Daily Global Market Summary - 24 March 2021

Most US and APAC equity markets closed lower, while most major European indices were higher. US and benchmark European government bonds closed higher for a second day. European iTraxx and CDX-NA closed almost flat on the day across IG and high yield. The US dollar, oil, and natural gas closed higher, silver was flat, and copper was lower on the day.

Americas

- Most major US equity indices closed lower; DJIA flat, S&P 500 -0.6%, Nasdaq -2.0%, and Russell 2000 -2.4%.

- 10yr US govt bonds closed -1bp/1.62% yield and 30yr bonds -2bps/2.31% yield.

- CDX-NAIG closed flat/58bps and CDX-NAHY +1bp/304bps.

- DXY US dollar index closed +0.2%/92.53.

- Gold closed +0.5%/$1,733 per troy oz, silver flat/$25.23 per troy oz, and copper -0.4%/$4.06 per pound.

- Crude oil closed +5.9%/$61.18 per barrel and natural gas closed +0.7%/$2.57 per mmbtu.

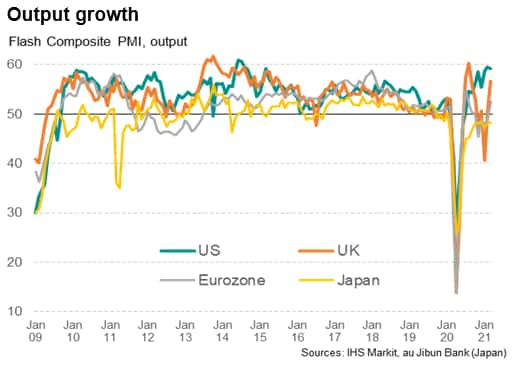

- Flash PMI survey data showed business activity in the United

States rising sharply at the end of the first quarter of 2021,

rounding off the economy's best performance since the third quarter

of 2014. The IHS Markit composite PMI registered 59.1 compared to

59.5 in February, resulting in a first quarter average of 59.1. The

quarterly average signifies strong economic growth of around 1.5%,

or approximately 5% on an annualized basis, which builds on a 1.0%

rise in the fourth quarter of last year. (IHS Markit Economist

Chris Williamson)

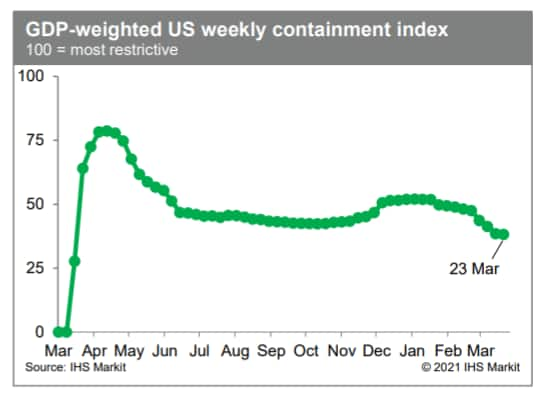

- The IHS Markit GDP-weighted US weekly containment index

declined 0.4 index point this week to 38.2, reflecting easing

restrictions on social and economic activities in three

states—Massachusetts, Michigan, and Connecticut—and in

Washington, DC. This was the shallowest decline in several weeks.

(IHS Markit Economist Ben Herzon and Joel Prakken)

- US manufacturers' orders for durable goods declined 1.1% in

February, while shipments of durable goods fell 3.5% and

inventories of durable goods rose 0.7%. In response to the details

that inform our GDP tracking, we lowered our forecast of

first-quarter GDP growth 0.2 percentage point to 4.4%. (IHS Markit

Economists Ben Herzon and Lawrence Nelson)

- The decline in topline orders was reflected in several major industrial categories, with an 8.7% decline in new orders for motor vehicles and parts more than accounting for the overall decline.

- Both orders and shipments of nondefense capital goods excluding aircraft declined in February, in contrast to our assumptions of modest increases. We had been assuming these would begin turning down in March follow robust gains in recent months that left both measures way above their pre-pandemic trends. Todays' report moves the initial declines one month sooner.

- Shipments of civilian aircraft declined sharply in February; we had anticipated little change. We expect these shipments to move higher, as Boeing continues with resumed deliveries of their 737 MAX line of aircraft.

- Fidelity Investments applied to list a Bitcoin exchange-traded fund that would track the cryptocurrency using pricing from U.S.-based exchanges. The firm's Wise Orgin Bitcoin Trust would use underlying prices from exchanges that include Bitstamp, Coinbase, Gemini, itBit and Kraken, Fidelity said in a filing Wednesday with the Securities and Exchange Commission. (Bloomberg)

- Chemours said yesterday that it is exploring a sale of its cyanides business, called mining solutions. The business is a major producer of solid sodium cyanide, which is used in the extraction process for gold and silver from mined ores, as well as hydrogen cyanide. It is part of Chemours' chemical solutions reporting segment. The mining solutions business generated $203 million in sales in 2020, down from $268 million in 2019 and $289 million in 2018. Net proceeds from the divestiture "could run $300-350 million," according to Laurence Alexander, an analyst with Jefferies (New York, New York). (IHS Markit Chemical Advisory)

- Autonomous truck startup TuSimple has filed for an initial public offering (IPO) in the United States, reports TechCrunch. The company did not disclose the number of shares and the price range for the proposed offering. TuSimple intends to be publicly listed on Nasdaq under the ticker symbol "TSP". Morgan Stanley, Citigroup, and J.P. Morgan are the lead underwriters for the proposed offering. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Automotive supplier BorgWarner yesterday (23 March) announced plans at an investor day presentation to increase its EV revenues to 45% of total revenues by 2030 and to achieve carbon neutrality by 2035. BorgWarner has a sweeping plan to accelerate its electrification strategy to deliver organic and inorganic growth while maintaining high margins. Through a new plan called Project Charging Forward, the company targets revenue from EVs to grow from 3% of the total in 2021 to 25% as soon as 2025, and then to 45% by 2030. To get there, BorgWarner CEO Frédéric Lissalde said that the company will profitably scale electric light vehicles, expand into electric commercial vehicles (eCVs), and optimize its combustion portfolio by selling businesses with between USD3 billion and USD4 billion in aggregate revenue. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mercedes-Benz has announced the suspension of production of vehicles at its Brazilian factories located in São Bernardo do Campo (in the state of São Paulo) and Juiz de Fora (in the state of Minas Gerais) between 26 March and 5 April because of the worsening of the COVID-19 virus pandemic in the country, reports Automotive Business. (IHS Markit AutoIntelligence's Tarun Thakur)

- General Motors (GM) plans to keep Brazilian plants open as the country continues to battle the COVID-19 virus pandemic, noting that its protocols have been effective in preventing infection, according to Reuters. Reuters quotes a GM statement as saying, "Our protocols have been shown to be efficient at preventing infection and internal surveys show that our workers feel safer in factories than they do in their own houses and communities. As a result, we do not see any reason that would lead us to alter our production schedule at this moment." GM has idled its Gravatai plant over the semiconductor shortage, however. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The latest data from Argentina's National Institute of

Statistics and Censuses (Instituto Nacional de Estadística y

Censos: INDEC) show that GDP decreased by 4.3% year on year (y/y)

in the fourth quarter of 2020. (IHS Markit Economist Paula

Diosquez-Rice)

- The estimate for the GDP deflator in the fourth quarter of 2020 shows a rise of 35.3% y/y, while the private-sector consumption deflator increased at a higher rate of 36.9% y/y during the same period.

- By sector, the GDP data show mostly annual declines in the fourth quarter; for example in mining; transport and communication; non-profit and social services; fishing; real estate and business services; and the primary sector. The hospitality and restaurants sector posted a decline of 53.8% y/y.

- The unemployment rate retreated to 10.1% in the biggest urban area in the country, the city of Buenos Aires, in the fourth quarter of 2020; however, the labor force remains depressed when compared with a year before. Meanwhile, the underemployment rate decreased to 12.5%.

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +0.6%, Italy +0.4%, UK +0.2%, France flat, and Germany -0.4%.

- 10yr European govt bonds closed higher; France/Spain -2bps and Italy/Germany/UK -1bp.

- iTraxx-Europe closed flat/54bps and iTraxx-Xover -2bps/269bps.

- Brent crude closed +5.6%/$64.25 per barrel.

- The UK economy rebounded from two months of decline in March,

according to the latest flash PMI data from IHS Markit and CIPS.

Business activity grew at its fastest rate since last August as

children returned to schools, businesses prepared for the reopening

of the economy and the vaccine roll-out boosted confidence. The

headline PMI covering both manufacturing and services rose from

49.6 in February to 56.6 in March. (IHS Markit Economist Chris

Williamson)

- Companies reported an influx of new orders on a scale exceeded only once in almost four years, and business expectations for growth in the year ahead surged to the highest since comparable data were first available in 2012.

- Service sector employment rose for the first time in 13 months, with hiring also boosted by business expectations for the year ahead surging to the highest since January 2004.

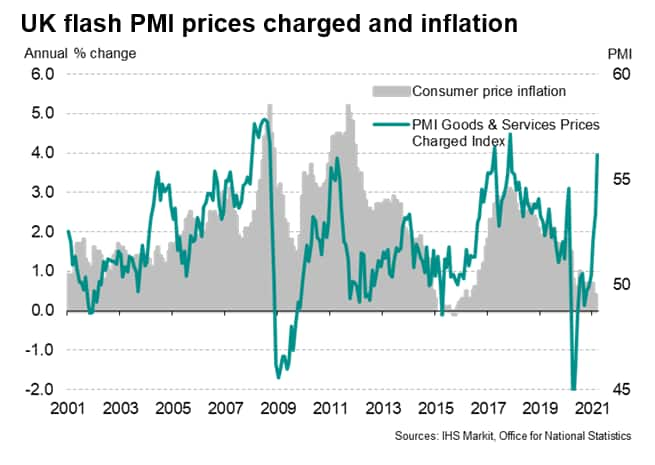

- The latest survey data also showing prices charged for goods

and services rising at rates rarely exceeded in recent history,

consumer price inflation looks set to pick up further in coming

months.

- The headline IHS Markit Eurozone Composite PMI rose from 48.8

in February to 52.5 in March, according to the preliminary 'flash'

reading. By rising above 50.0, the latest reading indicated the

first increase in business activity since last September, with the

current expansion the largest recorded since last July and the

second-steepest seen over the past 28 months. (IHS Markit Economist

Chris Williamson)

- While manufacturing output growth accelerated sharply to the highest since data were first available in 1997, the service sector continued to be constrained by the COVID-19 pandemic, with social distancing restrictions leading to a seventh successive monthly fall in business activity.

- Looking at growth over both sectors combined, Germany's resulting upturn was the strongest for just over three years (the composite PMI rising from 51.1 to 56.8), contrasting with a decline in France for the seventh successive month (albeit with the index at 49.5, up from 47.0 in February). The rest of the region saw a modest return to growth for the first time since last July (composite index at 50.6 versus 48.2 in February).

- The German Federal Statistical Office (FSO) reports that growth of real monthly earnings in the whole economy (including employees in the public sector, and bonus payments, and assuming for analytical purposes that the employment structure of the previous year has remained constant) recovered further from -1.3% year on year (y/y) in the third quarter to 0.4% y/y in the fourth quarter of 2020, having reached an all-time low of -4.7% in the second quarter. The long-term (1992-2020) average of this series is 0.4% (IHS Markit Economist Timo Klein)

- Italian dairy giant Granarolo has reported that despite a

challenging year, its full-year 2020 financial results have met the

company's profitability targets. (IHS Markit Food and Agricultural

Commodities' Jana Sutenko)

- Consolidated revenue stood at EUR1.280 billion, down 3% the previous year. Revenue on a like-for-like basis (adjusted for exchange rates) was down 3.1%, primarily due to reduced sales in the Normal Trade and Foodservice channels, both within Italy and in the other countries. Foreign sales represented 33% of total turnover.

- On the other hand, the group's EBITDA stood in line with company forecasts, at EUR78.5 million or 6.1% of revenue, an improvement of 8% (EUR5.8 million) on 2019.

- Ford is set to become the first mass producer of battery electric vehicles (BEVs) in Russia after the company announced that its joint-venture partner, Sollers, will build the electric Transit light commercial vehicle (LCV) from 2022, according to a Kommersant report. Sollers says that it expects strong demand for BEV vans from Russia's hugely growing online retail businesses, which are investing heavily in logistics and infrastructure. The company says that the electric van can be 40% more efficient and 20% cheaper to operate than its diesel equivalent. (IHS Markit AutoIntelligence's Tim Urquhart)

- China Dynamics (Holdings) Limited, an integrated solution provider of new-energy vehicle technology, and W Motors Automotive Group Holding Limited (W Motors), a UAE-based automotive company, have signed a memorandum of understanding (MOU) for strategic business co-operation, reports Zawya. The companies plan to form a 30:70 joint venture (JV) in Dubai (United Arab Emirates) for the manufacture, assembly, sales, and distribution of electric vehicles (EVs) across the world. (IHS Markit AutoIntelligence's Tarun Thakur)

- The Central Bank of Nigeria (CBN) has left the Monetary Policy

Rate (MPR) unchanged at 11.5% following the Monetary Policy

Committee (MPC) meeting on 23 March. The asymmetric corridor of

+100/-700 basis points around the MPR and the Cash Reserve Ratio

(CRR) of 27.5% were also left unchanged during the meeting. (IHS

Markit Economist Thea Fourie)

- MPC members acknowledge that lowering interest rates will allow for a speedy recovery in investment, employment, and overall growth in the economy, but is likely to create excess liquidity in the domestic market that will increase pressure on the naira exchange rate.

- Headline inflation in Nigeria accelerated to 17.3% year on year (y/y) in February as higher food and transport costs fueled price pressures in the economy. "Core" inflation, excluding farming and energy products, was 1.3% month on month (m/m) in February, leaving the annual rate at 12.9% last month, from 12.5% in the previous month.

Asia-Pacific

- Most APAC equity markets closed lower except for Australia +0.5%; South Korea -0.3%, Mainland China -1.3%, India -1.7%, Hong Kong -2.0%, and Japan -2.0%.

- China's targeted policy support for vulnerable areas of the

economy could continue until their recoveries regain solid footing.

(IHS Markit Economist Lei Yi)

- Selected tax-relief policies targeting micro, small, and medium enterprises (MSMEs) and the film industry will be extended until the end of 2021, according to a joint announcement issued by the Ministry of Finance (MOF) and State Taxation Administration (STA) on 23 March.

- Value-added tax (VAT) cuts for small-scale taxpayers will be further extended to 31 December 2021. However, the current differentiated treatment between Hubei and non-Hubei taxpayers will no longer apply from April onward.

- For the film industry, the duration of tax relief measures - introduced in May 2020 and initially set to expire in December 2020 - has been extended by a year.

- COOEC has scored better financial performance in 2020 on higher

workload. Revenue in 2020 grew 20% year-on-year (y/y) to USD2.6

billion (CNY17.9 billion). It made a net profit of USD52 million

(CNY363 million), significantly higher compared with USD4 million

(CNY28 million) in 2019. (IHS Markit Upstream Costs and

Technology's Jessica Goh)

- Similarly, operating profit also jumped to USD74 million (CNY517 million) in 2020 from USD26 million (CNY179 million) a year ago. The company attributed the significant increase in profits to the completion of 10 projects, cost reduction and improved efficiency in project execution.

- Fourth quarter 2020 revenue fell 9% y/y to USD860 million (CNY6.0 billion) while net profit more than halved to USD41 million (CNY284 million) from USD94 million (CNY663 million) a year earlier. Operating profit fell 55% y/y to USD54 million (CNY377 million).

- With increased workload, COOEC expects to achieve a 20% y/y growth in revenue in 2021. It will continue to implement cost reduction measures and improve operation efficiency.

- Volvo Cars has announced that it has signed a memorandum of understanding (MOU) for the creation of an infotainment joint venture (JV) with Chinese technology company ECARX. According to a statement, the planned JV would cover the development and commercialization of a new platform that "would allow both companies and the wider Geely Group to speed up technology development, improve cost efficiency and create new revenue streams". (IHS Markit AutoIntelligence's Ian Fletcher)

- Toyota Motor Corporation, Isuzu Motors, and Hino Motors have entered into a partnership in the area of commercial vehicles (CVs). The three companies will work together on the development of battery electric vehicles (BEVs), fuel-cell electric vehicles (FCEVs), autonomous vehicle (AV) technologies, and electronic platforms centered on the domain of small commercial-purpose trucks. The name of the new partnership company will be Commercial Japan Partnership Technologies Corporation, which will be based out of Tokyo and will receive an investment of JPY10 million, with 80% from Toyota and 10% each from Isuzu and Hino. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korea's SK Holdings and China's Zhejiang Geely Holding Group (Geely) have agreed to jointly create a mobility investment fund, which is set to raise as much as USD300 million. Both the parties will invest USD30 million each in the fund, reports Reuters. The fund will invest in mid-to-late stage growth companies in fields such as autonomous vehicles, electrification, and connectivity. It also aims to attract global investors, including European banks and pension funds in Asia. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korea plans to invest KRW1.1 trillion (USD974 million) by 2027 to accelerate the development of Level 4 autonomous technology, reports Yonhap News Agency. At Level 4, one stage before full autonomy, vehicles require no human intervention, but its applications are limited to specific conditions. Under the plan, South Korea will support 84 projects to develop vehicle convergence, information and communication, and road traffic technologies, as well as autonomous services and the broader ecosystem of autonomous vehicles (AVs). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai Motor Group (HMG), the parent company of Hyundai and Kia, will establish its own high-speed charging infrastructure under a new brand name, 'E-pit', for its electric vehicle (EV) models in South Korea, reports the Yonhap News Agency. Hyundai and Kia's customers will be able to recharge up to 80% of their EV's battery capacity within 18 minutes on a single charge. Initially, HMG will install 20 E-pit high-speed charging stations in 2021. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.