Daily Global Market Summary - 5 March 2021

US equity markets closed higher, while all major indices in Europe and APAC were modestly lower. US government bonds closed mixed/flatter on the long end of the curve and benchmark European bonds closed lower. European iTraxx closed wider across IG and high yield, and CDX-NA was tighter on the day. The US dollar, oil, and copper closed higher, while gold and silver were lower. Today's US nonfarm payroll report exceeded expectations by a wide margin driven by substantial increases in restaurant and hospitality jobs that have benefited directly from the recent loosening of restrictions.

Americas

- US equity markets closed higher; Russell 2000 +2.1%, S&P 500 +2.0%, DJIA +1.9%, and Nasdaq +1.6%.

- 10yr US govt bonds closed +1bp/1.57% yield and 30yr bonds -2bps/2.30% yield.

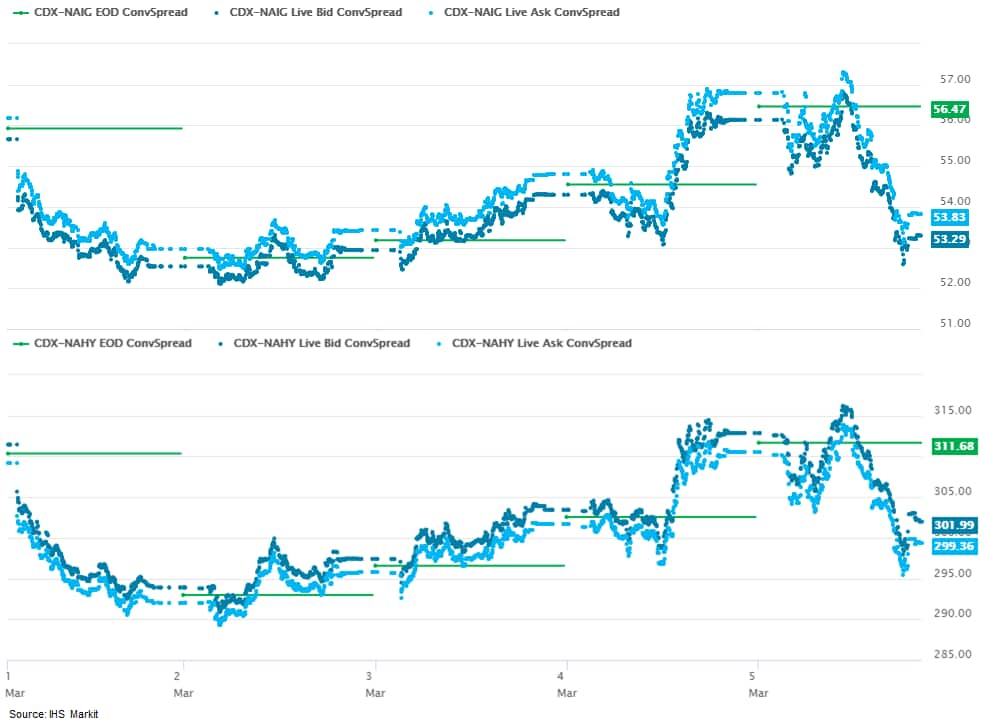

- CDX-NAIG closed -3bps/54bps and CDX-NAHY -11bps/301bps, which

is -2bps and -9bps week-over-week, respectively.

- DXY US dollar index closed +0.4%/91.98, which is the highest close since 25 November.

- Gold closed -0.1%/$1,699 per ounce, silver -0.7%/$25.29 per ounce, and copper +2.5%/$4.08 per pound.

- Crude oil closed +3.5%/$66.09 per barrel, which is the highest close since April 2019.

- Saudi Arabia's oil minister Prince Abdul Aziz bin Salman on 4 March 2021 surprised oil markets once again, this time by extending his country's voluntary reduction of 1 MMb/d for an indefinite period. As in January, the unilateral Saudi move came alongside a decision by OPEC+ ministers to keep output allocations unchanged, this time through April, for all countries except Russia and Kazakhstan, which were granted the ability to add another 150,000 b/d combined next month. A rollover of most OPEC+ cuts, and a gradual return of the additional 1 MMb/d from Saudi Arabia reinforces the Kingdom's commitment to riding oil prices higher, even if it means holding back barrels as demand enters its fast recovery phase. The forceful price-boosting stance of Saudi Arabia, enabled by less vocal opposition than meetings past within the OPEC+ ranks, will tighten physical markets through 2Q and keep nudging oil prices higher. Oil prices at or above $70/bbl are now within reach should Saudi Arabia's "leading from behind" maneuver bear fruit, and stock draws fuel already-robust bullish momentum. (IHS Markit Energy Financial Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- US nonfarm payroll employment rose 379,000 in February, beating

expectations by a wide margin. Private payrolls expanded by more

(465,000). Revisions were mixed. (IHS Markit Economists Ben Herzon

and Michael Konidaris)

- The gain in overall payroll employment was nearly fully accounted for by a 355,000 increase in leisure and hospitality, where loosening restrictions, most notably on restaurants, are allowing for firming activity.

- While encouraging, today's reported gain in payrolls left the number of jobs still 9.5 million below the pre-pandemic peak reached last February and even further below what had been a firming trend.

- About three-quarters of this shortfall is in private service-sector employment. It will take further robust gains in aggregate demand and continued relaxation of restrictions on social and economic activity to pull employment back in line with the pre-pandemic trend.

- Unusually harsh winter weather across much of the US had an impact on a few aspects of today's report. Employment in the construction sector fell by 61,000 in February. This was the first decline in construction employment so far in the recovery.

- Also, the private workweek declined sharply in February, led by an outsized decline in the construction industry. Combined with a 0.2% increase in average hourly earnings and the gain in private employment noted above, this implies a roughly flat reading on private wage-and-salary income in February.

- In the Household Survey, the unemployment rate declined 0.1 percentage point to 6.2%. This reflected a solid gain in civilian employment (208,000) that outpaced a 50,000 increase in the civilian labor force.

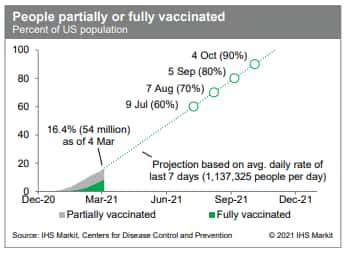

- Revenue per available room at US hotels slipped last week,

according to STR, but remained in line with what has been an

improving trend over the last several weeks. Meanwhile, the trend

in passenger throughput at US airports has been firming in recent

weeks, according to daily data from the TSA. When combined with

improvement in hotels revenues, this could be an indication of the

beginning of recovery in the travel sector. Separately, over the

last seven days, an average of about 1.1 million people per day

were newly vaccinated, raising the total number of US residents at

least partially vaccinated against COVID-19 to 54 million, or

roughly 16% of the population. At the current rate, 60% of the

population will be vaccinated by 9 July and 80% by 5 September,

although there is reason to expect the daily rate of vaccinations

to rise, as production and distribution of the newly authorized

vaccine from Johnson and Johnson ramps up. (IHS Markit Economists

Ben Herzon and Joel Prakken)

- Outstanding nonmortgage consumer credit fell $1 billion to

$4.18 trillion in January after a $9 billion increase in December.

The 12-month change in outstanding consumer credit fell 0.2

percentage point to -0.2%, as declines in revolving consumer credit

have essentially offset increases in the nonrevolving category.

(IHS Markit Economist David Deull)

- Revolving (mostly credit card) consumer credit hastened its decline in a fourth consecutive monthly decrease, ramping down by $10 billion, which brought its cumulative decline since February 2020 to $132 billion. The 12-month change in this category was -11.6%, another record low in data that begin in 1969.

- Nonrevolving credit increased $9 billion in January and its 12-month growth rate was 3.8%. This category includes student and auto loans, and the growth of these types of obligations has remained steady.

- The ratio of nonmortgage consumer credit to disposable personal income dove 2.5 percentage points to 21.7% as stimulus checks and renewed unemployment benefits produced a surge in personal income during the month.

- Consumers have pulled back dramatically on credit-card spending

during the pandemic and paid down card balances. The arrival of

fiscal stimulus aligns neatly with declines in consumer credit as

many households have used the extra cash to reduce their

high-interest debt obligations. Still more stimulus expected as

part of the Biden administration's American Rescue Plan will extend

this phenomenon.

- Amgen (US) announced on 4 March that it intends to acquire Five Prime Therapeutics (US) in a USD1.9-billion deal that would bolster the company's oncology development pipeline. The takeover will give Amgen access to Five Prime's promising Phase II investigational HER2- gastric/gastroesophageal cancer candidate bemarituzumab, a potential first-in-class antibody that is being developed as a targeted therapy for tumors that overexpress FGFR2b. In November 2020, Five Prime Therapeutics released Phase II (FIGHT) trial results indicating that bemarituzumab plus chemotherapy demonstrated significantly improved progression-free survival (PFS) and overall survival (OS) compared with placebo plus chemotherapy in front-line advanced gastric and gastroesophageal junction cancer. Median PFS improved from 7.4 months to 9.5 months, while median OS improved from 12.9 months. (IHS Markit Life Sciences' Eóin Ryan)

- The US automotive industry could be hit by a shortage of seat form as early as the week beginning 8 March, as a result of a recent winter storm shutting down petrochemical plants in Texas, according to media reports. A Crain's Detroit Business report quotes an auto industry executive, who declined to be named, as saying that some seating suppliers' assembly lines could run out of foam on 8 March. The executive reportedly said, "A lot of production is down still for oil refinery byproduct and in a few days, no one is going to be able to make [propylene oxide]. Everyone is scrambling. This problem is bigger and closer than the semiconductor issue." Automotive News reports that other sources suggested the impact of the problem could be felt in mid-March. The report quotes a Toyota spokesperson as saying, "We are aware of the petrochemical industry's condition and are working with our supplier partners to mitigate any impact to our production plan. At this time, it is too early to predict the potential near-term impact." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Shipping company FedEx has announced new targets for achieving carbon neutrality, including plans for all of its parcel pickup and delivery (PUD) vehicles to be zero-emission vehicles (ZEVs) by 2040. FedEx says that it aims to achieve that goal through phased targets on purchases to replace existing vehicles. The company expects 50% of its PUD vehicle purchases globally to be ZEVs by 2025 and this increases to 100% by 2030. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) and joint venture partner LG Chem are reportedly considering building a second US battery plant. The second plant could be in Tennessee, with a decision expected by mid-2021. A Reuters report quotes sources as saying the automaker and its battery partner LG Chem are in talks with Tennessee state officials on potentially building the plant near GM's current Spring Hill assembly plant. The report also quotes a GM source as saying the company is "exploring the feasibility of constructing a second, state of the art battery cell manufacturing plant in the United States", and that the plant would be built through the Ultium Cells LLC joint venture with LG Chem. Reuters also reports an LG Chem source as saying that the company was in talks with GM, without disclosing specific details. Reportedly, the LG Chem source added, "LG Energy Solution is also planning additional capacity expansion for other global OEMs located in the US." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's Ivey Purchasing Managers Index (PMI) surged 11.6

points to 60.0 in February. (IHS Markit Economist Chul-Woo Hong)

- The employment index was the biggest mover, up 12.5 points, followed by the supplier deliveries index (up 3.9 points) and the inventories index (up 1.1 points).

- The prices index decreased 2.6 points, the first drop since August 2020.

- As business optimism improves, real GDP output will modestly grow in the short term.

- After staying in contraction mode in the previous two months with strict regional lockdowns, the Ivey PMI showed a strong recovery in February as purchasing managers' spending activity solidly increased.

- The employment index rebounded to 54, following three consecutive months in contraction mode. This increase supports our forecast of a healthy net employment gain in February.

- US renewable fuel proponents praised Environment and Climate Change Canada's (ECCC) proposed Clean Fuel Regulations (CFR), urging that US biofuels be treated the same as those produced in Canada under the rule and seeking more clarity on a proposed fuel greenhouse gas (GHG) lifecycle analysis. Canada published the proposed regulation in December 2020 in the Canada Gazette. The groups filed comments on the plan, addressing several issues in the regulation, including land use and biodiversity, fair treatment on carbon capture and sequestration (CCS) and enhanced oil recovery (EOR) and other areas. (IHS Markit Food and Agricultural Policy's Richard Morrison)

Europe/Middle East/Africa

- European equity markets closed lower; Germany -1.0%, France/Spain -0.8%, Italy -0.6%, and UK -0.3%.

- 10yr European govt bonds closed lower; Spain/UK +3bps, Italy +2bps, Germany +1bp, and France flat.

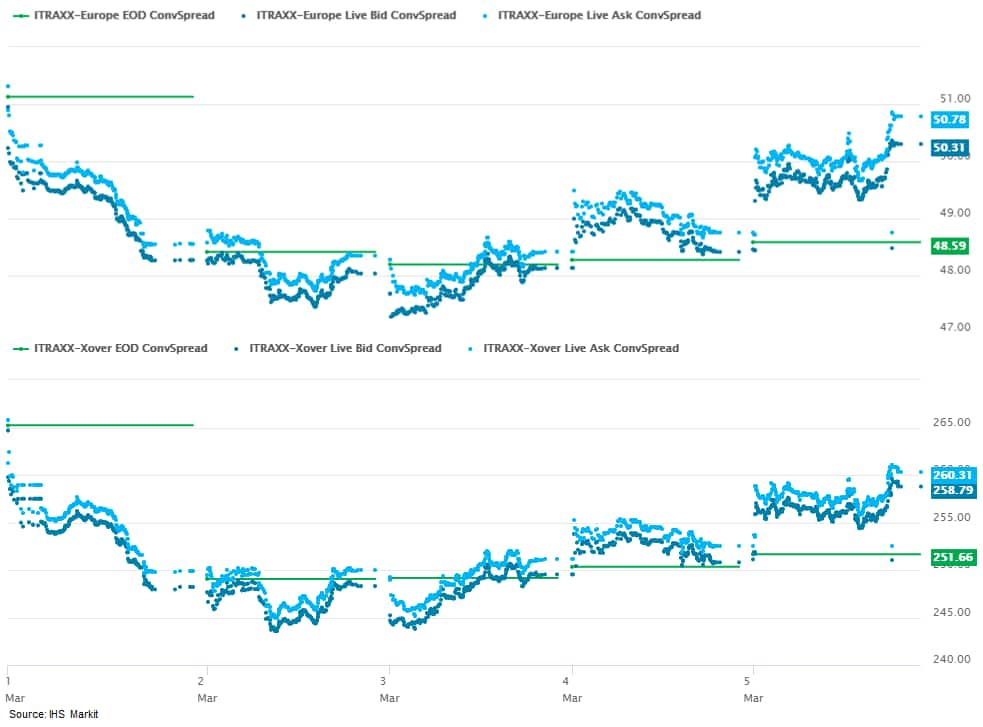

- iTraxx-Europe closed +2bps/51bps and iTraxx-Xover +8bps/260bps,

which is flat and -5bps week-over-week, respectively.

- Brent crude closed +3.9%/$69.36 per barrel, which is the highest close since May 2019.

- Ardagh Metal Packaging has sold an upsized USD2.8-billion

package of sub-investment grade Green Bonds, upsized from a

USD2.65-billion equivalent initial size. (IHS Markit Economist

Brian Lawson)

- It placed EUR450 million of 2% 2028 secured notes alongside USD600 million of 3.25% 2028 secured debt. It also sold EUR500 million and USD1050 million of 2029 senior notes at 3% and 4% respectively.

- The offering, conducted on 26 February, is the largest junk-rated green bond to date, being over triple the size of French recycling group Paprec's 2018 EUR800-million two-tranche offering, previously the largest in this category.

- Dealogic data showed that sub-investment grade borrowers raised only USD12 billion in total in Green Bond format during 2020.

- Following another exceptionally large COVID-19-driven drop in

January, eurozone retail sales are 7% below their pre-pandemic

level. Private consumption will be even weaker still during the

first quarter. (IHS Markit Economist Ken Wattret)

- Eurozone retail sales volumes plunged by 5.9% month on month (m/m) in January, the biggest decline in the history of the series excluding the collapse in March and April 2020 during the first wave of the COVID-19 virus pandemic.

- The outcome was far weaker than the market consensus expectation (of -1.1% m/m, according to Reuters' survey), although the monthly series tends to be very volatile even though it is seasonally and calendar adjusted.

- January's weakness followed another exceptionally large m/m contraction in November 2020 (-5.1%) and only a partial rebound during December (+1.8%), implying very weak "carry over" effects for the first quarter of 2021.

- On a three-month/three-month basis, retail sales volumes contracted by 5.6% in January, again by far the biggest decline in the history of the series with the exception of early 2020.

- Porsche will evaluate an entry in the FIA Formula One (F1) world championship if the series adopts e-fuels when new engine regulations are adopted in 2025, according to a BBC report. The German sports car manufacturer is undertaking its own e-fuel program as a way of retaining its internal combustion engine (ICE) technology, which is a key selling point of its high-performance models, and F1's potential switch to e-fuels could appeal to the brand. Porsche Motorsport vice-president Fritz Enzinger said, "It would be of great interest if aspects of sustainability - for instance, the implementation of e-fuels - play a role in this. Should these aspects be confirmed, we will evaluate them in detail within the Volkswagen Group and discuss further steps." Enzinger added that Porsche was "observing" the development of the new regulations, as it did for "all relevant racing series around the world". (IHS Markit AutoIntelligence's Tim Urquhart)

- Germany's Federal Network Agency (Bundeshetzagentur) has floated three offshore wind sites for tender. Two sites, with estimated yield of 658 MW are in the North Sea, with one site of up to 300 MW in the Baltic Sea. All development work must be complete with the sites online by 2026. The sites are tendered under a new central model structure with funding and grid connection capacity, together with the planning approval from the Federal Maritime and Hydrographic Agency (BSH) for the development of the areas tendered together. The tenders were launched after preliminary site investigations by the BSH and the publication of the investigation results. The North Sea sites are located 30 to 40 kilometers north of the island of Borkum, near the Gode Wind cluster. The Baltic Sea site is about 40 kilometers northeast of the island of Rugen, near the Wikinger wind farm. Bids are open until 1 September 2021, with the maximum value capped at 7.3 eurocents per kWh. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to data published by Statistics Austria, which has

taken over the final quarterly GDP releases from the Austrian

Institute of Economic Research (Österreichisches Institut für

Wirtschaftsforschung: WIFO) on a permanent basis, Austrian GDP

declined by 2.7% quarter on quarter (q/q) in seasonally and

working-day-adjusted (SWDA) terms during the fourth quarter of

2020. This is substantially weaker than the 4.3% fall published as

a "flash" estimate a month ago by WIFO on the same methodological

basis. (IHS Markit Economist Diego Iscaro)

- This follows a downwardly revised rebound of 11.8% q/q during the third quarter of 2020 (previously estimated as +12.0% q/q) and a fall of 10.7% q/q during the second quarter (revised from 10.6% q/q).

- Austrian GDP dropped by 6.6% in 2020, slightly below a contraction of 6.8% in the eurozone.

- The substantial revision compared with the flash estimates was mainly driven by private consumption, which is now estimated to have declined by 5.2% q/q during the fourth quarter, as opposed to 8.3% q/q.

- The Spanish government is to team up with SEAT and Spanish energy firm Iberdrola to set up a battery plant in the country, reports Reuters. Minister of Industry, Trade and Tourism Reyes Maroto was quoted at an event held by the UGT union as stating, "The project will allow the development of... the necessary infrastructure, installations and mechanisms to autonomously and competitively manufacture a connected electric vehicle". Maroto added that while the site would help SEAT to build battery electric vehicles (BEVs) at its site in Martorell (Spain), it would also be open to other companies as part of a drive to help Spain localise BEV production. (IHS Markit AutoIntelligence's Ian Fletcher)

- Eni has completed the acquisition of a 20% stake in the 2.4 GW Dogger Bank A and B offshore wind farms in the United Kingdom for a total consideration of GBP206.4 million (USD286 million). Following Eni's acquisition, Equinor and SSE Renewables will each hold equal stakes of 40% each. The third phase of the project, Dogger Bank C, is expected to reach financial close by 2021. Equinor and SSE Renewables hold equal stakes in the project at 50% each. Equinor, has over the last two years, farmed down its interests in the Arkona, Empire Wind, and Dogger Bank projects, generating a gain of around USD1.5 billion. The first two phases will require a total investment of USD8.3 billion, which includes offshore transmission capex costs of around USD1.1 billion for each phase. (IHS Markit Upstream Costs and Technology's Melvin Leong)

Asia-Pacific

- APAC equity markets closed lower; India -0.9%, Australia -0.7%, South Korea -0.6%, Hong Kong -0.5%, Japan -0.2%, and Mainland China flat.

- Chinese internet technology company ByteDance is reportedly investing in local autonomous vehicle (AV) startup QCraft. According to the report by Bloomberg, ByteDance will participate in QCraft's latest fundraising round of at least USD25 million. The deal, which may be announced as early as next week, will mark ByteDance's debut in the automotive industry. In a separate statement, it has been announced that Ouster will supply its digital LiDAR sensors for QCraft's third fleet of robobuses deployed in Wuhan (China). The sensors help to eliminate blind spots with their wide field of view and high resolution. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup NIO and Anhui Jianghuai Automobile Group Corp Ltd (JAC Group) signed an agreement on 4 March to establish a new joint venture (JV) company in Anhui province, China. According a statement published by JAC Group, NIO is to hold a 49% share in the new JV company and contribute a capital investment of CNY245 million (USD37.8 million), while JAC is to hold the remaining 51% of shares and contribute CNY255 million. The board of the JV is to consist of three directors appointed by JAC and two directors appointed by NIO. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Honda has started leasing the Legend Hybrid EX sedan fitted with its Level 3 autonomous system, SENSING Elite, in Japan. A variation of the Honda SENSING suite of advanced safety and driver-assist technologies currently available on Honda vehicles globally, SENSING Elite features additional technologies such as Traffic Jam Pilot that qualify for Level 3 automated vehicles. The automaker claims to have developed the system with approximately 10 million simulations of real-world situations and to have tested it on expressways for a total of approximately 1.3 million kilometers (800,000 miles). Honda last year announced its plans to mass-produce vehicles with automated capabilities that meet Level 3 standards. Honda has received approval from Japan's Ministry of Land, Infrastructure, Transport and Tourism for its Traffic Jam Pilot system. This is in line with Japan's aim to promote autonomous technology, with the intention of selling fully autonomous vehicles (AVs) in 2025. (IHS Markit AutoIntelligence's Nitin Budhiraja and Surabhi Rajpal)

- Some of Asia's coal industry leaders see a viable future - despite "unpredictable" conditions - for the commodity in the region's industrial mix. Representatives from the public and private sectors in China, India, and Indonesia emphasized at CERAWeek by IHS Markit that coal has the longevity to maintain a steady presence in regional industries like power generation and steel for decades to come. That remains true, they said in panel discussion on 5 March, even as many of the world's advancing and emerging economies pledge to reach net-zero carbon emissions. Two factors - national policies, and coal's regional market fundamentals - will continue to shape the commodity's presence and trade in Asia, said Yaokun Gao, a Beijing-based managing director at Coeclerici Far East. Gao pointed to the ongoing trade dispute between China and Australia as a game-changer for Asian coal. China was a major destination for Australian thermal and metallurgical coal exports, with shipments effectively banned to the world's largest steelmaker. "For the short term, I'm pessimistic," on the chances of a quick resolution of the China-Australia dispute, Gao said. Progress should not be expected before the end of 2021, he added. Longer term, "I believe world leaders will be wise enough to find a solution" to the trade tensions, Gao said. (IHS Markit Climate and Sustainability News' William Fleeson)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.