Daily Global Market Summary - 26 February 2021

Major APAC and European equity indices closed sharply lower, while US performance was mixed. US and benchmark European government bonds closed higher and retraced large portions of yesterday's substantial sell-off losses. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. The US dollar closed higher, while oil, gold, silver, and copper were lower.

Americas

- US equity markets closed mixed; Nasdaq +0.6%, Russell 2000 flat, S&P 500 -0.5%, and DJIA -1.5%.

- 10yr US govt bonds closed -11bps/1.42% yield and 30yr bonds -15bps/2.15% yield.

- CDX-NAIG closed flat/56bps and CDX-NAHY -2bps/310bps, which is

+4bps and +15bps week-over-week, respectively.

- DXY US dollar index closed +0.8%/90.88.

- Gold closed -2.6%/$1,729 per ounce, silver -4.4%/$26.44 per ounce, and copper -4.0%/$4.09 per pound.

- Crude oil closed -3.2%/$61.50 per barrel.

- US personal income rose 10.0% in January thanks primarily to

stimulus checks distributed through the Coronavirus Response and

Relief Supplemental Appropriations (CRRSA) Act. Real disposable

personal income (DPI) increased 11.0% and was 1.2% shy of the April

2020 peak reached after the initial round of pandemic relief

payments. (IHS Markit James Bohnaker and David Deull)

- Stimulus checks to individuals, classified as "economic impact payments" by the Bureau of Economic Analysis (BEA), totaled $1.7 trillion (annual rate) in January. Unemployment insurance increased by $263 billion (annual rate) as the CRRSA Act reintroduced supplemental weekly benefits of $300 for unemployed persons.

- The stimulus-fueled surge in personal income resulted in an increase in the personal saving rate to 20.5%, from 13.4% in December.

- Real personal consumption expenditures (PCE) rose 2.0% in January, which was a smaller increase than we expected, implying less PCE in the first quarter. As a result, we lowered our estimate of first-quarter PCE growth by 0.8 percentage point to 3.3%.

- The January round of stimulus checks contributed to strong durable goods spending. Real PCE for durable goods surged 8.3% (not annualized), led by double-digit increases in several categories such as furniture (up 13.3%) and recreational goods and vehicles (up 10.6%).

- The core PCE price index (excluding food and energy) increased 0.3% in January and was up 1.5% on a 12-month basis.

- Additional stimulus this spring, as well as progress on COVID-19 vaccinations, will provide tailwinds for PCE growth over the next several months.

- The US University of Michigan Consumer Sentiment Index fell 2.2

points (2.8%) from its January level to 76.8 in the final February

reading. This was 0.6 point higher than the mid-February reading,

indicating that consumers were modestly more optimistic in the

latter half of the month. (IHS Markit Economists David Deull and

James Bohnaker)

- The February decline was led by lower expectations regarding the next year. The expectations index fell 3.3 points in February to 70.7, while the present situation index slipped 0.5 point to 86.2. However, the entire increase in the headline index relative to the midmonth reading was due to a 0.9-point improvement in expectations.

- The index was 24.2 points beneath its pre-pandemic February high and 5.0 points above its April trough. Sentiment has remained depressed despite substantial economic recovery since the second quarter of 2020.

- As the employment recovery lags for lower-wage workers, especially those in the service and hospitality industries, the gap in consumer sentiment between households at either end of the income distribution has widened. The measure of consumer sentiment among households earning less than $75,000 a year fell 4.0 points in February to 70.5, but among households with earnings above that threshold, sentiment rose 0.5 point to 83.8. At 13.3, the gap between them was tied for the largest since August 2018.

- The expected one-year inflation rate rose 0.3 percentage point in February to 3.3%, a high last seen in 2014, as some prices (such as for gasoline) jumped in January. Expected five-year inflation was stable at 2.7%.

- Views on buying conditions worsened in February. The index of buying conditions for large household durable goods fell 2 points to 113, and that for vehicles fell 8 points to 109, the lowest since 2008. The index of buying conditions for homes fell 1 point to 125, a nine-month low.

- Toyota Mobility Foundation (TMF), in partnership with Energy Systems Network (ESN), has selected May Mobility and Udelv to deploy autonomous shuttles in Indiana (United States). These deployments will be a part of the Future Mobility District initiative, established in collaboration with the Indiana Economic Development Corporation (IEDC), which is aimed at boosting research and development in advanced mobility technologies in Indiana state. May Mobility will operate two autonomous shuttle pilots that will run for six months each in Indianapolis and Fishers. Meanwhile, Udelv will integrate its Delivery Management System (DMS) technology into the Toyota Sienna to allow contactless deliveries in Indianapolis. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tesla has temporarily halted the Model 3 production line at its plant in California over supply-chain issues, while GM has confirmed its Corvette plant in the United States is to be down for one week over supply problems. According to a Bloomberg report, Tesla has told its workers of the temporary Model 3 production stoppage. The production line will be down from 22 February to 7 March, the Bloomberg source said. Separately, GM plans to idle its plant in Bowling Green, Kentucky, which builds the Corvette, from 1 March to 5 March. The company reportedly said production of the Corvette was affected by a supply issue, but GM specifically said the interruption was not related to the global semiconductor shortage. The interruptions to Tesla's and GM's production in the US reflect ongoing supply-chain issues. Although the global semiconductor shortage remains in the headlines and has the potential to continue into fourth quarter, it is not the only COVID-19-pandemic-related supply-chain issue. These latest reports suggest that other supply issues are also slowing production. Both the Chevrolet Corvette and the Tesla Model 3 are in high demand and the production suspensions are likely to affect their sales to some degree. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to Spain's El País newspaper, J.P. Morgan Mexico, the 10th largest bank in the country by assets, is to close its private banking business, referring its clients to BBVA México instead. The firm will retain its investment banking and treasury services activities in the country, focusing on the wholesale market. J.P. Morgan made similar moves in Brazil in September 2020, when it transferred part of its private banking business to Bradesco. Neither J.P. Morgan nor BBVA have issued statements on the development and have declined to make any comments to the press. In addition to J.P. Morgan's reduction of its presence in the country, two other banks - Bank of Montreal and Mizrahi Tefahot Bank - with a small-scale presence in Mexico have recently closed their representative offices there. As at the end of 2020, J.P. Morgan Mexico displayed substantially lower profitability ratios than the wider sector with its return on assets (ROA) at 0.47% versus 0.91% for the sector overall; its return on equity (ROE) stood at 4.97% versus 8.93% for the aggregate sector. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- After growing by 1.7% year on year (y/y) in 2020, merchandise

exports from Costa Rica continued to increase in January 2021,

expanding by 15.0% y/y compared with January last year. (IHS Markit

Economist Lindsay Jagla)

- Costa Rica's merchandise exports have proved resilient amid the COVID-19-virus pandemic, ending 2020 with positive growth and beginning 2021 well above levels from a year ago. Merchandise export strength has been driven primarily by exports of medical instruments and supplies that make up 30% of Costa Rica's goods exports and grew by 7.7% y/y in 2020.

- Merchandise exports have historically made up about 55% of Costa Rica's total exports, with service exports accounting for the rest. A large portion of Costa Rica's service exports tie directly to the tourism industry, which has been hit significantly by the pandemic; in January 2021, total international arrivals were still 83% below pre-COVID-19-virus levels.

- General Motors (GM) has suspended production at its Gravatai plant in Brazil over a lack of components, while Honda has confirmed previously reported Civic production disruption at its Sumare plant in Brazil over supply problems. Automotive Business reports that GM is halting Chevrolet Onix production at its Gravatai plant over the month of March to replenish stocks of missing items, electronics in particular. Production will resume when there is sufficient supply to avoid interruptions to shifts. GM's vehicle assembly and system suppliers are affected and GM employees are to be placed on collective vacation initially. However, after the collective vacation, GM is proposing to lay off about half of the plant's workforce (1,000 people) for a period of two to five months as the component supplies are re-established. According to the Automotive Business report, if five months is not enough, the layoffs could be extended. Separately, the same news outlet reports that Honda has confirmed that production at its Sumare plant has been affected by supply issues, specifically the Civic line. Production at Sumare was impacted for a week earlier this month, it is reported, and another production interruption is scheduled for 1 March through 10 March. Honda is to put about 1,000 employees on collective vacation. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed lower; UK -2.5%, France -1.4%, Spain -1.1%, Italy -0.9%, and Germany -0.7%.

- Most 10yr European govt bonds closed higher except for UK +4bps; Spain -8bps, France -4bps, and Germany/Italy -3bps.

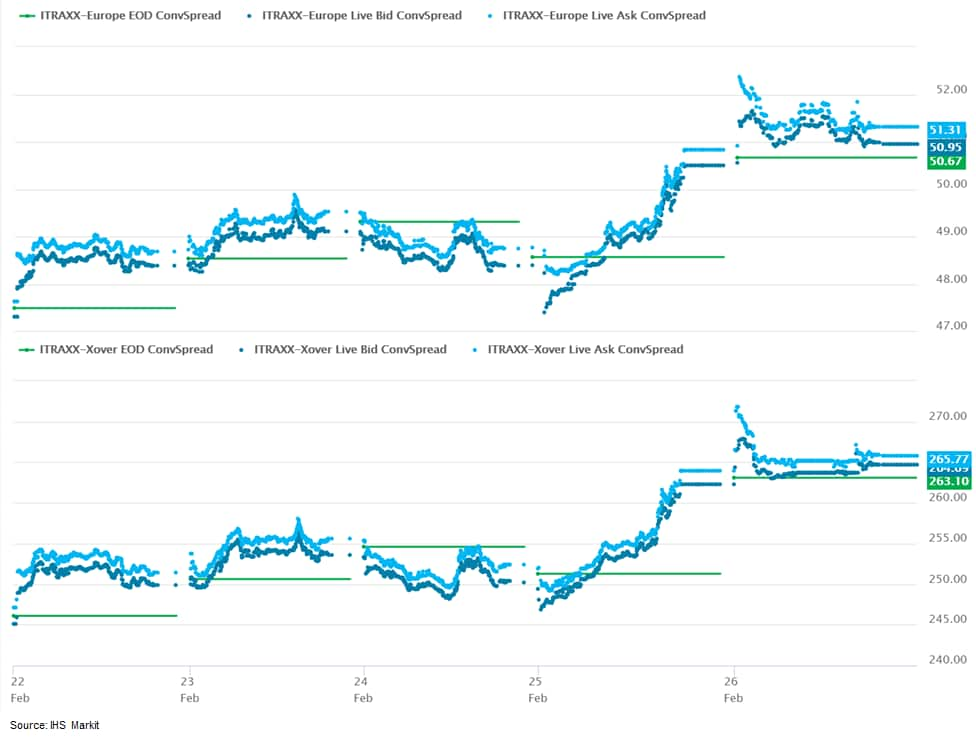

- iTraxx-Europe closed flat/51bps and iTraxx-Xover +2bps/265bps,

which is +4bps and +19bps week-over-week, respectively.

- Brent crude closed -2.6%/$64.42 per barrel.

- US biofuel interests welcomed news that the UK will implement a new E10 (10% ethanol/90% gasoline) standard this September in a move aimed at reducing carbon emissions from the UK transportation sector. Currently, the two widely available UK gasoline blends contain no more than 5% ethanol (E5). The new policy increases that share to up to 10% ethanol—the same as most fuel sold in the US. The change "could cut transport carbon dioxide (CO2) emissions by 750,000 tons a year - the equivalent of taking 350,000 cars off the road," the Department of Transport wrote in a release announcing the new policy. In 2020, the US exported around 600,000 barrels of ethanol to the UK, down roughly 55,000 barrels from 2019, according to the US Energy Information Administration (EIA) data. Overall UK consumption of ethanol stood at around 4.7 million barrels in 2019, according to the latest UK government data. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- The "headline" economic sentiment indicator (ESI) for the

eurozone surprised to the upside for the second straight month in

February, rising to its highest level since March 2020 (93.4).

Despite the upward surprises, the ESI remained over 6 percentage

points below its average since 2000 and 12 percentage points below

its pre-COVID-19 virus level. (IHS Markit Economist Ken Wattret)

- The main takeaway from the breakdown by sector is the ongoing outperformance of industrial sentiment, which has the highest weighting in the ESI (of 40%). It rose for the 9th month in 10, rising back above its long-term average for the first time in a year.

- The three sub-components that contribute to industrial sentiment all improved: production expectations, orderbooks, and stocks of finished products. Of the non-contributory sub-components, export orderbooks and past production also rose.

- The selling price index rose by almost 5 points to 9.7 in February, its highest level in more than two years and around 5 percentage points above its long-run average. Notably, the three-month moving average increase in the index was the second highest on record.

- Retail sentiment, meanwhile, has failed to regain any of the ground lost during its plunge in January owing to ongoing COVID-19 restrictions.

- Daimler and Cummins have announced a memorandum of understanding for a global strategic partnership on medium-duty engine systems. The companies are also evaluating other opportunities for collaboration. According to a joint statement, Cummins is to invest in further development of medium-duty engine systems for Daimler Trucks and Buses. Cummins is to carry out global production and delivery of medium-duty engines to Daimler Trucks and Buses from the second half of the decade. The deal with Cummins enables Daimler Truck to focus on alternative drive technologies and heavy-duty commercial vehicle engines, while ensuring supplies of medium-duty engines that are Euro VII compliant. For Cummins, the deal will increase the scale of its engine production. (IHS Markit AutoIntelligence's Stephanie Brinley)

- German automotive semiconductor manufacturer Infineon has said that its decision to expand production at a new plant in Austria will help to end the current chip shortage that is blighting the European car industry, according to a Reuters report. The company will open a new semiconductor facility in Villach (Austria) in August, which will be capable of manufacturing enough power semiconductors to equip the powertrains of 25 million battery electric vehicles (BEVs), according to the company's CEO Reinhard Ploss. Following the commissioning of the EUR1.6-billion (USD1.95-billion) facility in Villach, which will make chips on large, 300-millimetre wafers, Infineon will add a twin production line to a similar plant in Dresden (Germany), thereby boosting capacity significantly. (IHS Markit AutoIntelligence's Tim Urquhart)

- The employment barometer for the fourth quarter of 2020,

published by the Swiss Federal Statistical Office, reveals that the

recovery of employment that began in mid-2020 has lost considerable

momentum. (IHS Markit Economist Timo Klein)

- The so-called BESTA statistics - based on a comprehensive picture of the corporate landscape, using pension-system statistics that also include many micro firms and employees with less than six weekly work hours - show that seasonally adjusted employment increased by just 0.1% quarter on quarter (q/q) in the fourth quarter of 2020, following an increase of 0.4% in the third quarter and a decline of -1.0% in the second quarter. This compares with an average quarterly increase of 0.4% q/q during 2019. Having reached an all-time high of 5.15 million at end-2019, employment fell to 5.10 million in the second quarter of 2020 before recovering to 5.13 million in the fourth quarter.

- Vacancies, which had plummeted to -13.3% y/y in the first quarter of 2020 already and bottomed at -26.9% y/y in the second quarter, deteriorated modestly from -15.1% in the third quarter to -16.1% in the fourth quarter.

- Finally, the indicator measuring the degree of perceived skills shortages, which had rebounded from its second-quarter nadir of -5.0% to -2.8% y/y in the third quarter, worsened again to -3.9% y/y. The share of firms (weighted by the size of their workforce) reporting difficulties in finding qualified personnel therefore diminished anew to 28.2%, which compares with a 32.2% average during 2019.

- Mobileye has partnered with Transdev ATS and Lohr Group to jointly develop and deploy commercial autonomous shuttles for public transportation services. As part of the deal, the companies plan to integrate Mobileye's driverless system into Lohr's i-Cristal shuttle. These autonomous shuttles will be deployed in Transdev's existing public transportation networks across the globe, starting with Europe. Initially, the companies will test autonomous shuttles on roadways in France and Israel, aiming for production in 2022 and the launch of commercial operations by 2023. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Africa's main budget deficit is expected to end FY

2020/21 at 12.3% of GDP, decreasing to 6.5% of GDP by FY 2023/24.

For the upcoming FY 2021/22, Finance Minister Tito Mboweni proposed

a main budget deficit of 9.0% of GDP. (IHS Markit Economist Thea

Fourie)

- The current fiscal trajectory is an improvement from the budget path outlined in the 2020 medium-term expenditure framework (MTEF), released in October 2020.

- The MTEF showed an expected main budget deficit of 14.6% for FY 2020/21, with the deficit falling to 7.3% of GDP by FY 2023/24. Public-sector debt is expected to peak at 88.9% of GDP in FY 2025/26, down from the 95.3% of GDP previously expected under the MTEF.

- A revenue overrun of ZAR99.6 billion (USD6.8 billion) for FY 2020/21 will fund additional spending in FY 2021/22 and lower overall government bond issuance during the upcoming FY.

Asia-Pacific

- APAC equity markets closed sharply lower; Japan -4.0%, India -3.8%, Hong Kong -3.6%, South Korea -2.8%, Australia -2.4%, and Mainland China -2.1%.

- Chinese battery-maker Contemporary Amperex Technology Co Limited (CATL) plans to increase the battery production capacity of its joint venture (JV) plant with Chinese automaker SAIC Motor, according to a company statement. The plant expansion project is to involve construction in phases and an investment of up to CNY12 billion (USD1.86 billion). CATL currently holds 51% of the equity of the CATL-SAIC JV established in 2017. SAIC holds the remaining 49% of the JV company. CATL has announced a series of new investments since the end of last year involving a total investment exceeding CNY50 billion. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The March paraxylene Asia contract price settled on Friday at $870/mt CFR, up $165/mt or 23.4% from February. A major settlement was concluded between Reliance and Shenghong; Yisheng and SK Global Chemical and Eneos, sources close to the negotiation process said. Initial offers ranged from $920-1,020/mt while bids were heard between $720-790/mt CFR despite the spot market already trading at a high of $898/mt CFR on Thursday. Production disruptions at Chinese PX units as well as the start up a new PTA plant were factors contributing to tightening PX supply, sources said. This was further aggravated by a crude oil rally following a cold snap in Texas last week which sent oil prices to a 13-month high. In swift response, the PX spot price jumped $102.25/mt or 13% within a week, IHS Markit data showed. (IHS Markit Chemical Market Advisory's Sok Peng Chua)

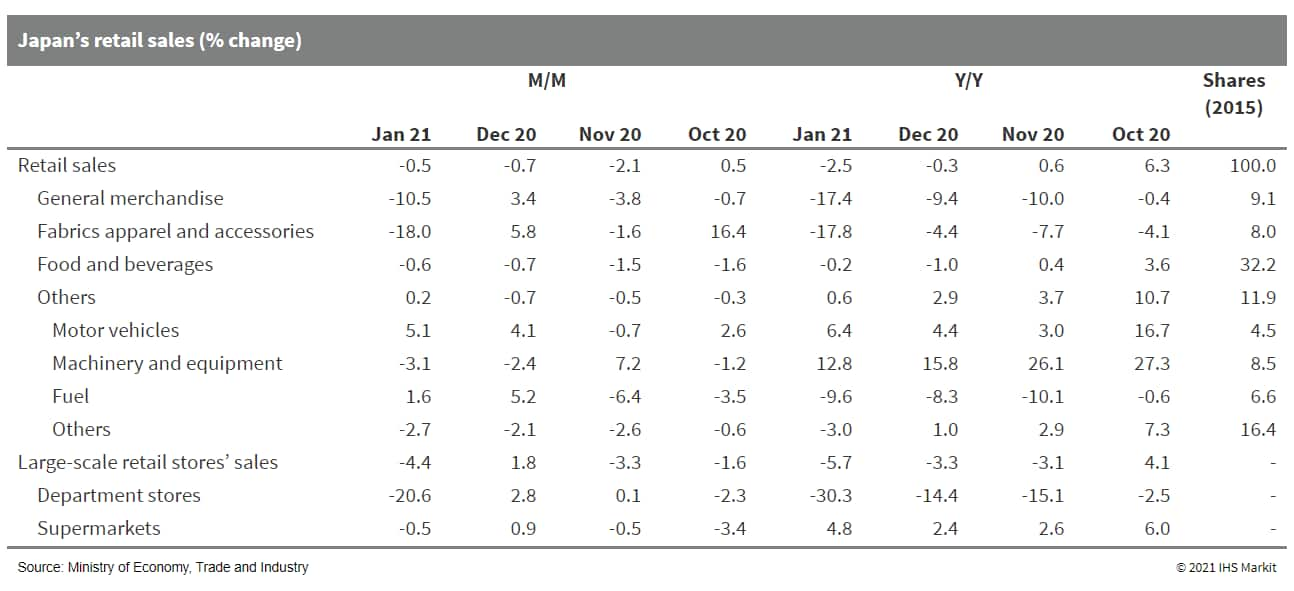

- Japan's retail sales continued to fall in January. Despite the

likelihood of the lifting of the state of emergency, continued

uncertainties over COVID-19 and sluggish wages could weigh on

retail sales. (IHS Markit Economist Harumi Taguchi)

- Japan's retail sales fell by 0.5% month on month (m/m) in January for the third consecutive month of decline. The weakness largely reflected drops in sales of fabrics apparel and accessories and general merchandise as well as continued falls in sales of food and beverages and machinery and equipment.

- Sharp drops in sales of fabrics apparel and accessories and

general merchandise were due largely to shorter operating hours and

declines in customer visits because of the state of emergency for

Tokyo and 10 prefectures. Decreases in large retail stores' sales

by prefecture suggest the resurgence of COVID-19 has made consumers

cautious about going out in Japan in general - not only the

prefectures covered under the state of emergency.

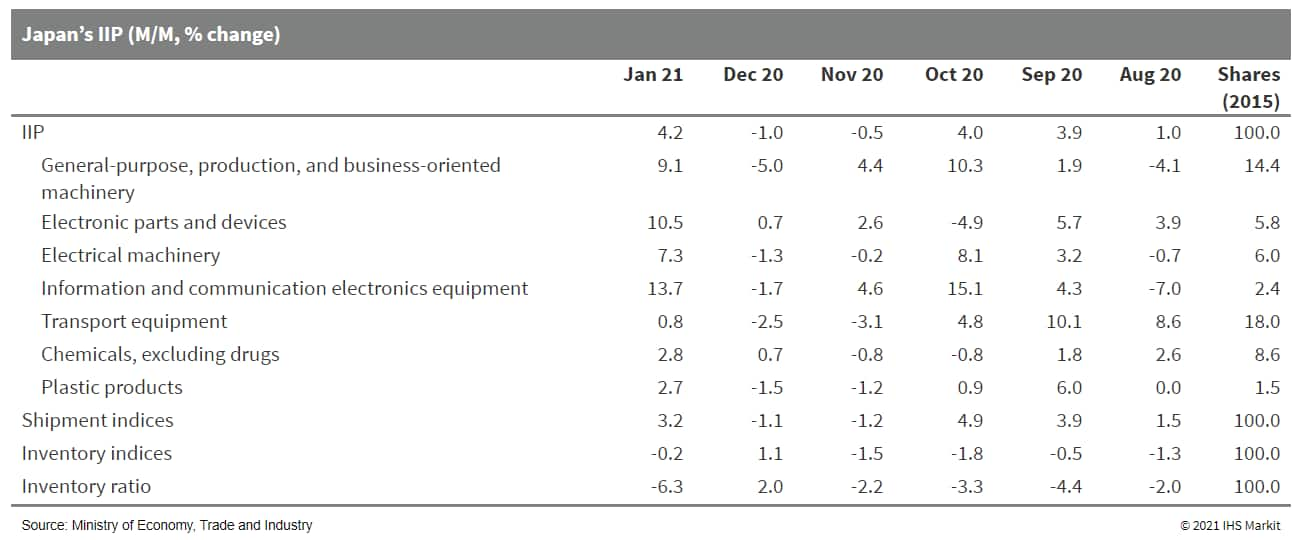

- Japan's index of industrial production (IIP) rebounded solidly

in January, but upward momentum could ease because of the drop-out

of the influence of the Lunar Near Year holidays and supply chain

disruption. (IHS Markit Economist Harumi Taguchi)

- Japan's IIP rose by 4.2% month on month (m/m) in January 2021 following two consecutive months of declines but remained below the December 2019 level. Manufacturers' shipments also increased by 3.2% m/m, while inventories fell by 0.2% m/m. This led to a 6.3% m/m drop in the index of inventory ratio, which declined to its lowest level since April 2019.

- The solid rise in IIP reflected increases in a broad range of

industry groups, with particularly solid rebounds in production of

general-purpose, production, and business-oriented machinery and

information and communication electronics equipment and continued

rises in production of electronic parts and devices and chemical

production. Solid increases in machinery tool orders from Asia (up

82.5% y/y in January 2021) suggest rising production, particularly

in China, has driven exports and production of capital goods.

- Toyota Motor Corporation has developed a compact fuel-cell module that has a wide voltage range (400 V to 750 V) and can be directly connected to an existing electrical instrument provided with a motor, inverter, and battery. According to a company statement, the new module will be easily utilized by companies that are developing and manufacturing FC products for a wide variety of applications, including mobility such as trucks, buses, trains, and ships, as well as stationary generators. The module is available in four models - a vertical type and a horizontal type with output of either 60 kW or 80 kW. (IHS Markit AutoIntelligence's Nitin Budhiraja)

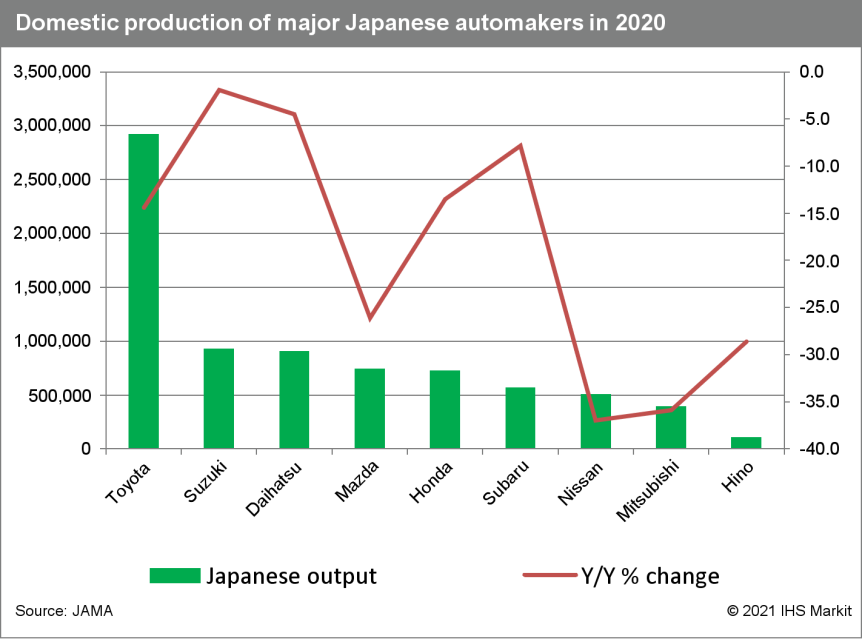

- According to figures released by the Japan Automobile

Manufacturers Association (JAMA) today (26 February), Japanese

vehicle production experienced an increase of 3.63% year on year

(y/y) to 751,629 units during December 2020. The figure includes

passenger vehicles, trucks, and buses. The growth in output in the

last few months was not sufficient to offset the declines in the

first three quarters of 2020, as full-year volumes were down by

over 16%. Production is expected to experience a boost in the next

few months, once the process of vaccination reaches a considerable

segment of the population. IHS Markit currently forecasts Japanese

light-vehicle production at 8.322 million units in 2021. (IHS

Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai has received 23,760 bookings for the new IONIQ 5 midsize electric crossover utility vehicle (CUV) in just one day in South Korea, reports the Yonhap News Agency. The automaker started receiving bookings for the IONIQ 5 on 25 February, well ahead of the model's launch in the domestic market in the second quarter of 2021. The report highlights that first-day pre-orders for the IONIQ 5 even outpaced the previous record of 17,294 pre-orders for the facelifted Hyundai Grandeur sedan launched in late 2019. The IONIQ 5 is the first model under Hyundai's new IONIQ brand dedicated to electric vehicles. It is also the first vehicle to be built on the recently revealed electric-global modular platform (E-GMP), a dedicated EV architecture. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea is planning to build a hydrogen industry hub in the city of Ulsan that it said will be the largest in Northeast Asia as part of overarching efforts to decarbonize the country's economy by midcentury. The hydrogen hub, slated for completion in 2022, will be spread across 4.7 square kilometers and comprises three main areas: a hydrogen industry base district focused on producing hydrogen fuel cells; an electrogene auto factory for manufacturing hydrogen-fueled electric vehicle parts and supplies; and a research and development business center. Funding for the development of the hydrogen hub is expected to come from domestic and international companies as well as through public support. The Ulsan Free Economic Zone Authority expects to attract $500 million from overseas investors by 2030 and aims to attract 5.3 trillion won ($4.8 billion) from domestic companies, according to Heo. (IHS Markit Climate and Sustainability News' Soo Cheng Bernadette Lee)

- India's rising power demand over the next two decades is driving its decision to continue to rely on a substantial amount of coal-fired power, but a new report suggests that the economics of renewable generation, plus the age of India's coal fleet, could have seen the tipping point reached for a slow, long-term decline for coal. "Has coal-fired generation peaked in India?" is the provocative title of a report released by the UK-based renewables think tank Ember, in February. The answer: maybe. India's coal-fired generation declined by 5% year on year in 2020, due to the COVID-19 pandemic, and it had declined in 2019 by 3% as well, mostly due to a struggling national economy. It is possible that new renewable resources—not coal—could capture that share of the market as demand rebounds in the next few years, said Ember. (IHS Markit Climate and Sustainability News' Kevin Adler)

- The Reserve Bank of New Zealand (RBNZ) Monetary Policy

Committee (MPC) decided to maintain its current monetary policy

settings during its 24 February meeting. This was in line with the

guidance initiated in March 2020, which stated that it would leave

the official cash rate (OCR) on hold at 0.25%, and also means that

the large-scale asset purchase (LSAP) program and Funding for

Lending Programme (FLP) were unchanged from what was decided in the

November 2020 meeting. (IHS Markit Economist Andrew Vogel)

- Ensuring sustainable employment is one of the two core objectives for the RBNZ alongside its inflation target of 1-3%. Before the pandemic, unemployment had been trending downwards from a peak of 6.7% in the September 2012 quarter. Last year's extraordinary contraction in economic activity both domestically and globally created a risk that both inflation and employment will stay below the RBNZ's target levels, hence the bank's policy to leave the door open for further quantitative easing.

- Nominal retail sales may have contracted modestly in 2020, due largely to the sharp retrenchment recorded during the country's lockdown in the June quarter. However, a few key retail sub-sectors recorded annual sales growth, including core retail sales and supermarket and grocery retailers. The clear exception was sectors reliant on international tourists, such as hospitality and dining.

- IHS Markit does not expect that the OCR will need to go negative, with the rate most likely to stay at 0.25% until early 2024. That said, if conditions deteriorate well beyond our current expectations, a slip into negative territory is possible, as the RBNZ has adopted a "least regrets" strategy - that is, preferring to do too much too soon, rather than too little too late.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.