Daily Global Market Summary - 26 July 2021

All major US equity indices closed higher, while European and APAC markets were mixed. US government bonds closed lower and benchmark European bonds were mixed. European iTraxx closed slightly wider across IG and high yield, and CDX-NA was almost flat on the day. Copper, silver, natural gas, and Brent closed higher, while the US dollar, WTI, and gold were lower on the day. All eyes will be on this week's FOMC, which begins tomorrow (Tuesday), for any signs of tapering QE purchases and changes in their inflation outlook.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher, with the DJIA +0.2%, S&P 500 +0.2%, and Nasdaq +0.03% closing at new record highs; Russell 2000 +0.3%.

- 10yr US govt bonds closed +2bps/1.30% yield and 30yr bonds +3bps/1.95% yield.

- The real yield on 10-year Treasuries fell to a record low as concerns mounted over the outlook for economic growth even as investor flows fueled appetite for inflation-linked debt. The real rate, which strips out the expected impact of inflation over the next decade, fell as much as six basis points to minus 1.13%. The move was compounded by a lack of trading liquidity, with the 10-year breakeven rate -- a market proxy for the predicted average annual rate of consumer price gains over the next decade -- topping 2.41% Monday in the wake of substantial flows into the largest exchange-traded fund that's tied to inflation bonds. (Bloomberg)

- CDX-NAIG closed flat/49bps and CDX-NAHY +2bps/283bps.

- DXY US dollar index closed -0.3%/92.65.

- Gold closed -0.1%/$1,799 per troy oz, silver +0.3%/$25.32 per troy oz, and copper +4.2%/$4.59 per pound.

- Crude oil closed -0.2%/$71.91 per barrel and natural gas closed +1.0%/$4.08 per mmbtu.

- With COVID-19 reducing mobility and shrinking the nation's

economy, US CO2 emissions from energy consumption fell to the

lowest level since 1983, the US Energy Information Administration

(EIA) reported 26 July. (IHS Markit Net-Zero Business Daily's Kevin

Adler)

- The data, which confirm modeling from other organizations, indicate that 4.6 billion metric tons (mt) of CO2 was emitted from energy consumption in 2020, or an 11% decrease from 2019. This is the largest annual decrease on record, EIA said in a statement.

- This won't last for the US or the world, however. EIA is projecting that US energy-related CO2 emissions will rise by 0.3 billion mt in 2021, or 7%.

- Globally, the International Energy Agency said in April that it detected a 4.8% decline in CO2 emissions in 2021, but is forecasting an increase of 5.8% in 2021. That will leave worldwide carbon emissions in 2021 at 33 billion mt. On a global basis, the increase of 1.5 billion mt, or the largest in a single year since 2015, with IHS Markit energy experts saying it will be driven by rebounding economies around the world.

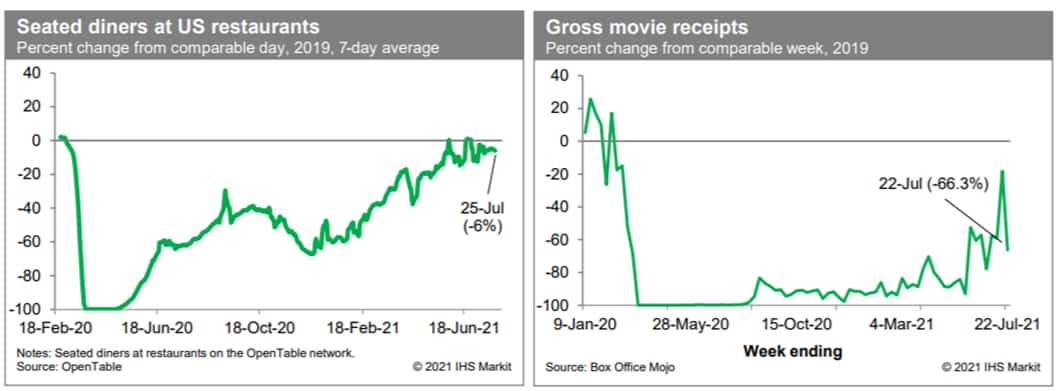

- The count of seated diners on the OpenTable platform averaged

over the last week was about 6% below the comparable period in

2019, in line with the recent trend. The recovery in restaurant

activity has been robust to date and has yet to show signs of

vulnerability to rising case counts. Meanwhile, box office revenues

last week, relative to the comparable week in 2019, were down

66.3%, a sharp drop from the prior week's comparison. The week in

2019 to which last week's revenues are compared included the

release of the Lion King remake. To be sure, these weekly

comparisons will be volatile, reflecting the uneven distribution of

major movie releases over the year (this year and in 2019). Still,

the takeaway of the recent data is that people appear willing to

get back into movie theaters, if properly motivated. Of course,

this could change as spread of the Delta variant accelerates. (IHS

Markit Economists Ben

Herzon and Joel

Prakken)

- US new home sales fell 6.6% in June (±16.5%, not statistically

significant) to a 676,000-unit seasonally adjusted annual rate.

January's 993,000 sales total may turn out to be a cyclical high.

(IHS Markit Economist Patrick

Newport)

- Second-quarter sales were down 18.7% from the first quarter—the third straight quarterly decline (quarterly estimates are more reliable than monthly estimates because averaging reduces statistical noise).

- Sales figures for March through May were collectively revised down by 90,000 units. Note: about one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions.

- The prices of new homes have skyrocketed—the median and average new home prices in the second quarter were up 16% and 17%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly changed.

- Meanwhile, the Census's construction cost index for homes under construction was up 11% from a year earlier in the second quarter.

- Inventory rose by 23,000 units to 353,000. However, only 36,000 of the homes classified as inventory were completed; 105,000 of these units had not been started.

- According to the state housing permits data released this morning, builders took out 588,000 single-family housing permits in the first six months of this year, 36% and 41% more than in the first six months of 2020 and 2019, respectively. Texas and Florida accounted for 33% of the two-year increase in permits from 2019 to 2021; adding South Carolina, Georgia, and Arizona to the mix raises that number to 49%.

- Electric vehicle (EV) startup Lucid Air has announced the closing of its deal to go public, with the stock trading on the NASDAQ stock exchange from today (26 July). Following Lucid's merger deal with a special-purpose acquisition company (SPAC) to become a public company, Peter Rawlinson continues as Lucid CEO and chief technology officer. Lucid merged with Churchill Capital Corp IV (CCIV), with the deal closing officially on 23 July. CCIV's shares were traded on the New York Stock Exchange and it has been delisted there. Lucid will trade under the stock ticker 'LCID' for common stock and 'LCIDW' for warrants. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Members of Mexico's Revolutionary Confederation of Workers' and Farmers (Confederación Revolucionaria de Obreros y Campesinos: CROC) demonstrated outside the US Embassy in Mexico City on 15 July to demand that the US authorities request an investigation from their Mexican counterparts under the United States-Mexico-Canada Agreement (USMCA)'s labor provisions into an alleged breach of workers' unionization rights at two hotels in Baja California Sur state during a dispute between the CROC and rival Confederation of Mexican Workers (Confederación de Trabajadores de México: CTM) over the control of their collective contracts since 2019; the US Trade Representative (USTR) is responsible for raising the concern with Mexico. Both the CTM and the hotels' management deny any breach of workers' rights. Since the entry into force of USMCA in July 2020, the United States has called for labor-related investigations in Mexico twice; both cases involved automotive sector facilities in which workers were represented by CTM-affiliated unions. Along with measures aimed at expanding workers' benefits, such as a minimum wage raise, agreeing to stricter labor standards under the USMCA, and legal reforms on subcontracting and enhancing unionization rights, President Andrés Manuel López Obrador (AMLO) has fostered a gradual reconfiguration of the Mexican union landscape. (IHS Markit Country Risk's Jose Enrique Sevilla-Macip)

Europe/Middle East/Africa

- Major European equity indices markets closed mixed; Italy/Spain +0.7%, France +0.2%, UK flat, and Germany -0.3%.

- 10yr European govt bonds closed mixed; UK -1bp, Italy/Germany/France flat, and Spain +1bp.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Europe +3bps/235bps.

- Brent crude closed +0.5%/$74.50 per barrel.

- The World Wildlife Fund (WWF) has shown that over 15% of food

could be lost before it leaves the farm and called for radically

changes in agri-food policy to address the problem. (IHS Markit

Food and Agricultural Policy's Steve Gillman)

- On 21 July, WWF released its 'Driven to Waste' report which found that 1.2 billion tons - or 15.3% - of food produced around the world is already lost during harvest or slaughter.

- The NGO said their findings mean that as much as 40% of all food could be wasted globally when both farming and post-farming are considered.

- Previous estimates on food waste, including those made by the UN Food and Agriculture Organization (FAO), often base their estimations on the weight of production of a harvested crop which excludes what is left on fields. The FAO's 2011 estimate using such a post-harvest approach found that 1.3 billion tons of all food is wasted each year, but if it this was combined with WWF's findings the total problem could be closer to 2.5 billion tons.

- WWF said that one of the main factors behind this is agricultural overproduction and the saturation of markets, which subsequently drives prices down and creates a structural problem that perpetuates waste.

- In July, Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

declined from June's two-and-a-half-year high of 101.7 to 100.8.

Although remaining above its long-term average of 97.0, the

November 2017 series high of 104.7 (since January 2005) is getting

out of sight again. The Ifo institute comments by saying that

supply bottlenecks and concerns over newly rising infection numbers

are weighing on the German economy. (IHS Markit Economist Timo

Klein)

- Business expectations posted a sizeable dip from a 10-year high of 103.7 (revised down from 104.0) to 101.2. Expectations worsened to a similar degree across all sectors apart from construction. In manufacturing, July is already the fourth consecutive month of deterioration, as this sector is affected the most by supply bottlenecks and skilled labour shortages. In comparison, expectations in the retail and service sectors had been on an upward trend until June.

- In contrast, the assessment of current conditions improved once more, its sub-index increasing from 99.7 to a 25-month high of 100.4. Note this even exceeds the levels during the second half of 2019, prior to the pandemic. Improvements were seen in all sectors, even in manufacturing where firms are grappling with the aforementioned supply shortages and associated price increases for inputs. Indeed, capacity utilization increased from 85.9% to 87.1% in manufacturing, well above its long-term average of 83.5%.

- Looking at July's sectoral breakdown of overall indices, declines were similar across the board. Retail and services, which boasted the largest confidence gains during May-June in reaction to loosened pandemic-related restrictions, corrected slightly more than the others. Construction was the exception, posting its third consecutive gain, but it still underperforms the others in terms of levels. Indeed, the confidence level for the retail sector is still the second-highest of the past four years despite July's correction, demonstrating the strength of pent-up consumer demand.

- Stellantis has announced that it has signed a new revolving credit facility (RCF) with several banks, replacing former PSA (EUR3.0 billion) and FCA (EUR6.25 billion) RCF agreements, according to a company statement. The new RCFs also increase the company's credit availability from EUR9.25 billion, combined. The new RCF is structured in two tranches, EUR6.0 billion with a three-year tenor and EUR6.0 billion with a five-year tenor; both have two one-year extension options. (IHS Markit AutoIntelligence's Stephanie Brinley)

- On 23 July, the Bank of Russia Board of Directors opted for a

decisive 100-basis-point increase in the key lending rate. The

Board noted that the Russian economy has already returned to

pre-pandemic levels, which explains the persistent nature of the

annual inflation. (IHS Markit Economist Lilit

Gevorgyan)

- According to the Russian Federal State Statistical Service (RosStat), headline inflation accelerated further in June, reaching 6.5% y/y, up from 6.0% y/y in May. It is noteworthy that annual core inflation, which excludes fresh produce and energy prices, outstripped the headline inflation for the first time since the first half of 2016, rising to 6.6% y/y.

- Double-digit increases in some food categories such as vegetable oil and sugar prices, as well as sharp increases in the cost of construction materials, led the continued surge in annual inflation in June.

- The Board of Directors also noted that demand-side inflationary risks were the key contributors to the elevated inflation. Both consumer and business inflation expectations remain high, adding to inflationary pressures and longer deviation from the inflation target rate.

- The bank also noted that expectations of monetary tightening have slowed the rate of deposits. The more decisive rate tightening is expected to help the adjustment of bank rates to the monetary policy and encourage bank deposits for households.

Asia-Pacific

- Major APAC equity indices closed mixed; Japan +1.0%, Australia flat, India -0.2%, South Korea -0.9%, Mainland China -2.3%, and Hong Kong -4.1%.

- The au Jibun Bank Flash Japan Composite PMI, compiled by IHS

Markit and published ahead of the final PMI results, indicated

Japan's private sector shrank for a third straight month in July.

The Flash Composite PMI Output Index slipped to 47.7 in July from

48.9 in June, indicating an increased rate of decline. Although

both services and manufacturing output indices declined,

manufacturing managed to sustain moderate growth while services

activity slipped further into contraction. (IHS Markit Economist

Jingyi Pan)

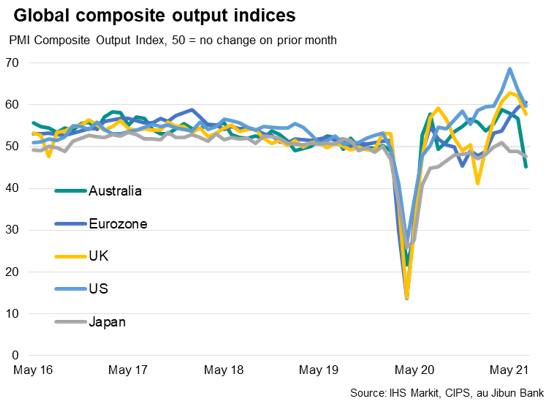

- Assessing the indications from July flash PMIs, we have seen the eurozone signaling the fastest economic growth for 21 years. The US and UK composite flash PMIs had eased, but notably from multi-year highs and remain at elevated by historical levels. In contrast, Australia and Japan both saw their economies contract in July, according to flash PMI indications, suffering the disruptions from the more infectious Delta variant. Both Japan and Australia also lag various developed world counterparts pertaining to their vaccination progress, highlighting the importance of ramping up inoculation to enjoy vaccine dividends.

- Zooming into the effects of the Delta variant spread, one would

intuitively expect services to be relatively more affected than

manufacturing, and that had certainly been the case in July.

Despite the resurgence of COVID-19 cases amongst APAC economies,

Japan and Australia manufacturing PMI continued to run above the

50.0 no-change mark, however, and continued to see their suppliers'

delivery times lengthening as demand remained resilient.

- Kia has suspended production operations at its number 1 Sohari plant in South Korea today (26 July) as dozens of workers at the plant have been infected with COVID-19 in recent days, reports the Yonhap News Agency. The plant's suspension may be extended depending on the result of COVID-19 tests on its workers, according to an unnamed Kia spokesperson. (IHS Markit AutoIntelligence's Jamal Amir)

- In comments posted to social media site Twitter, Tesla CEO Elon Musk called an India plant "quite likely," if Tesla could start with imported vehicle sales. The CEO's comments were in response to a Twitter question about potential sales in India. "Import duties are the highest in the world by far of any large country. Moreover, clean energy vehicles are treated the same as diesel or petrol, which does not seem entirely consistent with the climate goals of India." Musk also noted that the company is hopeful India will offer "at least a temporary tariff relief for electric vehicles… If Tesla is able to succeed with imported vehicles, than a factory in India is quite likely," Musk wrote. Bloomberg reports that Tesla has requested a reduction of import duties on electric vehicles (EVs) to 40% from the current range of 60% for cars priced below USD40,000 and 100% for those above USD40,000; given Tesla's pricing, all Tesla products would be subject to the 100% tariff, except the base model of the Model 3. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Omega Seiki Mobility (OSM), an Indian electric vehicle (EV) company, has announced potential plans to invest USD300-600 million in the next five to seven years in the electric mobility business, reports Economic Times Auto. According to the source, the EV-maker has plans to set up a manufacturing facility in addition to the one in Faridabad (Haryana), open an R&D center in collaboration with a European OEM, and expand its presence into the African market. (IHS Markit AutoIntelligence's Tarun Thakur)

- With economic growth recovery prospects being dimmed by a

significantly stronger wave of COVID-19 infections related to the

Delta variant, Indonesian policy-makers have been put in a tough

position of balancing the need to bolster the economy and the

citizens of Indonesia, but also needing to ensure essential foreign

capital inflows. (IHS Markit Economist Bree

Neff)

- The BI held the seven-day reverse repurchase (repo) rate unchanged at 3.50% following its July meeting, indicating that it remains at an appropriate level to maintain the stability of the Indonesian rupiah and the financial system in case of volatility and "flights to quality" in global markets.

- In light of the current and more significant wave of COVID-19 infections domestically, which has triggered more significant restricted mobility measures to contain infections, the BI has lowered its 2021 GDP growth forecast range to 3.5-4.3% from 4.1-5.1%. Households remain the weakest link in the economy, while exports appear to be holding up by BI's accounts.

- Inflation is forecast by the central bank to remain below its 2-4% target band through 2022, especially after it eased back to just 1.3% year on year (y/y) in June following the Eid al-Fitr festive season. Ordinarily, that weak inflation reading would allow for further interest rate cuts, but rupiah stability is back on the radar with the BI concerned that flight-to-quality assets will gain momentum as major central banks start discussing monetary policy tightening.

- The central bank indicated that the country recorded net portfolio inflows of USD4.28 billion in the second quarter of 2021, but for 1-19 July, the country had recorded a minor outflow of USD0.7 billion.

- The government announced last week that it had raised the National Economic Recovery (known locally as PEN) budget to IDR744.8 trillion (USD51.45 billion) from IDR699.4 trillion as it boosted its budgets for social protection programs and the health sector. The extra funding for the National Economic Recovery budget was sourced from reprioritizing spending from a number of ministries and government agencies to hit the government's budgeted fiscal deficit of 5.7% of GDP for 2021.

- The Dole Sunshine Company has established a partnership with

Annas Anam, the London-based company behind Piñatex, to manufacture

leather made from sustainably sourced pineapple leaf fibers. (IHS

Markit Food and Agricultural Commodities' Hope Lee)

- Annas Anam produces innovative natural textile made from waste pineapple leaf fibre. It is now a Certified B Corporation.

- Through the collection and extraction of fiber from pineapple leaves from its farms in the Philippines, Dole is taking another step toward its Promise of zero fruit loss by 2025. Globally, sustainable materials are becoming increasingly important sources as lifestyle brand owners are looking for these alternatives to satisfy consumers' demand.

- Ananas Anam's Piñatex has been used by global lifestyle brands including Nike, Hugo Boss, H&M, Paul Smith and the Hilton Hotel London Bankside for the world's first vegan suite.

- Additionally, Dole is also working toward a more circular economy and finding new packaging solutions for its products to reduce not only food waste but plastics overall.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.