Daily Global Market Summary - 23 December 2021

Please note that we will be taking a brief publishing holiday from December 24-29, and resuming next Thursday, December 30.

All major US, European, and APAC equity indices closed higher. US and benchmark European government bonds closed lower on the day. European iTraxx and CDX-NA closed tighter across IG and high yield. Oil, gold, and silver closed higher, copper was flat, and the US dollar and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +0.9%, Nasdaq +0.9%, S&P 500 +0.6%, and DJIA +0.6%.

- 10yr US govt bonds closed +4bps/1.50% yield and 30yr bonds +6bps/1.91% yield. US bond markets closed at 1:00pm ET in observance of the Christmas holiday.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -4bps/292bps, which is

-3bps and -16bps week-over-week, respectively.

- DXY US dollar index closed -0.1%/96.02.

- Gold closed +0.5%/$1,812 per troy oz, silver +0.5%/$22.94 per troy oz, and copper flat/$4.39 per pound.

- Crude oil closed +1.4%/$73.79 per barrel and natural gas closed -6.2%/$3.73 per mmbtu.

- Siemens Gamesa along with Dominion Energy, has signed an agreement for the delivery of offshore 176 SG 14-222DD wind turbines and ten years of service for the 2.6GW Coastal Virginia Offshore Wind (CVOW) commercial project. The agreement is still subject to customary conditions including required governmental permitting, which is expected to be successfully closed by the first quarter 2023. This agreement has followed Siemens Gamesa was named to be the preferred turbine supplier for the CVOW commercial project in January 2020 and the conditional deal from May, when Dominion Energy signed up for the company's SG 14-222 DD after confirming the exact quantity of turbines to be deployed which was subject to site conditions. Installation of the wind farm is expected to begin off the coast of the Commonwealth of Virginia in 2024. The project is scheduled to be completed by 2026. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- US personal income increased 0.4% in November while real

disposable personal income (DPI) decreased 0.2% amid higher

consumer prices. Underlying the increase in personal income, wage

and salary income increased 0.5% in November. Wage and salary

income has essentially recovered to its pre-pandemic trend, up

12.5% over the last two years. (IHS Markit Economists Kathleen

Navin and Gordon Greer III)

- Ongoing advance payments of the Child Tax Credit authorized under the American Rescue Plan raised personal income by $223 billion (annual rate), roughly the same amount as in the previous four months. Fewer unemployment insurance payments under pandemic-era programs—which expired in early September—continued to act as a drag on income.

- Real personal consumption expenditures (PCE) were flat in November, as real PCE for goods declined 0.8% and real PCE for services increased 0.5%. The decline in real PCE for goods was close to our estimate, while the increase in real PCE for services was softer than we anticipated.

- Virus-sensitive categories, such as food services and accommodations, posted increases in November, suggesting concerns arising from news of the Omicron variant of COVID-19 were not yet a major factor in the November report.

- The PCE price index increased 0.6% in November, and its 12-month change was 5.7%. Excluding food and energy, for which prices rose strongly, the core PCE price index rose 0.5% in November and 4.7% over 12 months.

- The pandemic and elevated inflation remain headwinds for household spending, but personal income growth, rooted in strongly rising wages, is expected to support faster expansion in PCE in coming months.

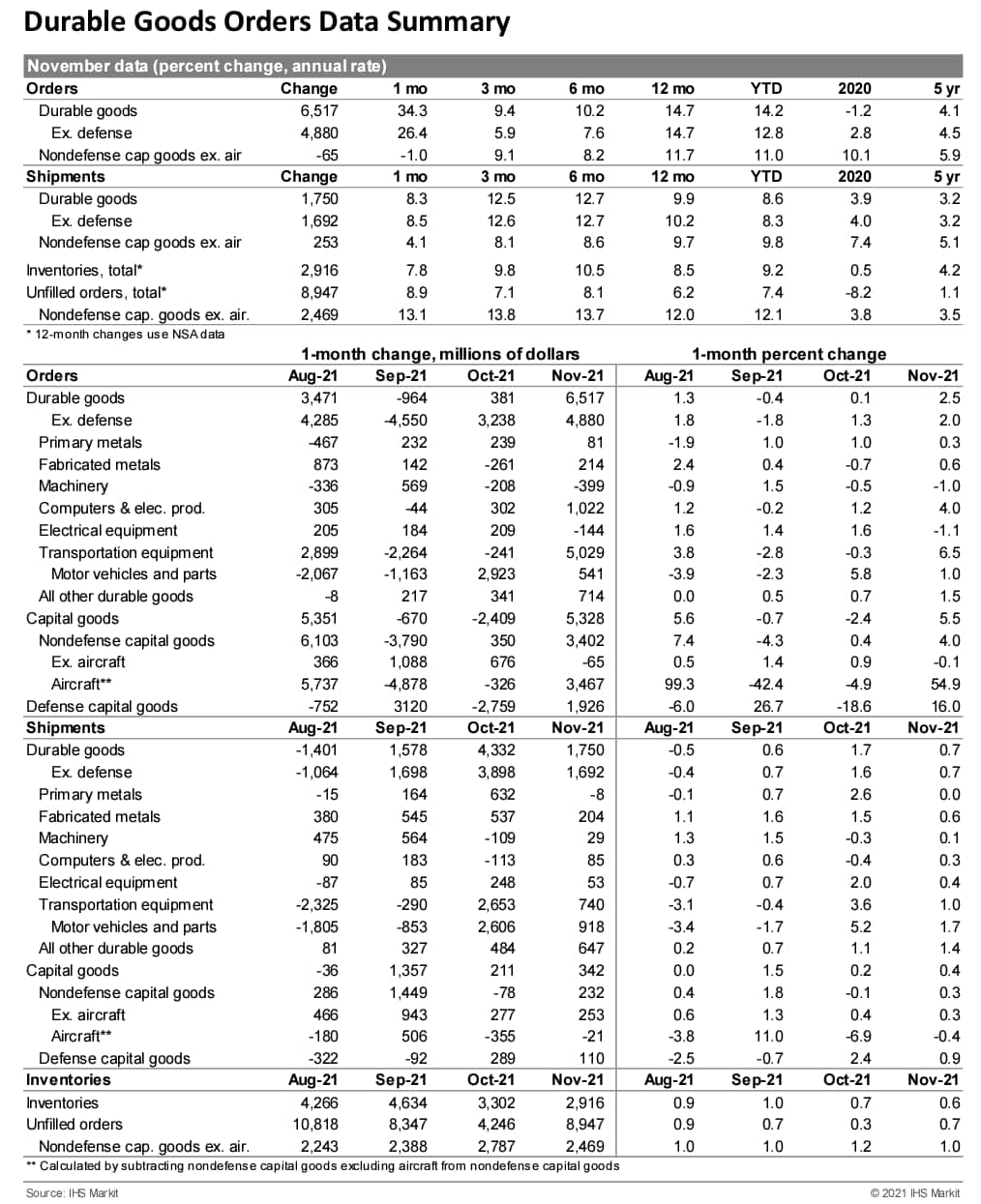

- US manufacturers' orders for durable goods rose 2.5% in

November, outpacing the consensus expectation for a 1.5% increase.

Shipments of durable goods rose 0.7% and inventories of durable

goods rose 0.6%. (IHS Markit Ben

Herzon and Lawrence Nelson)

- The advance report also includes estimates for nondurable shipments and inventories, which rose 0.5% and 0.7%, respectively.

- Nominal figures in the manufacturing sector continue to be boosted by rapid price gains. The producer price index (PPI) for the net output of the manufacturing sector rose a stunning 15.3% from December 2020 through November 2021. Using this as a deflator, real manufacturers' shipments are actually down 3.9% on the year (measured December through November).

- Rapid price gains and reduced shipping volumes are both symptoms of ongoing supply bottlenecks impacting the manufacturing sector.

- Core orders slipped 0.1% in November following an October reading that was revised 0.2 percentage point higher. Through November, these orders were about as expected.

- Core shipments, on the other hand, rose 0.3% in November, which was short of our assumption. Nevertheless, for all of this year, core shipments have been considerably below core orders, as manufacturers of these capital goods have been unable to keep pace with orders. Unfilled orders for core capital goods, as a result, have risen substantially.

- The increase in manufacturers' inventories continued a solid

run of gains this year. But these gains have reflected surging

prices as well. Real manufacturing inventories have been trending

lower this year.

- The US University of Michigan Consumer Sentiment Index rose 3.2

points from its November level to 70.6 in the final December

reading—recovering from the decade low it dropped to in

December. (IHS Markit Economists Akshat Goel and William Magee)

- The present situation index rose 0.6 point to 74.2 and the expectations index jumped 4.8 points to 68.3.

- The increase in consumer sentiment in December was driven by significant gains among households with incomes in the bottom half of the distribution. While the index of sentiment for households earning over $100,000 per year declined 2.1 points, that for households earning below $100,000 per year jumped 7.5 points. According to the report, the uptick in sentiment among the bottom half was the result of an expectation of a substantial increase in income in the year ahead.

- Elevated inflation remains the foremost drag on sentiment. At 6.8%, the 12-month increase in the consumer price index (CPI) in November was the fastest since 1982, with energy prices up a stunning 33.3%. The median expected one-year inflation rate in the University of Michigan survey edged down from 4.9%—its highest level since 2008—to 4.8%.

- The indexes of buying conditions for large household durable goods, automobiles, and homes improved in December but continue to be held back by high prices and limited inventories.

- Despite an improvement in sentiment this month, consumer sentiment remains low and underscores the downside risks related to a prolonged period of above-trend inflation. The emergence of the Omicron variant is another downside risk; according to the report, there were not enough data to capture the impact of the rapid spread of the Omicron variant. Uncontrolled spread of the Omicron variant and a continued increase in prices could sour consumer sentiment and depress spending.

- US new home sales shot up 12.4% in November to a 744,000-unit

seasonally adjusted annual rate. A double-digit sales increase

sounds impressive. This one is not because (1) it was not

statistically significant and (2) the Census revised down October's

reading by 83,000, which was more than November's 82,000-unit gain.

(IHS Markit Economist Patrick

Newport)

- Sales for the previous three months were collectively revised down a whopping 125,000 units. Last month, the prior three months were revised down 75,000. Note: About one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions. The large negative revisions in the past three month suggest that the algorithm the Census is using to impute sales is off.

- The median and average new home prices (three-month averages) soared 18.1% and 18.9%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' costs have also soared. The Census's construction cost index for homes under construction (the three-month average), which came out today (23 December), was up 14.9% in November.

- Inventory—the number of homes for sale at the end of the month—increased by 10,000 in November to a 13-year-high 402,000. Only 39,000 homes classified as inventory were completed; inventory units still in the planning stage were 110,000.

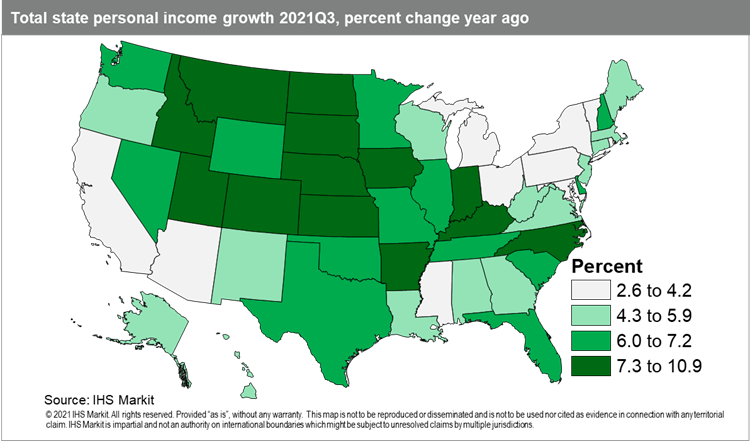

- In the third quarter of 2021, total state personal income

increased in 43 states, after historic losses during the previous

quarter. This resulted from sharp declines in transfer receipts

following an end to direct economic payments and reductions in

federally enhanced unemployment insurance payments. While transfer

payments continued to fall during the third quarter as states wound

down their enhanced UI programs the drop was much less severe, down

15.7% versus the 72.6% fall in the second quarter. Meanwhile, there

were notable expansions in net earnings and modest contributions

from dividends, interest, and rental income across the country as

state economic recoveries continued. On a state level, total

personal income growth was strongest in Kentucky, which added 6.7%

(annualized) thanks to a rise in earnings from the

healthcare/social assistance and transportation/warehousing

sectors. Close behind were Colorado (5.9%) and Utah (5.7%), with

gains driven by earnings in professional services and construction,

respectively. Among the eight states where personal income

contracted, the largest decline was in North Dakota, where personal

income fell by 4.3% (annualized), after experiencing the largest

drop in net earnings of any state due to a sharp contraction in

farm income. New Hampshire down -3.5%) and Vermont (down 1.9%) saw

the second and third worst income contractions during the third

quarter. New Hampshire saw the largest contraction in net earnings

during the quarter after a rapid contraction in the earnings for

the management of companies and enterprises. Vermont had the second

largest decline in transfer receipts, partly driven by the rapid

decline in unemployment insurance claims during the third quarter.

(IHS Markit Economist Alexander Minelli)

- Cargill and Continental Grain's proposed merger with Sanderson

Farms is getting a close review by the Justice Department. Cargill

and Continental Grain announced a deal in August 2021 to acquire

Sanderson Farms. Under the proposed merger, Cargill and Continental

Grain will combine Sanderson Farms with Wayne Farms, a poultry

producer subsidiary of Continental Grain, to form a new, privately

held poultry business. (IHS Markit Food and Agricultural Policy's

Joan Murphy)

- Sanderson Farms shareholders approved the $4.53 billion deal in October but according to the company's filing with the US Securities and Exchange Commission (SEC), the Department of Justice is putting a hold on the deal to allow time to review the merger.

- In a December 21 filing with SEC, Sanderson Farms, the third largest poultry producer, disclosed it has received a second request by the Justice Department asking for more information as federal regulators review the merger agreement.

- Sen. Chuck Grassley (R-Iowa) wrote Richard Powers, acting assistant attorney general for DOJ's Antitrust Division, on August 9 after the merger announcement to raise concerns about the poultry processing deal.

- "According to industry analysts, a combined Cargill-Continental Grain-Sanderson Farms would control approximately 15% of the U.S. chicken market," Grassley told DOJ. "I am concerned that continued mergers and acquisitions in an already concentrated poultry industry will increase consolidation, frustrate competition and reduce marketing options. I also am concerned about the impact on consumer choice and price of poultry products."

- General Motors (GM) has announced plans to supply electrification components for electric vehicle (EV) conversion projects, commercial equipment, and marine applications. Some of the elements of the announcement have been announced previously. The aim of the plans is to generate revenue beyond new vehicle sales, as well as to create new business models. In a company statement, GM's vice-president of EV growth operations said, "GM has an established strategy, network of integrators and co-development agreements to apply an extensive array of components and solutions to a broad range of customers and use cases. As companies across many industries look to reduce their environmental impact, GM is uniquely positioned to serve as a leader not only through exciting new EVs across our brands, but through additional technology applications, and we look forward to bringing customers - existing and new - along with us on our zero-emissions journey." In the statement, GM provided a series of examples of its expected efforts, rather than a definitive list of products. Among these are Electronic Connect and Cruise eCrate packages, the aim of which is to enable customers to work with qualified installers to replace a vehicle's ICE with a fully electric propulsion system. The installers will work through GM's electric specialty vehicle modifier (eSVM) program. GM has been exploring this idea with previous proof-of-concepts including a Chevrolet S-10 pick-up conversion called E-10 Pickup, the K-5 Blazer-E, the eCOPO Camaro, and Project X. The most recent project is conversion of a 1972 El Camino SS, on which GM worked with Lingenfelter Performance Engineering. GM says the El Camino SS project is the first independent installation of the eCrate package, due to be launched in 2022. GM says that the new EV components business segment could create a total addressable market of USD20 billion by 2030, and the company looks to be part of that market. GM's plans are aggressive and could have a substantial impact on its revenue, as well as possibly help provide scale for some components and engineering developments. In addition to creating the revenue stream, these projects create opportunities for GM's engineering teams, including in integration, battery development, control units, and other areas, to expand their expertise and knowledge base. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nikola has announced receipt of a letter of intent (LOI) from Heniff Transportation to purchase 100 Nikola Tre battery-electric trucks, with the first deliveries due in the first half of 2022. According to a company statement, the purchase agreement is between Heniff Transportation and Thompson Truck Centers as part of a fleet-as-a-service business model. Thompson is to provide the sales, service, maintenance, and energy infrastructure for operating the Nikola Tre trucks. According to the statement, after initial deployment of 10 units of the zero-emission trucks in their bulk transportation operation, Heniff and Thompson agreed to "pursue the placement" of an additional 90 units in Heniff's fleet. Heniff has a fleet of more than 2,000 vehicles and 100 sites connected nationwide. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US electric vehicle (EV) manufacturer Rivian has delivered the first R1S sport utility vehicles (SUVs) to CEO RJ Scaringe and chief financial officer (CFO) Claire McDonough, according to a company post on Twitter. The tweet states, "We made our first R1S deliveries last week from our factory in Normal, IL [Illinois, United States] to RJ and our CFO Claire. We're working towards ramping production over the next few months on our way to full volume production. Thanks to our team for all the hard work to make it happen!" Although these first deliveries of the SUV have been made to company executives, Rivian indicated last month that deliveries of the R1S to non-employee customers would be delayed. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain +1.2%, Germany +1.0%, France +0.8%, Italy +0.7%, and UK +0.4%.

- 10yr European govt bonds closed sharply lower; Germany/UK +4bps and Italy/France/Spain +5bps.

- iTraxx-Europe closed -1bp/48bps and iTraxx-Xover -6bps/244bps,

which is -2bps and -10bps week-over-week, respectively.

- Brent crude closed +1.8%/$76.64 per barrel.

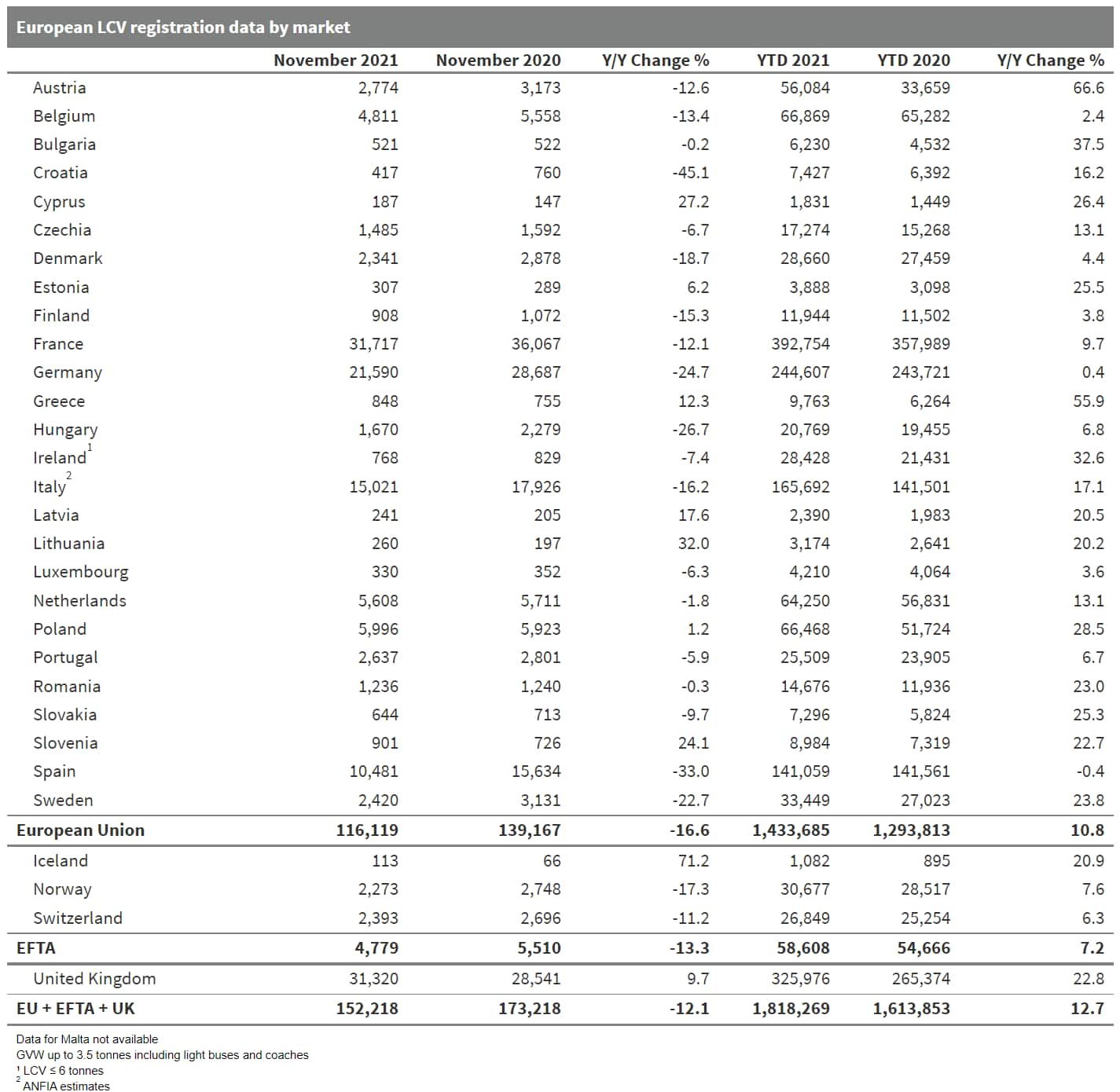

- Commercial vehicle (CV) registrations in the European Union

(EU) have declined again during November, as the semiconductor

shortage continues to drag on vehicle supply. According to data

published by the European Automobile Manufacturers' Association

(ACEA), sales of light commercial vehicles (LCVs) under 3.5 tons,

medium and heavy commercial vehicles (MHCVs), and medium and heavy

buses and coaches over 3.5 tons contracted by 14.7% year on year

(y/y) to 142,480 units. Nevertheless, because of the low base

during the first half of 2020 caused by coronavirus disease 2019

(COVID-19) virus lockdown measures, volumes remain up 11.5% y/y

during the first 11 months of 2021. Volumes for this period now

stand at 1,723,817 units. It has been another difficult month for

the CV market in the EU. While growth in the first half of the year

was underpinned by the low base of comparison due to lockdown

measures to prevent the spread of COVID-19 virus the year before,

there was a shift towards decline at this year's halfway point. The

biggest drag has come from LCVs - like the passenger car category,

stoppages have hit production at the manufacturing facilities of

various OEMs throughout the year so far because of the

semiconductor shortage. The rate of decline for LCVs has not been

as great as for passenger cars, as automakers have diverted

available components to some of their most profitable and high

demand vehicles, which have included LCVs. Nevertheless, Ford,

Stellantis and Renault Group are still among those that have had to

manage their output during the past 12 months. IHS Markit currently

anticipates that despite the disruptions to component supply and

vehicle production, EU registration volumes of LCVs with a GVW of

over 6 tons will grow by 8.8% y/y to under 1.51 million units,

although this will still be down by around 9.5% compared to the

performance recorded during 2019. While we anticipate 2022 will be

flatter, gains will return in the coming years, with 2019 volumes

being surpassed in 2024. (IHS Markit AutoIntelligence's Ian

Fletcher)

- Siemens Gamesa has announced the firm order for the supply of

wind turbines and a five-year service agreement for Ørsted's Gode

Wind 3 offshore wind farm in the German North Sea. The preferred

supplier agreement between Siemens Gamesa and Ørsted for Gode Wind

3 was announced on 4th March 2020. (IHS Markit Upstream Costs and

Technology's Monish Thakkar)

- The project will feature 23 units of SG 11.0-200 DD turbines. These offshore wind turbine features a 200-metre diameter rotor utilizing the 97-metre Siemens Gamesa B97 IntegralBlades. The nacelles will be produced in Cuxhaven.

- Installation of Gode Wind 3 is expected to begin in 2023, with commissioning to be completed in 2024.

- Note: Gode Wind 3 combines Ørsted's Gode Wind 3 and 4 projects that the developer secured in domestic offshore wind tenders in 2017 and 2018, respectively. After a year, it merged the two schemes under the Gode Wind 3 plan, which in turn forms part of a larger cluster of wind farms.

- Private consumption remained the major growth driver in the

third quarter of 2021, while government consumption declined more

sharply than initially estimated. Despite overall positive economic

picture, uncertainties related to the Omicron variant of COVID-19

continue to weigh down on the outlook. (IHS Markit Economist Michal

Plochec)

- In the final release, Statistics Denmark revised its detailed real GDP estimates for the third quarter of 2021 to 1.1% quarter on quarter (q/q), from 0.9% q/q.

- Also, the second quarter of 2021 was revised to 2.1% q/q, from 2.2% q/q. These modest revisions reshaped the quarterly path in the last two quarters, but did not affect the third-quarter growth in annual terms, which is still estimated at 3.6% year on year (y/y).

- When looking at the new quarterly growth rates of particular components of detailed expenditure breakdown, the main growth driver in the third quarter of 2021 remained private consumption, but it is now estimated to have grown by 2.4 % q/q (up from 2.1% q/q). Government consumption was revised to -4.5% q/q (down from -2.5% q/q), along with gross fixed investment, which is now estimated to have shrunk by 0.6% q/q (down from the growth of 0.2% reported previously).

- Both exports and imports increased by 1.1% q/q in the third quarter, but in annual terms exports increased by 5.2% y/y while imports grew by 7.9% y/y, which means that contribution from net exports to the headline growth remained a drag in terms of growth. Nevertheless, as for the levels, total value of Danish exports significantly surpassed imports. October's data show that the current-account surplus has improved significantly on the onset of the fourth quarter, after bottoming through the first.

- Iran's real GDP as reported by the central bank expanded by

3.3% y/y in the first half of FY 2021, following a mild 1.0% y/y

increase in the second quarter. (IHS Markit Economist Jamil Naayem)

- The second quarter and first half performances were mostly supported by growth in the oil sector. Real oil GDP grew by 7.4% y/y in the second quarter of the current fiscal year, leading to a 15.1% y/y increase in the first half period.

- Non-oil activity continued to progress but at much milder pace. Real non-oil GDP expanded by 0.5% y/y in the second quarter and by 2.4% y/y in the first half of FY 2021.

- Although services activity posted healthy performances, up by 4.2% y/y in Q2 and 5.7% y/y in H1, real non-oil GDP performance was dragged down by the agriculture and industries and mines sectors. Agriculture shrank by close to 2% y/y in real terms in both Q2 and H1 mostly due to lower rainfall, and industries and mines declined by 5.3% y/y in Q2 and 1.9% y/y in H1 due power outages in the summer period, according to the central bank.

- Real private and government consumption spending grew by close to 3% y/y each in the first half of the current fiscal year. Real exports posted a 15% y/y rise noting that Iran boosted oil production in tandem with the start of Vienna talks earlier in 2021, while gross fixed capital formation shrank by almost 9% y/y in real terms in H1, as per central bank data.

Asia-Pacific

- All major APAC equity indices closed higher; India +0.7%, Japan +0.8%, Hong Kong +0.4%, Mainland China +0.6%, South Korea +0.5%, and Australia +0.3%.

- Mainland China's provincial government of northeastern rust

belt province Heilongjiang held a meeting on 20 December that

called for "all-out" support to restore the province's real estate

industry, according to a report by Caixin, citing an announcement

previously published on the government website. Measures mentioned

included carrying out online sales campaigns for developers and

providing subsidies to home purchasers. However, the announcement

was reportedly removed from the website the day after it was

published. (IHS Markit Economist Yating

Xu)

- The local government of another northeastern province, Jilin, listed further stabilizing the real estate market as one of its main tasks for the first quarter of 2022 and vowed to encourage lower-level governments to subsidize property purchases and provide support to help rural residents buy homes in urban areas. Also, the local governments of Wuhu of Jiangsu Province and Guilin of Guangxi Province have rolled out polices encouraging residents to buy property.

- The recent moves to issue regional-level stimulus to boost housing purchases, provide financing support for mergers and acquisitions of developers, and ease mortgage policies, are aligned with the vow taken by top Chinese leaders at the Central Economic Work Conference in early December to promote the healthy development of the real estate sector.

- Autonomous vehicle (AV) company Idriverplus has delivered its first batch of modified robotaxis to ride-sharing platform T3 Mobility, reports Gasgoo. The robotaxis initially will operate in a pilot scheme in the Chinese city of Suzhou, with the plan to expand the services gradually to the entire country. The two companies are collaborating on an innovative robotaxi commercialization model including both autonomous and manual driving modes. The companies have devised this solution so that the robotaxis can travel in non-designated zones to serve more users. The vehicles drive in autonomous mode in permitted pilot zones and allow onboard safety drivers to take over the ride manually outside of the zones. According to the report, the robotaxis adopt a "1+4" LiDAR deployment scheme, using LiDARs supplied by RoboSense. T3 Mobility is a ride-sharing platform established by three major Chinese automakers - FAW Group, Dongfeng Group, and Changan Auto - and technology giants Tencent and Alibaba. The platform is available in 68 Chinese cities with over 75 million registered users. Meanwhile, Idriverplus develops autonomous solutions for street-cleaning vehicles, passenger cars, and logistics vehicles. The company is working on two solutions for autonomous passenger vehicles: automatic parking (AVP) and highway follow-up (HWP). Last year, the Beijing municipal government granted a T3 licence to Idriverplus. To date, Idriverplus's AVs have logged over 1.2 million miles and have been sold to countries including Germany, Japan, Malaysia, Russia, Singapore, the United Arab Emirates (Dubai), and the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's National Police Agency is considering creating a system to screen and approve service providers of fully automated vehicles to operate within limited areas, reports The Japan Times. The agency plans to submit an amendment to the road traffic law to parliament next year, as the government intends to begin "Level 4" automated mobility services in designated areas of the country, in the fiscal year that runs through March 2023. At Level 4, the vehicle requires no human intervention, but its applications are limited to specific conditions. The amendment will allow fully automated operation only for vehicles operating in designated areas for providing mobility services for passengers, rather than private vehicles. In such services, vehicles will be operated autonomously under remote monitoring without a driver. Service providers will be required to submit their operational plans to respective prefectural public safety commissions and must adhere to traffic laws and follow safety measures. The public safety commissions can suspend or withdraw approval, as well as issue appropriate orders, if there are any traffic violations or incidents that deviate from the submitted plans. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A trial run of fuel-cell heavy-duty trucks has started in South Korea today (23 December) as part of the government's broader efforts for a shift to alternative-powertrain vehicles in line with the carbon emission cut initiative, reports the Yonhap News Agency. Five 11-ton fuel-cell trucks, including Hyundai's Xcient, will run on roads in the Seoul metropolitan area and the southern region for the next 12 months. CJ Logistics and Hyundai Glovis, as well as e-commerce giant Coupang, will take part in the project to deliver international express cargo and steel plates. The South Korean government will provide them with subsidies and charging stations, as well as other support. The government will use the project to collect data needed to check and set up the overall hydrogen-based logistics system. (IHS Markit AutoIntelligence's Jamal Amir)

- Indian Oil Corporation (IndianOil) has announced it will spend INR9,2080 crore (USD1.2 billion) on a new crude oil pipeline system of 17.5 million metric tons per year to connect Mundra, Gurjarat to Panipat, Haryana in the north of India. As part of the project, IndianOil will also build nine crude oil tanks of 370,000 barrels each at Mundra. The project is expected to be completed in synchronization with the commissioning of its Panipat refinery expansion which is scheduled for completion in the second half of 2024. (IHS Markit Upstream Costs and Technology's Chris Alexander)

- India's Ministry of Agriculture and Farmers Welfare has published a draft order, "Prohibition of Streptomycin + Tetracycline in agriculture, Order, 2021", with the intent of banning agricultural uses of the antibiotics, streptomycin and tetracycline. The draft seeks to prohibit the import, manufacture and formulation of the antibiotics for use in agriculture from February 1st 2022, while all agricultural uses involving them are to cease from January 1st 2024. The notification will be valid from the date of its publication in the country's official gazette. The order seeks to mitigate concerns over antimicrobial resistance to the active ingredients in several crops and follows recommendations from the country's Central Insecticides Board and Registration Committee (CIBRC). (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- MG Motor India has teamed up with Attero Recycling to reuse and recycle li-ion batteries of the electric ZS sport utility vehicle (SUV), reports the Mint. Commenting on the development, Rajeev Chaba, president and managing director of, MG Motor India, said, "Ensuring end-to-end sustainability for electric vehicles is something we are passionate about at MG. Since battery waste is a challenge for sustainable mobility, we believe battery recycling is the optimum way of bridging this void. We look forward to doing more work in this space to create sustainable, end-to-end solutions that will help us drive radical impact". (IHS Markit AutoIntelligence's Isha Sharma)

- Floating offshore wind specialist BlueFloat Energy laid out

ambitious plans for multiple projects in waters off the southern

and eastern coasts of Australia 22 December, although the company

admits there's a long way to go before the first turbines are

spinning as the country takes its first voyages into the sector.

(IHS Markit Net-Zero Business Daily's Keiron Greenhalgh)

- The private equity-backed developer is teaming up with Australian advisory firm Energy Estate to develop three offshore wind projects, two of which are set to be floating facilities, while the third will be a bottom-fixed development.

- The 1.4-GW Hunter Coast Offshore Wind Project will be located in waters off the coast of New South Wales while the 1.6-GW Wollongong Offshore Wind Project will be located across two sites in waters further south along the state's coast. The 1.3-GW Greater Gippsland Offshore Wind Project is a bottom-fixed facility in state of Victoria waters planned by the joint venture (JV).

- However, the partnership is also assessing a number of

additional sites off the coasts of Victoria, South Australia, and

Tasmania and plans to announce further projects in early 2022, the

companies said. In addition, the JV hopes to share transmission

infrastructure with other offshore wind developers, tap into

developers' growing enthusiasm in Oceania for green hydrogen and

energy storage via partnerships, and attract manufacturers in the

sector to Australia, they said.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.