Daily Global Market Summary - 23 March 2021

Most major equity indices closed lower across the US, APAC, and European markets. US and European benchmark government bonds closed sharply higher. European iTraxx closed slightly tighter across IG and high yield, while CDX-NA was modestly wider. The US dollar closed higher, while oil, natural gas, gold, silver, and copper were all lower on the day.

Americas

- The US equity market closed lower; S&P 500 -0.8%, DJIA -0.9%, Nasdaq -1.1%, and Russell 2000 -3.6%.

- 10yr US govt bonds closed -7bps/1.63% yield and 30yr bonds -7bps/2.33% yield.

- CDX-NAIG closed +1bp/58bps and CDX-NAHY +7bps/297bps.

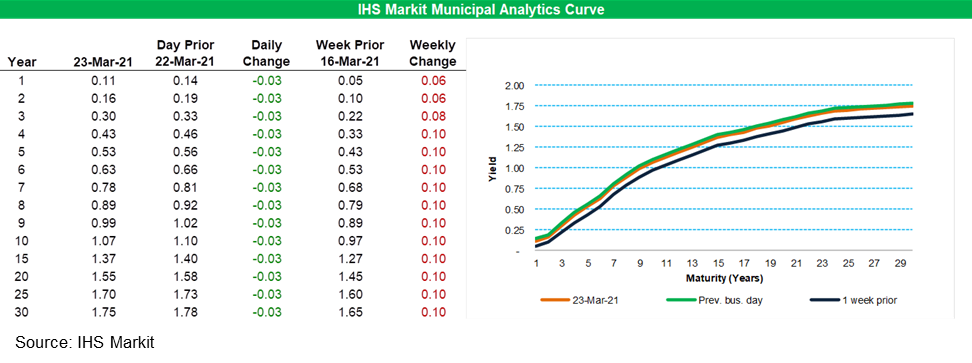

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

yields improved by 3bps across the curve today.

- DXY US dollar index closed +0.6%/92.34.

- Gold closed -0.7%/$1,725 per troy oz, silver -2.1%/$25.23 per troy oz, and copper -1.4%/$4.08 per pound.

- Crude oil closed -6.2%/$57.76 per barrel and natural gas -2.5%/$2.55 per mmbtu.

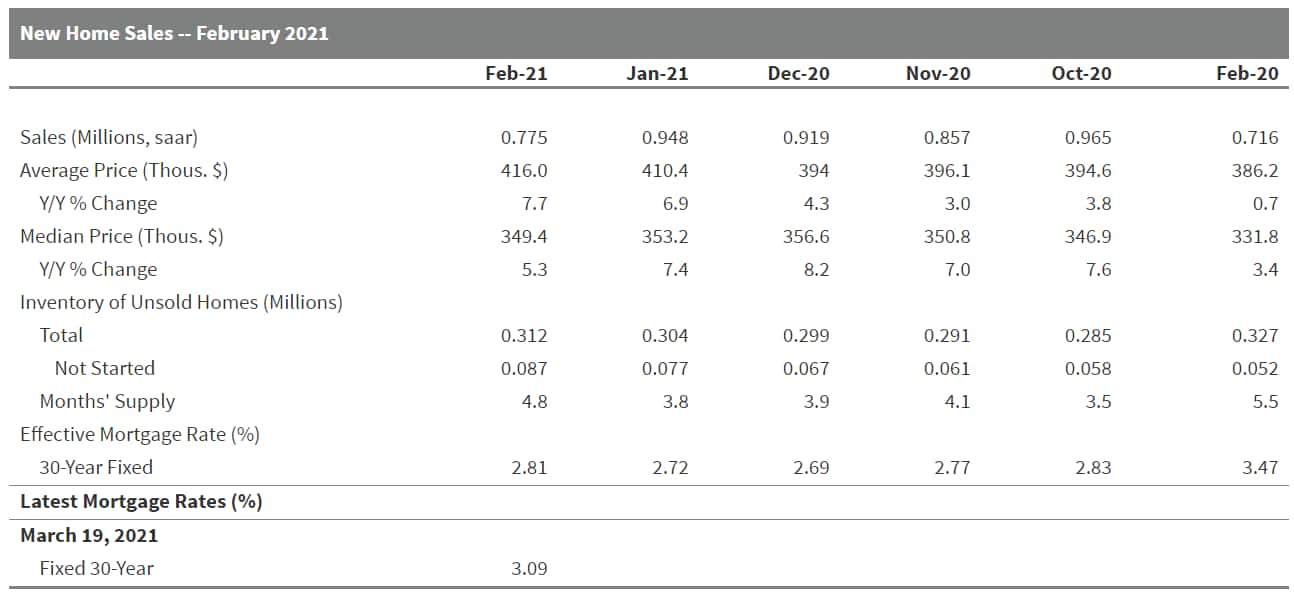

- US new home sales plunged 18.2% in February (±13.9%,

statistically significant) to a seasonally adjusted annual rate of

775,000. Sales for the previous three months were revised up

77,000. (Note: About one-fourth of new home sales are

imputed—these are homes sold before a permit is issued. Imputed

sales account for most of the data revisions to new home sales).

(IHS Markit Economist Patrick Newport)

- After hardly any growth since 2017, new home prices are moving up. The three-month average median price was 7.0% higher than a year earlier; the average price (three-month average) was 6.3% higher. The monthly average price shot up to a record $416,800.

- The Census Bureau's monthly construction cost index (three-month average) was up 6.2% from a year earlier in February—so builders' profit margins in red-hot markets are hardly rising—according to Census Bureau data.

- Inventory is lean—40,000 completed new homes for sale were listed in February, down from 77,000 in February 2020—and not far above the June 2013 record low of 35,000.

- The Census Bureau also released housing permits data at the

state level for February. These shed light on why seasonally

adjusted single-family permits plunged 10% on the heels of nine

straight monthly increases. Not seasonally adjusted single-family

permits in two states, Texas, where power outages brought economic

activity to a standstill for a few days, and Florida, which enjoyed

mild weather in February, fell by a combined 3,000, which was more

than the national drop of 2,800.

- The US economy has been outperforming its trading partners'

economies. As a result, its imports have picked up more than its

exports. This largely explains the widening current-account

deficit—to 3.5% of GDP for the fourth quarter of 2020 from 1.9%

of GDP four quarters earlier. We expect a further widening to 3.7%

of GDP by the second quarter; the current account then starts

shrinking as economies across the world gather speed. (IHS Markit

Economist Patrick Newport)

- The current-account deficit widened by $7.6 billion to $188.5 billion in the fourth quarter of 2020.

- The goods and services deficit expanded by $8.6 billion as imports increased more than exports.

- For 2020, the current-account deficit totaled $647 billion, the largest deficit since 2008.

- Food giants Danone North America, Mars, Nestlé, and Unilever are backing the idea of placing a federal fee on packaging to help fund improvements in the US recycling infrastructure, a top Nestlé USA official told a House Appropriations subcommittee last week. The four companies - who comprise the Sustainable Food Policy Alliance - are supporting a federal Extended Producer Responsibility (EPR) system based on the recognition that "systemic change" is needed to reach corporate packaging goals, boost actual recycling of plastic packaging and reduce the amount of recyclable materials that are being sent to landfills, said Nicole Collier, Nestlé USA senior director of corporate affairs. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Two Californian senators are pressuring US President Joe Biden to set a date for ending ICE sales in the United States, in a similar way to the zero-emission vehicle (ZEV) order California's governor has introduced for the state. A Reuters report quotes a letter from US senators from California Alex Padilla and Diane Feinstein as asking President Biden to "to follow California's lead and set a date by which all new cars and passenger trucks sold be zero-emission vehicles". The statement from the Californian lawmakers is not a particular surprise, although it remains unclear what position the current presidential administration will take on the issue. (IHS Markit AutoIntelligence's Stephanie Brinley)

- BMW and utility company Pacific Gas & Electric (PG&E) have announced Phase 3 of their ChargeForward program, which explores "how to optimize EV charging with renewables on the electric grid and enable more customers to power their EVs with cleaner energy," according to a BMW statement. The enrollment period began on 22 March 2021, with the official program starting in mid-April and running through March 2023. The program encourages electric and plug-in hybrid electric vehicle (EV and PHEV) owners to charge at times when there is less electric demand on the grid as well as when there is more renewable electricity is on the grid. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The proposed Annova LNG project in the United States has been discontinued. The project had planned to build a 6.5 metric tons per annum (MMtpa) LNG export facility on the Port of Brownsville. Annova LNG cited changes in the global LNG market as the reason for the discontinuation. The majority owner Exelon had reportedly tried, but failed, to find a suitable offer to sell its majority stake in the project. The project's EPC contractors, Black & Veatch and Kiewit, also have equity stakes in the project. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +0.6%, Germany flat, France/UK -0.4%, and Italy -0.6%.

- 10yr European govt bonds closed sharply higher; Italy/Spain/UK -5bps, France -4bps, and Germany -3bps.

- iTraxx-Europe closed -1bp/54bps and iTraxx-Xover -1bp/271bps.

- Brent crude closed -5.9%/$60.79 per barrel.

- According to the UK Office for National Statistics (ONS), the

early estimate for February 2021 suggests that the number of

workers on payroll has shrunk by 2.4%, or 693,000, since February

2020. (IHS Markit Economist Raj Badiani)

- The highest incidence of job losses during the COVID-19 pandemic related to employees working in the accommodation and food service activities and wholesale and retail trade sector, which shed 368,000 and 123,000, respectively.

- The number of payrolls rose for a third successive month, increasing by 0.1% month on month (m/m) or 68,000 m/m in February 2021 after falling in the previous nine months.

- Parkopedia, a United Kingdom-based parking services provider company, has launched a production version of its indoor mapping technology for in-vehicle navigation use, reports Tu-Auto. The technology uses indoor maps that are based on high-definition (HD) 3D models of indoor parking facilities that do not usually receive a GPS signal. According to the source, GPS signal blackout poses a challenge in finding a vehicle within large parking facilities as well as locating vital services such as EV charging stations. (IHS Markit Automotive Mobility's Tarun Thakur)

- Air Liquide has outlined a series of new environment, social, and governance (ESG) objectives in line with its sustainable growth strategy, including firm targets to start lowering its absolute carbon dioxide (CO2) emissions by 2025 and invest approximately €8.0 billion ($9.5 billion) in the hydrogen supply chain as part of its carbon-neutrality goals. The company says it is aiming to accelerate its hydrogen developments to "at least triple" its annual revenue from hydrogen activities to more than €6.0 billion by 2035. (IHS Markit Chemical Advisory)

- Versalis will permanently shut its ageing steam cracker and

aromatics complex at Porto Marghera, near Venice, Italy, starting

in spring 2022, according to parent company Eni (Rome, Italy). (IHS

Markit Chemical Advisory)The Porto Marghera naphtha cracker, built

in the early 1970s by the former Montedison and upgraded several

times since, has a current nameplate production capacity for

490,000 metric tons/year of ethylene and 250,000 metric tons/year

of propylene, according to IHS Markit data.

- The aromatics complex has capacity for 110,000 metric tons/year of benzene and 50,000 metric tons/year of toluene, IHS Markit says.

- Eni outlined a €200-million ($239 million) plan in 2014 to convert its production facility at Porto Marghera into a "green chemistry" platform. This included converting its crude refinery there to a biorefinery, which was completed in 2014, and more recently upgrading the biorefinery's capacity to 600,000 metric tons/year, which is due to be completed this year. The biorefinery uses mainly refined vegetable and cooking oils, animal fat, and other non-edible waste as feedstock, producing mostly biodiesel. Eni also converted its Gela refinery in Sicily to a biorefinery in late 2019.

- SEAT has announced that it will launch a battery electric city car by 2025, as part of the brand's Future Fast Forward plan presented at its 2021 Annual Press Conference that took place yesterday (22 March). According to a statement, the "urban electric vehicle" will be priced between EUR20,000 and EUR25,000 and be built at its Martorell (Spain) facility at a rate of up to 500,000 units. In comments related to the announcement, SEAT president Wayne Griffiths said that the vehicle will not only be developed and built at its facilities to sell under its own banner, but will also be used by other Volkswagen (VW) Group brands. (IHS Markit AutoIntelligence's Ian Fletcher)

- Traton AG has announced plans to invest EUR1.6 billion (USD1.9 billion) in electrification research and development (R&D). According to a company statement, the money is to be spent from 2021 to 2025 on R&D of electric drivetrains for medium and heavy commercial vehicles (MHCVs). The amount of investment is EUR600 million higher than the originally planned electromobility spending by Traton during this period. At the same time, Traton plans to reduce R&D spending on conventional drivetrains to only one-fifth of the combined product development spend. (IHS Markit AutoIntelligence's Tim Urquhart)

- Israel's current-account surplus rose to 5.0% of GDP in 2020

from 3.4% in 2019, driven by import compression of both goods

(mostly fuel) and services (mostly travel); foreign direct

investment and portfolio investment also soared. In 2021, the

surplus may decline slightly as imports rebound but should remain

elevated, supporting the shekel exchange rate and foreign exchange

reserves. (IHS Markit Economist Ana Melica)

- Exports of manufactured computers, electronics, and medical instruments experienced increased demand amid the COVID-19 pandemic and were the only major category of goods exports to increase, rising 3.8% to USD13.6 billion (23% of goods exports).

- Pharmaceutical exports, however, declined substantially despite the global medical emergency, by 41% to USD1.9 billion.

- Diamond exports (including wholesale and working of) barely changed. However, diamond imports, which are almost as large, fell by 13%. Therefore, net diamond exports increased by nearly half but remained relatively small at USD1.4 billion.

- Finance Minister Iipumbu Shiimi presented Namibia's FY 2021/22 national budget to parliament on 17 March. The budget deficit is expected to narrow to 8.6% of GDP in FY2021/22, from a downwardly revised 9.7% of GDP in FY 2020/21. No major tax changes were announced, even though lower Southern African Customs Union (SACU) inflows are expected during 2021. The development budget will prioritize capital projects in the rail, road, and water projects, while Nampower will continue the rollout of investment projects in energy generation. The procurement process for the upgrading of Rundu and Oshakati water treatment plants has commenced with the support of the African Development Bank, while various other central and coastal water projects are to be implemented in collaboration with the German government. The development budget stands at NAD5.6 billion or 3% of GDP. (IHS Markit Economist Thea Fourie)

Asia-Pacific

- Most APAC equity markets closed lower except for India +0.6%; Australia -0.1%, Japan -0.6%, Mainland China -0.9%, South Korea -1.0%, and Hong Kong -1.3%.

- Chinese Premier Li Keqiang stated at a State Council executive

meeting on 15 March that China's macro leverage should kept stable

while the government's leverage ratio should be cut this year. The

National People's Congress of Finance and Economics Committee, in

its review of the 2020 Fiscal Budget performance, highlighted in

particular the issues of heavy debt burden faced by some local

governments and the rising level of hidden debt. (IHS Markit

Economist Yating Xu)

- According to the estimates by the Chinese Academy of Social Science (CASS), China's macro leverage as a share of GDP reached 270.1% by the end of 2020, up 23.6 percentage points from the rate in 2019. During the same period, government leverage rose by 7.1 percentage points to 45.6%, with the central government's leverage ratio up 3.1 percentage points and local governments' leverage ratio up 4.1 percentage points.

- The government's latest deleveraging efforts will likely be focused on tackling the issue of rising implicit debt as China's 2021 fiscal budget and bond issuance plan does not support a reduction in the explicit leverage ratio.

- Given the planned fiscal deficit level of CNY3.57 trillion and with the quota for local government special-purpose bonds reduced to CNY3.65 trillion, a nominal GDP growth of at least 15.5% in 2021 would be required to achieve a leverage ratio lower than 45.8%.

- Imports of dairy product into China saw a 28% y/y surge in January-February, with strong demand pushing imports to their highest on record. Total volumes reached 716,000 tons and were value at USD1.84 billion, which is up 19% y/y. The primary driver for this increase were liquid milk and cream (up 55%) and whey (up 50%), which rose to 196,000 tons and 126,000 tons, respectively. As IHS Markit already reported, despite the COVID-19 pandemic, consumer demand for liquid (white) milk has been growing at an exponential rate, boosted by the government's new dairy consumption guidelines and the view of milk as a drink that is healthy and nutritious. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Chinese electric vehicle (EV) battery maker SVOLT Energy Technology (SVOLT) has reportedly started the B-round of financing with the target to raise between CNY3 billion (USD460 million) and CNY4 billion. According to Chinese media Yiche, SVOLT will begin preparations for an initial public offering (IPO) in China after the B-round fundraising. Prior to the reported B-round financing, in February SVOLT secured CNY3.5 billion of investment in its A-round financing, involving a group of investors led by Bank of China Investment Company and State Development and Investment Corporation (SDIC). (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese autonomous vehicle (AV) startup Momenta announced its strategic co-operation with Toyota to provide automated high definition (HD) mapping and updates via camera-based technologies, according to company sources. With the strategic co-operation, both companies aim to promote the commercialization of Toyota's Automated Mapping Platform (AMP) in the China market. Momenta's camera-based HD mapping uses camera, GPS, and inertial measurement unit (IMU) to generate HD maps by using technologies like deep learning-based perception and simultaneous localization and mapping (SLAM). Last week, Momenta said it has raised USD500 million from SAIC Motor, Toyota Motor, and auto parts supplier Bosch. (IHS Markit Automotive Mobility's Tarun Thakur)

- Sony Corporation and NTT Docomo, Inc., one of the major mobile operators of Japan, announced the successful remote control maneuvering of Sony's Sociable Cart (SC-1) entertainment vehicle by using 5G connectivity, reports Autocar. The vehicle was carrying passengers in Guam (United States) and was being controlled remotely from a base in Tokyo (Japan) over 2,500 km away. The video of the vehicle's perimeter was captured with Sony image sensors while the vehicle was driven remotely by an operator using 5G high-speed connectivity provided by Docomo Pacific. (IHS Markit Automotive Mobility's Tarun Thakur)

- Hyundai has signed a memorandum of understanding (MoU) with Singtel, a Singapore-based telecom group, to co-operate in supporting smart manufacturing and connectivity for electric vehicle (EV) battery subscription services, according to a company press release. The automaker will combine its expertise in developing innovative automotive and manufacturing solutions with Singtel's capabilities in 5G, Internet of Things (IoT), and next-generation information and communications technologies and solutions to develop Industry 4.0 advanced digital solutions to transform the way vehicles are manufactured. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.