focus on high modularity and scalability in order to support different truck applications and flexible compatibility with future e-truck models. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Sandoz (the German-based generics/biosimilars division of Swiss firm Novartis) has announced an investment of EUR150 million (USD183 million) in an expansion of its antibiotic manufacturing capabilities at its European facilities, including Kundl in Austria and Palafolls in Spain. The funding will cover modernisation and streamlining of Sandoz's European manufacturing facilities over the next three to five years, including increased oral antibiotic production in Kundl, and expansion of the sterile active pharmaceutical ingredient (API) facility in Palafolls. As an initial step, Sandoz will investing more than EUR100 million in the introduction of new production technology for oral amoxicillin production in Kundl, allowing Sandoz to use this facility as a hub for the only major end-to-end antibiotics supply chain within Europe. At the Spanish Palafolls site, Sandoz plans to invest EUR50 million in new technology and scale-up of sterile penicillin API and sterile API mixture manufacturing to support production of Sandoz's leading penicillin product, amoxicillin + clavulanic acid (a generic version of Augmentin). (IHS Markit Life Sciences' Janet Beal)

- Chinese automaker BYD is planning to deliver 1,500 battery electric vehicles (BEVs) to Norway during 2021. As part of an announcement from BYD that it had built its 1 millionth vehicle, the company said that the first batch of 100 Tang sport utility vehicles (SUVs) are ready to be shipped to Norway by the end of May. These vehicles are scheduled to be delivered to Norwegian customers during the third quarter. BYD also aims for a further 1,400 vehicles to reach Norway before the end of this year. BYD already has a presence in Europe, supplying buses with partner Alexandra Dennis Limited (ADL), and has formerly supplied the e6, an earlier-generation compact battery electric crossover, in some parts of the region. However, this latest move looks to be a serious push by the brand as the market for BEVs in Europe expands. (IHS Markit AutoIntelligence's Ian Fletcher)

- Russia sold a two-part euro-denominated bond on 20 May, placing EUR1 billion of 15-year debt at 2.65%, versus 2.875% guidance, and adding EUR500 million to its 1.125% 2027 issue at 1.367%. Demand reached EUR2.1 billion. Russian investors took 47% of the 15-year tranche, with 22% taken by German and Austrian subscribers: 65% of 2027 the tap went to Russian buyers. (IHS Markit Economist Brian Lawson)

- The monetary policy committee (MPC) of the South African

Reserve Bank (SARB) left is key policy rate, the repo rate,

unchanged at 3.5% during its May meeting. The SARB has cut the repo

rate by a cumulative 325 basis points since 2018. (IHS Markit

Economist Thea

Fourie)

- At the meeting, the SARB lowered its inflation expectation for 2021 to 4.2% (from 4.3% previously) and left the 2022 and 2023 outlooks unchanged at 4.4% and 4.5% respectively. However, the SARB did change the risk to the medium-term inflation outlook to the upside from balance previously.

- Rising domestic and global producer prices combined with the risk of a weaker exchange rate of the rand, despite the pass-through effect currently being contained, pose increasing risk to South Africa's medium-term inflation expectations.

- If the current uptick in headline inflation shifts medium-term inflation expectations and becomes entrenched in upcoming wage agreements and unit labor costs, the SARB's response will be swift, in IHS Markit's view.

- According to GhanaWeb's Business News of 19 May, the new

Development Bank Ghana (DBG) will begin operations in July this

year. The bank's main aim is to provide long-term development

capital at sustainable interest rates to critical sectors like

agribusiness, manufacturing, and high-value services. The

establishment of the bank forms part of the government's

post-COVID-19-virus push to support economic recovery through

private-sector growth. (IHS Markit Banking Risk's Ronel Oberholzer)

- The World Bank provided USD250 million of start-up capital on concessional terms from the International Development Association (IDA), and expresses its hope that the bank will increase the availability of long-term financing.

- In a project appraisal document for the DBG, released in early October 2020, the World Bank noted that long-term financing was particularly scarce in Ghana, which reflected the strained availability of long-term financing funding for financial institutions. The scarcity of these loans was reflected in the fact that only 33% of the volume of banks' loans and advances had a maturity of more than three years in 2018. Loans with maturities of more than five years were only 15% of total loans.

- Furthermore, the document highlighted that the share of bank loans to agriculture and manufacturing was much smaller than their economic contribution to overall GDP. For instance, in December 2020, the share of bank loans for agriculture (including forestry and fishing) was just 3.7% (according to IHS Markit estimations), much smaller than the sector's contribution to Ghana's GDP (21%) in 2020.

- IHS Markit expects the establishment of the DBF to be risk positive for credit growth in the sector; not only is credit supply to be boosted, but demand is likely to increase as more borrowers from the private sector gain access to credit.

Asia-Pacific

- APAC equity markets closed mixed; India +2.0%, Japan +0.8%, Australia +0.2%, Hong Kong 0%, South Korea -0.2%, and Mainland China -0.6%.

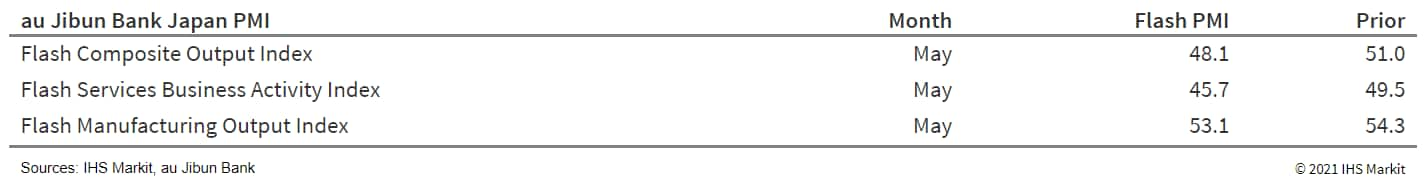

- The au Jibun Bank Flash Japan Composite PMI, compiled by IHS

Markit and published ahead of the final PMI results, indicated

Japan's private sector reverted into contraction in May. This comes

after just one month of expansion in April, which was in turn

preceded by 14 consecutive months of recession. The service sector

slipped further into contraction while manufacturing sustained a

fourth straight month of expansion, albeit at a slower rate. This

perhaps comes as no surprise given the reimposition of a state of

emergency across various prefectures since April that had now been

extended to end-May. (IHS Markit Economist Jingyi Pan)

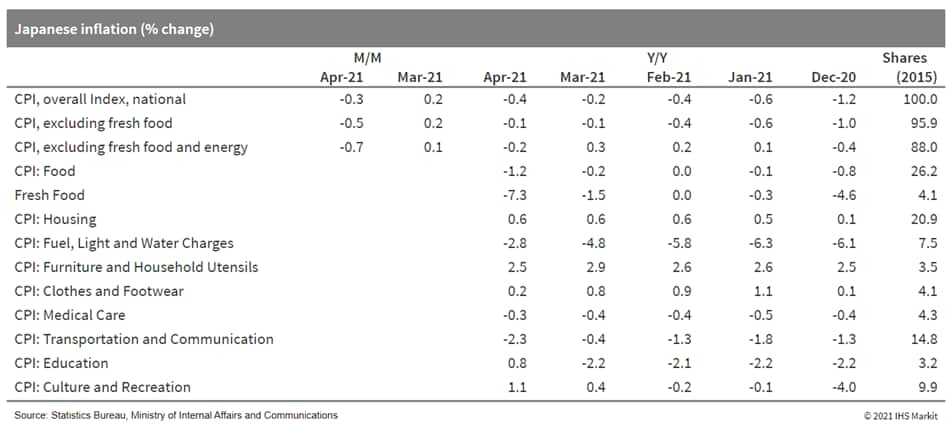

- Japan's CPI fell by 0.4% month on month (m/m) on a seasonally

adjusted basis in April and the year-on-year (y/y) contraction

widened to 0.4% from a 0.2% drop in March. (IHS Markit Economist Harumi

Taguchi)

- The CPI excluding fresh food fell by 0.5% m/m and the y/y contraction was unchanged 0.1% while the CPI excluding food and energy (the core-core CPI) fell by 0.7% m/m and 0.3% y/y.

- The major reasons for the declines in consumer prices were

weaker fresh food prices in line with better harvests and low

mobile phone charges introduced by major carriers. Those weakness

offset the first increase in energy prices since January 2020 (up

0.7% y/y) and higher prices for furniture and household utensils

and education.

- Japan's trade balance recorded a surplus of JPY255 billion

(USD2.3 billion) in March, up from JPY7.0 billion a year earlier on

a non-seasonally adjusted basis. (IHS Markit Economist Harumi

Taguchi)

- The seasonally adjusted balance also recorded a surplus of JPY65 billion, but this was down from JPY372 billion in the previous month.

- The trade surplus reflected a 38.0% y/y surge of exports while growth of imports rose to 12.8% y/y from a 5.8% rise in the previous month.

- The solid rise in exports was due partially to low base effects because of a plunge a year earlier due to the global spread of lockdowns, but primarily driven by exports to Asia (up 32.7% y/y).

- Exports to the European Union and the US rose by 39.6% y/y and 45.1% y/y, respectively.

- Major contributors to the increase were exports of autos, auto parts, and semiconductor production machinery.

- The faster rise in imports largely reflected higher prices for energy and other commodities as growth for import volume softened to 2.4% y/y from 3.9% y/y in the previous month. Accordingly, major contributors to the increase were crude oil, petroleum products, and non-ferrous metal products. In addition, imports of electrical machinery, particularly semiconductors, rose solidly in line with increased digitalization-related demand.

- Prime Planet Energy & Solutions, a battery joint venture (JV) between Toyota and Panasonic, has announced plans to boost production of batteries for electric vehicles (EVs) at its plants in China and Japan, reports Kyodo News. The automaker will install a new production line at its existing plant owned by the company's Chinese subsidiary, Prime Planet Energy Dalian, in Dalian in the northeastern Chinese province of Liaoning to produce prismatic lithium-ion (Li-ion) cells. The new facility is scheduled to start production this year. The JV will also set up a new production line at its Himeji plant, located in Hyogo Prefecture (Japan), to produce prismatic Li-ion cells. The report adds that the new production lines in China and Japan will have an annual production capacity to provide batteries for 400,000 hybrid electric vehicles and 80,000 EVs, respectively. (IHS Markit AutoIntelligence's Isha Sharma)

- Indonesia's anti-trust agency, the Commission for the Supervision of Business Competition (Komisi Pengawas Persaingan Usaha: KPPU) has said that it will inspect the merger deal between Gojek and Tokopedia to check for potential monopolistic behavior, reports Reuters. The companies recently merged to form GoTo Group, which includes online shopping, courier services, ride hailing, food delivery, and other services. The KPPU will review the deal "to focus on various relevant markets in the GoTo Group ecosystem, as well as the potential for monopolistic practices or unfair business competition that can arise after the transaction". (IHS Markit Automotive Mobility's Surabhi Rajpal)

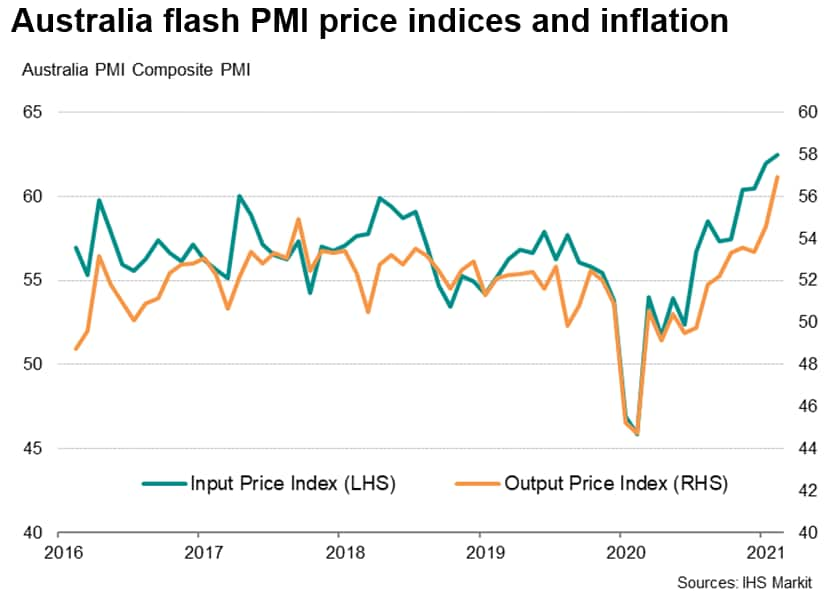

- Australia's flash composite PMI output index, covering both

services and manufacturing, eased from 58.9 in April to 58.1 in

May. However, April's flash PMI had marked the fastest rate of

expansion for the Australian economy since the survey began in May

2016, and is one of only two occasions to have beaten May's

expansion. (IHS Markit Economist Jingyi Pan)

- Additional capacity pressures had also led to firms sustaining the expansion of their workforces into May. Notably, private sector growth employment increased at a rate that was the strongest seen since the inception of the survey in May 2016.

- The highly watched input cost and output charge inflation

gauges meanwhile pointed to new records in May, signaling the

continued build-up of price pressures. This is of no surprise,

given soaring commodity prices, though the survey also reveals

pricing power having been buoyed as demand exceeded supply for many

goods and services, as reflected in a further marked lengthening of

supplier delivery times and a record build-up of backlogs of work

as businesses struggled to fulfil new orders.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.