Daily Global Market Summary - 22 September 2021

All major European and US equity indices closed higher, while APAC was mixed. US government bonds and most benchmark European bonds closed higher. European iTraxx and CDX-NA closed tighter across IG and high yield. The US dollar, oil, copper, and silver closed higher, while gold and natural gas were flat on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.5%, Nasdaq +1.0%, DJIA +1.0%, and S&P 500 +1.0%.

- 10yr US govt bonds closed -1bp/1.31% yield and 30yr bonds -4bps/1.82% yield.

- CDX-NAIG closed -2bps/51bps and CDX-NAHY -7bps/277bps.

- DXY US dollar index closed +0.3%/93.46, rallying +0.5% between 2:35pm-3:03pm ET during Chairman Powell's FOMC press conference.

- Gold closed flat/$1,779 per troy oz, silver +1.3%/$22.91 per troy oz, and copper +3.1%/$4.25 per pound.

- Crude oil closed +2.5%/$72.23 per barrel and natural gas closed flat/$4.81 per mmbtu.

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon (22 September). The statement released at the conclusion of the meeting strongly suggested that the Federal Reserve will soon announce a reduction in the pace of securities purchases. Updated projections from FOMC participants indicate that exactly one-half expects the first increase in the federal funds rate target in 2022, with almost all remaining participants expecting the first rate hike in 2023. Median FOMC projections anticipate higher core inflation in 2022 and 2023 and a higher path for the federal funds rate from 2022 through 2024 than in our forecast. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- During today's press briefing, Federal Reserve Chair Jerome Powell reviewed the outcome of the 21-22 September meeting of the Federal Open Market Committee (FOMC), in which there was a unanimous vote to maintain the target range for the federal funds rate at 0% to 0.25%, to continue large-scale asset purchases at a pace of approximately $120 billion per month, and to signal that the FOMC is likely to announce a reduction in the pace of asset purchases in the near future. The FOMC stated previously that it would not begin to taper until "substantial further progress has been made toward its maximum employment and price stability goals." During today's briefing, Chair Powell stated that the test of substantial further progress towards their inflation objective had been met and that substantial further progress in terms of labor markets had been "all but met". We view it as highly likely that the FOMC will announce it will begin to taper securities purchases at the next meeting, which will conclude 3 November. Although a taper could begin soon, the economy is far from the conditions that would call for beginning to raise interest rates. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Lobby groups are warning that activity in the world's biggest bond market could grind to a halt at the end of this month without last-minute exemptions to an obscure 50-year-old rule in the US that has previously taken aim only at stocks. The SEC's 1971 statute, known as 'rule 15c2-11', governs the "publication or submission" of prices to buy and sell securities away from exchanges. Market participants have largely considered it an attempt to guard retail investors from predatory schemes and fraudulent activity in penny stocks. The rule requires broker dealers to check a wide range of information on issuers, including quarterly and annual reports. Last year the SEC, then led by Jay Clayton, tweaked the rules for the first time in almost three decades, and included a requirement for the information to be publicly available. (FT)

- With the summer months winding down in what is typically a

quiet period for equity markets, US stocks notched new highs in mid

September before experiencing a sell off on 20 September. Investors

returning from vacation now grapple with potential threats to the

economic recovery ranging from rising delta variant cases, tapering

of Federal Reserve bond purchases, increasing taxes, intensifying

geopolitical risks and, most recently, roiling Chinese credit

markets and fears of contagion from Evergrande's debt crisis. With

these pressures in mind, we review several signals identifying

various headwinds facing sectors. (IHS Markit Research Signals)

- A new IHS Markit Investment Manager Index™ survey, based on monthly data collected between 7th and 13th September, identified a slide in overall US equity investor sentiment in addition to survey record lows towards Consumer Discretionary and Industrials

- Healthcare, Information Technology and Industrials have seen the highest frequency of negative earnings revisions, exposing them to higher risk of further downward revisions given the forecasted slowdown in Q3 GDP

- The proposed tax on share buybacks would be most detrimental to Financials given their higher propensity for buybacks, coupled with reduced revenues for investment banks.

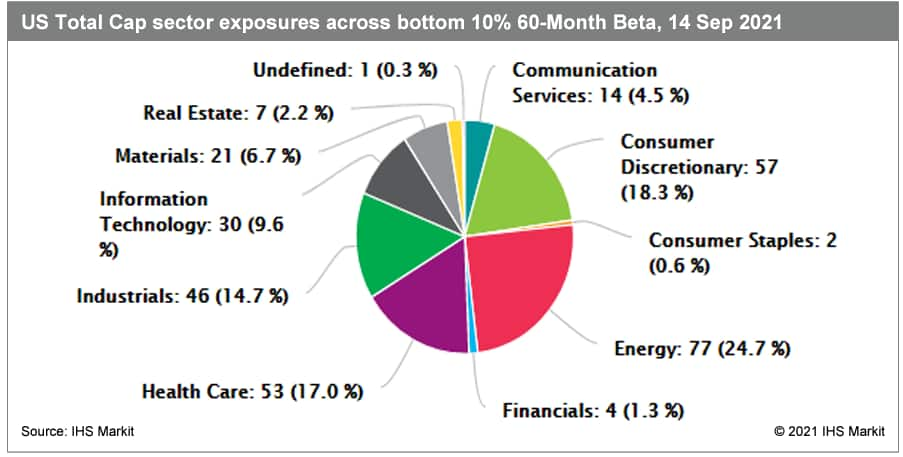

- Research Signals Stock Screener was used to view sector

exposures to those stocks in the bottom 10% of 60-Month Beta ranks,

in other words, the highest risk stocks. We found that the Energy

and Consumer Discretionary sectors have the highest representation,

indicating a greater negative exposure to increasing investor risk

aversion.

- US existing home sales slipped 2.0% to a 5.88-million-unit

annual rate in August; sales were down in all four regions.

Year-to-date sales remain solid: 16% and 12% higher than in 2020

and 2019, respectively. (IHS Markit Economist Patrick

Newport)

- The median price of a single-family home was up 15.6% from a year earlier, while the average price climbed 10.2%. All four regions continue to see double-digit increases in the median price.

- Inventory (data go back to July 1999) moved down by 20,000 to 1.29 million units. Our seasonally adjusted estimate dropped by 18,000 to 1.20 million. The months' supply was 2.6 months, unchanged from July. Over 2011-19, the months' supply, which is not seasonally adjusted, averaged 4.7 months.

- Low inventory has suppressed sales. This might be changing. The Mortgage Bankers Association (MBA)'s Purchase Index—a leading indicator for home sales—has turned in recent weeks, ending an eight-month slide.

- Properties took 17 days to sell in August, unchanged from July and down from 22 in August 2020; 87% of homes sold in August were on the market less than a month.

- Bottom line: Sales remain solid—above their pre-pandemic levels—but have slowed because of soaring prices and low supply. MBA data suggest that sales may be getting a second wind.

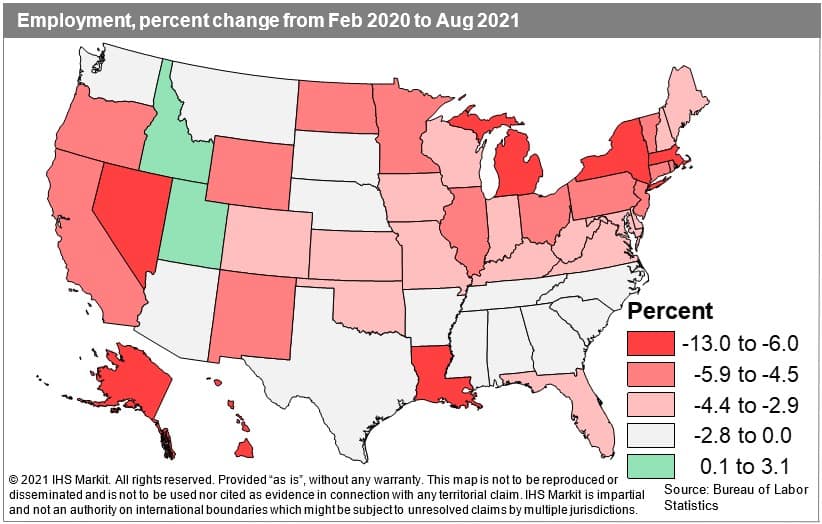

- As the Delta variant surge swept the country this summer,

employment growth lost significant momentum in August in the South

and Midwest. The threat of the virus, plus skyrocketing

hospitalizations in less-vaccinated regions, led to a sharp

drop-off in state payroll gains that were still recovering from

their 2020 dive. Leisure/hospitality and education/health services

in particular declined in many states in the South and Midwest, and

while the Northeast and West also experienced decelerating job

growth, their slowdowns were not as marked. Going into the summer,

the job recovery had seen widespread momentum across all four

regions as the removal of business restrictions, increasing

consumer confidence, and higher levels of leisure travel sparked a

steep rise in hiring. Then, the fast-spreading Delta variant tapped

the brakes on that recovery. This occurred without widespread

reimplementation of pandemic containment measures, indicating that

consumers chose to scale back both spending and leisure activities

as virus concerns returned. While the leisure and hospitality

industries in all states remain below their pre-pandemic employment

levels, stagnating spending on restaurants and travel as the Delta

variant spread restrained the overall recovery in August. (IHS

Markit Economist James

Kelly)

- Growth in the Midwest rapidly shifted into a decline in August, a result of modest drops in manufacturing employment throughout the region and strong declines in leisure/hospitality and education/health services. Iowa, Wisconsin, Indiana, and South Dakota all saw outright declines in total nonfarm employment in August, with Iowa seeing a notable deterioration in many of its major employment sectors.

- Similar trends affected states in the South, the region with the highest rates of Delta variant hospitalizations in August. Job contractions in leisure and hospitality services were widespread, affecting tourism-dependent states such as Georgia and Florida. Manufacturing hiring did manage to continue rising in most Southern states as producers were able to hire more workers to keep up with demand for food, automobiles, and other goods.

- Meanwhile, with more-vaccinated populations and fewer

hospitalizations overall, strong recoveries in leisure and

hospitality services benefited states in the Northeast and West in

August. Job gains were led by Nevada, California, New Jersey,

Washington, and New York. With the Delta variant striking less

severely in these two regions, consumers continued their early

summer trend of resuming more normal patterns of leisure spending

and travel.

- NYMEX front-month natural gas futures saw a fourth consecutive day of losses on Tuesday in the midst of heavy profit-taking that stemmed from a much lower demand temperature outlook for the next couple of weeks. The NYMEX October 2021 gas futures contract fell 18 cents to close at $4.805/MMBtu, marking the lowest close since September 7. Since hitting an intraday high of $5.65/MMBtu one week ago, prices have tumbled 15%. The chief reason for the selling was led by the 15-day temperature outlook for late September and early October for the Lower 48 states. The temperature scheme appears to be getting ever closer to becoming demand-neutral, which is a period during the low-demand 'Shoulder Season' when the temperatures are still a bit too cool for significant Heating Degree Days (HDDs), but still too warm for notable Cooling Degree Days (CDDs). The most recent Gas Weighted Degree Days (GWDDs) data for the September 22-October 5 period are showing the fewest in the past 5 years, which will in turn bolster weekly natural gas storage injections. This situation is a bearish price-setting mechanism. In addition to lower CCDs during the next few weeks, gas market players also had to contend with news that the Cove Point LNG export facility going offline for a likely 3-week annual maintenance period. (IHS Markit PointLogic)

- New York State regulatory agencies announced 20 September that

Clean Path NY and Champlain Hudson Power Express (CHPE) have been

chosen to construct and operate a pair of transmission lines that

will deliver a total of 2.55 GW of renewable energy from upstate

New York and Canada to the state's more populous areas. The New

York State Energy Research and Development Authority (NYSERDA) said

the two projects-which have yet to receive final permitting-would

deliver 18 million MWh per year upon completion. That's enough to

power more than 2.5 million homes and reduce GHG emissions by 77

million mt over the next 15 years, the equivalent of taking 1

million cars off the road. (IHS Markit Net-Zero Business Daily's

Kevin Adler)

- The projects were announced during the first day of New York Climate Week by Governor Kathy Hochul, less than a month after she assumed the position when Andrew Cuomo stepped down. Hochul said the projects will help the state reach its goal of 70% of its energy coming from renewable sources by 2030 and 100% by 2040, per the Climate Leadership and Community Protection Act that Cuomo signed in 2019.

- Clean Path NY is a 1.3-GW, 174-mile underground line that will deliver power from 20 wind and solar projects. It is being developed by Forward Power, a joint venture of Invenergy and energyRe, and the state-owned New York Power Authority.

- CHPE is a 1.25-GW, 339-mile underground and underwater transmission project that will deliver wind energy and hydropower from Quebec to Queens, New York, and locations along the way. It is being developed by Blackstone-backed Transmission Developers and Hydro-Québec, and it will run under Lake Champlain and part of the Hudson River on its route downstate.

- Concurrent with the announcement that it is part of the winning bid on the CHPE project, Hydro-Quebec said on 20 September it has signed a 25-year deal to sell power to New York worth approximately $20 billion.

- The US federal government has opted to buy up to 187 million rapid COVID-19 antigen tests from Abbott Laboratories (US) and Celltrion (South Korea) for up to USD1.2 billion, it has been widely reported in US media, based on statements by an official in the Department of Health and Human Services (HHS). Further purchase options are included in the purchase agreements, which are part of a wider USD2-billion investment announced earlier this month by the Biden administration, aimed at broadening the availability of rapid tests. As reported by Bloomberg, the new agreements will involve Abbott supplying between 13.4 million and 168 million of its BinaxNOW tests for USD44.3 million - USD554.4 million, as confirmed by an Abbott spokesperson; Celltrion will provide a minimum of 19 million and a maximum of 232 million of its DiaTrust tests for USD50 million - USD626.4 million, as confirmed by an HHS official. This follows the announcement in the previous week of deals worth USD647 million for four companies to supply the federal government with 60 million over-the-counter rapid tests; the companies involved are Abbott Rapid DX North America, Quidel Corp, OraSure Technologies, and Intrivio Holdings Corp. As highlighted in a New York Times article, rapid tests are relatively difficult to find in the US, in contrast with Europe, where they are subsidized by governments. The poor availability is being seen as one of the contributors to the spread of the virus in the US, and these latest deals show the Biden administration's response to this challenge. (IHS Markit Life Sciences' Brendan Melck)

- Uber Technologies has said that it could post its first profit on an adjusted basis for the current quarter. It said that it is expecting its adjusted EBITDA, a profitability metric it uses, to be between a loss of USD25 million and a profit of USD25 million for the third quarter of 2021. This is an improvement from the company's prior forecast of a loss of USD100 million. Uber expects gross bookings for the current quarter to be between USD22.8 billion and USD23.2 billion, up from its previous forecast of USD22 billion and USD24 billion. Dara Khosrowshahi, CEO of Uber, said, "We've not only grown our global leadership across both mobility and delivery; we've done so more profitably than ever before... Uber is reaching an important milestone." This milestone is sooner than expected as Uber sees its online food orders surging and ride bookings recovering from the COVID-19 virus lows. Over the past year, the company has reduced staffing, offloaded its food delivery business in unprofitable markets, and sold its air taxi and autonomous vehicle (AV) businesses to reduce costs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The latest IRI data shows that rising COVID-19 cases led to

increasing fresh fruit and vegetable retail sales in August. Fruits

were the driving force. The share of meals prepared at home

increased once more to nearly 80% from 76.6% in July. Shoppers

continued to spend less time in-store than they did pre-pandemic.

(IHS Markit Food and Agricultural Commodities' Hope Lee)

- The price index for fresh produce is right in line with total food and beverages most weeks currently showing a 6% increase versus 2020 this past August. Restaurant price increases reached a record high and there were very similar boosts for food-at-home.

- The five August weeks generated $7 billion of retail sales of fresh produce, 1% up y/y and 12% up over pre-pandemic August 2019.

- Fruit sales lifted overall fresh produce sales. Fruit has recorded slightly higher inflation thus far in 2021 than vegetables. In August, cherry sales remained in the top 10. Apples, grapes, bananas and avocados showed strong performance.

- Berries, apples, bananas and grapes have been steady top 10 sellers, but mandarins, peaches, cherries and mixed fruit are all relative newcomers. In August, berry sales reached $745 million, 8% up y/y and 24% up from August 2019. Apple sales were $348 million, 10.5% up y/y and 9.9% up from August 2019. Mixed fruits reached $100 million, 29.5% up y/y and 28.5% up from 2019.

- Vegetables generated about $3.2 billion in August. Vegetable sales increased massively in 2020, thus, facing a challenge to further accelerate sales. Tomato sales reached $355 million, 4.7% down y/y and 10.5% up from 2019. Packaged salad was $318 million, 10% up y/y, 24.8% up from 2019.

Europe/Middle East/Africa

- All major European equity indices closed higher for a second consecutive day; UK +1.5%, Italy +1.4%, France +1.3%, Germany +1.0%, and Spain +0.6%.

- Most 10yr European govt bonds closed higher except for France flat; Italy -3bps and Germany/France/Spain/UK -1bp.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -6bps/242bps.

- Brent crude closed +2.5%/$76.19 per barrel.

- The world's largest floating offshore wind farm has gone into operations, a month after the last turbine was installed at the 50 MW Kincardine offshore floating wind farm. All the power generated will be sold to Statkraft with a minimum guaranteed price until 2029. The project, consisting five Vestas 9.5 MW and one Vestas 2 MW offshiren turbines, is developed by Kincardine Offshore Wind, a wholly-owned subsidiary of Pilot Offshore Renewables (POR). The EPC and commissioning of the wind farm was carried out by Cobra Wind, a subsidiary of ACS Group. The wind farm is located 15 kilometers off the coast of Aberdeenshire, Scotland, in water depths of 60 to 80 meters. The 2 MW turbine has been installed and operating since October 2018, however the construction of the rest of the 9.5 MW turbines had been delayed by more than year due to the COVD-19 situation. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Developing countries will need to do more to show that they

meet international standards on climate change and labor protection

if they are to continue receiving tariff concessions under the EU's

Generalised System of Preferences (GSP). (IHS Markit Food and

Agricultural Policy's Chris Horseman)

- This is one of the main elements in a proposed overhaul of the GSP system presented by the European Commission on September 22.

- The current safeguard mechanisms will be overhauled to make it easier for the Commission to withdraw GSP preferences in case of a breach of commitments - and agri-food and other producers will find it slightly easier to trigger safeguards if imports from GSP countries start to cause economic harm.

- The Commission has aimed to steer a middle course between promoting its development credentials in offering trade concessions to the world's poorer countries and appearing tough on developing countries which fail to meet labor and environment laws.

- National officials are set to endorse the authorization of

frozen and dried formulations of migratory locust (Locusta

migratoria) as a novel food at a September 28 meeting, clearing the

way for the second European authorization of an insect under the

EU's 2015 novel food regulation (2283/2015). (IHS Markit Food and

Agricultural Policy's Sara Lewis)

- The European Commission is asking the Standing Committee on Plants, Animals, Food and Feed (PAFF) Novel Foods and Toxicological Safety of the Food Chain section to approve the implementing regulation, adding migratory locust to the Union list of novel foods following a favorable opinion from the European Food Safety Authority (EFSA).

- Published in July, EFSA's May 25 opinion concluded that the locust products from Dutch producer Fair Insects were safe if used as proposed. Fair Insects intends to sell three formulations - frozen, dried and ground - of migratory locusts to the general population as a snack or ingredient in a range of different food products.

- Authorization will not come immediately after the PAFF Committee meeting, however. A Commission spokesperson explained to IHS Markit that if the PAFF Committee delivers a favorable opinion on the proposal, it will be then translated into all of the EU's official languages (there are 24 including English), a process that takes around a month.

- Germany's Federal Statistical Office (FSO) has reported that

real monthly earnings growth in the whole economy (including

employees in the public sector, including bonus payments, and

assuming for analytical purposes that the employment structure of

the previous year has remained constant) shot up from -2.0% year on

year (y/y) in the first quarter to +3.0% y/y in the second quarter.

This compares with an all-time low of -4.7% in the second quarter

of 2020, a series peak of +6.0% in the third quarter of 1992, and a

long-term (1992-2020) average of +0.4%. (IHS Markit Economist Timo

Klein)

- Nominal wage growth jumped even more strongly from -0.7% to +5.5% y/y, owing to another large increase in consumer price inflation from 1.3% to 2.4%. The rate of 5.5% markedly exceeds its long-term average of 2.1%.

- As in the four previous quarters affected by the pandemic, the number of hours worked had a critical influence on monthly earnings. As the number of people on short-time work schedules has been declining since March, the annual change in the number of hours worked swung from -3.1% to +4.0% y/y. This matters because government subsidies for short-time work are not classified as earnings as reported in these statistics (employees who were furloughed, i.e. effectively put on 0% short-time work, are ignored altogether).

- The second-quarter breakdown by different types of employment shows that nominal wage growth (total: 5.5% y/y) recovered most strongly for full-time employees (from -0.5% in the first quarter to +5.6%), followed by part-time workers (from -1.0% to +4.6%) and the holders of so-called "mini jobs" (from -1.8% to +3.7%). Nevertheless, all groups benefited markedly from the staggered loosening of lockdown restrictions affecting service-sector activities, especially those in the recreation, entertainment, and catering sectors.

- Volkswagen (VW) is to supply a UK-based taxi fleet with its battery electric vehicles (BEVs). Addison Lee, which is based in London, has said that it will make its passenger car fleet BEV-only by 2023, and will base it around VW's ID.4. It added that beginning in November, around 200 vehicles per month will be added to its fleet, representing an investment of around GBP160 million. The company added that it is also in discussion with EV charging partners to meet the demands of its drivers using these vehicles in London. Although some private hire firms in London have featured BEVs as part of their fleet or, in some smaller cases, their entire fleet, the move by Addison Lee is a big step. While this will focus on its private hire fleet rather than its black hackney carriage taxi operation ComCab, which requires more specialized vehicles, if these VW ID.4s are a like-for-like replacement with existing vehicles, it could be over 4,000 vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

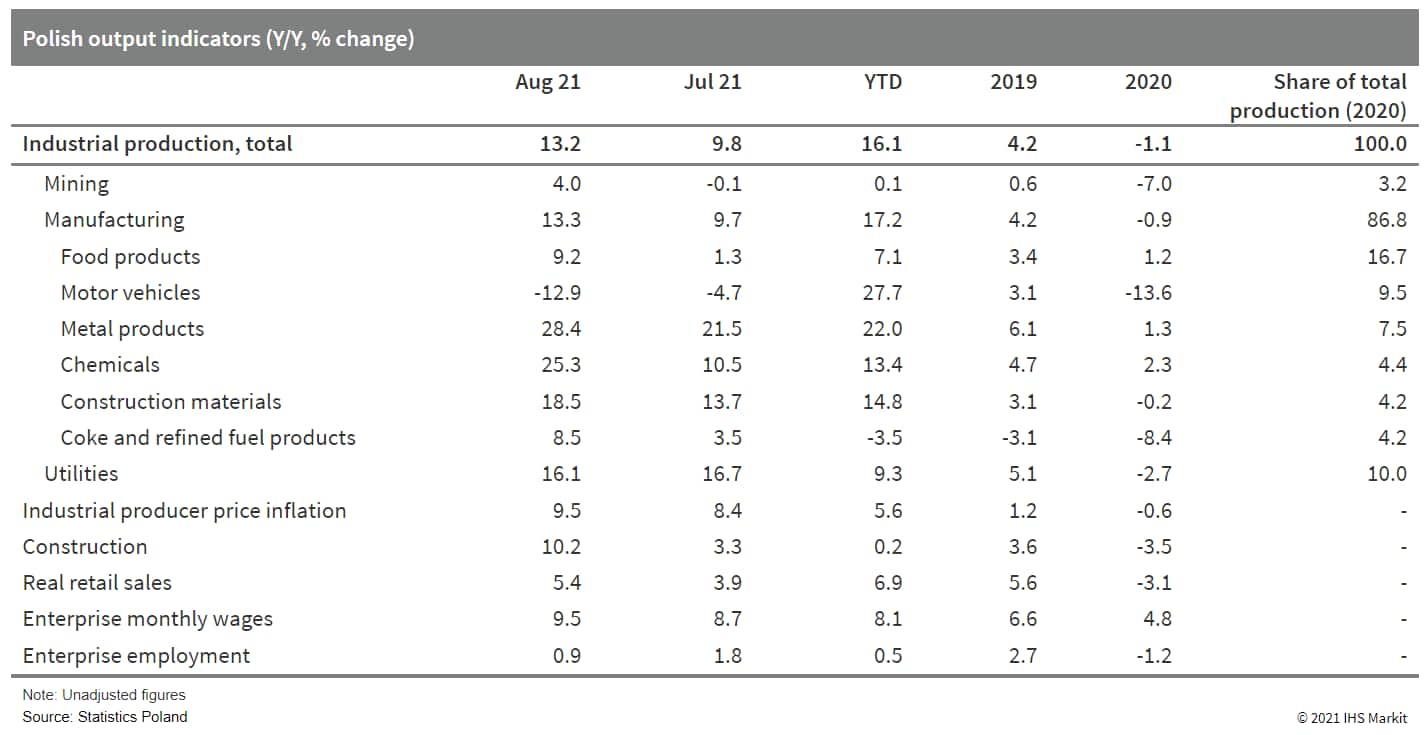

- Poland's unadjusted industrial output rose by 13.2% year on

year (y/y) in August. However, seasonally adjusted results were

less encouraging, rising by 10.7% y/y and declining by 0.3% month

on month (m/m). (IHS Markit Economist Sharon

Fisher)

- Several important manufacturing branches recorded robust y/y growth in August, including metal products, chemicals, and construction materials. In contrast, motor vehicles production fell sharply amid ongoing supply-chain challenges.

- By industrial group, intermediate goods, energy, and durable consumer goods reported double-digit y/y gains, while capital and non-durable consumer goods rose by 6-7% y/y.

- Supply shortages and increased demand triggered a continued surge in industrial producer prices in August, rising by 0.6% m/m and 9.5% y/y. Price growth was fastest in basic metals manufacturing (up by 4.4% m/m).

- Retail sales growth also disappointed on the downside in August, edging up by just 0.4% m/m in real, seasonally adjusted terms, thereby failing to compensate for the July decline. In a y/y comparison, retail sales increased by 5.4% y/y, while nominal growth was considerably faster (at 10.7% y/y), boosted by the high rate of inflation.

- On the building front, unadjusted construction activity surged

by 10.2% y/y in August, the best result since April 2019. Although

seasonally adjusted production was considerably weaker (up by 7.1%

y/y), m/m growth reached 1.6%, after two straight periods of

decline.

- Technip Energies and National Petroleum Construction Company (NPCC), a subsidiary of National Marine Dredging company, have signed a Memorandum of Understanding (MoU) to advance the energy transition in United Arab Emirates (UAE) and other countries in the Middle East and North Africa (MENA) region. The aim of this agreement is to explore and capitalize on the evolution of the energy industry towards decarbonization and clean energy and to provide added-value services. The two companies will create a Joint Venture (JV) to enhance these goals. The strategic partnership will focus on capturing opportunities in the energy transition and on fostering best engineering practices. It will also enhance cooperation in carbon capture, and blue and green hydrogen and related decarbonization projects in addition to industrial projects in the fields of waste-to-energy, biorefining, biochemistry and ammonia. (IHS Markit Upstream Costs and Technology's William Cunningham)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +0.4%, Australia +0.3%, India -0.1%, and Japan -0.7%.

- An autonomous bus manufactured by China's CRRC Electric Vehicle Co is conducting trials on open roads in Paris (France). Clement Bayard, a French company, imported the 12-metre-long autonomous bus into France. It travelled a 6-km route along the 393 bus route in southeast Paris. In about 40 minutes, the bus passed 26 traffic lights and 10 bus stops. It is scheduled to start regular passenger services in Paris next year. Christelle Tang, president of Clement Bayard, said, "The Chinese technology has been adapted to the French market in collaboration between our company and RATP", reports China Daily. This marks the debut of a Chinese autonomous vehicle entering the French market. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The BoJ maintained its monetary policy during the 21 and 22

September monetary policy meeting (MPM). The bank will continue

quantitative and qualitative monetary easing (QQE) with yield curve

control (YCC). The BoJ also maintained its commitment to increase

the monetary base until the year-on-year (y/y) rate of increase in

the observed Consumer Price Index (CPI) exceeds 2% and stays above

this target in a stable manner. The bank decided the details of its

Climate Change Financing Operation after releasing a preliminary

outline at a previous MPM. (IHS Markit Economist Harumi

Taguchi)

- The BoJ assesses that Japan's economy has picked up as a trend, although the negative effects of the pandemic continue to severely affect economic conditions at home and abroad and supply-side constraints are dampening some exports and production.

- The bank maintained its outlook for economic activity, anticipating a recovery as the negative effects of the pandemic wane gradually; and its outlook for prices, which are expected to increase gradually in line with the continued improvement in economic activity and the drop-out of the effects of reductions in mobile-phone charges. However, risks remain skewed to the downside largely because of pandemic-related uncertainties.

- Subaru is considering selling vehicles equipped with Level 2

automated technology for use on ordinary roads in the second half

of the 2020s, reports the Japan Times. Level 2 automated vehicles

allow drivers to take their hands off the steering wheel under

certain conditions, but they are required to monitor the driving at

all times. Subaru plans to develop a next-generation system by

integrating its EyeSight driver assist and artificial intelligence

(AI) technologies to identify traffic lanes even when the white

line on the road cannot be seen. Subaru aims to reduce traffic

accidents, including deaths, and advance its safety technology

developed through its EyeSight driver assist system. Subaru has

selected Xilinx's programmable AI-based chips to power its EyeSight

car safety system. (IHS Markit Automotive Mobility's Surabhi

Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.