Daily Global Market Summary - 3 March 2021

All major APAC equity indices closed higher, Europe was mixed, and US indices were lower. US and benchmark European government bonds closed sharply lower. European iTraxx was flat across IG and high yield, while CDX-NA was modestly wider. The US dollar and oil closed higher, while gold, silver, and copper were lower on the day.

Americas

- US equity markets closed lower, with the Nasdaq -2.7% on the day closing at a two-month low; S&P 500 -1.3%, Russell 2000 -1.1%, and DJIA -0.4%.

- CDX-NAIG closed +1bp/55bps and CDX-NAHY +5bps/302bps.

- 10yr US govt bonds closed +8bps/1.49% yield and 30yr bonds +8bps/2.28% yield.

- DXY US dollar index closed +0.2%/90.95.

- Gold closed -1.0%/$1,716 per ounce, silver -1.8%/$26.39 per ounce, and copper -1.9%/$4.14 per pound.

- Crude oil closed +2.6%/$61.28 per barrel.

- Pioneer Resources chief Scott Sheffield said at the CERAWeek session 'North America Shale: What's the path ahead?' yesterday that US output will be flat this year and may grow 5% next year at current prices. The big variable is what majors like ExxonMobil and Chevron decide to do, he said. Right now, there are about 200 rigs in the Permian, down from the record high of 500. Executives are shy of saying, "this time is different," when talking about US shale growth, yet all are quick to point to the new emphasis on cash flow at the expense of capex. Wall Street banks expect capex to fall to 65¢-80¢ for every dollar invested compared to past overspending. (IHS Markit Energy Advisory's Roger Diwan)

- Company payrolls rose by 117,000 during the month, according to ADP Research Institute data released Wednesday. The median projection in a Bloomberg survey of economists called for an increase of 205,000. The prior month was revised up to a 195,000 advance. (Bloomberg)

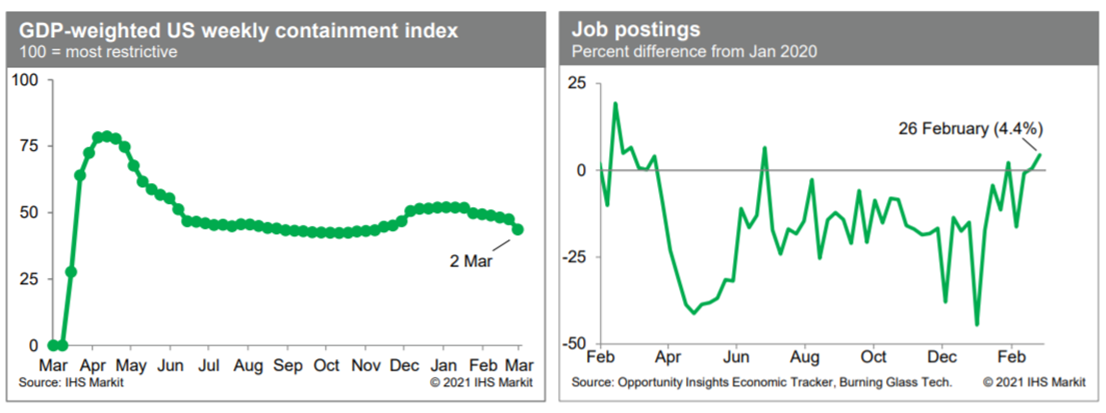

- The IHS Markit US weekly containment index fell 3.8 index

points this week to 43.7, by far the largest decline in a string of

weekly easings that began in late January. The decline this week

reflected easing social and economic restrictions in seven states:

California, Texas, Massachusetts, North Carolina, New York,

Virginia, and New Mexico. Meanwhile, job postings improved in late

February to 4.4% above the January 2020 level, according to the

Opportunity Insights Economic Tracker. This series has been

volatile in recent weeks, but recent averages are well above

averages during the summer and fall. Nevertheless, we would expect

robust recovery in labor demand to coincide with averages in this

series that are higher still. (IHS Markit Economists Ben Herzon and

Joel Prakken)

- The seasonally adjusted final IHS Markit US Services PMI

Business Activity Index registered 59.8 in February, up from 58.3

in January and above the earlier 'flash' figure of 58.9. The

expansion in output was the sharpest in over six-and-a-half years.

The upturn was reportedly linked to stronger client demand and a

further rise in new business. (IHS Markit Economist Chris

Williamson)

- The increase in new sales also accelerated in February. New order inflows expanded at the steepest pace since April 2018.

- Input costs rose further in February, amid hikes in supplier charges and wage bills. Some service providers also noted that higher PPE prices pushed up cost burdens.

- The rate of job creation eased to the slowest in the current eight-month sequence of growth.

- Due to little-changed staffing levels, backlogs of work were accumulated at the sharpest pace for five months.

- Service providers signaled upbeat expectations regarding the outlook for output over the coming year in February.

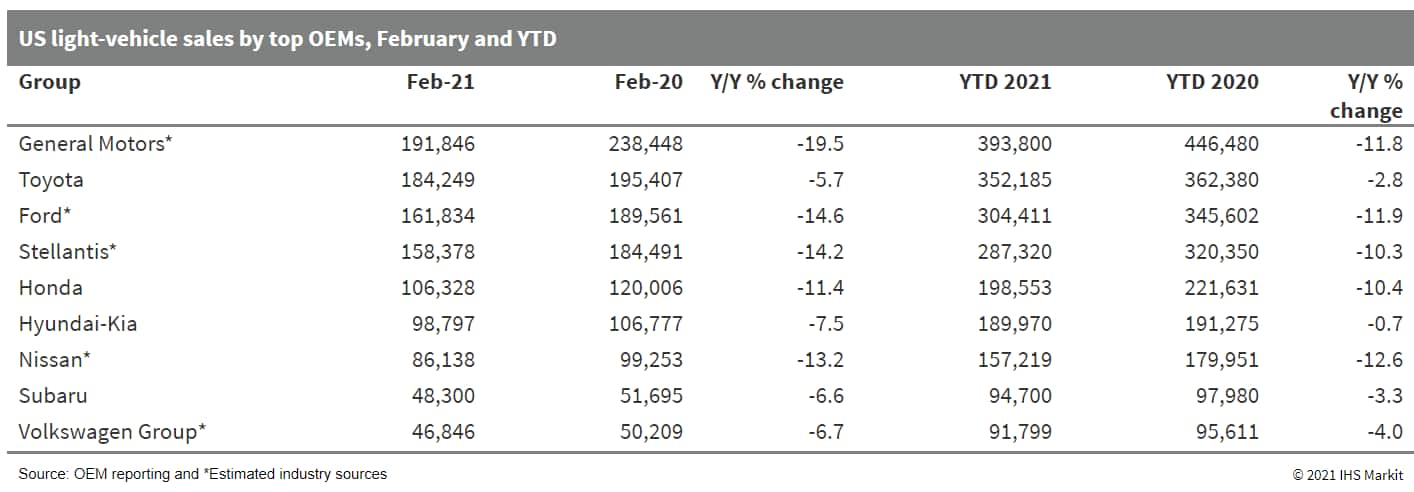

- February 2021 had two fewer selling days than February 2020, as

well as bitterly cold winter weather affecting several areas of the

US, and sales declined 12.7% y/y. Last month, the seasonally

adjusted annual rate (SAAR) of light-vehicle sales, estimated at

between 15.6 and 15.9 million units, also dropped from a strong

January 2021 result. February's light-vehicle sales SAAR declined

substantially from the 16.6 million units in January 2021. The

sales results for the month sustained many of the ongoing trends,

namely retail demand levels continuing to be down on pre-COVID-19

levels, while sales to the fleet sector remain muted. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- Dana has announced the acquisition of Pi Innovo, an embedded software solutions and electronics control units company. Dana's announcement did not give details of the terms of the acquisition. The supplier says the acquisition enables it to increase its in-house electrodynamics capabilities and electrification product portfolio. Buying Pi Innovo gives Dana turnkey electric vehicle application software, vehicle level controllers, and auxiliary controllers, according to Dana's statement. The acquisition follows Dana having earlier acquired a non-controlling interest in the company. The Pi Innovo acquisition further develops Dana's capabilities in e-propulsion systems, key technology in the future in the industry. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Vehicle-sharing platform Fluid Truck has raised USD63 million in its first external round of fundraising. The funding round was led by Bison Capital, with participation from Ingka Investments, Sumitomo Corporation of Americas, and Fluid Vehicle Owners. The company plans to use the infused capital to invest in the platform, expand the engineering and operations teams, and add new markets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Financial Stability Committee (Comitê de Estabilidade Financeira: Comef) of the Central Bank of Brazil (Banco Central do Brasil: BCB) on 2 March declared that it would maintain the countercyclical capital buffer (CCyB) requirement at 0% until at least the end of 2021. Comef stated that despite uncertainty in the solvency of some borrowers because of the COVID-19-virus pandemic, "the financial system is resilient in the face of these risks". The committee also added that the capital conservation buffer, which had been halved in March 2020 as a response to the pandemic, will be progressively raised from the current 1.25% to 1.625% by April 2021, 2.0% by October 2021, and 2.5% by April 2022. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

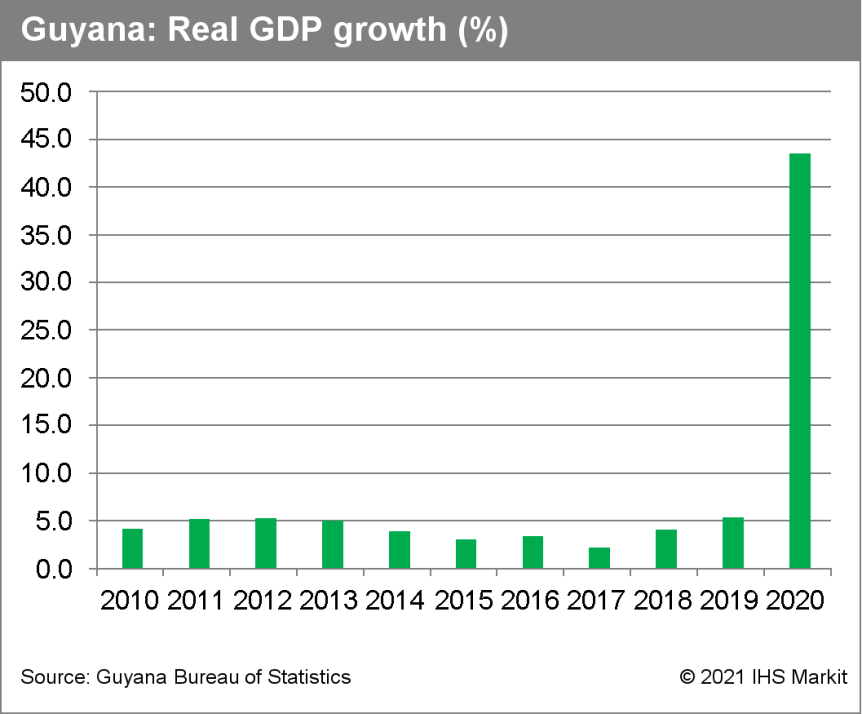

- Guyana posted real GDP growth of 43.5% in 2020, according to

the country's Bureau of Statistics. With crude oil production

projected to increase by more than six-fold by 2026, Guyana's

economic transformation has only just begun. (IHS Markit Economist

Jeremy Smith)

- Guyana is the world's fastest growing economy and the newest oil producer. The eye-popping 2020 result comes despite a 7.3% decline in real non-oil GDP, driven particularly by a large decrease in service sector activities and work stoppages at gold and bauxite mining operations. Unlike most economic sectors, offshore oil production has been largely unaffected by the COVID-19-virus pandemic.

- Although crude oil production began as recently as December 2019, the petroleum and gas sector already contributes more than a third of economic output. Merchandise exports rose by 65% overall in 2020 to USD2.6 billion, swinging a persistent trade deficit to a surplus.

- Although rapid GDP growth is inevitable in the years ahead,

broader sustainable development is far from certain. The Guyanese

authorities are keenly aware of the dangers of the so-called 'Dutch

Disease' that threatens to erode the competitiveness of non-oil

sectors via inflation and exchange-rate appreciation, leaving the

economy to be highly undiversified.

Europe/Middle East/Africa

- European equity markets closed mixed; UK +0.9%, France +0.4%, Germany +0.3%, Italy -0.2%, and Spain -0.3%.

- 10yr European govt bonds closed sharply lower; UK +9bps, France/Germany/Italy +6bps, and Spain +5bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover +1bp/250bps.

- Brent crude closed +2.2%/$64.07 per barrel.

- Eurozone producer price index (PPI) inflation accelerated in January for the seventh month in the past eight months. While the year-on-year (y/y) rate of change remained low, at zero in January, this was the first month in over a year and a half that the rate did not show a negative figure. Energy prices have been primarily responsible for the marked acceleration. The y/y rate of change in the energy sub-index, while still negative in January (-1.6%), accelerated by over 15 percentage points relative to its trough in May 2020. (IHS Markit Economist Ken Wattret)

- Italy's key fiscal metrics deteriorated notably in 2020 after

the COVID-19 virus triggered an unprecedented decline in GDP and an

aggressive fiscal response to the crisis. (IHS Markit Economist Raj

Badiani)

- The national statistical office confirmed that the economy contracted by 8.9% in 2020, with consumer spending and fixed investment falling by 10.7% and 9.1%, respectively.

- The country recorded a record fiscal shortfall in 2020, with the general government deficit standing at 9.5% of GDP. This was preceded by deficits of 1.6% in 2019 and 2.2% in 2018.

- Total government revenues fell by 6.4% to EUR789.26 billion (USD953.23 billion), or 47.8% of GDP, in 2020. Tax receipts plummeted owing to shrinking economic activity alongside deferred tax payments from households and firms, namely the postponement of value-added tax (VAT), corporate taxes, and social security contributions, as well as property taxes.

- The largest revenue decline arose from indirect taxes, down 12.2% to EUR228.9 billion, primarily due to lower consumer spending and deferred payments.

- Meanwhile, total government expenditure jumped by 12.2% to EUR945.6 billion in 2020, meaning that it rose by 8.7 percentage points to a record high of 57.3% of GDP. The largest spending items included additional resources for medical equipment, staff, and COVID-19 vaccines, a broader wage supplementation fund to provide income support, and grants for small and medium-sized enterprises (SMEs) to cover rents and utility bills.

- Meanwhile, the public debt ratio rose to a record high of 155.6% of GDP in 2020, or EUR2.57 trillion, which represents a significant step up from 134.6% in 2019.

- Despite the rising public debt pile, government interest expenditure fell by 5.0% to EUR57.3 billion, and this is in line with the retreat of sovereign borrowing costs across the maturity range.

- The Norwegian passenger car market recorded a gain of 3.3% year on year (y/y) in February. According to the latest data published by the country's Road Traffic Information Council (Opplysningsrådet for Veitrafikken: OFV), registrations increased from 10,346 units in February 2020 to 10,687 units. The biggest-selling brand during the month was Volvo, which registered 1,546 units, an increase of 141.6% y/y. In second place was Toyota, which posted a gain of 48.8% y/y to 1,360 units, while in third was Peugeot, whose sales jumped by 80.7% y/y to 833 units. The gains seen during the first two months of this year mean that passenger car registrations are now up by 5.4% y/y in the year to date (YTD) at 20,988 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- The US State Department yesterday (2 March) issued a press

release outlining fresh sanctions against Russia. The US government

accuses Russia of using "a chemical weapon against its own

nationals, in violation of the Chemical Weapons Convention", and

the new sanctions are in response to the "attempted assassination

of Russian opposition figure Aleksey Navalny in August 2020 and his

subsequent imprisonment in January 2021", according to the press

release. (IHS Markit Economist Lilit Gevorgyan)

- The punitive measures were coordinated with the European Union, a clear signal that Washington and Brussels are coordinating their position in demanding the immediate release of Navalny, who is seen as a political prisoner by the United States, the EU, G7 countries, and the European Court of Human Rights. Russia has denied all accusations.

- The uncertainty ahead of the US and EU sanctions resulted in a 1.5% decline in the ruble's external value against the US dollar by the end of February. However, the news of the milder-than-expected sanctions helped the Russian tender to regain its lost ground after 2 March. Investor jitters also led to Russian 10-year bond yields rising from 6.6% to 6.8% during 24-26 February, but these too have since declined by nearly one percentage point.

- Non-economic factors remain among the key downside risks to the ruble. Despite a faster than previously expected recovery in crude oil prices, the ruble remains relatively weak.

- On 3 March, South Africa's largest bank by assets, Standard

Bank (SB), issued a statement cautioning shareholders on expected

earnings decline for the annual year ended December 2020. SB

expects earnings to decline by 40-50% compared with earnings during

the same period in 2019, reported BusinessTech. (IHS Markit Banking

Risk's Ana Souto)

- SB cited an increase in impairments, particularly in its personal and business banking portfolio, mostly within personal unsecured lending as the main reason for the decline.

- SB is the largest bank by assets in South Africa and the African continent, accounting for about 25.1% of total sector's assets in South Africa at the end of 2019 and 17 subsidiaries across the continent.

- Owing to a prolonged period of subdued growth that was exacerbated by the COVID-19-virus pandemic, impairments in the banking sector have been gradually increasing since the end of 2017.

- The non-performing-loan (NPL) ratio rose from 2.8% in 2017 to 3.9% at the end of 2019, and from 4% in March 2020 (when the country reported its first COVID-19 case) to 5.2% at the end of 2020 despite loan restructuring of about 20% of total private-sector loans.

- Data published by Zimbabwe's central bank, the Reserve Bank of

Zimbabwe (RBZ), show postal and telecommunications export receipts

jumped 100% in 2020, with the next strongest sectoral performance

recorded in gold mining, while diaspora remittances surged,

supporting total foreign-currency receipts. (IHS Markit Economist

Alisa Strobel)

- The mining sector and telecommunications sector were the key drivers of export receipts in 2020, with growth of 16.8% and 100%, respectively. While export receipts of services, including construction, dropped 76.1% in 2020, a sharper decrease in exports receipts of 97.6% was recorded in the tourism sector.

- The biggest driver of the mining sector's performance was gold mining, with 57.2% growth in 2020. On the other hand, the platinum mining and diamond segments dropped 13.2% and 54.2% respectively.

- On a positive note, manufacturing showed an increase of 39.6% in 2020, while export receipts from the horticulture segment rose by 7.8%. The agricultural sector's export receipts dropped by 12.8% in 2020, with tobacco declining by 12.9%. The transportation sector showed a decline of 3.5% last year.

- IHS Markit anticipates a slow and moderate recovery in Zimbabwe's real GDP in 2021, with growth of 1.1%, fueled mainly by a good performance by the agricultural sector due to favorable harvest conditions.

Asia-Pacific

- APAC equity markets closed higher; Hong Kong +2.7%, India +2.3%, Mainland China +2.0%, South Korea +1.3%, Australia +0.8%, and Japan +0.5%.

- Geometry, the electric vehicle (EV) brand of Geely Auto, has launched a battery-leasing program in China. Customers can now opt to pay a monthly subscription fee of CNY666 (USD103) to rent a battery pack for the Geometry C battery electric vehicle (BEV). Under the leasing program, which lasts for three years, the down payment for the Geometry C with a 53-kWh battery pack will start at CNY31,140. The automaker also allows customers to lease a battery pack for the top-of-range Long-Range Geometry C, which is fitted with a larger 70-kWh lithium-ion battery pack. The monthly fee for the Long-Range Geometry C is CNY888. The Geometry C is a compact battery electric crossover utility vehicle (CUV). The price of the entry-level Standard-Range Geometry C with a 53-kWh battery starts at CNY129,800, while the price of the 70-kWh model starts at CNY162,800. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's unemployment rate declined to 2.9% in January thanks to

an increase in the number of employees from the previous month and

greater labor participation. (IHS Markit Economist Harumi Taguchi)

- A faster drop for part-timers (down 1.5% year on year [y/y]) largely reflected widening contractions in the number of employees in accommodation, eating and drinking services, wholesale and retail trade, and life-related services because of negative effects of the state of emergency on Tokyo and several prefectures.

- The state of emergency also prompted the number of furloughs to increase by a half million from a year earlier, up from a 160,000 y/y rise in the previous month. Most of the rises were for part-time positions in accommodation, eating and drinking services, life-related services, and other services.

- The ratio of active job openings to active job applications rose from 1.05 in December 2020 to 1.10 in January 2021, reaching the highest level since June 2020. That said, the improvement was thanks to a decline in the number of active job applications as the state of emergency kept people from applying for jobs. The ratio of new job openings to new job applications fell to 2.03 from 2.11 in December 2020, largely because of a drop in the number of new job openings.

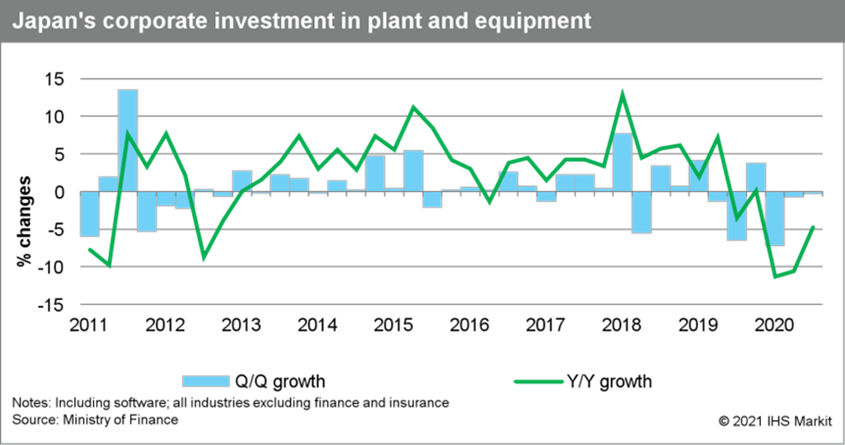

- According to statistics from financial statements for the

fourth quarter of 2020, sales for all of Japan's industrial

sectors, excluding finance and insurance, rose by 2.5% quarter on

quarter (q/q) for the second consecutive quarter of increase, and

the year-on-year (y/y) contraction narrowed to 4.5%. (IHS Markit

Economist Harumi Taguchi)

- The improvement in y/y sales reflected increases in sales in real estate and production, transmission and distribution of electricity, transportation equipment, and general-purpose machinery, while the contractions of sales in the majority of other industry groups softened thanks to the resumption of economic activity.

- Ordinary profits rose by 15.5% q/q, and the y/y contraction narrowed to 0.7% from 28.4% thanks largely to a 31.7% q/q rise in manufacturing sector.

- The 21.9% rise in ordinary profits for manufacturing was the first y/y increase since the second quarter of 2018 and was driven by rises in transportation equipment, production machinery, and some other industry groupings.

- While weak sales remained the major factor containing ordinary profits, sluggishness was partially offset by lower payroll costs (down 3.6% y/y), although the contraction in the number of employees softened to 1.6% y/y from 2.9% y/y in the previous quarter. Declines in costs of sales also helped improve profits in the manufacturing sector.

- Despite improvement in sales and profits, investment in plant

and equipment (including software) continued to decline, by 0.3%

q/q and 4.8% y/y. A 0.7% q/q rise in investment in machinery and

equipment for non-manufacturing was offset by a 2.3% q/q drop for

manufacturing.

- South Korea's five major conglomerates - Hyundai Motor Group, SK Group, POSCO, Hanwha Group, and Hyosung Group - plan to invest KRW43 trillion (USD38.2 billion) in the hydrogen industry in the latest move to meet growing demand for the energy source, reports Maeil Business Newspaper. They plan to build a wide range of hydrogen infrastructure for the production, storage, and transport of hydrogen fuel by 2030. In particular, SK Group plans to invest KRW18.5 trillion over the next five years in a two-phase plan to build the world's largest liquefied hydrogen plant with annual capacity of 30,000 tons as well as a more environment-friendly hydrogen production plant with annual capacity of 250,000 tons of so-called blue and green hydrogen that generates little or no carbon emissions. Hyundai Motor Group plans to invest KRW11.1 trillion in the research and development (R&D) projects of fuel-cell electric vehicles (FCEVs) and establishing hydrogen refueling stations, while Posco will spend KRW10 trillion to replace coal with hydrogen in steel production. Hanwha Group will inject KRW1.3 trillion in creating a green hydrogen ecosystem, and Hyosung Group will invest KRW1.2 trillion in establishing liquefied hydrogen plants and installing more charging stations. (IHS Markit AutoIntelligence's Jamal Amir)

- Indian Transport Minister Nitin Gadkari has reportedly said that the government would provide enough incentives to ensure localized production was the least-expensive option for Tesla, if the company decided to manufacture electric vehicles (EVs) in the country. According to a Reuters report, Gadkari said, "Rather than assembling [cars] in India, they should make the entire product in the country by hiring local vendors. Then we can give higher concessions… The government will make sure the production cost for Tesla will be the lowest when compared with the world, even China, when they start manufacturing their cars in India. We will assure that." Tesla plans to launch sales of the Model 3 in India in 2021. Reuters reports that Tesla did not reply to a request for a comment, so whether Tesla is interested in starting production in India is unclear. Tesla CEO Elon Musk previously indicated that he would like to begin sales in India and has stated that he would like the company to manufacture vehicles close to where they are sold. (IHS Markit AutoIntelligence's Stephanie Brinley)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.