Daily Global Market Summary - 28 April 2021

Most major European and APAC equity indices closed higher, while the US was mostly lower. US government bonds closed higher despite being lower for most of the day up until the post-FOMC meeting press conference. Benchmark European government bonds closed modestly lower. European iTraxx closed unchanged on the day across IG and high yield, while CDX-NA was slightly tighter on the day. The US dollar, gold, and silver closed lower, while copper, oil, and natural gas were higher. US markets will be closely watching tomorrow's advance US Q1 GDP estimate and weekly claims for unemployment insurance releases at 8:30am EST.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon (28 April). The statement released at the 2:00pm EST conclusion of this week's meeting contained no surprises. There was no change to the stance of monetary policy: the target for the federal funds rate was maintained at a range of 0.00-0.25% and asset purchases will continue at current rates (approximately $120 billion per month), with both measures subject to the same forward guidance as before. There was unanimous support among the 11 voting members for maintaining the current stance of policy. The statement noted that indicators of economic activity and employment have strengthened, and that inflation has risen largely because of transitory factors. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Most major US equity indices closed lower except for Russell 2000 +0.1%; S&P 500 -0.1%, Nasdaq -0.3%, and DJIA -0.5%.

- 10yr US govt bonds closed -1bp/1.61% yield and 30yr bonds -1bp/2.29% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -4bps/288bps.

- DXY US dollar index closed -0.3%/90.61.

- Gold closed -0.3%/$1,774 per troy oz, silver -1.2%/$26.09 per troy oz, and copper +0.2%/$4.50 per pound.

- Crude oil closed +1.5%/$63.86 per barrel and natural gas closed +0.6%/$2.96 per mmbtu.

- ExxonMobil recently unveiled a $100-billion vision for a carbon capture and storage (CCS) hub south of the oil major's Texas headquarters. The hub plan, which is being called the CCS Innovation Zone, is expected to be a public-private partnership that will attract participation and funding from companies and government entities. The hub would be sited outside Houston, the locus for many oil, natural gas, and other energy-related companies and industries. The CCS project could capture "hundreds of millions of tons" of CO2 that result from human production and use of fossil fuels like oil, gas, and coal. The hub could draw up to 50 million mt of CO2 from the air by 2030, and 100 million mt by 2040. The latter figure would be a sevenfold increase from total US carbon capture of 13 million mt in 2019, the company said, citing data from the Global CCS Institute. (IHS Markit Climate and Sustainability News' William Fleeson)

- Apple Inc. reported a profit of $23.6 billion in the latest quarter as revenue rose 54% to $89.6 billion, far exceeding Wall Street expectations. The company also announced a 7% increase to its cash dividend to 22 cents a share and that the board had authorized an increase of $90 billion to an existing share-repurchase program. (WSJ)

- The US nominal goods deficit widened by $3.5 billion in March

to $90.6 billion, as both exports (+8.7%) and imports (+6.8%)

surged, more than reversing declines in February. Inventories

stalled in March. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- The widening of the trade deficit was more than IHS Markit had assumed; this mainly reflected unexpected strength in net imports of capital goods.

- Nevertheless, as of March, exports of goods had surpassed pre-pandemic averages, marking a full recovery in nominal goods exports. Imports surpassed pre-pandemic averages last fall and remained elevated in March. The strength in imports, relative to pre-pandemic averages, is largely in consumer goods, with lesser (but material) strength also exhibited in industrial supplies and materials and nonautomotive capital goods.

- Ford would make 1.1 million fewer vehicles this year because of the worldwide shortage of semiconductors, the carmaker said on Wednesday, significantly more disruption that previously hoped. The company had earlier forecast it would make between 200,000 and 400,000 fewer vehicles. Under its new guidance, Ford's production will be down 50% in the second quarter and 10% in the second half of the year. (FT)

- Ford has created a new team dedicated to battery development, called Ion Park, and plans to build a new USD185-million center of excellence for battery development, to be opened by late 2022. The new development will be in southeast Michigan, although Ford is still determining the final location. According to Anand Sankaran, who has been appointed as director of Ion Park, the company has specific needs for the site and is evaluating several locations. Locating in southeast Michigan, however, keeps the facility near Ford's Dearborn headquarters as well as local Ford manufacturing of motors and drive systems, and to the Allen Park Battery lab. (IHS Markit AutoIntelligence's Stephanie Brinley)

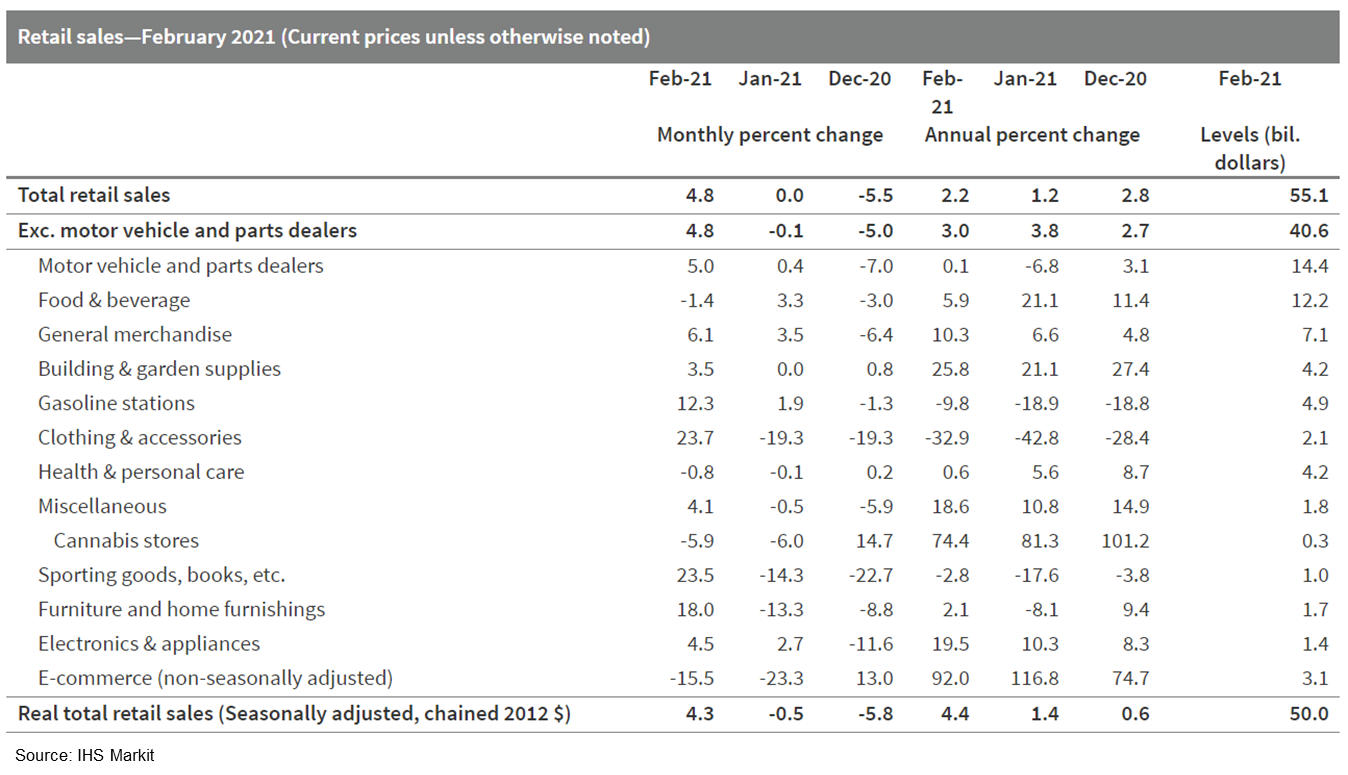

- Canada's nominal retail sales handily jumped 4.8% month on

month (m/m) to $55.1 billion in February—the third-largest

monthly gain on record. (IHS Markit Economist Evan Andrade)

- The 3.8% m/m jump in core retail sales—excluding motor vehicles and parts dealers and gasoline stations—was the third-highest on record as well.

- Retail sales volumes rebounded 4.3% m/m, after declines in the previous two months.

- Statistics Canada's preliminary estimated growth for March is 2.3% m/m, as some regional restrictions were lifted.

- Building upon surprise consumer resiliency seen in January,

national retail sales rose 4.8% m/m and beat the already impressive

flash estimate calling for a gain of 4.0% m/m.

- Volkswagen (VW) is reportedly planning production stoppages in Mexico during May to address the semiconductor shortage, affecting the Tiguan and Jetta. VW will suspend production of the Tiguan from 6 to 16 May and then the Jetta from 3 to 19 May, according to media reports citing the company. The Taos and Golf are currently not affected. VW has been alternating production stoppages between its models at its Puebla plant in Mexico to work through the semiconductor shortage, including an announcement in April. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Cummins has partnered with Plus to develop autonomous trucks powered by natural gas, according to a company statement. Under this partnership, the compressed natural gas engine trucks supplied by Cummins is integrated with Plus's autonomous system, PlusDrive. The companies claim these trucks to be more fuel efficient as they are deployed with Plus's AI-enabled fuel optimization algorithms and Cummins powertrain features. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- During the week of 26-30 April, Brazil will offer a new round

of concessions for infrastructure assets that the Ministry of

Infrastructure has valued at around USD7.31 billion. This new sale

follows the successful auctioning of 22 airports, 5 port terminals,

and 1 railway line between 7 and 9 April, which attracted

significant participation from private companies, setting a

favorable precedent. (IHS Markit Country Risk's Ailsa Bryce and Carlos

Caicedo)

- Brazil is offering an attractive operational environment for infrastructure projects to attract foreign capital. Brazil's agenda for concessions has been designed to attract foreign investment that is needed to offset the effects of economic downturn on public-sector finances and improve the country's infrastructure.

- The improved regulatory environment will assist the auctioning of future airport concessions.

- New private investment will address port bottlenecks and cover a lack of state capacity to finance development. The positive impact of successful asset sales is shown by the recent sale of five port terminals, with the auction raising USD38 million.

- Despite low revenue generation, the railway concession will have positive consequences for numerous key industries. Mining company Bahia Mineração (BAMIN), a subsidiary of Kazakh Eurasian Resources (ERG), offered the only bid to finish building and exploit a 527-km rail route linking the cities of Caetité to the Port of Ilhéus, both in the state of Bahia.

- Chinese demand helped drive up Argentine beef exports in the

first quarter of this year, while volumes consumed within Argentina

itself fell to their lowest levels for almost two decades.

Argentina exported 146,352 tons of unprocessed beef in

January-March 2021 - an increase of 22% y/y. (IHS Markit Food and

Agricultural Commodities' Ana Andrade and Max Green)

- Three quarters of this total went to mainland China, which took 109,253 tons - up 36% y/y. Shipments to Israel increased by 30% y/y to 11,095 tons but exports to Chile fell by 12% y/y to 8,725 tons.

- Although overall volumes increased, total export earnings in the first quarter were almost unchanged on last year at USD614 million.

- Average export prices for Argentinian beef fell to USD4,196 per ton - down 18% y/y. China was one of the lowest paying markets, averaging just USD3,343 per ton - a decrease of 21% y/y. Prices for beef exported to Israel fell to USD6,882 per ton (-6% y/y).

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Italy -0.1%; France/Spain +0.5% and Germany/UK +0.3%.

- 10yr European govt bonds closed lower; Germany/France/UK/Spain +2bps and Italy +1bp.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover flat/251bps.

- Brent crude closed +1.4%/$66.78 per barrel.

- The UK government has announced plans to regulate the use of autonomous vehicles (AVs) at slow speeds on motorways, reports Reuters. It added that these vehicles can be put into operation on public roads as soon as this year. The Transport Ministry is working on updating the country's highway code for the safe use of autonomous systems, starting with Automated Lane Keeping Systems (ALKS). This system uses sensors and software helping the driver to steer, accelerate and brake automatically within one lane. The government has restricted the use of ALKS capability at speeds under 60 km/h on motorways. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- At its Driving Tomorrow presentation on 27 April, Lotus outlined an investment plan worth more than GBP2 billion that will lead to the development of four new vehicle architectures; a technology roadmap towards being a BEV-only OEM, and a fresh global retail identity. With the business now on more solid foundations and with better financial backing than in any time in its recent history, it can now look forward to broadening its product range and growing volumes. IHS Markit currently expects brand production to break through the 50,000-upa barrier by 2026, underpinned by models that include two new crossovers. (IHS Markit AutoIntelligence's Ian Fletcher)

- Tesla has said that it will 'tweak' the application for its already nearly completed factory at its first European production location in Gruenheide outside Berlin (Germany), according to a Reuters report. The company went on to add that it did not know how long it would take for the plant to gain the retrospective planning permission it is seeking, with the agreement with the authorities of the State of Brandenburg. Tesla had said on 26 April that it was moving forward, adding that production and deliveries were "on track for late 2021." It had previously stated that it would have the plant up and running by 1 July. (IHS Markit AutoIntelligence's Tim Urquhart)

- The majority-controlling shareholder in automotive supplier Hella, the Hueck family, is considering selling its 60% stake in the business according to a Reuters report, which cites Manager Magazin. The controlling family investor has approached the Rothschild investment bank to sound out potential buyers and look at valuations, according to one banking source close to the matter. Hella's spokespeople were not available for comment when contacted by Reuters. The company has a current market value of EUR5.1 billion (USD6.2 billion), giving a 60% stake a value of around EUR3 billion for the Hueck family if it does choose to sell its share in the business. (IHS Markit AutoIntelligence's Tim Urquhart)

- A continued rebound in demand, as well as higher sales volumes

and prices, boosted Covestro's first-quarter net earnings to €393

million ($474 million) from €20 million in the year-ago period,

with sales rising more than 18% to €3.3 billion. EBITDA almost

tripled year on year (YOY) to €743 million, Covestro says. (IHS

Markit Chemical Advisory)

- Covestro's polyurethanes segment reported YOY core volume sales growth of 2.5%, with positive volume growth in APAC more than balancing limited product availability and the resulting adverse effect on growth potential in other regions, it says. Higher margins and a "favorable competitive situation" saw sales increase 30.7% compared with the prior-year period to €1.66 billion, with selling prices up 36.1%. EBITDA jumped to €443 million from €50 million a year earlier due to higher prices.

- The polycarbonates segment saw YOY core sales volume growth of 11.6%, due mainly to the continued upswing in demand and expansion of core volumes sold to the electrical, electronics, and household appliances industry, and the automotive and transportation industry, especially in APAC, Covestro says. Sales rose 21.3% YOY to €889 million, driven largely by higher average selling prices, up 13.8%, and higher volumes, up 12.5%. The segment's EBITDA more than doubled YOY to €222 million.

- In the coatings, adhesives, and specialties segment, core volume sales growth of 7.1% YOY was again based mainly on the recovery in APAC. Volumes grew in all main customer industries, especially the furniture and wood-processing industry, it notes. Revenue increased 4% YOY to €595 million, due mainly to higher volumes sold, up 5.6%, and selling prices, up 2.4%. EBITDA declined, however, to €114 million from €130 million in the year-ago period due primarily to higher provisions for variable compensation, despite positive volume effects and higher prices, the company says.

- France's consumer confidence index has remained stable in

April. The headline index has stood at 94, equaling March's

three-month high. (IHS Markit Economist Diego

Iscaro)

- Consumer confidence has remained relatively stable since the start of the pandemic. The headline index has ranged between 89 and 95 since early 2020, standing below its long-term average of 100.

- April's survey also shown some encouraging improvements in the number of households willing to make a major purchase over the coming year, with the respective index rising to a four-month high.

- Although this is good news, the breakdown of the figures still suggests that households remain cautious about the economic outlook.

- The Swedish central bank (Riksbank) in its April monetary

policy meeting left the key policy rate unchanged at 0%. The repo

rate has been at this level since it was increased by 25 basis

points in December 2019. The expected interest rate profile remains

flat until the end of the Riksbank's forecast horizon, currently

running until the second quarter of 2024. (IHS Markit Economist Venla

Sipilä)

- Similarly, the Riksbank is also keeping its asset purchase program unchanged, within the envelope of SEK700 billion (USD83.5 billion). It reiterated that it is planning to fully utilise the envelope by the end of 2021 and maintain the size of its holdings until the end of 2022.

- The central bank notes that while both the Swedish and global economies now are on their way to recovery, major uncertainties still prevail, and the speed of the improvement will greatly vary between countries and sectors.

- The Riksbank continues to maintain that a repo rate cut remains possible, particularly if confidence in the inflation target (2%) is threatened. In any case, asset purchases and other lending-supporting monetary policy measures will be implemented as long as necessary and will be likely needed for a prolonged time.

- Ford has announced a USD300-million investment into its Craiova Assembly Plant in Romania to support a new light commercial vehicle (LCV) in 2023 and an all-electric version in 2024. According to a company statement, Craiova will follow electric vehicle (EV) production at Ford's Cologne and the Ford Otasan Kocaeli plant in Turkey. Ford also confirmed that the new LCV will have gasoline (petrol) and diesel powertrains, sourced from Ford's Dagenham engine plant, with transmissions sourced from Ford Halewood Transmission. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Estonia-based ride-hailing company Bolt has expanded its partnership with the University of Tartu to develop technology for autonomous vehicles (AVs), according to a statement released by the university. The partnership aims at enhancing the technical capabilities of the current Autonomous Driving Lab in fields of "artificial intelligence (AI), maps and algorithms, create better conditions for connecting technology to urban traffic infrastructures". The University of Tartu's Institute of Computer Science has also announced plans to expand the autonomous technology research group as this will support the creation of better opportunities in this field and the practical training of students. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Most APAC equity markets closed higher except for South Korea -1.1%. India +1.6%, Hong Kong +0.5%, Australia +0.4%, Mainland China +0.4%, and Japan +0.2%.

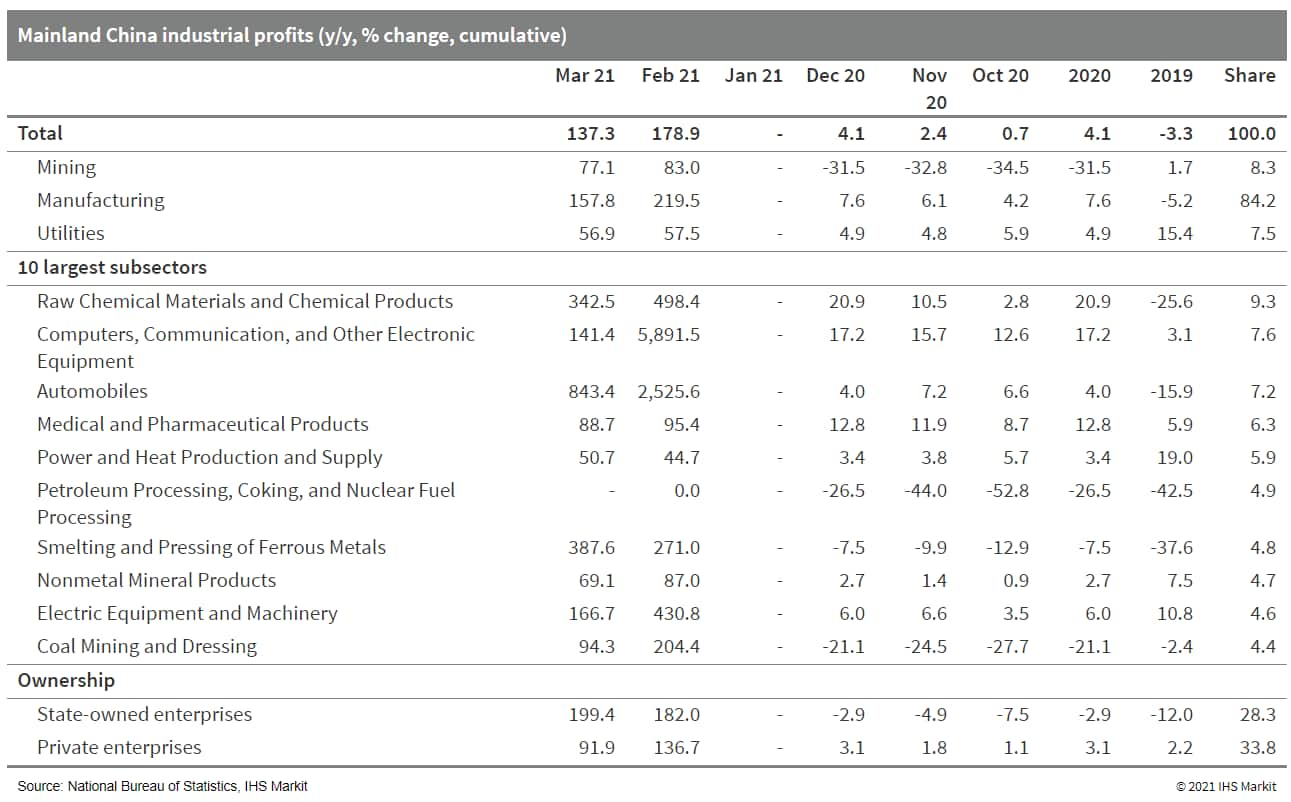

- Mainland China's industrial profits expanded by 137% year on

year (y/y) in the first quarter of 2021, down by 41.6 percentage

points from the first two months of the year as the low-base effect

diminished. (IHS Markit Economist Lei Yi)

- On a two-year (2020-21) average basis, industrial profits expanded by 22.6% y/y cumulatively through March, down by 8.6 percentage points from February. For March alone, industrial profits increased by 92.3% y/y.

- By sector, raw material manufacturing took the notable lead in overall industrial profits recovery, largely benefiting from the sustained global commodity price rally. Profits of raw material manufacturing enterprises surged by 434% y/y, or a two-year average of 40.7% y/y, outpacing the headline growth rate by 18.1 percentage points.

- Strength in equipment and high-tech manufacturing continued to

hold over the first quarter, with their profits jumping by 189% y/y

and 126% y/y, or a two-year average of 24.1% y/y and 36.8% y/y,

respectively.

- Volkswagen (VW) Group has broken ground on an all-new MEB plant in Anhui (China). According to a company press release, the plant is due for completion by mid-2022 with production scheduled to start from the second half of 2023. VW seems quite ambitious in its aim to become a market leader in the NEV sector in China. The upcoming plant in Anhui will be VW Group's third electric vehicle (EV) plant in the country following the SAIC VW plant in Anting and FAW-VW plant in Foshan. The announcement is in line with an earlier announcement that VW, along with its joint-venture (JV) partner JAC Motors, will invest CNY20 billion (USD3.08 billion) in an EV plant in Hefei in eastern China's Anhui province. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- China's meat imports reached record levels in March driven by

sharp increases for pork and sheepmeat along with more modest gains

for beef and chicken. Total imports of meat and offal rose by 12%

y/y to surpass one million tons for the first time ever in a single

month. (IHS Markit Food and Agricultural Commodities' Max Green)

- These purchases were worth more than USD3.2 billion - an increase of 4% when compared to March 2020.

- The overall increase was driven by higher Chinese demand for pork, imports of which jumped by 17% y/y to 451,250 tons. Pork imports for the month were worth USD1.26 billion - up 9% y/y.

- More than a third of all March pork imports came from Spain, which has taken up much of the slack left by China's ban on German pig products. Chinese imports of Spanish pork reached 153,000 tons in March - more than double the amount imported in the same month last year.

- Pork imports from the US fell by 10% y/y to 57,000 tons but purchases from Brazil gained 8% y/y to reach 45,000 tons.

- China Three Gorges (CTG) launched its newbuild wind turbine installation vessel (WTIV) San Xia Neng Yuan 001 at Jiangsu New Hantong Ship Heavy Industry (NHT) in Mainland China on 20 April. A naming ceremony was held at the shipyard. The newbuild, with a length of 85.8 m, a width of 40 m, and a depth of 7 m, will be fitted with an 800-metric-ton capacity crane and four 91 m cylindrical legs. The derrick will be able to operate at water depths of up to 55 m and transport wind turbine components and foundations in a single trip. Upon its delivery in the second half of 2021, the vessel is expected to be deployed to work on CTG New Energy's (CTGNE) offshore wind farm projects in Mainland China. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

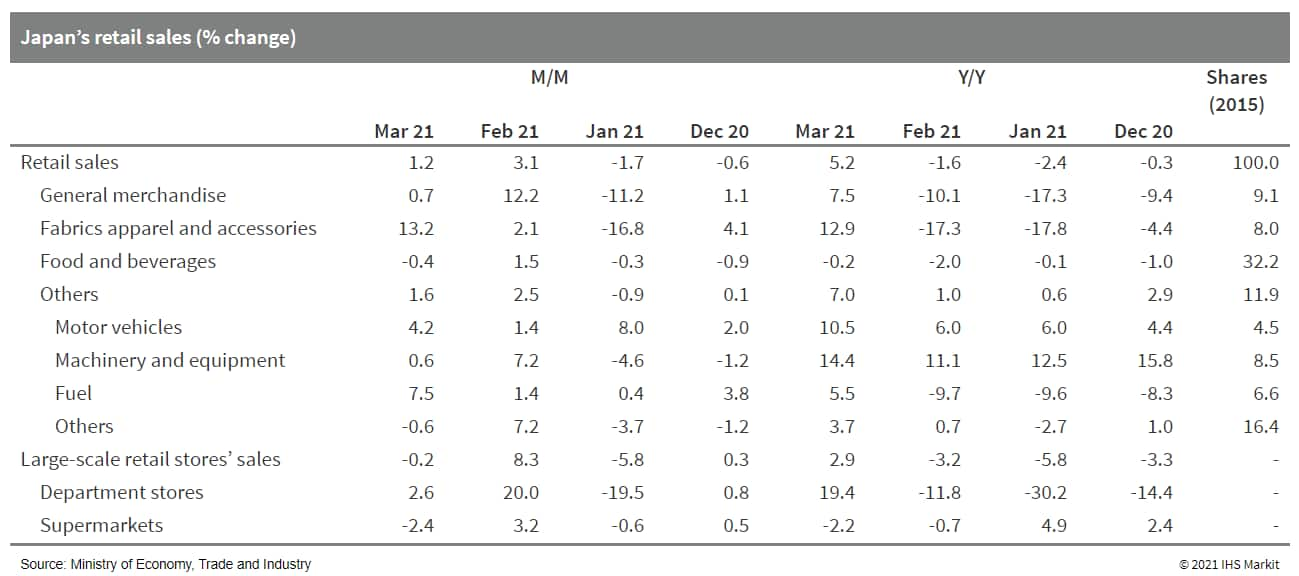

- Japan's retail sales rose by 1.2% month on month (m/m) and 5.2%

year on year (y/y) in March. Although the solid y/y increase was

due partially to low base effects, the seasonally adjusted retail

sales index reached its highest level since September 2019, a month

ahead of the introduction of a consumption tax increase to 10% from

8%. That said, the improvement was largely driven by sales of motor

vehicles and machinery and equipment, supported by social

distancing preferences and stay-home lifestyles, while sales of

general merchandise and fabrics apparel and accessories remained

well below the pre-pandemic level. (IHS Markit Economist Harumi

Taguchi)

- Shin-Etsu Chemical reports a drop of 6.5% in net profit to

¥293.7 billion ($2.79 billion) for the fiscal year ended 31 March.

Operating income decreased 3.4% to ¥392.2 billion and sales

declined 3.0% to ¥1.4 trillion. Quarterly figures have not been

disclosed. (IHS Markit Chemical Advisory)

- Shin-Etsu's polyvinyl chloride (PVC) and chlor-alkali business saw operating income grow 5.3% to ¥97.0 billion, on sales of ¥469.7 billion, down 3.0%.

- Shin-Etsu's silicones business recorded a 26.6% drop in operating income to ¥45.1 billion. Sales were down 8.2% to ¥208.3 billion, with this sector pressured by a decline in prices and sluggish demand for products with cosmetics and automotive applications.

- For the specialty chemicals business, operating income decreased 21.3% to ¥21.8 billion and sales declined 1.9% to ¥112.6 billion. The business for pharmaceutical products was firm. Demand for products with construction material and building applications was weak. The polyvinyl alcohol brand Poval was challenged by market conditions.

- The company's semiconductor and silicon business increased its operating income by 0.6% to ¥144.1 billion on sales of ¥374.0 billion, down 3.5%, with profit boosted by a high level of shipments.

- The electronics and functional materials business reported a 2.6% rise in operating income to ¥70.2 billion on 4.3% growth in sales to ¥234.8 billion. The rare-earth magnets business was hurt in the first half of the fiscal year but showed a recovery in the second half. Shipments of products for hard disk drives were higher and automotive applications showed a strong recovery in the second half.

- Seajacks jackup Zaratan arrived in Akita Port, Japan, on 23 April 2021 and is scheduled to begin offshore foundation installation for Akita Wind Corporation's wind farms imminently. The derrick was undergoing administrative process and vessel inspection at the port following its arrival. The first round of foundation installations for the developer's Akita Port and Noshiro Port offshore wind farms will be carried out until the end of December. The vessel is scheduled to install wind turbines from early 2022 until the end of November 2022. The Akita and Noshiro Port wind project will consist of 33 Vestas V117-4.2 MW wind turbines, installed 2 km off the Akita Prefecture coastline. Thirteen typhoon variant turbines will be installed at the Akita Port site, while the Noshiro Port site will comprise 20 turbines. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

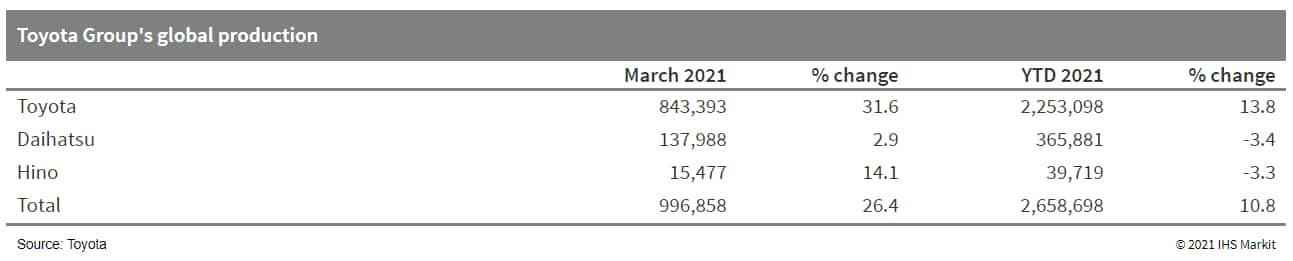

- Toyota Group's overseas production increased for the seventh

consecutive month in March, while domestic output grew for the

first time in three months. The significant increase in production

during the month can be attributed to a low base of comparison as

Toyota Group's global output fell 17.6% year on year (y/y) in March

2020 as a result of the COVID-19 pandemic. According to IHS

Markit's latest production forecasts, Toyota Group's light-vehicle

production (including the Hino, Daihatsu, Toyota, and Lexus brands)

is expected to reach around 10.412 million units in 2021. At its

Japanese plants, total light-vehicle production during 2021 is

expected to be around 4.058 million units. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- LG Chem reports first-quarter net profit of 1.37 trillion South

Korean won ($1.2 billion), a big increase from W36 billion in the

prior-year quarter. The company recorded quarterly operating profit

of W1.4 trillion, jumping from W206 billion a year earlier. Sales

rose 43.4% year on year (YOY), to W9.6 trillion. (IHS Markit

Chemical Advisory)

- First-quarter operating profit at LG Chem's petrochemicals division grew fourfold to W984 billion from W243 billion a year earlier. Sales at this sector grew 19.2% YOY to W4.4 trillion.

- Revenue had decreased last year due to lower oil prices and the COVID-19 pandemic. The company's polyolefin business contributed 28% of petchem revenue; plasticizers, 19%; acrylonitrile-butadiene-styrene, 32%; and acrylates, 10%.

- The company says it achieved a solid performance at the petchem business due to strong demand for major end-use products such as home appliances, medical supplies, and building materials.

- It projects that sales growth and solid profitability will continue in the second quarter with the operation of new capacity for value-added products such as nitrile-butadiene rubber, together with operation of the company's No. 2 naphtha cracking center at Yeosu, South Korea.

- The LG Energy Solution business, specialized in automotive batteries, swung to an operating profit of W341 billion from an operating loss of W52 billion a year earlier. Sales at this unit leapt 88% YOY, to W4.2 trillion.

- Operating profit more than doubled at LG Chem's advanced materials division to W88 billion, from W39 billion in the prior-year period. Sales in this sector increased by 41.7% YOY to W1.1 trillion. LG Chem's battery materials business contributed 35% of the division's revenue with IT/semiconductor materials contributing 31% and engineering materials 28%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.