Daily Global Market Summary - 26 March 2021

All major equity indices closed higher across the globe, with none of the largest APAC or European indices falling into negative territory during the trading session. US and benchmark European government bonds closed lower on the day. European iTraxx and CDX-NA closing tighter across IG and high yield. The US dollar closed flat and oil, natural gas, gold, silver, and copper closed higher on the day.

Americas

- Major US equity indices closed higher on the day, with the Russell 2000 +1.8% and Nasdaq +1.2% being the only major indices across the globe to have been in negative territory at any point of the session. S&P 500 closed +1.7% and DJIA +1.4%.

- 10yr US govt bonds closed +6bps/1.69% yield and 30yr bonds +4bps/2.39% yield.

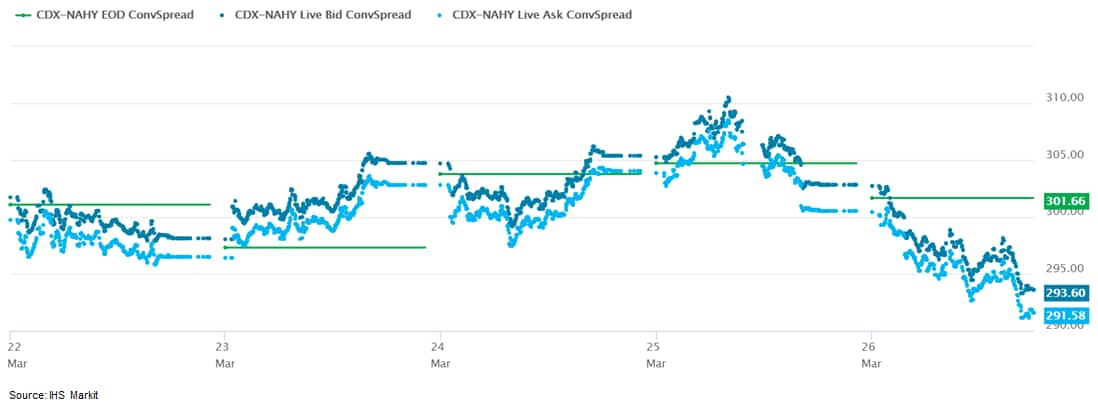

- CDX-NAIG closed -2bps/56bps and CDX-NAHY -9bps/293bps. CDX-NAHY

finished the week at -8bps week-over-week.

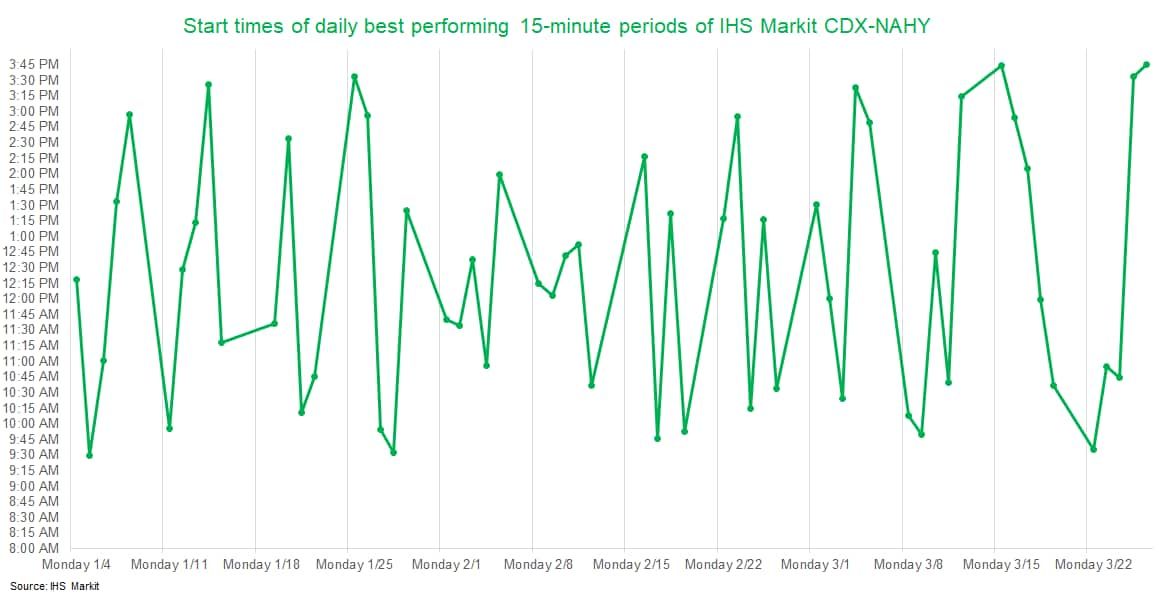

- The below chart shows the start of the best 15-minute period of

CDX-NAHY performance daily for 2021. The data indicates some degree

of cyclicality on the timing of each day's best 15-minutes, with

the day-over-day time varying by under an hour 28% percent of the

58 trading days assessed.

- DXY US dollar index closed flat/92.77.

- Gold closed +0.4%/$1,732 per troy oz, silver +0.3%/$25.11 per troy oz, and copper +2.3%/$4.07 per pound.

- As per IHS Markit's Commodities at Sea, Chilean copper concentrate shipments out of Latin America in January 2021 declined 40% y/y due to rough seas at the major loading terminals. Strong demand from Mainland China but a slower supply of copper concentrates spiked the prices post-Chinese New Year to a decade-high level. Peru and Chile copper concentrate shipments during February 2021 increased and stood at 1.4mt (up 3% y/y on a 30-Day basis) and 404kt (up 39%), respectively. Shipments were loaded which had got postponed during the previous month. During the reported period, shipments to China, Japan, the USA, and South Korea stood at 880kt (up 41% y/y on a 30-Day basis), 132kt (down 40%), 281kt (down 17%), and 69kt (down 27%), respectively. (IHS Markit Maritime and Trades' Pranay Shukla)

- Crude oil closed +4.1%/$60.97 per barrel and natural gas closed +0.1%/$2.62 per mmbtu.

- It is estimated the Ever Given will take several days to be

pulled free, and the Suez Canal blockage is leading to a rapid

build-up of ships both in the Red Sea and Mediterranean. (IHS

Markit Energy Advisory's Roger Diwan)

- Congestion is expected to significantly worsen in coming days as it is unlikely that many vessels would detour, considering the expensive deviation cost. 34 dry bulkers are scheduled for Suez canal transit in near future (Red Sea); waiting vessels increased significantly from average 5 ships to 16 ships daily according to Commodities at Sea.

- The Suez Canal tide calendar indicates the next few days would be critical timing to refloat the vessel with high tide expected during the full moon period. If refloating operation fails during this period, the delays for shipping traffic will likely get even worse since high tide will return only in another two weeks.

- If it continues, freight rates would become stronger again owing to immediate replacement demand for the delayed cargo and ships. We already observed sentiment of freight market turn positive over the last few days and assessments for Forward Freight Agreement (FFA) increased again since the accident happened.

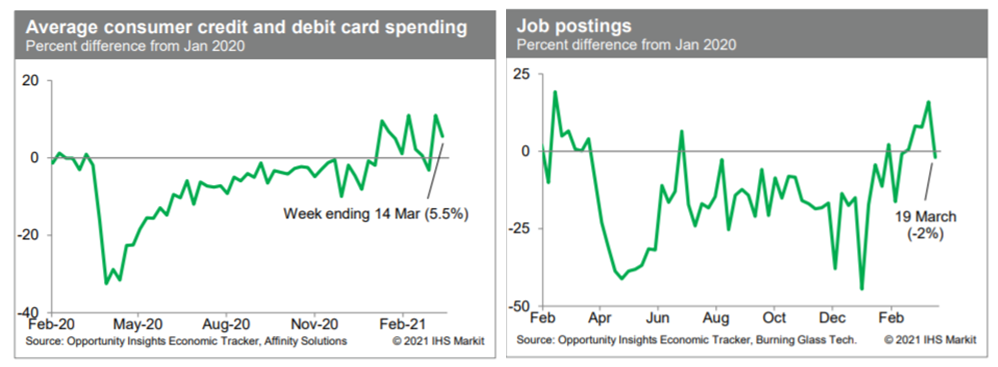

- Average consumer credit- and debit-card spending for the week

ending 14 March was 5.5% above the January 2020 level, according to

the Opportunity Insights Economic Tracker. This followed an even

stronger reading the week prior. These data predate the 17 March

distribution of $242 billion of economic stimulus payments and,

therefore, speak to recent underlying resilience of consumer

spending. We will be processing these data and marking up our

near-term forecast of consumer spending in response. Job postings

declined last week, according to the Opportunity Insights Economic

Tracker, but recent averages remain elevated relative to last

summer and fall. (IHS Markit Economists Ben Herzon and Joel

Prakken)

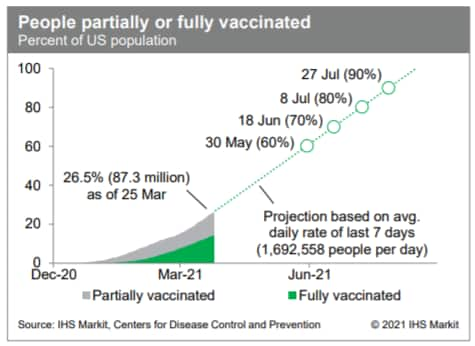

- As of yesterday, 87.3 million US residents, roughly 26.5% of

the total US population, were partially or fully vaccinated.

Averaged over the week ending yesterday, 1.7 million US residents

per day received a first (and only, in the case of the Johnson

& Johnson vaccine) dose of a vaccine, up from about 1.6 million

per day the prior week. At the current rate, 60% of residents will

be partially or fully vaccinated by 30 May and 80% by 8 July. These

benchmarks are a few days earlier than shown last week, owing to

the slightly faster rate of first shots this week. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- The US University of Michigan Consumer Sentiment Index rose 8.1

points (10.5%) from its February level to 84.9 in the final March

reading. This was 1.9 points higher than the mid-March reading,

indicating a persistent rise in consumer sentiment that took place

during the month. (IHS Markit Economists David Deull and James

Bohnaker)

- The level of consumer sentiment was the highest since the beginning of the pandemic-related shutdowns in March 2020 and supports our expectation for robust consumer spending growth in the first half of 2021.

- The March gain in consumer sentiment was broadly based. The expectations index rose 9.0 points to 79.7, while the index of current conditions rose 6.8 points to 93.0. Both were higher than in the early-March reading.

- Consumer sentiment surged among lower-income households in March. Sentiment reported for households earning less than $75,000 a year rose 10.8 points to 81.3, while sentiment for higher earners rose 3.9 points to 87.7. Both rose over the latter portion of the month to their respective highest levels since March 2020.

- Views on buying conditions improved markedly in March, although the improvement was complete by the time of the preliminary reading. The index of buying conditions for large household durable goods jumped 15 points to 128, the highest since one year before. The indices for vehicles and for homes rose by 5 and 2 points, respectively.

- US personal income decreased 7.1% in February and real

disposable personal income (DPI) declined 8.2%. Employee

compensation was essentially unchanged in February and 0.2% higher

than 12 months earlier. (IHS Markit Economist James Bohnaker and

David Deull)

- The decline in personal income in February was primarily due to sharply lower levels of economic impact payments (stimulus checks) distributed through the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act. Economic impact payments totaled just $8 billion (not annualized) in February, down from $138 billion in January.

- Real personal consumption expenditures (PCE) declined 1.2% in February, which was a larger decline than we expected, implying less PCE in the first quarter. This lowered our estimate of first-quarter PCE growth by 0.6 percentage point to 5.3%.

- After a stimulus-fueled surge in January, real PCE for goods dropped 3.3% in February and for services declined 0.1%. Harsh winter storms in Texas and elsewhere likely disrupted consumer activity.

- Legislation to boost the number of charging stations for electric vehicles (EVs) and hydrogen refueling stations was introduced in the US Senate 25 March. The "Securing America's Clean Fuels Infrastructure Act" would achieve that end by extending the federal tax credit, which was due to expire at the end of 2021, by another eight years to 31 December 2029, and by increasing the cap for business investments from $30,000 to $200,000. This means any installation installed by 31 December 2029 would be eligible for the tax credit, and that it would apply to "any such item" on the property, meaning it can applied to individual charging or refueling units instead of the property as a whole. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- Porsche has announced the expansion of the Porsche Drive Subscription and Rental program in the United States, and that it is making the Taycan electric vehicle (EV) available under the program. Porsche is adding five new cities to four existing cities under the subscription program. The program is already available in Atlanta, Georgia; Phoenix, Arizona; and San Diego and Los Angeles, California. The company is expanding the program to Houston, Texas, and four more cities in California, comprising Irvine, Monterey, San Francisco, and San Diego. On the addition of the Taycan EV to the program, Porsche says only the Taycan 4S is available initially and only as a single-vehicle subscription - the service provides single- or multiple-vehicle subscription, as well as a shorter-term rental service. (IHS Markit AutoIntelligence's Stephanie Brinley)

- SF Motors has reportedly confirmed that it is to sell its plant in Mishawaka, Indiana, United States, to commercial electric vehicle (EV) startup Electric Last Mile Solutions (ELMS) for USD145 million. Once the sale of the plant closes, SF Motors is to grant Electric Last Mile a license to distribute two EV models in the US, Canada, and Mexico. Electric Last Mile is to procure the two vehicles and associated kits and components from China. The announcement seems largely a formal confirmation and follows plans by SF Motors to produce vehicles under its Seres brand in the US. SF Motors and Seres are subsidiaries of China's Chongqing Sokon Industry Group and Electric Last Mile has ties to the group. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volkswagen (VW) has set up AI Detroit, a North American hub for the company's artificial intelligence (AI) research and development, according to a company announcement. In a statement, VW Group of America chief operating officer Johann de Nysschen said, "We want to leverage new opportunities in applied Artificial Intelligence to further improve products and services for our customers, supporting our employees and become even more efficient as a company." The AI Detroit unit is led by Daniel Weimer and includes machine-learning scientists and software engineers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Robotics firm Nuro, which develops autonomous delivery vehicles, has added new investors to its Series C funding round, according to a company statement. The company received funding from Woven Capital, Chipotle, and other new investors. Nuro will use the proceeds to advance its autonomous vehicle (AV) technology and expand its team and delivery service. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A coalition of environmentalists and farmworker advocates have sued EPA to reverse a decision to allow use of the antibiotic streptomycin on citrus crops. EPA issued its decision to allow use of streptomycin on citrus in January 2021 during the final days of the Trump administration. The approval allows Florida growers to apply some 650,000 pounds to groves across the state and will remain in effect through Jan. 12, 2028. The agency said the antibiotic is a needed tool for growers struggling with citrus greening - the disease has ravaged Florida citrus for more than a decade, costing the industry some $3 billion in lost revenues. Production in the state is down more than 70% from 20 years ago. For the past five years, EPA has approved emergency use of streptomycin on Florida citrus to help with citrus greening and to combat the invasive insect that spreads the disease. (IHS Markit Food and Agricultural Policy's JR Pegg)

- At its 25 March policy meeting, the central bank of Mexico

(Banxico) decided to keep the policy rate at 4.00%. At its previous

meeting, the bank had cut the rate from 4.25% to 4.00% but higher

inflation has precluded what could have been a new easing cycle.

(IHS Markit Economist Rafael Amiel)

- On 11 February, the monetary policy committee reported that inflation had come down from 4.1% in October 2020 to 3.5% in January, but in yesterday's meeting they pointed out that the pace of price increases had accelerated back to 4.1% as of mid-March.

- Core inflation, which exclude items with volatile prices such as agricultural products and energy related goods and services increased from 3.8% in January to 4.1% as of mid-March. This is above the targeted band: Banxico targets inflation at 3.0% +/- 1 percentage point.

- At IHS Markit we do not see high inflation as a major threat: there may be temporary increases due to higher oil prices that will continue to translate into higher domestic prices of fuels mainly gasoline and diesel.

Europe/Middle East/Africa

- European equity markets closed higher; Spain +1.1%, UK +1.0%, Germany +0.9%, Italy +0.7%, and France +0.6%.

- 10yr European govt bonds closed lower; Germany +4bps, France/Italy +3bps, and Spain +2bps.

- iTraxx-Europe closed -1bp/54bps and iTraxx-Xover -8bps/263bps.

- Brent crude closed +4.3%/$64.43 per barrel.

- Aker Solutions and Doosan Babcock have agreed to jointly deliver projects for low-carbon solutions and renewable energy in the UK. The partners will particularly focus on pursuing and winning contracts for new hydrogen production plants, and facilities for carbon capture, utilization and storage (CCUS). Opportunities for other projects within the process and energy industries will also be explored. The duo has signed a memorandum of understanding (MoU) and established a team with key people from both organizations. The combination of Aker Solutions and Doosan Babcock will provide EPCI solutions for the UK's energy transition agenda. (IHS Markit Upstream Costs and Technology's Helge Qvam)

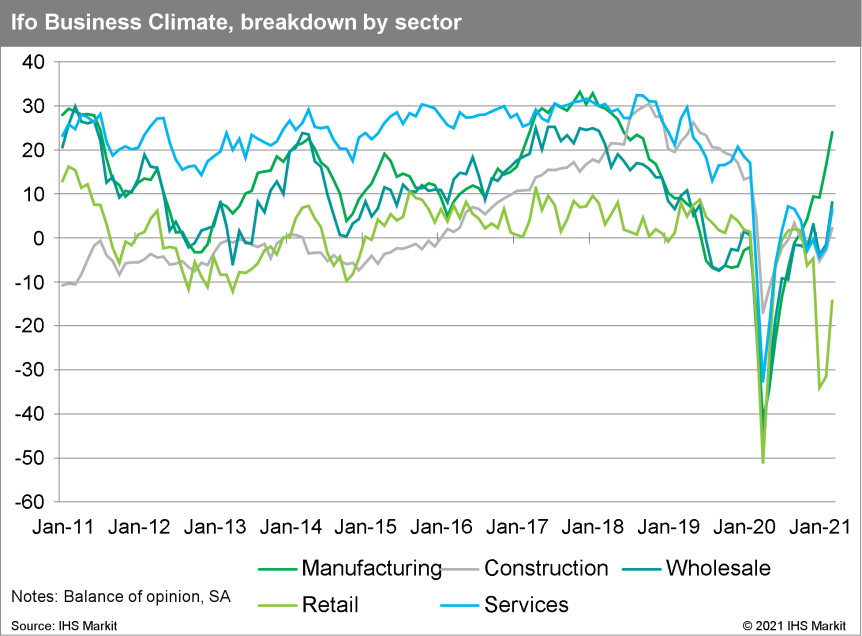

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has increased even more strongly in March than in February, gaining

from 92.7 (revised up from 92.4) to 96.6. This is not only the

highest level since the pandemic began a year ago, but also exceeds

the levels seen in the immediate pre-pandemic period; a better

business climate was last recorded in June 2019, and the long-term

average (97.0) is within reach. (IHS Markit Economist Timo

Klein)

- The German government has announced that it will provide EUR5.5 billion towards the funding of new public BEV charging infrastructure to support the electrification of the country's vehicle market, according to a Bloomberg report. German government spokesperson Steffen Seibert said that the funds will be available between now and 2024 in an effort to accelerate the construction of charging infrastructure in the short and medium term. The announcement followed a video conference between Chancellor Angela Merkel and the heads of the German carmakers, who came with the message that they have fulfilled their part of the bargain in offering an increasing range of full BEVs, so now the government must come to the table with a significant pledge to support charging infrastructure, which it has now done. Pure BEV passenger car sales in Germany last year increased by 205.3% year on year (y/y) to 194,030 units, in an overall market that declined by 19.6% y/y during the year. (IHS Markit AutoIntelligence's Tim Urquhart)

- Siemens Energy and Aker Carbon Capture (ACC) have signed a memorandum of understanding aimed at developing combined offerings for carbon capture solutions that can be applied to gas turbines and gas-fired power plants. The parties will explore a technology collaboration to further advance technical optimization within the whole process of power generation and carbon capture combining ACC's capture technology with Siemens Energy's offerings in the energy sector. ACC and Siemens Energy will also explore ways to jointly fast-track development of major projects globally. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

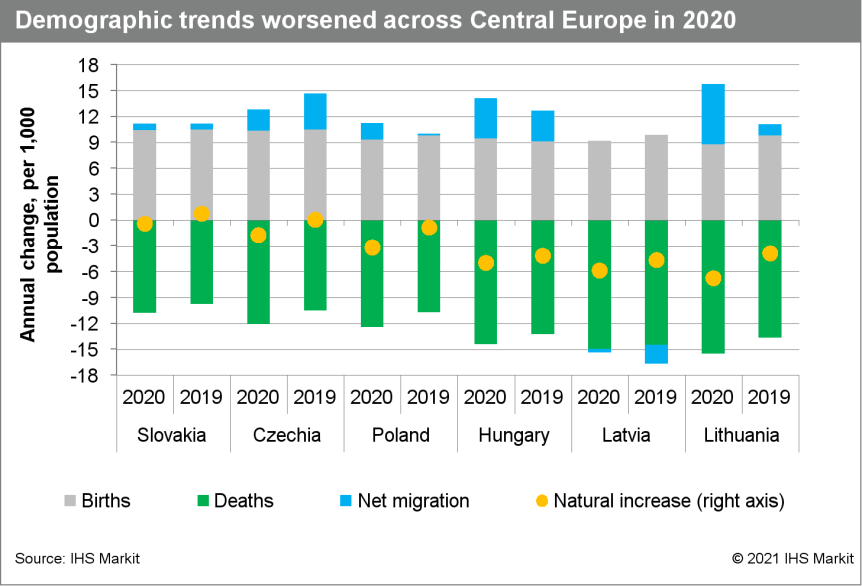

- Preliminary 2020 data from six Central European countries

indicate that the natural increase in the population deteriorated

amid the COVID-19 virus pandemic. Across the region, annual birth

rates per 1,000 population diminished, while death rates increased.

In many countries, the deteriorating natural increase in the

population was matched by an improvement in migration trends,

driven partly by return migration from abroad. (IHS Markit

Economist Sharon Fisher)

- Finland's current account in the fourth quarter of 2020

recorded a surplus of EUR3.34 billion (USD3.9 billion), which marks

a strengthening of about 72% year on year (y/y), and a dramatic

improvement compared with the third-quarter surplus of EUR243

million. (IHS Markit Economist Venla Sipilä)

- The deep deficits registered in the first and second quarters left the 2020 total surplus at a more moderate level of EUR716 million, although this shows a clear improvement compared with the 2019 shortfall of EUR823 million.

- After being nearly eliminated in the first and third quarters of 2020, Finland's goods trade surplus regained its strength in the fourth quarter, as imports fell clearly faster than exports. The slide in exports, at nearly 8%, was close to the fall of imports at 10% for 2020 as a whole, and the full-year trade surplus strengthened, growing by 48% from 2019.

- The monetary policy committee (MPC) of the Banque Centrale du

Congo (BCC), the DRC's central bank, held its meeting in March, its

second meeting this year, to discuss the latest developments in the

domestic economy and the implications of current global economic

conditions for the country's macroeconomic growth performance. (IHS

Markit Economist Alisa Strobel)

- The MPC decided to cut the BCC's discount policy rate to 15.5%, after hiking the discount rate from 7.5% to 18.5% in August 2020.

- The MPC highlighted that macroeconomic indicator readings continue to show a gradual stabilization of the economy and the aim of the rate cut is to reduce the cost of refinancing to banks.

- According to the BCC's press release, the central bank is to maintain the coefficients of the compulsory reserve on sight and term currency deposits at 13.0% and 12.0%. Liquidity regulation is to continue.

Asia-Pacific

- Most APAC equity markets closed higher; Mainland China/Japan +1.6%, Hong Kong +1.6%, India +1.2%, South Korea +1.1%, and Australia +0.5%.

- China's second largest logistics company, SF Express, has selected autonomous truck firm Plus to demonstrate a commercial freight pilot scheme. The companies, in partnership with fleet operator Zhihong Logistics, have been conducting the trials since December 2020. Plus is deploying its autonomous vehicle (AV) solution, PlusDrive, which is designed to have a professional truck operator onboard to supervise the autonomous system. Plus is running its autonomous trucks on two long-haul routes in China: Wuhan to Wuxi (900-mile round trip) and Changshu to Wuhan (1,000-mile round trip). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker SAIC Motor has reportedly partnered with appliance giant Haier Group to jointly develop intelligent transportation systems and smart homes. Under this partnership, Haier will invest in a SAIC unit that will be formed to develop autonomous vehicle (AV) technology at Yangshan Port (China). The companies will also co-operate on developing lightweight materials and establish a fund to invest in areas such as intelligent manufacturing, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Wanhua Chemical plans to build a propane dehydrogenation (PDH) plant in Fujian Province, southern China, adding to the PDH plant it operates at Yantai, eastern China. The new plant will be built within the Fujian Jiangyin economic zone, near the city of Fuqing, which is also home to a PDH unit operated by Fujian Meide with capacity for 660,000 metric tons/year of propylene. Wanhua did not reveal the capacity and expected completion time for the new unit, but it may be expected in 2023, according to sources. The company's board has also approved plans to build associated downstream propylene derivative production chains in the Fujian Jiangyin zone. Wanhua's PDH unit at Yantai has 750,000 metric tons/year of propylene capacity. It also operates a steam cracker with capacity for 1 million metric tons/year (MMt/y) of ethylene and 520,000 metric tons/year of propylene at Yantai that came online in November last year. The cracker primarily uses propane as feedstock, according to IHS Markit data. (IHS Markit Chemical Advisory)

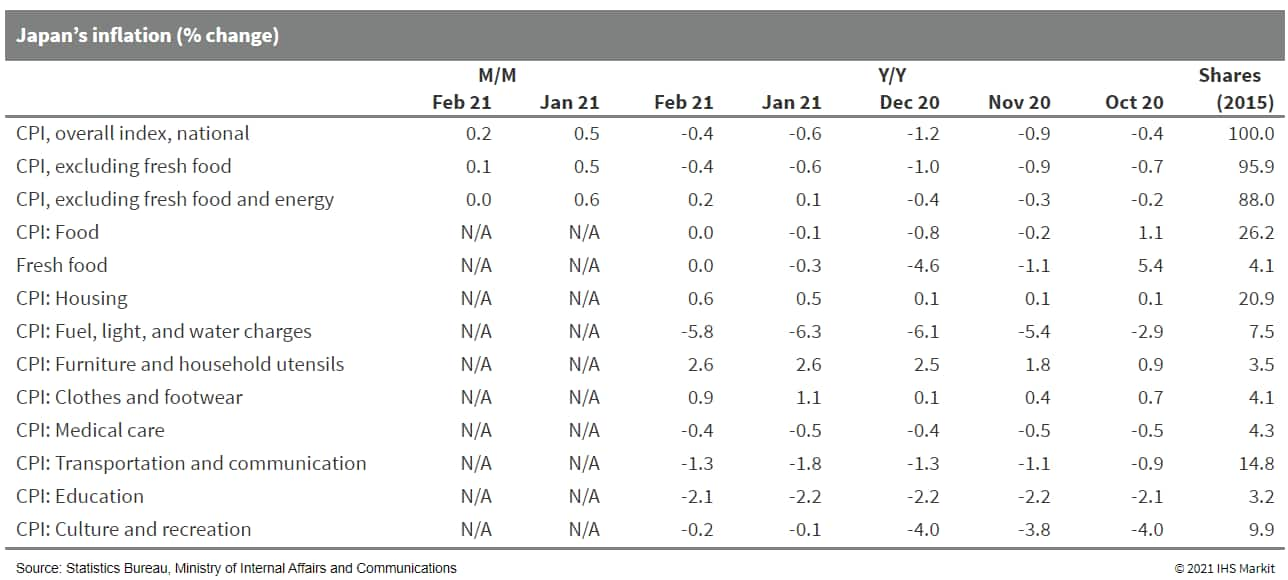

- Japan's CPI rose by 0.2% month on month (m/m) on a seasonally

adjusted basis in February, and the year-on-year (y/y) contraction

softened to 0.4% from a 0.6% drop in January. Milder declines in

energy prices were the major factor behind the improvement. The CPI

excluding food and energy (the core-core CPI) remained at the

January level, but rose to 0.2% y/y. (IHS Markit Economist Harumi

Taguchi)

- Subaru has started a used car subscription service that provides cars to users on a monthly flat rate basis, according to a company statement. Called the "Subaru Subscription Plan", the service will allow users to hire a Subaru car starting from JPY29,820 monthly including 10% consumption tax, automobile insurance premiums, and maintenance costs. The plan is currently available in Kanagawa and Niigata prefectures in Japan, and will be expanded to other areas in the future. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Australia's first publicly available hydrogen refueling station has opened in Fyshwick, Canberra, according to Parall. Energy and Emissions Reduction Minister Shane Rattenbury said, "The ACT [Australian Capital Territory] Government will also use this station to service Australia's first government fleet of hydrogen vehicles, 20 Hyundai NEXOs, as we continue to transition 100% of our passenger fleet to zero emissions vehicles." (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.