Daily Global Market Summary - 28 October 2021

All major US equity indices closed higher, Europe was mixed, and all APAC markets were lower. US and benchmark European government bonds closed sharply lower. CDX-NA closed tighter across IG and high yield, and European iTraxx was wider on the day. Copper, gold, and WTI closed higher, while the US dollar, Brent, silver, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher, with the Nasdaq +1.4% and S&P 500 +1.0% closing at new all-time highs; Russell 2000 +2.0% and DJIA +0.7%.

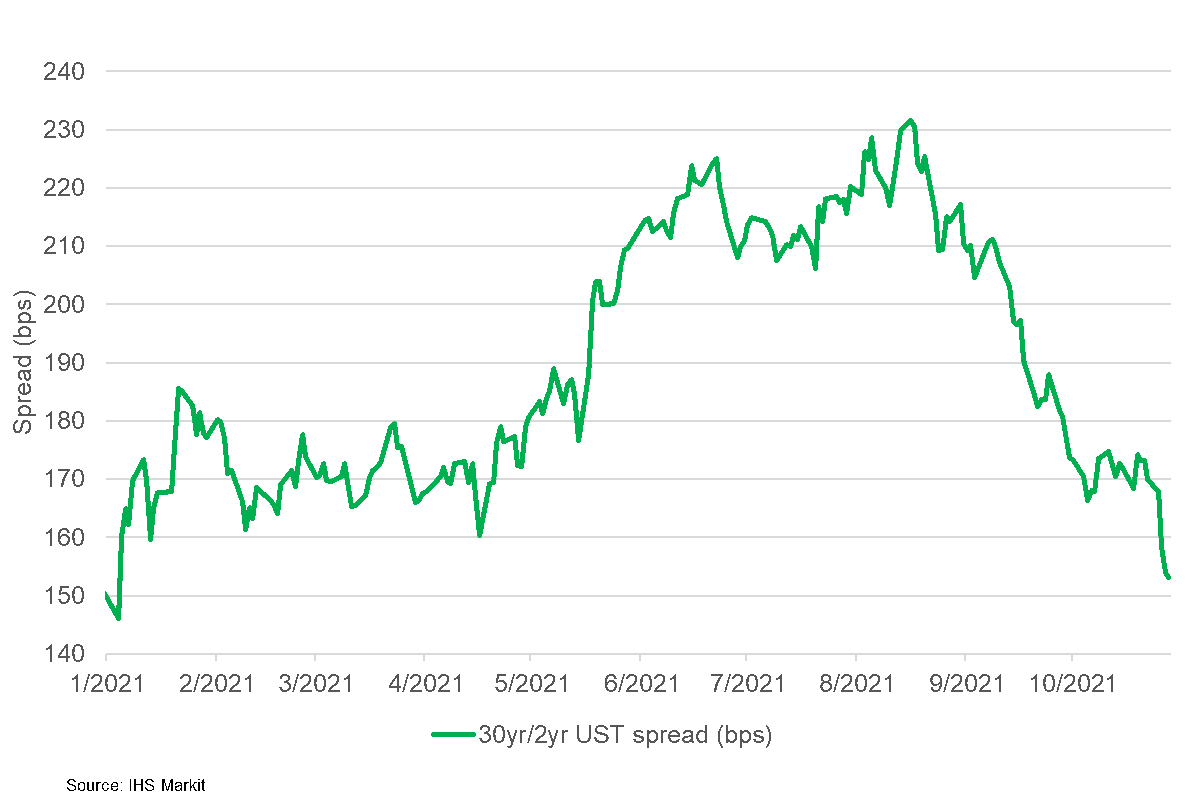

- 10yr US govt bonds closed +3bps/1.58% yield and 30yr bonds

+3bps/1.98% yield, with the 30yr/2yr UST spread near its flattest

point of this year at +153bps.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -2bps/300bps.

- DXY US dollar index closed -0.5%/93.35.

- Gold closed +0.2%/$1,803 per troy oz, silver -0.3%/$24.12 per troy oz, and copper +1.1%/$4.44 per pound.

- Crude oil closed +0.2%/$82.81 per barrel and natural gas closed -6.5%/$5.87 per mmbtu.

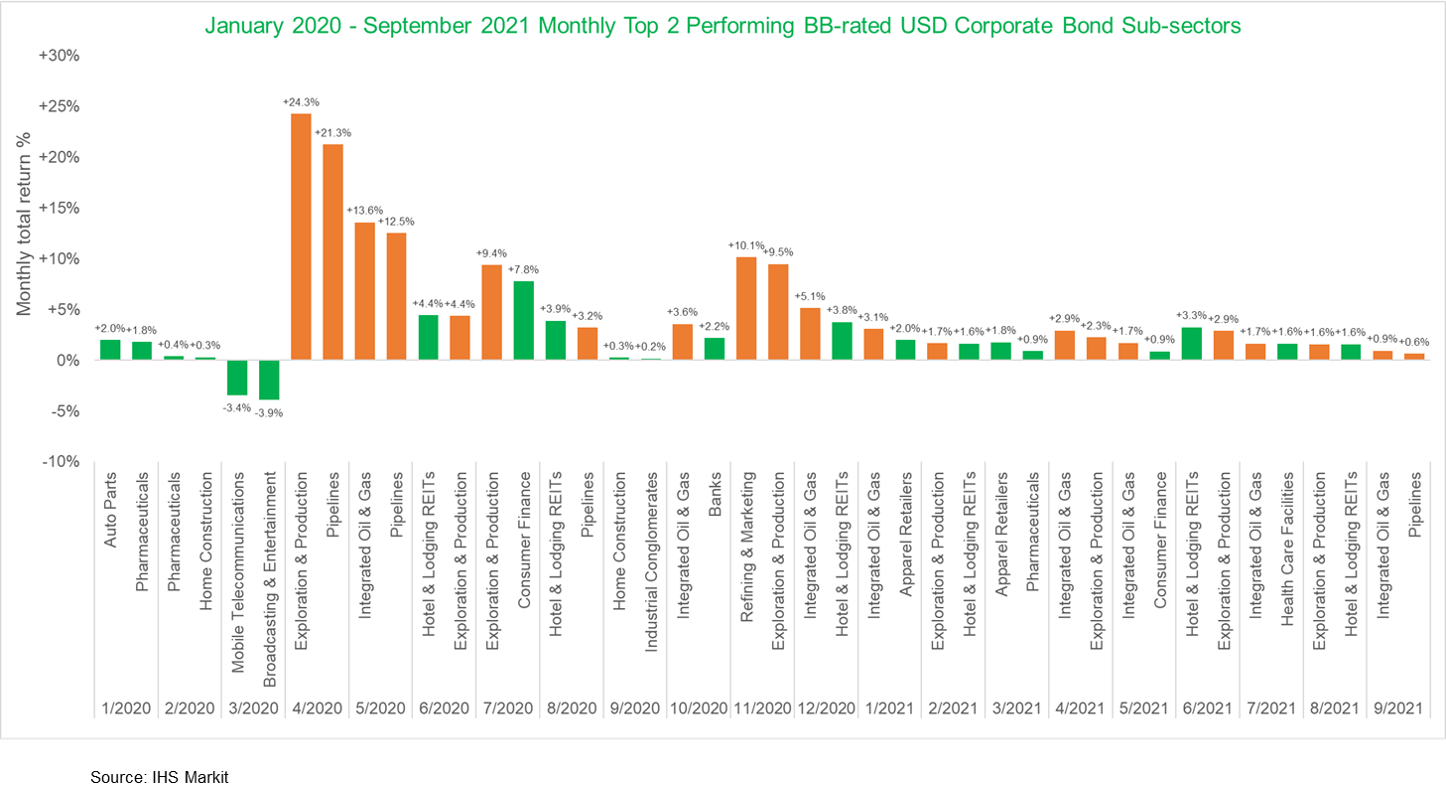

- The below graph shows the top 2 performing BB-rated USD

corporate bond sectors each month since January 2020, with energy

subsectors indicated in orange. The analysis highlights how the

energy sector has outperformed the broader US high yield debt

market the majority of months since April 2020.

- Amazon posted lower-than-expected third-quarter sales and signaled that a tight labor market and supply-chain disruptions would weigh on earnings. In its first quarterly earnings report covering a period primarily under new Chief Executive Andy Jassy, who on July 5 succeeded founder Jeff Bezos in the top job at Amazon, the online retailing giant posted sales of $110.8 billion and generated a profit of $3.2 billion, down from the $6.3 billion the company made during the same period a year earlier. Wall Street expected $111.6 billion in quarterly revenue and profit of $4.6 billion. (WSJ)

- Apple Inc. fell in late trading after quarterly revenue missed analysts' estimates, hurt by supply constraints that took a bigger-than-expected bite out of sales. Fiscal fourth-quarter revenue amounted to $83.4 billion, the tech giant said Thursday, missing estimates of $84.7 billion. That represents growth of 29% from the year-earlier period, but that quarter didn't include a new iPhone. Apple released the iPhone 13 in the last few weeks of the latest quarter, helping bolster sales. (Bloomberg)

- US GDP rose at a 2.0% annual rate in the third quarter

according to the Bureau of Economic Analysis (BEA)'s "advance"

estimate, 0.4 percentage point higher than the latest IHS Markit

tracking estimate. GDP growth slowed sharply from 6.7% in the

second quarter in response to a resurgence of COVID-19 cases and

ongoing supply-chain problems. Federal government assistance to

households, businesses, and state and local governments declined

materially. (IHS Markit Economists Ken

Matheny, Michael

Konidaris, and Lawrence Nelson)

- Relative to the IHS Markit tracking estimates, final sales were higher than expected but inventory investment was lower. The former reinforced IHS Markit expectations for robust growth of final sales in the fourth quarter, while the latter suggested a larger increase of inventory investment in the fourth quarter. The combination implied an upward revision to the IHS Markit forecast of fourth-quarter GDP growth to 5.1%. The strength in final sales relative to IHS Markit estimates was primarily accounted for by personal consumption expenditures (PCE) and net exports.

- The slowdown in GDP growth in the third quarter was led by PCE, which grew at a 1.6% annual rate, down from 12.0% in the second quarter. Also contributing to the slowing in GDP growth in the third quarter were business fixed investment (where growth slowed) and net exports. Net exports fell $67 billion (less of a decline than IHS Markit experts had estimated) as exports fell but imports continued to grow. Inventory investment rebounded in the third quarter, contributing 2.1 percentage points to GDP growth.

- US seasonally adjusted initial claims for unemployment

insurance decreased by 10,000 to 281,000 in the week ended 23

October, hitting its lowest level since 14 March 2020. With the

peak of the fourth wave of COVID-19 behind us and consumer spending

expected to post strong gains in the fourth quarter, hiring should

continue to improve and the level of claims should continue

trending towards its pre-pandemic steady state. (IHS Markit

Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 237,000 to 2,243,000 in the week ended 16 October, hitting its lowest since 14 March 2020. The insured unemployment rate edged down 0.1 percentage point to 1.7%.

- In the week ended 9 October, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) program fell by 87,188 to 244,379.

- In the week ended 9 October, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 247,936 to 270,013. Because no benefits can be paid for weeks of unemployment after 4 September, the 514,000 individuals still receiving benefits under these federal programs are likely being paid for backdated weeks of unemployment as some states continue to process such claims retroactively.

- In the week ended 9 October, the unadjusted total of continuing claims for benefits in all programs fell by 448,386 to 2,830,661. With the expiration of pandemic-related benefits, claims under all programs have declined sharply—there were 11,250,306 claimants in the week ended 4 September.

- The US Pending Home Sales Index (PHSI) fell 2.3% in September

from an August seven-month high. All four regions saw

month-on-month and year-over-year declines. (IHS Markit Economist

Patrick

Newport)

- According to Lawrence Yun, the National Association of Realtors' chief economist, "Contract transactions slowed a bit in September and are showing signs of a calmer home price trend, as the market is running comfortably ahead of pre-pandemic activity…It's worth noting that there will be less inventory until the end of the year compared to the summer months, which happens nearly every year."

- The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average), which had been sliding since January but turned two months ago, growing 9% since, is pointing to higher sales in the fourth quarter than in the previous two quarters.

- Demand remains strong, which s why home prices are surging. Low inventory is suppressing sales. Lawrence Yun "expects inventory to turn the corner in 2022."

- The PHSI leads existing home sales by a month or two. The latest two PHSI readings point to flat sales in existing home sales in October and November.

- Pending home sales declined in September, reversing a portion of a large increase in August, but not by as much as we had assumed, implying more growth of brokers' commissions in the fourth quarter. As a result, we raised our tracking forecast of fourth-quarter GDP growth by 0.1 percentage point to 5.2%.

- The Coca-Cola Company has reported a 16% y/y increase in net

revenues to $10.0 billion in the third quarter, resulting in better

net revenues than in 2019, while organic revenues grew 14%. In

volume terms, the company has reported that Q3 volume this year was

ahead of 2019 driven by improved performance in away-from-home

(AFH) channels along with continued strength in at-home channels.

(IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Unit case volume grew 6% in Q3, resulting in volume ahead of 2019, primarily led by developing and emerging markets. Growth in developing and emerging markets was led by India, Russia and Brazil, while growth in developed markets was led by the US, Great Britain and Mexico.

- Nutrition, juice, dairy and plant-based beverages grew 12% y/y in volume, a low single-digit acceleration versus 2019, due to solid performance by Minute Maid Pulpy juice drinks in China, the Maaza fruit drink brand in India and Del Valle juice brand in Mexico.

- Sparkling soft drinks grew 6%, resulting in volume ahead of 2019, driven by strong performance across all geographic operating segments. Sparkling flavours grew 7%, resulting in even performance on a two-year basis.

- Concentrate sales were two points ahead of unit case volume in the quarter, primarily attributable to bottler inventory build to manage through near-term supply disruption.

- Prompted by rising spot prices for commodities, Coca-Cola management conceded that juice is the key commodity for The Coca-Cola Company in terms of size.

- "The biggest commodity that flows through the company's P&L (profit and loss) [statement] is actually juice, the cost of buying juice whose spot price is not projected to shoot up as much next year as this year. It has obviously increased in 2021 over 2020 but it is looking more in the range that we've talked about going into 2022. So, from the company's perspective the spot price of our biggest commodity is not wildly projected to be out of line," said Quincey.

- Hertz has announced a partnership with Uber to add as many as 50,000 Teslas to the Uber network by 2023, according to a company statement. Hertz has rented vehicles to Uber drivers since 2016, and recently announced an order for 100,000 Tesla vehicles in 2022. According to the statement, Hertz will begin renting Tesla vehicles to Uber drivers in Los Angeles, San Francisco, San Diego, and Washington DC from 1 November 2021; a national program is planned in the coming weeks, Hertz notes. In the statement, Mark Fields, interim CEO of Hertz, said, "Today's partnership with Uber is another major step forward in Hertz becoming an essential component of the modern mobility ecosystem and executing on our commitment to being an environmentally forward company. We are creating the new Hertz and charting a dynamic, new course for the future of travel, mobility and the auto industry." Although pricing for the rental was not included, Uber has programs to encourage use of EVs for its ride-hailing fleet, including EVgo charging discounts, benefits for Uber's green future program and incentives including USD1 more per trip up to USD4,000 annually for drivers transitioning from gasoline (petrol) vehicles to electric vehicles (EVs). Although the Hertz program starts with up to 50,000 vehicles by 2023, Hertz also says, "If successful, the program could expand to 150,000 Teslas during the next three years." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Installations of renewable energy and sales of electric

vehicles (EVs) set records in the US in recent quarters, as the

economy rebounded from COVID-19 and the energy transition continued

to gain steam. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- The American Clean Power Association (ACP) said the US installed 3,336 MW of new wind, solar, and storage capacity during the third quarter of 2021, with additions totaling 15,317 MW in the first three quarters, a 23% increase compared with 2020.

- There is now 186,674 MW of operational clean power capacity in the US, ACP said. At the start of 2020, less than 140,000 MW of capacity was installed.

- Project owners commissioned a total of 49 new utility-scale projects across 20 states during the third quarter of 2021, representing investments of about $23 billion, ACP said. Breaking it down by category, the trade association identified: 7 wind projects, 34 solar projects, and 8 energy storage projects.

- The number of clean power projects under construction and under development continues to grow significantly. At the end of September, the near-term development pipeline consisted of over 900 projects totaling 109,596 MW of capacity, including 38,122 MW under construction and 71,474 MW in "advanced development," according to ACP.

- The project pipeline is 28% larger than at the end of the first quarter of 2021 and 7% higher than at the close of the second quarter of 2021.

- Solar represents the largest share of capacity in the clean power pipeline, accounting for 54%, followed by land-based wind at 23%, offshore wind at 13%, and battery storage at 9%.

- Also on the rise are hybrid systems that combine renewables and energy storage. ACP said 2,443 MW of solar-plus-storage was added to the grid in the past quarter, bringing the on-the-grid total to 3,574 MW, with another 1,931 MW partially online and 21,185 MW in the pipeline. For wind-plus-storage, 1,892 MW is online. (Hybrid projects are considered partially online if one technology is online, and the other is still under construction or in advanced development.)

Europe/Middle East/Africa

- Major European equity indices closed mixed; France +0.8%, Spain +0.6%, Italy +0.3%, UK -0.1%, and Germany -0.1%.

- 10yr European govt bonds closed sharply lower; UK +2bps, Germany/France +4bps, Spain +5bps, and Italy +10bps.

- iTraxx-Europe closed +1bp/50bps and iTraxx-Xover +3bps/257bps.

- Brent crude closed -0.3%/$83.66 per barrel.

- In late October, the UK government published the Net-Zero Strategy, outlining its long-term policy priorities and instruments that will be deployed across key sectors of the economy, including the oil and gas industry, to achieve net-zero emissions by 2050. The strategy establishes a whole-government approach to the United Kingdom's climate goals to ensure that government bodies factor emission-reduction targets in their decision-making, which is likely to result in more thorough environmental reviews of hydrocarbon developments. The implementation of the Net-Zero Strategy is likely to prompt increased scrutiny of oil and gas projects and more frequent interventions by regulatory bodies to enforce the country's emission-reduction targets. According to the strategy, environmental protection and the prevention of adverse environmental impacts (such as greenhouse gas [GHG] emissions) will be the guiding principles in developing new policies. The changes are likely to have an impact on the preparation of future offshore licensing rounds and form the basis of the Climate Compatibility Checkpoint, which is expected to be finalized before the end of 2021. (IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

- UK passenger car production has fallen yet again during September as shortages of components continue. According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), output dropped by 41.5% year on year (y/y) to 67,169 units. Of this total, 52,872 units were built for export markets, a contraction of 39.6% y/y, while 14,297 units were manufactured for domestic sale, down 47.4% y/y. Despite the latest September decline, the rises during the first half of the year due to the low base of comparison against the same period in 2020 has meant that volumes are still up in the year to date (YTD) by 3.8% y/y, to 656,776 units. Separately, the SMMT has reported that commercial vehicle (CV) production has grown marginally during September, increasing by 1.8% y/y to 7,799 units last month. Of the total number of CVs built in September, 3,496 units were for domestic sale, a gain of 27.3% y/y, while those built for export dropped by 12.4% y/y to 4,303 units. Overall, production in the year to date (YTD) now stands at 50,921 units, a gain of 15.4% y/y. It has been another challenging month for passenger car production in the UK. Output has now dropped for three months in succession, and the performance this month is the worst performing September since 1982, according to the SMMT. (IHS Markit AutoIntelligence's Ian Fletcher)

- October's meeting was largely seen as a holding operation ahead

of December's quarterly update of staff macroeconomic projections.

As expected, the key elements of the ECB's current policy stance

remain unchanged (IHS Markit Economist Diego Iscaro):

- The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility remain unchanged at 0.00%, 0.25%, and -0.50%, respectively.

- Interest rates will remain at their current level, or lower, until The Governing Council sees inflation "reaching 2% well ahead of the end of its projection horizon"; it judges that the target is reached "durably" for the rest of the projection horizon; and underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term. This may also imply a transitory period in which inflation is moderately above target.

- Net purchases under the Asset Purchase Programme (APP) will continue at a monthly pace of EUR20 billion (USD23 billion). Net purchases under the APP are expected to run for as long as necessary and to end shortly before ECB interest rates start to rise.

- Reinvestment of the principal payments from maturing securities purchased under the APP will continue for an extended period past the date when ECB interest rates start to rise.

- Net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) with a total envelope of EUR1.85 trillion will continue until at least the end of March 2022 and, in any case, until the COVID-19 crisis phase is over.

- Net purchases under the PEPP over the current quarter will be carried out at a moderately lower pace than in the second and third quarters of this year.

- Germany's Federal Statistical Office (FSO) has reported, based

on data from various regional states, that the country's national

consumer price index (CPI) has increased by 0.5% month on month

(m/m) in October. This drives up the annual inflation rate from

4.1% in September to 4.5% year on year (y/y), a level not observed

since 1993. (IHS Markit Economist Timo

Klein)

- The EU-harmonised CPI measure has equally increased by 0.5% m/m, its y/y rate thus even increasing from 4.1% to 4.6% y/y given differing base effects. Unlike during the first eight months of 2021, when different weighting patterns between the two measures provided for large gaps at times, the differential should remain small from now on.

- The detailed breakdown of the German national data will only be published with the final numbers on 10 November, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). The CPI in this state has increased by 0.4% m/m, lifting its y/y rate from September's 4.4% to 4.5%.

- In NRW, energy prices have increased sharply by 3.5% m/m, boosting their annual rate from September's 13.6% to 17.0%. Elsewhere, however, only alcohol/tobacco (from 2.6% to 3.0%) and 'miscellaneous goods and services' (from 3.6% to 3.8%) have posted rising inflation rates, whereas food (down from 4.9% to 4.3%) and - somewhat surprisingly - the recreation/entertainment category (down from 4.0% to 3.0%) have exerted an offsetting dampening influence. The latter partly owes to an above-average softening of package-tour prices after the autumn school holidays.

- With respect to durable goods, prices of clothing/shoes have declined - allowing the y/y rate to drop yet again from 2.1% to 0.8% - but inflation of furniture/household goods remains at an elevated 4.0%.

- Seasonally adjusted German unemployment declined by 39,000

month on month (m/m) in October, a somewhat steeper drop than the

monthly average of 32,000 during the first nine months of 2021. A

total of 70% of the initial, pandemic-related unemployment surge in

the second quarter of 2020 has now been unwound. (IHS Markit

Economist Timo

Klein)

- The Labour Agency calculates a cumulative coronavirus disease 2019 (COVID-19) net boosting effect on unemployment of 174,000 as of October 2021, down from 232,000 in September and an interim peak of 638,000 in June 2020. This represents a comparison with a hypothetical continuation of the pre-pandemic trend if the pandemic had never occurred.

- Germany's (national) unemployment rate has declined from 5.5% to 5.4% in October. This compares with a peak of 6.4% after the end of the first wave of the pandemic in mid-2020 and a pre-pandemic 40-year low of 5.0% in March 2020.

- Employment, data for which regularly lag by one month, increased by 31,000 to 45.001 million in September. Due to downward revisions of past data, this was slightly below the originally reported level for August, however, meaning that the shortfall versus the pre-pandemic high recorded in February 2020 remained at 0.9%. The sub-category of 'regular' jobs - for which employers pay social security contributions, i.e. excluding the self-employed, 'mini-jobs', or other forms of precarious employment - exceeded its level of a year earlier by 1.5% in August (latest data available). This outperformed the mere 0.6% annual increase for total employment, confirming previous evidence that the recovery of precarious forms of employment still lags considerably. Meanwhile, among regular jobs, part-time employment continued to outperform full-time employment - up 2.1% versus 1.2% year on year (y/y) - but the gap is narrowing now.

- Mercedes-Benz's CEO Ola Källenius has said that the company will move to cheaper batteries in its lower-segment battery electric vehicles (BEVs) in order to mitigate rising raw material costs, according to a Bloomberg report. These batteries are less powerful, but Mercedes is bargaining that customers will accept a slight compromise on vehicle range for a more reasonable asking price. As a result, the next generation of the EQA and EQB will use lithium iron phosphate (LFP) batteries which do not use nickel, which is found in more expensive batteries of the sort that are used in the company's brand new flagship EQS BEV. (IHS Markit AutoIntelligence's Tim Urquhart)

- Vehicle rental company LeasePlan has begun discussions with ALD Automotive about a potential merger, reports Europa Press. According to the report, there is no certainty that these talks will result in a deal. In April, the possibility of these two companies exploring a merger deal was reported. This tie-up is expected to create a European leasing and mobility powerhouse. LeasePlan operates in 29 countries and has a global fleet of about 1.8 million vehicles. By 2030, the company expects to achieve net zero emissions from its fleet. ALD Automotive, which is majority owned by Société Générale, provides full-service leasing and fleet management services across 43 countries and manages 1.76 million vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

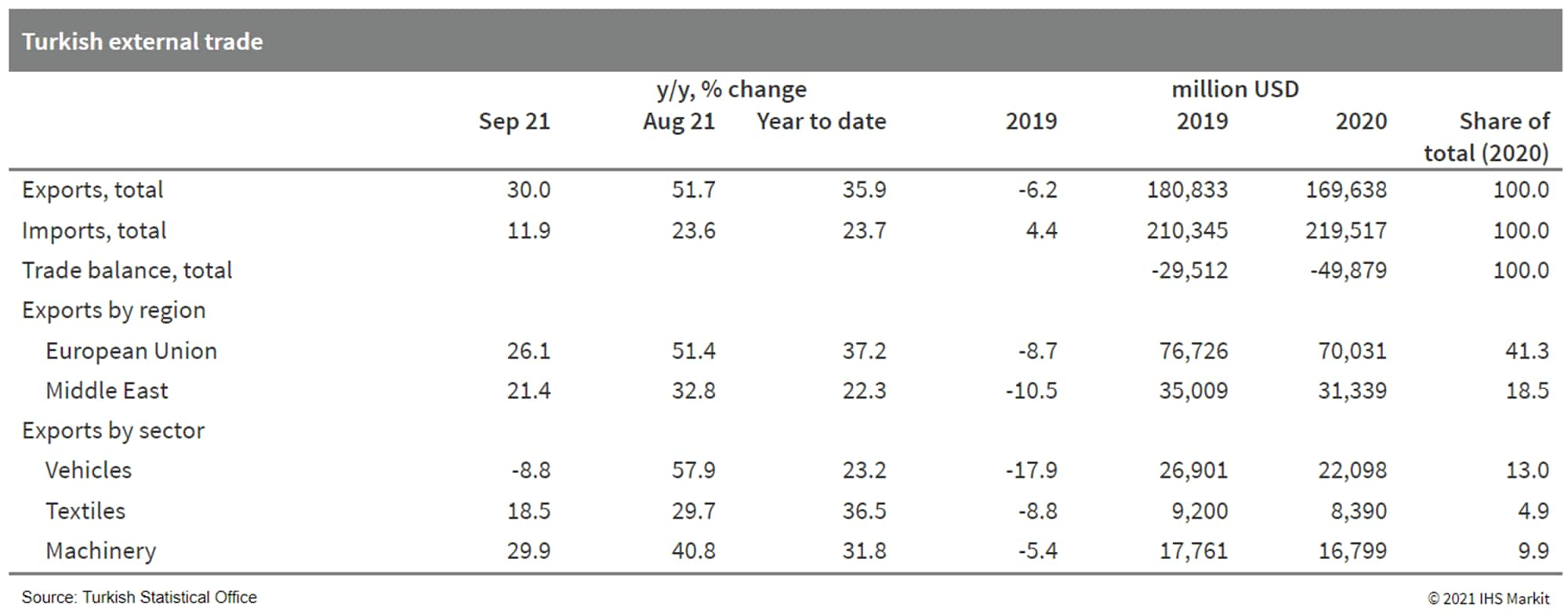

- Through the first three quarters of 2021, Turkey posted a

merchandise-trade deficit of USD32.4 billion, down by over USD5.5

billion from the same period of 2020 according to data from the

Turkish Statistical Institute. The trade gap narrowed particularly

sharply in August and September, down by 32.1% year on year (y/y)

and 47.5% y/y, respectively. (IHS Markit Economist Andrew

Birch)

- Vigorous export gains that accelerated in August and September were the primary cause for the narrowing of the trade gap. Overall in the first three quarters, exports increased by 35.9% y/y.

- The shipment of intermediate, including low-technology goods has been resilient despite global supply chain and production problems. Iron and steel, plastics, and aluminium exports all grew stronger than the average both through the first three quarters as a whole and in recent months as well. On the other hand, the country's top export commodity, automobiles and their parts, is suffering in the face of the global backlogs, with overall, January-September growth just 22.9% y/y and monthly totals falling against year-earlier levels.

- Import growth was strong through September, but somewhat weaker

since mid-year. The lira's sharp depreciation early in 2021 and

again beginning in September has undermined import demand.

- Israeli automotive technology startup Tactile Mobility has raised USD27 million in a Series C funding round, according to a company statement. This financing round was led by Delek Motors, with strategic investment from Goodyear Ventures and Porsche Ventures and support from Union Group, The Group Ventures, Zvi Neta (AEV), Giora Ackerstein, and Doron Livnat. Tactile Mobility plans to use the infused capital to meet the rapidly growing demand for sensing technology and data, expand into new segments, and broaden its offerings. (IHS Markit Automotive Mobility's Surabhi Rajpal)

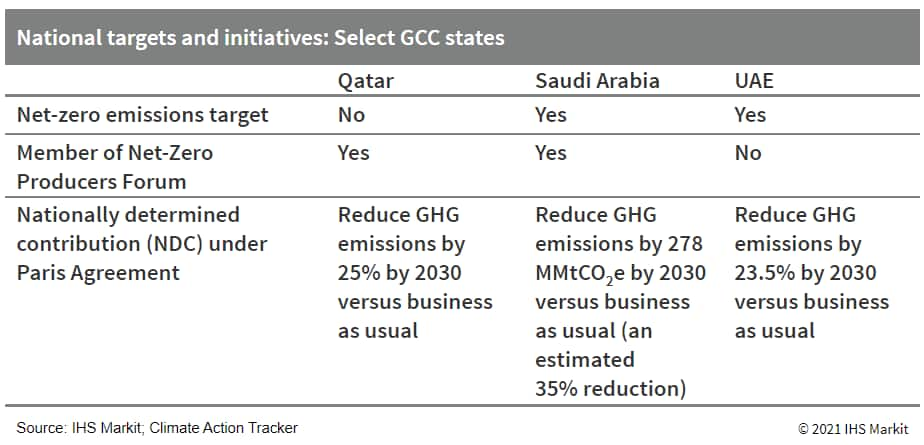

- In late October, the governments of Saudi Arabia and Bahrain

announced that they are targeting net-zero greenhouse gas (GHG)

emissions by 2060, following the United Arab Emirates' declaration

of a 2050 net-zero target earlier this month. Saudi Arabia also

stated that it would join 30+ countries seeking to reduce methane

emissions by 30% by 2030 under a global methane pledge. The Saudi

government's announcement was quickly followed by a statement by

national oil company (NOC) Saudi Aramco that it would target

net-zero emissions by 2050. Also in October, Qatar Petroleum

announced that it was rebranding as Qatar Energy to better reflect

its ambition to focus on energy efficiency and green technologies,

although the Qatari government has not announced a net-zero

emissions target. The recent announcements - coming amid a flurry

of similar global pledges in advance of the 26th UN Climate Change

Conference of the Parties (COP26) - reflect the ambitions of Saudi

Arabia, Qatar, and the UAE to adapt to the energy transition by

reducing and (for Saudi Arabia and the UAE) eventually eliminating

GHG emissions over the medium-to-long term while safeguarding and

accelerating the monetization of remaining hydrocarbon resources

(see 3 June 2021: Gulf states adapt upstream strategies as they

stare down the energy transition). However, these targets are

highly unlikely to be paired with any scaling back of oil and gas

activity. Notably, the net-zero target set by Saudi Aramco does not

include scope 3 emissions, and as such, the combustion of exported

oil will not factor into its calculations. (IHS Markit E&P

Terms and Above-Ground Risk's Mariam

Al-Shamma)

Asia-Pacific

- All major APAC equity indices closed lower; Australia -0.3%, Hong Kong -0.3%, South Korea -0.5%, Japan -1.0%, Mainland China -1.2%, and India -1.9%.

- Chinese autonomous vehicle (AV) technology startup Leadgentech has completed a Pre-A round of financing worth tens of millions of yuan, reports Pandaily. The investment was secured from Deepshire, ZhenXin Capital, well-known economist Deng Haiqing, and the core team of Leadgenchtech. The company plans to use the infused capital towards accelerating the commercialization of autonomous buses and autonomous logistics vehicles for urban environments. It will also be used to expand the company's technical teams. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup Hozon Auto, owner of EV brand Neta, has announced that it has raised CNY4 billion (USD626 million) in its D1 funding round, reports Gasgoo. The recently closed financing round was led by the Chinese internet safety giant 360 Security, which put in CNY2 billion. In addition to 360 Security, the funding round involved the participation of CCB International, CITIC Securities, GF Venture Capital, as well as a new energy industrial fund under Shenwan Hongyuan Securities (H.K.) Limited. On 18 October, 360 Security announced that it would invest CNY2.9 billion in Hozon Auto. It will become the second largest shareholder in the EV startup after the investment is completed, with a 16.594% indirect equity stake. It had completed the signing of relevant contracts for the investment and completed the procedures required by government departments as of 25 October. (IHS Markit AutoIntelligence's Jamal Amir)

- Chery New Energy Automotive Technology has signed a strategic co-operation agreement with Anhui Cowarobot, according to a news report by Pandaily. The deal will enable Cowarobot to integrate its technology developments with applications in the autonomous vehicle space. In the future, Cowarobot will collaborate with Chery to implement Level 4 commercial applications in public spaces. The two parties will fully utilize their respective advantages and will work closely in the fields of online control of vehicle chassis, key sensing devices for automatic driving, and automatic driving algorithms. Chery New Energy focuses on research and development (R&D), production, sales, and investment in new-energy vehicles (NEVs) and their key components. It has an international-level vehicle development process and standard system, as well as core technologies in 32-bit vehicle control, integrated thermal management, heat pump air conditioning, and NEV-integrated battery packs. (IHS Markit AutoIntelligence's Jamal Amir)

- The BoJ left its monetary policy unchanged during its 27 and 28

October monetary policy meeting (MPM). The bank will continue

quantitative and qualitative monetary easing (QQE) with yield curve

control (YCC). The BoJ also maintained its commitment to increase

the monetary base until the year-on-year (y/y) rate of rise in the

observed Consumer Price Index (CPI) exceeds 2% and stays above this

target in a stable manner. (IHS Markit Economist Harumi

Taguchi)

- The BoJ's assessment was unchanged in that Japan's economy has picked up as a trend with signs of improvement in private consumption and housing investment. Nevertheless, the bank revised down its economic outlook for fiscal year (FY) 2021/22, reflecting the negative effects of the constrained supply chain on exports and production. Even so, the bank raised up its real GDP forecast growth for FY 2022/23 marginally.

- Despite recent rises in energy prices and inflation expectations, the inflation outlook for FY 2021/22 was revised down because of the effects of reductions in mobile-phone charges. The moderate inflation outlooks for FY 2022/23 and FY 2023/24 were unchanged, even though the BoJ forecasts that the improvement in the output gap will encourage wage increases, which will improve households' tolerance of price rises.

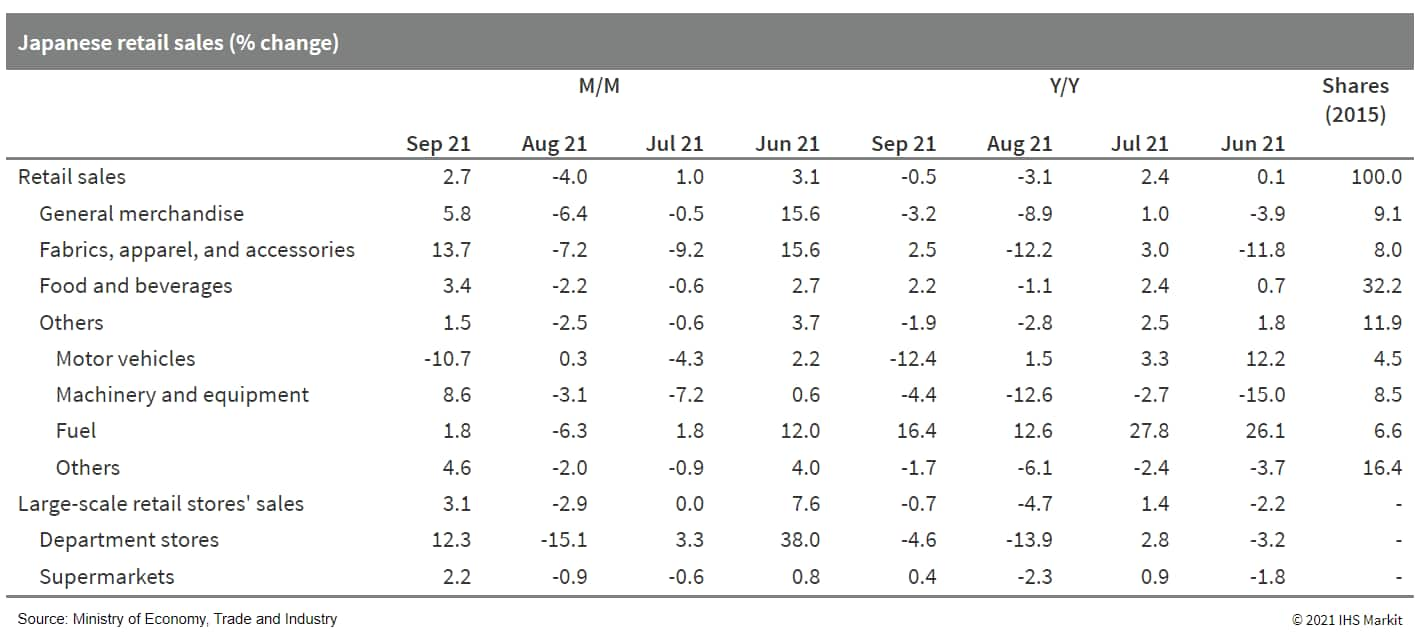

- Japan's retail sales increased by 2.7% month on month (m/m) in

September following a 4.0% m/m drop in the previous month. The

year-on-year (y/y) figure continued to decline, moving down 0.5%.

The improvement largely reflected a notable decrease in

Delta-variant infections and improved weather, which drove rebounds

in a broad range of retail sales areas. (IHS Markit Economist Harumi

Taguchi)

- The major contributors to the improvement were sales of fabrics, apparel, and accessories, as well as food and beverages, which offset a weakness for auto sales due to difficulties in delivering new cars caused by shortages of semiconductors and parts. The improvement also partially reflected higher prices of fresh food and gasoline.

- The September results were better than IHS Markit's

expectation, but a rise of only 0.2% for retail sales in real terms

(realized by the Consumer Price Index of goods) for the third

quarter of 2021 suggests a decline in real private consumption in

the national accounts for the quarter (which will be released on 15

November). Private consumption of goods for the third quarter was

probably not strong enough to offset the effects of a decline in

private consumption on services, which has been more affected by

containment measures during the state of emergency that ended on 30

September.

- Takeda (Japan) plans to exercise its option to acquire GammaDelta Therapeutics (UK), Takeda said in a statement. The option will allow Takeda to obtain GammaDelta's allogeneic variable delta 1 (Vδ1) gamma-delta (γδ) T-cell therapy platforms and early-stage cell therapy programs, for an undisclosed pre-negotiated upfront payment as well as potential development and regulatory milestones. The development follows a collaboration agreement signed by the two companies in 2017, under which Takeda acquired an equity stake and an exclusive right to purchase GammaDelta. The companies expect the deal to close in the first quarter of Takeda's fiscal year 2022. Further financial details were not disclosed. The development will help to expand Takeda's immunotherapy and cell therapy portfolio, allowing the company to leverage the properties of γδ T cells for immunotherapy targeting both solid tumors and blood cancers. The deal also comes only one month after GammaDelta Therapeutics initiated a Phase I clinical trial of its lead candidate, allogeneic gamma delta T-cell therapy candidate GDX012, for the treatment of acute myeloid leukemia (AML). (IHS Markit Life Sciences' Sophie Cairns)

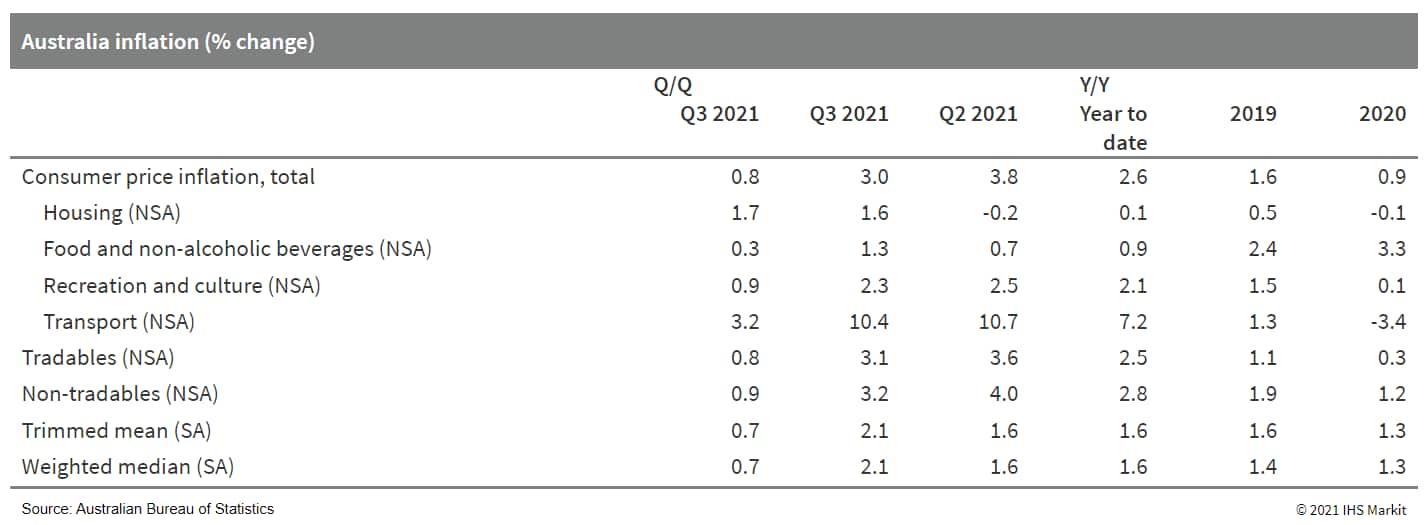

- According to the Australian Bureau of Statistics (ABS), the

rise in the headline consumer price index (CPI) was driven by the

transport component of the index as automotive fuel prices rose

7.1% quarter on quarter (q/q) and edged close to a record high that

was last reached in early 2014. Another key source of inflationary

pressure was a 3.3% q/q surge in new home prices, as construction

activity boomed but was affected by supply chain disruptions for

key materials such as timber. (IHS Markit Economist Bree

Neff)

- The greatest downside pressure on prices arose from retailers slashing prices on winter apparel and footwear owing to a milder winter and strict lockdown measures keeping citizens in New South Wales and Victoria states primarily at home during the quarter. Despite concerns about insufficient numbers of workers in the agricultural sector, fruit prices fell by 8.3% q/q due to strong harvests and reduced restaurant demand amid lockdown measures.

- The biggest surprise in the inflation data was the surge in the

core inflation measures of trimmed mean and weighted median, which

both recorded their largest quarterly increases since the June

quarter of 2014 and the largest year-on-year (y/y) expansions since

the December quarter of 2015, despite the strict coronavirus

disease 2019 (COVID-19) containment measures maintained throughout

the quarter for large portions of the population. This is likely

related to the rise in new dwelling prices, which drove up the

non-tradables sub-component of the consumer price index (CPI),

although higher prices for electronics and home furnishings due to

supply chain issues also contributed.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.