Daily Global Market Summary - 30 March 2021

Most major European and APAC equity indices closed higher, while most US indices were lower. US government bonds closed mixed with the curve flatter, while benchmark European bonds were sharply lower. European iTraxx and CDX-NA were close to unchanged on the day across IG and high yield. The US dollar was higher, while oil, natural gas, gold, silver, and copper were lower.

Americas

- Most major US equity indices closed lower today, except for the Russell 2000 +1.7%; Nasdaq -0.1% and DJIA/S&P 500 -0.3%.

- 10yr US govt bonds closed flat/1.72% yield and 30yr bonds -4bps/2.37% yield.

- CDX-NAIG closed flat/56bps and CDX-NAHY +2bps/317bps.

- DXY US dollar index closed +0.4%/93.3.

- Gold closed -1.7%/$1,686 per troy oz, silver -2.6%/$24.14 per troy oz, and copper -1.4%/$3.98 per pound.

- Crude oil closed -1.6%/$60.55 per barrel and natural gas closed -1.1%/$2.62 per mmbtu.

- The US government announced plans 29 March to build 30 GW of offshore wind capacity by 2030, equivalent to a 1,000-fold expansion of current commercial capacity. Achieving such a target will pave the way to 110 GW of generation capacity by 2050, the White House said. The proposed rapid expansion of the US offshore wind generation fleet will see more than $12 billion/year in capital investment in projects, the Biden administration revealed after a meeting with stakeholders. The White House said it expects more than 44,000 workers to be employed in the offshore wind sector by 2030 and nearly 33,000 additional jobs in communities supported by offshore wind activity. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

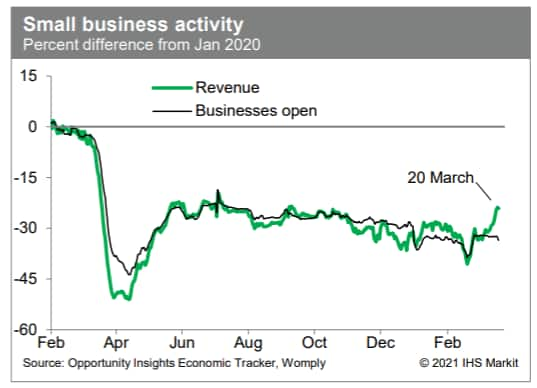

- Revenues at small businesses have turned up sharply in recent

days, according to the Opportunity Insights Economic Tracker, a

hopeful sign for this struggling sector. (IHS Markit Economists Ben

Herzon and Joel Prakken)

- The US Conference Board Consumer Confidence Index jumped 19.3

points (21.3%) in March to 109.7. The index was the highest since

the prior March and was roughly at the midpoint between the

February 2020 peak of 132.6 and the April 2020 bottom of 85.7. (IHS

Markit Economists David Deull and James Bohnaker)

- Although still far from pre-pandemic highs, the robust recovery in consumer confidence, reflected also in the University of Michigan's Index of Consumer Sentiment, supports our expectation for strong growth of consumer spending in the first and second quarters of this year.

- The index measuring views on the present situation rose 20.4 points to 110.0, while the expectations index rose 18.7 points to 109.6, passing its pre-pandemic level to reach a high last seen in July 2019.

- Though expectations regarding business conditions surged in March, consumers were far less likely to expect a positive impact on their own finances. The net percent of respondents expecting better business conditions in six months jumped 16.8 percentage points to 29.8%, and the net percent expecting better employment conditions rose 16.6 points, to 22.7%. Even so, only a net of 2.2% expected to see improvement in personal income.

- Still, the labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) rose 8.6 percentage points to 7.8%, moving firmly into positive territory.

- Purchasing plans rose in March, especially in the red-hot housing sector. The share of respondents planning to buy homes in the next six months rose 2.4 points to 8.4%, a 17-year high. The share planning to buy autos increased 1.7 percentage points to 11.9%, while the share planning to buy major appliances rose 3.6 percentage points to 53.2%, swinging to the highest since February 2020.

- The Federal Housing Finance Agency (FHFA) House Price Index

(HPI) increased 1.0% in January—the eighth straight month it

has risen by 1% or more. (IHS Markit Economist Patrick Newport)

- The index has shot up 10.5% in eight months—this is unprecedented in the index's history, which dates back to January 1991. Although hard data does not exist, it is likely unprecedented in US history.

- The index is up 12.0% from January 2020—the fastest 12-month pace on record.

- Monthly changes ranged from a 1.5% gain in the Mountain Division (Arizona, Colorado, Idaho, Montana, New Mexico, Nevada, Utah, and Wyoming) to a 0.2% drop in the East South Central Division (Alabama, Kentucky, Mississippi, and Tennessee.)

- S&P CoreLogic Case-Shiller indices monthly home price

appreciation remained strong in the first month of 2021. Both the

10-city index and 20-city index were up 1.2% month over month (m/m)

in January. (IHS Markit Economist Troy Walters)

- Month-over-month gains in January were positive in all 20 cities, ranging from 0.7% in Cleveland to 1.9% in Phoenix.

- Both the 10-city and 20-city composite indices experienced record growth again in January, beating out the previous month's record gains. The 10-city index was up 10.9% year over year (y/y) while the 20-city index was up 11.1% y/y. In both cases, this was the fastest pace of growth since March 2014.

- Annual price appreciation was positive in all 20 cities covered. Not only that, an unprecedented 15 of the 20 cities were in double-digit territory in January. Phoenix retained the top spot with an increase of 15.8% y/y. Seattle and San Diego were not far behind at 14.3% and 14.2% y/y, respectively. Las Vegas experienced the slowest pace of annual growth but remained quite strong at 8.5% y/y.

- Growth in the national index reached 11.2% y/y in January, the fastest pace since March 2006.

- With the availability of new tools to evaluate chemical

toxicity, the US Food and Drug Administration (FDA) should

prioritize immunotoxicity testing for chemical preservatives in

food, as well as for chemicals such as per- and polyfluoroalkyl

substances (PFAS) that can migrate into food from food packaging

materials, say Environmental Working Group (EWG) researchers in a

recent study published in the International Journal of

Environmental Research and Public Health. For the study, the

researchers reviewed data from the Environmental Protection

Agency's (EPA's) Toxicity Forecaster, or ToxCast, which includes

data from a newer screening methodology -- nonanimal

high-throughput in-vitro chemical analysis. (IHS Markit Food and

Agricultural Policy's William Schulz)

- TBHQ is found in many processed foods, EWG says, and it serves no function aside from increasing product shelf-life.

- For PFAS, the EWG researchers say they gathered all publicly available data on how it can migrate to food from food-packaging materials like coated food wrappers and bags or from processing equipment. According to EWG, epidemiological studies show that PFAS suppresses human immune function and decreases vaccine efficacy. What is more, they say, studies have found a link between high blood levels of PFAS and COVID-19 severity.

- Paraguayan GDP grew by 1.0% year on year (y/y) in the fourth quarter, according to the country's central bank, the Central Bank of Paraguay. This result is close to IHS Markit's expectations, but slightly worse than the growth rate implied by the monthly index of economic activity, a proxy indicator for output. Construction was the standout sector in the fourth quarter, growing by 18.1% y/y and contributing 1.2 percentage points to growth despite accounting for 7.5% of overall output. Services remained the greatest drag on growth but approached 2019 levels, declining by 0.8% y/y. (IHS Markit Economist Jeremy Smith)

- General Motors (GM) has announced a production stoppage at its São Caetano do Sul plant in Brazil from 29 March to 2 April, reports Automotive Business. The decision has been taken to help contain the spread of the COVID-19 virus amid the worsening outbreak conditions in the country. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed higher; Germany +1.3%, France +1.2%, Spain +1.2%, Italy +0.9%, and UK +0.5%.

- 10yr European govt bonds closed sharply lower; Italy +5bps, France/Spain/UK +4bps, and Germany +3bps.

- iTraxx-Europe closed flat/54bps and iTraxx-Xover -2bps/262bps.

- Brent crude closed -1.2%/$64.17 per barrel.

- BP is acquiring a partnership stake in a vehicle charging company founded by BMW Group and Daimler AG unit Daimler Mobility. The agreement announced 30 March calls for the oil major to hold a one-third stake in Digital Charging Solutions (DCS). DCS already offers access to 228,000 charging points in 32 countries, according to the announcement. The agreement is expected to see BP add 8,700 charging points in Europe. These charging points will include ultrafast chargers of more than 150 kw. BP is also expected to develop new integrated offers for fleets, including through its Fuel & Charge program. (IHS Markit OPIS's Steve Cronin)

- The "headline" economic sentiment indicator (ESI) for the

eurozone surprised massively to the upside in March, jumping by a

stonking 7.6 points, one of the biggest increases in the series'

history and 5 points above the market consensus expectation (based

on Reuters' survey). (IHS Markit Economist Ken Wattret)

- At 101 in March, the ESI is now back above its average since 2000 for the first time since the COVID-19 virus shock, although the index remains three points below its pre-pandemic level in February 2020.

- Industrial sentiment rose by a little over 5 percentage points, again one of the largest gains on record, for the 10th improvement in the past 11 months.

- Services and retail sentiment both increased by around 7 points, with construction and consumer sentiment rising by around 5 and 4 points, respectively, again some of the largest gains on record, in some cases surpassed only by the rebounds in mid-2020 following the easing of COVID-19 virus containment measures.

- Mercedes-Benz and Siemens have agreed a joint-venture (JV) alliance to focus on the digitization of sustainable production methods, according to a company statement. The two companies have already collaborated for decades on Mercedes-Benz's production line technology, but this partnership will focus on 'innovative solutions for the qualification of employees, digitalization and for increasing energy efficiency in production.' Siemens will work with Daimler to accelerate Industry 4.0 digital production processes, with a particular focus on sustainability. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's consumer confidence index has improved by three points

in March, standing at 94. The index had stood at 91 in February,

and March's is the highest reading in three months. (IHS Markit

Economist Diego Iscaro)

- Households are more upbeat about the outlook for their personal finances, although the index rose less markedly (up by 4 points to -4, a three-month high).

- The number of households considering making a major purchase over the next year increased by 2 points to -15 (also a three-month high), still below its 2019 average of -11.

- Simultaneously, the index measuring households' savings intentions continued to rise, reaching its highest level since the series started to be collected in 1972. High savings intentions may be related to concerns about future unemployment, which remain high despite a moderate easing in March.

- China's Didi Chuxing (DiDi) will begin offering its ride-hailing service in Cape Town (South Africa), according to a company statement. This follows the successful launch of DiDi's pilot operation in Gqeberha (South Africa). DiDi said more than 2,000 drivers have registered for the service on its app. In South Africa, DiDi will face competition with Bolt and Uber. DiDi has strengthened its presence in markets beyond China and operates in Japan, Australia, Latin America, and Russia. In Latin America, DiDi's service is available in Argentina, Brazil, Chile, Colombia, Costa Rica, Mexico, and Panama. Globally, DiDi has more than 31 million drivers registered on its platform and has attracted 550 million customers who are using the company's range of app-based transportation options. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The monetary policy committee (MPC) of Angola's central bank,

the BNA, met on 28-29 March to discuss the latest developments in

the domestic economy. The MPC highlighted that short-term

inflationary pressures are set to persist, despite stable liquidity

conditions and the stability in the foreign-exchange market. (IHS

Markit Economist Alisa Strobel)

- The MPC decided once more to maintain the BNA's key policy rate, with the basic rate at 15.5%, after last lowering its key policy rate by 25 basis points to 15.5% during its May 2019 meeting, which brought the cumulative reduction in the central bank's policy rate to 250 basis points since June 2018.

- The MPC decided to keep the interest rate of the Liquidity-Freeness Facility indexed to the market interest rate of Treasury bills for 91 days, plus 0.5%. However, the MPC decided to increase the interest rate of the Permanent Liquidity Absorption Facility with maturity of seven days from 7% to 12%.

- Zambia's real GDP contracted by 3.0% in 2020, latest statistics

from the Zambia Statistical Service (ZamStats) show. The COVID-19

pandemic had a severe impact on the economy's services sector. (IHS

Markit Economist Thea Fourie)

- Output in the restaurants and bars sector contacted by 21.9% during 2020, while wholesale and retail trade activity decreased 12.6% and other services (including government services) activity contracted 12.5%. The manufacturing and construction sectors were also a drag on overall growth, contracting by 1.3% and 5.2% respectively last year.

- Sector output that remained resilient in 2020 regardless of the COVID-19 pandemic included agricultural production, up 17.8%, and mining and quarrying, up 8.2%. Transport and storage output improved by 14.0% in 2020, followed by the information and communication category with 13.2% growth and the finance and insurance category with 13.1% growth.

Asia-Pacific

- Most APAC equity markets closed higher except for Australia -0.9%; India +2.3%, South Korea +1.1%, Hong Kong +0.8%, Mainland China +0.6%, and Japan +0.2%.

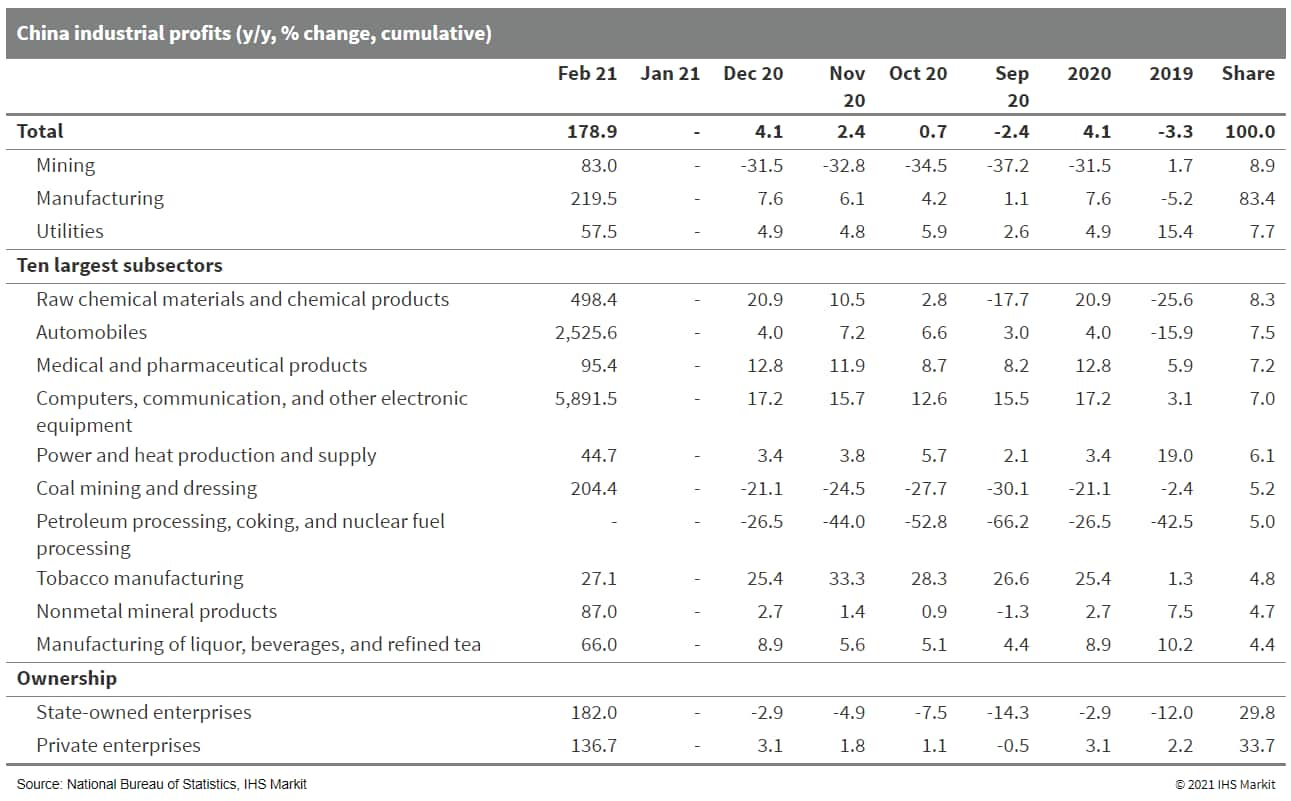

- Mainland China's industrial profits grew 179% year on year

(y/y) cumulatively in the first two months of 2021, largely owing

to the COVID-19 pandemic-induced low base in 2020. Compared with

January-February 2019, industrial profits expanded by 72.1%, or by

an average growth rate of 31.2% y/y over 2020-21, according to the

National Bureau of Statistics. (IHS Markit Economist Lei Yi)

- By sector, the manufacturing sector continued to lead the headline profits recovery. Notably, profits in the equipment and high-tech manufacturing sectors jumped by 707% y/y and 308% y/y, or by a two-year average of 55.3% y/y and 60.2%, respectively, in the first two months of 2021.

- Thanks to the accelerated vaccine deployment, profits in the

medical and pharmaceutical products manufacturing sector surged

95.4% y/y. Raw material manufacturing continued to benefit from the

global commodity rally.

- China's DiDi Chuxing is reportedly planning to raise new funds for its autonomous vehicle (AV) unit. The unit is expected to raise as much as USD500 million at a valuation of approximately USD6 billion, reports Bloomberg. The company will use the infused capital towards accelerating mass production of AVs and will invest in technologies such as artificial intelligence chips. The company is reportedly eyeing the United States for its IPO and is seeking at least a USD100-billion valuation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Sinopec (Beijing, China) reports EBIT earnings from its

chemicals business of 12.03 billion renminbi ($1.8 billion) for the

full year 2020, down 46% compared with the prior year, on sales

that fell 28% to 371.8 billion renminbi, due primarily to lower

product prices and declines in sales volumes for certain products.

(IHS Markit Chemical Advisory)

- Despite the year-on-year (YOY) decline, Sinopec says it plans to almost double capital expenditure (capex) in 2021 in its chemicals segment to 48.6 billion renminbi from 26.2 billion renminbi in 2020, and increase its total ethylene production for the year by almost 1 million metric tons (MMt) to 13.00 MMt in 2021, from 12.06 MMt last year.

- Sinopec's chemicals business will focus in 2021 on a "basic plus high-end" development concept, it says, accelerating advanced capacity building, deepening structural adjustments, and "improving production scale in high-end and new materials, including medical and health care feedstock and degradable plastics, so as to extend our industry chain and foster new growth points." It will also make structural enhancements to its three major synthetic materials and fine chemical products, optimize the feedstock mix, reduce raw materials costs, and further schedule facility utilization to maximize effective production capacity, it adds.

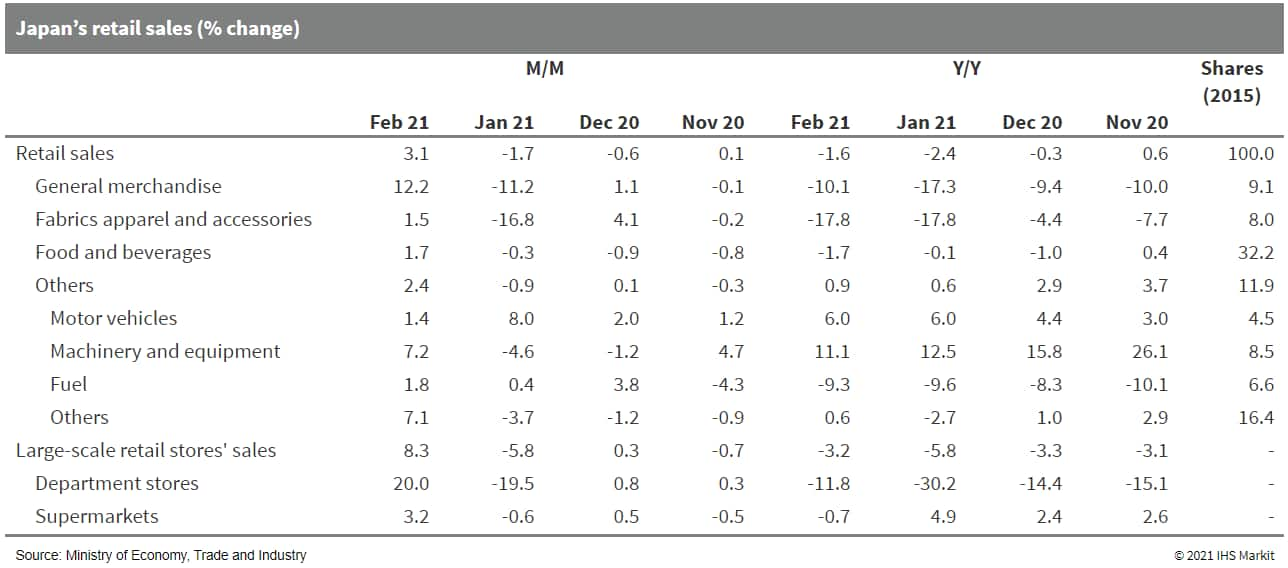

- Japan's retail sales rose by 3.1% month on month (m/m) in

February following two consecutive months of declines, although

year-on-year (y/y) growth remained sluggish, recording a 1.6% drop.

(IHS Markit Economist Harumi Taguchi)

- Despite the extension of the state of emergency for 11 prefectures, the m/m improvement reflected solid rebounds in sales of general merchandise, food and beverages, and other/miscellaneous category.

- The wealth effect thanks to rising stock prices supported sales of high-end goods at department stores, and stay-home/work-from-home lifestyles lifted sales of foods and household durables.

- The unemployment rate remained at 2.9% in February, while the

number of employed increased marginally from the previous month.

However, containment measures because of the extended state of

emergency accelerated the y/y contraction in the number of

non-regular workers, while the number of employed declined by 13.4%

y/y in accommodations and drinking/eating places.

- Japan's largest refinery Eneos Corp. has shut down all units at

its 127,500 b/d Wakayama refinery on Monday after a fire, market

sources and a company official said. (IHS Markit Chemical Advisory)

- The Wakayama refinery houses two paraxylene units each with an annual capacity of 130,000 mt/year. Eneos' total PX capacity stands at 2.55 million mt/year with eight other PX units located in Aichi, Kanagawa, Mizushjima, Oita and Sakai.

- According to IHS Markit data, Japan's PX capacity loss for March and April were estimated at 10% due to scheduled turnaround and reduced operation rates. The sudden shutdown of the Wakayama units will increase Asia's PX capacity loss at a time when supply is already tight due to numerous turnarounds.

- Telecoms company KT will test 5G-connected autonomous buses at a smart industrial complex in Pangyo, South Korea. The company will deploy two of these buses that use vehicle-to-everything (V2X) technology to communicate with each other and on-road structures such as traffic lights and pedestrian monitoring devices. It also features real-time kinematic (RTK) positioning satellite navigation technology as well as a local dynamic map (LDM) and a geographic information system (GIS). The vehicles are manufactured in partnership with electric vehicle maker Edison Motors and tech firm Phantom AI, reports Aju Business Daily. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SP Group and Chevron Singapore Pte. Ltd., which operates the Caltex refueling stations in Singapore, have announced a partnership to offer fast electric vehicle (EV) charging services at selected Caltex service stations, SP said in a press release. They will be equipped with 50-kW direct current (DC) chargers that can charge an EV in 30 minutes. The chargers will be installed by the second quarter of 2021, and will be incorporated on the SP Utilities mobile app, which allows EV drivers to search for the nearest charging points, receive real-time updates on their charging sessions, and make direct, cashless payment. (IHS Markit AutoIntelligence's Jamal Amir)

- Sapura Energy, through its wholly owned subsidiary Sapura TMC, has secured multi-currency financing facilities of USD2.5 billion (MYR10.3 billion) from a consortium of Malaysian, regional and international banks for a period of 7 years. The planned refinancing is part of the company's capital management program to lengthen the maturity of its debt, which will provide timely financial headroom in a recovering energy market, allowing Sapura Energy to continue winning new oil & gas contracts and explore emerging opportunities in the renewable energy sector. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Preliminary data from the General Statistics Office of Vietnam

showed that Vietnam's economic activities expanded by 4.48% year on

year (y/y) during the first quarter of 2021. Real GDP growth

remained unchanged from the fourth quarter of 2020 despite the

setback from the largest domestic outbreak grappling Vietnam in

late January. (IHS Markit Economist Jola Pasku)

- The industries that have reaped the largest benefits from the supply chain shifts are electronics and wood and furniture products. Changing trends towards increased remote working during a pandemic and a shift towards suburb living have served as a catalyst to Vietnam's exports of furniture and electronics. Shipments of electronics and computers grew by 44% y/y, while those of key wood and wood products picked up by 51% y/y during the first quarter.

- The textile industry was negatively affected by COVID-19-related disruptions in supply chains, as evidenced by moderate growth of 1% y/y in exports during the first two months of 2021.

- The slump in the textile industry will probably be temporary as the EU-Vietnam free-trade agreement should boost growth in this industry. Under the agreement, 42.5% of textile and apparel products made in Vietnam and exported to the European Union have benefitted from zero tariffs as of 1 August 2020, while the remaining tariffs in place on textiles and apparel will be reduced to 0% over the next eight years.

- Phenikaa Group, a multi-sectoral corporation, has unveiled a prototype of Vietnam's first Level 4 autonomous vehicle (AV), reports Việt Nam News. The vehicle features technologies such as artificial intelligence, SLAM (simultaneous localization and mapping), machine learning, and deep learning. In addition, the vehicle has LiDAR sensors and is equipped with 40 autonomous features. Le Anh Son, director of Phenikaa-X JSC, said, "We hope the introduction of Vietnam's first level-4 smart autonomous vehicle will facilitate the development of the self-operating industry, localize technological products and meet the market demand for high-quality, internationally standardized products and services." (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.