Daily Global Market Summary - 22 April 2021

All major European and most APAC equity indices closed higher, while US markets were lower on a midday news release about a White House proposal to increase capital gains tax. US government bonds closed higher and benchmark European bonds were mixed. European iTraxx closed flat across IG and high yield, while CDX-NAIG and CDX-NAHY were wider on the day. The US dollar, natural gas, and oil closed higher, while silver, gold, and copper were lower.

Americas

- President Joe Biden will propose almost doubling the capital gains tax rate for wealthy individuals to 39.6% to help pay for a raft of social spending that addresses long-standing inequality, according to people familiar with the proposal. For those earning $1 million or more, the new top rate, coupled with an existing surtax on investment income, means that federal tax rates for wealthy investors could be as high as 43.4%. The new marginal 39.6% rate would be an increase from the current base rate of 20%, the people said on the condition of anonymity because the plan is not yet public. (Bloomberg)

- The Bloomberg news report on the US capital gains tax proposal resulted in the start of the worst 15-minutes of the day for the S&P 500/CDX-NAHY and best 15-minutes for 10yr US govt bonds all occurring between 12:57-1:04pm EST.

- US equity indices closed lower; Russell 2000 -0.3%, S&P 500 -0.9%, DJIA -0.9%, and Nasdaq -0.9%.

- 10yr US govt bonds closed -1bp/1.55% yield and 30yr bonds -3bps/2.24% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +2bps/297bps.

- DXY US dollar index closed +0.2%/91.33.

- Gold closed -0.6%/$1,782 per troy oz, silver -1.5%/$26.18 per troy oz, and copper -0.1%/$4.27 per pound.

- Crude oil closed +0.1%/$61.43 per barrel and natural gas closed +2.1%/$2.75 per mmbtu.

- Saying the bill will serve as the engine of a transition to a carbon-free economy, senior Democrats in the US Senate unveiled a sweeping proposal to overhaul the energy tax credit system on 21 April. The Clean Energy for America Act would consolidate more than 40 current ad hoc tax credits into three technology-neutral categories that would provide tax incentives for zero-emission power generation and storage, transmission lines, electric vehicles, and energy efficiency. Proposed by Senate Finance Committee Chairman Ron Wyden, Democrat-Oregon, and co-sponsored by 24 other Democrats, the bill would offer a 30% "direct-payment tax credit" to any zero- or negative-emissions generator regardless of technology — meaning eligible projects would include not just wind and solar but nuclear, fossil fuel power plants fitted with carbon capture and storage (CCS), geothermal, or other clean resources. (IHS Markit Climate and Sustainability News' Kevin Adler)

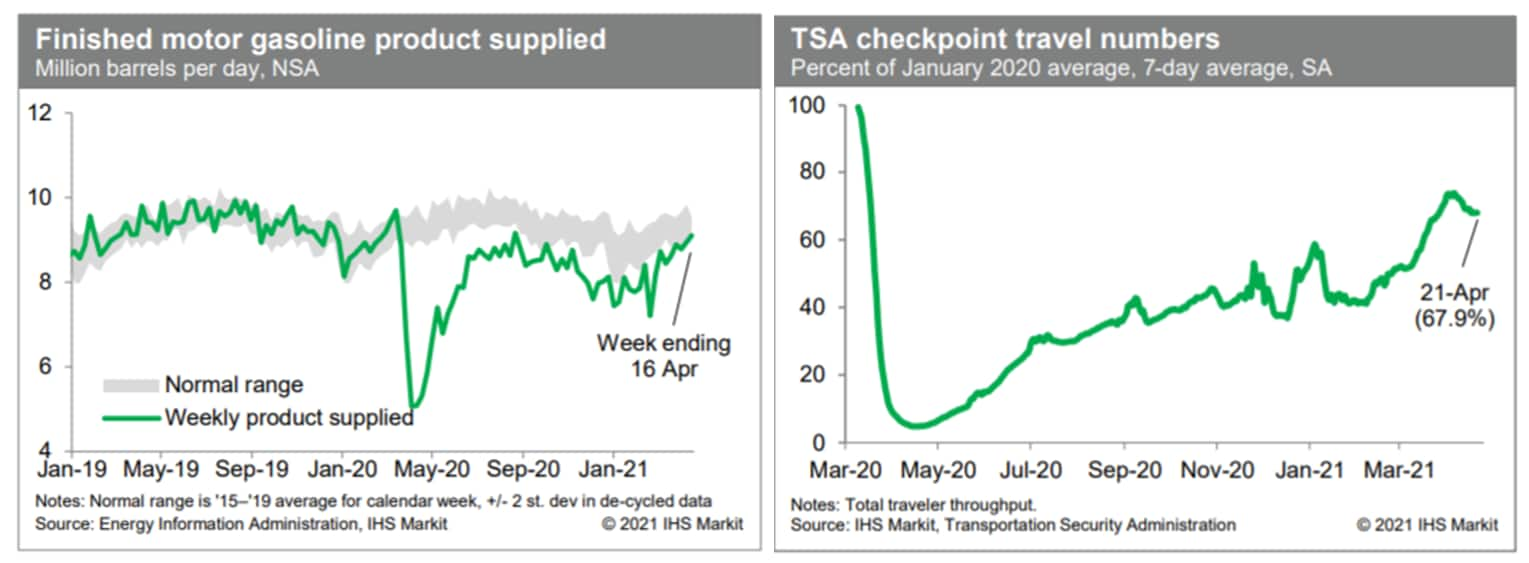

- Consumption of gasoline rose last week and remained near the

lower end of a normal range, suggesting that internal mobility is

approaching normal. Meanwhile, passenger throughput at US airports

(seasonally adjusted) in recent days has been running at about 68%

of the January 2020 level, down somewhat from a week or so ago, but

well up from levels around 40% this past winter. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 39,000 to 547,000 in the week ended 17 April, the

lowest since 14 March 2020, which recorded 256,000 claims. (IHS

Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 34,000 to 3,674,000 in the week ended 10 April, the lowest since 21 March 2020. The insured unemployment rate edged down 0.1 percentage point to 2.6%.

- In the week ended 3 April, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 447,704 to 5,605,935.

- There were 133,319 unadjusted initial claims for PUA in the week ended 17 April. In the week ended 3 April, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 265,228 to 7,309,604.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 3 April, the unadjusted total rose by 491,674 to 17,405,094.

- US existing home sales fell 3.7% in March to a

6.01-million-unit annual rate and total sales stand 5.4% above the

pre-pandemic (i.e., February 2020) level. Sales were down in all

four regions and single-family sales dropped for the third straight

time. (IHS Markit Economist Patrick Newport)

- Quarterly national sales were down 5.3% from the fourth quarter and were down in all four regions.

- Total inventory (data go back to March 1999) climbed from 1.03 million units to 1.07 million units; inventory of single-family homes (data go back to June 1982) increased from 870,000 to 900,000 units. These increases are seasonal: our estimate of seasonally adjusted single-family homes for sale hit another record low in March.

- According to a Wells Fargo report, listings are "down sharply" in nearly all states. This has led to large increases in home prices in many places. Nationally, the median price of a single-family home was up 18.4% from a year earlier in March, while the average price was up 13.2%. All four regions are seeing double-digit increases in both median and average prices.

- Properties took 18 days to sell in March, down from 20 in February and 29 in March 2020. Eighty-three percent of homes sold in March were on the market less than a month.

- Dow Inc. topped estimates as sharp margin and price recovery

more than offset US winter storm production impacts. First-quarter

net income was $1.0 billion, up from $258 million in the year-ago

quarter. (IHS Markit Chemical Advisory)

- Net sales were $11.9 billion, a gain of 22% year on year (YOY) with strong price gains across all segments and regions. Local price was up 19% YOY. Volumes were flat as gains in packaging and specialty plastics offset declines in industrial intermediates and performance chemicals.

- Reported operating earnings of $1.36/share were up 77 cts YOY and 24% above estimates, as reported by Zacks Investment Research.

- Packaging & specialty plastics segment net sales were $6.1 billion, up 32% versus the year-ago period. Operating EBIT was $1.2 billion, up 112% YOY, reflecting margin improvement and increased equity earnings. Segment price was up 24% YOY led by local price gains in industrial & consumer packaging, and flexible food & beverage packaging applications. Volume was up 5% YOY on gains in Asia Pacific.

- Industrial intermediates & infrastructure segment net sales were $3.6 billion, up 18% versus the year ago period. Operating EBIT was $326 million, up 86% YOY, due to strong supply and demand fundamentals in polyurethanes & construction chemicals and improved results at Sadara.

- Performance materials & coatings segment net sales were $2.1 billion, up 3% over the year-ago period. Operating EBIT was $62 million, down 62% YOY as local price gains across the portfolio and strong demand for coatings and silicones applications were more than offset by the impact of the winter storm and planned maintenance activity.

- US sales of fresh produce packaging is forecast to grow about 4% annually to about USD7.0 billion by 2024, according to Freedonia Group's latest analysis. Demand from consumers and the foodservice sector for produce sold in various forms of packaging are expected to continue to rise. These formats include pouches, bags and rigid plastic containers. Among the key drivers of growth will be increasing sales of ready-to-eat (RTE) salads, as well as pre-cut produce such as apple slices, melon spears, and carrot sticks - which are typically sold in clamshells, cups, and other plastic containers. There are several contributing factors. Surging grocery sales including more packaging-intensive online grocery orders have boosted plastic usage. Consumers are concerned about the safety of loose bulk-bin items that have been handled by others in stores. There is rising demand for RTE produce, which require minimal or no preparation before consumption. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- CF Industries Holdings has signed an engineering and procurement contract with Thyssenkrupp for its planned 20,000-metric tons/year green ammonia and hydrogen project at its Donaldsonville, Louisiana, manufacturing complex. Thyssenkrupp will supply a 20-megawatt (MW) alkaline water electrolysis plant to produce green hydrogen. CF Industries will integrate the carbon-free hydrogen generated by the electrolysis plant into existing ammonia synthesis loops at Donaldsonville. (IHS Markit Chemical Advisory)

- US-based software-as-a-service (SaaS) solution provider Ridecell has launched a platform, called Fleet IoT Automation, for fleet-based businesses. The platform is designed to convert today's manual processes into automated workflow, complementing existing fleet management systems and connected vehicle and telematics platforms. The Ridecell platform integrates data insights with digital vehicle control to bring digital transformation to fleets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Velodyne Lidar and autonomous technology company Gatik have entered into a multi-year LiDAR sensor supply agreement. Gatik will integrate Velodyne's Alpha Prime and Ultra Puck LiDAR sensors, which will provide real-time navigation to support its autonomous short-haul logistics. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Major European equity indices closed higher for the second consecutive day; Spain +1.6%, Italy +1.0%, France +0.9%, Germany +0.8%, and UK +0.6%.

- 10yr European govt bonds closed mixed; France/Germany +1bp and UK/Italy/Spain flat.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover flat/252bps.

- Brent crude closed +0.1%/$65.40 per barrel.

- The Office for National Statistics (ONS) has reported that the

United Kingdom's 12-month rate of consumer price index (CPI)

inflation rose to 0.7% in March from 0.4% in the previous month.

(IHS Markit Economist Raj Badiani)

- During 2020, inflation averaged 0.9%, well below the Bank of England's target of 2.0%.

- A breakdown of the inflation rate in March reveals continued price gains for several consumer-facing services, namely communications (+1.7% year on year [y/y]), recreation and culture (+2.2% y/y), and education (+2.1% y/y).

- Clothing and footwear prices dropped by 3.8% y/y in March as unseasonal price discounting continued during the month. Specifically, high-street retailers with closed physical outlets continued to resort to online price discounting to clear stock and bolster their financials.

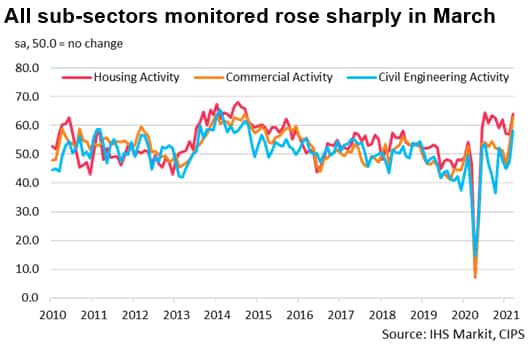

- The IHS Markit/CIPS UK Construction PMI Total Activity Index

registered well above the neutral 50.0 level at 61.7 in March, up

sharply from 53.3 in February. (IHS Markit Economist Usamah Bhatti)

- The latest survey highlighted much-improved trends for output, order books and employment, despite headwinds stemming from sustained supply chain disruption and the sharpest price hikes in nearly 13 years.

- The headline index reached the highest level since September 2014 to point to a rapid increase in overall activity.

- Restaurant and café prices rose for the seventh straight month

in March, by 1.0% y/y, despite only being able to serve takeaways.

This was also at odds with the value-added tax (VAT) rate cut from

20% to 5% in the hospitality, accommodation, and tourist attraction

sectors since mid-July 2020.

- The UK government's plan to have autonomous vehicles (AVs) on British motorways has come under criticism from insurance companies, reports Automotive News Europe. Insurance companies believe that automated technology will help reduce accidents and deaths, and save them billions of pounds in pay-outs. However, they are also concerned that drivers might equate today's lower levels of automation with fully autonomous vehicles. This, they say, could potentially cause more accidents in the short term and harm public confidence in automated technology. The insurance companies have previously warned that the use of automated lane keeping systems (ALKS) should not be classed as "automated", meaning that drivers can take their hands off the steering wheel. The automated system potentially needs to return control to a human driver within three seconds to avert high-speed collisions - but insurers' research found that it takes 15 seconds for the driver to be sufficiently engaged to react to avoid a hazard, or roughly 500 meters distance on a motorway. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- CGG has signed a strategic framework agreement (SFA) to help dCarbonX in the subsurface evaluation of its clean energy projects offshore Ireland and the UK involving the development and commercialization of CCUS, geothermal energy and hydrogen, CO2 and ammonia storage. CGG will apply its mindset to bring its integrated geoscience solution to support recognition and de-risk storage, sequestration and geothermal energy sites working in engineering, geological, geophysical, modelling, and monitoring technologies. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- The European Central Bank (ECB) did not make any significant

changes to its policy stance following its latest policy meeting,

reiterating the following key points in its regular statement (IHS

Markit Economist Ken Wattret):

- Net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) will continue to at least the end of March 2022, with a total envelope of EUR1,850 billion.

- Purchases under the PEPP over the current quarter will continue to be conducted at a significantly higher pace than during the first months of the year, given the ECB's assessment of financing conditions and the inflation outlook.

- If favorable financing conditions can be maintained with asset purchases that do not exhaust the current PEPP envelope, it need not be used in full. Equally, it can be recalibrated if required to maintain favorable financing conditions.

- Principal payments from maturing securities purchased under the PEPP will continue to be reinvested until at least the end of 2023.

- Net purchases under the Asset Purchase Programme (APP) will continue at a monthly pace of EUR20 billion for as long as necessary.

- ECB interest rates are expected to remain at their present or lower levels until the inflation outlook robustly converges to a level sufficiently close to, but below, 2% within its projection horizon, consistently reflected in underlying inflation dynamics.

- Daimler has announced that it will move around 18,500 employees onto short-time working at its Rastatt and Bremen plants as a result of the ongoing semiconductor shortages affecting global passenger car production, according to a Reuters report. Daimler said it could give no indication as to how much production would be affected by the short-time working program. (IHS Markit AutoIntelligence's Tim Urquhart)

- AkzoNobel says its first-quarter net profits leapt 90% year on

year (YOY), to €227.0 million ($272.7 million) on 10% higher sales

of €2.26 billion. Volumes were up 16% YOY, mainly due to strong

end-market demand, and prices increased 2% YOY, the company says.

(IHS Markit Chemical Advisory)

- Operating income was up 62% YOY, to €303.0 million, beating analysts' consensus estimate of €267.6 million, provided by Vara Research (Frankfurt, Germany), by 13.2%, driven by volume increases and cost discipline, AkzoNobel says.

- EBITDA increased 40% YOY, to €338.0 million, missing consensus of €362.6 million.

- The company's decorative paints business posted 23% YOY growth in first-quarter sales, to €930.0 million, with 28% higher volumes as revenue increased in all regions.

- The performance coatings business of AkzoNobel recorded a 3% YOY increase in sales, to €1.33 billion, on 10% higher volumes.

- Responding to rising demand for plant-based products, Cargill

is investing in Bflike, a Dutch start-up that makes ingredients for

meat and fish alternatives. (IHS Markit Food and Agricultural

Commodities' Max Green)

- By combining its own food ingredient solutions with Bflike's recipes and technology, Cargill said the partnership would give food manufacturers and retailers the opportunity to bring tasty plant-based products to market quickly and affordably.

- Bflike has a product pipeline of meat and fish alternative formulations, ready to hit the market this year, next to the vegetarian burger and minced meat already available. Cargill said the collaboration would position customers to move seamlessly from pilot to commercialization and allow them to scale up quickly using their own production process and machinery.

- The Cargill investment in Bflike is realized through a joint venture with Blue Ocean Xlerator NV (BOX), a Dutch private incubator/accelerator focused on sustainable innovations in the food sector. Bflike also benefits from the technical support of TOP BV, a Dutch food technology service provider based in Wageningen Food Valley.

- Jordan reported a widening fiscal shortfall in 2020, according

to a recently issued Ministry of Finance report covering the full

year. Jordan's fiscal deficit reached JOD2.18 billion (USD3.08

billion, 7.0% of GDP), from a much lower JOD1.06 billion (USD1.49

billion, 3.3% of GDP) in 2019, as per the official statistics. (IHS

Markit Economist Jamil Naayem)

- The rising deficit comes as fiscal receipts dwindled due to the COVID-19 pandemic-driven closures and the ensuing contraction in economic activity, with authorities estimating real GDP growth of -1.6%. Also, spending expanded as authorities prioritized support measures to counter the impact of the crisis on the domestic economy.

- Fiscal revenues actually declined by 9.4% on a yearly basis to reach JOD7.03 billion (USD9.91 billion) in 2020. This is entirely due to a drop in domestic revenues, as foreign grants slightly edged up in 2020.

- South Africa's headline inflation rate edged up to 3.2% year on

year (y/y) in March, from 2.9% y/y in the previous month. This

leaves South Africa's headline inflation rate at 3.1% during the

first quarter of 2021, down from the 4.4% recorded over the same

period last year. (IHS Markit Economist Thea Fourie)

- Food and non-alcoholic beverages showed the largest contribution to the overall annual price gains during March, with prices in the category rising by 5.7% y/y and contributing 1.0 percentage point to the overall rate.

- This category was followed by housing and utilities prices, up 2.2% y/y and contributing 0.5 percentage point, and transport prices, up 3.8% y/y and contributing 0.5 percentage point.

- The miscellaneous goods and services category made a 0.7-percentage-point contribution to the annual overall inflation rate during March.

- 'Core' inflation (excluding food and non-alcoholic beverages, fuel, and energy) edged up by 0.5% month on month (m/m) during March, leaving the annual growth rate at 2.5% during the month.

Asia-Pacific

- Most APAC equity markets closed higher except for Mainland China -0.2%; Japan +2.4%, Australia +0.8%, India +0.8%, Hong Kong +0.5%, and South Korea +0.2%.

- RoboSense has partnered with Banma and AutoX to develop an autonomous platform for intelligent vehicles. The partnership will allow the integration of smart cockpits with autonomous vehicle (AV) systems through the fusion of hardware, software, and artificial intelligence (AI) capabilities. RoboSense will provide its 3D LiDAR sensor and Banma will offer advanced intelligent cockpit systems, which will be integrated with AutoX's AV system, AI Driver. Jianxiong Xiao, founder and CEO of AutoX, said, "With the fully driverless RoboTaxi becoming a reality in China, passengers will have more free time in the car. More intelligent services and interactions with the car are needed for a smart and enjoyable travel experience. A complete product ecosystem formed by three parties will create a safe and enjoyable autonomous driving solution." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota has announced that it is using motorsport to develop an internal combustion engine (ICE) powered by hydrogen. According to a statement, the 3-cylinder 1.6-litre turbocharged engine is to be installed in a Corolla Sport that has had its fuel supply and injection system modified from using gasoline (petrol) to using hydrogen. The vehicle is to compete under the ORC ROOKIE Racing banner and race in the third round of this year's Super Taikyu Series at the Fuji Speedway (Japan), held over 24 hours on 22 and 23 May. (IHS Markit AutoIntelligence's Jamal Amir)

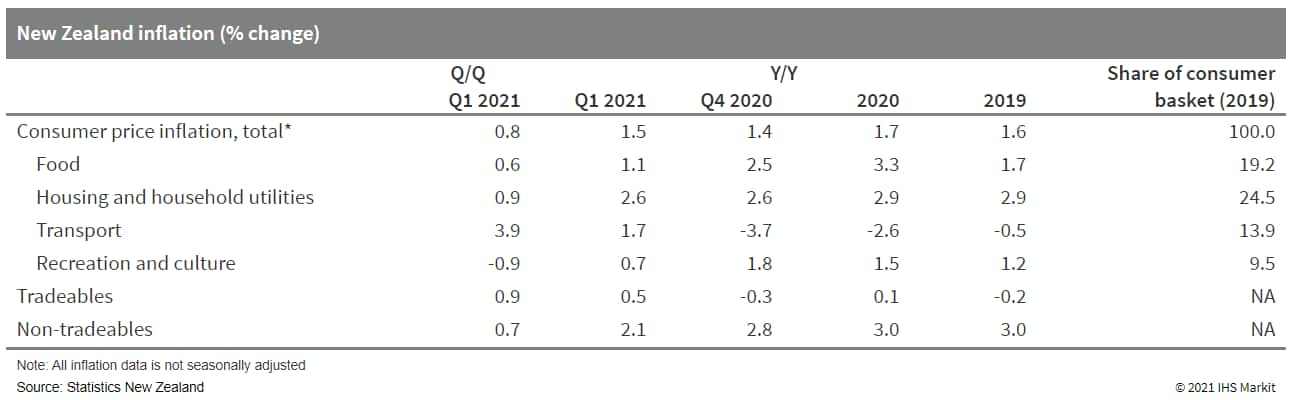

- New Zealand's headline consumer price index (CPI) rose 0.8% q/q

on a non-seasonally adjusted basis in the first (March 2021)

quarter, which was led by transport costs, according to official

figures from Statistics New Zealand. Annual inflation rose to 1.5%

y/y. (IHS Markit Economist Andrew Vogel)

- The largest contributor to the uptick in CPI in the March quarter was transport costs (up 3.9% q/q, or 1.7% y/y), which includes prices for private transport supplies and services (up 4.6% q/q), petrol (up 7.0% q/q), and purchases of vehicles (up 2.6% q/q) - the latter driven in particular by an increase in prices for second-hand vehicles.

- Housing and household utilities costs also rose notably (0.9%

q/q, or 2.6% y/y) owing to increases in the costs of home ownership

(up 1.2% q/q, or 3.5%) and housing rentals (up 1.0% q/q, or 2.7%

y/y). Regionally, rental prices increased 0.5% q/q in Auckland,

1.7% q/q in Wellington, and 0.8% q/q in Canterbury.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.