Daily Global Market Summary - 3 August 2020

European and US equity markets closed higher today, while APAC markets were mixed. iTraxx closed tighter across IG and high yield, while CDX IG was tighter and high yield slightly wider on the day. European government bonds were close to unchanged on the day, while US government bond yields were higher and the curve steepened. The number of large retailers filing for bankruptcy protection grew further over the weekend, while on a positive note bondholders appear to be close to an agreement with Argentina's government over the country's debt restructuring.

Americas

- US equity markets closed higher on the day; Russell 2000 +1.8%, Nasdaq +1.5%, DJIA +0.9%, and S&P 500 +0.7%.

- 10yr US govt bonds closed +2bps/0.56% yield and 30yr bonds +4bps/1.25% yield.

- CDX-NAIG closed -2bps/68bps and CDX-NAHY +1bp/434bps.

- Gold closed flat/$1,986.30 per ounce, but was as high as $2009/per ounce intraday, which is the first time it broke through $2,000/per ounce.

- Crude oil closed +1.8%/$41.01 per barrel.

- Argentina's government is finalizing an agreement with a group led by BlackRock Inc. and a handful of large U.S. investment firms to restructure about $65 billion in foreign debt and resolve the country's third sovereign default in 20 years, said people involved in the talks. Committees representing investors holding the bulk of Argentina's external debt have agreed to exchange their defaulted bonds for new securities under a settlement worth nearly 55 cents on the dollar, these people said. (WSJ)

- Offshore drilling contractor Noble Corporation has entered into

a restructuring support agreement with two ad hoc groups of the

largest holders of its outstanding bond debt regarding a consensual

financial restructuring transaction. Noble and selected

subsidiaries have filed voluntary petitions for relief under

chapter 11 of the United States Bankruptcy Code in the United

States Bankruptcy Court for the Southern District of Texas. (IHS

Markit Upstream Costs and Technology's Matthew Donovan)

- The restructuring will be implemented through a plan of reorganization that the company expects to be confirmed by this fall, allowing Noble to emerge from chapter 11 before the end of 2020.

- The restructuring support agreement outlines a plan for the elimination of all of the company's bond debt, which currently represents over USD3.4 billion of debt, through the cancellation and exchange of debt for new equity in the reorganized company. The company's major bondholders have agreed to invest USD200 million of new capital in the form of new second lien notes.

- Noble Corporation will also emerge with a new USD675 million secured revolving credit facility to be provided by its current syndicate of revolving credit facility lenders, with JPMorgan Chase Bank, N.A. as administrative agent.

- Noble plans to continue to operate as normal during the restructuring and will continue to pay employee wages and health and welfare benefits as well as vendors in the normal course.

- The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers' Index (PMI) posted 50.9 at the start of the third quarter, up from 49.8 in June but slightly lower than the previously released 'flash' estimate of 51.3. The latest figure signaled a marginal improvement in the performance of the U.S. manufacturing sector, the first since February. (IHS Markit Economist Chris Williamson)

- Monthly US GDP rose 5.0% in June following a 4.4% increase in May. The back-to-back increases followed back-to-back declines over March and April that lowered GDP a cumulative 15.3%; the increases over May and June reversed about one-half of that decline. About two-thirds of the June increase was accounted for by personal consumption expenditures. Other important contributors included nonfarm inventory investment, net exports, and the portion of monthly GDP not covered by the monthly source data. The level of GDP in June was 20.4% above the second-quarter average at an annual rate; i.e., zero growth of monthly GDP in each month of the third quarter would imply 20.4% annualized growth of GDP for the third quarter. This is about what we expect (we currently look for 20.1% annualized growth in the third quarter). (IHS Markit's US Macroeconomics Team)

- Total US construction spending declined 0.7% in June; IHS

Markit had expected a 1.2% decline. (IHS Markit economists Ben

Herzon and Lawrence Nelson)

- Core construction spending, which excludes federal and private residential outside of new housing (and which enters our GDP tracking), declined 0.9%, also a bit less than we expected. In response, we left our estimate of second-quarter GDP growth unrevised (to one decimal) at -32.9% (annual rate), and we raised our forecast of third-quarter GDP growth 0.1 percentage point to a 20.1% annualized rate of increase.

- The decline in total construction spending in June marked the fourth consecutive monthly decline after reaching a pre-pandemic peak in February. Since February, total construction spending has declined 6.0%.

- Relative to the manufacturing sector, where industrial production dropped 20.1% over March and April, the construction sector has, so far, held up well.

- Manufacturing is already recovering, and we think construction is near a trough. One reason to be optimistic about construction is that homebuilders have become optimistic. The National Association of Home Builders (NAHB) Housing Market Index for July has all but regained its pre-pandemic (February) level.

- On the other hand, one reason not to be optimistic about construction is that some of the recent weakness is unrelated to the pandemic and may continue in coming months. Averaged over the second quarter, education dropped for the fifth straight quarter, lodging for the fourth straight quarter, and office and manufacturing for the third straight quarter. These categories were sliding even before the pandemic caused the recession.

- In the week ended 18 July, US states reported 1,369,798 total

initial unemployment claims, a decrease of 134,950 from the prior

week. (IHS Markit Economists Alex Minelli and Fran Hagarty)

- After experiencing sizable decreases for several weeks following their peak in the week ended 4 April, the descent of initial claims from record highs has slowed considerably over the past six weeks, and an increase was even seen in the week ended 11 July as reopening efforts in multiple states have been halted because of recent viral outbreaks.

- By the week ended 13 June, new claims for unemployment insurance had fallen more than 76% from their April peak. Since then, they have declined less than 6% and remain far above pre-COVID-19 levels.

- Of the 35 states that saw a decrease in initial filings, Florida (down 23,855), Texas (down 17,608), and Georgia (down 16,139) saw the largest declines in the week ended 18 July.

- Florida's sizable decrease is attributable to fewer layoffs in goods-producing industries such as construction and manufacturing, while Georgia owes its decline to less separations in the service sector.

- The largest increases in initial claims occurred in Louisiana (5,728), Virginia (5,654), and California (4,680). This is the third week in a row claims have risen in California as viral outbreaks across the state led officials to reverse reopening efforts.

- Continuing claims in the week ended 11 July numbered 16,128,018, down 964,281 from the week ended 4 July. Of the 37 states where continuing claims decreased, the largest declines were in California (down 241,903), Florida (down 166,797), and Pennsylvania (down 144,381).

- On the other end of the scale, 13 states and Washington DC did experience increases in continuing claims, led by Mississippi (22,495), New York (14,747), Colorado (10,874), and Nevada (10,083).

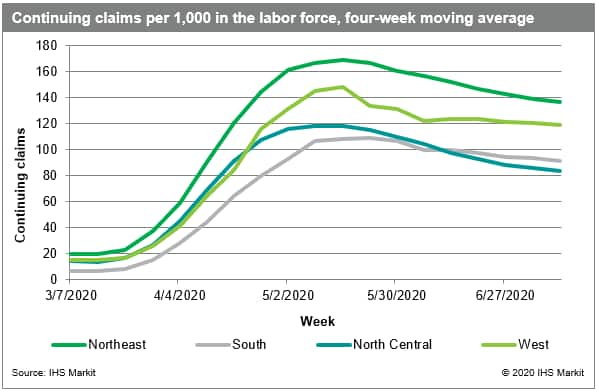

- On a regional basis, the Northeast and North Central con tinue

to see decreases in the four-week moving average of continuing

claims as a proportion of their labor forces. Meanwhile, the West

and South have remained flat since the beginning of June despite

showing signs of improvement in May.

- Over the weekend, Tailored Brands Inc. -- the owner of Men's Wearhouse and JoS. A. Bank -- and department store Lord & Taylor filed for Chapter 11. The Canadian unit of Chico's FAS Inc. declared bankruptcy on July 31. The previous week, it was Ann Taylor and Lane Bryant parent Ascena Retail Group Inc. At least 25 major retailers have now filed for bankruptcy this year, with 10 of these coming over the last five weeks. (Bloomberg)

- IDEXX Laboratories has recorded animal health revenues growth

of 3% in the second quarter of 2020. (IHS Markit Animal Health's

Sian Lazell)

- Total animal health sales amounted to $598.3 million in Q2. Companion animal group (CAG) sales were up 3% (+4% organic) during the quarter to $566.1m.

- CAG diagnostics achieved recurring revenue growth of 7% on both a reported and organic basis, generating $510.2m. IDEXX said growth across its major modalities improved in Q2, reflecting the "broader market recovery for clinical visits and related diagnostic products and services".

- However, overall CAG sales growth was constrained by a decline in new instrument placements due to continued restrictions on access to some veterinary clinics and deferral of purchasing decisions.

- Despite these impacts, IDEXX's premium instrument installed base expanded 14% year-on-year, backed by high customer retention.

- Sales of the company's VetLab consumables were up 12% (+13% organic) to $196.1m, supported by ongoing expansion of the firm's global premium instrument installed base, strong customer retention, higher testing utilization and moderate net price gains.

- Reference laboratory diagnostic and consulting services climbed 7% (+6% organic) to $228.8m. This growth was supported by volume gains through existing customers, moderate net price realization and new customers.Revenues from rapid assay products dropped 6% (-5% organic) to $64.7m. This unit was impacted by early quarter volume pressure cause by the COVID-19 pandemic and "unfavorable revenue impacts related to promotional program timing".

- Veterinary software, services and diagnostic imaging systems turnover also declined to around $37m, representing a decrease of 4% (-3% organic). IDEXX saw double-digit growth in subscription-based service revenues, moderated by declines in new veterinary software and diagnostic imaging systems placements.

- By region, CAG revenues grew 5.5% in the US but was down by around 1% internationally during the second quarter of 2020.

- In contrast to the overall growth in the CAG division, IDEXX's smaller livestock, poultry and dairy (LPD) business saw turnover drop to $32.2m - representing a downward trajectory of 3% but growth of 2% on an organic basis.

- IDEXX said the performance of its LPD division was influenced by an unfavorable impact from the reversal of accelerated customer stocking orders related to COVID-19 in the first quarter, of approximately $2.5m. This reduced revenue growth by 8%.

- The business saw improvements in core swine testing volumes, continued benefits from new African swine fever diagnostic testing programs in Asia and growth in poultry testing. However, these gains were restricted by "lower herd health screening levels, compared to strong prior-year results".

Europe/Middle East/ Africa

- European equity markets closed sharply higher; Germany +2.7%, UK +2.3%, France +1.9%, Italy +1.5%, and Spain +1.4%.

- European govt bonds were close to unchanged on the day; Spain +1bp and Germany/UK/France and Italy flat.

- iTraxx-Europe closed -2bps/58bps and iTraxx-Xover -15bps/360bps.

- Brent crude closed +1.4%/$44.15 per barrel.

- Germany's Federal Statistical Office (FSO) has reported, based

on data from various regional states, that the country's national

Consumer Price Index (CPI) declined by 0.5% month on month (m/m) in

July. On a year-on-year (y/y) basis, consumer prices edged

downwards by 0.1% in July 2020, its lowest reading since April

2016. (IHS Markit Economist Diego Iscaro)

- Using the EU-harmonised CPI measure, prices declined by 0.5% m/m and stagnated on a y/y basis.

- While the detailed breakdown of the German national data will only be published with the final numbers on 13 August 2020, the breakdown by selected products shows prices of goods, which had increased by 0.2% m/m in June, declining by 1.4% y/y in July.

- While the decline in energy prices accelerated from 6.2% y/y to 6.7% y/y, the increase in food prices moderated sharply from 4.4% y/y to 1.2% y/y. Service price inflation also moderated from 1.4% y/y to 1.2% y/y.

- Components are also available from the largest and most populous state of North Rhine-Westphalia (NRW). Inflation in NRW declined by 0.7% m/m and 0.2% y/y for its headline index - the latter following a rise of 0.9% in June. The marked deceleration in the annual inflation rate was mainly due to lower food prices (+0.8% y/y following +3.9% y/y in June), while NRW's core rate of inflation without food and energy eased from 1.2% y/y to 0.8% y/y.

- The management reshuffle being undertaken by the Volkswagen (VW) Group is 80% complete, according to the automaker's CEO, Herbert Diess. According to an interview conducted by Frankfurter Allgemeine Zeitung and reported by Reuters, the senior executive said, "We are 80% done with our personnel decisions. Some outstanding decisions have been prepared and we will implement them in a planned manner." Diess added that the automaker is seeking to enact an "integrative" leadership style, which has been successfully enacted by Thomas Schmall, the chairman of the board of management of Volkswagen Group Components, and that it will do more to bring on managers internally. Diess also told the newspaper that the automaker's Skoda brand needed to do more to compete with South Korean and French brands. There have been a host of managerial changes in the senior ranks of the VW Group of late, including the appointment of new heads of the VW brand, the OEM's software development, and the Traton truck business. (IHS Markit AutoIntelligence's Ian Fletcher)

- According to the Swiss Federal Statistical Office (SFSO), Swiss

consumer prices declined by 0.2% month on month (m/m) in July. On a

year-on-year (y/y) basis, prices declined by 0.9%, following a

four-year low of 1.3% y/y during the previous two months. (IHS

Markit Economist Diego Iscaro)

- The EU-harmonized measure, with its different composition, was slightly positive in m/m terms (+0.1%), while the y/y decline stood at 1.2%.

- The easing of the annual deflation rate was mainly the result of a substantially weaker decline in transport prices (see table below). Prices of recreation and culture also fell at a softer pace, while prices of clothing and footwear rose marginally for the first time in four months.

- Core consumer prices, a measure that excludes the effect from volatile components such as food and energy, declined by 0.1% m/m and were thus slightly softer than the flat (national) headline measure. The core inflation annual rate declined once more from -0.8% y/y to -0.4% y/y, its weakest fall in four months.

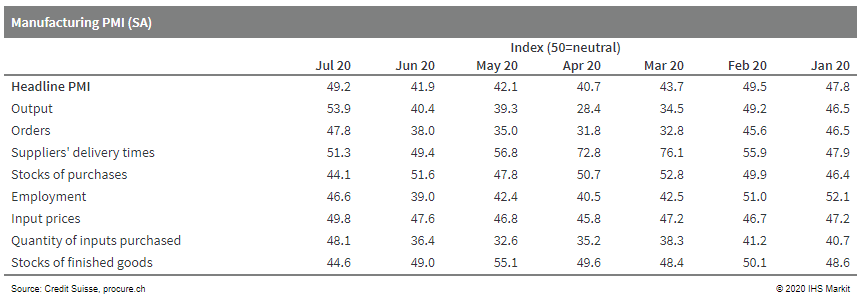

- The May PMI for the Swiss manufacturing sector (seasonally

adjusted) - compiled by the Association for Procurement and Supply

Management (procure.ch) and published by Credit Suisse - recovered

significantly after four months of prints in the low-40s. The

headline index stood at 49.2 in July, up from 41.9 in June. (IHS

Markit Economist Daniel Kral)

- Despite the significant improvement, the index remained below the critical 50-level, which indicates expansion. Switzerland's headline manufacturing PMI continued to underperform the eurozone, which had a reading of 51.8 in July, and its main trading partner Germany, at 51.0.

- The breakdown into individual components reveals that the output sub-index rebounded by 13.4 points between June and July, to 53.4, indicating strong expansion. However, apart from suppliers' delivery times, all other subcomponents that contribute towards the headline index remained in contraction territory. Employment and orders in July were at 46.6 and 47.8, respectively, although both recorded strong improvements compared with June.

- The KOF Barometer (released on 30 July) improved by 25 points,

from 60.6 in June to 85.7 in July, the biggest monthly improvement

in the history of the series. This represents a quick rebound from

the all-time low of 49.6 in May amid severe COVID-19-related

restrictions in Switzerland and Europe.

- CNH Industrial has reported losses during the second quarter of

2020, as its sales revenues have contracted amid the COVID-19 virus

pandemic. (IHS Markit AutoIntelligence's Ian Fletcher)

- For the three months ending 30 June, the company's consolidated revenues fell by 26.3% year on year (y/y) to USD5,578 million.

- Its adjusted EBITDA dropped by 68.7% y/y to USD298 million in the second quarter, as adjusted EBIT profits dropped from USD651 million during the second quarter of 2019 to just USD15 million.

- CNH Industrial's net income fell by 15.5% y/y but still stood at USD361 million as this included a gain of USD1,475 million from the re-measurement at fair value of its investment in Nikola Corporation, in which it holds a 7% stake of the newly listed entity.

- However, this was partly offset by USD840 million worth of non-cash impairment charges primarily related to the goodwill allocated to construction, as well as asset optimization charges of USD282 million, mainly as a result of the COVID-19 virus pandemic's impact on used trucks.

- On an adjusted basis, the company's net income slipped from a profit of USD430 million to a loss of USD85 million in the second quarter.

- From a business unit perspective, the revenues of CNH Industrial's Commercial and Specialty Vehicles unit, which includes the Iveco brand, fell by 35.5% y/y to USD1,739 million in the second quarter.

- At CNH Industrial's Powertrain business, which it intends to spin off alongside the majority of Commercial and Specialty Vehicles assets eventually, net revenues fell by approximately 32.7% y/y to USD763 million due to the COVID-19 virus pandemic reducing volumes.

Asia-Pacific

- APAC equity markets closed mixed; India -1.8%, Hong Kong -0.6%, Australia flat, South Korea +0.1%, China +1.8%, and Japan +2.2%.

- The Office of the United States Trade Representative (USTR) on

29 July announced an additional 12-month extension of exemptions

for 14 categories of imported Chinese products, mostly related to

medical supplies, from Section 301 tariffs. The USTR had initially

granted exemptions for 69 categories of products from Section 301

tariffs in July 2019. (IHS Markit Country Risk's David Li)

- The impact of the COVID-19 virus pandemic has rendered China increasingly unlikely to fully meet phase-one agreement purchasing targets. China has committed to increasing its imports from the United States by USD200 billion above the 2017 baseline by the end of 2021, representing a 92% increase in the value of its imports of the products covered

- China is likely to significantly increase agricultural purchases during the autumn harvest season, which also aligns with central government concerns about food security amid the COVID-19 virus outbreak and severe floods.

- China has demonstrated intent to preserve the phase-one agreement and prevent its collapse, with the key goal of seeking to avoid further deterioration in China-US economic relations. Rather than using COVID-19 as a reason to renegotiate its conditions or withdraw from the deal altogether - by invoking the deal's force majeure clause - both sides have repeatedly reaffirmed their intention to meet their commitments.

- The Chinese new energy vehicle (NEV) market is set to witness another year of contraction of sales and production during 2020, after an expansionary period between 2014 and 2018. Demand for NEVs contracted for the first time in 2019, with a fall of 4% year on year (y/y) in sales volumes, according to data from China Association of Automobile Manufacturers (CAAM). Due to the impact of the coronavirus disease 2019 (COVID-19) virus outbreak and the dwindling subsidies for NEVs, IHS Markit forecasts production of NEVs in China, which mainly consist of plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs), to decrease by 9.3% to around 1.09 million units in 2020. Of this total, BEV production volumes are expected to drop by 15.2% to around 840,000 units. Despite a plethora of models on offer, the forecast decline in NEV output largely reflects falling demand in the retail market as private vehicle buyers still lack interest in BEVs, the largest NEV category in the Chinese market. In this article, we have highlighted the top performers in the NEV market in an attempt to provide some insights into consumer preferences in the world's largest NEV market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) maker Xpeng Motors has raised an additional USD300 million from investors, including Qatar's sovereign wealth fund, reports Reuters, citing sources familiar with the matter. The report also indicates that the EV startup has filed for an initial public offering (IPO) in the United States. Xpeng has already launched two models, the G3 electric crossover and the P7 high-performance electric sedan, on the market. With the latest funds raised, Xpeng is expected to have raised around USD800 million in its C+ round of fundraising. The startup is likely to follow its rivals, NIO and Li Auto, in going public in US in an effort to secure capital needed to support the development of new products and technologies. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Preliminary data show that Taiwan's real GDP fell 0.7% year on

year (y/y) in the second quarter of 2020, reversing noticeably from

a 1.6% y/y expansion posted in the first quarter. It was not only

the first contraction since the first quarter of 2016, but also the

largest decline since the third quarter of 2009 as the COVID-19

virus outbreak took a heavy toll on consumption and tourism-related

activities. (IHS Markit Economist Ling-Wei Chung)

- In seasonally adjusted terms, the economy contracted as well in the second quarter, at an annualized 8.8% from the preceding quarter, representing the worst decline since the fourth quarter of 2008 during the peak of the 2008-09 global financial crisis.

- The decline in the second quarter was seen across the board, except gross investment.

- Domestic demand fell 0.7% y/y in the second quarter, dragged down especially by a record contraction in private consumption, subtracting 2.7 percentage points from economic growth.

- Shrinking consumer spending more than offset a jump in gross investment, which contributed 2.2 percentage points to second-quarter growth.

- Although imports continued to shrink at a faster pace than exports during the second quarter, the decline in exports accelerated noticeably, which resulted in negative contribution from net exports by 0.1 percentage point.

- The main drag continued to come from private consumption, dropping at a record pace of 5.1% y/y, as consumption and tourism-related activities were hit the hardest by the pandemic.

- Dampened by travel restrictions locally and globally, outbound tourism collapsed with the numbers of residents travelling overseas plunging by a record 98.9% y/y and resulting in a 96.4% y/y slump in overseas travel spending, which subtracted six percentage points from private consumption.

- That said, with the reduction in overseas travelling, some residents turned more to spending at home, which provided some offset to the pandemic impact that became more evident in the second quarter. Within resident spending at home, spending on food services was hardest hit by the pandemic, plunging the most by 12.4% y/y, while retail sales dropped 5.8% y/y in the second quarter.

- Coupled with the plunges in consumption related to public transportation, lodging, hotels, and recreations, they remained the key factors weighing down private consumption in the second quarter.

- On the other hand, consumption related to e-commerce, online shopping, delivery services, online games, and other sales related to staying at home continued to surge. In particular, online shopping jumped 18.3% y/y in the three months through June.

- These, combined with the vibrant local stock market with a 54% y/y surge in the trading value, provided some support and helped moderate the fall in private consumption during the second quarter.

- Concurrently, gross investment continued to expand for three straight quarters, jumping 9.6% y/y in the second quarter. This is reflected by a 0.8% y/y increase in imports of capital goods (in Taiwan dollar terms), although the gain moderated from a 1.5% expansion in the first quarter as imports of semi-conductor equipment virtually flattened with a 0.1% fall.

- Despite the impact of the COVID-19 pandemic on world trade and

the severe economic contraction during second-quarter 2020 in key

export markets such as the United States, European Union and Japan,

Vietnam's exports remained resilient in July, showing a marginal

increase of 0.3% year on year (y/y). (IHS Markit Economist Rajiv

Biswas)

- Industrial production rose by 1.1% y/y in July, with manufacturing up 2.1% y/y while electricity production rose by 2.7% y/y and mining output contracted by 7.9% y/y. For the first seven months of 2020, industrial production rose by 2.6% y/y, reflecting a very resilient performance compared with many other Asian industrial economies, which have faced sharp contractions in industrial output due to the pandemic and related lockdowns.

- Reflecting Vietnam's success in limiting the domestic spread of the COVID-19 virus during the first seven months of 2020, retail sales of goods and services rose by 4.3% y/y in July.

- Vietnam's export sector has also weathered the economic shocks to key global markets relatively well, with exports having remained stable y/y over the first seven months of 2020 despite the sharp slump in world trade. With economic activity rebounding in the United States and European Union as COVID-19 lockdowns have been gradually eased, orders for Vietnamese exports should be given a boost during the second half of 2020.

- However, a key new risk that has emerged in recent days has been an outbreak of new COVID-19 cases in Vietnam's third-largest city, Danang. This has forced authorities to put lockdown measures in place in the city, with several cases reported in Danang's factories.

- Nissan has announced that it is enabling owners of battery electric vehicles (BEVs) to pay for parking by discharging power from their batteries at the new Nissan Pavilion exhibition space in Yokohama (Japan). The company said that the 10,000-square-metre space has zero emissions and is supplied with electricity from installed solar panels and from hydroelectric power. The company noted that the sites Nissan Chaya Café is also off the electricity grid and is only supported by power from solar panels or plugged-in vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.