Daily Global Market Summary - 25 March 2021

Major US equity indices closed higher after being lower for the first half of the session, while European and APAC markets closed mixed. US government bonds closed lower and most benchmark European bonds were higher. European iTraxx and CDX-NA credit indices were almost unchanged across IG and high yield. The US dollar and natural gas closed higher, while oil, gold, silver, and copper were lower.

Americas

- Major US equity indices closed higher after being lower for most of the day; Russell 2000 +2.3%, DJIA +0.6%, S&P 500 +0.5%, and Nasdaq +0.1%.

- 10yr US govt bonds closed +1bp/1.63% yield and 30yr bonds +4bps/2.35% yield.

- CDX-NAIG closed flat/58bps and CDX-NAHY -3bps/302bps.

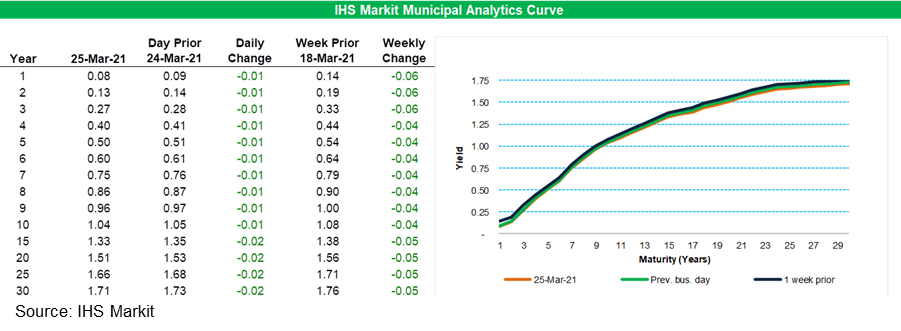

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

yields improved by 1-2bps across the curve today, with maturities

three-years and shorter 6bps better week-over-week.

- DXY US dollar index closed +0.3%/92.81.

- Gold closed -0.5%/$1,725 per troy oz, silver -0.7%/$25.05 per troy oz, and copper -2.1%/$3.98 per pound.

- Crude oil closed -4.3%/$58.56 per barrel and natural gas closed +1.9%/$2.62 per mmbtu.

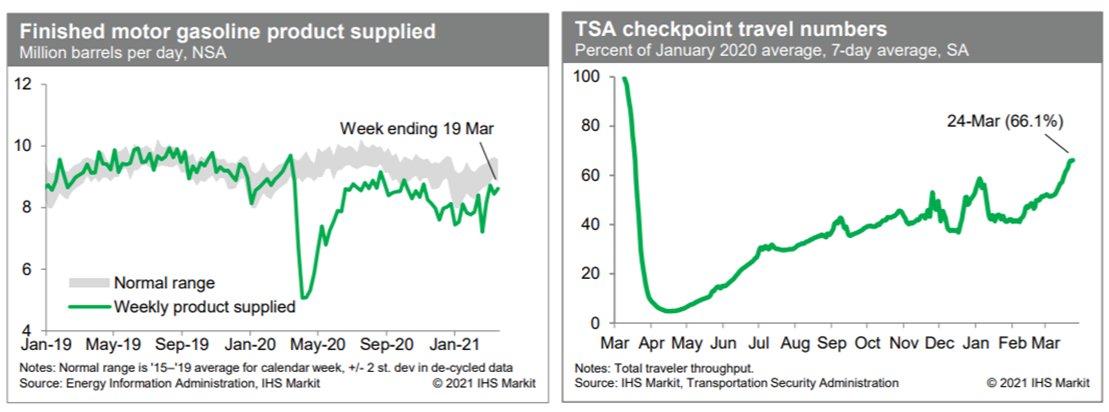

- Consumption of gasoline turned up last week, according to the

Energy Information Administration, but remained below what we

estimate to be a normal range, an indication of ongoing reduced

internal mobility. Meanwhile, passenger throughput at US airports

has continued to firm in recent days. Averaged over the last week,

and after seasonal adjustment, passenger throughput at US airports

was 66.1% of the January 2020 level. The recovery in air travel has

come a long way but has a long way yet to go. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 97,000 to 684,000 in the week ended 20 March, its

lowest tally since the pandemic first forced millions out of jobs

last March. The president signed the American Rescue Plan (ARP) Act

in March, which provides enhanced benefits of up to $300 per week

through 6 September 2021 and exempts the first $10,400 of benefits

from 2020 income taxes. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 264,000 to 3,870,000 in the week ended 13 March. The insured unemployment rate fell 0.2 percentage point to 2.7%.

- In the week ended 6 March, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 734,692 to 5,551,215. Even as continuing claims under regular state programs continue to decline, continuing claims under PEUC have been on an upward trajectory.

- There were 241,745 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 20 March. In the week ended 6 March, continuing claims for PUA rose by 118,898 to 7,735,491.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 6 March, the unadjusted total rose by 733,862 to 18,952,795.

- The Canadian Pest Management Regulatory Agency (PMRA) has granted registration to the herbicide active ingredient, imazypyr, and the end-use product, Habitat Aqua, for the control of certain invasive plants that grow in and around aquatic sites. The registration was proposed in December last year. The decision is based on an evaluation of the information submitted in support of registering the ai and the derived formulation, with the PMRA stating that the health and environmental risks posed by the products were found to be "acceptable". Imazapyr is already registered in the country for control of weeds in non-cropland sites, and in imazapyr-tolerant canola and lentil crops. (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- The Supreme Court of Canada ruled 25 March that the government's pollution pricing regime, which includes a national carbon tax, is constitutional. In a 6-3 decision, the court upheld the carbon tax, saying the government has the right to set minimum standards for GHG emissions, and it can set a floor price for emissions to ensure those standards are met. As part of Canada's commitment to the Paris Agreement, Prime Minister Justin Trudeau set a 2030 target of cutting emissions to 30% below 2005 levels ahead of reaching net zero in 2050. The carbon tax is a critical component of that plan. It was introduced through the Greenhouse Gas Pollution Pricing Act, which passed in June 2018. The tax on fuels is set at C$30 (US$24) per ton of carbon dioxide equivalent (CO2e), and set to rise annually to C$170 (US$135) in 2030. (IHS Markit Climate and Sustainability News' Kevin Adler)

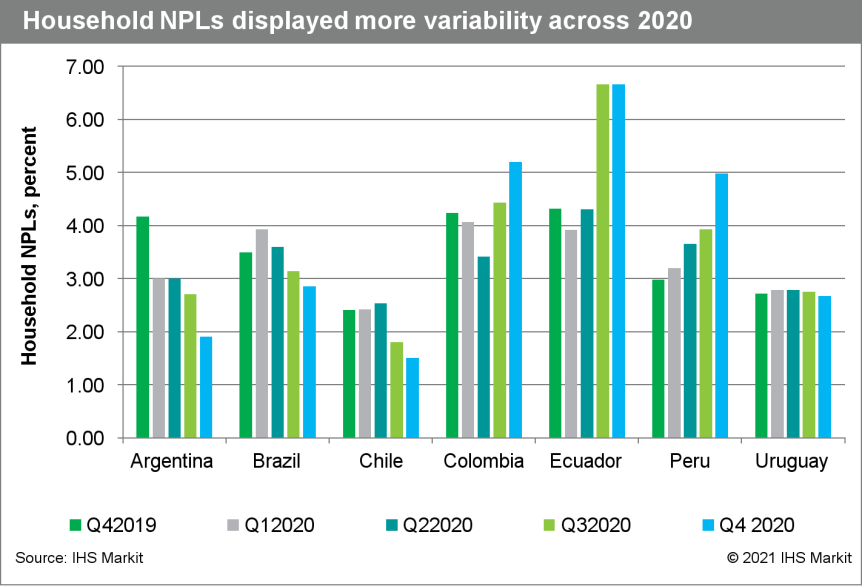

- IHS Markit analyses the main banking indicators for Argentina,

Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, and

Uruguay - the Dominican Republic and Panama were also added, given

their tight relationship with the region. Our key findings

highlight that credit growth has been contained; however, the sharp

decline in economic activity has affected profitability, and very

likely asset quality. (IHS Markit Banking Risk's Alejandro

Duran-Carrete)

- Credit increased in 2020, aided by stimulus measures; although growth was contained compared with previous years. In 2020, the average credit growth in the region stood at 6.5% year on year (y/y). The sharp economic decline of all these countries did not lead to a credit contraction in most of the region because of the lending incentives enacted by the regulations - such as lower reserve requirements and open market operations.

- Non-performing loans (NPLs) stayed very close to 2019 levels, but these are likely to increase as forbearance measures are retracted. NPLs stayed at an average 2.7% of total loans. Most of these are at similar levels to those of 2019 due to the forbearance measures instituted in these sectors.

- Provisioning rose, affecting profitability. The coverage ratio grew in all countries, going from an average of 154% of total NPLs in 2019 to 185% in 2020. This was contributed to by banks' large accumulation of reserves, given that they expect a rise in impairment through 2021.

- The sector's liquidity profile benefited from a surge in deposits. The average deposit growth stood at 22.1% in 2020, up by 12.6 percentage points from 2019. This allowed the sector to improve its liquidity figures, not only from the reduction of the loan-to-deposit ratio (LDR) from an average of 91.8% in end-2019 to 81.3% in end-2020, which has historically been one of the main warning indicators of the region (Argentina and Uruguay excluded), but also by the significant accumulation in liquid assets.

- Banks have been able to withstand a rapid contraction in foreign liabilities, displaying resilience in their liability profile, however, it is likely that this funding will return in 2021. During the second quarter of 2020 the region experienced a significant withdrawal of foreign funds. Banks were able to cope with these, aided by the small proportion that foreign funds represented in their liabilities balance sheet.

- Capital ratios remain high for most of the region and are

likely to remain robust over the short term. With an average

capital adequacy ratio (CAR) of 18.5% and an average Tier 1 ratio

of 17.8% as of end-2020, the region remains well capitalized.

- Colombia's seasonally adjusted monthly economic activity index

contracted by 4.55% y/y in January. In addition to remaining well

below pre-COVID-19-virus pandemic levels, Colombia's economic

activity in January declined in monthly terms for the first time

since August 2020: -1.53% month on month (m/m). (IHS Markit

Economist Lindsay Jagla)

- Agricultural activities and mining and quarrying (primary activities) drove the annual contraction, declining by -7.83%. The decline in manufacturing and construction (secondary activities) followed closely at -7.09%.

- Tertiary activities, which include a variety of activities such as utilities management, retail, and hospitality services, contracted slightly less at -2.79% y/y.

- Nissan has announced the temporary suspension of operations at its factory in Resende, Rio de Janeiro state, Brazil, for two weeks between 26 March and 9 April because of the worsening of the COVID-19 virus pandemic in the country, reports Automotive Business. The automaker is to grant collective vacations to employees at the plant for the period of the suspension of operations, before resuming production on 12 April. (IHS Markit AutoIntelligence Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed mixed; France/Germany +0.1%, Italy flat, Spain -0.4%, and UK -0.6%.

- Most 10yr European govt bonds closed higher; Germany -3bps, France/UK -2bps, Italy -1bp, and Spain flat.

- iTraxx-Europe closed +1bp/55bps and iTraxx-Xover +2bps/271bps.

- Brent crude closed -3.8%/$61.80 per barrel.

- RWE has made the financial investment decision to proceed with

the 1.4 GW Sofia offshore wind farm project. The project, situated

in the Dogger Bank area 195 kilometers from the North East cost of

the United Kingdom, is fully owned by RWE with a total investment

of approximately GBP 3 billion (USD4.1 billion). Construction is

due to start in 2023 with completion targeted for Q4 2026. The

project has been awarded a Contract for Difference (CfD) in 2019,

with strike price of GBP 39.65 per MWh. Contracts with preferred

suppliers are expected to be finalized shortly with the following

companies (IHS Markit Upstream Costs and Technology's Melvin

Leong):

- Wind turbines: Siemens Gamesa Renewable Energy (SGRE), 100 SG14-222 DD wind turbines

- Offshore converter stations: Consortium of Sembcorp Marine and GE Renewable Energy's Grid Solutions, two HVDC converter stations.

- EPCI, Monopile foundations, array cables, logistics hub: Van Oord

- High voltage cables: Prysmian Group, includes both submarine and land export cables. Installation by Prysmian with installation vessel Leonardo da Vinci.

- Dairy product exports from the UK to the EU saw a 96% decline y/y, as businesses rushed to complete deals earlier to avoid shipping issues anticipated in January, according to AHDB. January 2021 exports of milk products totaled 2,000 tons, compared to 103,000 tons exported in the same month last year. The largest drop in exports was seen in the fermented product (buttermilk and yogurt) and whey categories, which fell by 89% and 98% respectively. The drop is partly the result of added difficulties and costs associated with trading with the EU, particularly for fresh milk and cream. However, lower demand due to the pandemic, combined with issues around availability of shipping containers, has been the main reason for lower shipments. This can be seen in the drop off in exports to non-EU markets, which were down 27% over the same 4-month period. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Mercedes-Benz Trucks has outlined details of the field testing program for its eActros battery electric vehicle (BEV). It undertook a joint testing program with longstanding customer Logistik Schmitt in the Northern Black Forest since 2019. During this period the 25-tonne prototype eActros has completed 50,000 km of purely battery-electric operation to date - over 5,000 trips. As a result of the successful testing program Mercedes-Benz Trucks will deliver enhanced near-series production eActros to Logistik Schmitt in the next few months for further testing. (IHS Markit AutoIntelligence's Tim Urquhart)

- Welcon has clinched a deal to supply 140 offshore wind turbine towers to Siemens Gamesa Renewable Energy (SGRE). The towers to be supplied will be for the Hollandse Kust Zuid project in the Netherlands (78 towers), Kaskasi in Germany (38), and Neart na Gaoithe in the United Kingdom (24). The earliest delivery will be at the end of 2021 for the former, with the rest of the towers in 2022 for the later projects. The order will drive Welcon to expand capacity and capability for tower production at its facility in Give, Denmark. (IHS Markit Upstream Costs and Technology's Melvin Leong)

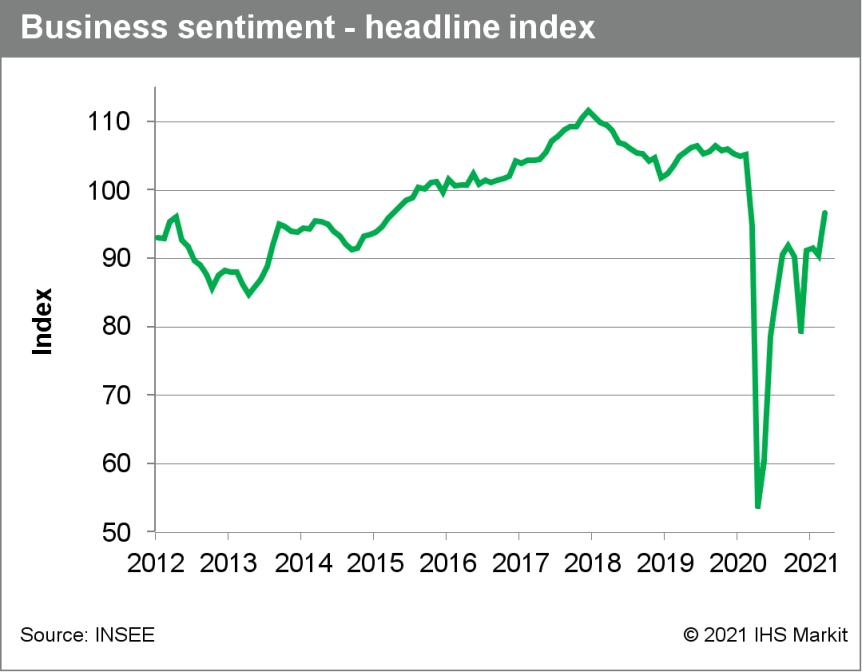

- France's business sentiment index based on the INSEE survey has

gained by 7 points to 97 in March, approaching its long-term

average of 100 and reaching its highest level since February 2020

(then 105; see chart below). The index is quite sensitive to

changes in COVID-19 virus-related restrictions, suggesting that the

announcement on 18 March of an upcoming tightening of rules will

have a negative impact next month (the latest survey responses were

collected between 26 February and 22 March). (IHS Markit Economist

Timo Klein)

- Baker Hughes and Horisont Energi have signed a MoU for the Polaris carbon storage project off the northern coast of Norway. Under the agreement, the two companies will explore the development and integration of technologies to minimize the carbon footprint, cost and delivery time of carbon capture, transport and storage (CCTS). Horisont Energi's Polaris offshore carbon storage facility is part of its Barents Blue project, which is the first global and full-scale carbon neutral ammonia production plant. The Polaris project is expected to have a total carbon storage capacity in excess of 100 million tons, which is equivalent to twice Norway's annual greenhouse gas emissions. Horisont Energi's Polaris offshore carbon storage facility is part of its Barents Blue project, which is the first global and full-scale carbon neutral ammonia production plant. (IHS Markit Upstream Costs and Technology's Helge Qvam)

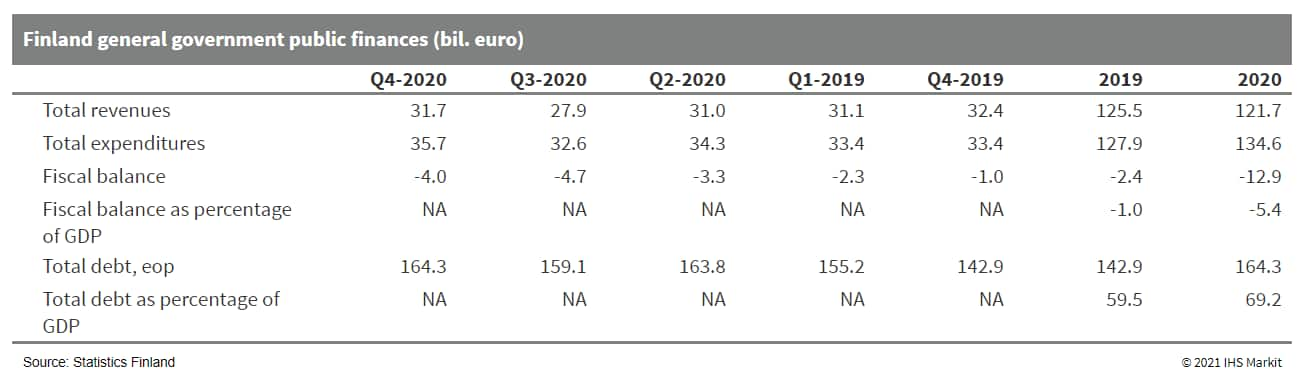

- Finland's consolidated general government (comprising of the

central and local governments and the social security funds)

revenues in the fourth quarter of 2020 decreased by a slightly

decelerated rate of 2.2% year on year (y/y), while the sharper fall

in the second quarter left the contraction for the year as a whole

at 3.1%. Meanwhile, expenditure growth in the final quarter

re-accelerated to 6.6% y/y, increasing the 2020 spending to 5.2%.

(IHS Markit Economist Venla Sipilä)

- South Africa's headline inflation rate slowed to 2.9% in February, from 3.2% in the previous month, the South African statistical service, Statistics SA, has reported. This leaves South Africa's headline inflation rate below the central bank's inflation target range of 3-6%. A modest uptick in medical fund premiums compared to previous years was mostly responsible for the favorable headline inflation outcome during February. Large private-sector medical funds reported a strong improvement in operating surpluses during 2020 as members avoided doctors' appointments and less-urgent operations during the first COVID-19 lockdown period. The stronger cash position will allow medical funds to contain premium increases during the first half of 2021. (IHS Markit Economist Thea Fourie)

Asia-Pacific

- Most APAC equity markets closed mixed; Japan +1.1%, South Korea +0.4%, Australia +0.2%, Hong Kong/Mainland China -0.1%, and India -1.5%.

- China's ride-hailing giant Didi Chuxing (DiDi) is reportedly inclined towards picking New York (US) over Hong Kong SAR for its initial public offering (IPO). DiDi has concerns that the its IPO application in Hong Kong SAR could meet with tighter regulatory inspection, especially in the context of using unlicensed vehicles and part-time drivers, reports Reuters. It sees a New York IPO as a more predictable listing place, and it offers a deeper pool of capital. According to the report, If DiDi selects New York, it may still go for a second listing in Hong Kong SAR. DiDi is seeking at least a USD100-billion valuation; given the high valuation target, it is expected to opt for a traditional IPO rather than listing through a special purpose acquisition company (SPAC). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's Hesai technology will supply its LiDAR sensors to autonomous truck startup Kodiak Robotics, reports Reuters. LiDAR sensors are necessary for the operation of autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. Kodiak will integrate Hesai's LiDAR sensors on each side of its trucks and will use one forward-facing LiDAR by Luminar. Kodiak Robotics focuses on developing AV technology for long-haul trucking. In August 2019, it received USD40 million in funding and began its first commercial deliveries in Texas (United States). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tesla raised the price of the Model Y in China on 24 March. The price for the Model Y Long Range All-Wheel Drive has increased by CNY8,000 (USD1,224) to CNY347,900 while the Performance variant is priced at CNY377,900, compared to CNY369,900 before the adjustment. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Vitesco Technologies, recently spun off from Continental, has announced an order from Hyundai Motor Group for an 800-volt inverter with silicon carbide technology for the automaker's upcoming E-GMP platform. The announcement does not indicate whether Vitesco is the sole supplier for the platform, although at this point no other supplier has been named. Of interest as well is the selection of 800-volt and silicon carbide technology by Hyundai; the more advanced technology charges faster than 400 volts but is also more expensive in the vehicle as well as at charging stations (supporting distribution of electricity to take advantage of the 800v capacity requires more robust charging stations and faster electricity throughput) and, depending on application, can see lower range. (IHS Markit AutoIntelligence's Stephanie Brinley)

- HHI Holdings has signed a deal with Korea Investment Corp. (KIC), South Korea's sovereign wealth fund, to jointly invest USD900 million (KRW1.0 trillion) towards mergers and acquisitions of global companies to strengthen the Group's competitiveness. Under the deal, HHI Holdings will seek acquisitions of companies in areas of AI, robots, remote autonomous ships, and hydrogen fuel cells. HHI is currently pushing to close the merger with DSME. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Shareholders of LG Electronics approved the spin-off of an electric vehicle (EV) powertrain unit to set up a joint venture (JV) with Canadian auto component supplier Magna International, reports Korea JoongAng Daily. LG's EV powertrain business will be spun off from the vehicle component division as a wholly owned subsidiary. Magna will eventually buy a 49% stake, while LG will own the remaining 51% stake. The JV will tentatively be named LG Magna e-Powertrain and is slated to be launched in July. It will be headquartered in Incheon, Gyeonggi, South Korea, with more than 1,000 workers now working for LG. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietnamese automaker VinFast has started accepting orders for its first electric vehicle (EV), the VF e34, at a price of VND690 million (USD29,802), according to a company press release. Customers who order the vehicle from now until 30 June can buy it at a reduced price of VND590 million, in addition to receiving one year's free battery subscription. The VF e34 was introduced in January as the VF31, alongside the larger VF32 and VF33, which have been confirmed for export sale. (IHS Markit AutoIntelligence's Jamal Amir)

- Australia saw 7 GW of renewable energy capacity additions in 2020, the country's highest single year of additions, according to a report released by the country's Clean Energy Regulator earlier in March. The 7 GW was nearly 40% higher than 2019's total, as well as exceeding the regulator's projection of 6.3 GW for the year. The jump was driven in part by an increase in rooftop solar installations and partially by several utility-scale solar and wind projects coming online at the end of 2020, ahead of their scheduled start-up dates in early 2021, said David Parker, chair of the Clean Energy Regulator. (IHS Markit Climate and Sustainability News' Bernadette Lee)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.